Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Asia Pacific and Japan All Cap

The strategy was launched in June 1988, and since September 2019 has been a dedicated sustainability strategy. This equity-only strategy aims to achieve long-term capital growth by investing in a portfolio of between 30-60 companies in the Asia Pacific region, including Japan, that are helping to bring about a more sustainable future.

The ability to invest directly in Japan allows clients to own high-quality Japanese companies far earlier in their Asian growth journeys, as well as accessing a greater pool of domestic companies with attractive growth opportunities that are positioned to contribute to, and benefit from, sustainable development.

Strategy highlights: a focus on quality and sustainability

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

- Companies must contribute to sustainable development. Portfolio Explorer >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Latest insights

Quarterly updates

Strategy update: Q4 2025

Asia Pacific and Japan All Cap strategy update: 1 October - 31 December 2025

In November 2025, First Sentier Group (FSG) announced a strategic transition of Stewart Investors’ (SI) investment management responsibilities to its affiliate investment team, FSSA Investment Managers (FSSA). This was decided to be in the best interests of our clients, given the significant overlap in SI’s and FSSA’s investment capabilities and our shared history and heritage.

Introducing FSSA Investment Managers

FSSA has been investing in Asia Pacific and Global Emerging Market equities since 1988 as part of the former Stewart Ivory & Company, which subsequently became First State Stewart. After years of organic growth, the First State Stewart team split in two in 2015, leading to the formation of FSSA Investment Managers and Stewart Investors.

Like SI, we are long-term and quality-focused investors. We pay little attention to the index or short-term performance, preferring to focus on generating absolute returns for our clients in the long run. From our research, we aim to construct relatively concentrated portfolios made up of the best ideas that we can find across Asia and emerging markets. As responsible, long-term shareholders, we have integrated sustainability analysis into our investment process and engage extensively with companies on environmental, labour and governance issues.

Following the transition of SI’s portfolios to FSSA, the Stewart Investors Asia Pacific and Japan All Cap portfolio is now being managed by Rizi Mohanty and Martin Lau.

Rizi Mohanty is a Portfolio Manager at FSSA Investment Managers. He joined the team in 2016 and focuses on the Southeast Asian markets as well as Asia ex-Japan equities more broadly. He is the lead manager of the FSSA ASEAN All Cap and FSSA Asian Growth strategies. Rizi has more than 14 years of investment experience and is based in Hong Kong.

Martin Lau is one of the Managing Partners of FSSA Investment Managers. He has been with the team for more than 23 years (since 2002) and worked closely with members of the SI team before the 2015 reorganisation. He is a well-known and experienced investor and is lead manager of a number of FSSA strategies, including FSSA Asian Equity Plus, FSSA Asia Focus, FSSA China Growth and FSSA Hong Kong Growth. Martin has more than 30 years of investment experience and is also based in Hong Kong.

Rizi and Martin are supported by a broader team of investment analysts, with an average of 14 years of investment experience and 8 years tenure with the team. All 15 members of the FSSA investment team are analysts first and foremost, including the portfolio managers, and we spend the majority of our time meeting companies, writing research and seeking quality companies to invest in.

How we invest

FSSA’s investment philosophy, which shares its genesis with SI, has remained broadly unchanged since the First State Stewart team was established in 1988. We focus on identifying quality companies, buying them at a sensible price and holding them for the long term. Most importantly, we invest our clients’ capital as if it were our own. As long-term investors and owners of businesses on behalf of our clients, we look for founders and management teams that act with integrity and risk awareness, and dominant franchises that have the ability to deliver sustainable and predictable returns over the long term.

As a team, we conduct over 1,000 direct company meetings each year across Asia and other emerging markets. The most significant source of investment ideas comes from these company visits and country research trips. We find that our reputation as patient, long-term investors has given us unparalleled access to management, which allows us to gain valuable insights and a thorough understanding of the businesses we want to invest in.

As a result of our long-term time horizon and conservative investment approach, our portfolios – and our performance – can look very different to the index. We shy away from “flavour of the month” themes (such as the current AI-driven boom), and instead look for high-quality companies that can deliver attractive returns for much longer than the market expects – and extend our investment time horizon to capture that advantage. When you own quality businesses, time isn’t a risk – it’s an asset.

Our performance may lag in very buoyant or momentum-driven markets, but we usually compensate very quickly once such bubbles burst. Based on historical data, our long-term track record shows that our portfolios tend to perform better in “normal” markets (-15% to +15% returns over one year) and bear markets (more than 15% decline), than in steeply rising markets (defined as over 15% returns over one year).

A smooth transition

Given the significant overlap in SI’s and FSSA’s investment philosophy and portfolios, we know all the holdings well. As part of the transition, we made a few changes to tilt the portfolio towards companies with stronger cash generation, higher returns and better long-term growth prospects. In general, we are adding to holdings in China, where we have found leading businesses like Tencent, with strong competitive advantages and attractive growth at reasonable valuations. We are reducing exposure to India, mainly in cyclical businesses like Tube Investments of India and Motilal Oswal, where valuations are expensive and the growth outlook has deteriorated.

Below, we highlight a few of the key additions and disposals over the fourth quarter of 2025.

New purchases:

Tencent Holdings is the largest social media network and online gaming company in China, with growing businesses in online advertising, cloud services, e-payments/e-commerce and overseas gaming. Tencent has created an ecosystem of businesses which are unrivalled and should continue growing over the medium term. It has continued to develop new functions within WeChat (such as Video Accounts and Mini Shops), which should slowly improve monetisation and enhance the quality of the franchise. At FSSA, we have been shareholders of Tencent since 2005 and have consistently found the management to be effective long-term stewards of the business. In recent times, we have been impressed by Tencent’s AI strategy and its disciplined approach to technology investments, which aligns with our conservative view on AI capex spending.

Kotak Mahindra Bank (KMB) is one of India’s leading financial services companies – it has consistently improved the strength of its deposit franchise and maintained better asset quality than peers through the business cycle. While the founder, Uday Kotak, has stepped down from his managing director/CEO role due to the central bank’s limits on leadership terms, he remains closely involved as a board director and should ensure that the bank’s risk awareness and long-term thinking is maintained. Meanwhile, the new CEO (Ashok Vaswani) aspires to grow the business further by focusing on consumer banking and digitisation. We expect to see a growing trend of formalised financial savings, benefiting KMB’s insurance, mutual funds and asset management businesses.

Mediatek is one of the largest chip design companies globally. We have been following Mediatek for many years and have witnessed its performance through the cycles. Throughout the ups and downs in its history, its talented engineers and well-aligned management team usually find a way through to the next “big thing”. From optical drives for computers to scan CDs, it entered the smartphone supply chain with 2G modem chips and benefited from technology upgrades each year – until it collapsed in 2015-17 amid poor execution and competition from both low- and high-end competitors. In 2018 Rick Tsai joined Mediatek from TSMC and focused on getting the basics right again. We believe Mediatek has been transformed under his leadership into a better-quality company. In recent years, the company has improved its competitiveness, and we believe its market share will likely remain stable. With the smartphone market now in the mature stages, the company is investing into new areas (ASIC, auto, augmented reality/virtual reality, Internet of Things, artificial intelligence) to diversify and internationalise its business in the long run.

Complete sales:

Milkyway Intelligent Supply Chain is a chemical materials logistics company in China. We sold out of the position on concerns about leverage and poor cash generation.

Naver was sold on strength to consolidate the portfolio into higher conviction ideas. While the shares have bounced due to excitement around Korea and AI, we believe the business faces structural challenges in terms of slowing e-commerce growth, and we have been concerned about their lack of financial discipline in the past.

Motilal Oswal Financial Services is a non-bank financial company (NBFC) in India. We sold out of a lower conviction holding to raise cash for better ideas elsewhere.

Performance and outlook

With our long-term investment time horizon, we tend not to pay much attention to short-term market fluctuations. We invest on at least a three-to-five-year view, though we often hold on to companies for much longer. In an industry rife with short-termism, we believe our long-term approach stands out from the crowd.

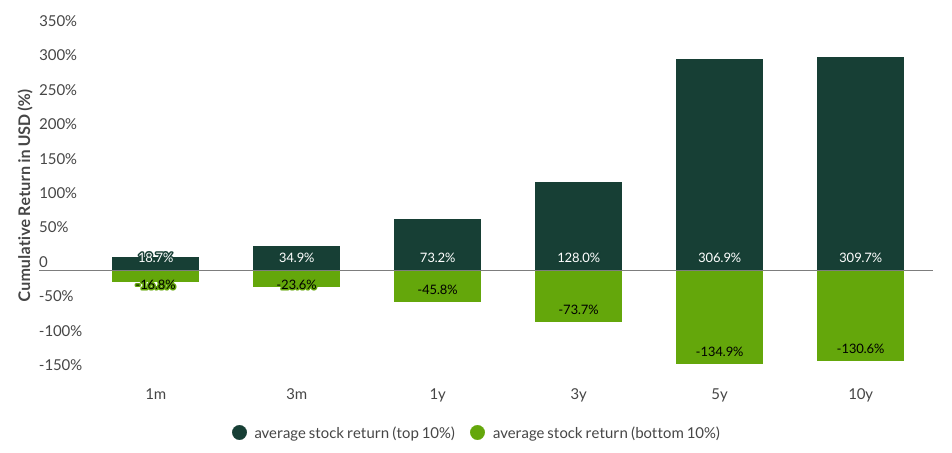

What we have seen, over the past few decades, is that average holding periods for stocks have fallen from over eight years in the 1960s to less than six months today. Yet this shift has come at a cost: it reduces investors’ ability to generate outsized returns that are materially different from the broader market. The reason is simple — as investment horizons shrink, so does the return dispersion between the best- and worst-performing companies. With less time in the market, investors end up tracking the index, not beating it.

Emerging Markets: time horizons matter

MSCI EM Index -dispersion around mean return for top 10% top / bottom stock performers

Source: MSCI Emerging Markets Index, as at 31 May 2025

In a world where markets rise consistently, that might seem like an acceptable outcome. But markets don’t move in straight lines; and in addition to the higher costs and transaction fees that come with frantic trading activity, the bigger issue is that investors miss out on what is far more important – the future value creation that the best companies tend to generate. This is often poorly understood by the market, with many investors simply focusing on the next quarter or year ahead. Yet the real drivers of returns lie in the cash flows that come well beyond that timeframe.

With that context in mind, we highlight the key contributors and detractors from performance over the fourth quarter of 2025.

The largest contributor to performance over the period was Samsung Electronics, a leading manufacturer of memory and semiconductor chips. In recent years, Samsung’s foundry business has been a major point of investor concern, which culminated in significant losses in the first half of 2025. These losses were exacerbated by one-time charges related to US export controls to China. The company has since undertaken a strategic shift from a “capacity-first” to a “customer-first” model, which appears to be bearing fruit. The shares rose during the quarter, as Samsung continued to benefit from surging AI-related demand for its high-bandwidth memory chips as well as tightness in traditional DRAM demand-supply. Strong results from US chipmaker Micron reinforced expectations of a sustained memory upcycle into 2026. With the turnaround in its foundry business and a strong legacy memory business, we believe the risk-reward looks favourable.

Taiwan Semiconductor Manufacturing (TSMC) was the second largest contributor to performance, as it continued to see solid revenue growth and strong demand from cloud AI for its leading-edge chips. Given the lead time and supply shortages, this provides visibility into 2026 earnings and possibly even beyond into 2027. TSMC is expected to invest in capacity expansion, with top line growth to follow.

The third largest contributor to performance was DFI Retail, a leading pan-Asian retailing group with a dominant market position across various segments, including drug stores, supermarkets, convenience stores, IKEA and Maxim’s (a joint venture catering and restaurants business). After years of lacklustre performance, DFI – and the broader Jardine group – has redoubled efforts to grow the business, and to improve operational efficiencies and returns on capital while optimising capital allocation. Improving total shareholder return is the new mantra for the group, and there are now clear signs of improvement. We believe margins could improve still further and lead to underlying profit growth.

On the negative side, the largest detractor over the quarter was Japan Elevator Services, despite strong earnings results. Sales and profits have continued to grow steadily, and gross profit margins have improved due to productivity gains and cost controls. However, the shares are expensive; and with rising interest rates in Japan, the earnings multiple is compressing. We have reduced the position size due to rich valuations.

Voltronic Power has had a challenging year and was the second biggest detractor from returns over the quarter. Around a third of its uninterruptible power supply (UPS) sales goes to the US and was subject to higher tariffs after “Liberation Day”, while its inverter business – which has been hit by weak demand and competition – appears to be challenged. While the UPS business should normalise sometime in the future, we assume lower growth for the inverter business and have applied a lower valuation accordingly. On the other hand, given the share price has halved over 2025 (from a high base), we believe the current valuation seems attractive overall.

The third largest detractor was Tube Investments of India, as it reported sluggish business performance and rising competition in the electric vehicle (EV) space. Despite its early mover advantage, Tube has struggled to maintain market share. It plans to arrest these challenges by increasing the number of dealership partners and entering new sub-segments in EV battery packs. On a positive note, the core business is stable with robust returns on capital employed, and it generates healthy free cash flow which is being invested in new businesses with high returns potential. In this endeavour, we are backing the management, particularly Vellayan Subbiah (executive chairman), who has an exceptional track record and has created tremendous value for shareholders.

Looking forward

We are optimistic on the outlook for Asian equities. With a rising share of global gross domestic product (GDP) growth, Asia should continue to benefit from the shift towards higher value services-led growth, digital transformation and the financial activities across the region. Valuations also look attractive in comparison to developed markets like the US, while low ownership of Asian equities in global portfolios provides a good backdrop for positive returns.

Across the team’s Asian equity portfolios, our core holdings have continued to deliver good underlying business performance and shareholder returns. Current portfolio valuations remain attractive – as they have been over the last couple of years. Looking forward, we expect earnings to grow at low double-digit rates with circa 20% average returns on equity, while companies are generating more cash and returning it to shareholders.

While we can’t second guess when the AI theme might run its course, our holdings are characterised by strong competitive advantages, and they have historically managed to preserve margins and profitability through the cycles. We are confident that their strong fundamentals will translate into attractive shareholder returns in the long run, as the market broadens, over time, from its narrow focus on AI.

SFDR Article 9 and FSSA’s approach to sustainability

All SI portfolios will continue to be managed true to label, with due consideration given to SI’s SFDR Article 9 sustainability requirements. Importantly, both FSSA and SI had operated as one team for 27 years (1988-2015) before the decision was made in 2015 to split into two teams. This is heavily reflected in our investment philosophies and processes and our respective approaches to sustainability.

At FSSA, we believe it is everyone’s responsibility to think about sustainability as part of his or her investment decision-making. We don’t use external consultants or environmental, social and governance (ESG) ratings, nor do we outsource the sustainability work to a separate team. In our research, we focus on evaluating the long-term merits of a given investment opportunity. Given that sustainability issues are effectively investment issues, we believe that these challenges and opportunities – and management’s response to them – can have a significant impact on a company’s returns. As such, we look for evidence that the management operates the business effectively and in the interests of all stakeholders – both now and for the longer term.

While issues relating to climate change, or people and communities, are often the ones that get the most attention, most of our company engagements relate to management quality and corporate governance systems, as we believe that good governance is the foundation on which great companies are built. We often engage with management teams on capital allocation and strategy, remuneration structures and succession planning, board diversity and tenure, and ensuring high levels of transparency and company disclosure – to highlight just a few.

For more information on FSSA, or if you have any questions about the transition, please do not hesitate to contact us.

NB Both Stewart Investors and FSSA have been supported by the same centralised Responsible Investment team within the First Sentier Group, who will continue to support FSSA after the transition of SI funds.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q3 2025

Asia Pacific and Japan All Cap strategy update: 1 July - 30 September 2025

- Responsibility for managing some of Stewart Investors' portfolios has changed but our engrained investment philosophy, process, and organisational ethos have not.

- Over the short term, our style of investing, which aims to deliver compelling absolute returns over the long term, has not kept pace with returns from regional indices, which have been led by sharp gains from mega-cap technology stocks.

- Although we continue to find interesting investment opportunities in China, we are not willing to compromise on quality to invest in many of the country's largest companies, whose recent gains could prove ephemeral.

- We added new holdings in two companies – Jardine Matheson and AIA – to the portfolio over the quarter.

Review: continuity and change

On one level, the third quarter saw significant changes at Stewart Investors. After acting as careful stewards of our clients’ capital over many years, three of our colleagues stepped back from their portfolio-management responsibilities in August and left the business.

While our team looks different now than it did when the quarter began, on a deeper level, nothing has changed: the philosophy and approach that has defined Stewart Investors since 1988 is deeply engrained and continues to define what we do. Our structure is flat. Every member of the investment team is first and foremost an analyst and our collective focus is on identifying high-quality companies, with resilient financials, guided by ambitious stewards. This is the bedrock on which the returns of all our strategies, including Asia Pacific and Japan All Cap, have been built.

This strategy’s manager has not changed. Doug Ledingham continues to apply the same principles to managing this strategy that have guided it since its launch, working as part of the same tight-knit group of investment analysts and drawing on a common pool of investment ideas. He recently wrote a piece explaining why we consciously resist the growing pressure to focus on the short term:

“At Stewart Investors, we have always sought to occupy a space that protects our clients’ capital. One of the threats we are striving to protect it from is short-termism: from the incessant distraction provided by 24-hour news, from the temptation to digest every morsel of noise, from the danger of trying to react to every macro data point or tweet, and from the pressure to fixate on quarterly earnings. That’s increasingly important in a world where long-term thinking is in increasingly short supply.”

You can read the rest of the piece here: Slow has all the power: why we invest alongside long-term owners.

Investing in the ‘picks and shovels’ of the AI boom while focusing on the long term

Our clients have understandably been keen to discuss the changes that have taken place within our business. Set against that, however, we have been careful to ensure that the majority of our time and attention remains on companies. As part of this, we have been discussing the broader forces being felt by companies across the Asia Pacific region, particularly the extraordinary surge of investment in the build out of AI infrastructure. Although AI is often viewed as a US-focused phenomenon, many of the leaders in this space are actually found in Asia rather than America. They include the manufacturers of the advanced semiconductors that supply computing power to AI data centres, the companies whose technology tests those semiconductors for reliability, and the suppliers of essential components to data centres, such as uninterruptible power supplies.

Many of the immediate financial beneficiaries of the AI infrastructure boom have, therefore, been suppliers of its ‘picks and shovels’. We are cognizant of the intense geopolitical pressures that surround some of these companies, such as the desire of the US to ‘nearshore’ production of semiconductors or to keep the most advanced chips out of the hands of its perceived strategic enemies. These carry the potential to influence corporate behaviour in a way that may not necessarily be to the advantage of long-term shareholders. This is something we are debating and watching closely.

To deepen their understanding of this subject, two members of our team recently visited South Korea, which, along with Taiwan, is at the heart of the global semiconductor industry. Korea is also enacting corporate governance reforms designed to improve shareholder returns. Recent trip reports from Indonesia, India and the Philippines are available on our Insights page, and a report from South Korea should be available next quarter.

A final illustration of continuity over the past quarter: turnover within the portfolio remained typically low. We added two new holdings while making no complete sales. The final section of this update describes the reasoning behind those changes. Our longstanding clients have grown accustomed to seeing modest levels of turnover within the portfolio and, while there may be periods when turnover waxes and wanes, they should not expect that to change.

Looking ahead

Today, our companies generally enjoy lower leverage (less debt) and generate higher free cashflows than the benchmark index. This gives them a buffer against any renewed macroeconomic volatility or geopolitical instability. We believe they can use their financial strength to take advantage of any renewed short-term uncertainty and to extend their advantage relative to their peers. Those companies also have multi-year opportunities for growth in front of them.

At a time of change in markets, trade and geopolitics, our underlying approach remains consistent: we continue to focus on generating attractive returns over the long term rather than attempting to outperform through every short-term period. We look forward to demonstrating the fruits of that approach over the years and decades to come.

Activity

New holding: AIA (Hong Kong: Financials)

Over the course of more than a century, AIA has steadily developed a distinct culture combining a conservative approach to investment with an entrepreneurial structure. Its business is built around a high-quality salesforce who foster long-term relationships with its customers. AIA demands higher levels of professionalisation from its agents than many of its peers, who often rely on armies of part-time agents. Although this means there have been times when AIA has grown more slowly than its peers, putting the needs of its customers above drive for short-term expansion has enabled it to build a premium brand. It now has an opportunity to grow by fulfilling unmet insurance needs across China, India and Southeast Asia. While those countries are getting richer, they lack social safety nets, making insurance products a necessity. This is especially true in China, where the regulator has recently allowed AIA to expand into new regions beyond its historical areas of strength in Beijing, Shanghai, and the Pearl River Delta.

New holding: Jardine Matheson (Hong Kong: Industrials)

Jardine Matheson is a complicated company whose journey towards greater simplicity and professionalisation has the potential to reward patient investors. The current chairman, Ben Keswick, took over from his uncle in 2019. He inherited a sprawling Asian conglomerate whose interests span retail, property, financial services, healthcare, autos, construction equipment, hotels and mining. He has steadily divested non-core assets in a way that would have previously been unthinkable. One result is that debt, excluding financial services operations, fell by more than a fifth over the first half of 2025.1 His vision is to appoint high-quality professionals to run the company’s business units, give them well-defined targets and then grant them autonomy to hit those targets. He keeps a deliberately low profile and acknowledges the missteps the business made over the past decade. Both are valuable signals of humility and an openness to change.

A new chief executive, Lincoln Pan, is due to join later this year. His initial focus seems likely to be on Astra, the listed Indonesian conglomerate, in which Jardine own a majority stake and which is a major contributor to group cashflows. Political uncertainties are an overhang in Indonesia. But as we discussed in a recent report– Is Indonesia still ‘at a crossroads’? – investing in companies who have been able to grow and refine their franchises, and to generate returns for their shareholders irrespective of the wider flux in Indonesia’s economy and politics, is an exciting prospect. Astra currently trades on price-to-book and price-to-earnings multiples not seen since the global financial crisis; one of Mr Pan’s goals will be to change that. Jardine Matheson is some distance from being the highest quality company in our portfolio, but we believe that will start to change over time.

[1] Source: Jardine Matheson Analyst Presentation: 2025 Half-Year Results, pg 15.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2025

Asia Pacific and Japan All Cap strategy update: 1 April - 30 June 2025

Shortly after the quarter began, President Trump announced his ‘Liberation Day’ tariffs. With China responding in kind, the prospect of a sharp contraction in global trade saw markets worldwide – including those in Asia – falling sharply.

Within a matter of days, however, a fall in the US dollar and the threat of a rout in the US government bond market encouraged the president to impose a 90-day moratorium on introducing many of his tariffs. As the world pulled back from an outright trade war, Asian markets rallied, with the gains being led by markets in the export-dominated economies of South Korea and Taiwan. Given our enthusiasm for a number of India’s high-quality, entrepreneurial companies, we were pleased to see share prices in that country starting to rally off the lows seen earlier in the year. The rally was aided by a cut in interest rates but also, we would argue, by valuations that appear attractive in view of those companies’ long-term growth potential.

Although share prices in some parts of Asia have recovered from the sell-off seen at the start of the quarter, the on/off discussions on tariffs have undoubtedly created lingering uncertainty. Some of the companies we have met are looking ahead to a potential resumption of talks on trade through the summer. Although we won’t try to predict their outcome, we would note that business leaders are often preparing for the worst while hoping for the best. While the market waits for greater clarity on trade, we continue as usual: seeking companies led by high-quality stewards, with strong franchises and resilient financials. We have found this combination provides resilience during periods of uncertainty.

We added three new holdings over the quarter. Trip.com (China: Consumer Discretionary), a leading online travel agency, is set to benefit from the growth in the number of Chinese tourists travelling both domestically and overseas. Similar companies in the US and Europe have shown how attractive the economics of online travel platforms can be and have shown the tendency for market leaders in this industry to dominate their smaller rivals over time. Sea (Singapore: Communication Services) is the parent company of the Southeast Asian e-commerce retailer Shoppee. It has built a strong presence across the region by offering attractive prices, a wide selection and reliable delivery. We expect it to benefit from the growth of e-commerce across the region, from its expansion into the Brazilian market and by offering credit to Shoppee users and merchants. Motilal Oswal Financial Services (India: Financials) is a financial conglomerate operating in retail and institutional broking, asset management, wealth management, investment banking, and housing finance. It is led by an ambitious-but-conservative steward and should benefit from meeting the savings and investment needs of India’s growing middle class.

We continued to add to our existing positions in Alibaba (China: Consumer Discretionary), DFI Retail (Hong Kong: Consumer Staples), and Ayala (Philippines: Industrials). We also added to Techtronic Industries (Hong Kong: Industrials), which makes power tools under the Milwaukee and Ryobi brands. Its share price fell sharply in response to President Trump’s tariffs. We have followed this company for more than two decades and have seen it emerging stronger from every crisis it has confronted in that time. This is testament to the focus and long-term orientation of its management team, who anticipated the recent tensions around trade by moving the majority of the company’s US-bound production out of China.

To finance these new investments, we sold our position in Advantech (Taiwan: Information Technology), whose valuation no longer appeared attractive. Additionally, we sold Unicharm (Japan: Consumer Staples) due to the rising competitive intensity it faces from local brands across region. We also sold out of positions in Zhejiang Supor (China: Consumer Discretionary) and Syngene (India: Health Care) to fund better ideas elsewhere.

We estimate that, of the holdings in our Asian portfolios, roughly three-quarters are primarily focused on selling to their domestic markets, offering them a useful buffer amid ongoing concerns about potential disruptions to international trade. With valuations across Asia currently standing at what we regard as extremely attractive levels, we remain confident in the prospects for returns from our carefully selected high-quality companies.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q1 2025

Asia Pacific and Japan All Cap strategy update: 1 January - 31 March 2025

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term.

Most notable was the extent of the divergence in returns between markets in India (down) and China (up). Investors’ enthusiasm for Chinese equities came in response to DeepSeek’s impressive demonstration of the progress the country is making in AI, some market-friendly rhetoric from the government in Beijing and hopes that the United States’ trade tariffs might not prove too onerous. In contrast, while there was relatively little news from India, share prices fell back from elevated levels, as they did in many other parts of the world; returns from the Indian market over the quarter were broadly in-line with those from markets in the United States.

During the quarter, we added new positions in S.F. Holding (China: Industrials), Mindray (China: Health Care) and Alibaba (China: Consumer Discretionary). S.F. Holding is China’s number one provider of logistics and is well placed to benefit from the growth in time-sensitive logistics across Asia more broadly. Mindray is a global leader in affordable medical devices and is steadily climbing up the value chain. Alibaba has an important role to play in China’s new emphasis on increasing national self-reliance, particularly in the realms of AI and cloud computing. In recent years, the stewards of Chinese companies have, often for the first time, been tested by genuine economic and political adversity. They have applied the lessons learned, strengthening their franchises and balance sheets. This, in combination with valuations that appear modest by global standards, means we have been identifying a greater number of new investment ideas in China.

Elsewhere, we added a new holding in Ayala (Philippines: Industrials), a high-quality, family-owned conglomerate whose new management is focused on improving lacklustre returns. In India, we added new holdings in Triveni Turbines (India: Industrials), a leading manufacturer of steam turbines and Bajaj Auto (India: Consumer Discretionary), a leading manufacturer of motorcycles, scooters and auto rickshaws backed by a high-quality steward. These are high-quality franchises whose share prices had been weak.

We took advantage of lower valuations to add to our existing holdings in high-quality franchises such as MANI (Japan: Health Care), Elgi Equipments (India: Industrials), Tube Investments (India: Consumer Discretionary) and Samsung Electronics (South Korea: Information Technology).

To finance these additions, we sold Fisher & Paykel Healthcare (New Zealand: Health Care), whose cashflows we believe may be at risk from the imposition of new tariffs by the Trump administration. Similarly, we sold out of Dr. Lal PathLabs (India: Health Care) and Cyient (India: Industrials) because of their potential exposure to changes in US trade policy. We sold Godrej Consumer Products (India: Consumer Staples), whose shares had begun to look expensive. Finally, we sold Nihon M&A Center (Japan: Financials) and Koh Young Technology (South Korea: Industrials) to fund better ideas elsewhere.

To control position sizes, we reduced our exposure to IndiaMART (India: Industrials), Tech Mahindra (India: Information Technology), Mahindra & Mahindra (India: Consumer Discretionary) and Japan Elevator Service (Japan: Industrials). We trimmed the holdings in Advantech (Taiwan: Information Technology), CSL (Australia: Health Care) and Vitasoy (Hong Kong: Consumer Staples) to fund additions to more attractively valued companies elsewhere.

As the long period of US exceptionalism draws to an end, we hope investors will begin to pay attention to the abundance of attractively valued companies to be found in the Asia Pacific region. Clearly, if the US economy falters and global demand falls, then economies across Asia will be impacted, albeit to differing degrees. We are also conscious that political risks appear to be rising in many Asian countries. Those risks, however, are far from uniform. The region’s technology complex, centred around Taiwan, South Korea and China, would appear to be particularly vulnerable to a global slowdown. India, by contrast, remains a domestically driven growth story and, as such, is somewhat isolated from the tumult in the global economy. The Philippines, meanwhile, could receive a significant economic boost if a global slowdown results in a meaningful fall in oil prices.

Predicting how any of today’s economic and geopolitical challenges will play out lies beyond our remit and our skillset. Fortunately, the Asian companies we invest in tend to have long memories; they still have the scar tissue formed during previous crises. These businesses have been forced to learn, to adapt and to become resilient. As a result, we believe they are set up not only to perform when conditions are fair but to navigate through whatever political and economic turbulence lies ahead.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Portfolio Explorer

Portfolio Explorer tells the stories of the companies we invest in. The company profiles have been written by our own team so that you can see why they believe that the companies they invest in are making the world a better place.

Fund data and information

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Asia Pacific and Japan All Cap (UK OEIC)

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Asia Pacific and Japan All Cap Class A (Acc) | OEIC | GBP | 1672.83 | 0.84 | 26 Feb 2026 | |

| Stewart Investors Asia Pacific and Japan All Cap Class A (Inc) | OEIC | GBP | 292.66 | 0.84 | 26 Feb 2026 | |

| Stewart Investors Asia Pacific and Japan All Cap Class B (Acc) | OEIC | GBP | 2007.05 | 0.84 | 26 Feb 2026 | |

| Stewart Investors Asia Pacific and Japan All Cap Class B (Inc) | OEIC | GBP | 301.09 | 0.84 | 26 Feb 2026 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.