Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Worldwide Leaders

The strategy was launched in November 2013. It invests in the shares of between 30-60 global companies.

A Leaders strategy generally invests in market leading companies which means, for this strategy, that they are valued at over US$5 billion.

You can see all of the companies that this strategy invests in by filtering on our Portfolio Explorer tool.

- We define investment risk as losing clients’ money – this means we focus on looking after your money as well as growing it

- Companies must contribute to sustainable development and make a positive impact towards a more sustainable future. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Quarterly updates

Strategy update: Q3 2025

Worldwide Leaders strategy update: 1 July - 30 September 2025

On one level, the third quarter saw significant changes at Stewart Investors. After acting as careful stewards of our clients’ capital over many years, three of our colleagues stepped back from their portfolio-management responsibilities in August and left the business.

As part of those changes, Nick Edgerton has been appointed as the new lead manager of the Worldwide Leaders strategy. As the existing lead portfolio manager of our Worldwide All Cap strategy, Nick has been involved in analysing companies and discussing the construction of Stewart Investors’ worldwide strategies since he joined the investment team in 2012. He will continue to apply the same principles to managing this strategy that have guided it since its launch, working as part of the same tight-knit group of investment analysts and drawing on the same common pool of investment ideas.

The artificial intelligence boom: are the risks of disappointment growing?

It has been nearly three years since ChatGPT astonished the world and triggered a wave of investment in the infrastructure needed to support the rollout of artificial intelligence (AI) models. During that time, the share prices of the companies that are paying for much of that infrastructure – such as Microsoft, Meta, Alphabet and Amazon – have risen sharply. Companies who provide the components of the data centres required to train and run the AI models have also enjoyed significant gains. Nvidia has the highest profile of these companies but the past three years have also seen sharp gains for the likes of TSMC, which manufactures advanced semiconductors, and Arista Networks, which makes networking switches.

One consequence of this investment boom is that movements in stock market indices have come to be dominated by the fortunes of fewer and fewer stocks. This has happened before, typically when the excitement surrounding a new technology has sparked an infrastructure boom. A similar thing happened with railways in the nineteenth century and then again with the internet 25 years ago. As investors become increasingly excited about the potential for a new technology to transform corporate profits, they are prepared to pay an increasingly large premium to buy the shares of the companies they believe will benefit from it. As those companies’ share prices rise, they come to represent a larger and larger proportion of stock market indices. In this instance, the market is becoming increasingly dependent on the continuation of the AI boom and the risks of disappointment are growing.

The long-term beneficiaries of today’s AI boom will not necessarily be the companies spending billions building data centres

In the current boom, one risk is that real-world limitations will eventually restrict the number of data centres that can be built. This was highlighted to us by the management teams of some of the companies we met during our recent trip to Texas, one of the states at the centre of the data centre boom.

Another risk is the uncertainty about who will benefit the most from the infrastructure investments being made today. It might not necessarily be the companies that are currently investing billions of dollars in building data centres. During the railway and internet booms, the long-term winners were the businesses that found ways to use the new infrastructure in ways that weren’t fully appreciated at the time it was being built. For example, the profits that companies like Netflix are making today arguably rest on the lossmaking investments that telecoms companies made in laying fibre optic cables during the last technology boom.

We invest in a diverse range of companies that are benefitting from a broad range of long-term trends

How should long-term investors approach the risks, opportunities, and uncertainties being presented by the AI boom? Although we invest in the shares of some companies that are benefitting from the current wave of investment in AI and data centres, we have taken great care not to put all of our eggs in one basket. Our investment philosophy is based on the premise that the best way to deliver long-term returns to our clients is to invest in a blend of companies meeting a broad range of unmet needs.

We established two new positions during the quarter.

Singtel (Singapore: Communication Services) has significant shareholdings in various telecoms businesses across Asia, including the Philippines, Indonesia, India, Thailand, and Australia in addition to its home territory of Singapore. That its share price looks low relative to its profits suggests that it remains deeply out of favour among investors despite the fact that, under the leadership of Kuan Moon Yeun, we believe it is better managed than it has been for some time. Since 2021, he has brought more focus to the company by selling off businesses bought by the previous management team in areas such as digital marketing and online advertising. Telecoms companies tend not to grow quickly but they do deliver cash in a steady and predictable manner.

We also brought W.W. Grainger (United States: Industrials). Grainger is a leading distributor of maintenance, repair, and operations (MRO) products. It serves a diverse range of sectors including manufacturing, government, and healthcare. The breadth of its product range, its excellent logistics and the strength of its relationships should enable it to continue to grow at the expense of its smaller competitors. To fund this addition, we sold the holding in MonotaRO (Japan: Industrials). MonotaRO is in a similar business to Grainger, by whom it is partly owned. This switch gives the portfolio exposure to growth in the US as well as Japan.

Elsewhere, we topped up our existing position in cybersecurity specialist Fortinet (United States: Information Technology). Its share price fell in August when it signalled that the short-term boost to sales from upgrading its customers’ firewalls could tail off sooner than investors had realised. The company responded to the fall by signalling it would buy back more of its shares. This suggests that it thinks the weakness in its share price represents a great buying opportunity.

We also added to Synopsys (United States: Information Technology) after its share price fell when its short-term profits fell short of expectations. We believe the long-term drivers of its growth remain in place. To help fund these additions, we sold holdings in Beiersdorf (Germany: Consumer Staples) and Hoya (Japan: Health Care).

We focus on delivering returns over the long term, rather than taking risks to pursue short-term gains

Fear of missing out – ‘FOMO’ – is not confined to the young; it is a natural human instinct. We are conscious that our style of investing, which is designed to deliver returns over the long term (a decade or longer) and to minimise losses, has not kept pace with returns from global indices over the short term. We don’t believe that means our philosophy of investing in high-quality companies for extended periods of time has suddenly ceased to work. At a time of change in markets, trade and geopolitics, our underlying approach remains consistent: we continue to focus on generating attractive returns over the long term rather than attempting to keep pace with the wider market through every short-term period. We look forward to demonstrating the fruits of that approach over the years and decades to come.

Case Study: Arista Networks

Listing: New York Stock Exchange

Market cap: USD183 billion1

Held since: 2020

Company description

Arista Networks’ software and hardware connects networks, data centres and cloud-computing nodes.

Investment rationale

Arista was founded in 2004 by three engineers who recognised that the market for networking switches was dominated by sleepy incumbents churning out predictable products with minimal upgrades. They set out to disrupt this industry by creating high-performance, low-latency ethernet switches specifically designed for cloud computing and data centres. Having experienced firsthand how Cisco Systems operated, they knew that they could create a company that did things differently in its focus on innovation, in its operating model, and in its culture.

At the time of its launch in 2010, the company’s first product had five times the throughput of its closest competitor.2 It then enhanced its lead by pursuing a programme of innovation and improvement, made possible by investing heavily in research and development.

Two early decisions taken by the company’s founders provided a platform for its subsequent growth. The first was to integrate a proprietary operating system, Arista EOS, into its hardware. This allows its customers to see what is happening across their networks in a single image and to fix issues seamlessly and with minimal network downtime. Arista built that software using open-source (Linux) code, allowing new best-of-breed software to be incorporated as it becomes available.

Their second key decision was to use microchips made by third parties rather than developing their own. By using off-the-shelf components and outsourcing manufacturing to local fulfilment centres, Arista can keep costs down, bring new innovations to market quickly, and benefit from industry-wide improvements in chip size, power usage and computing capacity.

Although two of the company’s three founders remain involved today, they made an early decision to hire a chief executive to run it. Jayshree Ullal joined in 2008, two years before Arista’s first product launch and six years before its IPO (initial public offering). She has been the key to establishing and nurturing its culture of customer focus, innovation, frugality, and flat hierarchies. This combination of a longstanding chief executive supported by the company’s founders has created an ownership mentality that has cascaded through the workforce, helped by its flat structure and lean workforce. Employees are accountable and empowered to openly address and fix problems.

One part of that culture is a refusal to sacrifice quality for speed; Arista will not ship a new product until its engineers are happy that it will operate as expected. This maintains its reputation for reliability, helps it to win repeat business, and supports its long-term partnerships with its two largest customers, Microsoft and Meta, who together account for approximately a third of its revenues.3 And although that means it faces a degree of concentration risk, it also makes it a direct beneficiary of the investments these companies are making in building artificial intelligence (AI) data centres.

Arista is taking steps to mitigate that concentration risk by diversifying its customer base within the US, which currently accounts for approximately three quarters of its revenues, as well as by expanding overseas.4 For example, it recently launched a ‘Make in India’ initiative, through which it is investing in local manufacturing, developing skills, and building centres of excellence in ‘AI for networking’ across the country.

Arista’s strong cash-flow generation, its high profit margins and low debts give it the financial firepower to continue investing in research and development while also acquiring companies to benefit from their technology and engineering expertise. This continual reinvestment in innovation should help it to stay ahead of the pack while exploiting the significant areas of potential growth in front of it.

What could go wrong? / Risks

The clearest risk is posed by customer concentration; any difficulties in Arista’s relationships with either Microsoft or Meta could lead to a fall in its revenues and potential reputational issues. Ongoing price deflation, meanwhile, means that it must innovate continually – and run harder – to increase sales and profits. Finally, there is always the risk that an acquisition goes badly, affecting the company’s culture and causing it to lose its leadership in innovation.

[1] Source: FactSet as at 1 October 2025.

[2] Source: Arista: Arista 7500 - Sets New Standard for 10 Gigabit Ethernet Networking https://www.arista.com/en/company/news/press-release/280-pr-20100419-01.

[3] Source: Arista Networks 10-Q 6 August 2025.

[4] Source: FactSet as of 1 October 2025.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2025

Worldwide Leaders strategy update: 1 April - 30 June 2025

Draw a circle around Asia on a world map and it would look relatively small in comparison to the rest of the globe. That small circle, however, would contain more than four billion people1 and some of the world’s fastest-growing economies: India, China, Taiwan, South Korea, the Philippines, and Indonesia.

Reflecting the continent’s strong culture of equity investment, it also boasts a disproportionately large share of companies raising capital through initial public offerings (IPOs)2. Stewart Investors’ heritage of investing in Asian markets means we are well-equipped to tap into the opportunities this presents.

This quarter, we invested in Trip.com (China: Consumer Discretionary), a multinational travel agency that owns several platforms including MakeMyTrip and Skyscanner. Trip.com has survived a gruelling decade of intense competition in China, emerging as the country’s leading online travel agency, with a 60% market share3. We also believe it has an outstanding culture, putting its customers first while also taking care of more than 40,000 employees4. This should allow it to maintain its leadership in domestic tourism while expanding internationally as a growing number of Chinese tourists venture overseas5.

The quarter’s second key addition was Chubb (United States: Financials). Founded in 1882, Chubb is a world-leading insurer, operating in over 50 countries. It takes a cautious approach to writing new business, being prepared to sacrifice sales today to protect its long-term profitability. This approach is at the core of Chubb’s business. Such cultures are rare and can only built with patience.

We continued to build our positions in Alibaba (China: Consumer Discretionary) and ABB (Switzerland: Industrials). We also increased our position in Arista Networks (United States: Information Technology), taking advantage of a spell of weakness in its share price.

We sold our holdings in six companies over the quarter. Copart (United States: Industrials) and Fastenal (United States: Industrials) remain high-quality businesses but their shares look less attractively priced than they once did. We sold Tata Consultancy Services (India: Information Technology) as its valuation left little room for error despite the current elevated level of uncertainty around trade. Similarly, we sold Expeditors (United States: Industrials) in the belief that any slowdown in world trade would present a challenge to its growth. Lastly, we sold Ashtead Group (United Kingdom: Industrials) and Rentokil Initial (United Kingdom: Industrials) after deciding that we had stronger investment ideas elsewhere.

A rapidly evolving security situation combined with rising trade tensions and the imposition of barriers to technology exports mean that our companies could face a different set of opportunities – and risks – in the coming decades. Despite this, we are confident that our long-term investment horizon and our philosophy of focussing on growing, high-quality companies whose shares trade at reasonable valuations will deliver attractive returns.

[1] Source: International Monetary Fund - World Economic Outlook April 2025.

[2] Source: ‘Hong Kong IPO boom challenges the city’s critics’ Financial Times 29 June 2025.

[3] Source: Bernstein China SMID Internet: Diamonds in the Sky...Initiating with Trip.com Group November 2024.

[4] Source: Trip.com – Annual report to 31 December 2024.

[5] Horizon Insight Closers to Chinese Markets: Trip.com (TCOM) Earnings Review 13 September 2024.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q1 2025

Worldwide Leaders strategy update: 1 January - 31 March 2025

“Only two things make up a railroad: a track and a locomotive.” Amid the constant news about tariffs, trade wars and global political realignment, this recent comment – by the chief financial officer (CFO) of one of our companies – provided a timely reminder that things are sometimes simple. It also underscored why we are glad that our focus is on seeking to understand individual companies rather than trying to predict global events. Through all the noise of the first quarter of 2025, we focused on finding companies with experience in navigating unpredictable political and economic conditions and who keep their eyes firmly fixed on their long-term goals.

This quarter saw a significant ‘first’ for Worldwide Leaders – its first investment in a Chinese company - Alibaba (China: Consumer Discretionary). We approached our assessment of Alibaba as we would with any company, by considering the quality of its people, its franchise and its financials. Alibaba is led by a highly capable management team that combines a private-sector mindset alongside alignment with the goals of the Chinese government. It is reinvesting cashflows from its mature retail business in building a new cloud business. It has plenty of cash and a share-buyback programme (when a company buys back its own shares) that is friendly to smaller shareholders. In our view, the combination of an attractive valuation with the potential for Alibaba’s technology to help China meet some of the development challenges it faces provides a strong investment case.

We also added a new position in ABB (Switzerland: Industrials). This high-quality engineering business is a market leader in electrification, motion and automation. Its motors, drives and transformers are a small but critical part of its customers’ overall budget, and the depth of the relationships ABB has fostered with them puts it in a strong competitive position. We believe the combination of increasing demand for electricity worldwide and the company’s focus on improving profits puts ABB in a good position to perform well over the next 10 years.

We continued to grow the size of our holding in a number of recent additions such as Brown & Brown (United States: Financials), NVR (United States: Consumer Discretionary) and Carlisle Companies (United States: Industrials). The attractive valuation of Samsung Electronics (South Korea: Information Technology) also encouraged us to add to our position.

During the quarter, we sold Costco (United States: Consumer Staples). This is still a high-quality company but the high valuation of its shares suggested that future returns may be lower. On a similar note, we also trimmed the size of our holdings in Fortinet (United States: Information Technology), Copart (United States: Industrials) and Watsco (United States: Industrials) due to high valuations. Rising global political risks led us to trim the size of our holding in TSMC (Taiwan: Information Technology).

We continue to find opportunities to invest in the shares of reasonably valued companies from around the world that we believe can (profitably) help to solve a range of development challenges. Our focus on individual companies allows us to capture those opportunities wherever they arise. At a time of rapid economic and political change, we continue to apply our investment philosophy consistently and to focus on the things that we believe matter over our investment timeframe. As for what comes next? Another comment from the CFO we quoted earlier sums up our view: “there’s only one way to go in rail, and that’s forward!”

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

Worldwide Leaders strategy update: 1 October - 31 December 2024

“We are allocating our own money, we act like owners.”1 It’s always pleasing to meet with a company that thinks similarly to us. We are stewards of our clients’ capital, aiming to look after our clients’ savings as well as we would look after our own. Our Hippocratic Oath is is our pledge as an investment team to uphold the principle of stewardship through our conduct and work practices. One key point in the oath is “We will not forget in our search for returns that the primary risk faced by our clients is losing their capital”. The oath underpins our investment philosophy, which is based on identifying quality leaders and stewards of strong business franchises with good long-term growth prospects.

During the quarter we bought five new companies and the quote above is from a meeting with the company management of the first of them. Brown & Brown (United States: Financials) was founded in 1939 and is still led and stewarded by the Brown family. Over the past 85 years, the competent, ambitious and long-term management team has enabled it to grow beyond its Florida base to become the sixth largest insurance broker2 in the United States. The company has also been expanding to Asia and Europe and as the insurance brokerage industry is made up of many small companies, there is plenty more room to grow in the decades ahead.

Carlisle Companies (United States: Industrials) make and sell construction materials, particularly the products needed to roof and waterproof buildings. Using high-quality products in houses leads to better ventilation and protection from weather as well as reducing energy usage and improving longevity. The high demand for new housing across America will provide strong long-term growth opportunities for this company as well as another new purchase, NVR (United States: Consumer Discretionary). Based in Virginia, NVR is the fourth largest homebuilder3 in the United States, focused on building high-quality homes for first-time owners. The management team have lots of experience and a history of using periods of slowdown in the industry to expand their business in a controlled way. This allows them to benefit when housing demand increases.

Wabtec (United States: Industrials) is a leading provider of components for rail transportation and can trace its roots back over 100 years. The rail industry is as important now as it was then, as it plays a crucial role in reducing global carbon emissions in both commercial freight and passenger transportation. Rising investment in rail infrastructure along with Wabtec’s increasing position size in the market and improving profits provide positive long-term opportunities for growth.

Synopsys (United States: Information Technology) is the market leader4 in software for the design of semiconductors, with their products being used by almost all major semiconductor designers and manufacturers. The founder continues to lead and steward the company as Chairman of the Board, enabling them to make long-term investments in research & development (R&D). This ensures that their products remain relevant for decades and also provides excellent growth potential.

The new positions were funded by selling Edwards Lifesciences (United States: Health Care) which manufacturers artificial heart valves and Halma (United Kingdom: Information Technology) which holds a portfolio of companies targeting solutions for safety, health, environment and testing. In both cases, we felt that there were greater opportunities for growth in other companies.

The US election took place in November, sending Donald Trump back to the White House along with a Republican Party majority in the House of Representatives and the Senate. There have been many news stories written about taxes, tariffs and other general speculation about what the incoming administration might do. We don’t have any insights into the workings of a Trump presidency, instead, we focus on finding companies that are good at navigating difficult situations and experienced at generating growth from the opportunities in front of them. Another point of our Hippocratic Oath is “We will strive to achieve, through hard work, sober analysis and sound judgement, the best risk-adjusted returns possible for our clients.” This focus means we will continue to seek companies like, Brown & Brown, who we believe will be excellent stewards of our clients’ savings.

[1] Source: Stewart Investors company meeting with Brown & Brown, February 2024.

[2] Source: Brown & Brown website - https://www.bbrown.com/us/about/

[3] Source: Builder. https://www.builderonline.com/builder-100/builder-100-list/2023/

[4] Source: Synopsys company data - https://s201.q4cdn.com/778493406/files/doc_earnings/2024/q4/presentation/InvestorOverviewPresentationFinal-Q4.pdf

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Voting

Proxy voting: Q3 2025

Worldwide Leaders voting: 1 July - 30 September 2025

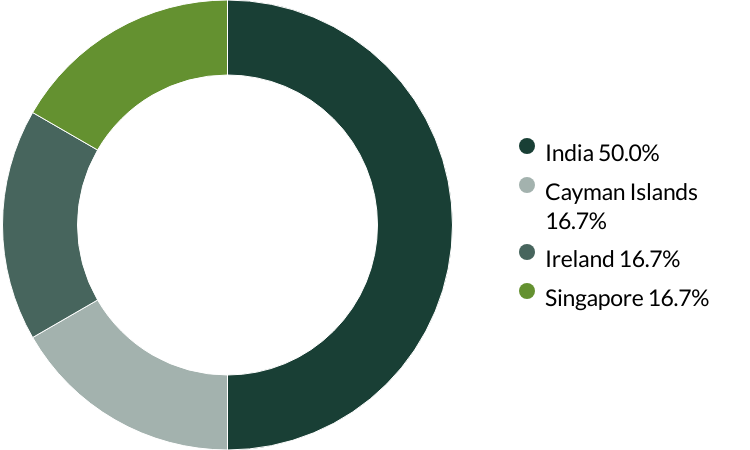

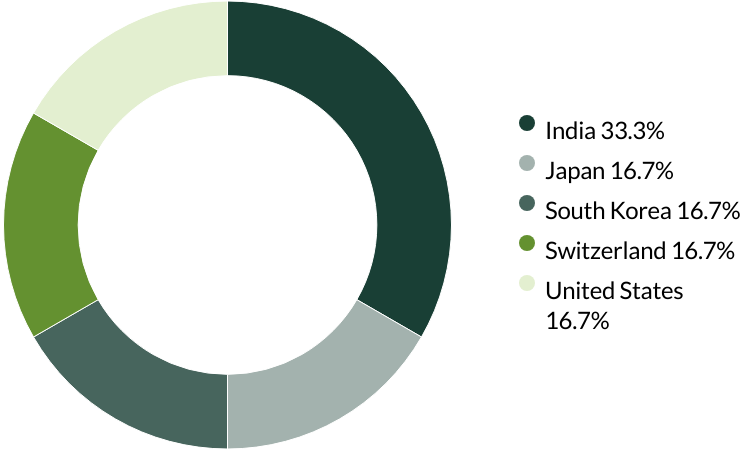

Voting by country of origin

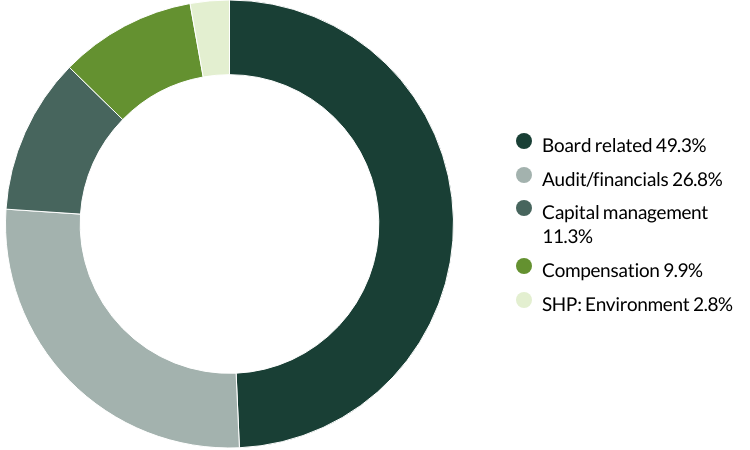

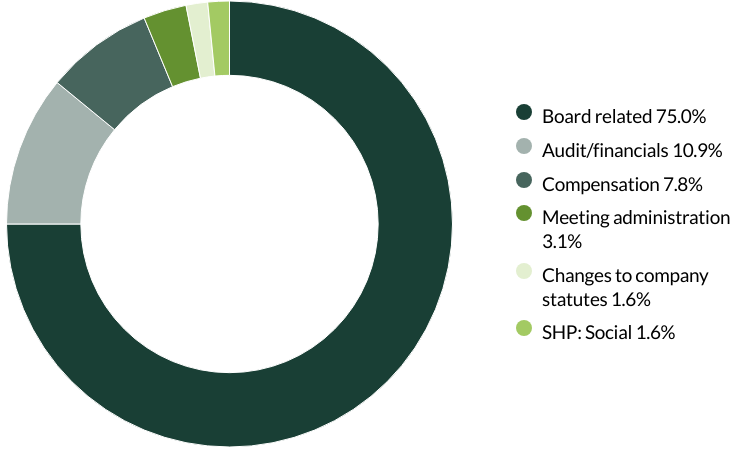

Voting by proposal category

During the quarter there were 74 proposals from five companies to vote on. On behalf of our clients, we did not vote against any proposals.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2025

Worldwide Leaders voting: 1 April - 30 June 2025

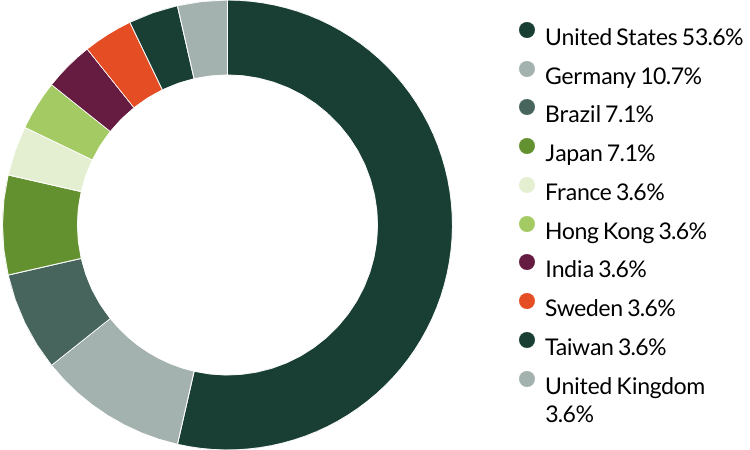

Voting by country of origin

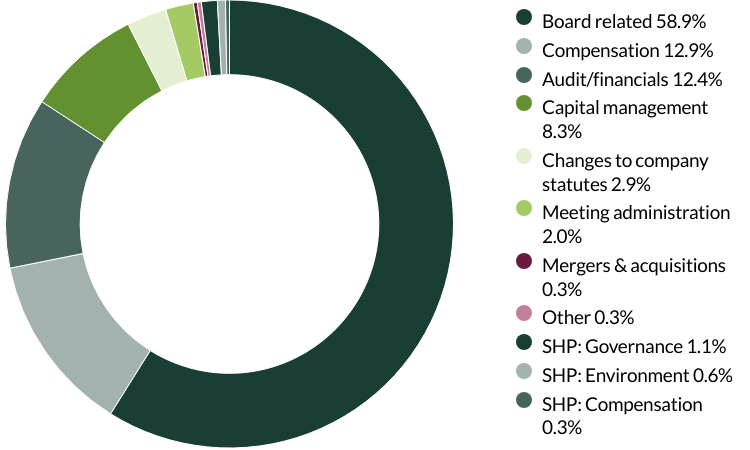

Voting by proposal category

During the quarter there were 348 proposals from 27 companies to vote on. On behalf of our clients, we voted against 14 proposals and abstained from voting on six proposals.

We voted against the appointment of the auditor at Arista Networks, Brown & Brown, Expeditors, Fortinet, Lincoln Electric, Markel, NVR, Old Dominion Freight Line, Roper Technologies, Texas Instruments and Westinghouse Air Brake Technologies Corporation (Wabtec) as they have been in place for over 10 years. These companies have given no information on rotating their auditors, something we believe is important to ensure a fresh perspective is brought to their accounts. (11 proposals)

We voted against the recasting of votes (the ability for voters to change their original votes on a particular matter in response to new information or changes to a proposal) for the supervisory council at WEG as we believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. We also abstained from voting on a request for a separate board election and the election of a supervisory council position. According to Brazilian voting practices, we are unable to vote for this proposal while simultaneously supporting the board in its candidate elections. (two proposals)

We abstained from voting on proposals at Rentokil Initial that would grant the company the authority to issue shares as it did not disclose the reasons for the issuance. Without clearer information regarding the potential capacity expansion and/or acquisition for which this issuance is intended, it is difficult for investors to assess the potential value creation and strategic fit of such an investment. (three proposals)

We abstained from voting on amendments to articles (rules and regulations that govern the company's operations) at bioMérieux as the company did not provide enough information on the amendments. (one proposal)

We abstained from voting on a shareholder proposal at Old Dominion Freight Line regarding the adoption of greenhouse gas (GHG) emissions targets aligned with the Paris Agreement. We were scheduled to meet the company shortly after the annual general meeting (AGM) and prefer to continue discussing this topic directly with the company. (one proposal)

We voted against a shareholder proposal requesting that an independent director serve as chair of the board at Fortinet. We continue to support the current CEO and chair of the board. (one proposal)

We voted against a shareholder proposal regarding simple majority voting at Markel as we support the stewards of the company. (one proposal)

We supported a shareholder proposal regarding greenhouse gas (GHG) emissions disclosure at Markel to encourage improved transparency and better disclosure of relevant emissions data. (one proposal)

We supported shareholder proposals regarding the right to call a special meeting at both NVR and Texas Instruments as we believe that the stock ownership threshold of 10% to call a meeting is appropriate, given the companies’ size and shareholder base. (two proposals)

We supported a shareholder proposal at Synopsys regarding the approval for severance payments (an amount paid to an employee on the early termination of a contract) when they exceed the stated threshold. This support is due to concerns about potential shareholder dilution that larger severance policies might cause. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q1 2025

Worldwide Leaders proxy voting: 1 January - 31 March 2025

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 64 resolutions from five companies to vote on. On behalf of clients, we voted against six resolutions.

We voted against a proposal on transaction of business at ABB, as they did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (one resolution)

We voted against the appointment of the auditor at Costco as they have been in place for over 10 years. The company has given no information on intended rotation, which we believe is important to provide a fresh perspective on the accounts. We voted against a shareholder proposal requesting the company publish a report assessing the risks of maintaining its current diversity, equity and inclusion (DEI) roles, policies and goals as we support the company in their commitment to obey with the law and that their DEI efforts are legally appropriate. (two resolutions)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2024

Worldwide Leaders proxy voting: 1 October - 31 December 2024

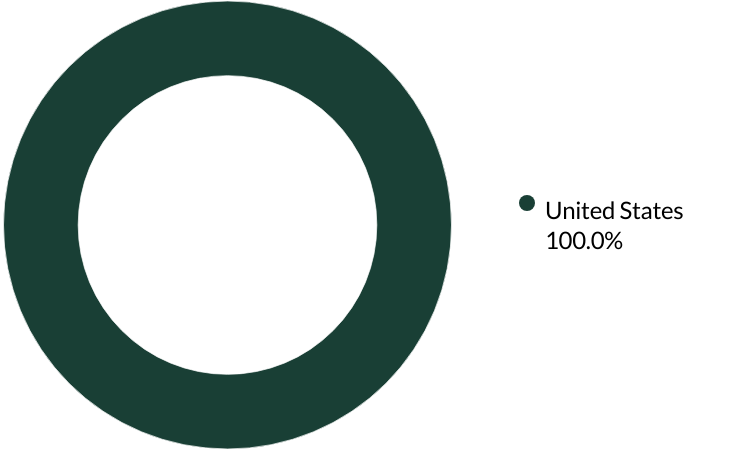

Proxy voting by country of origin

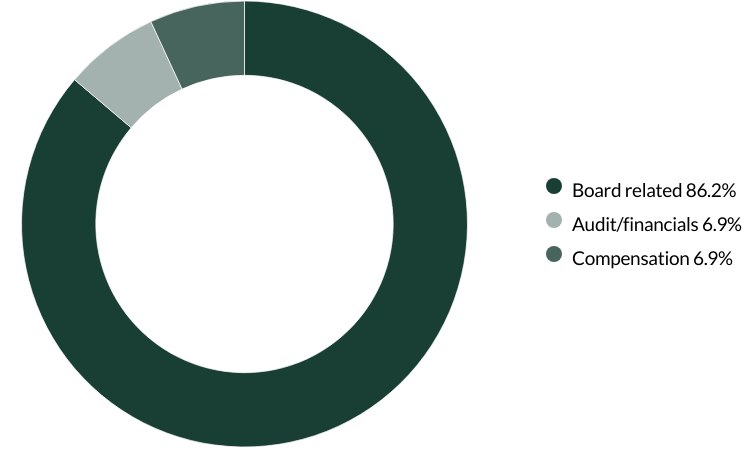

Proxy voting by proposal category

During the quarter there were 25 resolutions from two companies to vote on. On behalf of clients, we voted against one resolution.

We voted against the re-appointment of the auditor at Copart as they have been in place for or over 10 years and the company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Sustainable investment labels help investors find products that have a specific sustainability goal. This product does not have a UK sustainable investment label as it does not have a non-financial sustainability objective. Its objective is to achieve capital growth over the long-term by following its investment policy and strategy.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 September 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Worldwide Leaders (UK OEIC)

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Worldwide Leaders Class A (Acc) | OEIC | GBP | 760.28 | 0.42 | 08 Dec 2025 | |

| Stewart Investors Worldwide Leaders Class B (Acc) | OEIC | GBP | 916.76 | 0.43 | 08 Dec 2025 |

Stewart Investors Worldwide Leaders (Irish VCC/Offshore)

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Worldwide Leaders Class I (Acc) | Irish UCITs | USD | 22.09 | 0.24 | 08 Dec 2025 | |

| Stewart Investors Worldwide Leaders Class III (G Acc) | Irish UCITs | USD | 42.69 | 0.25 | 08 Dec 2025 | |

| Stewart Investors Worldwide Leaders Class III (Acc) | Irish UCITs | USD | 18.86 | 0.25 | 08 Dec 2025 | |

| Stewart Investors Worldwide Leaders Class VI (Acc) | Irish UCITs | EUR | 9.68 | 0.25 | 08 Dec 2025 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.