Get the right experience for you. Please select your location and investor type.

European (ex UK) All Cap

Investing in 30-45 companies in Europe (excluding the UK), the strategy was launched in January 2022.

We invest in companies that we consider to be the very best sustainability companies in Europe. These businesses have strong and competitive franchises, exceptional people and distinctive cultures, and resilient financials. Individually and collectively they are solving difficult problems, meeting critical needs, and helping bring about a more sustainable future.

By focusing on the highest quality and best sustainability companies in Europe, we believe we can offer an exciting portfolio that stands out from the crowd.

For European investors this strategy is available in our VCC but due to regional differences includes UK companies.

Why invest in European companies?

World-leading sustainability companies

- Europe has a large listed universe, including world-leading health care, clean energy, manufacturing and IT companies

- Many of these companies have large and growing end-markets, including in many emerging economies, and a strong presence globally and locally

Exceptional people and cultures

- Many companies are run by outstanding management teams and are often controlled by long-term stewards – foundations, families and entrepreneurs

- Europe has a high concentration of companies with strong cultures, great franchises, and healthy balance sheets and financial characteristics

Sustainability tailwinds

- Social norms, policies and regulations are often favourable for companies advancing sustainable technologies and solutions

- European companies are known and respected for setting high standards

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q2 2025

European (ex UK) All Cap strategy update: 1 April - 30 June 2025

Helped by government commitments to increase spending on infrastructure and defence, European equity markets have been relatively buoyant since the start of the year. At the same time, inflation continued to stabilise and interest rates began to fall. This more than offset the increased uncertainty arising from geopolitical tensions, the escalation of nearby wars and repeated changes to tariffs on trade, which threatened to cause investment decisions to be delayed.

Over the course of the quarter we added to our holdings in a number of reasonably valued consumer stocks, including Axfood (Sweden: Consumer Staples), L'Oréal (France: Consumer Staples) and Beiersdorf (Germany: Consumer Staples).

We sold our holding in Nemetschek (Germany: Information Technology) and Bankinter (Spain: Financials) on valuation grounds. Also for valuation reasons, we reduced our exposure to Dino Polska (Poland: Consumer Staples) and to two banks: Ringkjøbing Landbobank (Denmark: Financials) and Handelsbanken (Sweden: Financials).

Amid uncertainty around trade and geopolitics, we continue to focus on finding high-quality companies, run by excellent stewards, that we believe have the ability to thrive under a broad range of economic and political scenarios.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q1 2025

European (ex UK) All Cap strategy update: 1 January - 31 March 2025

While it may be a new year, the events of the first quarter suggested that 2025 could see a continuation of the volatility, geopolitical tensions and trade uncertainties that characterised 2024. The silver lining was that it also brought a number of developments that could benefit the high-quality European companies we invest in. Those positive dynamics included an easing of Germany’s fiscal debt brake, a willingness to cut excessive bureaucracy and a growing recognition of Europe’s need to become more self-sufficient. Together, these could help to stimulate demand across a range of sectors.

Over the course of the quarter, we added three new companies to the portfolio. The first was Axfood (Sweden: Consumer Staples) which operates a diverse range of food retailers across Sweden. Its brands include Willys (a discounter), Hemköp (mid-range) and the recently acquired hypermarket chain City Gross. After a long period of investment in an automated fulfilment centre, we see the potential for Axfood’s margins to expand and for sales growth to accelerate.

The second new holding was L’Oréal (France: Consumer Staples), which has a broad portfolio of well-known beauty and skincare brands. Under the stewardship of the Bettencourt Meyers family, its long-tenured management team has repeatedly shown its ability to identify, acquire and integrate new brands and reinvest in their long-term growth. The result is a business with impressive pricing power and resilient cash generation. Around 40% of L’Oréal’s sales come from skincare and sun protection but its focus is shifting to treatments for dermatological conditions such as psoriasis, dermatitis and acne1.

The third new holding was SKF (Sweden: Industrials), one of the world’s largest manufacturers of ball bearings. It is currently transforming its business and will soon spin off its (lower margin) automotive business. It is stewarded by the Wallenberg family, with whom we were already familiar through their association with our existing holdings in Atlas Copco and Epiroc.

During the quarter, we made opportunistic additions to some of our existing holdings. Brake manufacturer Knorr-Bremse (Germany: Industrials) continues to improve its operational efficiency and potential for growth, while Handelsbanken (Sweden: Financials) is investing in technology to further enhance its relationship-centric growth model. We also added to the holding in Wolters Kluwer (Netherlands: Industrials), a diversified provider of business services and software, when its share price weakened following the (planned) departure of its long-tenured chief executive. We remain excited about its potential to grow through using AI-based tools to maximise the value of its business data and insights.

We made three complete sales over the quarter. In the case of Belimo (Switzerland: Industrials), investors’ excitement about demand for its actuators, which make the cooling systems in data centres more efficient, had seen the valuation of its shares running run ahead of the business fundamentals. We also sold Tecan (Switzerland: Health Care) and Sartorius (Germany: Health Care). A protracted post-Covid destocking cycle complicated the task of assessing the progress of these two companies but the shape of the cycle is now becoming clearer and, as a result, we prefer to consolidate our exposure into the higher-quality businesses in this area that we already hold, such as Roche (Switzerland: Health Care), DiaSorin (Italy: Health Care) and bioMérieux (France: Health Care).

Elsewhere, we trimmed a number of holdings in response to the elevated expectations their valuations implied. These included architectural software provider Nemetschek (Germany: Information Technology) and semiconductor manufacturer Infineon Technologies (Germany: Information Technology), where the impact of changes in trade policies and tariffs remains uncertain.

As the geopolitical and economic landscape continues to evolve, we remain focused on finding high-quality companies that are run by exceptional people which we believe have the ability to thrive under a broad range of scenarios.

[1] Source: L’Oréal Annual Report 2024.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

European (ex UK) All Cap strategy update: 1 October - 31 December 2024

2024 will be remembered as another year of geopolitical turbulence and pronounced market fluctuations. European economies and stock markets continued to be impacted by the war in Ukraine, a slowdown in China, rising political polarisation, and sluggish economic growth in almost every major European economy apart from Spain and Poland, despite softer inflation.

The strategy’s performance over the year was bifurcated. Strong contributions from many industrial and technology holdings, such as Nexans (France: Industrials), Addtech (Sweden: Industrials) and Wolters Kluwer (Netherlands: Industrials), were undermined by a number of healthcare holdings, including Tecan (Switzerland: Health Care), Sartorius (Germany: Health Care) and Carl Zeiss Meditec (Germany: Health Care).

Many healthcare companies continued to struggle with post covid de-stocking, declining demand from China, and a lack of investment due to stretched public purses. Moving into 2025, we are seeing signs of an end to de-stocking cycles among both healthcare and other industrial companies.

Over the year, we took the opportunity to trim some holdings whose valuations became excessive, including Indutrade (Sweden: Industrials), Nemetschek (Germany: Information Technology) and Ringkjøbing Landbobank (Denmark: Financials). In turn, we built-up positions in companies we believe are attractively valued. This included Endava (United States: Information Technology), a developer of bespoke software solutions that operates mainly out of eastern Europe, Allegro (Poland: Consumer Discretionary), the largest e-commerce operator in Poland, and Dino Polska (Poland: Consumer Staples), a discount grocer.

We also continued to build positions in two exceptional software companies, Wolters Kluwer (Netherlands: Industrials) and Vitec Software (Sweden: Information Technology) which offer strong growth potential and consistent, recurring cash flows.

In the last quarter of the year, we sold two companies; SFS Group (Switzerland: Industrials), a maker of mechanical fastening systems and Naturenergie (Switzerland: Utilities) a Swiss-German provider of hydro-electric and renewable energy company. SFS Group has proven to be even more cyclical than we expected, and we took the opportunity to sell at an elevated valuation towards the end of the year. Naturenergie has also lacked the steadiness we expected from a Swiss-German government backed utility. In place of these companies, we initiated a position in Epiroc (Sweden: Industrials), a leading global provider of mining equipment and tools which is investing behind electrification and battery technology.

We enter 2025 convinced of the long-term potential of the high-quality companies we hold on behalf of clients. Although macroeconomic sentiment towards most European countries is pessimistic, we remind clients that we do not invest in countries or even regions; we invest in companies. As always, we remain focused on the long term, and on investing in companies run by exceptional stewards, that can navigate and adapt to complex environments, and thus thrive long into the future.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2024

European (ex UK) All Cap strategy update: 1 July - 30 September 2024

The performance of the portfolio looks to have stabilised following a relatively weak start to 2024. As market turbulence around the uncertainty of interest rates and geopolitics appears to settle, we remain excited by our holdings, many of which we believe are very attractively valued for their long-term growth potential.

Three new companies were added to the portfolio during the quarter. The first, ASML (Netherlands: Information Technology), is the global leader in lithography machines used to produce chips for semiconductors. Its culture is exceptional for its focus on engineering, with almost 40% of employees working in research and development with a budget of EUR4 billion in 2023.1

We also bought another Dutch-listed, but global-facing company, Wolters Kluwer (Netherlands: Industrials), which provides professional information, software and services to a diverse range of end markets. Most of Wolter Kluwer’s sales are recurring, with inflation-linked pricing. This enables stable cash flows and a consistent investment into new products, such as their CCH® Tagetik solution, which helps companies measure and report on their environmental performance.

The final company added to the portfolio was Knorr Bremse (Germany: Industrials), a leading provider of brakes for rail and commercial vehicles. A new CEO, Marc Llistosella, has brought a renewed focus on culture, operational efficiencies and additional growth opportunities around automation and digitalisation.

During the quarter, three companies were sold; Bechtle (Germany: Information Technology) and Teqnion (Sweden: Industrials) due to waning conviction in the sustainability and scalability of the franchise, and a small position in LEM Holdings (Switzerland: Industrials) due to concerns about increasing competition from Chinese suppliers.

Two of the Swedish serial acquirers held in the strategy, Addtech (Sweden: Industrials) and Indutrade (Sweden: Industrials), both experienced strong earnings growth in the quarter. These businesses acquire niche product companies and allow them to run autonomously, using their cash flows to acquire more companies. Addtech and Indutrade both benefit from structural growth within renewable energy, automation and electrification, in which their components are used.

We visited both Addtech and Indutrade on a research trip to Stockholm during the quarter, as well as ten other companies. This included other portfolio holdings, such as access solutions provider Assa Abloy (Sweden: Industrials), the 153-year-old bank Handelsbanken (Sweden: Financials), the world’s leading manufacturer of air compressors Atlas Copco (Sweden: Industrials), and specialised software acquirer Vitec Software (Sweden: Information Technology).

The opportunity to meet with company management on their ‘home turf’ is invaluable; it is much easier to get a sense of how culture and people have shaped a company and its future return profile when sitting within their offices; or, in the case of Atlas Copco, 20 metres below their office in a test mine. We continue to find excellent investment ideas by focussing on the impact that outstanding people can have on businesses with strong franchises and resilient financials.

1 Source: ASML Annual Report 2023

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Voting

Voting: Q2 2025

European (ex UK) All Cap voting : 1 April - 30 June 2025

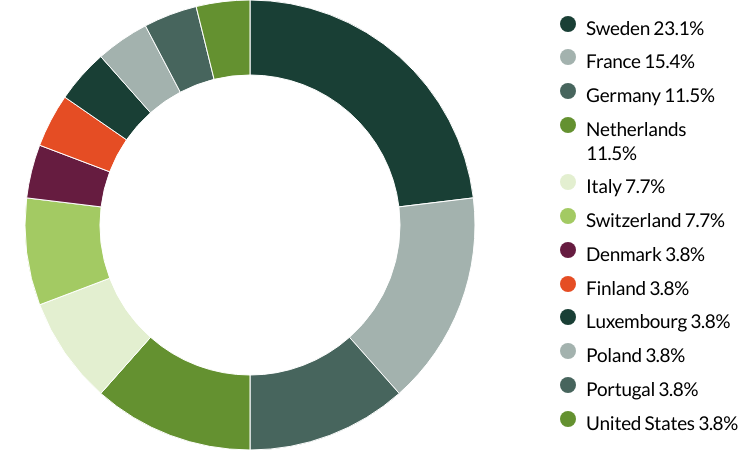

Voting by country of origin

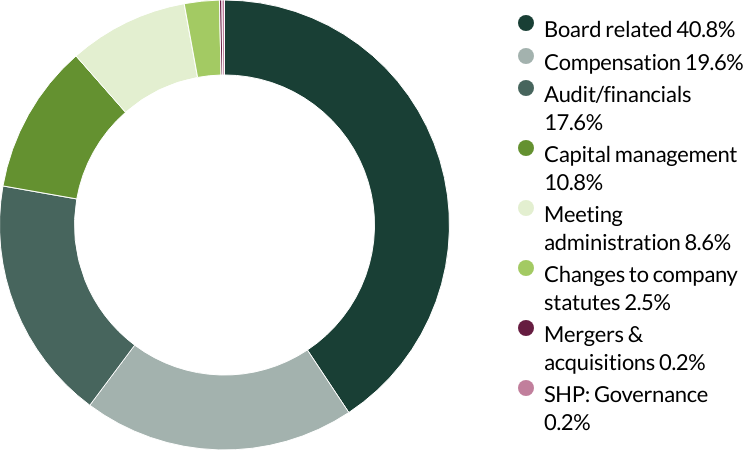

Voting by proposal category

During the quarter there were 560 proposals from 25 companies to vote on. On behalf of our clients, we voted against eight proposals and abstained from voting on four proposals.

We voted against proposals on transaction of business at Alcon and INFICON, as they did not provide enough information about the proposals. We wanted to avoid giving unrestricted decision-making power without sufficient clarity. (two proposals)

We voted against the remuneration report at Dino Polska as we believe the current policy does not encourage executives to focus on long-term goals. Implementing a long-term incentive plan, along with enhanced disclosure and transparency on the remuneration structure could be beneficial for both the company and its shareholders. (one proposal)

We voted against changing the terms of the board at EPAM Systems as the proposed changes would require all directors to stand for election annually instead of on staggered terms. While we understand the rationale for annual elections, we believe that a staggered approach provides continuity and helps prevent excessive turnover. We also voted against changes to limit the liability of certain officers, as we believe the company has demonstrated its ability to attract and retain an admirable management team under the current structure, which encourages managers to think and act as long-term owners. Finally, we voted against the appointment of the auditor as they have been in place for over 10 years. The company has given no information on rotating its auditors, a practice we believe is important to ensure a fresh perspective is brought to its accounts. (three proposals)

We voted against the election of an employee shareholder representative at Nexans. With two candidates standing for election, we chose to support the candidate who was elected by employees who are registered shareholders and was also the board's preferred candidate, due to their international experience as a corporate officer. (one proposal)

We abstained from voting on amendments to articles (rules and regulations that govern the company's operations) at bioMérieux as the company did not provide enough information on the amendments. (one proposal)

By supporting the appointment of the auditor at Jerónimo Martins, we abstained from voting on three other proposals related to auditor appointments. (three proposals)

We voted against a shareholder proposal regarding simple majority voting at EPAM Systems as this topic was already covered by the company's own proposal, which we supported. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q1 2025

European (ex UK) All Cap voting : 1 January - 31 March 2025

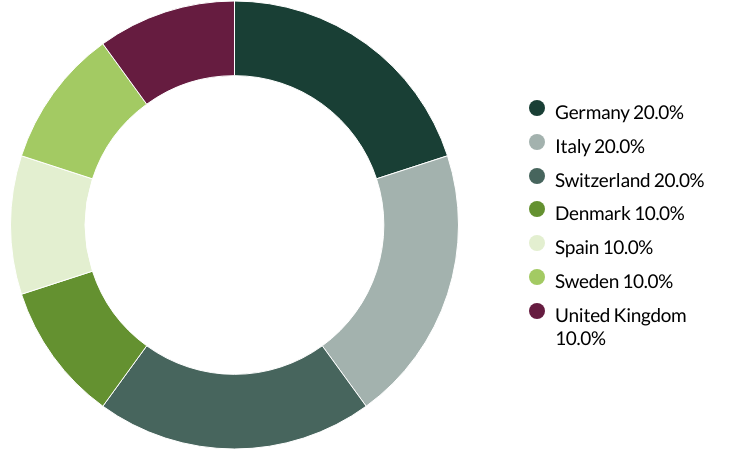

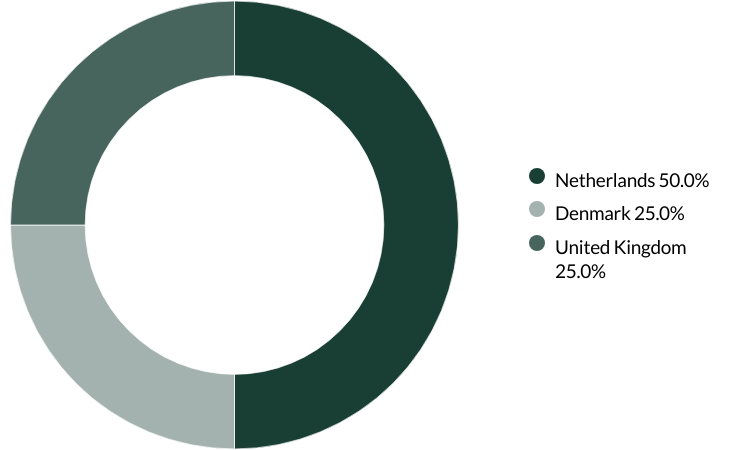

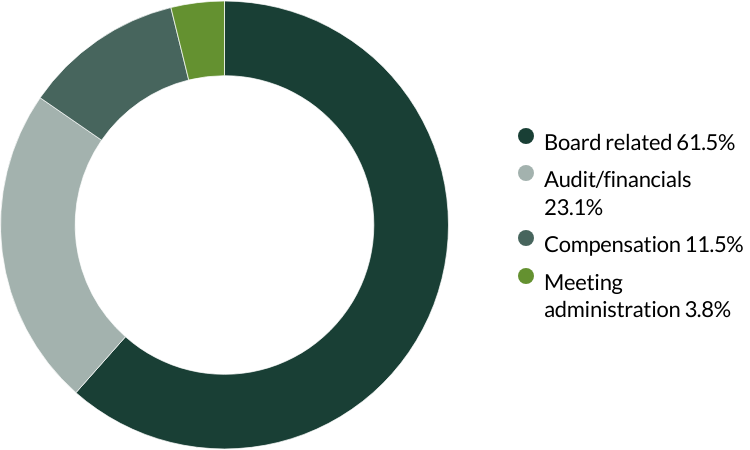

Voting by country of origin

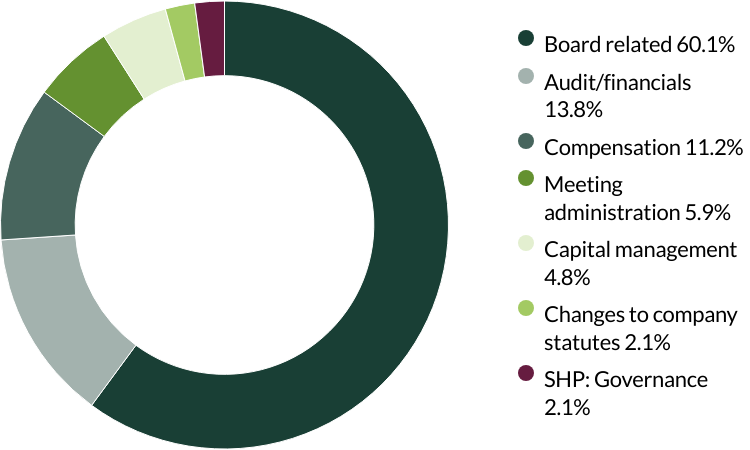

Voting by proposal category

During the quarter there were 188 resolutions from 10 companies to vote on. On behalf of clients, we voted against nine resolutions.

We voted against a proposal on transaction of business at Sika, as they did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (one resolution)

We voted against three shareholder proposals at Handelsbanken regarding banking identification security improvements and changes to dividend payment schedules. We believe management is best positioned to manage security risks and decide on dividend payments. (three resolutions)

We voted against a shareholder proposal requesting shareholder approval to recruit and appoint candidates to the shareholders committee at Ringkjøbing Landbobank. The committee is a channel for recruiting board members, and we believe the board are best placed to identity the skills and experiences required for this committee and future board appointments. (one resolution)

We voted against executive remuneration and the remuneration report at Roche as we believe executive pay is high and there is a lack of metrics to determine and/or justify those awards. We voted against a proposal on transaction of business as the company did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (four resolutions).

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q4 2024

European (ex UK) All Cap voting : 1 October - 31 December 2024

Voting by country of origin

Voting by proposal category

During the quarter there were 26 resolutions from four companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q3 2024

European (ex UK) All Cap voting : 1 July - 30 September 2024

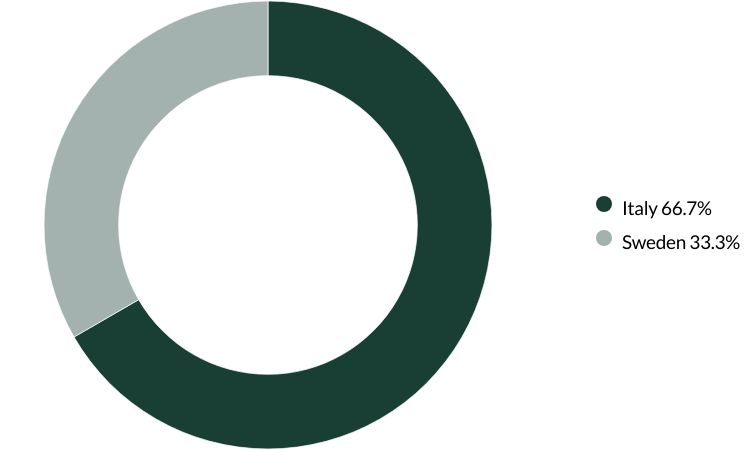

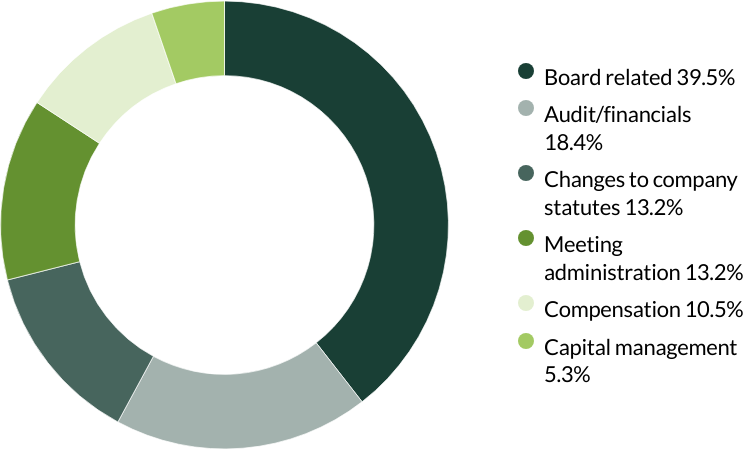

Voting by country of origin

Voting by proposal category

During the quarter there were 38 resolutions from two companies to vote on. On behalf of clients, we voted against two resolutions.

We voted against proposals related to amendments to articles (rules and regulations that govern the company's operations) at DiaSorin as the company did not provide enough information on the amendments. (two resolutions*)

*The same proposal was voted on different stock lines.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, European All Cap Strategy, European (ex UK) All Cap Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 June 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.