Get the right experience for you. Please select your location and investor type.

Asia Pacific and Japan All Cap

The strategy was launched in June 1988. It invests in the shares of between 30-60 companies in the Asia Pacific region.

You can see all of the companies that this strategy invests in by filtering on our Portfolio Explorer tool.

- We define investment risk as losing clients’ money – this means we focus on looking after your money as well as growing it

- Companies must contribute to sustainable development and make a positive impact towards a more sustainable future. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Quarterly updates

Strategy update: Q1 2025

Asia Pacific and Japan All Cap strategy update: 1 January - 31 March 2025

While broad Asia Pacific market indices edged slightly higher over the quarter in both US dollar and Australian dollar terms, they moved slightly lower in euro and sterling terms.

Perhaps of greater significance was that political turbulence resulted in some wide differences in returns on a country level. Market indices in China, South Korea and Singapore moved higher but fell across the rest of the region, with some markets suffering steep falls.

Most notable was the contrast in returns between India (which was down) and China (which was up). Investors’ enthusiasm for Chinese equities was, in part, a response to artificial intelligence (AI) company DeepSeek’s impressive demonstration of the progress the country is making in AI. And while there was less news from India, share prices fell back from high levels, as they did in many other parts of the world. Returns from the Indian market over the quarter were broadly in-line with those from the United States (US).

During the quarter, we bought S.F. Holding (China: Industrials), Mindray (China: Health Care) and Alibaba (China: Consumer Discretionary). We believe each of these companies has the potential to benefit from China’s increased emphasis on national self-reliance (producing more of its own goods and services and reducing imports). Over the last five years, the leaders of Chinese companies have, often for the first time, been tested by genuine economic and political instability. They have learned valuable lessons and many have become financially stronger, reducing their reliance on borrowing. This, in combination with valuations that appear modest by global standards, means we have been identifying a greater number of new investment ideas in China.

Elsewhere, we added a new holding in Ayala (Philippines: Industrials), a family-owned business group whose new management is focused on improving returns. In India, we added new holdings in Triveni Turbines (India: Industrials), a leading manufacturer of steam turbines and Bajaj Auto (India: Consumer Discretionary), a leading manufacturer of motorcycles, scooters and auto rickshaws.

We took advantage of lower valuations to add to our existing holdings in MANI (Japan: Health Care), Elgi Equipments (India: Industrials), Tube Investments (India: Consumer Discretionary) and Samsung Electronics (South Korea: Information Technology).

To finance these additions, we sold Fisher & Paykel Healthcare (New Zealand: Health Care), which could be vulnerable to new tariffs imposed by the Trump administration. Similarly, we sold Dr. Lal PathLabs (India: Health Care) and Cyient (India: Industrials) because of their potential exposure to changes in US trade policy. We sold Godrej Consumer Products (India: Consumer Staples), whose shares had begun to look expensive. Finally, we sold Nihon M&A Center (Japan: Financials) and Koh Young Technology (South Korea: Industrials) to fund better ideas elsewhere.

To control position sizes, we reduced our holdings in IndiaMART (India: Industrials), Tech Mahindra (India: Information Technology), Mahindra & Mahindra (India: Consumer Discretionary) and Japan Elevator Service (Japan: Industrials). We trimmed the holdings in Advantech (Taiwan: Information Technology), CSL (Australia: Health Care) and Vitasoy (Hong Kong: Consumer Staples) to fund additions to more attractively valued companies elsewhere.

After a long period in which returns from the US have outperformed those from most other regions, we hope investors will begin to pay attention to the attractively valued companies to be found in the Asia Pacific region. If the US economy falters, then economies across Asia will also be impacted, albeit to differing degrees. We are also conscious that political risks appear to be rising in many Asian countries. Those risks are not the same for every country or company. For example, the region’s large technology companies, many of which are found in Taiwan, South Korea and China, look particularly vulnerable to a global slowdown. India, by contrast, is more isolated from turbulence in the wider global economy. The Philippines, meanwhile, could receive a significant economic boost if a global slowdown results in a meaningful fall in oil prices.

Predicting how any of today’s economic and political challenges will unfold lies beyond our remit and our skillset. Fortunately, the Asian companies we invest in tend to have long memories; they still have the scar tissue formed during previous crises. These businesses have been forced to learn, to adapt and to become resilient. As a result, we believe they are set up not only to perform when conditions are fair but to navigate through whatever political and economic turbulence lies ahead.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

Asia Pacific and Japan All Cap strategy update: 1 October - 31 December 2024

Over most three-month periods, there should be relatively little change to the investments in the portfolio. We aim to build resilient portfolios of high-quality companies with various ways of earning money that have the ability to grow in value over the long term.

Many Chinese stocks lost some of the performance gains that they saw in the third quarter of 2024 when the government announced positive economic events. The performance of the Indian market index struggled after some of the largest companies in India faced governance issues that became subject to enquiry by the regulator in the United States. The re-election of Mr Trump in the United States election in November also seemed to distract global investors from Asian equities. At Stewart Investors we continue to concentrate on companies rather than unpredictable economic and political news.

During the quarter we bought DFI Retail Group (Hong Kong: Consumer Staples), a pan-Asian retailer led and stewarded by the Keswick family. We also bought Naver (South Korea: Communication Services), South Korea’s dominant internet search engine which has significantly improved how it allocates and spends its financial resources in recent years.

We also took advantage of attractive valuations to increase the size of our positions in AirTAC International (Taiwan: Industrials), Yiheda Automation (China: Industrials), Techtronic (Hong Kong: Industrials), Sysmex (Japan: Health Care), MANI (Japan: Health Care) and AS ONE (Japan: Health Care).

Due to lower confidence, high valuations, or finding better ideas elsewhere, we sold Pentamaster (Malaysia: Information Technology), Advanced Energy Solution (Taiwan: Industrials) and Samsung C&T (South Korea: Industrials).

To control position sizes, we trimmed our holdings in Mahindra & Mahindra (India: Consumer Discretionary), CG Power (India: Industrials), CSL (Australia: Health Care), HDFC Bank (India: Financials), Syngene (India: Health Care) and Fisher & Paykel Healthcare (New Zealand: Health Care).

Views on investment opportunities in Asia have not changed; the strategy continues to look to invest in high-quality companies that are aligned with sustainable development. We look for company leaders who are low profile, competent, long-term decision makers, franchises free from political agendas and financials that are resilient, not frail. Our focus is on quality, and we remain indifferent to many of the large, well-known companies, regardless of lower valuations.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2024

Asia Pacific and Japan All Cap strategy update: 1 July - 30 September 2024

Over most three-month periods, there should be relatively little change to the investments in the portfolio. We aim to build resilient portfolios of high-quality companies with various ways of earning money that have the ability to grow in value over the long term.

During the last few days of the quarter the Chinese central bank and government announced changes to public spending and taxation rates to boost the economy. This caused Chinese stocks to rise significantly. Whilst it is heartening to see the Chinese authorities attempting to address the problems within the economy it remains unclear whether the changes will adequately address broader issues like the lack of consumer demand.

We bought Yiheda Automation (China: Industrials), China’s leading supplier of factory automation components. Yiheda has a business model that we have seen create large, profitable companies elsewhere in the world. Due to the high level of resources and investments required for these types of businesses, as well as the close relationships they form with customers, the early leaders tend to be in a strong position and newer companies can find it difficult to catch up. Yiheda are currently affected by falling industrial demand but in the long run they have the opportunity to consolidate a growing market that is still largely dominated by small family-run businesses.

During the quarter we added to Aavas Financiers (India: Financials). We also took advantage of lower valuations in businesses exposed to China to add to AirTAC International (Taiwan: Industrials) and Inovance (China: Industrials).

We sold RBL Bank (India: Financials) and Hamamatsu Photonics (Japan: Information Technology), both of which were smaller positions where our confidence had lowered over time. We also sold Kotak Mahindra Bank (India: Financials) to fund better ideas elsewhere.

We controlled the position size by trimming our large holding in Mahindra & Mahindra (India: Consumer Discretionary), and also trimmed Fisher & Paykel Healthcare (New Zealand: Health Care) and Unicharm (Japan: Consumer Staples).

Views on investment opportunities in Asia have not changed; the strategy continues to look to invest in high-quality companies that are aligned with sustainable development. We look for company leaders who are low profile, competent, long-term decision makers, franchises free from political agendas and financials that are resilient, not frail. Our focus is on quality, and we remain indifferent to many of the large, well-known companies, regardless of lower valuations.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2024

Asia Pacific and Japan All Cap strategy update: 1 April - 30 June 2024

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term.

During the quarter we bought Samsung Electronics (South Korea: Information Technology). The company is a leader in consumer electronics and semiconductor chip manufacturing. Over the past 50 years Samsung has been managed conservatively and with a long-term vision which has helped it become a market leader. During the good times, management set aside cash to be used to acquire and outlast rivals in more challenging periods. This simple, yet effective, approach sets them aside from competitors and has allowed them to consolidate a semiconductor market that is divided amount many providers. Recently we have also been pleased to see governance improvements within the Samsung Group.

We took advantage of a lower valuation to add to SHIFT (Japan: Information Technology). We also continued to add to the position size of AirTAC International (Taiwan: Industrials), Voltronic Power (Taiwan: Industrials), Techtronic Industries (Hong Kong: Industrials), MonotaRO (Japan: Industrials), Japan Elevator Service (Japan: Industrials), Mainfreight (New Zealand: Industrials), Aavas Financiers (India: Financials), Samsung Electronics (South Korea: Information Technology), and Anest Iwata (Japan: Industrials). This reflected our positive views on their quality and long-term prospects.

We trimmed Mahindra & Mahindra (India: Consumer Discretionary) and CG Power (India: Industrials) to control the size of their position. We trimmed Marico (India: Consumer Staples) due to high valuation concerns and reduced Tech Mahindra (India: Information Technology) to invest in better ideas elsewhere.

We sold WuXi Biologics (China: Health Care) after a proposed bill in the United States Congress aimed to restrict some Chinese biotech business ties with United States companies due to national security concerns. It was a mistake to invest in WuXi Biologics given the geopolitical risk the company is exposed to. We sold small positions in Amoy Diagnostics (China: Health Care) and Kingmed Diagnostics (China: Health Care) due to their exposure to regulatory risk. In China the government is driving to reduce healthcare spending. Despite the value provided to customers from their medical solutions, it is difficult for us to assess the risk of forced pricing cuts coming from external factors and not business decisions. We reassessed the business franchise and quality at Pigeon (Japan: Consumer Staples) and sold the position. We believe Cochlear (Australia: Health Care) and Tata Consumer Products (India: Consumer Staples) remain excellent businesses but were sold due to their extreme valuation.

Views on investment opportunities in Asia have not changed; the strategy continues to look to invest in high-quality companies that are aligned with sustainable development. We look for company leaders who are low profile, competent, long-term decision makers, franchises free from political agendas and financials that are resilient, not frail. Our focus is on quality, and we remain indifferent to many of the large, well-known companies, regardless of lower valuations.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Proxy voting: Q1 2025

Asia Pacific and Japan All Cap proxy voting: 1 January - 31 March 2025

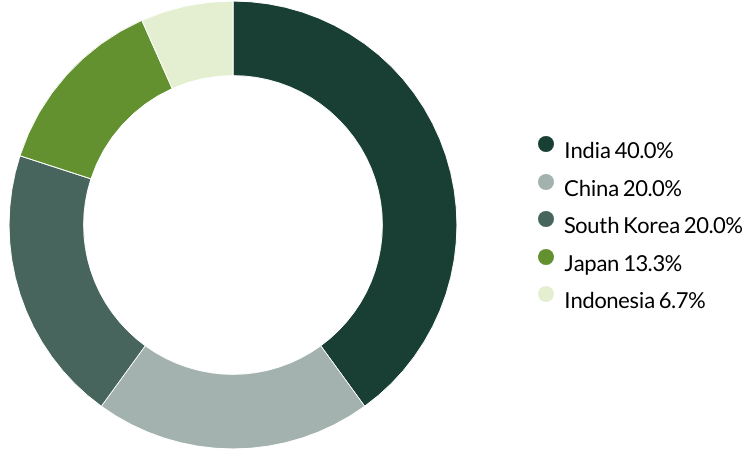

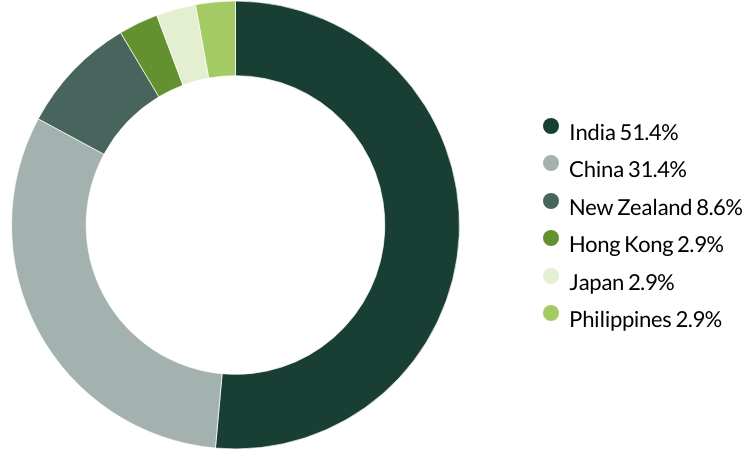

Proxy voting by country of origin

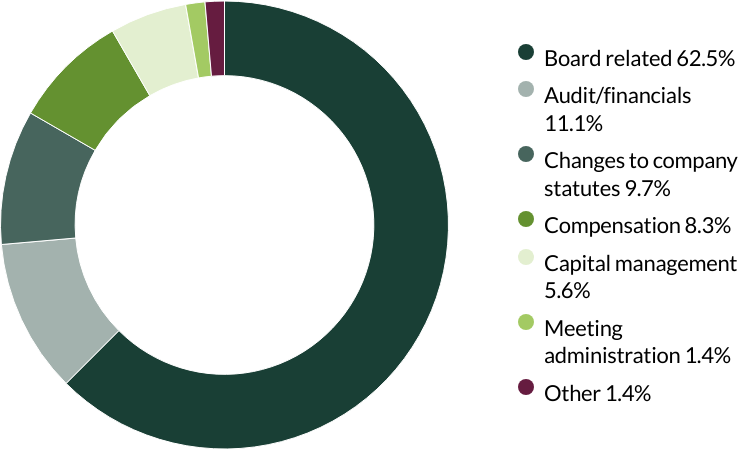

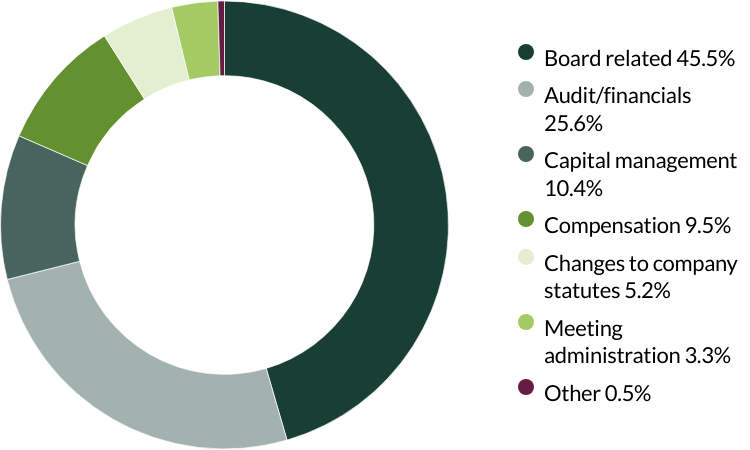

Proxy voting by proposal category

During the quarter there were 72 resolutions from 14 companies to vote on. On behalf of clients, we voted against six resolutions.

We voted against executive remuneration at Bank Central Asia because we believed it was excessive. (one resolution)

We voted against the election of a director and their remuneration at IndiaMART as we seek to encourage greater diversity and independence on the board. (one resolution)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

We voted against the election of the audit committee chair at Unicharm as we do not believe they are independent. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2024

Asia Pacific and Japan All Cap proxy voting: 1 October - 31 December 2024

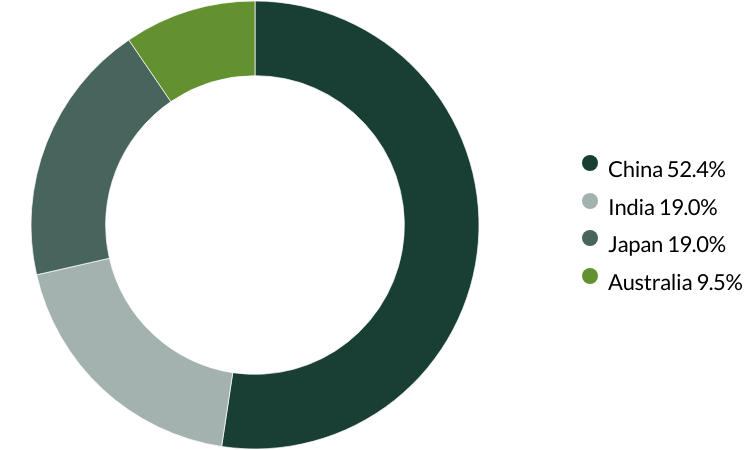

Proxy voting by country of origin

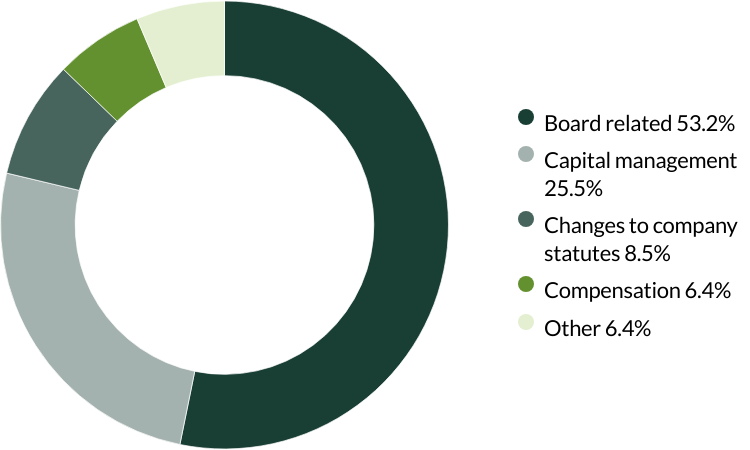

Proxy voting by proposal category

During the quarter there were 47 resolutions from 10 companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2024

Asia Pacific and Japan All Cap proxy voting: 1 July - 30 September 2024

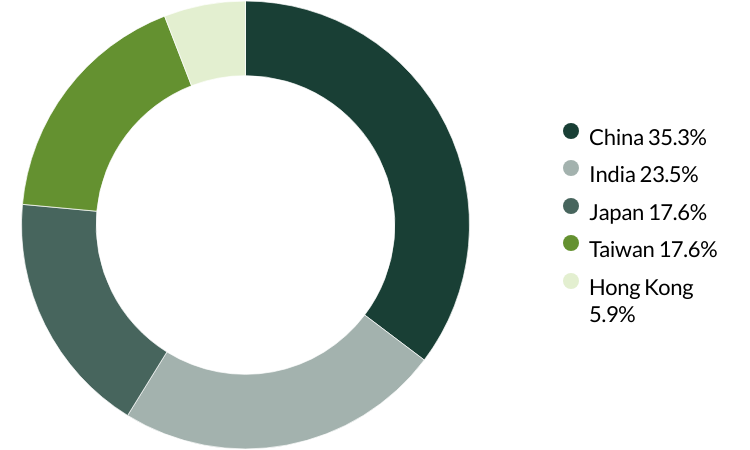

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 211 resolutions from 24 companies to vote on. On behalf of clients, we voted against three resolutions.

We voted against the appointment of the auditor at Philippine Seven as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. We also voted against proposals on transaction of business, as the company did not provide enough information about the proposals. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (two resolutions)

We voted against the appointment of the auditor at Vitasoy as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2024

Asia Pacific and Japan All Cap proxy voting: 1 April - 30 June 2024

Proxy voting by country of origin

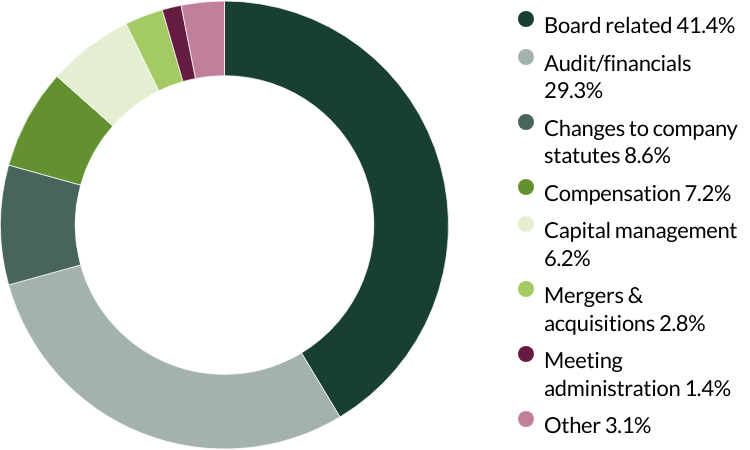

Proxy voting by proposal category

During the quarter there were 290 resolutions from 31 companies to vote on. On behalf of clients, we voted against seven resolutions.

We abstained from voting on amendments to work systems for independent directors and board meeting procedures at Amoy Diagnostics as the company did not provide enough data on the proposed amendments. (two resolutions)

We voted against the appointment of the auditor at Glodon, Yifeng Pharmacy Chain and Zhejiang Supor as they have been in place for over 10 years and the companies’ have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (three resolutions)

We voted against the proposed employee stock ownership plan at Midea as we believe that involving non-executive directors in the plan could create conflicts of interest and would not be in the best interest of the shareholders. (three resolutions)

We voted against a capital management proposal at Pentamaster as we do not believe shares should be issued without pre-emptive rights. Pre-emptive rights offer existing shareholders to purchase additional shares of a company before they are offered to the general public. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Sustainable investment labels help investors find products that have a specific sustainability goal. This product does not have a UK sustainable investment label as it does not have a non-financial sustainability objective. Its objective is to achieve capital growth over the long-term by following its investment policy and strategy.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, European All Cap Strategy, European (ex UK) All Cap Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 31 March 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Asia Pacific and Japan All Cap Fund

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Asia Pacific and Japan All Cap Class A (Acc) | OEIC | GBP | 1547.93 | -0.68 | 08 May 2025 | |

| Stewart Investors Asia Pacific and Japan All Cap Class A (Inc) | OEIC | GBP | 271.42 | -0.68 | 08 May 2025 | |

| Stewart Investors Asia Pacific and Japan All Cap Class B (Acc) | OEIC | GBP | 1847.24 | -0.67 | 08 May 2025 | |

| Stewart Investors Asia Pacific and Japan All Cap Class B (Inc) | OEIC | GBP | 278.59 | -0.67 | 08 May 2025 | |

| Stewart Investors Asia Pacific and Japan All Cap Class E (Acc) | Irish UCITs | EUR | 9.46 | -0.49 | 08 May 2025 | |

| Stewart Investors Asia Pacific and Japan All Cap Class E (Acc) | Irish UCITs | USD | 9.77 | -1.11 | 08 May 2025 | |

| Stewart Investors Asia Pacific and Japan All Cap Class VI (Acc) | Irish UCITs | EUR | 9.44 | -0.49 | 08 May 2025 | |

| Stewart Investors Asia Pacific and Japan All Cap Class VI (Acc) | Irish UCITs | USD | 9.76 | -1.11 | 08 May 2025 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.