Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Worldwide All Cap

The strategy was launched in November 2012. It invests in the shares of between 40-60 global companies.

As with all of our strategies, we are interested in finding only the very best businesses; those with high quality management teams, franchises, and financials, that are well positioned to contribute to, and benefit from, sustainable development.

You can see all of the companies that this strategy invests in by filtering on our Portfolio Explorer tool.

- We define investment risk as losing clients’ money – this means we focus on looking after your money as well as growing it

- Companies must contribute to sustainable development and make a positive impact towards a more sustainable future. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Quarterly updates

Strategy update: Q3 2025

Worldwide All Cap strategy update: 1 July - 30 September 2025

On one level, the third quarter saw significant changes at Stewart Investors. After acting as careful stewards of our clients’ capital over many years, three of our colleagues stepped back from their portfolio-management responsibilities in August and left the business.

Nick Edgerton continues to be the lead manager of the Worldwide All Cap strategy. He has been involved in analysing companies and discussing the construction of Stewart Investors’ worldwide strategies since he joined the investment team in 2012. He will continue to apply the same principles to managing this strategy that have guided it since its launch, working as part of the same tight-knit group of investment analysts and drawing on the same common pool of investment ideas.

The artificial intelligence boom: are the risks of disappointment growing?

It has been nearly three years since ChatGPT astonished the world and triggered a wave of investment in the infrastructure needed to support the rollout of artificial intelligence (AI) models. During that time, the share prices of the companies that are paying for much of that infrastructure – such as Microsoft, Meta, Alphabet and Amazon – have risen sharply. Companies who provide the components of the data centres required to train and run the AI models have also enjoyed significant gains. Nvidia has the highest profile of these companies but the past three years have also seen sharp gains for the likes of TSMC, which manufactures advanced semiconductors, and Arista Networks, which makes networking switches.

One consequence of this investment boom is that movements in stock market indices have come to be dominated by the fortunes of fewer and fewer stocks. This has happened before, typically when the excitement surrounding a new technology has sparked an infrastructure boom. A similar thing happened with railways in the nineteenth century and then again with the internet 25 years ago. As investors become increasingly excited about the potential for a new technology to transform corporate profits, they are prepared to pay an increasingly large premium to buy the shares of the companies they believe will benefit from it. As those companies’ share prices rise, they come to represent a larger and larger proportion of stock market indices. In this instance, the market is becoming increasingly dependent on the continuation of the AI boom and the risks of disappointment are growing.

The long-term beneficiaries of today’s AI boom will not necessarily be the companies spending billions building data centres

In the current boom, one risk is that real-world limitations will eventually restrict the number of data centres that can be built. This was highlighted to us by the management teams of some of the companies we met during our recent trip to Texas, one of the states at the centre of the data centre boom.

Another risk is the uncertainty about who will benefit the most from the infrastructure investments being made today. It might not necessarily be the companies that are currently investing billions of dollars in building data centres. During the railway and internet booms, the long-term winners were the businesses that found ways to use the new infrastructure in ways that weren’t fully appreciated at the time it was being built. For example, the profits that companies like Netflix are making today arguably rest on the lossmaking investments that telecoms companies made in laying fibre optic cables during the last technology boom.

We invest in a diverse range of companies that are benefitting from a broad range of long-term trends

How should long-term investors approach the risks, opportunities, and uncertainties being presented by the AI boom? Although we invest in the shares of some companies that are benefitting from the current wave of investment in AI and data centres, we have taken great care not to put all of our eggs in one basket. Our investment philosophy is based on the premise that the best way to deliver long-term returns to our clients is to invest in a blend of companies meeting a broad range of unmet needs.

We established two new positions during the quarter.

Bajaj Holdings & Investment (India: Financials) acts as the holding company for the Bajaj family’s investments in auto makers and financial businesses. The underlying companies in which it invests are leaders in their sectors and are helping to meet India’s needs for finance, housing, mobility, and cleaner transportation. As such, we believe they have many years of growth ahead of them.

The second new addition is Spirax Group (United Kingdom: Industrials). We have invested in this company before but sold our position because its end markets appeared to be shrinking at a time when its valuation left little room for error. Over the past 18 months, however, the company’s shares have become more reasonably valued, excess inventory is showing signs of being cleared, and demand in Spirax’s end markets is growing again. Together, we believe this points to healthy long-term returns for its shareholders.

Elsewhere, we topped up our existing position in cybersecurity specialist Fortinet (United States: Information Technology). Its share price fell in August when it signalled that the short-term boost to sales from upgrading its customers’ firewalls could tail off sooner than investors had realised. The company responded to the fall by signalling it would buy back more of its shares. This suggests that it thinks the weakness in its share price represents a great buying opportunity.

We funded these purchases by selling holdings in four companies. We have owned shares in HDFC Bank (India: Financials) for several years and it has delivered strong returns in that time. However, because this strategy has the flexibility to invest in companies with lower market capitalisations, it can take advantage of opportunities to invest in younger, smaller companies when they arise. This includes Bajaj Holdings & Investment, where we believe the balance between risk and potential reward is more attractive.

We sold Roche (Switzerland: Health Care) due to increased risks and uncertainty faced by pharmaceutical companies as the United States reinvents its policies on drug pricing and healthcare. To manage the strategy’s exposure to companies that rely on continued rapid growth in demand for semiconductors, we sold TSMC (Taiwan: Information Technology). For the same reason, we also reduced our position in Samsung Electronics (South Korea: Information Technology). We sold our position in Spectris (United Kingdom: Information Technology) having benefitted from a rise in its share price after a private equity firm made an offer to buy it.

We focus on delivering returns over the long term, rather than taking risks to pursue short-term gains

Fear of missing out – ‘FOMO’ – is not confined to the young; it is a natural human instinct. We are conscious that our style of investing, which is designed to deliver returns over the long term (a decade or longer) and to minimise losses, has not kept pace with returns from global indices over the short term. We don’t believe that means our philosophy of investing in high-quality companies for extended periods of time has suddenly ceased to work. At a time of change in markets, trade and geopolitics, our underlying approach remains consistent: we continue to focus on generating attractive returns over the long term rather than attempting to keep pace with the wider market through every short-term period. We look forward to demonstrating this over the years and decades to come.

Case Study: Arista Networks

Listing: New York Stock Exchange

Market cap: USD183 billion1

Held since: 2020

Company description

Arista Networks’ software and hardware connects networks, data centres and cloud-computing nodes.

Investment rationale

Arista was founded in 2004 by three engineers who recognised that the market for networking switches was dominated by sleepy incumbents churning out predictable products with minimal upgrades. They set out to disrupt this industry by creating high-performance, low-latency ethernet switches specifically designed for cloud computing and data centres. Having experienced firsthand how Cisco Systems operated, they knew that they could create a company that did things differently in its focus on innovation, in its operating model, and in its culture.

At the time of its launch in 2010, the company’s first product had five times the throughput of its closest competitor.2 It then enhanced its lead by pursuing a programme of innovation and improvement, made possible by investing heavily in research and development.

Two early decisions taken by the company’s founders provided a platform for its subsequent growth. The first was to integrate a proprietary operating system, Arista EOS, into its hardware. This allows its customers to see what is happening across their networks in a single image and to fix issues seamlessly and with minimal network downtime. Arista built that software using open-source (Linux) code, allowing new best-of-breed software to be incorporated as it becomes available.

Their second key decision was to use microchips made by third parties rather than developing their own. By using off-the-shelf components and outsourcing manufacturing to local fulfilment centres, Arista can keep costs down, bring new innovations to market quickly, and benefit from industry-wide improvements in chip size, power usage and computing capacity.

Although two of the company’s three founders remain involved today, they made an early decision to hire a chief executive to run it. Jayshree Ullal joined in 2008, two years before Arista’s first product launch and six years before its IPO (initial public offering). She has been the key to establishing and nurturing its culture of customer focus, innovation, frugality, and flat hierarchies. This combination of a longstanding chief executive supported by the company’s founders has created an ownership mentality that has cascaded through the workforce, helped by its flat structure and lean workforce. Employees are accountable and empowered to openly address and fix problems.

One part of that culture is a refusal to sacrifice quality for speed; Arista will not ship a new product until its engineers are happy that it will operate as expected. This maintains its reputation for reliability, helps it to win repeat business, and supports its long-term partnerships with its two largest customers, Microsoft and Meta, who together account for approximately a third of its revenues.3 And although that means it faces a degree of concentration risk, it also makes it a direct beneficiary of the investments these companies are making in building artificial intelligence (AI) data centres.

Arista is taking steps to mitigate that concentration risk by diversifying its customer base within the US, which currently accounts for approximately three quarters of its revenues, as well as by expanding overseas.4 For example, it recently launched a ‘Make in India’ initiative, through which it is investing in local manufacturing, developing skills, and building centres of excellence in ‘AI for networking’ across the country.

Arista’s strong cash-flow generation, its high profit margins and low debts give it the financial firepower to continue investing in research and development while also acquiring companies to benefit from their technology and engineering expertise. This continual reinvestment in innovation should help it to stay ahead of the pack while exploiting the significant areas of potential growth in front of it.

What could go wrong? / Risks

The clearest risk is posed by customer concentration; any difficulties in Arista’s relationships with either Microsoft or Meta could lead to a fall in its revenues and potential reputational issues. Ongoing price deflation, meanwhile, means that it must innovate continually – and run harder – to increase sales and profits. Finally, there is always the risk that an acquisition goes badly, affecting the company’s culture and causing it to lose its leadership in innovation.

[1] Source: FactSet as at 1 October 2025.

[2] Source: Arista: Arista 7500 - Sets New Standard for 10 Gigabit Ethernet Networking https://www.arista.com/en/company/news/press-release/280-pr-20100419-01.

[3] Source: Arista Networks 10-Q 6 August 2025.

[4] Source: FactSet as of 1 October 2025.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2025

Worldwide All Cap strategy update: 1 April - 30 June 2025

Draw a circle around Asia on a world map and it would look relatively small in comparison to the rest of the globe. That circle, however, would contain more than four billion people – roughly half of the world’s population. In addition to China and India, it also contains Taiwan, one of the world’s most technologically advanced economies, the dynamic economy of the Philippines and Indonesia, the world’s fourth most populous nation1.

Despite that, returns from companies in the United States tend to play a dominant role in driving returns from global market indices and, as such, the US is a key area of focus for many investors. At Stewart Investors, however, we start by looking at companies first, rather than at the index. Our heritage of investing in Asian and emerging markets means we can pay full attention to companies in countries with healthy domestic markets and abundant growth opportunities. One advantage of thinking in genuinely global terms is that we can find diversified sources of growth that are less dependent on the actions of any one politician or on the economic fortunes of a single country. We simply look for what we believe to be the highest quality companies in the world and seek to hold them for the long term.

We added five new holdings over the quarter. Ayala (Philippines: Industrials) can trace its history back to 1834. Over the past two centuries, it has expanded across a range of industries including real estate, banking and finance, telecoms, energy, and infrastructure. These businesses all benefit from the long-term growth of the Philippines but Ayala is also finding new growth opportunities in areas such as renewable energy, health, and logistics. The founding family still provides guidance, stewardship and a long-term perspective.

RaiaDrogasil (Brazil: Consumer Staples) is Latin America’s largest chain of drugstores, operating over 3,000 pharmacies across all 27 Brazilian states2. Thanks to its size, it enjoys significant cost advantages. It passes the resulting savings onto its customers, allowing it both to increase access to medicines and to win more customers.

Glodon (China: Information Technology) specialises in providing digital solutions to the construction industry. Its founder retains a substantial share of the business he started in 1998 and he continues to advise on its strategic development. Glodon has a long-term approach to decision-making that has seen it continually reinvesting profits it makes today in improving and growing its business. We believe Glodon is poised to benefit from two underlying trends: China’s construction companies are trying to make more efficient use of resources and they are increasingly adopting 3D design software.

Indutrade (Sweden: Industrials) specialises in buying and then developing technology and industrial companies. The group consists of over 200 underlying businesses spread across engineering, infrastructure, life sciences, energy and water, and technology. It reinvests the profits it makes today in acquiring new companies, providing a powerful driver for long-term growth.

Techtronic Industries (Hong Kong: Industrials) is a global leader in cordless technology for power tools, outdoor equipment, and floorcare products, which it sells under internationally recognised brands such as Hoover, Ryobi and Milwaukee. Techtronic is also playing a useful role in moving users away from fossil fuels and towards more energy-efficient tools.

To fund these purchases, we sold our holdings in Texas Instruments (United States: Information Technology), KLA (United States: Information Technology) and Hoya (Japan: Health Care) in view of the potential impact that a global trade war could have on their sales. We also reduced our position in TSMC (Taiwan: Information Technology).

We sold Nemetschek (Germany: Information Technology), partly because its shares are not as attractively priced as they once were and partly because we could see more compelling investment opportunities elsewhere. Finally, we sold Rentokil Initial (United Kingdom: Industrials) following a change of chief executive and in recognition of the challenges it faces in integrating US pest-control business Terminix.

Uncertainty around trade tariffs and associated worries about inflation remain a headache for many companies, particularly in the US. Despite this, we are still able to find opportunities to invest in companies that are growing and resilient. Our goal is to seize those opportunities wherever they arise.

[1] Source: International Monetary Fund - World Economic Outlook (April 2025).

[2] Source: RaiaDrogasil Q4 2024 Presentation.

Case Study: Diploma

Listing: London Stock Exchange

Market cap: GBP6.5 billion1

Held since: June 2020

Company description

While based in the UK, Diploma is an international group of businesses supplying specialised technical products and services across three core segments: controls, seals, and life sciences. With operations in over 30 countries and more than 3,000 employees, Diploma plays a critical role in supporting a range of industries, from healthcare and environmental technologies through to aerospace and industrial manufacturing2.

Investment rationale

As supply chains worldwide come under increasing pressure, Diploma has made itself useful by supplying essential components and consumables. These are often critical to the functioning of its customers’ operations but typically represent only a small portion of their total costs. This means Diploma’s products are deeply embedded in its customers’ workflows and demand for them tends to be robust. Its global footprint is extensive, with strong presences in North America, Europe, and Australasia. This reach is complemented by deep local expertise and technical support, which help to build customer loyalty and win sales.

Its portfolio is diversified across three areas:

- Seals: supplying sealing solutions for the heavy machinery used in the construction, mining, and energy sectors.

- Controls: providing connectors, fasteners, and control devices for applications in aerospace, defence, and the medical field.

- Life sciences: delivering medical devices and consumables to healthcare providers and laboratories, supporting diagnoses and treatment.

By empowering its operating units to make their own decisions, Diploma fosters entrepreneurial spirit and accountability and allows them to respond quickly to the needs of their customers. At the same time, it takes a patient approach, giving businesses across the group time and financial support they need to grow. Under the leadership of CEO Johnny Thompson, who took the helm in 2019, and CFO Chris Davies, who joined in 2022, Diploma has delivered impressive results. Since 2019, its sales have more than doubled, while its profits have tripled3.

In making acquisitions, it looks for complementary businesses that can enhance its existing capabilities, strengthen its technical expertise, deepen its customer relationships and so accelerate its growth.

The company’s sustainability framework, Delivering Value Responsibly, places a strong emphasis on talent and culture, viewing both as essential. A clear sense of identity and its disciplined approach to growth are reinforced by a thoughtful remuneration structure that aligns incentives with long-term performance.

What could go wrong? / Risks

The main risks facing Diploma include problems acquiring and then integrating good businesses. Some parts of its business, meanwhile, sell into industries that are sensitive to wider economic conditions. This could mean growth in its profits would slow in the event of a downturn.

[1] Source: S&P Capital IQ as of 30 June 2025.

[2] Source: Diploma Annual Report 2024.

[3] Source: S&P Capital IQ as of 30 June 2025.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q1 2025

Worldwide All Cap strategy update: 1 January - 31 March 2025

“Only two things make up a railroad: a track and a locomotive.” Amid the constant news about tariffs, trade wars and global political realignment, this recent comment – by the chief financial officer (CFO) of one of our companies – provided a timely reminder that things are sometimes simple. It also underscored why we are glad that our focus is on seeking to understand individual companies rather than trying to predict global events. Through all the noise of the first quarter of 2025, we focused on finding companies with experience in navigating unpredictable political and economic conditions and who keep their eyes firmly fixed on their long-term goals.

We added four new holdings over the quarter. The first, Cintas (United States: Industrials), began its life in 1929, just as the Great Depression began, by collecting old rags from factories, washing them and then selling them on. Since then, it has grown to become a leading provider of corporate uniforms and related business services, specialising in uniform rental, workplace cleaning and first aid and safety products. It combines the benefits of being a large-scale company with a local presence to provide value and excellent service to its customers across the United States.

Mahindra & Mahindra (India: Consumer Discretionary) is a company in which our Asian funds have been long-term investors. We believe it has plenty of room to grow by: taking advantage of its dominance in the agricultural sector to expand its tractor business; benefitting from the increasing demand for electric vehicles; diversifying its financial offerings to capture the growth of India’s middle-class population; and reinvesting in new businesses to help their international expansion.

BDO Unibank (Philippines: Financials) is the largest bank in the Philippines, with excellent growth opportunities. Financial inclusion in the Philippines remains low and the bank is expanding its digital services to reach people with little or no banking access. It benefits from being part of the larger SM Group and from its large branch network, through which it offers a variety of financial services. We believe BDO Unibank is attractively valued, particularly if we consider this alongside the strong economic growth potential of the Philippines and the opportunities it has to expand.

Finally, Air Liquide (France: Materials) is a global leader in supplying gases, technology and services to companies across a wide range of sectors including healthcare, chemicals, manufacturing, electronics and food and beverages. It operates in a market with few competitors and its long-term contracts linked to inflation should help cushion it from any sharp movements in the wider economy. The increasing use of hydrogen gas also gives it an opportunity to grow.

To fund these purchases, we sold our holdings in six companies during the quarter. In the case of three – Nordson (United States: Industrials), MonotaRO (Japan: Industrials) and Zebra Technologies (United States: Information Technology) – they had performed well but we began to have concerns over their future growth. We also sold Tata Communications (India: Communication Services) after reassessing the balance between risk and opportunity.

Lastly, we sold the remainder of our holdings in two health-related companies: CSL (Australia: Health Care) and Novonesis (Denmark: Materials). Both had been excellent performers for us but a combination of high valuations and lower growth expectations led us to look for better ideas elsewhere.

We continue to find opportunities to invest in the shares of reasonably valued companies from around the world that we believe can (profitably) help to solve a range of development challenges. Our focus on individual companies allows us to capture those opportunities wherever they arise. At a time of rapid economic and political change, we continue to apply our investment philosophy consistently and to focus on the things that we believe matter over our investment timeframe. As for what comes next? Another comment from the CFO we quoted earlier sums up our view: “there’s only one way to go in rail, and that’s forward!”

Case Study: Halma

Listing: London Stock Exchange

Market cap: GBP10 billion1

Held in fund since: March 2020

Company description

Halma is a global group of companies who develop innovative safety, health and environmental technologies aimed at enhancing quality of life and protecting people and the planet. Its stated purpose is “to grow a safer, cleaner, healthier future for everyone, every day.”

Why do we like it? / Investment rationale

In a world in which the importance of health and safety is rightly receiving increased attention, a relatively unknown UK engineering company has been quietly innovating and saving lives for more than 50 years. It has also consistently reinvested cashflows and generated compound returns for its shareholders. Since its foundation in 1972 by David Barber and Mike Arthur, Halma has combined strategic long-term vision with underlying purpose – a combination that still holds true today.

From its early years, Halma has focused on developing innovative safety solutions for industry. Not only has it gained a reputation for quality and reliability, it has also developed a distinctive business model along the way. Key to that business model is the acquisition of niche companies. Halma is a disciplined buyer, targeting well-run small-to-medium-sized companies whose technologies are helping solve some of the world’s most pressing challenges and keeping people safer, cleaner and healthier. Over 50 years on from its founding, Halma consists of nearly 50 companies and employs over 8000 people in over 20 countries.2

- In safety… businesses include Firetrace, which automatically detects and suppresses fires in high-risk equipment.

- In environmental analysis… businesses include Deep Trekker, whose cutting-edge underwater robotics make maintaining offshore wind farms easier.

- In healthcare… businesses include PeriGen, which monitors more than 600,000 births a year, tracking foetal heart rate and labour progression to provide early warnings if things start going wrong. According to the WHO, over 800 women and one million newborns die each year due to preventable causes during pregnancy and childbirth3. After the PeriGen technology was introduced into a regional hospital in central Africa, the mortality rate was reduced by more than 80%.4

By supporting the management of the businesses it acquires and allowing a brand to grow even after the original founder steps away, Halma has steadily built a reputation as a ‘good owner’. This has helped make it the preferred buyer for many founders. This, in turn, has supported Halma’s organic growth and given its shareholders access to the cashflows of businesses that would otherwise have remained in private hands.

Halma’s focus is on growing the market and providing value to its customers by acquiring niche companies, rather than trying to take market share from competitors. Using its internal cashflows to buy companies in areas in which it is already an expert, reduces risk and increases the chances of generating enduring returns. Over the past 20 years, it has grown its cashflows by 12% per annum and its earnings per share by 13% per annum5, as it continues to make good on its long-term vision.

With future growth supported by structural developments such as growing safety regulation, increasing demand for healthcare and clean water and efforts to address climate change and pollution, we see no reason why Halma’s growth can’t continue for at least another 50 years.

What could go wrong? / Risks

The chief risks facing Halma include the levels of debt on its balance sheet, a degradation of its ability to acquire good companies and the potential for product-related failures.

[1] Source: S&P Capital IQ as of 31 March 2025.

[2] https://www.halma.com/who-we-are

[3] https://www.who.int/news-room/fact-sheets/detail/maternal-mortality

[4] https://www.halma.com/our-impact/protecting-mothers-and-babies-during-childbirth

[5] Halma annual accounts between March 2004 and March 2024 as reported by FactSet.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

Worldwide All Cap strategy update: 1 October - 31 December 2024

“We are allocating our own money, we act like owners.”1 It’s always pleasing to meet with a company that thinks similarly to us. We are stewards of our clients’ capital, aiming to look after our clients’ savings as well as we would look after our own. Our Hippocratic Oath is is our pledge as an investment team to uphold the principle of stewardship through our conduct and work practices. One key point in the oath is “We will not forget in our search for returns that the primary risk faced by our clients is losing their capital”. The oath underpins our investment philosophy, which is based on identifying quality leaders and stewards of strong business franchises with good long-term growth prospects.

During the quarter we bought six new companies and the quote above is from a meeting with the company management of the first of them. Brown & Brown (United States: Financials) was founded in 1939 and is still led and stewarded by the Brown family. Over the past 85 years, the competent, ambitious and long-term management team has enabled it to grow beyond its Florida base to become the sixth largest insurance broker2 in the United States. The company has also been expanding to Asia and Europe and as the insurance brokerage industry is made up of many small companies, there is plenty more room to grow in the decades ahead.

Mining equipment manufacturer, Epiroc (Sweden: Industrials), started life over 150 years ago as part of another Swedish company, Atlas Copco. Epiroc then became a separate company in 2018. Their equipment makes it easier and safer to mine the metals that are essential for the functioning of modern society, including the transition to cleaner and renewable energy. The company has a management team with many years of experience, led by Chief Executive Officer Helena Hedblom. They have delivered good levels of growth over the years and have also positioned the company well for the future.

Nexans (France: Industrials) makes cables for a variety of uses including buildings and energy grids. The need for electrification creates a strong growth opportunity as more cables are needed to connect different energy sources as well as upgrading existing power grids. We have watched Nexans for some time and took the opportunity of an attractive valuation to buy the company during quarter.

Wabtec (United States: Industrials) is a leading provider of components for rail transportation and can trace its roots back over 100 years. The rail industry is as important now as it was then, as it plays a crucial role in reducing global carbon emissions in both commercial freight and passenger transportation. Rising investment in rail infrastructure along with Wabtec’s increasing position size in the market and improving profits provide positive long-term opportunities for growth.

KLA Corporation (United States: Information Technology) make inspection tools for the semiconductor industry. These help semiconductor chip manufacturers control their processes, maximise their output of finished chips and reduce waste. Due to their essential position in the semiconductor manufacturing process, KLA have been able to deliver good financial returns and consistent growth over many years.

Haleon (United Kingdom: Consumer Staples) was formed by a merger of the consumer health divisions of GlaxoSmithKline, Novartis and Pfizer in 2022. The company has well-known brand names such as Advil (pain relief), Sensodyne (toothpaste) and Centrum (vitamins). Providing necessary products to customers is a business model that we always appreciate. These types of businesses have the ability to produce consistent income levels and defend well during slower market conditions. With healthy profits margins and a strong market position, we believe Haleon is a good quality company to own.

The new positions were funded by selling five companies where we have concerns about the strength of their business franchises.

Tecan (Switzerland: Health Care) and Sartorius (Germany: Health Care) have both struggled over the past few years due to a slowdown in investment into biotechnology. Despite seeing positive growth in other areas of healthcare, these two companies are still struggling, from lack of visibility in customer orders, exposure to China and increasing competition.

We sold our position in Unicharm (Japan: Consumer Staples) as we lack confidence in the size of the growth opportunity in Asian consumer markets. We also sold Shimano (Japan: Consumer Discretionary) as we have concerns that their valuation will be impacted by increased competition from electric bikes. Finally, we sold A. O. Smith (United States: Industrials) as its growth potential in its core markets of the United States and China faces persistent challenges.

The US election took place in November, sending Donald Trump back to the White House along with a Republican Party majority in the House of Representatives and the Senate. There have been many news stories written about taxes, tariffs and other general speculation about what the incoming administration might do. We don’t have any insights into the workings of a Trump presidency, instead, we focus on finding companies that are good at navigating difficult situations and experienced at generating growth from the opportunities in front of them. Another point of our Hippocratic Oath is, “We will strive to achieve, through hard work, sober analysis and sound judgement, the best risk-adjusted returns possible for our clients.” This focus means we will continue to seek companies like, Brown & Brown, who we believe will be excellent stewards of our clients’ savings.

1 Source: Stewart Investors company meeting with Brown & Brown, February 2024.

2 Source: Brown & Brown website - https://www.bbrown.com/us/about/

Case Study: WEG

Listing: Brasil Bolsa Balcão

Market cap: US$37bn1

Held in fund since: November 2012

Company description

WEG manufactures electrical products, including energy efficient motors, transformers, turbines and generators. They have production facilities in 17 countries and produce around 19 million motors every year.2

Why do we like it? / Investment rationale

In 1961, a young electrician, mechanic and administrator founded the electric motor company to which they lent their initials: Werner Ricardo Voigt, Eggon João da Silva and Geraldo Werninghaus.

Today, WEG produces electrical products, including motors, for customer markets from industrial automation and power generation and distribution to large electric vehicles. The second generation of the three founding families are majority shareholders and the company is run by an experienced management team. The new Chief Executive Officer, Alberto Yoshikazu Kuba, is only the fourth in WEG’s history. He joined the business in 2002, aged 24 and demonstrates how much of WEG’s success comes from a culture built over 65 years.

WEG is a vertically integrated company. This means that they make every element of every product themselves, and even source packaging from their own forest. This helps them supply customers with more customised, hard-to-replace motors. Although it is less efficient than outsourcing and slows the rate that they can expand capacity, it provides a crucial advantage for WEG: it enables them to capture a larger share of the market when competitors are blocked by supply chain disruptions. WEG’s self-sufficiency is helping them supply transformers to data centres which require large amounts of electricity, while competitors face long delays building additional capacity.3

Doing more with less, under their own steam, is key to what WEG do. Vertical integration also makes WEG more efficient in their operations by helping to limit production waste. In Brazil, WEG collect and recycle older motors at the end of their life. They recycle the motors and the production scrap metal. WEG’s motors also help customers reduce their energy requirements and reduce their greenhouse gas emissions. One example of where they are used for a sustainability solution is the Kaleshwaram Lift Irrigation Project which helps address water shortages in India. WEG’s motors will help move 240 thousand million cubic feet of water over 500 kilometres into northern India.4 This amount is greater than the volume of Lake Michigan, one of the Great Lakes in North America.

WEG's strong focus on excellent operational processes helps it deliver steady profit levels, even with some ups and downs in sales growth. The company has a healthy cash balance, which allows it to buy raw materials when supply chains are strained and to grow by buying new companies in their international business. We are excited to see where WEG’s cautious approach and ongoing innovation take the company in the future.

What could go wrong? / Risks

Risks facing WEG include raw material prices, competition from Chinese and Indian manufacturers, and customer markets which are sensitive to economic cycles.

[1] As of 7.1.25.

[2] 2023 integrated report - https://api.mziq.com/mzfilemanager/v2/d/50c1bd3e-8ac6-42d9-884f-b9d69f690602/b96ceffc-95bf-5115-8eec-72fbc563ea72?origin=1. Production facilities as of 31.12.23; WEG in Numbers | WEG.

[3] World’s largest transformer maker warns of supply crunch’; Financial Times article, 3.11.24.

[4] WEG supply for Kaleshwaram irrigation project. 240 thousand cubic feet = 1.63 cubic miles. Lake Michigan is 1,180 cubic miles by volume: Lake Michigan: How Big Is It? - The Environmental Literacy Council.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Voting

Proxy voting: Q3 2025

Worldwide All Cap voting: 1 July - 30 September 2025

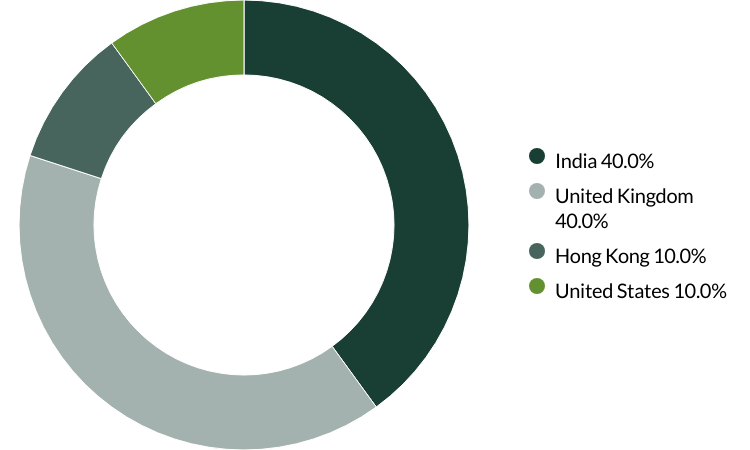

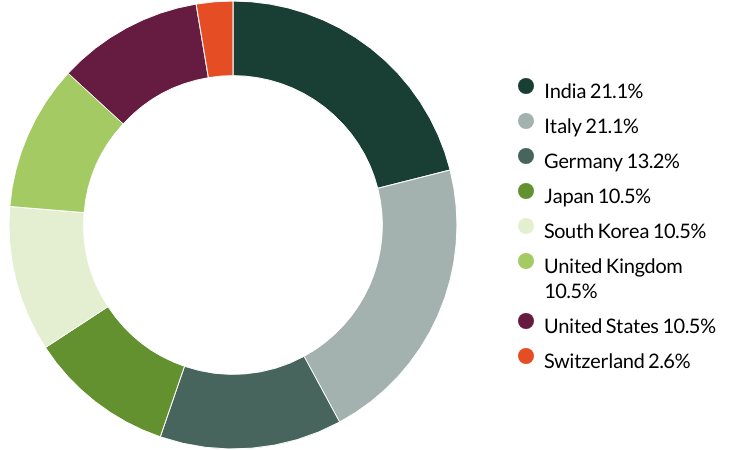

Voting by country of origin

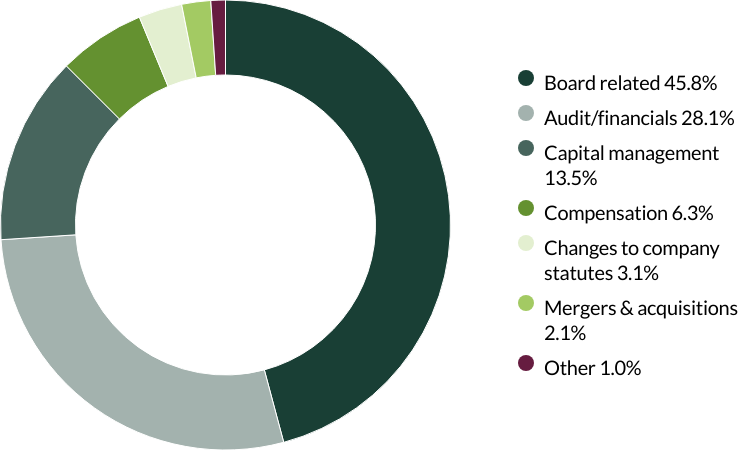

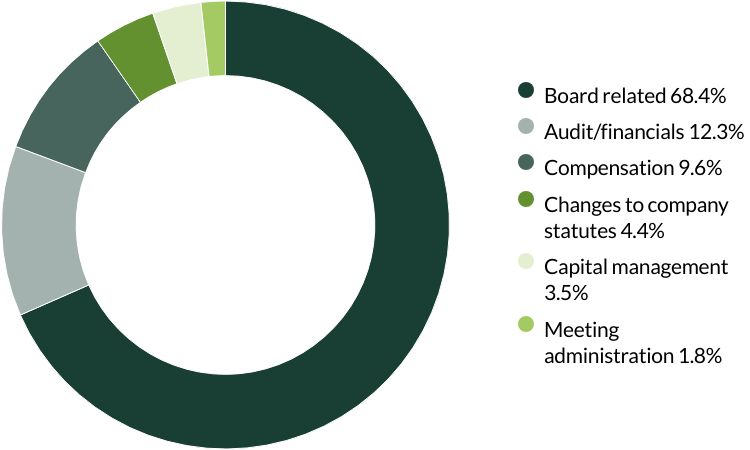

Voting by proposal category

During the quarter there were 96 proposals from eight companies to vote on. On behalf of our clients, we voted against two proposals.

We voted against the appointment of the auditor at Advanced Drainage Systems and Vitasoy, as they have been in place for over ten years. The companies have given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (two proposals)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2025

Worldwide All Cap voting: 1 April - 30 June 2025

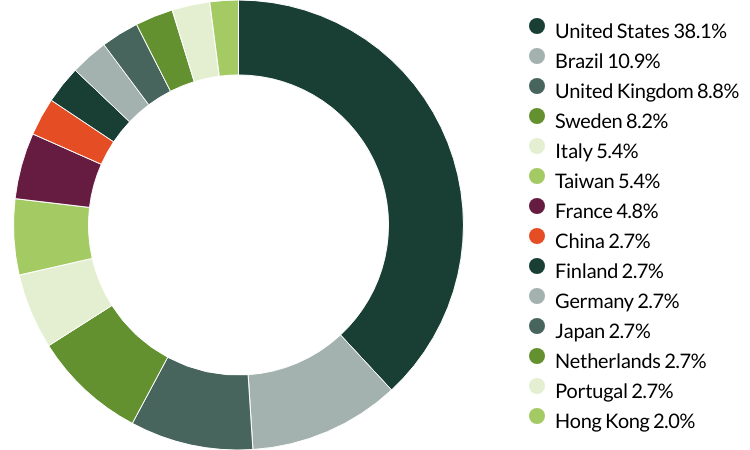

Voting by country of origin

Voting by proposal category

During the quarter there were 546 proposals from 35 companies to vote on. On behalf of our clients, we voted against 20 proposals and abstained from voting on four proposals.

We voted against the appointment of the auditor at Arista Networks, Brown & Brown, Edwards Lifesciences, Fortinet, Glodon, Markel, Roper Technologies, Texas Instruments, Veeva Systems and Westinghouse Air Brake Technologies Corporation (Wabtec) as they have been in place for over 10 years. The companies have given no information on rotating their auditors, a practice we believe is important to ensure a fresh perspective is brought to their accounts. (10 proposals)

We voted against changing the terms of the board at EPAM Systems as the proposed changes would require all directors to stand for election annually instead of on staggered terms. While we understand the rationale for annual elections, we believe that a staggered approach provides continuity and helps prevent excessive turnover. We also voted against changes to limit the liability of certain officers, as we believe the company has demonstrated its ability to attract and retain an admirable management team under the current structure, which encourages managers to think and act as long-term owners. Finally, we voted against the appointment of the auditor as they have been in place for over 10 years. The company has given no information on rotating its auditor, something we believe is important to ensure a fresh perspective on their accounts. (three proposals)

We voted against the election of an employee shareholder representative at Nexans. With two candidates standing for election, we chose to support the candidate who was elected by employees who are registered shareholders and was also the board's preferred candidate, due to their international experience as a corporate officer. (one proposal)

We voted against the recasting of votes (the ability for voters to change their original votes on a particular matter in response to new information or changes to a proposal) for directors and the supervisory council at RaiaDrogasil. We believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. (two proposals)

We abstained from voting on proposals at Rentokil Initial that would grant the company the authority to issue shares as it did not disclose the reasons for the issuance. Without clearer information regarding the potential capacity expansion and/or acquisition for which this issuance is intended, it is difficult for investors to assess the potential value creation and strategic fit of such an investment. (three proposals)

We voted against the recasting of votes for the supervisory council at WEG as we believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. We also abstained from voting on a request for a separate board election and the election of a supervisory council position. According to Brazilian voting practices, we are unable to vote for this proposal while simultaneously supporting the board in its candidate elections. (two proposals)

We voted against a shareholder proposal regarding simple majority voting at EPAM Systems as this topic was already covered by the company's own proposal, which we supported. (one proposal)

We voted against a shareholder proposal requesting that an independent director serve as chair of the board at Fortinet. We continue to support the current CEO and chair of the board. (one proposal)

We voted against a shareholder proposal regarding simple majority voting at Markel as we support the stewards of the company. (one proposal)

We supported a shareholder proposal regarding greenhouse gas (GHG) emissions disclosure at Markel to encourage improved transparency and better disclosure of relevant emissions data. (one proposal)

We supported a shareholder proposal regarding the right to call a special meeting at Texas Instruments as we believe that a stock ownership threshold of 10% to call a meeting is appropriate, considering the company’s size and shareholder base. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q1 2025

Worldwide All Cap proxy voting: 1 January - 31 March 2025

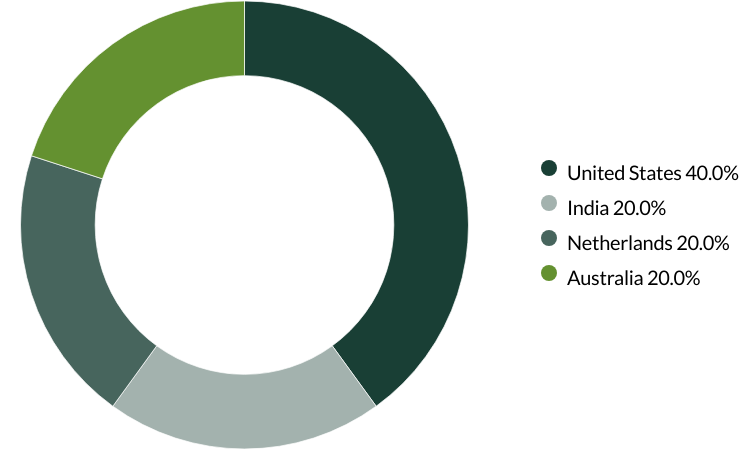

Proxy voting by country of origin

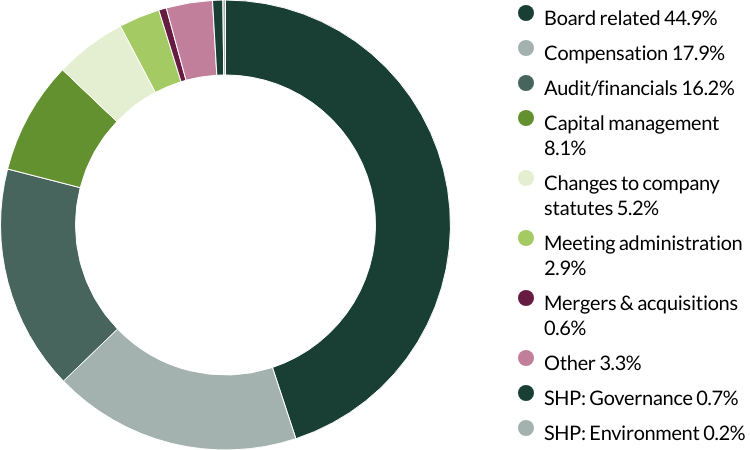

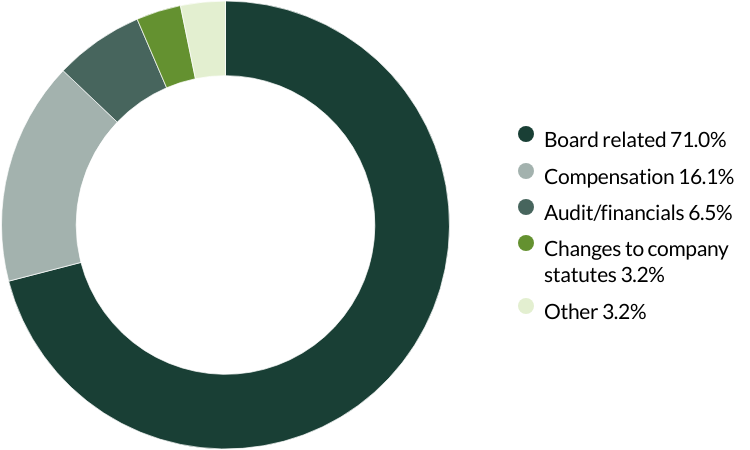

Proxy voting by proposal category

During the quarter there were 114 resolutions from eight companies to vote on. On behalf of clients, we voted against eight resolutions.

We voted against the remuneration policy at Diploma as we believe the increase in short-term (annual) bonus incentive does not encourage long term decision making. (one resolution)

We voted against executive remuneration and the remuneration report at Roche as we believe amounts paid to executives is high and lacks key metrics to determine and/or justify the amounts. We voted against a proposal on transaction of business as the company did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (four resolutions)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2024

Worldwide All Cap proxy voting: 1 October - 31 December 2024

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 31 resolutions from five companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Sustainable investment labels help investors find products that have a specific sustainability goal. This product does not have a UK sustainable investment label as it does not have a non-financial sustainability objective. Its objective is to achieve capital growth over the long-term by following its investment policy and strategy.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 September 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Key documents

- Factsheets and KIIDs

- Prospectuses

- Application forms

- Strategy Annual Review 2024 - ICVC

- Strategy Annual Review 2024 - VCC

- Strategy Climate Report 2021

- The race to zero: Climate Report 2021

- UK Task Force on Climate-related Financial Disclosures (“TCFD”) Public Product report

- SDR Client Facing Document

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Worldwide All Cap (UK OEIC)

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Worldwide All Cap Class A (Acc) | OEIC | GBP | 282.79 | 0.92 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class A (Inc) | OEIC | GBP | 273.95 | 0.92 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class B (Acc) | OEIC | GBP | 313.99 | 0.93 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class B (Inc) | OEIC | GBP | 271.26 | 0.93 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class B (Acc) | OEIC | EUR | 130.07 | 0.95 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class A (Acc) | OEIC | EUR | 241.01 | 0.95 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class A (Acc) | OEIC | USD | 186.77 | 0.68 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class B (Acc) | OEIC | USD | 197.72 | 0.69 | 09 Jan 2026 |

Stewart Investors Worldwide All Cap (Irish VCC/Offshore)

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Worldwide All Cap Class I (Acc) | Irish UCITs | EUR | 13.40 | 0.86 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class VI (Acc) | Irish UCITs | EUR | 2.86 | 0.86 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class VI (H Dist) | Irish UCITs | EUR | 13.22 | 0.86 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class VI (Acc) | Irish UCITs | GBP | 13.21 | 0.87 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class VI (Acc) | Irish UCITs | USD | 10.80 | 0.57 | 09 Jan 2026 | |

| Stewart Investors Worldwide All Cap Class VI (H Dist) | Irish UCITs | USD | 10.55 | 0.57 | 09 Jan 2026 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.