Get the right experience for you. Please select your location and investor type.

Worldwide Leaders

The Worldwide Leaders strategy launched in November 2013 and transitioned to become a dedicated sustainability strategy in October 2016.

Download overviewThe Worldwide Leaders strategy launched in November 2013 and transitioned to become a dedicated sustainability strategy in October 2016. The strategy invests in 30-60 high-quality global companies that are particularly well positioned to contribute to, and benefit from, sustainable development.

Leaders simply means that this strategy is focused on companies with a market cap value of at least USD5 billion.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Strategy name change

Please note, from 21 November 2024 Stewart Investors Worldwide Leaders Sustainability name will be updated to Worldwide Leaders. By 30 September 2025, the Stewart Investors NZ PIE Fund name will be updated to reflect these Strategy name changes. Please refer to this note for further information.

Latest insights

Quarterly updates

Worldwide Leaders strategy update: 1 January - 31 March 2025

“Only two things make up a railroad: a track and a locomotive.” Amid the constant barrage of news about tariffs, trade wars and geopolitical realignment, this recent comment – by the chief financial officer (CFO) of one of our companies – provided a timely reminder that things are sometimes simple. It also underscored why we are glad to be bottom-up investors. Through all the noise of the first quarter of 2025, we focused on finding companies with experience in navigating unpredictable political and economic storms and who keep their eyes firmly fixed on their long-term goals.

This quarter witnessed a significant ‘first’ for this strategy – its first investment in a Chinese company. We approached our assessment of Alibaba (China: Consumer Discretionary) as we would with any company, by considering the quality of its people, its franchise and its financials. Alibaba is led by a highly capable management team that combines a private-sector mindset with strategic alignment with the goals of the Chinese government. It is reinvesting the generous cashflows that its mature retail business generates in building a new cloud business. It has net cash on its balance sheet and a share-buyback programme that is friendly to its minority shareholders. In our view, the combination of an attractive valuation with the potential for Alibaba’s technology to help China meet some of the development challenges it faces make the investment case here compelling.

We also added a new position in ABB (Switzerland: Industrials). This high-quality engineering business is a market leader in electrification, motion and automation. Its motors, drives and transformers are a small but critical part of its customers’ overall budget, and the depth of the relationships ABB has fostered with them puts it in a strong competitive position. We believe, the combination of increasing demand for electricity worldwide and the company’s focus on improving margins leaves ABB well placed to generate returns over the coming decade.

We continued to build positions in a number of recent additions to the portfolio such as Brown & Brown (United States: Financials), NVR (United States: Consumer Discretionary) and Carlisle Companies (United States: Industrials). Elsewhere, we responded to the attractive valuation of Samsung Electronics (South Korea: Information Technology) by adding to our position.

During the quarter, we sold Costco (United States: Consumer Staples). This is still a high-quality company but the valuation of its shares indicated a likelihood that returns in the future would be lower. On a similar note, stretched valuations encouraged us to trim our holdings in Fortinet (United States: Information Technology), Copart (United States: Industrials) and Watsco (United States: Industrials). Elsewhere, rising geopolitical risks led us to trim the holding in TSMC (Taiwan: Information Technology).

We continue to find opportunities to invest in the shares of reasonably valued companies worldwide that we believe can (profitably) help to solve a range of development challenges. Being unconstrained by a benchmark allows us to seize those opportunities wherever they arise. At a time of rapid economic and geopolitical change, we continue to apply our investment philosophy consistently and to focus on the things that we believe matter over our investment timeframe. As for what comes next? Another comment from the CFO we quoted earlier encapsulates our view: “there’s only one way to go in rail, and that’s forward!”

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Worldwide Leaders strategy update: 1 October - 31 December 2024

“We are allocating our own money, we act like owners.”1 It’s always pleasing to meet with a company that thinks similarly to us. We are stewards of our clients’ capital, and one key tenet of our Hippocratic Oath is “We will not forget in our search for returns that the primary risk faced by our clients is losing their capital”. The oath underpins our investment philosophy, which is based on identifying quality stewards of strong franchises with good long-term growth prospects.

During the quarter we bought five new companies and the quote above is from a meeting with the company management of the first of them. Brown & Brown (United States: Financials) was founded in 1939 and is still stewarded by the Brown family. Over the past 85 years, the competent, ambitious and long-term management team has enabled it to grow beyond its Florida base to become the sixth largest insurance broker2 in the United States. The company has also been expanding to Asia and Europe and given the fragmented nature of the insurance brokerage industry, there is plenty more room to grow in the decades ahead.

Carlisle Companies (United States: Industrials) make and sell construction materials, particularly the products needed to roof and waterproof buildings. Using high-quality products in houses leads to better ventilation and protection from weather as well as reducing energy usage and improving longevity. The high demand for new housing across America will provide strong long-term growth opportunities for this company as well as another new purchase, NVR (United States: Consumer Discretionary). Based in Virginia, NVR is the fourth largest homebuilder3 in the United States, focused on building high-quality homes for first-time owners. The long-tenured management team have a history of using industry slowdowns to expand their business in a controlled way, allowing them to benefit when housing demand increases.

Wabtec (United States: Industrials) is a leading provider of components for rail transportation and can trace its roots back over 100 years. The rail industry is as important now as it was then, as it plays a crucial role in reducing global emissions through both freight and passenger transportation. Rising investment in rail infrastructure along with increasing market share and improving profit margins provide compelling growth drivers over the long term.

Synopsys (United States: Information Technology) is the market leader4 in software for the design of semiconductors, with their products being used by almost all major semiconductor designers and manufacturers. The founder continues to steward the company as Chairman of the Board, enabling them to make long-term investments in research & development (R&D). This ensures that their products remain relevant for decades and provides excellent growth potential.

The new positions were funded by selling Edwards Lifesciences (United States: Health Care) which manufacturers artificial heart valves, and Halma (United Kingdom: Information Technology) which holds a portfolio of companies targeting solutions for safety, health, environment and testing. In both cases, we felt that there were greater opportunities for growth in other companies.

In the past quarter the US election has taken place, sending Donald Trump back to the White House along with a Republican Party majority in the House of Representatives and the Senate. There have been many column inches written about taxes, tariffs and other general speculation about what the incoming administration might do. We don’t have any insights into the workings of a Trump presidency, instead, we focus on finding companies that are adept at navigating difficult situations and practised at generating growth from the opportunities in front of them. Another tenet of our Hippocratic Oath is “We will strive to achieve, through hard work, sober analysis and sound judgement, the best risk-adjusted returns possible for our clients.” This focus means we will continue to seek companies, like Brown & Brown, who we believe will be excellent stewards of our clients’ savings.

[1] Source: Stewart Investors company meeting with Brown & Brown, February 2024.

[2] Source: Brown & Brown website - https://www.bbrown.com/us/about/

[3] Source: Builder. https://www.builderonline.com/builder-100/builder-100-list/2023/

[4] Source: Synopsys company data - https://s201.q4cdn.com/778493406/files/doc_earnings/2024/q4/presentation/InvestorOverviewPresentationFinal-Q4.pdf

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Worldwide Leaders strategy update: 1 July - 30 September 2024

We initiated a position in one new company during the quarter. Rentokil Initial (United Kingdom: Industrials) is a global leader in pest control services, a necessary and critical health and hygiene service to secure homes, hospitals and businesses against disease and damage.

Its business model is fundamentally local in nature and generates lots of cash through resilient, recurring sales. The management team is focused on growth by increasing the density of its route network, and so driving improvements in profitability and earnings.

During the quarter we sold completely out of four companies as we grew concerned about their ability to grow their end customer markets. These include: Midea (China: Consumer Discretionary) which makes home appliances for the Chinese market; Infineon Technologies (Germany: Information Technology) which makes semiconductors for electric vehicle and renewable energy markets; Hamamatsu Photonics (Japan: Information Technology) which makes equipment to generate, detect and filter light for scanners, x-ray machines and automation devices such as barcode readers; and Graco (United States: Industrials) which specialises in paint sprayers and products that manage corrosive and other difficult-to-handle fluids.

We are always looking at new companies and recently visited Sweden to meet with some new and some old businesses, including Atlas Copco (Sweden: Industrials), the world's leading manufacturer of air compressors, which is held in the strategy. The opportunity to meet with company management on their ‘home turf’ is invaluable; it is much easier to get a sense of how culture and people have shaped a company and its future return profile when sitting within their offices; or, in the case of Atlas Copco, 20 metres below their office in a test mine. We continue to find excellent investment ideas by focussing on the impact that outstanding people can have on businesses with strong franchises and resilient financials.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Worldwide Leaders strategy update: 1 April - 30 June 2024

“We know we’re not going to get our money out, so we’d rather burn it up in paying our employees1”.

For Lincoln Electric (United States: Industrials), getting out the Russian market was an easy decision, the only question was how. They stopped production in April 2022 and have focused on supporting their former employees as they look for options to divest their facility. Meeting with companies in person helps us to understand the quality of management through the decisions that they take.

We recently visited the United States to meet with a wide range of industrial and consumer companies across Chicago, Cincinnati, Columbus, Cleveland, Boston and New York. In total we met with 50 companies, many of them leaders in their industries. We highlight some of the companies we met with in more detail here along with the reasons why we believe they fit so well with our investment approach. The trip was a great reminder of the number of excellent companies out there with competent and ethical stewards that generate returns by focusing on building long-term franchises in profitable niches.

During the quarter we added a new position in Ashtead Group (United Kingdom: Industrials), an industrial and construction equipment rental company with a long-tenured leadership team. Despite being founded in the UK in 1947, Ashtead Group currently derives more than 80% of its revenues from the United States due to its acquisition of Sunbelt in the 1990s2. Renting equipment reduces the need for companies to own equipment that sits idle leading to improved resource efficiency and reduced environmental impact. It also provides for a franchise that generates high returns and opportunities for strong growth prospects given the current fragmented nature of the equipment rental market. We continued to add to our position in TSMC (Taiwan: Information Technology) reflecting our conviction in the long-term potential of its business. We also added to positions in MonotaRO (Japan: Industrials), Fortinet (United States: Information Technology) and Old Dominion Freight Line (United States: Industrials).

We divested completely from two companies, Samsung C&T (South Korea: Industrials) and EPAM Systems (United States: Information Technology), preferring to consolidate exposure in higher conviction ideas. We also trimmed exposure to Mahindra & Mahindra (India: Industrials), and Infineon Technologies (Germany: Information Technology).

During the quarter, one of our companies was targeted by an activist investor who was concerned that it was overbuilding manufacturing capacity. Their concerns were based on near-term revenue expectations in an industry that is expected to grow by multiples in the coming years. We disagreed as the company’s record of counter cyclical and industry leading investments has handsomely rewarded patient shareholders and we wrote to offer them our support.

The overall market continues to become increasingly concentrated in any company connected with building Artificial Intelligence (AI) infrastructure. We do not have any insight into how new technologies work through an economy nor where the revenues or profits will appear. Instead of allowing ourselves to be distracted by a single growth driver, we seek to build a portfolio of companies that can benefit from a wide range of diverse growth drivers, as we believe that this is the best way to protect and grow our clients’ capital over the long term.

1 Source: Stewart Investors investment team, June 2024

2 Source: Stewart Investors investment team and company data

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Worldwide Leaders proxy voting: 1 January - 31 March 2025

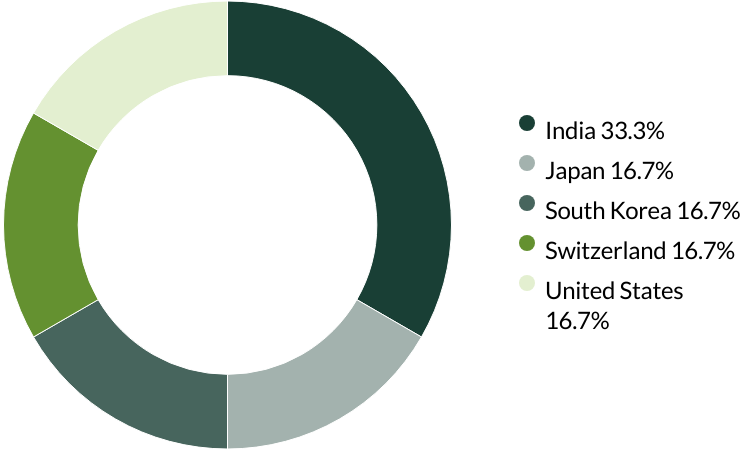

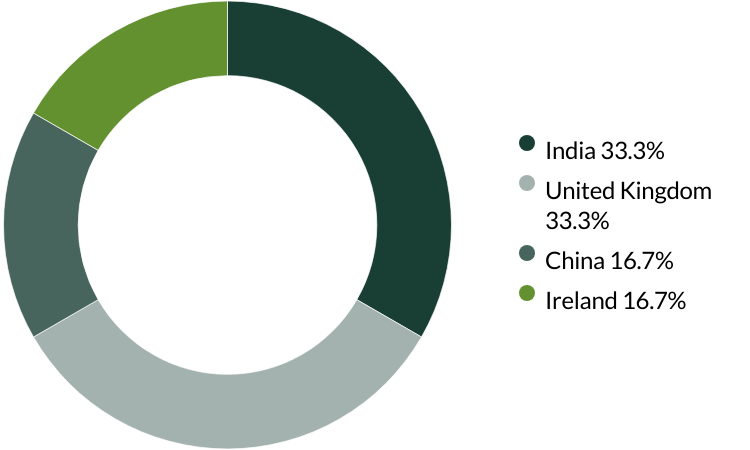

Proxy voting by country of origin

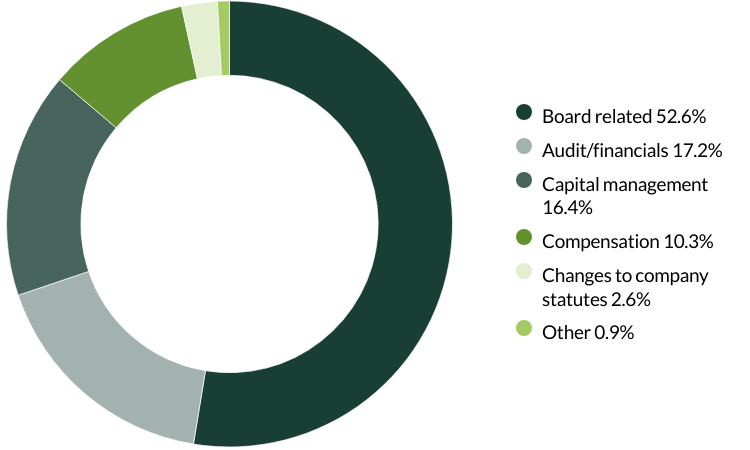

Proxy voting by proposal category

During the quarter there were 64 resolutions from five companies to vote on. On behalf of clients, we voted against six resolutions.

We voted against a proposal on transaction of business at ABB, as they did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (one resolution)

We voted against the appointment of the auditor at Costco as they have been in place for over 10 years. The company has given no information on intended rotation, which we believe is important to provide a fresh perspective on the accounts. We voted against a shareholder proposal requesting the company publish a report assessing the risks of maintaining its current diversity, equity and inclusion (DEI) roles, policies and goals as we support the company in their commitment to obey with the law and that their DEI efforts are legally appropriate. (two resolutions)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Worldwide Leaders proxy voting: 1 October - 31 December 2024

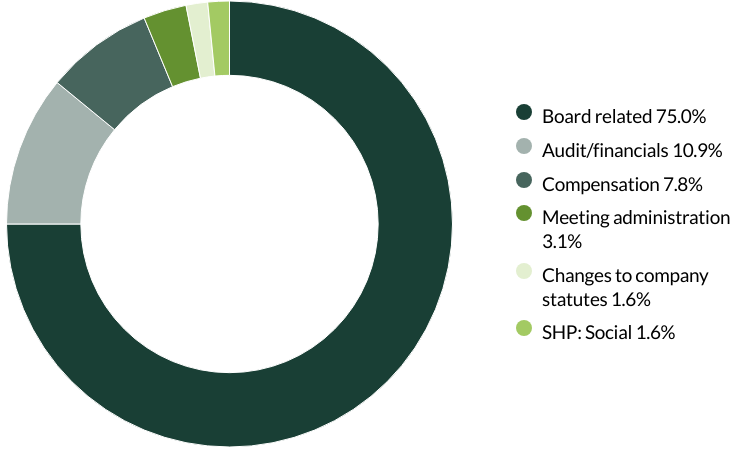

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 25 resolutions from two companies to vote on. On behalf of clients, we voted against one resolution.

We voted against the re-appointment of the auditor at Copart as they have been in place for or over 10 years and the company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

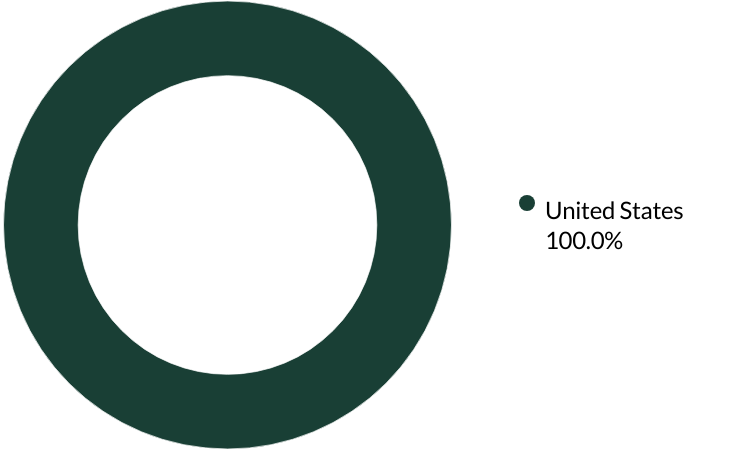

Worldwide Leaders proxy voting: 1 July - 30 September 2024

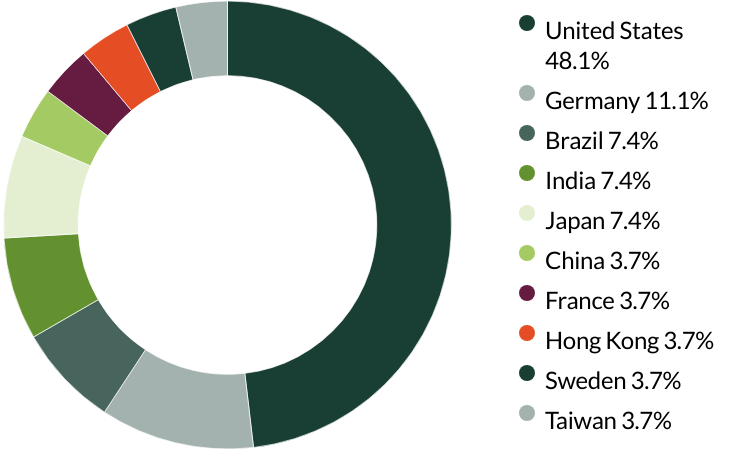

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 116 resolutions from six companies to vote on. On behalf of clients, we voted against four resolutions.

We voted against remuneration motions at Ashtead Group as we were concerned about excesses in CEO salary. (two resolutions)

We voted against the appointment of the auditor at Linde as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (two resolutions*)

*The same proposal was voted on different stock lines.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

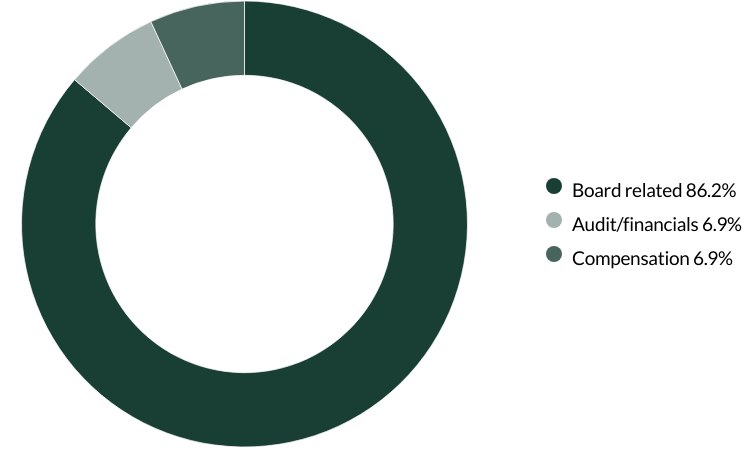

Worldwide Leaders proxy voting: 1 April - 30 June 2024

Proxy voting by country of origin

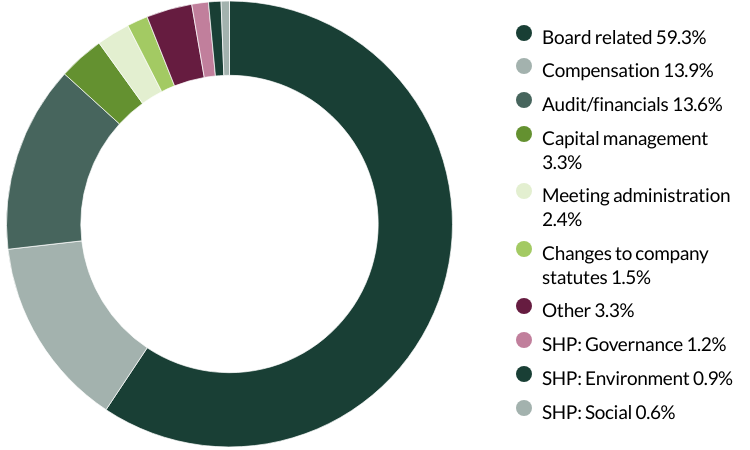

Proxy voting by proposal category

During the quarter there were 332 resolutions from 26 companies to vote on. On behalf of clients, we voted against 23 resolutions.

We voted against the appointment of the auditor at Arista Networks, bioMérieux, Edwards Lifesciences, EPAM Systems, Expeditors, Fastenal, Fortinet, Graco, Lincoln Electric, Markel, Old Dominion Freight Line, Roper Technologies and Texas Instruments as they have been in place for over 10 years and the companies’ have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (13 resolutions)

We voted against the proposed employee stock ownership plan at Midea as we believe non-executive director involvement could lead to conflict of interest and would not be in shareholders' interest. (three resolutions)

We voted against recasting and cumulative voting at WEG as this would allow the board to make changes without shareholder assessment or knowledge of candidates. (three resolutions)

We abstained from voting on requests for a separate board election and the election of a Supervisory Council position at WEG due to insufficient information and our preference for the current family stewards to remain in place. (two resolutions)

We voted against a shareholder proposal regarding board declassification at EPAM Systems as we do not deem it necessary for all directors to stand for election annually and believe this could destabilise the board by allowing excessive turnover. (one resolution)

We voted for a shareholder proposal encouraging alignment with the Paris Agreement with regards to greenhouse gas (GHG) emissions targets and also voted against a shareholder proposal requesting a Diversity & Inclusion Report at Expeditors as we believe this issue requires a wider discussion and cannot be resolved through disclosure alone. (two resolutions)

We voted against a shareholder proposal regarding simple majority voting at Fastenal as this was covered by the company's own proposals. (one resolution)

We voted against a shareholder proposal regarding GHG emissions disclosure at Markel as the proposal called for disclosure of emissions from underwriting, insuring and investments, which is not yet widely or reliably reported in the industry, hence we would prefer to discuss the issue with the company. (one resolution)

We abstained from voting on a shareholder proposal regarding the adoption of greenhouse gas (GHG) emissions targets aligned with the Paris Agreement at Old Dominion Freight Line as we have previously engaged with the company on this issue and prefer to continue dialogue to better understand their plans. (one resolution)

We abstained from voting on a shareholder proposal to remove supermajority requirements for certain issues at Roper Technologies as the board didn't provide a recommendation. (one resolution)

We voted for shareholder proposals regarding the right to call a special meeting and requesting a report on customer due diligence at Texas Instruments as we found both to be sensible. (two resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, European All Cap Strategy, European (ex UK) All Cap Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 31 March 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Important information

This document is intended for the exclusive use of NZ financial advisers. It is not to be used by retail investors and should not be distributed or published without the prior consent of FundRock NZ Limited.

This publication is provided by First Sentier Investors (Australia) IM Ltd ('FSI AIM' or 'Stewart Investors') in good faith and is designed as a summary to accompany the Product Disclosure Statement for the Stewart Investors Worldwide Leaders Sustainability Fund ('the Fund'). The Product Disclosure Statement for the Fund is available from FSI, or FundRock NZ Limited ('FundRock' or 'the Issuer') and on https://disclose-register.companiesoffice.govt.nz/or www.fundrock.com/fundrock-new-zealand/frnz-documents-and-reporting/.

FSI AIM forms part of First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group, Inc ('MUFG'). Stewart Investors is the name of an investment team forming part of the First Sentier Investors Group. The information contained in this publication is not an offer of units in the Fund or a proposal or an invitation to make an offer to sell, or a recommendation to subscribe for or purchase any units in the Fund. If you are making an investment directly then you will be required to complete the application form, which can be obtained from FundRock.

The information and any opinions in this publication are based on sources that Stewart Investors believes are reliable and accurate. Stewart Investors, its affiliates, directors, officers and employees make no representations or warranties of any kind as to the accuracy or completeness of the information contained in this publication and disclaim liability for any loss, damage, cost or expense that may arise from any reliance on the information or any opinions, conclusions or recommendations contained in it, whether that loss or damage is caused by any fault or negligence on the part of Stewart Investors, or otherwise, except for any statutory liability which cannot be excluded.

All opinions reflect Stewart Investors' judgment on the date of this publication and are subject to change without notice. This disclaimer extends to FundRock, and any entity that may distribute this publication. The information in this publication is not intended to be financial advice for the purposes of the Financial Markets Conduct Act 2013 (FMC Act), as amended by the Financial Services Legislation Amendment Act 2019 (FSLAA).

In particular, in preparing this publication, Stewart Investors did not take into account the investment objectives, financial situation and particular needs of any particular person. Professional investment advice from an appropriately qualified adviser should be taken before making any investment. Past performance is not necessarily indicative of future performance, unit prices may go down as well as up and an investor in the Fund may not recover the full amount the capital that they invest. No part of this publication may be reproduced without the permission of Stewart Investors or FundRock. FundRock is the issuer and manager of the Fund. Stewart Investors is the investment manager of the Fund.

© First Sentier Investors Group