Get the right experience for you. Please select your location and investor type.

European All Cap

The strategy was launched in June 2021. It invests in the shares of between 30-45 companies in the European region (including the UK).

You can see all of the companies that this strategy invests in by filtering on our Portfolio Explorer tool.

- We define investment risk as losing clients’ money – this means we focus on looking after your money as well as growing it

- Companies must contribute to sustainable development and make a positive impact towards a more sustainable future. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Quarterly updates

Strategy update: Q1 2025

European All Cap strategy update: 1 January - 31 March 2025

While it may be a new year, the events of the first quarter suggested that 2025 could see a continuation of the uncertainties that characterised 2024. The silver lining was that it also brought some developments that could benefit the high-quality European companies we invest in. They included an easing of Germany’s ‘debt brake’ to allow more government spending and investment, a willingness to cut excessive bureaucracy and a growing recognition of Europe’s need to become more self-sufficient. Together, these could help boost demand across a range of sectors.

Over the course of the quarter, we added three new companies to the portfolio. The first was Axfood (Sweden: Consumer Staples) which operates a diverse range of food retailers across Sweden. Its brands include Willys (a discount store), Hemköp (mid-range) and the recently acquired hypermarket chain City Gross. After a long period of investment in an automated fulfilment centre to improve warehouse management and stock levels, we see the potential for Axfood’s profits to grow.

The second new holding was L’Oréal (France: Consumer Staples), which has a broad range of well-known beauty and skincare brands. Under the ownership and leadership of the Bettencourt Meyers family, its long-serving management team has repeatedly shown its ability to identify, acquire and integrate new brands and reinvest in their long-term growth. Around 40% of L’Oréal’s sales come from skincare and sun protection but its focus is shifting to treatments for dermatological conditions such as psoriasis, dermatitis and acne1.

The third new holding was SKF (Sweden: Industrials), one of the world’s largest manufacturers of ball bearings. It is currently transforming its business and will soon separate its automotive business which is less profitable. It is owned and led by the Wallenberg family. We were familiar with the family through their involvement in two existing companies: Atlas Copco and Epiroc.

We have also increased the size of some of our existing holdings. We added to brake manufacturer, Knorr-Bremse (Germany: Industrials), which continues to improve its operational efficiency and increase its potential for growth. We increased our holding in Handelsbanken (Sweden: Financials), which is investing in technology to enhance its customer relationships. Elsewhere, we added to Haleon (United Kingdom: Health Care) due to the strength of its brand portfolio.

We also added to the holding in Wolters Kluwer (Netherlands: Industrials), a provider of business services and software, when its share price weakened following the planned departure of its long-serving chief executive. We remain excited about its potential to grow by applying artificial intelligence (AI) tools to its existing data sets.

We sold three companies over the quarter. We exited Belimo (Switzerland: Industrials) as investors’ excitement about demand for its actuators, which make the cooling systems in data centres more efficient, caused its share price to rise higher than expected, given its profit levels. We also sold Tecan (Switzerland: Health Care) and Sartorius (Germany: Health Care). Stocking issues following the covid pandemic made it hard for us to assess these two companies but this is now clearer and, as a result, we prefer to focus on the high-quality businesses in this area that we already hold, such as Roche (Switzerland: Health Care), DiaSorin (Italy: Health Care) and bioMérieux (France: Health Care).

Elsewhere, we trimmed the position size of a number of holdings due to high valuations. These included architectural software provider Nemetschek (Germany: Information Technology) and semiconductor manufacturer Infineon Technologies (Germany: Information Technology), where the impact of changes in trade policies and tariffs remains uncertain.

As the political and economic landscape continues to evolve, we remain focused on finding high-quality companies that are run by exceptional people which we believe have the ability to thrive under a broad range of scenarios.

[1] Source: L’Oréal Annual Report 2024.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

European All Cap strategy update: 1 October - 31 December 2024

2024 will be remembered as another year of world and political turbulence and strong stock market movements. European economies and stock markets continued to be impacted by the war in Ukraine, a growth slowdown in China, rising political divisions, and sluggish economic growth in almost every major European economy apart from Spain and Poland, despite a slower rise in the prices of goods and services (soft inflation).

Performance over the year was divided. Strong positive contributions from many industrial and technology holdings, such as Nexans (France: Industrials), Addtech (Sweden: Industrials) and Wolters Kluwer (Netherlands: Industrials), were undermined by a number of healthcare holdings, including Tecan (Switzerland: Health Care), Sartorius (Germany: Health Care) and Carl Zeiss Meditec (Germany: Health Care), which were negative contributors to overall performance.

Many healthcare companies saw declining demand from China and a lack of investment due to stretched public sector budgets. They also continued to struggle with post covid de-stocking levels. During the pandemic customers ordered a lot of stock which was in short supply and have been using up this stock before ordering new supplies. Moving into 2025, we are seeing signs of an end to de-stocking cycles and customer orders growing among both healthcare and other industrial companies.

Over the year, we trimmed the position size of some holdings which had very high valuations. These included Indutrade (Sweden: Industrials), Nemetschek (Germany: Information Technology) and Ringkjøbing Landbobank (Denmark: Financials). We added to position sizes in companies which were more attractively valued. These included Spectris (United Kingdom: Information Technology), a maker of precision testing and measurement equipment, Ashtead Group (United Kingdom: Industrials), which rents construction and industrial equipment and Dino Polska (Poland: Consumer Staples), a discount grocer.

We also continued to build the position size in two exceptional software companies: Wolters Kluwer (Netherlands: Industrials) and Vitec Software (Sweden: Information Technology) which offer strong growth potential and consistent and regular income levels.

In the last quarter of the year, we sold three companies: SFS Group (Switzerland: Industrials), a maker of mechanical fastening systems, Unilever (United Kingdom: Consumer Staples), a consumer goods company nearing the end of a substantial transformation programme, and Naturenergie (Switzerland: Utilities) a Swiss-German provider of hydro-electric and renewable energy. These were replaced by two companies we believe have better growth prospects. These were Epiroc (Sweden: Industrials), a leading global provider of mining equipment and tools which is investing behind electrification and battery technology, and Haleon (United Kingdom: Consumer Staples), a global leader in consumer health, focused on oral care, vitamins, and over-the-counter medicines, including pain relief.

We enter 2025 convinced of the long-term potential of the high-quality companies we hold on behalf of clients. Although general economic sentiment towards most European countries is pessimistic, we remind clients that we do not invest in countries or even regions; we invest in companies. As always, we remain focused on the long term, and on investing in companies run by exceptional leaders, that can navigate and adapt to complex environments, and thus thrive long into the future.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2024

European All Cap strategy update: 1 July - 30 September 2024

The performance of the portfolio looks to have stabilised following a relatively weak start to 2024. As market turbulence around the uncertainty of interest rates and geopolitics appears to settle, we remain excited by our holdings, many of which we believe are very attractively valued for their long-term growth potential.

Three new companies were added to the portfolio during the quarter. The first, ASML (Netherlands: Information Technology), is the global leader in lithography machines used to produce chips for semiconductors. Its culture is exceptional for its focus on engineering, with almost 40% of employees working in research and development with a budget of EUR4 billion in 2023.1

We also bought another Dutch-listed, but global-facing company, Wolters Kluwer (Netherlands: Industrials), which provides professional information, software and services to a diverse range of end customer markets. Most of Wolter Kluwer’s sales are on a repeating cycle, with pricing linked to inflation. This enables stable levels of cash to come into the business and also allows for consistent investment into new products, such as their CCH® Tagetik solution, which helps companies measure and report on their environmental performance.

The final company added to the portfolio was Knorr Bremse (Germany: Industrials), a leading provider of brakes for rail and commercial vehicles. A new CEO, Marc Llistosella, has brought a renewed focus on culture, operational efficiencies and additional growth opportunities around automation and digitalisation.

During the quarter, Bechtle (Germany: Information Technology) and Teqnion (Sweden: Industrials) were sold due to reduced confidence in the sustainability and scalability of the business.

Addtech (Sweden: Industrials) and Indutrade (Sweden: Industrials), both experienced strong income growth in the quarter. Addtech and Indutrade acquire other companies which provide niche or specialised products and allow them to operate independently. They then use their cash and income to acquire more companies. Addtech and Indutrade both benefit from long-term growth opportunities within renewable energy, automation and electrification, in which their components are used.

We visited both Addtech and Indutrade on a research trip to Stockholm during the quarter, as well as ten other companies. This included other portfolio holdings, such as access solutions provider Assa Abloy (Sweden: Industrials), the 153-year-old bank Handelsbanken (Sweden: Financials), the world’s leading manufacturer of air compressors Atlas Copco (Sweden: Industrials), and specialised software business acquirer Vitec Software (Sweden: Information Technology).

The opportunity to meet with company management on their ‘home turf’ is invaluable; it is much easier to get a sense of how culture and people have shaped a company and its future return profile when sitting within their offices; or, in the case of Atlas Copco, 20 metres below their office in a test mine. We continue to find excellent investment ideas by focussing on the impact that outstanding people can have on businesses with strong business franchises and resilient financials.

1 Source: ASML Annual Report 2023

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2024

European All Cap strategy update: 1 April - 30 June 2024

Following an improvement in the strategy’s performance in late 2023, the first half of 2024 has been relatively weak. Geopolitical and monetary policy uncertainty (e.g. interest rates) continue to concern markets, and the strategy was impacted by volatility (rapid and unpredictable price fluctuations) from a small number of holdings.

This volatility brought opportunities to build positions in companies we believe are well-positioned for the long term, such as our IT services holdings, Endava (United States: Information Technology) and EPAM Systems (United States: Information Technology). Despite short-term pressure on customer budgets, the long-term opportunity of digitalisation remains an exciting area of growth for both companies.

We also added to a number of existing holdings, including Dino Polska (Poland: Consumer Staples), admiring their consistent approach in a fast-growing retail market, Vitec Software (Sweden: Information Technology) which has strong financials and the global leader in locks, Assa Abloy (Sweden: Industrials).

We sold several positions, including ALK-Abellò (Denmark: Health Care), Admiral (United Kingdom: Financials) and Spirax Group (United Kingdom: Industrials) due to valuation concerns and Alfen (Netherlands: Industrials) after issues around stock reduction, management change, and slowing end customer markets.

We bought Ashtead Group (United Kingdom: Industrials), which rents construction and industrial equipment to a range of customers in the United States and further afield. Ashtead is run by an excellent management team who have reinvested income into the business. They have consolidated the market of equipment rental services by buying small-scale providers. The business model of equipment rental favours large-scale businesses with geographic reach, a wide range of products, and excellent customer service. We believe Ashtead is in a strong and still strengthening position. They should also benefit from strong sustainability opportunities (tailwinds), not only by helping to maximise equipment life and responsible disposal, but also by leasing equipment needed in infrastructure investment across areas such as semiconductors, electric vehicles (EVs), and renewable energy.

We also bought Air Liquide (France: Industrials), which supplies industrial gases such as oxygen, argon, hydrogen, and helium to a range of end customer markets, including healthcare, manufacturing, and electronics. The company is well-positioned within a market without too many competitors; pricing is both fair and linked to inflation, and the products are often essential for their customers’ day-to-day operations. In addition to building on their century-old core business, Air Liquide are exploring new areas of growth in carbon capture and green hydrogen. It has invested in 200 megawatts of planned hydrolyser capacity in Normandy as part of their target to invest EUR8 billion to reduce emissions from hydrogen production by 20351.

Amid the volatility, it was pleasing to see signs of a recovery in the portfolio’s largest position, Roche (Switzerland: Health Care). Following a long period of reducing stock after the covid-19 pandemic, Roche is positioned well to benefit from its market-leading diagnostics product offering, which consists of 600 tests and is planned to grow by 40 new tests each year. Strong growth and cash flows (the movement of money into and out of a business) from diagnostics support Roche’s long-term drug development and committed research & development (R&D) spending, including a 100-strong drug pipeline addressing unmet medical needs in a wide range of areas such as oncology, obesity, and multiple sclerosis.

Looking through short-term volatility and uncertainty, we remain confident in the long-term prospects of the portfolio and are excited by our exposure to high-quality companies with excellent sustainability opportunities.

1 Source: Stewart Investors investment team and company data

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Proxy voting: Q1 2025

European All Cap proxy voting: 1 January - 31 March 2025

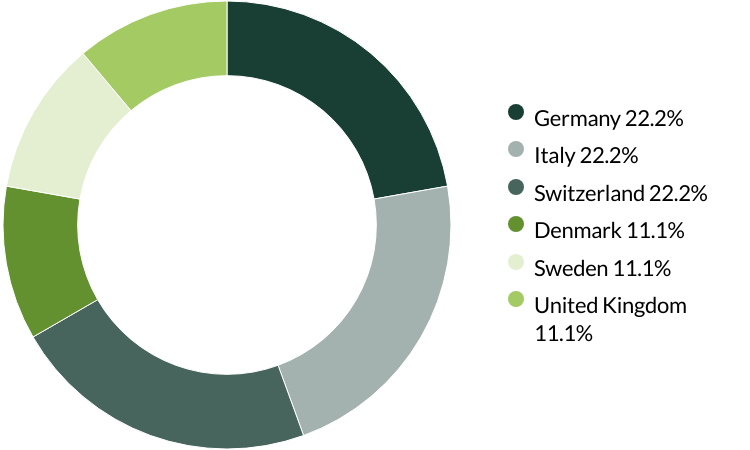

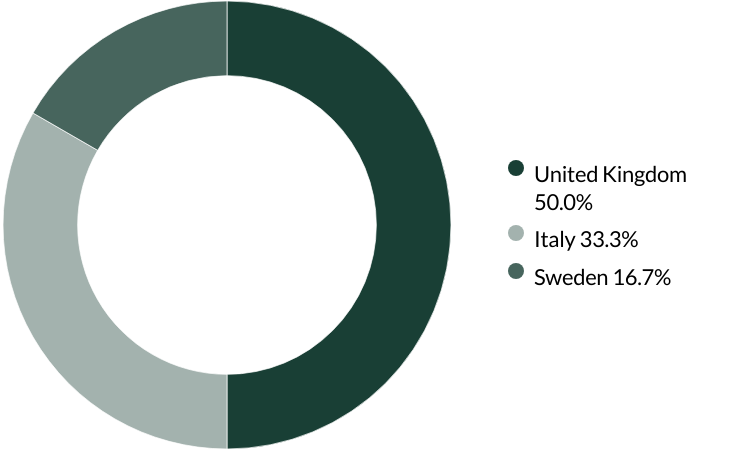

Proxy voting by country of origin

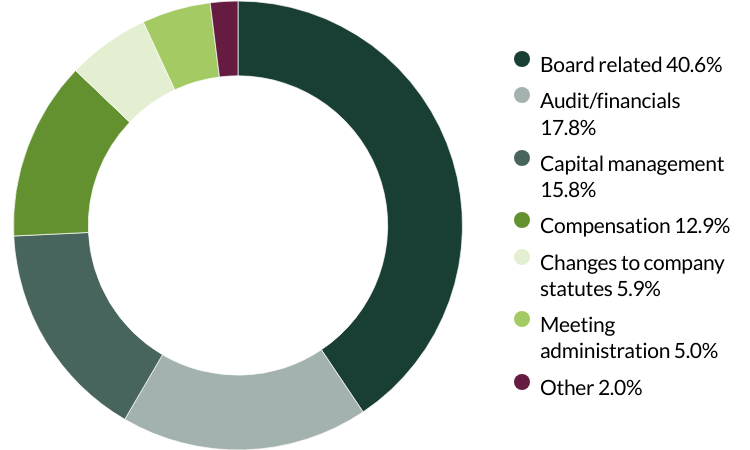

Proxy voting by proposal category

During the quarter there were 169 resolutions from eight companies to vote on. On behalf of clients, we voted against nine resolutions.

We voted against executive remuneration and the remuneration report at Roche as we believe executive pay is high and there is a lack of metrics to determine and/or justify those awards. We voted against a proposal on transaction of business as the company did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (four resolutions)

We voted against a proposal on transaction of business at Sika, as they did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (one resolution)

We voted against three shareholder proposals at Handelsbanken regarding banking identification security improvements and changes to dividend payment schedules. We believe management is best positioned to manage security risks and decide on dividend payments. (three resolutions)

We voted against a shareholder proposal requesting shareholder approval to recruit and appoint candidates to the shareholders committee at Ringkjøbing Landbobank. The committee is a channel for recruiting board members, and we believe the board are best placed to identity the skills and experiences required for this committee and future board appointments. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2024

European All Cap proxy voting: 1 October - 31 December 2024

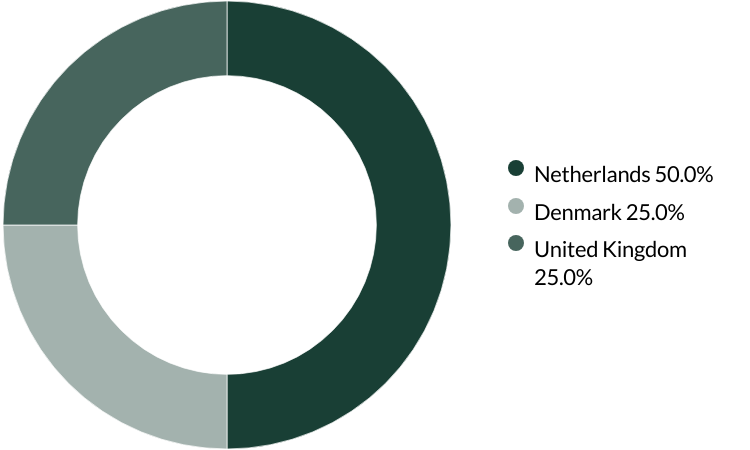

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 26 resolutions from four companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2024

European All Cap proxy voting: 1 July - 30 September 2024

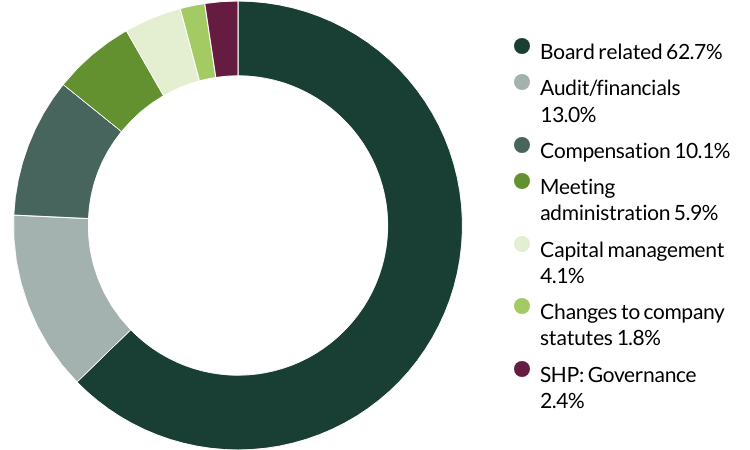

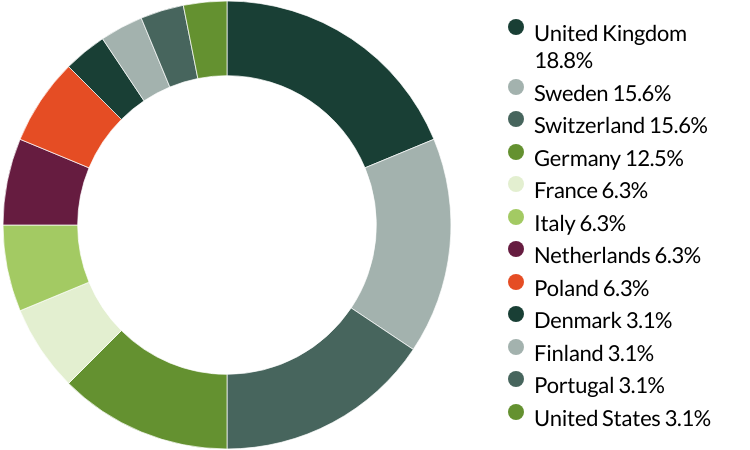

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 101 resolutions from five companies to vote on. On behalf of clients, we voted against three resolutions.

We voted against remuneration motions at Ashtead Group as we were concerned about excesses in CEO salary. (two resolutions)

We voted against proposals related to amendments to articles (rules and regulations that govern the company's operations) at DiaSorin as the company did not provide enough information on the amendments. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2024

European All Cap proxy voting: 1 April - 30 June 2024

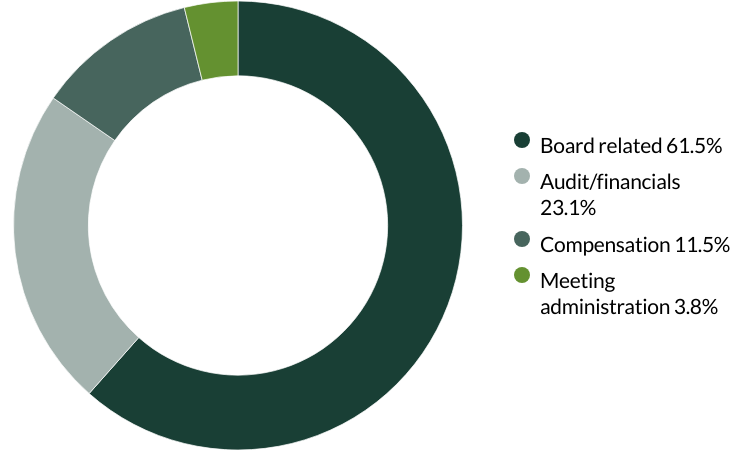

Proxy voting by country of origin

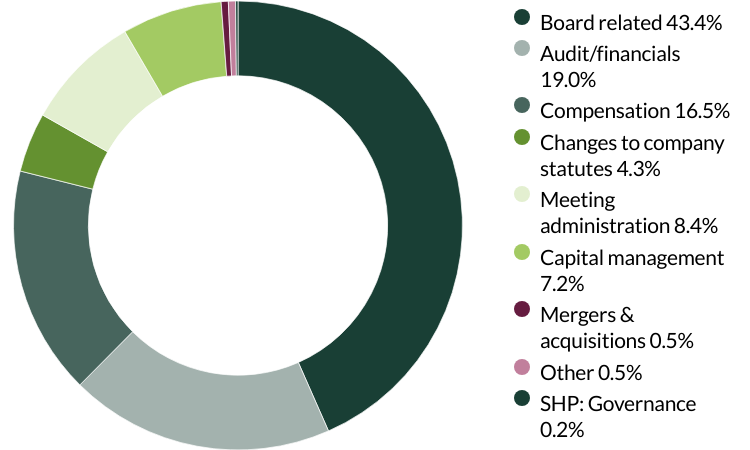

Proxy voting by proposal category

During the quarter there were 583 resolutions from 30 companies to vote on. On behalf of clients, we voted against 15 resolutions.

We voted against proposals on transaction of business at Alcon, Naturenergie, INFICON, SFS and Tecan as they did not provide enough information about the proposals. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (five resolutions)

We voted against remuneration motions at Assa Abloy. The company often buys other businesses through acquisition and we believe this type of business should reward management on financial performance as well as the number of shares they own. (two resolutions)

We voted against the appointment of the auditor at bioMérieux, EPAM Systems, Indutrade, SFS, Spirax Group and Unilever as they have been in place for over 10 years and the companies’ have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (six resolutions)

We voted against remuneration motions at Indutrade as we were concerned about excesses in CEO salary increases. (one resolution)

We voted against a shareholder proposal about board declassification at EPAM Systems as we do not believe it is necessary for all directors to stand for election annually and have concerns that this could destabilise the board by allowing excessive turnover. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Sustainable investment labels help investors find products that have a specific sustainability goal. This product does not have a UK sustainable investment label as it does not have a non-financial sustainability objective. Its objective is to achieve capital growth over the long-term by following its investment policy and strategy.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, European All Cap Strategy, European (ex UK) All Cap Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 31 March 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors European All Cap Fund

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors European All Cap Class E (Acc) | Irish UCITs | EUR | 9.85 | 0.55 | 09 May 2025 | |

| Stewart Investors European All Cap Class E (Acc) | Irish UCITs | GBP | 9.68 | 0.26 | 09 May 2025 | |

| Stewart Investors European All Cap Class E (Acc) | Irish UCITs | USD | 9.08 | 0.21 | 09 May 2025 | |

| Stewart Investors European All Cap Class VI (Acc) | Irish UCITs | EUR | 9.77 | 0.55 | 09 May 2025 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.