Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

News from the quarter

A round-up of news from the quarterly reports.

Q3: 1 July - 30 September 2025

Team update

After acting as careful stewards of our clients’ capital over many years, three of our colleagues - David Gait, Sashi Reddy, and Sujaya Desai - stepped back from their portfolio management responsibilities in August and left the business. Doug Ledingham, Jack Nelson and Nick Edgerton took over the lead portfolio manager responsibilities from the departing analysts.

Doug, Jack and Nick have extensive portfolio management experience, with a combined 48 years of industry experience between them. They have the support of a talented and tightly knit investment team. Stewart Investors has always operated with a team-based approach, with every investor being an analyst and all analysts being generalists. We are, and will always be, guided by our investment philosophy.

You can view the manager changes to our funds/strategies below. Please do get in touch if you have any questions.

In September 2025, we welcomed Chris Grey back to our team. Chris previously worked at Stewart Investors from 2015 to 2022. Chris joined us from Hollis Capital and before that he was at Chikara Investments, where he co-managed an emerging markets fund. Chris shares our way of thinking, and our passion for investing in high-quality businesses, and is already familiar with many of the companies we invest in. Since his return, he has actively contributed to portfolio construction discussions. It’s good to have him back.

Q2: 1 April - 30 June 2025

Annual Review 2024

Our annual review shows some of Stewart Investors’ activities in 2024 including:

- Our ongoing collaborative engagement with other investors and manufacturers – including semiconductor companies – in addressing the problem of ‘conflict minerals’ in supply chains.

- Reviewing our climate targets to simplify them and ensure their alignment with our investment philosophy, using measures that we believe more closely reflect companies’ real-world emissions performance.

- Commissioning research to enhance our understanding of the use of animal testing in the healthcare sector and the potential alternatives.

- Initiating a research partnership with the Access to Medicine Foundation, whose Generic & Biosimilar Medicines Programme we are helping to fund and which aims to increase access to affordable medicines worldwide.

- Refining our human development pillars, which provide a framework for assessing whether companies contribute to positive social outcomes.

Please also visit your regional area of the website to find information on our human development pillars, climate change solutions, harmful or controversial products, services or practices, engagement and voting, and climate data at a fund and/or strategy level.

Collaborative engagement update: tackling conflict minerals in semiconductor supply chains

“Demand for critical minerals has been dubbed the ‘gold rush of the 21st century’ due to their importance in emerging technologies”1.

Stewart Investors’ engagement on conflict minerals began in 2020 when we identified the issue as a serious human rights risk. This risk is frequently overlooked by governments, companies, investors and consumers. Tantalum, tin, tungsten and gold, collectively known as ‘conflict minerals’, are vital materials for the semiconductor industry and are powering the green transition. Poor traceability along complex supply chains can lead to the inadvertent financing of armed conflict and the abuse of human rights.

Reports from governments2, non-government organisations (NGOs) and the media highlight that mining minerals to produce semiconductors and other electronic and industrial components continues to result in displacement and death. This can have serious reputational and legal consequences for the companies involved.

Apple accused of using conflict minerals

“The Democratic Republic of Congo (DRC) has filed criminal complaints in France and Belgium against subsidiaries of the tech giant Apple, accusing it of using conflict minerals”. Lawyers for the DRC allege that tin, tantalum and tungsten is taken from conflict areas and then “laundered through international supply chains”3.

Over the years, we have engaged with a number of companies by highlighting the possible reputational risks that arise from the way they procure minerals. The discussions we have had with CEOs often highlight a lack of knowledge of the regulations and of the risks within their own supply chains. Many companies’ supply chain departments are under resourced, leaving them ill-equipped to perform the due diligence checks that are called for by the Organisation for Economic Co-operation and Development (OECD) guidance (and enshrined in US and European regulation). We also found that these departments are frequently considered to be ‘cost centres’ and therefore subject to cuts at times of financial pressure. This may be the main reason why, to date, little progress has been made.

Geopolitical tensions and tariffs on trade may prompt companies to reshape their supply chains

As investors, we consider it our duty to question senior management about reputational risk and frailties in their supply chains. We have therefore been impressing on them the need to allocate more resources to supply-chain management as well as to industry bodies, such as the Responsible Minerals Initiative (RMI) and the Initiative for Responsible Mining Assurance (IRMA), to ensure that best practice is followed and that risks are mitigated.

Understandably, some manufacturers may respond to heightened geopolitical tension and tariffs on trade by repositioning their supply chains. As they do, our fear is that companies might inadvertently overlook the importance of human rights. Accordingly, while there has been pushback against investor engagement, we feel it is necessary to engage companies on this topic. Conflict minerals present a clear, present and ongoing reputational and legal risk to companies that ignore this topic.

We advocate joining industry bodies to make engagement more effective

We would encourage investors to explore and join these bodies to help with more effect engagement:

- The Initiative for Responsible Mining Assurance (IRMA) membership, for the upstream. Further information on our involvement is available here.

- The Responsible Minerals Initiative (RMI) Investor Network, for the downstream. Further information on our involvement is available here.

We recently hosted a meeting on behalf of IRMA. It was attended by seven like-minded investment firms, all of whom were impressed by the progress that IRMA has made and by the professionalism it exhibits: it is the gold standard of independent mining audit and assessment. For example, Mercedes Benz insists that suppliers use IRMA audited mines. IRMA has also just announced Google as a new purchasing member. A list of members can be found on IRMA’s website.

While there are costs of membership, we believe these are outweighed by:

1. Connectivity. These organisations provide powerful connections to supply-chain managers and buyers in the automotive, electronics and industrial sectors. This allows investors to assess company culture and commitment to responsible supply chains at a different level from typical investor meetings. For example, at the OECD Forum on Responsible Mineral Supply Chains in Paris in May and at the Investing in African Mining Indaba Conference in Cape Town in February, we had the opportunity to meet the supply chain managers of Apple, Intel, Microsoft, Cisco, BMW and Mercedes.

2. Regulatory updates. The RMI is a good source of information about changes in regulation and their impact on supply chains. For example, recent (February 2025) amendments to the Corporate Sustainability Due Diligence Directive (CSDDD) appear to deepen legal complexity. This may have consequences for companies and investors. RMI membership helps us to keep abreast of such changes.

3. Help with engagement. Because membership of IRMA and the RMI is not obligatory for companies, it is a useful signal that their managers have chosen to adopt best practice. We note many companies – particularly in Asia – claim participation but are not paying members and are not active participants in industry conferences or discussions. Membership of the RMI provides access to their membership list. This makes it easier for investors to determine which companies are leading in their appreciation of the risks in their supply chain – and which are lagging. At this time of supply-chain disruption and repositioning, this could be a source of insight and comfort for investors.

Conclusion: progress takes patience

This initiative is complex and needs to be approached with patience and a long-term perspective. There will be no quick wins – sudden improvements in human rights – here. But this does not deter us. We will continue to advocate best practice as determined by IRMA and the RMI and to highlight the power and importance of correct procedure and independent assessment. And we will continue to raise this topic in meetings with upstream and downstream companies where it is relevant.

We have found that interest in collaboration on sustainable issues has decreased over the past year. But we have no intention of stopping our engagement on this important topic.

Footnotes

[1] The White House. President Trump takes immediate action to increase American mineral production. 20/3/25, https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-takes-immediate-action-to-increase-american-mineral-production/

[2] US Government Accountability Office, 07/10/24. Conflict Minerals: peace and security in the Democratic Republic of the Congo Have Not Improved with SEC Disclosure Rule, https://www.gao.gov/products/gao-25-107018.

[3] US Government Accountability Office, 07/10/24. Conflict Minerals: peace and security in the Democratic Republic of the Congo Have Not Improved with SEC Disclosure Rule, https://www.gao.gov/products/gao-25-107018.

Future Asset – careers insights day and impact report

We were delighted to support Future Asset and their careers insight day in June. Investment analyst Sarah Sheard explored the pros and cons of different companies from a sustainability perspective with groups of schoolgirls and alumnae. It was fantastic to see the enthusiasm and participation in the investment workshop.

During 2024, Future Asset engaged with over 2,700 students. Every year, the opportunities Future Asset provides to students continues to grow. Read more in their 2025 Impact Report.

Pacific Assets Trust – a new website

Visit pacific-assets.com to explore the Trust’s new website. Discover how the Trust invests, which companies it holds and what contribution these companies make to sustainable development.

Q1: 1 January - 31 March 2025

Industry initiative update: Future Asset’s ‘Growing Future Assets Investment Competition’

Supported by Stewart Investors since its founding in 2017, Future Asset is an initiative with a long-term mission to enhance inclusion in the financial industry in Scotland by improving gender diversity and breaking down existing stereotypes and barriers.

As part of this initiative, Future Asset hosts an annual Growing Future Assets Investment Competition. The competition allows girls in Scottish schools to experience the role of an investment analyst by working with investment professionals over a 10-week period to pitch a company with investment potential.

In its inaugural year in 2020, the competition featured 17 teams from 13 schools, with 71 girls participating. In the recent 2025 competition there were 209 teams from 100 schools, with over 900 girls registered. Our investment team members, Lorna Logan and Sarah Sheard were coaches and judges for the competition.

Congratulations to all participants, especially the junior winners from Mearns Castle High School near Glasgow and the senior winners from Fortrose Academy in the Scottish Highlands. Special mention to Marr College from Troon, coached by Lorna, who won the senior category for Best ESG pitch of the year.

We are thrilled to support this competition and inspire high school girls in Scotland to explore the investment world and consider careers in the industry.

To find out more about Future Asset, the competition and the ongoing opportunities they provide please follow them here - Future Asset on LinkedIn.

Human Development Pillars update

We first showed how our investee companies align with our 10 human development pillars in the third quarter of 2021 and we have been disclosing company assessments on Portfolio Explorer since that time. The pillars serve as the reference framework for assessing how companies contribute to positive social outcomes. All investee companies should contribute in a direct or enabling way to at least one of the pillars.

Updated human development pillars

In 2024, we reviewed our human development pillars. The result was some minor adjustments to how we will evaluate, disclose, and report on how our companies align with them. Our aim is to provide better balance across the categories, provide clearer distinction between some of the previous pillars that were perhaps too broad, and highlight solutions that could stand out more effectively in their own dedicated pillars. We now have 12 pillars, organised within the same four overarching categories.

| Health and wellbeing | Physical infrastructure | Economic welfare | Opportunity and empowerment |

|---|---|---|---|

| Nutrition | Energy | Livelihoods | Education & training |

| Healthcare | Housing | Financial services | Information technology |

| Hygiene & personal care | Water & sanitation | Material necessities | Transport & connectivity |

The company mappings on Portfolio Explorer reflect the updated human development pillars shown here. Reporting and fund documents and disclosures, where applicable, will be updated during their next cycle.

Q4: 1 October - 31 December 2024

Fund and strategy name changes

At the end of November, we began changing our fund and strategy names to:

1. Remove “Sustainability” from all fund / strategy names. We originally included “Sustainability” to distinguish our products from those managed by our former sibling team, St Andrews Partners (StAP). StAP was closed in 2022.

2. Add “All Cap” to the names of our products that invest across all market capitalisations. This further distinguishes them from the “Leaders” named products which invest in mid and large cap companies.

This is a name change only - our philosophy and investment process has not changed. We remain committed to investing in companies we believe are high quality with strong management teams that contribute to, and benefit from, sustainable development.

The timing of these changes has been influenced by regulatory changes within the UK Sustainable Disclosure Regulation (SDR) to ensure that our UK-domiciled OEIC funds adhere to the naming and marketing rules set out by SDR, which came into place on 2 December 2024. We also changed the names of our Irish-domiciled VCC funds to align with the annual Prospectus update. We will change our funds domiciled in the United States, Australia and New Zealand in 2025 when their offering documentation is updated. We have changed our strategy names, globally.

More detail on the reasons behind the change can be read in our Client letter: Why change a name?

Q3: 1 July - 30 September 2024

Stewart Investors Annual Review 2023

We published our 2023 Annual Review in August, reporting on our sustainable investment and business activities for the year. This year we have introduced fund and strategy data packs to supplement the main review. The data packs report on the human development pillars (positive social outcomes), climate change solutions (positive environmental outcomes), harmful or controversial products, services or practices, engagement and proxy voting. These can also be found on our website. We hope you find them informative and welcome your feedback.

Event update: Tackling Child Labour in Supply Chains

In September we were pleased to sponsor and attend our research partner Kumi Consulting’s event at the Impact Hub London, “Collaborative Partnerships to Tackle Child Labour in Supply Chains”. Co-hosted by Congo Children Trust, we heard accounts of child labour in mining and discussed challenges and potential solutions. Portfolio Manager Chris McGoldrick shared our perspective as an investor and how we are committed to tackling conflict minerals in the semiconductor supply chain through our ongoing collaborative engagement.

Research partnership update: Access to Medicine Foundation

On 1 January 2024 we entered a three-year research partnership with the Access to Medicine Foundation, an independent non-profit organisation that seeks to mobilise companies to expand access to their essential healthcare products in low- and middle-income countries. Our partnership and funding will primarily support the Foundation’s Generics & Biosimilar Medicines (G&BM) Programme, initially supporting engagement activities between the Foundation and various stakeholders on the opportunities identified in their G&BM report.

We have accepted the opportunity to become a ‘lead investor’ on the programme, jointly with investment management firm Castlefield, engaging directly with one of the five underlying companies (Hikma Pharmaceuticals) on behalf of the Foundation.

Further information on the partnership and our work with them can be found in this article.

Strategic partnership update: WRAP recyclable films trial

In February 2024, we committed to funding a pilot project run by WRAP, a UK-based global environmental NGO, and the Confederation of Indian Industry (CII). The project aims to demonstrate the positive use case for businesses to move from multi-laminate single-use plastic packaging to more recyclable packaging. Stewart Investors has been a long-term supporter of WRAP and CII (through the India Plastics Pact) and we are delighted to extend this partnership to explore alternative solutions for non-recyclable flexible packaging. This project represents the next step in our work on plastics, one of our key strategic initiatives, dating back to 2016.

The project launched in April 2024, inviting applications from companies wishing to participate in the trial. We are excited to announce that Godrej Consumer Products Ltd, Huhtamaki India and PepsiCo have been selected to lead five innovative projects focused on demonstrating recyclable solutions for flexible packaging. The projects are due to run until summer 2025.

Read more: Tackling plastic pollution in India

Collaborative engagement update: Tackling conflict mineral content in the semiconductor supply chain – Initiative for Responsible Mining Assurance membership

We are delighted to announce that Stewart Investors has become the first investment management firm to become a member of the Initiative for Responsible Mining Assurance (IRMA), an organization addressing the global demand for more socially and environmentally responsible mining. We are strongly aligned with IRMA’s mission and look forward to continuing to learn from its expertise as a member. We see membership and collaboration with IRMA as an exciting opportunity to bring stakeholders together and leverage collective action to drive progress in our collaborative engagement.

Q2: 1 April - 30 June 2024

Collaborative engagement update: Tackling conflict mineral content in the semiconductor supply chain – OECD Forum

In May we attended the Organisation for Economic Co-operation and Development (OECD) Forum on Responsible Mineral Supply Chains in Paris. The event brings together global actors from the upstream and downstream of the mining industry, as well as government representatives, industry bodies, non-governmental organisations (NGOs), investors and others to reflect on progress, challenges and opportunities regarding best practice in mining and mineral sourcing. We attended various sessions and side events, many of which featured our partners - the Responsible Minerals Initiative (RMI) and Kumi Consulting. It was useful to hear a wide range of perspectives on the issue of conflict minerals and human rights abuses within supply chains, particularly relevant given the event coincided with the adoption of the European Union’s Corporate Sustainability Due Diligence Directive (CSDDD), which introduces more stringent guidance than previous European regulation. We were lucky to also speak with professionals working in procurement and due diligence at the likes of Intel and BMW, helping us better understand their approach and outlook. There were clear calls up and down the value chain for more uniform, comprehensive and consistent regulation and action across the industry. We hope to see and continue to encourage increased collaboration and improvement in the coming months as we work with the RMI and others to build the Investor Network.1

Footnotes

1 Responsible Minerals Initiative (RMI) Investor Network, launched in February 2024, RMI Investor Network (responsiblemineralsinitiative.org)

Industry initiative update: Future Asset alumni visit and Summer Celebration

Future Asset encourages girls and young women to pursue careers in finance. We were delighted to host four Future Asset alumni in our Edinburgh office in June. Portfolio Manager Lorna Logan led a discussion on how we invest at Stewart Investors, the different types of roles the team have and what a typical day might look like. With our Investment Analyst Sarah Sheard, the girls discussed the sustainability pros and cons of a selection of companies. It was great to hear the girls’ ideas and we hope the visit fed their enthusiasm for the sector. In the evening, we attended the Future Asset Summer Celebration, where several alumni described their experience participating in the programme and the benefits for their confidence and skills development.

Sustainable Finance Disclosures Regulation (SFDR): Extract of Article 9 Level 2 reporting

The SFDR Level 2 reporting template for each of our Article 9 funds is available in a standalone document and also within the First Sentier Investors Global Umbrella Fund plc 2023 Annual Report. The social and environmental outcomes for the Funds are also available on the ESG reporting page.

Reporting for the Pacific Assets Trust is included within their 2024 Annual Report and on their website.

The report contains detail on the social (human development pillars) and environmental (Project Drawdown climate solutions) outcomes, transparency on any harmful products and services and Principal Adverse Indicators (PAIs) plus engagement and voting information.

Q1: 1 January - 31 March 2024

Collaborative engagement update: Tackling conflict mineral content in the semiconductor supply chain

Since our previous quarterly update, in which we explained our efforts to build a strong relationship with the Responsible Minerals Initiative (RMI), we were delighted to become the inaugural member of the RMI Investor Network in February.1

Working alongside the RMI, we plan to develop this working group and connect both fellow investors and companies to build consensus around the need for the adoption of more effective due diligence frameworks across supply chains. We believe membership of the network will offer investors a deeper understanding of mineral supply chains and greater engagement credibility. Membership should enrich engagements and help to emphasise the importance of mineral traceability to company leaders.

We are aware there is much still to be done in this space, but we look forward to continuing our collaboration with supporters and the RMI, and hope to see further progress in the coming months.

Industry initiative update: Future Asset

The aim of Future Asset is ’to inform girls in Scottish schools about the investment management industry, enthuse them about careers in the sector, and widen the talent pipeline to improve diversity in the industry.’

Stewart Investors founded Future Asset in 2017 and has supported it both financially and through involvement of our people since then. So far, Future Asset has engaged with over 1,800 girl students from over 220 schools in Scotland.

Their annual Growing Future Assets Investment Competition enables girls in Scottish schools to experience the role of an Investment Manager. In the first year of competition in 2020, there were 17 teams from 13 schools and 71 girls registered. In 2023/24 the participation has grown to 158 teams from 84 schools and 728 girls registered.

In the 2023/24 competition, investment team members Lorna Logan and Sarah Sheard were team mentors and Lorna was a judge in the Senior competition, presenting the winners’ award to the team from Preston Lodge High School in East Lothian. Many congratulations to them and to the Junior competition winners from Calderside Academy in South Lanarkshire, and everyone who took part.

We were delighted to be part of the competition and to encourage high school girls in Scotland to look at the world of investment and consider the industry for possible future careers.

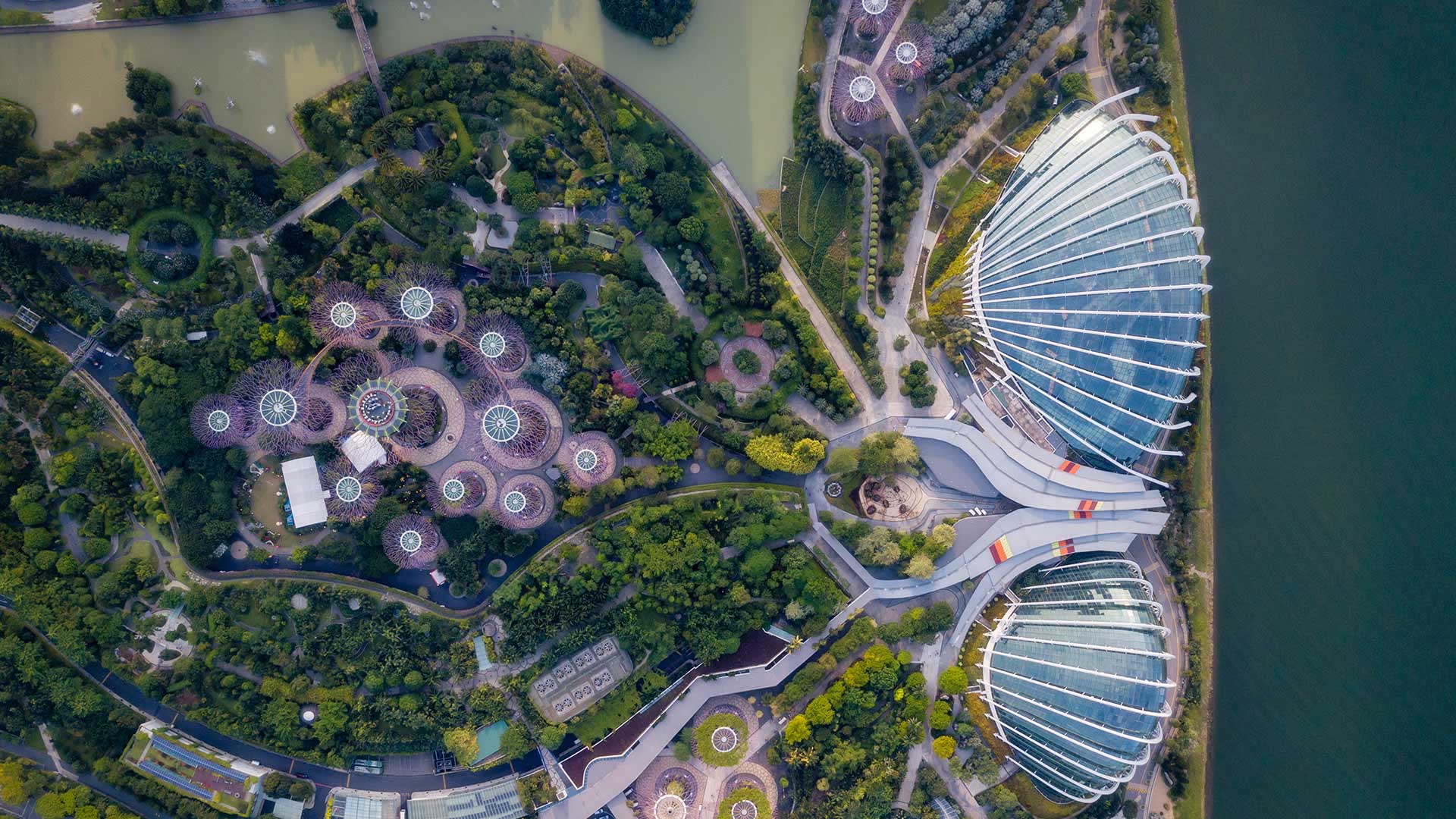

Event update: Singapore Investment Forum

In March we hosted the first Stewart Investors Investment Forum in Singapore. It was a huge success, drawing on Stewart Investors’ 30-year track record and the expertise of our special guest speakers to tackle some of the critical questions and misconceptions surrounding sustainable investing.

Global Emerging Markets Sustainability Strategy 15th anniversary

This February marked the fifteenth anniversary of Stewart Investors’ Global Emerging Markets Sustainability strategy.

Fifteen years ago, emerging markets investing was synonymous with resources, banks and telecoms. The most important companies were state-owned giants like Vale (Brazil), Gazprom (Russia), and China Mobile. There were relatively few genuinely innovative or globally competitive companies outside of materials extraction.

There has been a tremendous change in this regard. Emerging markets are now home to a raft of the world’s leading companies in fields as diverse as semiconductors, renewable energy technologies, software as a service, healthcare supplies, fintech and e-commerce.

Looking forward and on a bottom-up basis, the case for investing in emerging markets has never been stronger. The universe contains more quality companies than ever before and over the long term, this makes us very excited for what the next fifteen years can deliver in emerging markets.

Footnotes

1 Responsible Minerals Initiative (RMI) Investor Network, launched in February 2024, RMI Investor Network (responsiblemineralsinitiative.org)

Q4: 1 October - 31 December 2023

Collaborative engagement update: Tackling conflict mineral content in the semiconductor supply chain

We remain grateful for the continued support of our PRI collaborative engagement: Tackling conflict mineral content in the semiconductor supply chain, an initiative that first began in 2021. We are pleased to inform you of some recent developments and plans.

Recent achievements

- Strengthened relationship with the Responsible Minerals Initiative (RMI).1

- Built trust with leading US electronics companies, who are also steering committee members of the RMI.

- Chaired and hosted a closed-door workshop in October 2023, endorsed by the RMI, with sixteen leading electronic companies.

- Became the first investor to speak at the RBA2 and RMI’s Annual Conference in Santa Clara, California on the positive role of capital.

- Engaged with 21 electronic and industrial companies on mineral traceability.

- Commissioned Kumi Consulting Ltd (Kumi) to deepen our knowledge, contacts and engagements with companies, trade bodies and organisations like the OECD.

- Developed, with the help of Kumi, engagement guidelines for initiative supporters, and other investors, to improve their interactions with companies.

RMI Membership

Members of the RMI debated, over a number of months, whether they should allow investors to join their trade body. There were some initial reservations, however a number of company representatives and steering committee members of the RMI and RBA Board Liaison have been strong supporters. There is a growing feeling amongst RMI members that investors could bring a new and constructive perspective to help influence improvements along mineral supply chains. Representatives of the companies and other RMI members believe: “there is a big role for investors, they have a different point of leverage”.

We are pleased that the RMI has taken the significant step of allowing investors to become members of their trade body. This is one of the objectives we set last year.

We believe membership will provide initiative supporters and investors with a deeper understanding of mineral supply chains and greater engagement credibility. Membership should enrich engagements and highlight the importance of mineral traceability at the C-suite level (where we know, through our interactions with companies, that knowledge on this topic is weak). With the strength of collective voice, we must encourage CEOs not to cut corners and to invest more resources to achieve an untainted mineral supply chain, thereby minimising human rights abuse.

What more have we learned?

- The issue is grave. During a meeting, Fairphone3 explained that even they believe they are only 70% free of tainted minerals.

- Supply chain complexity means that even determined companies, such as Fairphone, can only map four out of the twelve tiers of companies in their supply chain.

- Accordingly, few CEOs have a deep awareness of the challenges in their mineral supply chain.

- Supply chain departments are often viewed as “cost drags” and are inadequately resourced.

- Many supply chain managers are ‘covert NGOs’ who are frustrated by the lack of impact.

- Upcoming EU regulations will pressurise companies and investors to focus more intently on human rights abuses in their supply chains.

What we plan to do next

- Join the RMI as an investor member and seek to establish an investor working group.

- Share details to initiative supporters and other investors to consider joining the RMI investor membership when it becomes available.

- Encourage more investors to collaborate on this initiative.

- Consider broadening the scope of the initiative beyond the 3TGs in line with EU regulations to include all minerals.

- Encourage initiative supporters to engage on this topic when meeting electronic companies.

- Engage with banks on lending practices to smelters or refiners (SORs) in the Asia Pacific region.

- Encourage companies to explore upstream certifications (IMRA4) in their supplier requirements.

Conclusion

We recognise that engagement on this topic will be a long journey, over a number of years, but we hope that by building a closer relationship with the RMI and influential companies in the electronics supply chain we are a step closer to effecting change.

Collaborative engagement update: Investor Initiative on Hazardous Chemicals (supported by ChemSec)

In line with our ongoing research into the risks of PFAS, polluting man-made substances known widely as “forever chemicals”, we became supporters of ChemSec’s Investor Initiative on Hazardous Chemicals (IIHC).

Prevalent in a wide range of consumer products for decades due to their non-stick qualities and ability to repel grease and stains, forever chemicals have proven toxic effects and do not break down in the natural environment, making them a threat to people and planet. We look forward to participating in this initiative, which will see 50+ investors representing over $10 trillion in AUM engage with major chemical producers to raise awareness of and therefore reduce the risk of these hazardous substances.

To learn more about the initiative, please visit the ChemSec website.

Footnotes

1 Responsible Minerals Initiative (RMI), a trade body with over 400 members, https://www.responsiblemineralsinitiative.org/

2 Responsible Business Alliance (RBA), the parent organisation of the RMI, and the world’s largest industry coalition dedicated to corporate social responsibility in global supply chain, https://www.responsiblebusiness.org/

3 Fairphone is a Dutch electronics manufacturer that designs and produces smartphones and headphones. It aims to minimise the ethical and environmental impact of its devices by using recycled, fairtrade and conflict-free materials, maintaining fair labour conditions throughout its workforce and suppliers, and enabling users to easily repair their own devices through modular design and by providing replacement parts.

4 IMRA: The Initiative for Responsible Mining Assurance. https://responsiblemining.net/what-we-do/assessment/

Q3: 1 July - 30 September 2023

Access to Medicine Foundation launches report on generic and biosimilar medicine manufacturers

The Access to Medicine Foundation is an independent non-profit that seeks to mobilise companies to expand access to their essential healthcare products in low- and middle-income countries (LMICs).

On 26 September, we were delighted to help co-host a multi-stakeholder event in Mumbai, India to launch their landmark report assessing five generic and biosimilar medicine manufacturers’ actions on expanding access to their products in LMICs.

Generic and biosimilar medicines have the potential to be lifelines for millions, offering the same therapeutic and clinical benefits as the originator medicines, but often at significantly lower prices. However, even if a product is comparatively cheaper, payers may still be unable to afford it, which is especially the case for those living in low-income countries and those from vulnerable populations. Among the medicines listed on the World Health Organization's Model List of Essential Medicines, only 10% are under patent protection, highlighting the essential role of generic and biosimilar medicine manufacturers in ensuring their products reach those who need them the most.

To assess what is currently being done by the generics industry to expand access to medicine in LMICs, the report profiles five market-leading companies: Cipla, Hikma, Sun Pharma, Teva, and Viatris. Along with detailed company profiles, it identifies opportunities to strengthen manufacturing and improve the availability of generic and biosimilar medicines.

The report, which marks the first time that any generic or biosimilar medicine manufacturers have been assessed in-depth on their access-to-medicine efforts, reveals areas where companies can focus their attention as they step up efforts to expand access to their essential medicine, such as affordability, product registration, supply, local availability, and adaptive research & development. Given their portfolios and footprints, the five companies assessed can now work to significantly enhance their efforts by acting on the opportunities and the tailored recommendations set out in their respective company profiles.

As long-term investors focused on quality and sustainability, we think generics franchises built on providing access to high-quality medicines at affordable prices are set to benefit from continued growth tailwinds over the coming decades. While these companies create tangible benefits for end users, we recognise areas for improvement within the industry, which is why we support the Foundation’s work to help provide a roadmap of how access to generics can be enhanced.

We are excited about the opportunity for generics companies to continue delivering greater access to healthcare globally while operating sustainably profitable business models.

2023 Investor Statement on Tobacco Prevention

Along with 57 financial institutions, representing over US$2.9trillion assets under management, we co-signed the 2023 Investor Statement on Tobacco Prevention urging governments to accelerate implementation of the World Health Organization Framework on Convention on Tobacco Control (WHO FCTC).

Tobacco is fundamentally an unsustainable product given its profound detrimental impact on human and planetary health worldwide. The financial impact of smoking on the global community (due to health costs and lost productivity) is estimated at US$1.4 trillion per year1.

We note that the WHO FCTC is a crucial tool in creating a future free from tobacco, and were delighted to attend the Tobacco-Free Finance Pledge High-Level side event on the sidelines of the 78th session of the UN General Assembly where the investor statement was launched.

1 Source: United Nations Tobacco Free Finance Pledge

Strategic partnerships and industry initiatives

In addition to collaborative engagements, we support a wide range of organisations, initiatives and industry bodies that contribute to the development of industry standards and improve best practice.

Q2: 1 April - 30 June 2023

Towards Sustainability label

During the quarter, our Irish-domiciled funds within the Asia Pacific Leaders, European, Global Emerging Markets and Worldwide Sustainability strategies were re-awarded the Towards Sustainability label, measured by the Towards Sustainability Quality Standard. The Belgian label aims to instil trust and reassure clients and potential investors that the awarded financial products are managed with sustainability in mind and are not exposed to unsustainable practices. More information on the label is available on the Towards Sustainability site.

Sustainable Finance Disclosures Regulation (SFDR) – Extract of Article 9 Level 2 reporting

The SFDR Level 2 reporting template for each of our Article 9 funds is available in a standalone document and also within the First Sentier Investors Global Umbrella Fund plc 2022 Annual Report. The social and environmental outcomes for the Funds are also available on the ESG reporting page.

Reporting for the Pacific Assets Trust is included within their 2023 Annual Report and on their website.

The report contains detail on the social (human development pillars) and environmental (Project Drawdown climate solutions) contributions, transparency on any harmful products and services and Principal Adverse Indicators (PAIs) plus engagement and voting information.

Indian Subcontinent Sustainability winner of Investment Week Fund Manager of the Year Awards

We are delighted that our UK-domiciled Indian Subcontinent Sustainability fund won best Indian Equity fund in the Investment Week Fund Manager of the Year Awards 2023. We have been investing in the region for almost two decades, and are thrilled to have been recognised.

Stewart Investors Investment Forum

On 10 May, we were pleased to host our 2023 Investment Forum. The day was focused on getting back to basics and sought to address: “What is the point of sustainable investing today?”

We welcomed guest speakers from two of our widely held portfolio companies: CSL and Aavas Financiers, and WRAP, the climate action NGO, whose India Plastics Pact we supported. In addition, members of our investment team provided updates on our strategies, engagements and shared their reflections on investing sustainability since 2005.

The Big Exchange

Our European (ex UK) Sustainability strategy has undergone its first assessment by The Big Exchange and received a silver medal for its positive contribution to people and the planet. Alongside our other UK-domiciled strategies, it is now live on their platform.

The Big Exchange is an independent ratings platform that seeks to make it easier for investors to choose funds that are creating positive solutions to combat the world’s biggest challenges. Further information is available on their website.

Q1: 1 January - 31 March 2023

Introducing the Indian Subcontinent Sustainability VCC

We are excited to announce that our Indian Subcontinent Sustainability strategy, first launched in 2003, is now available to investors in the EEA and Switzerland as an Irish-domiciled VCC. Managed by Sashi Reddy and David Gait since inception, the fund leverages the team’s expertise and strong track record of investing across Asia. Holding between 30-60 investments at one time, the fund will focus on delivering strong absolute returns over cycles and invest in companies based in, or where the majority of the company’s activities take place in, the Indian subcontinent region.

Team updates

In January, Anya Prakash who joined the team in January 2021 as a graduate investment analyst based in Edinburgh, left the business. Please join us in wishing Anya all the very best for her future endeavours.

Pensions for Purpose – Best Client-led Innovation

We are delighted to have won the award for Best Client-Led Innovation in the UK Pensions for Purpose Content Awards for our interactive Portfolio Explorer tool. We developed this tool to provide our clients with greater transparency, directly mapping the companies in which we invest to climate solutions, human development pillars and the Sustainable Development Goals.

Q4: 1 October - 31 December 2022

B Corp Certification

In 2022 First Sentier Investors became a certified B Corporation (B Corp), following a two-year certification process. As a semi-autonomous investment group within First Sentier Investors, Stewart Investors is covered by this certification.

The certification means that we are now part of a community of more than 6,000 companies with a shared goal to transform the communities in which we live and operate for the benefit of the people and our planet.

Global Emerging Markets

The St Andrews Partners global emerging markets pooled funds have now been fully aligned with Stewart Investors sustainability approach.

Portfolio Explorer – climate solutions update

We use Project Drawdown - www.drawdown.org- to help us understand the role companies can play in climate solutions. We map investee companies to Project Drawdown’s collection of climate solutions, which if scaled up, can deliver the Paris Agreement’s 1.5oC temperature goal.

In mid-2022, Project Drawdown announced 11 new solutions to their collection related to ocean resources, food production, methane management, and materials manufacturing and use. Bringing the total numbers of solutions in their framework to 93.

We have reviewed portfolio companies for alignment to these new solutions and included them on the Q4 2022 Portfolio Explorer update. We have mapped 26 companies to 6 of these solutions.

Following client feedback, we have also simplified how we define company contributions to Project Drawdown climate solutions and have removed Indirect (companies that are involved in and around the solution) as a measure. Contributions are defined as either Direct (directly attributable to products, services or practices provided by that company) or Enabling/Supporting (supported or made possible by products, technologies or practices provided by that company).

For further information on the companies mapped to these new solutions please click below.

Collaborative engagement update: Tackling conflict mineral content in the semiconductor supply chain

“As a shareholder you should want us to care about conflict minerals … to address it”.

Brian Krzanich, CEO of Intel, 2014.

At the end of 2021 we launched the PRI collaborative engagement: Tackling conflict mineral content in the semiconductor supply chain. The initiative was supported by 160 signatories amounting to US$6.59 trillion of assets. Since then it has attracted more interest from a number of large financial institutions.

Our engagements with companies, and industry and civil bodies, highlights that more action is required to improve practices on the provenance and reporting of conflict minerals within semiconductors.

A brief recap of the conflict mineral issue

Tin, Tungsten, Tantalum, Gold and Cobalt1 are essential ingredients in the manufacture of semiconductors. The mining of these minerals is associated with human rights abuses. Five broad trends are impacting the sourcing, processing and demand of these minerals.

- Mineral mining continues to shift to central Africa. 70% of Cobalt originates from the Democratic Republic of the Congo.

- SOR2 capacity continues to shift to Asia. 90% of Cobalt is refined by Chinese owned SORs.

- Governance over mineral traceability is outdated. OECD & RMI3 guidance is 5 and 10 years old.

- Companies’ efforts to identify and trace the provenance of minerals has stalled, as demand rises.

- Demands for a greener future necessitates more semiconductors and therefore more mineral mining.

Meanwhile, the associated problem of human rights abuses with mineral mining has not improved. This was underlined by testimony to US congress by Ida Sawyer, Human Rights Watch4, in July 2022.

“The humanitarian and human rights situation across the country, and especially in the east, remains dire. Nearly 5.5 million people are displaced across the country, and one in three people are facing severe or acute food insecurity, according to the United Nations. Some 120 armed groups are still active in eastern Congo, including several groups that include fighters from neighboring Burundi, Rwanda, and Uganda … Many of these groups, as well as their backers among the Congolese political and military elite, control lucrative mineral resources, land, and taxation rackets. Many of them have also recruited children among their ranks”.

Over the last decade, electronic companies have made insufficient progress on tracking the provenance and integrity of minerals in their supply chain. We need to re-double our engagement with companies to encourage better mineral sourcing, tracking and reporting practices.

What have we done in the last 6 months?

- Continued to engage with companies, and we have met with nine companies in person.

- Engaged with industry bodies. We attended the Responsible Minerals Initiative (RMI) annual conference and understand we are the first known investor to have done so.

- Engaged with civil bodies. We have met with Global Witness to discuss the findings of field research they recently carried out and published in their report: The ITSCI Laundromat: How a due diligence scheme appears to launder conflict minerals. A summary of the findings is available in this short interview.

What have we found?

- The issue of improperly sourced minerals and the associated human rights abuses within the semiconductor supply chain is more severe than we first anticipated.

- Actions by companies to address the issue is generally poor and progress has stalled.

- Frustration is rising amongst industry body members with their lack of impact.

- Geopolitical tensions are increasing government’s focus on supply chain transparency to identify frailties. Many companies are focusing resources on supply chain mapping. This is beneficial.

Have we achieved anything?

- Raised the profile of investors’ concerns about this issue with key companies in the supply chain.

- One South Korean foundry published, for the first time, a full list of the SORs they use.

- One Japanese company has committed to improve their transparency on this issue.

- Highlighted to all companies that actions to address the issue need to be improved.

- Raised the profile of investors’ concerns about this issue with the main industry body, the RMI.

- The RMI highlighted growing investor interest in this issue in their introductory comments at their annual conference.

- Raised the profile on investors’ concerns about this issue with civil bodies.

- Supported Global Witness to bring this issue to a larger audience. This helps improve information exchange.

Conclusion

It is extremely early days for this multi-year engagement but it is clear that tracing mineral provenance is an extremely complex challenge for companies. Progress is slow. While there is a unanimous desire to improve practices, some companies are more eager and able to meet this challenge than others. Surprisingly, the strength of ambition to improve practices has been independent, so far, of company size or industry prominence. This may point to complacency within certain areas of the industry.

We will continue to update you on any progress we make and any challenges we encounter.

Footnotes & Reference Material

1 Collectively known as conflict minerals with the exception of Cobalt which technically sits outside that legal definition

2 SOR = Smelting and Refining

3 RMI = Responsible Minerals Initiative

4 Child Labor and Human Rights Violations in the Mining Industry of the Democratic Republic of Congo. US Congress 14/7/22. https://humanrightscommission.house.gov/events/hearings/child-labor-and-human-rights-violations-mining-industry-democratic-republic-congo

Q3: 1 July - 30 September 2022

Stewart Investors website update

Following First Sentier Investors’ decision to wind-down and close the St Andrews Partners investment team - which concluded at the end of the quarter - the Sustainable Funds Group will now operate as Stewart Investors. We have realigned the Stewart Investors website to reflect this change.

Q2: 1 April - 30 June 2022

For more information on the largest emitters and contributors to carbon emissions, information on company-level climate change targets, and contributions to climate solutions for the individual strategies we manage.

European SRI Transparency Code Compliance (Eurosif)

We are committed to transparency and believe that we are as transparent as possible given the regulatory and competitive environments that exist in the countries in which we operate. We meet the full recommendations of the European SRI Transparency Code, and for our clients in the UK and Europe we have updated our statement of commitment for the period to 31 December 2022.

Towards Sustainability label

During the quarter, our Irish-domiciled funds within the Asia Pacific Leaders, European, Global Emerging Markets and Worldwide Sustainability strategies were awarded the Towards Sustainability label, measured by the Towards Sustainability Quality Standard. The label aims to instil trust and reassure clients and potential investors that the awarded financial products are managed with sustainability in mind and are not exposed to unsustainable practices. More information on the label is available on the Towards Sustainability site.

Investor Support for Deforestation-free legislation

We have supported a bill put forward by the Fostering Overseas Rule of Law and Environmentally Sound Trade (FOREST) Act, which would provide investors with important information on material financial and climate-related risks to companies potentially linked to deforestation. This bill would help investors mitigate material risks facing portfolios and the companies in which they invest.

We believe it will effectively contribute to curbing global deforestation, thereby helping reduce climate risk and protecting investments in vulnerable sectors. Moreover, the procurement piece of this bill would help investors identify companies that are adequately mitigating climate and forest risk by fulfilling their commitments to net-zero emissions and zero deforestation.

Team changes

Mohan Gundu is retiring from the financial services industry and will be leaving Stewart Investors on 24 July 2022.

Mohan has had a long, successful career that began in the late 80s with roles at various brokerage firms such as Jefferies and CLSA, following his Bachelor of Technology in Civil Engineering and MBA from the Indian Institute of Management. Mohan joined Stewart Investors, Sustainable Funds Group in December 2016 as a senior analyst, and now plans to spend his retirement with his family and pursuing his planned book on the history of capital markets within India.

Given Mohan’s decision to retire, we have undertaken an internal search for some additional research capabilities. With the First Sentier Investors decision to terminate St Andrews Partners in March 2022, we had the opportunity to interview the outgoing investment team prior to their departure. We are pleased to communicate that we have offered existing St Andrews Partners’ analyst, Tyler Thomas, a permanent role with Stewart Investors. Tyler commenced this role on the 27 June 2022.

Tyler was a graduate investment analyst with the St Andrews Partners team at Stewart Investors. He joined the team in September 2021. Tyler graduated with First Class Honours in Economics from the University of Durham in 2021. Prior to joining the team, Tyler gained internship experience with the St Andrews Partners team in Edinburgh.

Q1: 1 January - 31 March 2022

Collaborative engagement: Tackling conflict mineral content in the semiconductor supply chain

“As a shareholder you should want us to care about conflict minerals … to address it”.

Brian Krzanich, CEO of Intel, 2014.

We were overwhelmed with the support this initiative received, totalling 160 investors with collective assets under management of US$6.59 trillion1. It is clear that the investor community recognises the challenges of mineral sourcing within the semiconductor supply chain, and believes more action is required in order to develop conflict mineral-free supply chains and improve industry practice.

A brief recap of the conflict mineral issue

There have been five broad trends impacting the sourcing of Tin, Tungsten, Tantalum, Gold and Cobalt (known as conflict minerals (CMs)):

- The mining of these minerals has shifted from Australia and Canada to central Africa.

- Smelting & refining (SORs) capacity has moved to Asia. SOR ownership is increasingly Chinese.

- Frameworks on mineral traceability have stagnated. The OECD guidance is over five years old.

- Regulation and public opinion are forcing greater scrutiny of complex supply chains.

- High demand for semiconductors could encourage corner cutting in the sourcing of minerals.

Examination of a small sample of conflict mineral statements suggests that progress has been disappointing since an academic study of 1300 companies in 2015 found:

“The reports ultimately reveal shallow, almost cynical, compliance with poorly crafted rules built on a regulatory paradigm better suited to simpler contexts”. The Conflict Minerals Experiment. Jeff Schwartz. P133.

Despite valiant efforts, some conflict mineral statements show that progress is slow and that confidence in companies’ ability to track the provenance and integrity of minerals is low.

To this point, a central and candid sentence in the conflict mineral statement of one large American equipment manufacturer in 2021 has not meaningfully changed since the company started producing their SD form² for the SEC in 2014:

“For the significant majority of smelters reported by the Surveyed Suppliers, there is inadequate information available to assess the source of the conflict minerals they process. Therefore, for Covered Products manufactured in 2020… concluded in good faith that it lacks sufficient information to trace the chain of custody of any conflict minerals contained in its Covered Products up through the supply chain to a specific smelter or, in turn, to a country or mine of origin”.

The problem has not gone away and the associated human rights abuses are still evident. Only at the beginning of April we became aware of a crowd funding initiative to help finance legal proceedings against large technology brands by families from the Congo³. This points to intensifying reputational headwinds.

What have we done so far?

With the support from signatory investors, on 30 November 2021, we wrote to 29 companies. In the letter, we have encouraged the companies to:

- Develop and invest in technological solutions to improve traceability, possibly blockchain.

- Increase transparency and reporting on minerals from mine to product.

- Encourage and participate in industry wide collaboration to improve industry practices.

- Impose and enforce harsher sanctions on non-compliance.

- Reduce demand for new materials by improving recycling initiatives.

To date we have received a response from 21 of the companies. We have requested meetings with all the companies that have responded to the letter, and to date we have had meetings with eight companies.

What have we found?

- The industry made an early decision to trace minerals in the downstream from smelters or refiners (SORs) and not in the upstream, from the mines. This means that the problem of mineral mixing before the minerals arrive at the SORs materially hinders the tracing of mineral provenance from mine to product.

- The industry places a heavy reliance on the processes and assurances provided by the Responsible Mineral Initiative (RMI). Yet the RMI states clearly: “This assurance process does not result in a material certification nor does it determine that material at the company is “conflict-free” or is otherwise free of human rights abuses in the supply chain”.

- Despite relying on suppliers for information, there is little industry collaboration. One foundry said fears of collusion, as with price fixing, was an issue and an explanation.

- The RMI is considered to be the pinnacle of industry collaboration and yet some companies had little knowledge of the RMI. We note the RMI represents ten industries and is not dedicated to semiconductors.

- Conflict minerals remain an issue still to be integrated into many senior executive committee agendas.

- Few companies appear to be going beyond the requirements prescribed by OECD framework, as adopted by the RMI.

- No company interviewed, so far, has committed budget for research on conceptual/unproven technological solutions, like blockchain. A chicken and egg scenario was commented on here.

Have we achieved anything?

- Many companies have asked for suggestions on how they could do more and we have been asked to share any good ideas/better practices we may identify during this engagement.

- One company, which was previously unfamiliar with the RMI, now plans to pay for RMI services.

- A foundry stated that this letter, with the weight of interest from investors, will raise the prominence and profile of the conflict minerals issue to the board level.

- Another foundry suggested they would consider committing budget to research on conflict minerals tracing.

Conclusion

It is extremely early days for this multi-year engagement but it is clear that tracing mineral provenance is an extremely complex challenge for companies. Progress is slow. While there is a unanimous desire to improve practices, some companies are more eager and able to meet this challenge than others. Surprisingly, the strength of ambition to improve practices has been independent, so far, of company size or industry prominence. This may point to complacency within certain areas of the industry.

We will continue to update you on any progress we make and any challenges we encounter.

Footnotes

[1] As at 30 November 2021

[2] An SD form is a specialised disclosure report used for investment disclosure reports outside the typical filing categories for the U.S. Securities and Exchange Commission (SEC) forms. SD reports include Conflict Minerals Disclosures and Responsible Sourcing reports.

[3] International Rights Advocates. Multinational companies are liable for human rights abuses within their supply chains

Reference material

- Capturing conflict mineral trade in DRE. https://www.youtube.com/watch?v=jjVkNxT8Zsg

- Conflict minerals: The truth behind your smartphone. https://www.youtube.com/watch?v=yrcTxCOkuWA

- Congo Stories, Battling Five Centuries of Exploitation and Greed, 2018. John Prendergast and Fidel Bafilemba.

- The Conflict Mineral Experiment, 2015, J Schwartz. https://www.hblr.org/wp-content/uploads/sites/18/2016/06/HLB103_crop.pdf

- OECD Due Diligence Guidance, 3rd Edition.

- https://www.responsiblemineralsinitiative.org/

- The Rare Metals Wars, Dark Side of Clean Energy and Digital Tech, 2020, G Pitron

European (ex UK) Sustainability strategy launch

On the 25 January 2022, we launched a new European Sustainability strategy portfolio which excludes UK-listed companies. The portfolio comprises 39 companies we consider to be among the very best sustainability companies in Europe (ex-UK), and complements the European Sustainability (inc-UK) strategy, which was launched in mid-2021.

Within the EU/EEA and Switzerland, the European (ex UK) strategy is only available to investors via a segregated mandate account.

Morningstar awards

We are delighted that Stewart Investors Sustainable Funds Group has won the inaugural Fund Manager of the Year – Sustainable Investing category at the 2022 Morningstar Australia Awards; as well as the Best Asset Manager - Sustainable Investing category and the Best Global Equity Fund for the Stewart Investors Worldwide Leaders Sustainability Funds (USD ACC) at the 2022 Hong Kong Morningstar Awards for Investing Excellence.

First Sentier Investors announcement

On 1st March 2022, First Sentier Investors announced their decision to proceed with the closure and orderly wind-down of the St Andrews Partners investment team. This does not lead to any significant changes to the Sustainable Funds Group.

Q4: 1 October - 31 December 2021

Collaborative engagement: Tackling conflict mineral content in the semiconductor supply chain

During the quarter, we launched another collaborative engagement effort, supported by 160 investors with collective assets under management of US$6.59 trillion, focused on conflict minerals within the semiconductor supply chain.

Tantalum, tin, tungsten, gold and cobalt (referred to collectively as conflict minerals) are vital materials and building blocks of the semiconductor industry. The poor traceability of these minerals along complex supply chains, including smelting and refining, can obscure the provenance of these minerals. This can lead to the inadvertent financing of armed conflict and the abuse of human rights.

We are long-term investors who believe that sound labour practices and good environmental management go hand in glove with shareholder returns. As regulators and consumers pay increasing attention to the challenges of mineral sourcing within the semiconductor supply chain, we believe there is an opportunity for companies to take a lead in the development of conflict mineral-free supply chains. Specifically we wrote to 29 companies involved in the manufacture of semiconductors encouraging them to:

- develop and invest in technological solutions to improve traceability, possibly blockchain,

- increase transparency and reporting on minerals from mine to product,

- encourage and participate in industry wide collaboration to improve industry practices,

- impose and enforce harsher sanctions on non-compliance,

- reduce demand for new materials by improving recycling initiatives.

We are in the early stages of this engagement and intend to provide further updates on progress and company responses in due course.

UNCTAD Sustainable Fund Awards 2021

In October, at the World Investment Forum 2021, UNCTAD (United Nations Conference on Trade and Development) launched the Sustainable Fund Awards to recognise companies' commitment to Sustainable Development Goals (SDGs) funding and the achievements of high-quality, high-impact sustainable funds.

We are honoured that one of our Global Emerging Markets Sustainability funds was one of two winners awarded the UNCTAD Sustainable Emerging Market Fund Award 2021.

Further information on the awards is available online as well as the awards ceremony where Sujaya Desai, Co- Portfolio Manager, makes an acceptance speech on the team’s behalf.

Global Emerging Markets Leaders Sustainability - UK and European launch

On the 2 December 2021, our Global Emerging Markets Leaders Sustainability strategy, which launched in the US in April 2020, became available to clients in the UK and is now available in Europe.

The fund invests in 25-60 high-quality emerging markets companies that we consider to be particularly well positioned to contribute to, and benefit from, sustainable development.

More information on the fund and strategy is available on our website.

Subscribe to our updates

To get regular updates and content from Stewart Investors, please register here.