Get the right experience for you. Please select your location and investor type.

Indian Subcontinent All Cap

The strategy was launched in 2006. It invests in the shares of between 30-60 companies in the Indian region.

You can see all of the companies that this strategy invests in by filtering on our Portfolio Explorer tool.

- We define investment risk as losing clients’ money – this means we focus on looking after your money as well as growing it

- Companies must contribute to sustainable development and make a positive impact towards a more sustainable future. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Quarterly updates

Strategy update: Q1 2025

Indian Subcontinent All Cap strategy update: 1 January - 31 March 2025

Due to the recent falls in the Indian market, we have received lots of questions from clients and plenty of interest in the fund. Recent market declines have given us an opportunity to add to some of our existing holdings at more attractive valuations. We also bought a number of new companies.

Over the quarter, we bought Bajaj Auto (India: Consumer Discretionary), a leading manufacturer of automobiles. It joins our existing position in Bajaj Holdings & Investment (India: Financials), which is the holding company of siblings Rajiv and Sanjiv Bajaj, who have a good track record of delivering shareholder returns.

We continued to add to the position size of our holding in Sundaram Finance (India: Financials), a financial services institution led by the Sundaram Group. To benefit from lower valuations, we also added to our existing holdings in Tube Investments (India: Consumer Discretionary), Blue Dart Express (India: Industrials), SKF India (India: Industrials), Elgi Equipments (India: Industrials) and Cholamandalam Financial Holdings (India: Financials).

To fund these additions, we sold Havells (India: Industrials), Carborundum Universal (India: Materials) and Bosch India (India: Consumer Discretionary). Although we continue to believe in the long-term growth potential of these businesses, we believe there are better returns to be achieved via other ideas.

The fund’s performance over the past quarter (and over the past year) has been disappointing. We would have hoped that it would have exhibited greater resilience. At the same time, however, we would caution that a single quarter is too short a timeframe over which to measure returns. When considering the future of the underlying businesses that we invest in, we look several years – and sometimes decades – into the future. On reflection, perhaps we could have been more aggressive in selling the strongest performing industrial stocks. At the same time, however, we still see good value when considering their long-term potential.

The fall in the Indian market in recent months should be seen in the context of the strong returns that it has generated in recent years. Furthermore, equities typically deliver returns over the long term, so we continue to focus on the long-term growth potential of the companies we own. We have made three research visits to India over the past four months and remain excited by the opportunities we find there.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

Indian Subcontinent All Cap strategy update: 1 October - 31 December 2024

One question we increasingly encounter when speaking to clients is: “isn’t India expensive now”? We can understand why clients are asking this, after all the MSCI India index has risen over 85% in the five years to end December 2024 and has increased by over 12% over the past 12 months alone.1

Two answers spring to mind here: firstly, that we are not investing in the index, we are trying to find the highest-quality companies we can and secondly, we keep a keen eye on valuations and position sizes to try and ensure our investments deliver good, long-term returns whilst also protecting capital. We still see lots of reasons to be positive about the outlook for our India holdings.

We have found a few new ideas at acceptable valuations and during the period we purchased Narayana Health (India: Health Care) which is supplying affordable, private healthcare in India. We also increased our holding in insurer ICICI Lombard (India: Financials).

We sold Mahindra Finance (India: Financials) as we struggled to build confidence in how the business was going to grow in the future.

We slightly trimmed our holdings in Mahindra & Mahindra (India: Consumer Discretionary) and Dr. Lal PathLabs (India: Health Care) due to higher valuations. Our belief in their long-term success remains strong.

More generally, we continue to assess all our investments from an individual company perspective, trying to understand the quality of the people and businesses that we are backing with your money. We are doing our best not to overpay for these investments and to hold them for a long time. We continue to believe that this is essential for protecting client money invested (capital preservation) and growth.

[1] Source: FactSet. USD total returns.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2024

Indian Subcontinent All Cap strategy update: 1 July - 30 September 2024

“Red-hot Indian market”,1 “India overtakes China in world’s biggest investable stock benchmark”,2 “Five undervalued qualities of the Indian economy”3 and so on and so on; one is hard pushed to find negative news on India’s economy or financial markets in mainstream financial media these days.

For us, India remains the same exciting investment destination that it has long been and for the same reasons too: a multitude of fantastic companies providing necessary goods and services to a rapidly developing population which leaves long-term and quality-focused investors like us spoilt for choice.

We bought ICICI Lombard (India: Financials), one of India’s largest private sector general insurance companies. ICICI Lombard is addressing the underinsurance gap in India by expanding access to insurance products to help individuals, businesses and families better manage risks. The company is well-managed and our confidence in the business has grown enough to purchase for the strategy.

In the quarter, we added to the position size of Cholamandalam Financial Holdings (India: Financials), Aavas Financiers (India: Financials), Blue Dart Express (India: Industrials), Tata Communications (India: Communication Services) and SKF India (India: Industrials) as we believe they are all reasonably valued for good, long-term returns. We partially funded these by reducing our positions in CG Power (India: Industrials), as valuations continued to creep up, and HDFC Bank (India: Financials). We also sold RBL Bank (India: Financials) and Kotak Mahindra Bank (India: Financials) to fund the additions.

We continue to assess all our investments on an individual company basis, trying to gauge the quality of the people and businesses that we are backing with your money. We also do our best not to overpay for these investments and aim to hold them for the long term. We continue to believe that this is the bedrock of long-term capital preservation and growth.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2024

Indian Subcontinent All Cap strategy update: 1 April - 30 June 2024

India recently re-elected the Bharatiya Janata Party (BJP) back to power but not with a majority. The party is now in a coalition with a few regional parties. We believe Indian election results are important but their importance is overstated in the context of long-term investment returns since 1991. India’s development changed significantly after an economic crisis in 1991, commonly known as the balance of payments crisis. Since then, India’s growth and development has been fairly steady and predictable. This has been driven by continuity in political policy and reform and a vibrant sector of private companies that is contributing to, and benefitting from, India’s development. We believe this trajectory should continue for many decades to come.

We received an email from a research broker the day before election results which listed companies that should benefit from a strong result for the BJP. We were particularly pleased to note that out of the 50 companies named, we held only one of them. Our investment approach is to invest in companies with enduring long-term qualities. Their only competitive advantage is to deliver value to their customers every day. And they maintain this advantage by focussing on a combination of quality, innovation and trust. These attributes can only be built patiently over decades. Any dependence on politics or favourable regulations is a risk and at best a short-lived advantage – not the high level of quality we seek in our businesses.

Rapid urbanisation and water stress represent key risks for many of our companies. We commissioned some external research understand more about water stress across our portfolio companies. We also engaged with company management on the risks of rapid urbanisation. We will continue to evolve our understanding of these topics and how they relate to our companies.

We made two new investments in the last quarter, VST Tillers Tractors (India: Industrials) and SKF India (India: Industrials). VST is a family-owned company and India’s leading maker of small farm equipment. Under the stewardship of the next generation of the family and a professional CEO, the company is aiming to capture a bigger proportion of India’s growing farm equipment market. VST is also aiming to grow its exports and make better use of its manufacturing capacity while investing significantly behind new products, particularly electric (EV) tractors. We find this journey quite appealing and the valuations remain reasonable for the growth opportunities open to the company.

SKF India, majority-owned by parent company SKF Sweden, is India’s largest maker of ball bearings. Bearings are a small cost for customers but extremely important for the smooth functioning of manufacturing plants and automotive products and railway trains and carriages. Quality is important and SKF has built a reputation of trust and quality over many decades. SKF India should benefit from the rising use of machines and robots across many of its customer segments.

We funded these investments by selling Tata Consultancy Services (TCS) (India: Information Technology) and reducing our holdings in Mahindra & Mahindra (India: Consumer Discretionary) and CG Power (India: Industrials). TCS is a high-quality business. We sold TCS as we identified attractive opportunities in younger companies. We first invested in TCS in February 2007 and sold out completely in May 2024. During this period, TCS has delivered good returns, sales and profits. TCS has distributed surplus cash to shareholders.

This quarter, we also sold DBH Finance (Bangladesh: Financials). While the overall quality of the company's products or services has not been affected, they have faced increased regulatory pressures in their industry and general economic conditions have worsened.

We reduced our holdings in CG Power as long-term valuations begin to look expensive. Mahindra & Mahindra remains reasonably valued but we trimmed given rising position size. We also added to many companies such as GMM Pfaudler (India: Industrials) and Blue Dart Express (India: Industrials) as valuations became attractive.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Proxy voting: Q1 2025

Indian Subcontinent All Cap proxy voting: 1 January - 31 March 2025

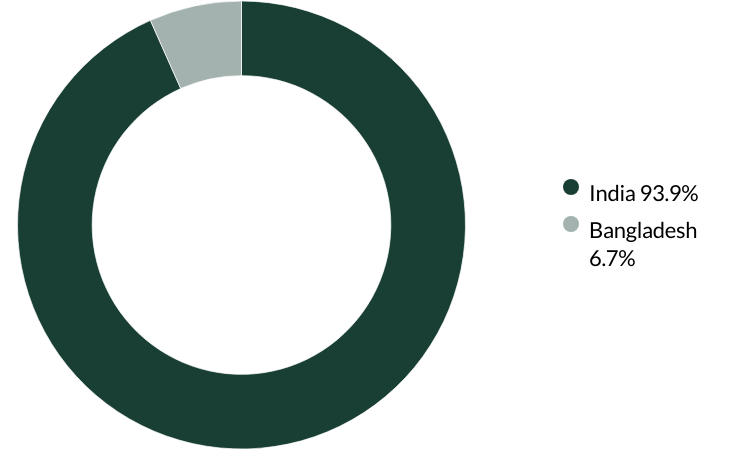

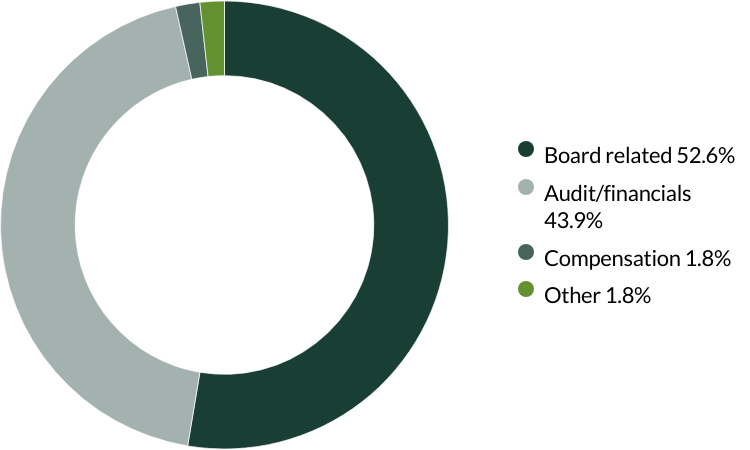

Proxy voting by country of origin

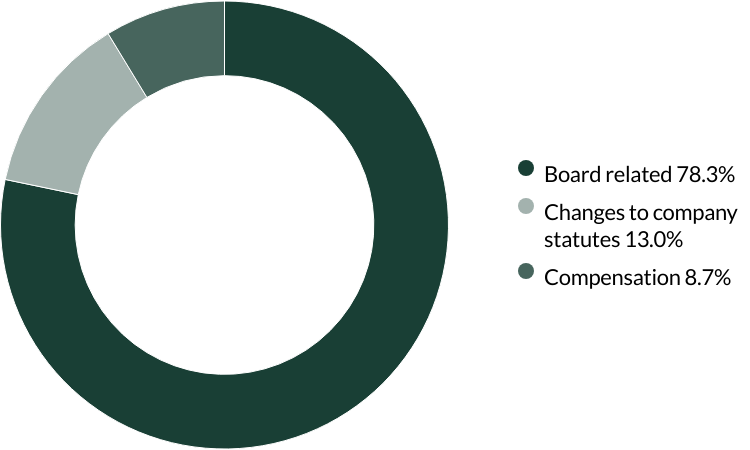

Proxy voting by proposal category

During the quarter there were 23 resolutions from 11 companies to vote on. On behalf of clients, we voted against one resolution.

We voted against the election of a director and their remuneration at IndiaMART as we seek to encourage greater diversity and independence on the board. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2024

Indian Subcontinent All Cap proxy voting: 1 October - 31 December 2024

Proxy voting by country of origin

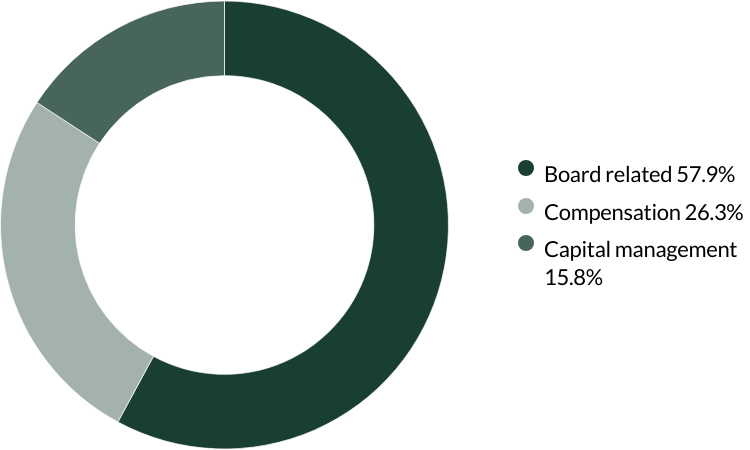

Proxy voting by proposal category

During the quarter there were 19 resolutions from seven companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2024

Indian Subcontinent All Cap proxy voting: 1 July - 30 September 2024

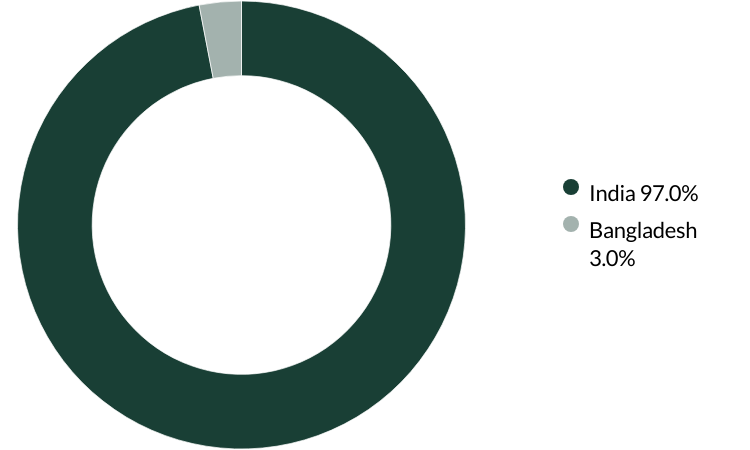

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 213 resolutions from 29 companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2024

Indian Subcontinent All Cap proxy voting: 1 April - 30 June 2024

Proxy voting by country of origin

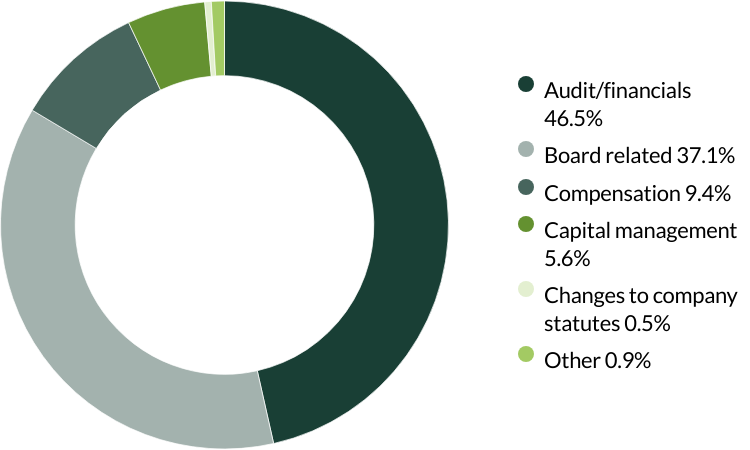

Proxy voting by proposal category

During the quarter there were 68 resolutions from 14 companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Sustainable investment labels help investors find products that have a specific sustainability goal. This product does not have a UK sustainable investment label as it does not have a non-financial sustainability objective. Its objective is to achieve capital growth over the long-term by following its investment policy and strategy.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, European All Cap Strategy, European (ex UK) All Cap Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 31 March 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Key documents

- Factsheets and KIIDs

- Prospectuses

- Application forms

- Strategy Annual Review 2023 - ICVC

- Strategy Annual Review 2023 - VCC

- Strategy Climate Report 2021

- The race to zero: Climate Report 2021

- UK Task Force on Climate-related Financial Disclosures (“TCFD”) Public Product report

- SDR Client Facing Disclosure

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Indian Subcontinent All Cap Fund

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.