Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

‘Green’ Bookkeeping Shows Real Business Costs

In 2010, Puma pioneered a new form of corporate reporting. The German sportswear company produced an environmental profit and loss account, which estimated the company and its supply chain to have caused €145m of environmental damage that year, relative to €202m of net profit.

In other words, if Puma expensed the costs to the environment of its activities and those of its suppliers, earnings would fall by more than two-thirds.

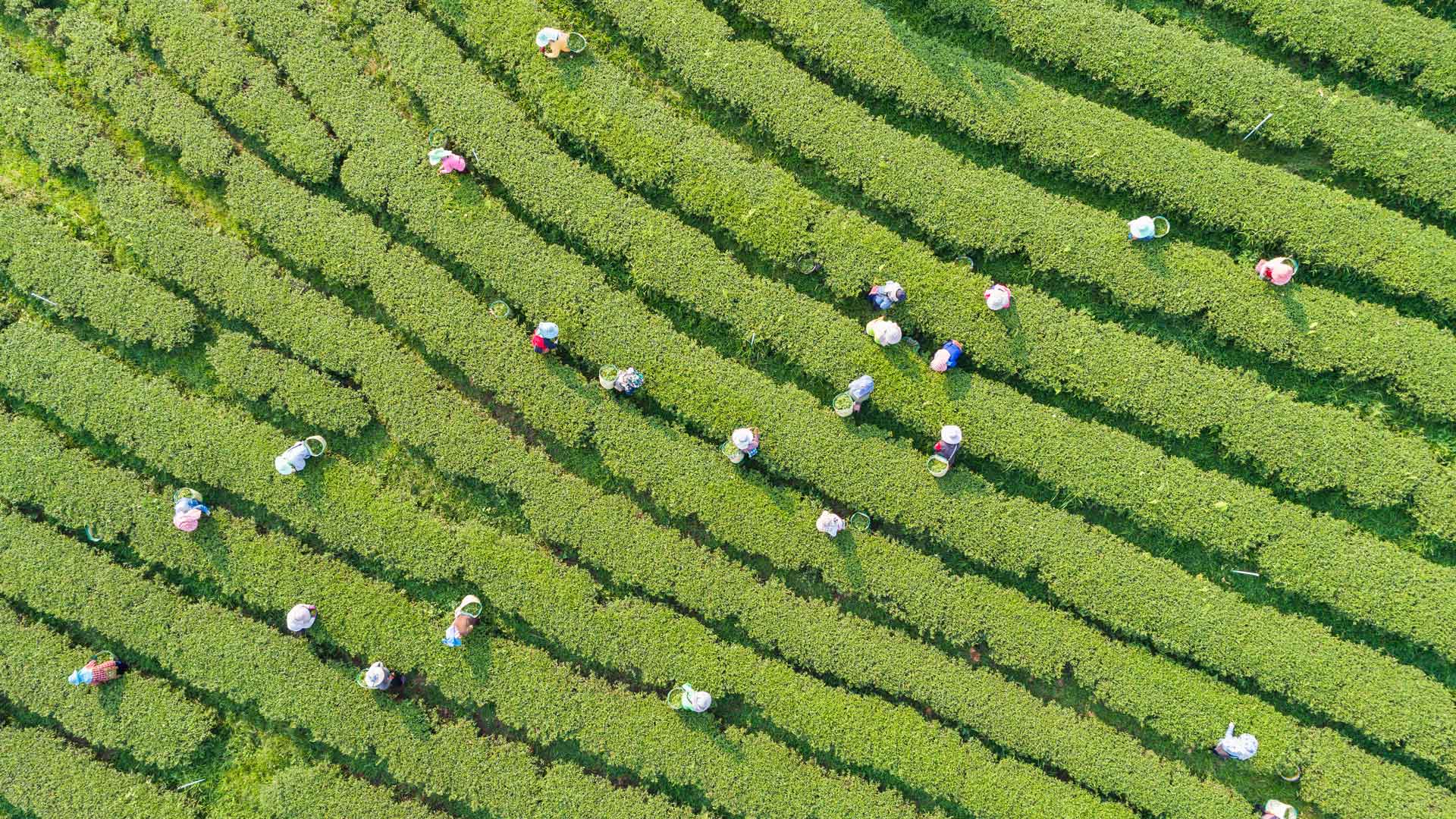

Conventional bookkeeping allows companies to ignore such damage. The activities of Puma’s supply chain involve a number of environmental and social costs, such as the chemical pollution of waterways via the dumping of untreated wastewater.

But because these costs are imposed on outside parties, and therefore fall outside the scope of suppliers’ P&Ls, there is no obligation to quantify or expense them. Instead, they go unrecorded and are borne by the rest of us.

This is what economists call market failure. Companies are not forced to pay their full costs, leading to socially inefficient outcomes – and the results are all too apparent. In China, the global centre for textile production, the government acknowledges that nearly half of the rivers are so contaminated with hazardous chemicals as to be unsuitable for human contact; Greenpeace, the environmental group, estimates the proportion is much higher.

Evidence suggests that Puma and its supply chain are not unusual. The activities of the largest 3,000 public companies globally are estimated to cause environmental damage equal to 50 per cent of combined earnings.

The same fundamental issue is triggering a parallel debate at a macroeconomic level. Chinese gross domestic product includes the output of the factories polluting its rivers, the necessary clean-up projects and the medical expenses of the villagers poisoned by lead, mercury and arsenic. It ignores the associated loss of life, livelihoods and ecological vitality.

The patent absurdity of using this as a guide to public policy has led to the formation of a number of alternative, broader conceptions of progress. Such ideas are slowly seeping into public discourse and policy formation around the world.

Chinese agencies, for instance, attempted to calculate a “green GDP”. Despite the results ultimately being blocked by the government, the idea survives. Pilot emissions trading schemes are in place, 74 cities have been forced to publish real time air quality data and companies in polluting industries made to procure “compulsory insurance” to ensure they can provide compensation to victims of the damage they inflict.

In China and elsewhere, political and regulatory threats to “business as usual” are rising. Privatisation of profits and socialisation of costs is increasingly unacceptable to the public and the principle of the polluter pays has gained widespread policy acceptance, in theory if not yet in practice.

The consequence is that the ability of the private sector to externalise costs is waning. Companies in numerous jurisdictions are already forced to pay for the most obvious aspects of their environmental damage through carbon taxes and cap and trade schemes, as well as emissions charges. To combat the threat they pose to public health, tobacco and alcohol producers and retailers are being regulated more onerously. In future, such state intervention is likely to broaden in scope and deepen in nature, be it to expand emissions schemes to more sectors and pollutants, or to target excessive fat, salt and sugar content through taxes or caps.

These threats present clear business risks to a very wide range of companies and industries. Executives and investors need to consider these as core business and investment issues.

Corporates ought to act pre-emptively to mitigate these risks by managing and reducing external costs wherever possible, and long-term investors ought to encourage and demand they do so. Not doing so means running the risk of losing long-term social licenses to operate.

Quantifying external costs is a powerful step in this direction. Puma’s 2010 environmental P&L is the first step of three that will attempt to incorporate the environmental, social and economic impacts of the company and its supply chain. The final version should represent a pioneering set of full cost accounts that allow managers to identify risks, audit the supply chain and take remedial action.

Putting a monetary value on external costs is particularly useful, since this allows companies to incorporate thinking about how to alleviate them directly into existing financial and operational systems.

Momentum is gathering behind such initiatives. Next year, a dozen companies are reported to be joining Puma in publishing EP&Ls and creating an industry coalition to push for broader adoption.

More widespread calculation and disclosure of environmental and social impacts – even at the margin and far short of Puma’s ambitious effort – should be welcomed and encouraged by long-term investors attempting to identify franchises that are well positioned for coming challenges.

Jack Nelson

First published in the Financial Times on Monday 24 June 2013

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Want to know more?

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group