Get the right experience for you. Please select your location and investor type.

Global Emerging Markets All Cap

The strategy was launched in 2009. It invests in the shares of between 30-75 companies in emerging markets.

You can see all of the companies that this strategy invests in by filtering on our Portfolio Explorer tool.

- We define investment risk as losing clients’ money – this means we focus on looking after your money as well as growing it

- Companies must contribute to sustainable development and make a positive impact towards a more sustainable future. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Quarterly updates

Strategy update: Q1 2025

Global Emerging Markets All Cap strategy update: 1 January - 31 March 2025

With the threat of US tariffs ever present, many of the challenges emerging markets faced in the final quarter of 2024 carried over into 2025. Share prices in India fell sharply due to concerns about a slowdown in the economy. China, by contrast, performed well as investors anticipated faster economic growth and began to identify value in many parts of the market. This sentiment was also supported by President Xi, who met executives from a number of private-sector companies.

We added eight new names and sold six during the quarter. In China, we sold Glodon (China: Information Technology) and Hangzhou Robam (China: Consumer Discretionary). We sold these companies because we believe the country's property market continues to have an issue with oversupply. Glodon provides software to construction and development companies and the majority of Hangzhou Robam’s appliances are sold to housing developers. These sales also allowed us to reallocate the capital to new investment ideas such as Alibaba (China: Consumer Discretionary), S.F. Holding (China: Industrials) and Mindray (China: Health Care).

Alibaba is one of China’s leading e-commerce platforms. It is using its financial strength to invest in building its artificial intelligence (AI) capabilities. S.F. Holding has grown into one of China’s biggest logistics businesses since its founding in 1992. Mindray is a leading medical company. As trade barriers are thrown up around the world, it has the potential to benefit should there be a shift in China towards buying products made locally.

We also added some new holdings in India while trimming back some others. We sold out of Godrej Consumer Products (India: Consumer Staples) because it was too expensive for the growth it offered. We sold out of Bajaj Housing Finance (India: Financials) and reinvested the cash in Bajaj Holdings & Investment (India: Financials) while also establishing a position in sister company Bajaj Auto (India: Consumer Discretionary), a leading manufacturer of motorcycles, scooters and auto rickshaws.

Other new companies in India included Cholamandalam Financial Holdings (India: Financials) and Triveni Turbines (India: Industrials). Cholamandalam is another business associated with the Muragappa family, who we rate highly. Triveni Turbines is a leading maker of steam turbines.

We also added a position in Walmart de Mexico (‘Walmex’) (Mexico: Consumer Staples). With the market having taken fright from the elections of Claudia Sheinbaum (in April 2024) and then Donald Trump (in November), Walmex share price had fallen sharply. Despite this, we believe it remains a solid, dependable long-term growth story. The final new addition was BDO Unibank (Philippines: Financials) which is the largest bank in the country with a good opportunity to grow in the outlying islands and by developing its digital offering1. We sold Koh Young Technology (South Korea: Information Technology), following a number of disappointments. We also sold Unicharm (Japan: Consumer Staples). While it has pivoted to making adult diapers in response to demographic changes, it has found this shift harder than it had originally envisaged.

While we are broadly positive on the outlook for emerging markets, we recognise that there is likely to be ongoing volatility for as long as worries about trade tariffs and global political tensions remain at elevated levels. Our task is to block out the short-term noise to focus on the underlying quality, growth and leadership of the companies we invest in.

[1] Source: BDO Unibank – Company Profile (as of 31 December 2024).

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

Global Emerging Markets All Cap strategy update: 1 October - 31 December 2024

Through the last quarter of 2024, stock markets had to deal with the re-election of Donald Trump in the United States and all the expected world and political noise that will come over the next four years. At the same time the US dollar currency continued to strengthen. We remain focused on our investment process and investing in high-quality companies. We will continue to seek out long-term growth opportunities regardless of who is the President in the White House.

We added one new position and sold out of two companies through the quarter. We bought Naver (South Korea: Communication Services), the leading internet search engine in South Korea. It was originally part of Samsung SDS before it became a separate company in 1999. It is still managed by the founder, Lee Hae-jin who has recently brought in a new management team which is aiming to return the company to a path of steady and profitable growth. One key aim for them is to use their large and stable search engine client base to drive growth in their e-commerce business. Their e-commerce business, which includes advertising, sales and memberships, is the second largest in South Korea2. We believe that Naver should achieve strong growth in the future and its attractive valuation gave us a good opportunity to invest at this time.

We sold Advanced Energy Solution (Taiwan: Industrials). The company makes battery module units for electric bikes and backup servers and after a tough few years, management announced improvements in demand from artificial intelligence (AI) coming from their server clients. We have tried to have a meeting with company management on a few occasions without success. Given this lack of communication, we find it difficult to build confidence in the company and fully exited the position. We used some of the proceeds from this sale to add to our holdings in Samsung Electronics (South Korea: Information Technology) and AirTAC International (Taiwan: Industrials).

We also sold Kotak Mahindra Bank (India: Financials) during the quarter. Earlier in the year the bank came under increased regulatory scrutiny because of some lapses in IT security and they were forced to pause issuing some credit cards. Since then, we have had several meetings with the company and think they could continue to struggle, especially as competitor public sector banks continue to improve. We believe there are better opportunities elsewhere in India.

We continue to look for high-quality companies which we can buy at reasonable valuations. We believe that valuations in emerging markets are currently very attractive. Additionally, we see numerous long-term growth opportunities that we can support over the next decade. The team is planning many research trips for 2025 to seek out new investment opportunities and update our knowledge of existing holdings. We look forward to sharing more with you as the year progresses.

1 Source: MSCI Index Factsheets as at 31 December 2024. All data USD, total returns.

2 Source: External market research.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2024

Global Emerging Markets All Cap strategy update: 1 July - 30 September 2024

Most of the quarter’s activity happened in September, as is often the case. It is in such moments, like the biggest stock market moves since 2009 in China and Hong Kong and rising geopolitical tensions in the Middle East, that we remain grateful for our long-term philosophy. It gives us the ability to step back in moments of such unpredictable change and reminds us to focus on what we believe are more important, company-focused drivers of change.

Over the course of the quarter, we have sold out of one of our Indian banks. RBL Bank (India: Financials), which we purchased in December 2023. We liked the new management team who seemed determined to move the bank towards less risky (more secured) lending. We also thought the company was attractively valued. Unfortunately, the quarter after we purchased the company, it became clear that unsecured bank loans had been growing at over 30%, and the path to a more balanced loan portfolio would be a lot longer than we had expected. Added to that, we are seeing a few banks that are struggling to grow their deposit base which impacts how they can fund their loan growth. For many years, most people and businesses who deposit their money in banks avoided the public sector banks as they feared they may lose their money. The public sector banks have now improved and professionalised which is great for the Indian saver and borrower but tougher for the private sector banks like RBL who now face tougher competition from the public sector banks. With prospects for RBL looking riskier and with better ideas elsewhere, we exited the position.

We sold Yifeng Pharmacy Chain (China: Consumer Staples) as we were worried about increased regulatory oversight, such as price cuts on drugs purchased through medical insurance plans, having a negative impact on profit margins.

We also fully sold Clicks (South Africa: Consumer Staples), another pharmacy chain. Growth has been phenomenal at this business with new store openings continuing at pace and a mix of available goods and services helping to drive profits. The valuation is expensive and we decided to exit the position to fund better-priced opportunities. We think Clicks remains a very high-quality business.

Finally, we sold Integrated Diagnostics (Egypt: Health Care) to fund better ideas elsewhere.

We did not buy any new companies during the quarter.

We continue to discuss our China company holdings at length, especially considering the recent stock market moves. But another area where we are doing a lot of thinking is Poland. Here we hold Allegro (Poland: Consumer Discretionary), Dino Polska (Poland: Consumer Staples) and Jerónimo Martins (Portugal: Consumer Staples), which is listed in Portugal but >50% of sales are from its Biedronka business in Poland.1 They all experienced strong growth through 2022 and 2023 as food price inflation helped them increase profits but the opposite has now happened. Deflation in food prices and rising costs have reduced profit margins.

As always, we spend most of our time continuing to understand as much as we can about the quality of the management, business franchise and financials of the companies we invest in and also continue to look for new ideas to add to the portfolio.

1 Source: Jerónimo Martins Annual Report 2023

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2024

Global Emerging Markets All Cap strategy update: 1 April - 30 June 2024

We have seen a continuation of geopolitical surprises throughout the quarter which have caused short-term volatility (rapid and unpredictable price fluctuations).

Claudia Sheinbaum was elected the first female President of Mexico with a large victory that her party now holds a two-thirds majority in both congressional houses and means it could make constitutional changes. India completed the largest democratic election in the world with a surprise vote removing Narendra Modi and the Bharatiya Janata Party’s absolute majority in the Lok Sabha (also known as the House of the People and the lower house in the Indian Parliament). The Nifty 50 (top 50 stocks by market capitalisation listed on the National Stock Exchange of India) rose the day before the election on the expectation that Modi would get over 400 seats. It then fell 7% when the news broke that he had lost his absolute majority before rising again in the days afterwards as the market decided Modi staying in power with a reduced majority was a positive for Indian democracy1. It is at times like this that we are thankful for our philosophy and process which focuses on the quality of individual companies over a long period of time.

We sold out of seven companies and only bought one new company in second quarter. We sold Amoy Diagnostics (China: Health Care) after a period of better performance. Whilst we still like the way the business is managed, the high operating profit margins generated in the healthcare sector means we have become worried about the regulatory environment stepping in to reduce those margins. We sold Kingmed Diagnostics (China: Health Care) for the same reason and both Amoy and Kingmed are good examples of where top-down country or sector views can break an investment case.

We also sold Tech Mahindra (India: Information Technology) and Dabur (India: Consumer Staples) having bought into both in 2009. Tech Mahindra (known then as Satyam) and Dabur have delivered good performance since first bought. Whilst we still believe that they are good companies, valuations are becoming problematic. Tech Mahindra has been a great investment over the last ten years but we believe we have a better option for the next ten years in Tata Consultancy Services (India: Information Technology). Tech Mahindra has seen profit margins reduce and it is also expensive. Dabur is a soaps and detergents producer in India which has delivered successful financial results but we expect growth to be lower in the future. Valuations in India remain one of our biggest concerns and we have been trimming back our positions there including Marico (India: Consumer Staples) and Mahindra & Mahindra (India: Consumer Discretionary) due to valuations. We also sold Pigeon (Japan: Consumer Staples) as we lost confidence in the speed and extent of the evolution of the business which is facing rising challenges (headwinds) such as declining birth rates.

Finally we sold out of Banco Bradesco (Brazil: Financials) and Infineon Technologies (Germany: Information Technology). Infineon is a semiconductor designer and manufacturer mainly serving the automotive sector and it is moving into software solutions, but we feel there are better ideas elsewhere. Banco Bradesco was a mistake which we are rectifying by exiting the position. We underestimated the impact of Nubank (a financial technology bank, known as a neobank) on the country’s banking sector and Banco Bradesco is behind in providing more advanced digital banking services. To compete, the company would have to change substantially at a time when Brazil’s economy is looking uncertain.

The only new company we have purchased is MediaTek (Taiwan: Information Technology), a leading fabless (outsources production) design house in Asia. It has a continued focus on quality and even more focus on the affordability of technology, helping to provide innovative solutions to many global development challenges. Barriers to enter the market for competitors are getting higher with faster product cycles and longer design times. The company has access to great designers in Taiwan. The company has steady financials and good management and we aim to hold this company for the long term.

We have been selectively adding to some positions in technology companies at lower prices to continue building a long-term position. We added to Samsung Electronics (South Korea: Information Technology) as we believe it is in the early stages of a memory cycle recovery. We also added to Globant (Argentina: Information Technology) which suffered as IT capital expenditure (capex) was postponed by several customers, but growth has held up better than we expected and we don’t see it as too expensive.

1 Source: Bloomberg

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Proxy voting: Q1 2025

Global Emerging Markets All Cap proxy voting: 1 January - 31 March 2025

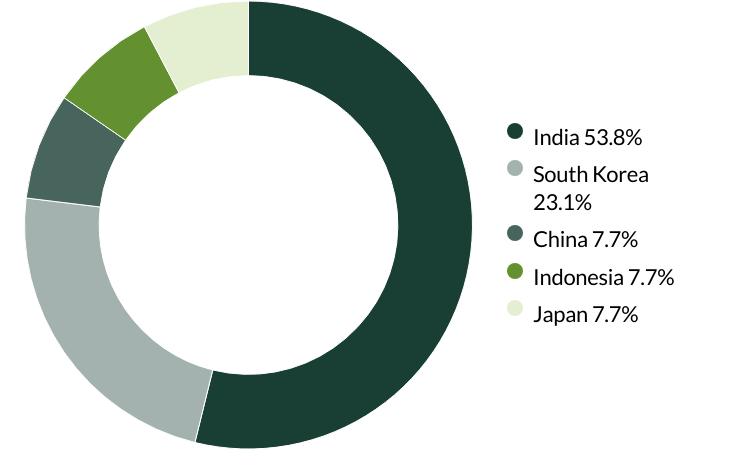

Proxy voting by country of origin

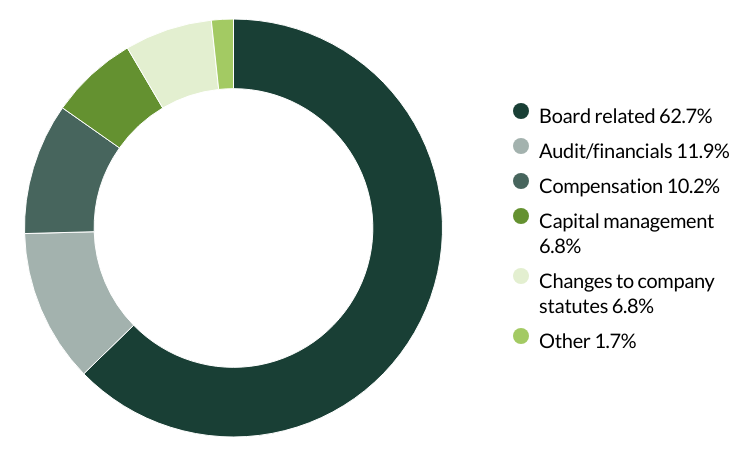

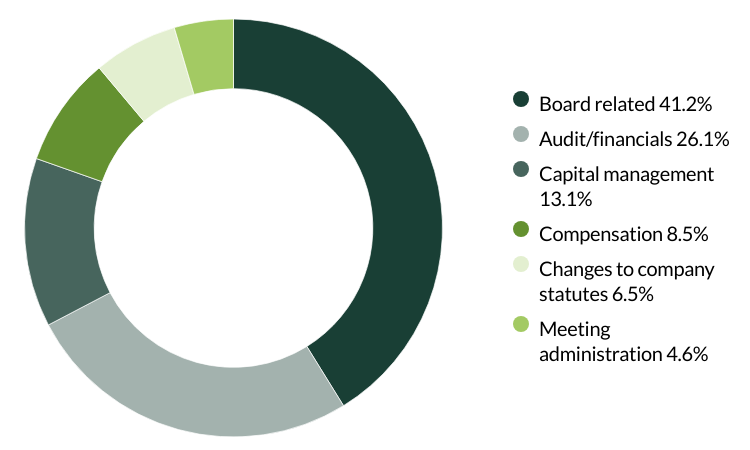

Proxy voting by proposal category

During the quarter there were 59 resolutions from 12 companies to vote on. On behalf of clients, we voted against six resolutions.

We voted against executive remuneration at Bank Central Asia because we believed it was excessive. (one resolution)

We voted against the election of a director and their remuneration at IndiaMART as we seek to encourage greater diversity and independence on the board. (one resolution)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

We voted against the election of the audit committee chair at Unicharm as we do not believe they are independent. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2024

Global Emerging Markets All Cap proxy voting: 1 October - 31 December 2024

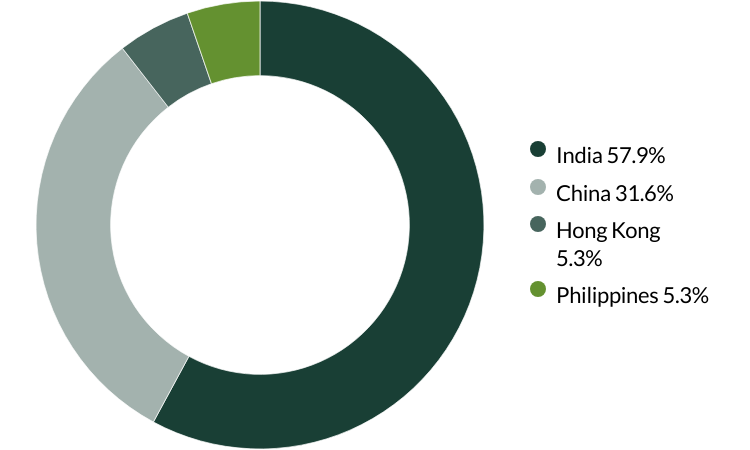

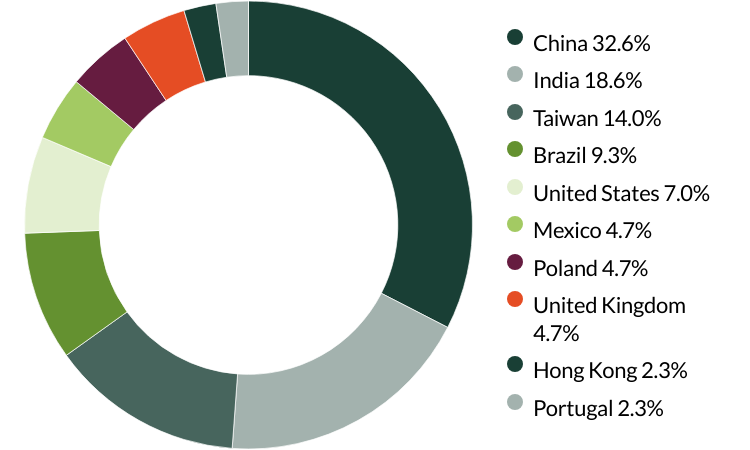

Proxy voting by country of origin

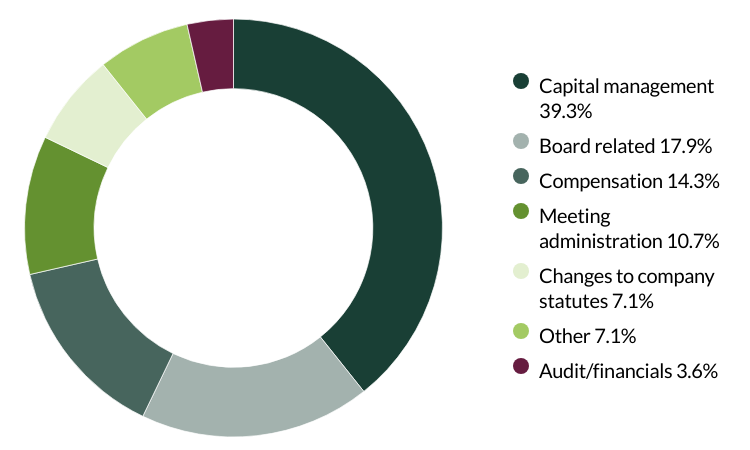

Proxy voting by proposal category

During the quarter there were 28 resolutions from eight companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2024

Global Emerging Markets All Cap proxy voting: 1 July - 30 September 2024

Proxy voting by country of origin

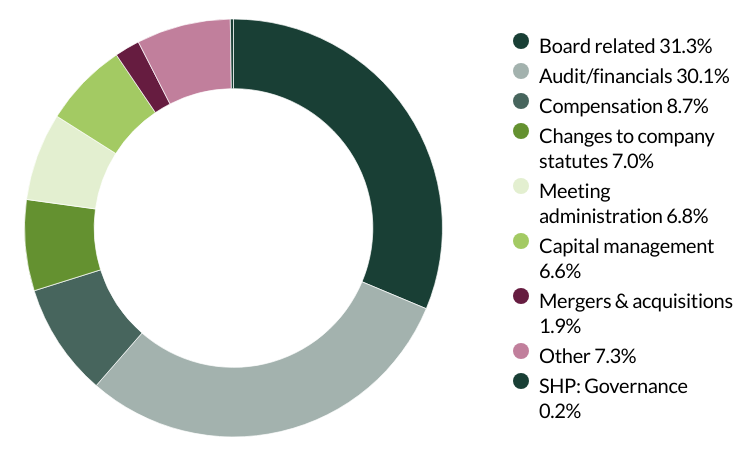

Proxy voting by proposal category

During the quarter there were 153 resolutions from 17 companies to vote on. On behalf of clients, we voted against three resolutions.

We voted against the appointment of the auditor at Philippine Seven as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. We also voted against proposals on transaction of business, as the company did not provide enough information about the proposals. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (two resolutions)

We voted against the appointment of the auditor at Vitasoy as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2024

Global Emerging Markets All Cap proxy voting: 1 April - 30 June 2024

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 412 resolutions from 38 companies to vote on. On behalf of clients, we voted against 14 resolutions.

We abstained from voting on amendments to work systems for independent directors and board meeting procedures at Amoy Diagnostics as the company did not provide enough data on the proposed amendments. (two resolutions)

We voted against the appointment of the auditor at EPAM Systems, Glodon, Yifeng Pharmacy Chain and Zhejiang Supor as they have been in place for over 10 years and the companies’ have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (four resolutions)

We voted against the proposed employee stock ownership plan at Midea as we believe that involving non-executive directors in the plan could create conflicts of interest and would not be in the best interest of the shareholders. (three resolutions)

We abstained from voting on amendments to articles (rules and regulations that govern the company's operations) at Quálitas as the company did not provide sufficient information on the amendments. (one resolution)

We voted against the recasting of votes (where previously cast votes on a particular matter are reconsidered or revised) for the supervisory council at RaiaDrogasil as we believe the principle of recasting votes for an amended slate (a revised list of candidates or nominees for a particular position or role at a company) is poor practice and would prefer the slate to be resubmitted for voting. (one resolution)

We abstained from voting on a series of proposals on capital and shares allocation and board elections and reports at Regional as the company did not provide enough information. (12 resolutions)

We voted against the establishment of a supervisory council and cumulative voting at TOTVS as no detail on the candidates was provided. (two resolutions)

We voted against recasting (where previously cast votes on a particular matter are reconsidered or revised) and cumulative voting at WEG as this would allow the board to make changes without shareholder assessment or knowledge of the candidates. (three resolutions)

We abstained from voting on requests for a separate board election and the election of a supervisory council position at WEG as there was not enough information and we would prefer the current family stewards remain in place. (two resolutions)

We voted against a shareholder proposal about board declassification at EPAM Systems as we do not believe it is necessary for all directors to stand for election annually and have concerns that this could destabilise the board by allowing excessive turnover. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Sustainable investment labels help investors find products that have a specific sustainability goal. This product does not have a UK sustainable investment label as it does not have a non-financial sustainability objective. Its objective is to achieve capital growth over the long-term by following its investment policy and strategy.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, European All Cap Strategy, European (ex UK) All Cap Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 31 March 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Key documents and links

- Factsheet and KIIDS

- Prospectuses

- Application forms

- Download overview

- Download Annual Review 2023 - ICVC

- Download Annual Review 2023 - VCC

- Strategy Climate Report 2021

- The race to zero: Climate Report 2021

- UK Task Force on Climate-related Financial Disclosures (“TCFD”) Public Product report

- SDR Client Facing Disclosure

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Global Emerging Markets All Cap Fund

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.