Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Research

All our investment ideas are generated in-house and followed up through a rigorous research process as we seek good quality companies to invest in.

The members of our investment teams are all analysts with a broad range of educational and industry experience. All are responsible for the research we do as part of our assessment of potential and ongoing investments.

Our approach to research combines extensive fundamental analysis, using qualitative information and quantitative data from multiple sources and perspectives, with regular company visits and other types of engagement.

Sometimes, in order to improve our understanding of a specific topic, we commission and pay for research from external providers whom we respect and value. Over time we believe that research tenders like this will contribute to and enhance our investment decision-making.

Research tenders

Our investment process is augmented through the use of external research. We find third party commissioned research helpful to challenge our thinking and extend our understanding of the subject matter our projects cover.

A vital part of our investment process is trying to understand better in which areas the companies, industries and sectors we invest will face headwinds or challenges.

We often find our key questions on these matters, crucial to our evaluation of investment opportunities and risks, are not adequately addressed by ‘off the peg’ research so we choose to commission and pay for one-off, standalone articles of research.

This has allowed us to select and establish relationships with a wide range of partners with different experiences, perspectives and insights.

If you’d like to find out more on our research tender process, please contact the team at [email protected].

Research tenders commissioned since 2016

The list below highlights all the research tenders we’ve commissioned since 2016.

2024

2023

2022

2020

- Conflict Minerals in the Semiconductor supply chain

- Antimicrobial Resistance Asian Biopharmaceutical Companies

- Sustainable Sourcing of Coffee

- In Vitro Diagnostics Industry Primer

- Investment and Sourcing through Smallholder Supply Chains

- Core versus Non-Core Profits

- Fintech and Financial Inclusion

- Accounting Quality of Chinese Internet Companies

- Accounting Practices of Inspection and Testing Companies

2019

2018

- Alternatives to palm oil

- Sustainability performance of top ten listed palm oil companies

- Sustainable sourcing of soy

- Improving gender diversity in companies

- Assessment of gender outcomes in IT-related services

- Benchmarking different company approaches to removing lead and Volatile Organic Compounds (VOCs) from paints

- Equality: affordable internet access

- Equality: bank charges and bottom of the pyramid

- Multinational corporations and their subsidiaries

- Nutrient pollution and ecosystem capacity considerations for consumer companies

2017

2016

- Brasilian corporate governance improvements

- Benefit Corporations

- Financial Inclusion

- Flaws of GDP accounting and alternative approaches in Asia

- IT firms in India – sustainable employment practices

- Labour practices at Asian manufacturers and assemblersLabour practices at Asian manufacturers and assemblers

- Latin American banks’ insurance and fund management businesses

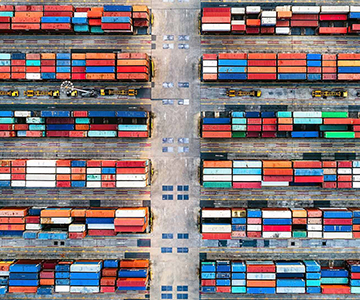

- Retail supply chains

- South Africa – historic instances of poor corporate governance and potential future risks

- Water scarcity as a business risk in GEM

- Asian company political donations and lobbying

- Conservative audit firms in Asia

- Diversity in Corporate Asia

- Emerging Markets healthy food and drinks leaders

- ESG credit assessment of Asian banks

- Fossil fuel dependent capital equipment

- Packaging leaders among emerging markets consumer companies

- Sales practices of Asian pharmaceuticals industry

- Social and environmental best and worst practice amongst leading mining companies

- Tax choices of Asian companies

- US remuneration practices

- US value destruction