Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Indian Subcontinent: the decade ahead

The Strategy did well in 2020, thanks in part to the generosity of central banks globally, while the real economy tried to shake off a pandemic. However, we believe that the real opportunity for investors in the subcontinent should be in the decade ahead. We are optimistic for two reasons.

Download PDF version1. Many macro-economic factors are beginning to turn in India’s favour

One may conclude from the past decade that India is likely to remain a low-growth economy. We disagree. Many ingredients are now in place for a revival in economic growth and sustainable development. Below are some of the macro-economic tailwinds that contribute to this view.

- A lower carbon future

- A potential revival in infrastructure investment

- A potential revival of the manufacturing sector

- A global health crisis that has further strengthened India’s IT services and pharmaceutical companies

- A potential resurgence of the property cycle

A lower carbon future

India has only produced 3% of total carbon dioxide emissions historically2. Surprised? We were too! The United States, Europe and China have together contributed 60%2. As a signatory to the Paris Agreement, India has committed to reduce carbon intensity by 33-35% by 20303. As part of this journey, 175 gigawatts (GW) of renewable generation capacity is already commissioned or in construction by 2022, up from just 34 GW in 20144. Falling solar prices could help India reach its target of 450–550 GW by 2030 or 60-65% of total generation capacity4. Changes in vehicle emission norms to European standards, rapid evolution of electric vehicle (EV) technology and introduction of scrappage vehicle policies should further reduce emissions intensity and improve the country’s finances. These are sound reasons to believe India will not follow a similar carbon-intensive development path as the west or even China.

A potential revival in infrastructure investment

Infrastructure investment has been India’s Achilles heel. It could well be its champion in the next decade. For instance, construction of new roads has continued behind the scenes at a good pace in the last five years. Private investments and participation have now begun to improve in areas such as airports, gas and power distribution, renewable energy and even parts of the railways. The government has embarked on many difficult but essential reforms in agriculture and labour markets. The pace of reforms is likely to be dictated by acceptance from various stakeholders. Such checks and balances are sometimes necessary to ensure the benefits of development are widespread and equitable.

Source: Ministry of Road Transport and Highways, Indian government. *Target for 31 March 2021.

Funding availability and lower interest rates are necessary ingredients to fuel an investment cycle. The previous cycle was overly dependent on the state banking system as a funding source. Today, insurance companies, infrastructure investment trusts, corporate bond markets and large well-capitalised private banks can participate in financing infrastructure. Unlike what we see elsewhere, corporate and bank balance sheets have been slow to repair in the last decade. The insurance industry’s assets have grown to USD600bn from just USD200bn a decade ago5. Approximately USD18trn in global debt earns negative returns5. If India keeps the inflation genie in the bottle, it could become an attractive destination for long-term debt capital. Interest rates today are at least 5%, which is 6% lower than the previous investment cycle5.

A potential revival of the manufacturing sector

India’s manufacturing sector is showing early signs of promise. While the government encourages investment in local manufacturing through attractive taxation and labour reforms, the case is becoming stronger from the bottom-up via productivity improvements. A large domestic market, improving infrastructure and the need to diversify global supply chains due to geopolitical tensions, add wind to India’s manufacturing sails. Apple’s* suppliers have invested close to a billion dollars to set up manufacturing units recently6. Many home appliance producers are localising manufacturing through companies such as Dixon Technologies and Amber Enterprises*. These are still early days but the conditions are far better today for Indian companies to become competitive at a global scale in this area.

Source: Country government statistics and OECD, 2020.

A global health crisis that has further strengthened India’s IT services and pharmaceutical companies

A crisis is an opportune time to build trust. Companies with time horizons spanning decades understand this well. Despite unexpectedly extreme conditions, companies such as Tata Consultancy Services and Infosys* ensured uninterrupted services to their clients by swiftly enabling hundreds of thousands of employees to work remotely. A monumental task given their scale. Clients rewarded them with USD40bn in new business during a pandemic7. A sign of trust! Indian pharmaceutical companies have long provided affordable drugs to the world. Companies like Serum Institute and Dr. Reddys* are preparing to produce billions of doses of affordable vaccines. The trust earned by supplying these at a reasonable cost should help cement their role as providers of quality affordable healthcare globally for decades to come. We believe that trust is one of the best barriers to entry for any business.

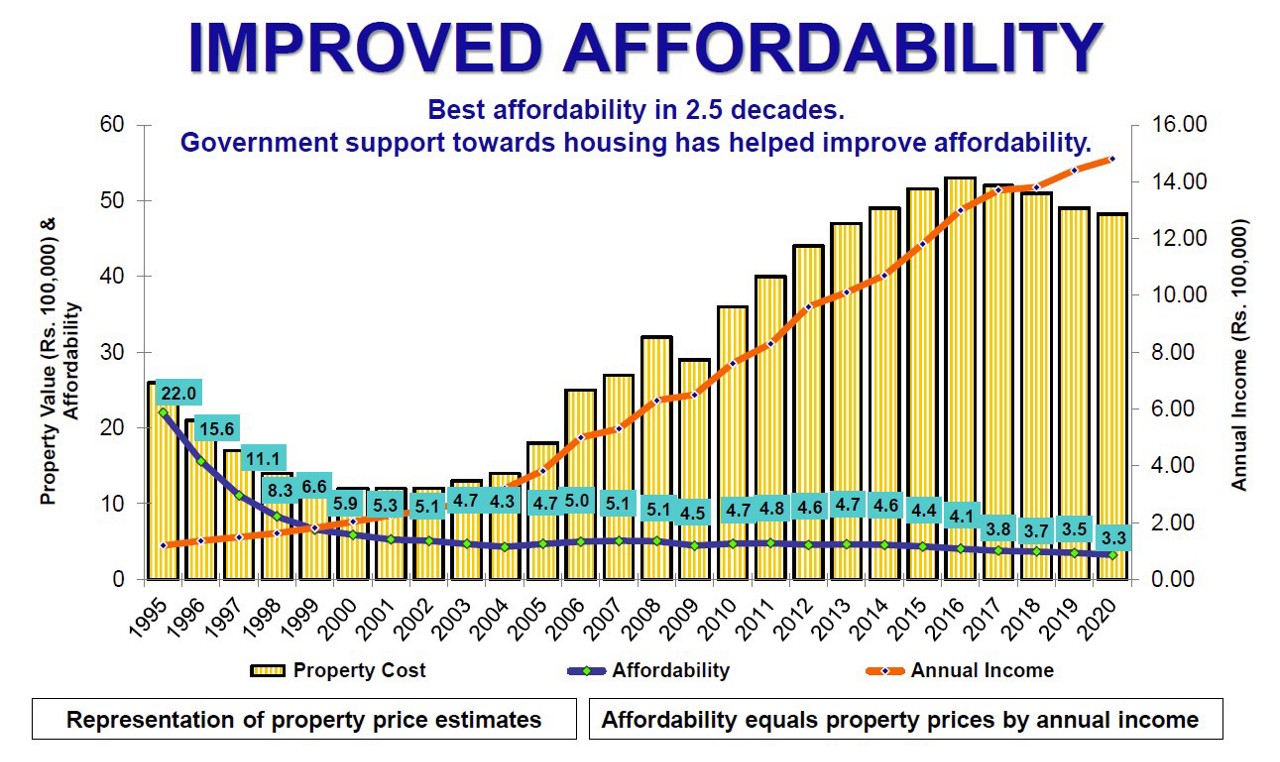

A potential resurgence of the property cycle

“More than ever before, people will want to own their homes. People will go to any length to hold on to their homes” – says Deepak Parekh’s (Chairman of HDFC8)*. Structural changes are afoot in how people view homes and the need for work spaces within homes. And property is more affordable today than at any time in the last 25 years9. Tax incentives for affordable housing materially reduce the cost of servicing mortgages. India remains one of the most attractive mortgage markets in the world due to low home ownership, low mortgage penetration and a young population. Mortgages would have to grow at twice the rate of GDP in the next 10 years just to catch up with China. This presents favourable conditions for the start of a multi-year property cycle.

Source: HDFC. Data reflective of HDFC’s customer base.

2. Quality companies should benefit disproportionately from macro-economic tailwinds

India is home to many high-quality companies. We have been saying this for many years. We are particularly excited by the resurgence of good old-fashioned Indian conglomerates - the Tatas, Murugappas and Mahindras*. The Strategy has around one-third of its assets invested across many companies stewarded by these groups. These companies engage in diverse businesses which are well positioned for sustainable development in the region.

It is difficult to reconcile with the unceremonious removal of Tata Sons’ previous Chairman Cyrus Mistry. But it is equally difficult to disagree with the choice of his successor – Natarajan Chandrasekharan, the former CEO of Tata Consultancy Services. Over the last four years, Chandra has been resolute in rekindling a culture of focus and performance, while holding on to the group’s cherished ethos and long termism. The group now desires less risky balance sheets while tilting its emphasis back to India after a decade of outward investments. Microsoft, under the leadership of Satya Nadella, is a good example of the potential returns investors can reap when good groups find quality managers to steer them ahead.

Source: Stewart Investors as at 28 February 2021.

The Murugappa Group felt the overhang of an inter-generational leadership transition within the family. The succession is now firmly in place and the group is becoming bolder in its aspirations. Tube Investments, is headed by Vellayan Subbiah. The recent acquisition of CG Power, a maker of industrial motors, is a clear sign that Tube Investments has set its sights on becoming a leading engineering conglomerate. We believe that the group’s multi-decadal time horizons, competent leadership and conservative approach to financials make them well positioned to succeed.

The Mahindra Group had two wonderful decades under the stewardship of Anand Mahindra. However, a global expansion in automobiles and some investment choices away from their core strengths set them back recently. Incoming CEO Anish Shah has spent the last six years understanding the group’s history, culture and evolution. He has sought inspiration from how the Mahindras responded to the oil crisis in the 1970s and to the dotcom bubble in the late 1990s. A raging pandemic did not stop the group from admitting to some of their recent strategic mistakes. Much of the repair is now well underway, paving the way for an exciting decade ahead.

In each of these groups, a generational transfer of leadership is leading to an exciting future. These institutions have survived and thrived over generations, partly because of their ability to admit to mistakes and correct the course when necessary. A rare and exceptional quality. This combination of internal improvements under highly competent leaders, in addition to macro tailwinds, could prove to be powerful for investment returns.

Risks are often misunderstood

It is rare to see tens of thousands of people protest peacefully outside a nation’s capital for months. It is more rare in the polarised times we live in. The ongoing farmer protests in India are a sign that society can challenge the prevailing government of the day. It is not the first time. Back in 2012, there were peaceful anti-corruption protests across the nation, which eventually led to the fall of the previous government. India’s vibrant and often loud democracy is misunderstood as chaotic and risky. We believe the opposite is true. The ability of companies and society to engage with governments and hold them accountable where necessary is key for the sustainable development of economies. We struggle far more with the opacity and the binary risks that come alongside investing in authoritarian regimes. Investing in the subcontinent is not without risks and potential market volatility. Fragile borders, water shortages, rising social divisions and climate change are key challenges. Moreover, society still has a pandemic to deal with. Quality private companies operating in unfavourable macro-economic conditions drove the Strategy’s performance in the last decade. We believe that many conditions should turn favourable and with good reason. We are optimistic that the subcontinent should reward patient investors with sound absolute returns in this decade.

Sashi Reddy

March 2021

*Source for company information: Stewart Investors and company data. For illustrative purposes only. Reference to the names of each company in this communication is merely for explaining the investment strategy, and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors.

Want to know more?

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group