Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Global Emerging Markets (ex China) Leaders

The Global Emerging Markets (ex China) Leaders strategy seeks to invest in 25-45 high-quality companies with exceptional cultures, strong franchises, and resilient financials outside of mainland China. It aims to achieve attractive long-term capital growth and contribute to a more sustainable future across global emerging markets.

It was launched in July 2024, reflecting investor appetite for global emerging market specialist funds without allocations to China, as well as pockets of concern over perceived investment risk and volatility in China.

Leaders simply means that the strategy is focused on companies with a market cap value of at least USD1 billion at the time of investment.

Strategy highlights: a focus on quality and sustainability

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

- Companies must contribute to sustainable development. Portfolio Explorer >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Latest insights

Quarterly updates

Strategy update: Q4 2025

Global Emerging Markets (ex China) Leaders strategy update: 1 October - 31 December 2025

In November 2025, First Sentier Group (FSG) announced a strategic transition of Stewart Investors’ (SI) investment management responsibilities to its affiliate investment team, FSSA Investment Managers (FSSA). This was decided to be in the best interests of our clients, given the significant overlap in SI’s and FSSA’s investment capabilities and our shared history and heritage.

Introducing FSSA Investment Managers

FSSA has been investing in Asia Pacific and Global Emerging Market equities since 1988 as part of the former Stewart Ivory & Company, which subsequently became First State Stewart. After years of organic growth, the First State Stewart team split in two in 2015, leading to the formation of FSSA Investment Managers and Stewart Investors.

Like SI, we are long-term and quality-focused investors. We pay little attention to the index or short-term performance, preferring to focus on generating absolute returns for our clients in the long run. From our research, we aim to construct relatively concentrated portfolios made up of the best ideas that we can find across Asia and emerging markets. As responsible, long-term shareholders, we have integrated sustainability analysis into our investment process and engage extensively with companies on environmental, labour and governance issues.

Following the transition of SI’s portfolios to FSSA, the Stewart Investors Global Emerging Markets Ex-China Leaders portfolio is now being managed by Rasmus Nemmoe and Rizi Mohanty.

Rasmus Nemmoe is a Portfolio Manager at FSSA Investment Managers. He joined the team in 2016 and is the lead manager of the FSSA Global Emerging Markets Focus strategies. Rasmus has more than 20 years of investment experience and is based in Hong Kong.

Rizi Mohanty is a Portfolio Manager at FSSA Investment Managers. He joined the team in 2016 and focuses on the Southeast Asian markets as well as Asia ex-Japan equities more broadly. He is the lead manager of the FSSA ASEAN All Cap and FSSA Asian Growth strategies. Rizi has more than 14 years of investment experience and is also based in Hong Kong.

Rasmus and Rizi are supported by a broader team of investment analysts, with an average of 14 years of investment experience and 8 years tenure with the team. All 15 members of the FSSA investment team are analysts first and foremost, including the portfolio managers, and we spend the majority of our time meeting companies, writing research and seeking quality companies to invest in.

How we invest

FSSA’s investment philosophy, which shares its genesis with SI, has remained broadly unchanged since the First State Stewart team was established in 1988. We focus on identifying quality companies, buying them at a sensible price and holding them for the long term. Most importantly, we invest our clients’ capital as if it were our own. As long-term investors and owners of businesses on behalf of our clients, we look for founders and management teams that act with integrity and risk awareness, and dominant franchises that have the ability to deliver sustainable and predictable returns over the long term.

As a team, we conduct over 1,000 direct company meetings each year across Asia and other emerging markets. The most significant source of investment ideas comes from these company visits and country research trips. We find that our reputation as patient, long-term investors has given us unparalleled access to management, which allows us to gain valuable insights and a thorough understanding of the businesses we want to invest in.

As a result of our long-term time horizon and conservative investment approach, our portfolios – and our performance – can look very different to the index. We shy away from “flavour of the month” themes (such as the current AI-driven boom), and instead look for high-quality companies that can deliver attractive returns for much longer than the market expects – and extend our investment time horizon to capture that advantage. When you own quality businesses, time isn’t a risk – it’s an asset.

Our performance may lag in very buoyant or momentum-driven markets, but we usually compensate very quickly once such bubbles burst. Based on historical data, our long-term track record shows that our portfolios tend to perform better in “normal” markets (-15% to +15% returns over one year) and bear markets (more than 15% decline), than in steeply rising markets (defined as over 15% returns over one year).

A smooth transition

Given the significant overlap in SI’s and FSSA’s investment philosophy and portfolios, we know all the holdings well. As part of the transition, we made a few changes to tilt the portfolio towards companies with stronger cash generation, higher returns and better long-term growth prospects.

Below, we highlight the key additions over the fourth quarter of 2025.

New purchases:

Mediatek is one of the largest chip design companies globally. We have been following Mediatek for many years and have witnessed its performance through the cycles. Throughout the ups and downs in its history, its talented engineers and well-aligned management team usually find a way through to the next “big thing”. From optical drives for computers to scan CDs, it entered the smartphone supply chain with 2G modem chips and benefited from technology upgrades each year – until it collapsed in 2015-17 amid poor execution and competition from both low- and high-end competitors. In 2018 Rick Tsai joined Mediatek from TSMC and focused on getting the basics right again. We believe Mediatek has been transformed under his leadership into a better-quality company. In recent years, the company has improved its competitiveness, and we believe its market share will likely remain stable. With the smartphone market now in the mature stages, the company is investing into new areas (ASIC, auto, augmented reality/virtual reality, Internet of Things, artificial intelligence) to diversify and internationalise its business in the long run.

Qualitas Controladora is the largest Mexican auto insurance company with more than 30% market share – more than twice the size of the #2 player. The company has built a dominant position in what is typically a commoditised industry through excellent service (fast response times and claims processing), wide national coverage, vertical integration and specialisation. We like the company’s customer-first mentality and conservative approach in building the business for the long term. Although growth is likely to normalise after a strong period, we believe it should remain healthy given the ongoing vehicle financing trends and rising adoption of formal insurance (only 30% of vehicles in Mexico are insured). The company has also recently entered the health insurance segment, another market that is under-served and under-penetrated in Mexico. We believe the core franchise and growth opportunity remains solid, and the valuation – particularly with capital returns – looks reasonable.

Complete sales:

There were no significant sales over the quarter.

Performance and outlook

With our long-term investment time horizon, we tend not to pay much attention to short-term market fluctuations. We invest on at least a three-to-five-year view, though we often hold on to companies for much longer. In an industry rife with short-termism, we believe our long-term approach stands out from the crowd.

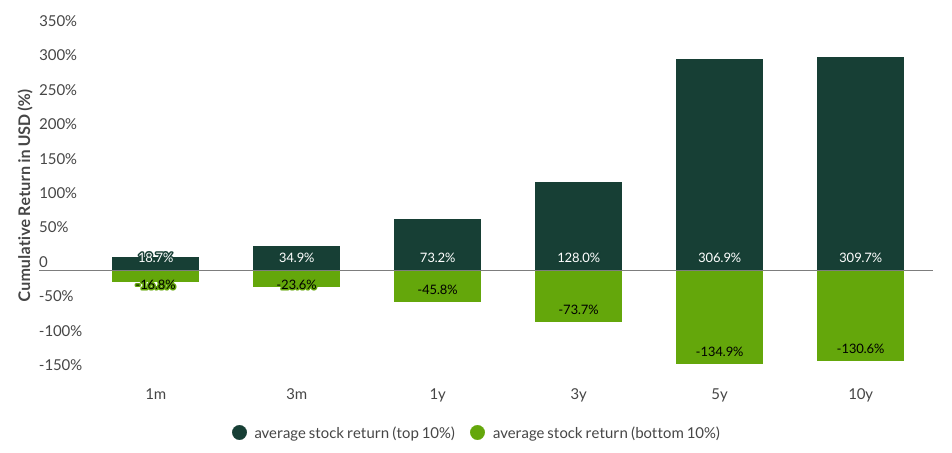

What we have seen, over the past few decades, is that average holding periods for stocks have fallen from over eight years in the 1960s to less than six months today. Yet this shift has come at a cost: it reduces investors’ ability to generate outsized returns that are materially different from the broader market. The reason is simple — as investment horizons shrink, so does the return dispersion between the best- and worst-performing companies. With less time in the market, investors end up tracking the index, not beating it.

Emerging Markets: time horizons matter

MSCI EM Index -dispersion around mean return for top 10% top / bottom stock performers

Source: MSCI Emerging Markets Index, as at 31 May 2025

In a world where markets rise consistently, that might seem like an acceptable outcome. But markets don’t move in straight lines; and in addition to the higher costs and transaction fees that come with frantic trading activity, the bigger issue is that investors miss out on what is far more important – the future value creation that the best companies tend to generate. This is often poorly understood by the market, with many investors simply focusing on the next quarter or year ahead. Yet the real drivers of returns lie in the cash flows that come well beyond that timeframe.

With that context in mind, we highlight the key contributors and detractors from performance over the fourth quarter of 2025.

The largest contributor to performance over the period was Samsung Electronics, a leading manufacturer of memory and semiconductor chips. In recent years, Samsung’s foundry business has been a major point of investor concern, which culminated in significant losses in the first half of 2025. These losses were exacerbated by one-time charges related to US export controls to China. The company has since undertaken a strategic shift from a “capacity-first” to a “customer-first” model, which appears to be bearing fruit. The shares rose during the quarter, as Samsung continued to benefit from surging AI-related demand for its high-bandwidth memory chips as well as tightness in traditional DRAM demand-supply. Strong results from US chipmaker Micron reinforced expectations of a sustained memory upcycle into 2026. With the turnaround in its foundry business and a strong legacy memory business, we believe the risk-reward looks favourable.

WEG, a Brazilian multinational electrical-equipment company, was the second largest contributor to performance. A leader in transformers and industrial electric motors, WEG continued to deliver solid profits in 2025, despite facing challenges due to US tariffs on imports from Brazil. Over the longer term, AI-driven power demand and the ongoing electrification of grids in Brazil and other key markets where WEG has a presence – including Mexico and South Africa – is expected to drive stronger revenue growth in the company’s core transformer business.

The third largest contributor to performance was Taiwan Semiconductor Manufacturing (TSMC), as it continued to see solid revenue growth and strong demand from cloud AI for its leading-edge chips. Given the lead time and supply shortages, this provides visibility into 2026 earnings and possibly even beyond into 2027. TSMC is expected to invest in capacity expansion, with top line growth to follow.

On the negative side, Sea was the biggest detractor from performance, as it continued to decline on concerns about margins, given its marketing tactics and promotional spending. Shopee, its e-commerce platform, has expanded its VIP program to Singapore and Taiwan (in addition to Indonesia, Malaysia, the Philippines, Thailand and Vietnam), which includes extra cash-back, monthly discount vouchers and free delivery – all for a fixed monthly subscription fee. On a positive note, recent results indicated robust earnings and growth across segments. Management subsequently announced a US$1bn share buyback, the first for the company, suggesting confidence in Sea’s outlook.

Silergy was the second biggest detractor. A manufacturer of integrated circuits, the company is seeing weak demand for its products, with management expecting slow orders into early 2026 due to lingering tariff-related uncertainty. However, Silergy reported progress in its automotive business.

Totvs, a leading provider of enterprise resource planning (ERP) software to small and medium sized businesses in Brazil, was the third biggest detractor. The decline in the stock price was probably driven by profit-taking after a period of strong growth, rather than any fundamental weakness. Totvs’ latest earnings results beat analyst expectations, as the company delivered strong revenue growth and margin expansion. Over the longer term, Totvs should be a beneficiary of the AI trend: with its proprietary datasets and in-house technology capabilities, Totvs is well placed to develop tailored AI solutions for its customers, strengthening its competitive position.

Looking forward

Despite the geopolitical uncertainty triggered by the US administration’s reciprocal tariff policy, emerging-market equities delivered robust performance in 2025. This reflects longer-term developments. The global economy is increasingly being led by emerging markets, a trend we expect to accelerate in the future. As concerns grow over the health of the US economy, investors are considering alternatives, as indicated by the strong demand for emerging-market equities over the last year.

Amid the market rise, it is important to keep a close eye on valuations. The growth in AI-related spending has led to a particularly sharp increase in the shares of chipmakers and other technology firms. While some of the Fund’s key holdings are benefiting from this trend, it is important not to get carried away by the hype around generative AI. In the tech sector as elsewhere, the Fund focuses on businesses with proven management teams and competitive advantages that allow them to capitalise on long-term shifts across emerging markets.

Whether it is the formalisation of the Indian economy, the continued financialisation of the South African population, or the growing enterprise resource planning (ERP) adoption by Brazilian SMEs, there are plenty of investment opportunities in emerging markets. Yet these kinds of businesses are not widely included in major market benchmarks, which is why the Fund focuses on high-quality companies rather than following the crowd.

SFDR Article 9 and FSSA’s approach to sustainability

All SI portfolios will continue to be managed true to label, with due consideration given to SI’s SFDR Article 9 sustainability requirements. Importantly, both FSSA and SI had operated as one team for 27 years (1988-2015) before the decision was made in 2015 to split into two teams. This is heavily reflected in our investment philosophies and processes and our respective approaches to sustainability.

At FSSA, we believe it is everyone’s responsibility to think about sustainability as part of his or her investment decision-making. We don’t use external consultants or environmental, social and governance (ESG) ratings, nor do we outsource the sustainability work to a separate team. In our research, we focus on evaluating the long-term merits of a given investment opportunity. Given that sustainability issues are effectively investment issues, we believe that these challenges and opportunities – and management’s response to them – can have a significant impact on a company’s returns. As such, we look for evidence that the management operates the business effectively and in the interests of all stakeholders – both now and for the longer term.

While issues relating to climate change, or people and communities, are often the ones that get the most attention, most of our company engagements relate to management quality and corporate governance systems, as we believe that good governance is the foundation on which great companies are built. We often engage with management teams on capital allocation and strategy, remuneration structures and succession planning, board diversity and tenure, and ensuring high levels of transparency and company disclosure – to highlight just a few.

For more information on FSSA, or if you have any questions about the transition, please do not hesitate to contact us.

NB Both Stewart Investors and FSSA have been supported by the same centralised Responsible Investment team within the First Sentier Group, who will continue to support FSSA after the transition of SI funds.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q3 2025

Global Emerging Markets (ex China) Leaders strategy update: 1 July - 30 September 2025

Emerging markets enjoyed another strong quarter. Given that market indices were driven higher by beneficiaries of the artificial intelligence (AI) boom, it is unsurprising that returns from our strategy lagged some way behind those from the benchmark. Such periods of thematically driven exuberance can be challenging for long-term investors in high-quality businesses who maintain a discipline around valuations. But we know that our philosophy and process have been proven to deliver over the long term.

One of our team, Doug Ledingham, recently wrote a piece explaining why we consciously resist the growing pressure to focus on the short term:

“At Stewart Investors, we have always sought to occupy a space that protects our clients’ capital. One of the threats we are striving to protect it from is short-termism: from the incessant distraction provided by 24-hour news, from the temptation to digest every morsel of noise, from the danger of trying to react to every macro data point or tweet, and from the pressure to fixate on quarterly earnings. That’s increasingly important in a world where long-term thinking is in increasingly short supply.”

You can read the rest of the piece here: Slow has all the power: why we invest alongside long-term owners. It helps to explain why we won’t be abandoning our core beliefs as long-term fundamental investors to chase the AI-driven rally in a bid to match returns from the index in the short term.

The long-term outlook for Indian companies remains bright

The past quarter has seen a continuation of a dynamic that was unhelpful for our strategy’s short-term relative performance: lacklustre returns from our holdings in India. Despite this, we remain enthusiastic investors in high-quality companies aligned with India’s economic development. So far, this year has seen a reduction in income taxes and a simplification of the Goods and Service Tax (‘GST’) system. The Reserve Bank of India, meanwhile, has been cutting interest rates. So demand is now being supported by both fiscal and monetary loosening.

There is, of course, more to emerging markets than India. Recent trip reports from Indonesia, India and the Philippines are available on our Insights page. Having visited South Korea in September, we are increasingly confident in the changes to corporate governance standards that are unfolding in that country. These echo similar reforms seen in Japan and should have positive effects on shareholder returns in Korea and perhaps across the region more widely – a similar mood of reform now seems to be infecting other countries across Asia.

Continuity and change

It would be remiss not to mention the changes that have taken place at Stewart Investors over the last quarter. After acting as careful stewards of our clients’ capital over many years, three of our colleagues stepped back from their portfolio-management responsibilities in August and left the business. While the list of portfolio-management responsibilities within our team looks different now than it did when the quarter began, on a deeper level, nothing has changed: the philosophy and approach that has defined Stewart Investors since 1988 is deeply engrained and continues to define what we do. Our structure is flat. Every member of the investment team is first and foremost an analyst and our collective focus is on identifying high-quality companies, with resilient financials, guided by ambitious stewards.

Jack Nelson remains this strategy’s lead manager. He continues to apply the same principles to managing it that have guided it since its launch, working as part of the same tight-knit group of investment analysts and drawing on a common pool of investment ideas.

Activity

We added five new holdings to the portfolio over the quarter. There were no complete sales.

New holding: Sea (Singapore: Consumer Discretionary)

In addition to Shopee, the dominant e-commerce platform in Southeast Asia, Sea owns digital entertainment brand Garena and provides digital financial services through SeaMoney. Shopee is increasingly well established around the world, employing 45,000 ‘partner-drivers’ in Brazil.1 We believe Sea now has an opportunity to expand into new markets as well as increasing the penetration of Shopee and SeaMoney. The company’s founder, Forrest Li, remains closely involved in the business but is now supported by a professional management team. He has built a great franchise backed by solid financials (the company has net cash on its balance sheet) that empowers millions of small businesses to grow and create jobs by giving them direct access to their customers.

New holding: Motilal Oswal Financial Services (India: Financials)

This brokerage and wealth management business is poised to benefit from the desire of India’s increasingly wealthy middle class to have greater access to capital markets. It is still managed by its founders, including the eponymous Motilal Oswal and we can see a steady growth path ahead for the coming decades.

New holding: MakeMyTrip (India: Consumer Discretionary)

India’s leading online travel website should benefit from a continuing shift towards booking travel online. Meanwhile, as the disposable incomes of Indian consumers grow, they will increasingly want to travel overseas as well as domestically. While it is 49% owned by Trip.com, the Chinese online travel business, the company’s founders remain involved in the business’s day-to-day activities, supported by a professional management team. It is already a leader in the online travel space in India but the real growth opportunity lies in the offline segment, specifically in bus and hotel bookings, many of which continue to be made in bricks-and-mortar travel agencies.

New holding: ICICI Lombard (India: Financials)

General insurance is one of the lowest penetrated services in India but Prime Minister Modi is committed to a programme of delivering ‘insurance for all’ by 2047; we believe ICICI Lombard, which is a private-sector general insurance provider, will benefit from this drive.

New holding: Cholamandalam Financial Holdings (India: Financials)

Indian financial services business Cholamandalam Financial Holdings, ‘Chola’, is rolling out general insurance across India. As such it should be a beneficiary of the same dynamic as ICICI Lombard. It is associated with the Muragappa family, who we believe to be good stewards of our clients’ capital.

[1] Source: Sea Shopee Celebrates 5 Years in Brazil, Strengthening Income Generation and Entrepreneurial Growth.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2025

Global Emerging Markets (ex China) Leaders strategy update: 1 April - 30 June 2025

The announcement of President Trump’s ‘Liberation Day’ tariffs on 2 April and the short, sharp trade war with China that followed ensured a volatile start to the quarter for emerging markets.

The uncertainty drove share prices sharply lower until the announcement of a 90-day pause on the introduction of the tariffs helped to calm investors. That calm endured even when Israel took direct military action against Iran, with the oil price spiking higher only briefly. Perhaps the most interesting development from our perspective, however, was that the US dollar had its weakest start to the year since 19731.

Towards the end of the quarter, we attended a conference at which we met a number of Indian companies. We were struck by how positive all of them were about the growth opportunities in front of them over the next 10 years. In our view, this potential growth continues to offer powerful support to valuations in the Indian market. We added to our existing holding in Bajaj Auto (India: Consumer Discretionary), the world’s largest manufacturer of three-wheeled vehicles, which provide an affordable form of transport. The company is also well placed to play a leading role in India’s growing adoption of electric two- and three-wheeled vehicles.

Although our outlook on emerging markets is positive, we have become increasingly concerned about the outlook for companies dependent on capital investment in IT systems and services. Although we can see the need for many clients to reach out for their help with incorporating artificial intelligence (AI) tools, it may be that AI actually replaces IT services in some areas. In view of the risk that postpone or cancel investments in their IT systems, we pared back our positions in Delta Electronics (Taiwan: Information Technology), Advantech (Taiwan: Information Technology), and AirTAC International (Taiwan: Industrials).

Looking ahead, any renewed weakness in the dollar could be the trigger for capital currently domiciled in the US to begin to flow into emerging markets. We continue to see particularly good growth opportunities in India, where the central bank recently started cutting interest rates, and a gradually recovering picture across Asia more broadly. We are currently planning a trip to South Korea, where we hope to improve our understanding of the improvements to corporate governance taking place under the new government. We also hope to gain insight into the progress being made by Samsung Electronics (South Korea: Information Technology). It had a difficult 2024 but we believe it could be turning a corner in terms of its growth outlook.

[1] Source: Financial Times, 30 June 2025 ‘US dollar suffers worst start to year since 1973’.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q1 2025

Global Emerging Markets (ex China) Leaders strategy update: 1 January - 31 March 2025

With the threat of US tariffs ever present, the volatility seen across emerging markets in the final quarter of 2024 carried over into 2025. Share prices in India fell sharply due to concerns about a cyclical slowdown. This reset in valuations means the competition between new ideas for a place in the portfolio has rarely been this intense. The result was a busier-than-normal quarter in which we added six new names to the portfolio.

In India, we allocated capital to some new ideas which have been on our focus list for a while but whose valuations meant we were unable to act until now. Info Edge (India: Communication Services) is a technology company whose online jobs portal caters to 132,000 corporate customers and hosts around 100 million CVs1. It also has property, matchmaking and educational portals. Tube Investments (India: Consumer Discretionary) is an industrial conglomerate whose share price had fallen sharply, providing us with what we believe is an excellent entry point. Bajaj Auto (India: Consumer Discretionary) had also sold off allowing us to add this leading manufacturer of motorcycles, scooters and auto rickshaws, which is backed by a high-quality steward. Bajaj Holdings & Investment (India: Financials) is the holding company of siblings Rajiv and Sanjiv Bajaj. They have demonstrated an exemplary track record of delivering returns for shareholders in autos and financial services.

Elsewhere, we built positions in Samsung Biologics (South Korea: Health Care), Alfamart (Indonesia: Consumer Staples), and BDO Unibank (Philippines: Financials). We believe Samsung Biologics can use the strength of its parent company’s balance sheet to add capacity more quickly than its competitors and win market share. Alfamart is the second biggest player in Indonesia’s convenience-store sector2. It plans to roll out new stores across the country over the next decade. Its shares sold off as the market took fright at Indonesia’s new government but we can see a clear and dependable growth path before it. Finally, BDO Unibank is the Philippines’ largest lender3. It is backed the Sy family, who we believe are great long-term stewards.

We made one complete sell during the quarter, Dino Polska (Poland: Consumer Staples), which had performed well but had become too expensive given its long-term growth prospects.

While we are broadly positive on the outlook for emerging markets, we recognise that there is likely to be ongoing volatility for as long as ‘top-down’ uncertainty – inspired by trade tariffs and geopolitical flux – remains at elevated levels. Valuations are certainly attractive and there remains plenty of domestically driven growth in the markets we favour. Our task is to block out the short-term noise to focus on the underlying quality, growth and stewardship of the companies we invest in.

[1] Source: InfoEdge: Annual Report 2023-24.

[2] Source: Fitch Ratings Fitch Revises Alfamart's Outlook to Positive; Affirms at 'AA(idn)'.

[3] Source : BDO Unibank – Company Profile (as of 31 December 2024).

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Portfolio Explorer

Portfolio Explorer tells the stories of the companies we invest in. The company profiles have been written by our own team so that you can see why they believe that the companies they invest in are making the world a better place.

Fund data and information

Key documents and links

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Global Emerging Markets (ex China) Leaders Fund

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Global Emerging Markets (ex China) Leaders Class E (Acc) | Irish UCITs | EUR | 9.42 | -1.54 | 03 Mar 2026 | |

| Stewart Investors Global Emerging Markets (ex China) Leaders Class I (Acc) | Irish UCITs | EUR | 9.65 | -1.55 | 03 Mar 2026 | |

| Stewart Investors Global Emerging Markets (ex China) Leaders Class VI (Acc) | Irish UCITs | EUR | 9.41 | -1.54 | 03 Mar 2026 | |

| Stewart Investors Global Emerging Markets (ex China) Leaders Class E (Acc) | Irish UCITs | USD | 10.07 | -2.78 | 03 Mar 2026 | |

| Stewart Investors Global Emerging Markets (ex China) Leaders Class VI (Acc) | Irish UCITs | USD | 10.06 | -2.78 | 03 Mar 2026 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Following the UK departure from the European Union, the First Sentier Investors ICVC, an open ended investment company registered in England and Wales ("OEIC") has ceased to qualify as a UCITS scheme and is instead an Alternative Investment Fund ("AIF") for European Union purposes under the terms of the Alternative Investment Fund Managers Directive (2011/61/EU). Accordingly, no marketing activities relating to the OEIC are being carried out by Stewart Investors in the European Union (or the additional EEA states) and the OEIC is not available for distribution in those jurisdictions. We have made documents available for existing EU investors in the ICVC which can be accessed here.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.