Get the right experience for you. Please select your location and investor type.

Asia Pacific Leaders Sustainability

The Asia Pacific Leaders strategy invests in large and mid-sized companies which generally have a total stock market value of at least US$1 billion.

The Asia Pacific Leaders strategy was originally launched in December 2003 and invests in large and mid-sized companies which generally have a total stock market value of at least US$1 billion (hence ‘Leaders’).

This equity-only strategy seeks to invest in between 30 to 60 high-quality businesses in the Asia Pacific region (including Australia and New Zealand, but excluding Japan) that are helping bring about a more sustainable future.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q1 2024

Asia Pacific Leaders Sustainability strategy update: 1 January - 31 March 2024

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term.

During the quarter we initiated three new positions in Samsung C&T (South Korea: Industrials), Techtronic Industries (Hong Kong: Industrials) and MediaTek (Taiwan: Information Technology).

Samsung C&T is the holding company for Samsung Biologics with sizeable positions in group companies such as Samsung Electronics (c.5%).

Samsung Biologics is a world leader in affordable healthcare. Samsung Electronics is a global leader in consumer electronics and chip manufacturing.

In its core business, the company is aiming to invest into areas with strong demand tailwinds such as renewable energy and battery recycling. The group aims to improve governance practices by returning excess cash to shareholders, cancelling treasury shares, improving profitability in core assets and articulating a clear strategy for future capital allocation.

Techtronic Industries is dominant internationally in an array of cordless, hand, measuring and trade power tools for both home and commercial use. They have ownership of strong brands in consolidated areas which results in pricing power. The company is positioned well to grow organically and by acquisition.

MediaTek is a fabless (outsourced production) semiconductor company. They are leaders in integrated chip system solutions which are estimated to power over two billion devices a year from smartphones to home entertainment, connectivity and the internet of things (IoT) products.

We exited Altium (Australia: Information Technology) and HDFC Life (India: Financials). We sold Altium after it was approached by Japanese listed Renesas Electronics for acquisition at 37% premium to the prevailing market price. HDFC Life was sold to fund better ideas elsewhere. We reduced Pigeon (Japan: Consumer Staples) as we have lost conviction in the speed and extent of the evolution of the franchise.

We took advantage of lower valuations in China and continue to build positions in Midea (China: Consumer Discretionary), Shenzhen Inovance Tech (China: Industrials), Glodon (China: Information Technology) and WuXi Biologics (China: Health Care). We also topped up the holding in Samsung Electronics (South Korea: Information Technology).

To finance new investments and our latest additions, and to control position size we trimmed holdings in Tata Consumer Products (India: Consumer Staples), Mahindra & Mahindra (India: Consumer Discretionary), Godrej Consumer Products (India: Consumer Staples), Tech Mahindra (India: Information Technology) and Bank Central Asia (Indonesia: Financials).

Views on investment opportunities in Asia have not changed; the strategy continues to look to invest in high-quality companies that are aligned with sustainable development. We look for stewards who are low profile, competent, long-term decision makers, franchises free from political agendas and financials that are resilient, not frail. Our focus is on quality, and we remain indifferent to many of the large, well-known companies, regardless of lower valuations.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q4 2023

Asia Pacific Leaders Sustainability strategy update: 1 October - 31 December 2023

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term.

High-quality companies at reasonable valuations tend not to come along too often. In the absence of such opportunities, we are very comfortable long-term owners of companies in the portfolio.

During the quarter we initiated two new positions in Samsung Biologics (South Korea: Health Care) and Wuxi Biologics (China: Health Care). We have admired the Samsung Biologics franchise for many years. They have expanded production capacity quickly and efficiently which has helped them to increase wallet share with existing clients and win important new clients. Our more constructive stance on governance at the Samsung Group was another important consideration. We have also been studying Wuxi Biologics for a number of years. It is a leading contract research provider and manufacturer for pharmaceutical companies. The stewards have spent the last decade nurturing strong relationships with customers across geographies, and are building on their research relationships to scale up manufacturing services. The nature of the business, where the timeline from drug discovery to manufacturing can be decades, means that long-term customer relationships are crucial, and the trust built is difficult to disrupt. In terms of additions, we continued to build our holding in Midea (China: Consumer Discretionary), the largest home appliances business in China.

There were no complete divestments during the period. We trimmed Tata Consumer Products (India: Consumer Staples) and Tech Mahindra (India: Information Technology) to control position size. We also reduced the holding in CSL (Australia: Health Care). We are still long-term supporters of this extremely high-quality franchise but consider there to be marginally better risk-reward opportunities elsewhere.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2023

Asia Pacific Leaders Sustainability strategy update: 1 July - 30 September 2023

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term. High-quality companies at reasonable valuations tend not to come along too often. In the absence of such opportunities, we are very comfortable long-term owners of companies in the portfolio.

During the quarter, we initiated a position in Samsung Electronics (South Korea: Information Technology). We have long admired the strength of the Samsung Electronics franchise which should benefit from strengthening geopolitical headwinds and a desire to reduce dependence on Taiwanese manufacturers. Samsung Electronics demonstrates an impressive ability to generate cash and boasts a solid balance sheet. A recent visit to South Korea prompted a reappraisal of the quality of governance which has improved significantly. We also initiated a position in Midea (China: Consumer Discretionary) which is a manufacturer of home appliances. Midea is a high-quality franchise where the stewards are investing cash flow from their dominant market position, in exciting new technologies and automation to enhance growth prospects.

We also added to holdings in OCBC Bank (Singapore: Financials), Glodon (China: Information Technology) and Telkom Indonesia (Indonesia: Communication Services).

We sold the holding in Infosys (India: Information Technology). We recognise that Infosys is an extremely high-quality company but feel there are better risk-reward opportunities available. We also sold Foshan Haitian Flavouring (China: Consumer Staples) where we have increasing concerns about franchise development. In addition to these sales we trimmed holdings in Tata Consumer Products (India: Consumer Staples), Dabur (India: Consumer Staples) and Godrej Consumer Products (India: Consumer Staples) on valuation. We also reduced Kingmed Diagnostics Group (China: Health Care) on increasing concerns about governance.

To control position sizes we trimmed holdings in Mahindra & Mahindra (India: Consumer Discretionary), Shenzhen Inovance Tech (China: Industrials) and CSL (Australia: Health Care).

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2023

Asia Pacific Leaders Sustainability strategy update: 1 April - 30 June 2023

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term. High-quality companies at reasonable valuations tend not to come along too often. In the absence of such opportunities, we are very comfortable long-term owners of investee companies.

We initiated one new position over the quarter with the purchase of Telkom Indonesia (Indonesia: Communication Services). Telkom Indonesia has a strong track record of growth and profitability sitting as the backbone of Indonesia’s digital growth. Telecoms is notoriously a tough industry as there is little in the way of differentiation between what tend to be equally matched players. In Indonesia, Telkom has significant market leadership in a consolidated market providing them valuable cash flows to reinvest in growth ahead of peers. Telkom is also a unique example of a telecom company that has a robust, near-net cash balance sheet.

Our Chinese holdings have been whipped around in recent months as short-term views shift on a daily basis on whether there is evidence of a post-covid economic recovery and what stimulative polices the government will resort to. The Chinese stock market is dominated by state-owned enterprises. These companies trade on very low valuation multiples – rightly in our view – which when viewing the Chinese market purely from a top-down perspective, muddies the picture on what valuations are being asked of privately-owned, high-quality franchises. We are starting to see such companies approach valuations that we are comfortable paying. But on the whole, we do not yet see the bargain valuations that tend to come up when there is genuine fear in a market. We added to our position in Shenzhen Inovance (China: Industrials) as top-down macro-driven concerns helped depress valuations.

To fund these transactions we trimmed three of our Indian holdings: Mahindra & Mahindra (India: Consumer Discretionary), Tata Consultancy Services (India: Information Technology) and Tata Consumer Products (India: Consumer Staples), and sold Pidilite Industries (India: Materials) for valuation reasons.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

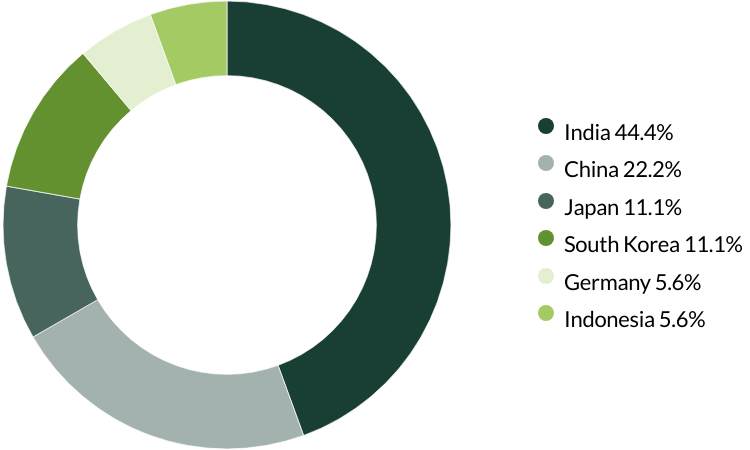

Proxy voting: Q1 2024

Asia Pacific Leaders Sustainability proxy voting: 1 January - 31 March 2024

Proxy voting by country of origin

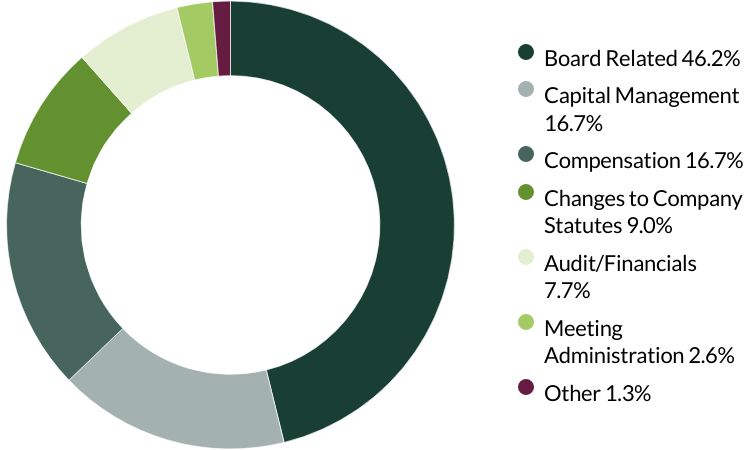

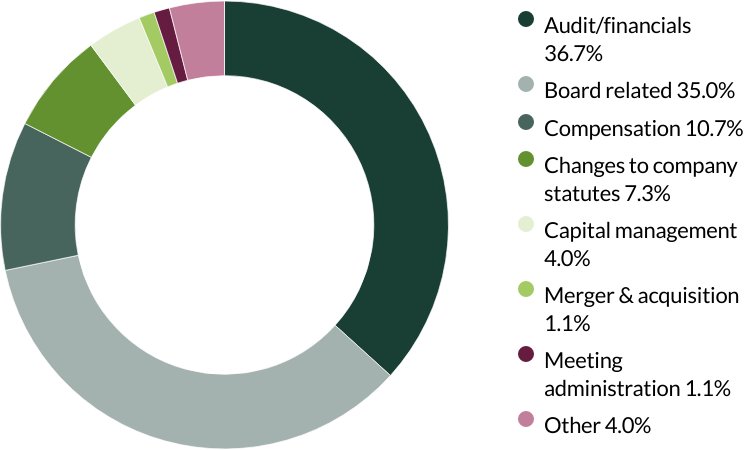

Proxy voting by proposal category

During the quarter there were 105 resolutions from 17 companies to vote on. On behalf of clients, we voted against 3 resolutions.

We voted against excessive executive remuneration at Bank Central Asia. (one resolution)

We voted against an adjustment of the Guarantee for Controlled Subsidiaries Assets Pool Business at Midea as we found the guarantee amount to be excessive and not in shareholders' best interests. (one resolution)

We voted against a Board appointment at Samsung Electronics as we would prefer to see more independent, non-family associated Directors. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2023

Asia Pacific Leaders Sustainability proxy voting: 1 October - 31 December 2023

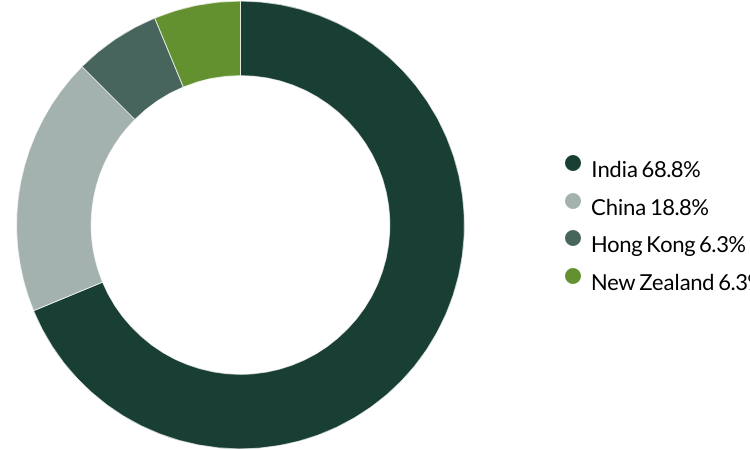

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 78 resolutions from 11 companies to vote on. On behalf of clients, we voted against 24 resolutions.

We voted against the Board re-election at ResMed as we were not able to vote against individual directors and opted to vote against Mr P Farrell who retired from the company 10 years ago and we believe he should step down from the board. We voted against the company’s executive remuneration, as we believe it to be complex and measured on many adjusted metrics. We also voted against the re-appointment of the auditor as they have been in place for 29 consecutive years. (24 resolutions - the resolutions for this company are duplicated as one vote instruction is for the company’s global meeting and the other is for the company’s domestic meeting)

We abstained from voting on the approval of a renewed liability insurance for Directors, Supervisors, and Senior Management at Midea Group as we did not have sufficient information on the details of the insurance policy at the time of voting. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

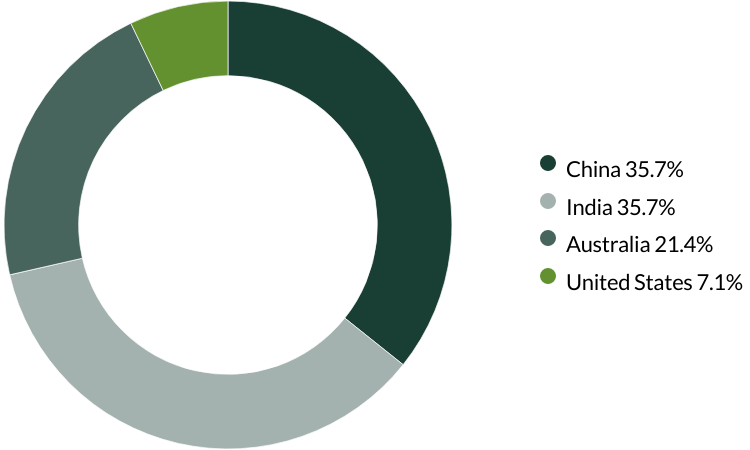

Proxy voting: Q3 2023

Asia Pacific Leaders Sustainability proxy voting: 1 July - 30 September 2023

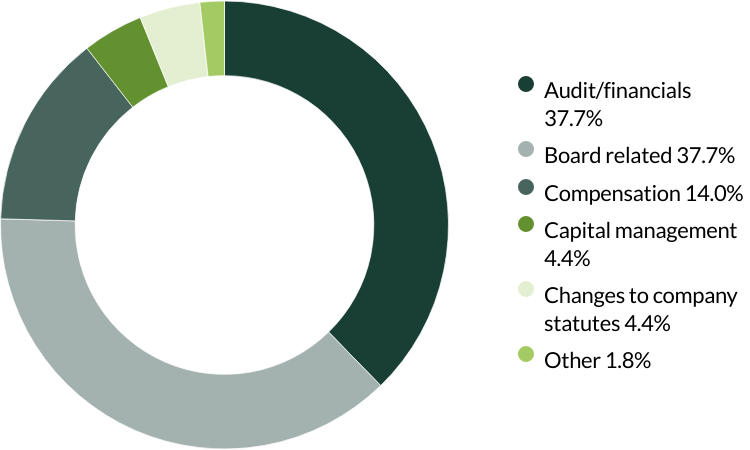

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 114 resolutions from 15 companies to vote on. On behalf of clients, we voted against two resolutions.

We voted against a related party transaction at Kingmed Diagnostics Group which would transfer 73% ownership of a subsidiary pharmaceutical company to the Deputy General Manager of the listco. We could not find any reasons behind the sale nor the valuation at which the transaction would happen. (one resolution)

We voted against the appointment of the auditor and the company’s ability to set auditor fees at Vitasoy as they have been in place for over 10 years and the company has given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

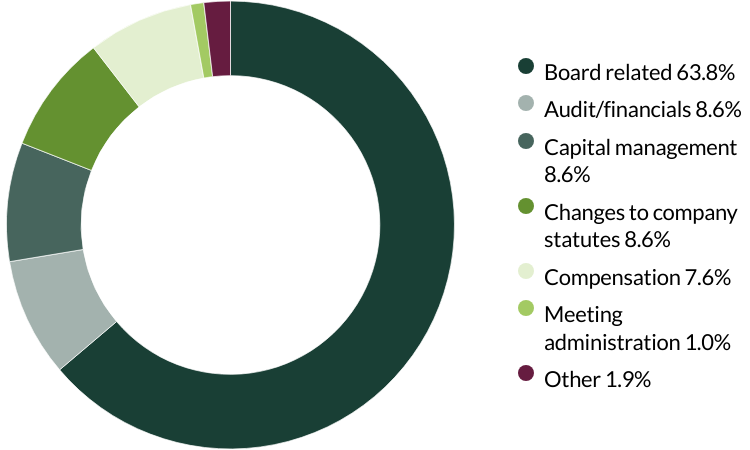

Proxy voting: Q2 2023

Asia Pacific Leaders Sustainability proxy voting: 1 April - 30 June 2023

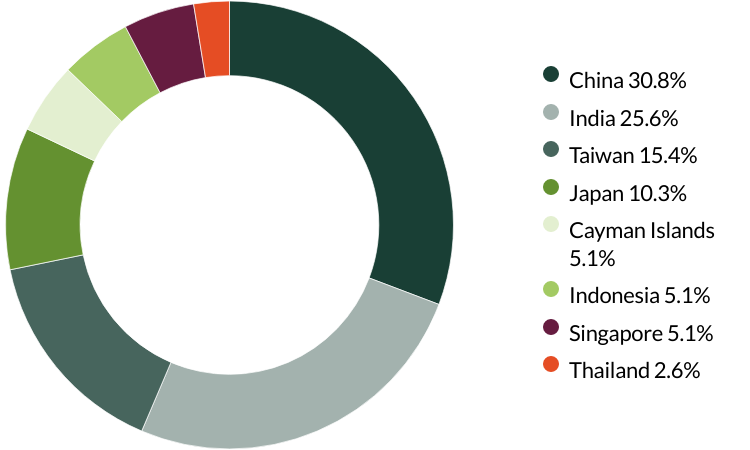

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 177 resolutions from 20 companies to vote on. On behalf of clients, we voted against 6 resolutions.

We voted against the appointment of the auditor at Foshan Haitian Flavouring, Glodon, Telkom Indonesia and Yifeng Pharmacy Chain as they have been in place for over 10 years and the companies have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (four resolutions)

We also voted against Foshan Haitian Flavouring’s request to approve connected transactions entered into between the Company and related entities and their respective annual caps. We do not believe these requests are in shareholders’ interests. (two resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific Sustainability Strategy, Asia Pacific & Japan Sustainability Strategy, Asia Pacific Leaders Sustainability Strategy, European Sustainability Strategy, European (ex UK) Sustainability Strategy, Global Emerging Markets Leaders Sustainability Strategy, Global Emerging Markets Sustainability Strategy, Indian Subcontinent Sustainability Strategy, Worldwide Sustainability Strategy and Worldwide Leaders Sustainability Strategy accounts as at 30 June 2024. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.