Get the right experience for you. Please select your location and investor type.

Worldwide Leaders

Download overviewThe Worldwide Leaders strategy launched in November 2013 and transitioned to become a dedicated sustainability strategy in October 2016. The strategy invests in 30-60 high-quality global companies that are particularly well positioned to contribute to, and benefit from, sustainable development.

Leaders simply means that this strategy is focused on companies with a market cap value of at least USD5 billion.

Strategy highlights: a focus on quality and sustainability

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

- Companies must contribute to sustainable development. Portfolio Explorer >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Latest insights

Quarterly updates

Strategy update: Q2 2025

Worldwide Leaders strategy update: 1 April - 30 June 2025

Draw a circle encompassing Asia on a world map and it would look relatively small in comparison to the rest of the globe. That small circle, however, would contain more than four billion people1 and some of the world’s fastest-growing economies: India, China, Taiwan, South Korea, the Philippines, and Indonesia.

Reflecting the continent’s strong culture of equity investment, it also boasts a disproportionately large share of companies raising capital through initial public offerings (IPOs)2. Stewart Investors’ heritage of investing in Asian markets means we are well-equipped to tap into the opportunities this presents.

This quarter, we invested in Trip.com (China: Consumer Discretionary), a multinational travel agency that owns several platforms including MakeMyTrip and Skyscanner. Trip.com has survived a gruelling decade of intense competition in China, emerging as the country’s leading online travel agency, with a 60% market share3. We also believe it has an outstanding culture, putting its customers first while also taking care of more than 40,000 employees4. This should allow it to maintain its leadership in domestic tourism while expanding its footprint as a growing number of Chinese tourists venture overseas5. The economics of platform businesses such as this are compelling once they reach scale (providing that they operate in a stable industry environment). Trip.com is using the strength of its balance sheet to buy back its shares at what we view as attractive valuations, thereby enhancing returns to long-term investors.

The quarter’s second key addition was Chubb (United States: Financials). Founded in 1882, Chubb is a world-leading property and casualty insurer, operating in over 50 countries. It merged with Ace Insurance in 2016, combining two high-quality businesses to create an insurer with global scale and a substantial balance sheet. Sound underwriting depends on thousands of underwriters being prepared to say ‘no’ to poor-quality premiums today to protect their company’s profits many years into the future. This approach is at the core of Chubb’s business and, crucially, it was able to preserve this through the merger. Such cultures are rare and can only be built with patience. Chubb’s chief executive, Evan Greenberg, has consistently reiterated his company’s conservative approach to taking on new business and the company’s website states that “Chubb is an underwriting company and we strive to emphasize quality of underwriting rather than volume of business or market share”. Scaling up these types of cultures is difficult – but we think Chubb has succeeded. We believe this combination of culture with the size of its balance sheet and its global reach should help it to both preserve and grow capital at attractive rates over the coming decades.

We continued to build positions in Alibaba (China: Consumer Discretionary) and ABB (Switzerland: Industrials). We also topped up our position in Arista Networks (United States: Information Technology), taking advantage of a spell of what we believe will prove to be temporary weakness in its share price.

We sold our holdings in six companies over the quarter. Copart (United States: Industrials) and Fastenal (United States: Industrials) remain high-quality businesses but their stretched valuations implied that future returns would be lower. We sold Tata Consultancy Services (India: Information Technology) as its valuation left little room for error despite the current elevated level of geopolitical uncertainty. Similarly, we sold Expeditors (United States: Industrials) in the belief that any slowdown in world trade would present a challenge to its growth. Lastly, we sold Ashtead Group (United Kingdom: Industrials) and Rentokil Initial (United Kingdom: Industrials). After reassessing the quality of their franchises and management, we decided that there were better homes for our clients’ capital elsewhere.

A rapidly evolving security situation combined with rising trade tensions and the imposition of barriers to technology exports mean that our companies could face a different set of opportunities – and risks – in the coming decades. Despite this, we are confident that our long-term investment horizon and our philosophy of focusing on stewardship, financial resilience and on growing, high-quality companies whose shares trade at reasonable valuations should continue to deliver attractive returns.

[1] Source: International Monetary Fund - World Economic Outlook April 2025.

[2] Source: ‘Hong Kong IPO boom challenges the city’s critics’ Financial Times 29 June 2025.

[3] Source: Bernstein China SMID Internet: Diamonds in the Sky...Initiating with Trip.com Group November 2024.

[4] Source: Trip.com – Annual report to 31 December 2024.

[5] Horizon Insight Closers to Chinese Markets: Trip.com (TCOM) Earnings Review 13 September 2024.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q1 2025

Worldwide Leaders strategy update: 1 January - 31 March 2025

“Only two things make up a railroad: a track and a locomotive.” Amid the constant barrage of news about tariffs, trade wars and geopolitical realignment, this recent comment – by the chief financial officer (CFO) of one of our companies – provided a timely reminder that things are sometimes simple. It also underscored why we are glad to be bottom-up investors. Through all the noise of the first quarter of 2025, we focused on finding companies with experience in navigating unpredictable political and economic storms and who keep their eyes firmly fixed on their long-term goals.

This quarter witnessed a significant ‘first’ for this strategy – its first investment in a Chinese company. We approached our assessment of Alibaba (China: Consumer Discretionary) as we would with any company, by considering the quality of its people, its franchise and its financials. Alibaba is led by a highly capable management team that combines a private-sector mindset with strategic alignment with the goals of the Chinese government. It is reinvesting the generous cashflows that its mature retail business generates in building a new cloud business. It has net cash on its balance sheet and a share-buyback programme that is friendly to its minority shareholders. In our view, the combination of an attractive valuation with the potential for Alibaba’s technology to help China meet some of the development challenges it faces make the investment case here compelling.

We also added a new position in ABB (Switzerland: Industrials). This high-quality engineering business is a market leader in electrification, motion and automation. Its motors, drives and transformers are a small but critical part of its customers’ overall budget, and the depth of the relationships ABB has fostered with them puts it in a strong competitive position. We believe, the combination of increasing demand for electricity worldwide and the company’s focus on improving margins leaves ABB well placed to generate returns over the coming decade.

We continued to build positions in a number of recent additions to the portfolio such as Brown & Brown (United States: Financials), NVR (United States: Consumer Discretionary) and Carlisle Companies (United States: Industrials). Elsewhere, we responded to the attractive valuation of Samsung Electronics (South Korea: Information Technology) by adding to our position.

During the quarter, we sold Costco (United States: Consumer Staples). This is still a high-quality company but the valuation of its shares indicated a likelihood that returns in the future would be lower. On a similar note, stretched valuations encouraged us to trim our holdings in Fortinet (United States: Information Technology), Copart (United States: Industrials) and Watsco (United States: Industrials). Elsewhere, rising geopolitical risks led us to trim the holding in TSMC (Taiwan: Information Technology).

We continue to find opportunities to invest in the shares of reasonably valued companies worldwide that we believe can (profitably) help to solve a range of development challenges. Being unconstrained by a benchmark allows us to seize those opportunities wherever they arise. At a time of rapid economic and geopolitical change, we continue to apply our investment philosophy consistently and to focus on the things that we believe matter over our investment timeframe. As for what comes next? Another comment from the CFO we quoted earlier encapsulates our view: “there’s only one way to go in rail, and that’s forward!”

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

Worldwide Leaders strategy update: 1 October - 31 December 2024

“We are allocating our own money, we act like owners.”1 It’s always pleasing to meet with a company that thinks similarly to us. We are stewards of our clients’ capital, and one key tenet of our Hippocratic Oath is “We will not forget in our search for returns that the primary risk faced by our clients is losing their capital”. The oath underpins our investment philosophy, which is based on identifying quality stewards of strong franchises with good long-term growth prospects.

During the quarter we bought five new companies and the quote above is from a meeting with the company management of the first of them. Brown & Brown (United States: Financials) was founded in 1939 and is still stewarded by the Brown family. Over the past 85 years, the competent, ambitious and long-term management team has enabled it to grow beyond its Florida base to become the sixth largest insurance broker2 in the United States. The company has also been expanding to Asia and Europe and given the fragmented nature of the insurance brokerage industry, there is plenty more room to grow in the decades ahead.

Carlisle Companies (United States: Industrials) make and sell construction materials, particularly the products needed to roof and waterproof buildings. Using high-quality products in houses leads to better ventilation and protection from weather as well as reducing energy usage and improving longevity. The high demand for new housing across America will provide strong long-term growth opportunities for this company as well as another new purchase, NVR (United States: Consumer Discretionary). Based in Virginia, NVR is the fourth largest homebuilder3 in the United States, focused on building high-quality homes for first-time owners. The long-tenured management team have a history of using industry slowdowns to expand their business in a controlled way, allowing them to benefit when housing demand increases.

Wabtec (United States: Industrials) is a leading provider of components for rail transportation and can trace its roots back over 100 years. The rail industry is as important now as it was then, as it plays a crucial role in reducing global emissions through both freight and passenger transportation. Rising investment in rail infrastructure along with increasing market share and improving profit margins provide compelling growth drivers over the long term.

Synopsys (United States: Information Technology) is the market leader4 in software for the design of semiconductors, with their products being used by almost all major semiconductor designers and manufacturers. The founder continues to steward the company as Chairman of the Board, enabling them to make long-term investments in research & development (R&D). This ensures that their products remain relevant for decades and provides excellent growth potential.

The new positions were funded by selling Edwards Lifesciences (United States: Health Care) which manufacturers artificial heart valves, and Halma (United Kingdom: Information Technology) which holds a portfolio of companies targeting solutions for safety, health, environment and testing. In both cases, we felt that there were greater opportunities for growth in other companies.

In the past quarter the US election has taken place, sending Donald Trump back to the White House along with a Republican Party majority in the House of Representatives and the Senate. There have been many column inches written about taxes, tariffs and other general speculation about what the incoming administration might do. We don’t have any insights into the workings of a Trump presidency, instead, we focus on finding companies that are adept at navigating difficult situations and practised at generating growth from the opportunities in front of them. Another tenet of our Hippocratic Oath is “We will strive to achieve, through hard work, sober analysis and sound judgement, the best risk-adjusted returns possible for our clients.” This focus means we will continue to seek companies, like Brown & Brown, who we believe will be excellent stewards of our clients’ savings.

[1] Source: Stewart Investors company meeting with Brown & Brown, February 2024.

[2] Source: Brown & Brown website - https://www.bbrown.com/us/about/

[3] Source: Builder. https://www.builderonline.com/builder-100/builder-100-list/2023/

[4] Source: Synopsys company data - https://s201.q4cdn.com/778493406/files/doc_earnings/2024/q4/presentation/InvestorOverviewPresentationFinal-Q4.pdf

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2024

Worldwide Leaders strategy update: 1 July - 30 September 2024

We initiated a position in one new company during the quarter. Rentokil Initial (United Kingdom: Industrials) is a global leader in pest control services, a necessary and critical health and hygiene service to secure homes, hospitals and businesses against disease and damage.

Its business model is fundamentally local in nature and generates lots of cash through resilient, recurring sales. The management team is focused on growth by increasing the density of its route network, and so driving improvements in profitability and earnings.

During the quarter we sold completely out of four companies as we grew concerned about their ability to grow their end customer markets. These include: Midea (China: Consumer Discretionary) which makes home appliances for the Chinese market; Infineon Technologies (Germany: Information Technology) which makes semiconductors for electric vehicle and renewable energy markets; Hamamatsu Photonics (Japan: Information Technology) which makes equipment to generate, detect and filter light for scanners, x-ray machines and automation devices such as barcode readers; and Graco (United States: Industrials) which specialises in paint sprayers and products that manage corrosive and other difficult-to-handle fluids.

We are always looking at new companies and recently visited Sweden to meet with some new and some old businesses, including Atlas Copco (Sweden: Industrials), the world's leading manufacturer of air compressors, which is held in the strategy. The opportunity to meet with company management on their ‘home turf’ is invaluable; it is much easier to get a sense of how culture and people have shaped a company and its future return profile when sitting within their offices; or, in the case of Atlas Copco, 20 metres below their office in a test mine. We continue to find excellent investment ideas by focussing on the impact that outstanding people can have on businesses with strong franchises and resilient financials.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Voting

Voting: Q2 2025

Worldwide Leaders voting: 1 April - 30 June 2025

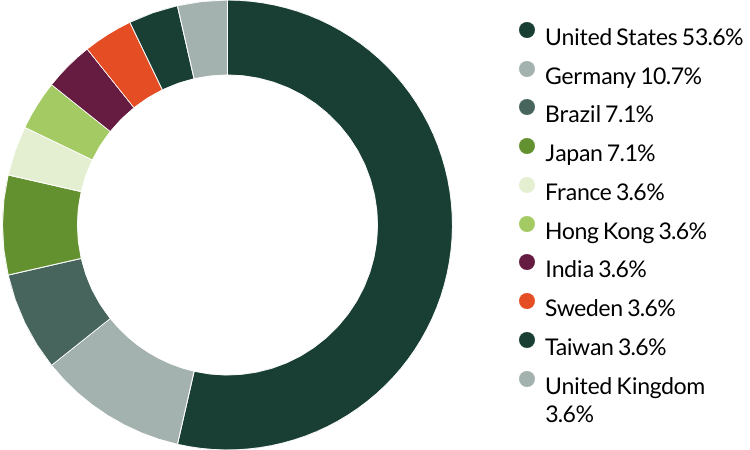

Voting by country of origin

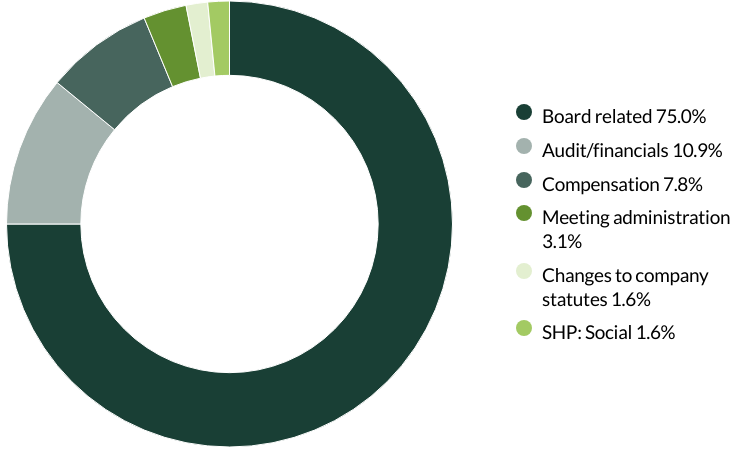

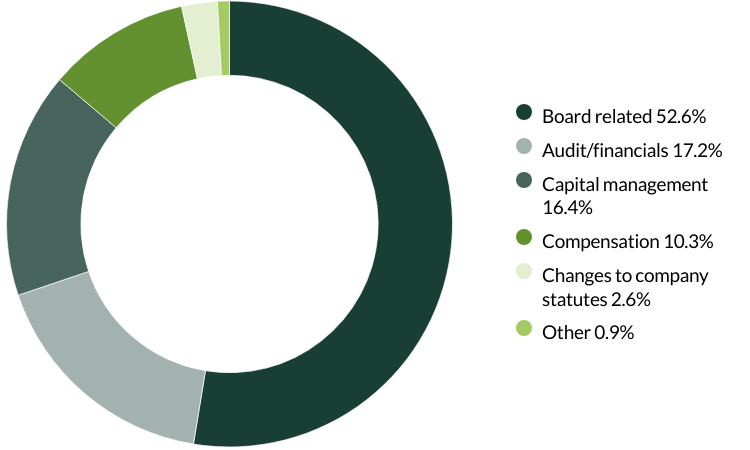

Voting by proposal category

During the quarter there were 348 proposals from 27 companies to vote on. On behalf of our clients, we voted against 14 proposals and abstained from voting on six proposals.

We voted against the appointment of the auditor at Arista Networks, Brown & Brown, Expeditors, Fortinet, Lincoln Electric, Markel, NVR, Old Dominion Freight Line, Roper Technologies, Texas Instruments and Westinghouse Air Brake Technologies Corporation (Wabtec) as they have been in place for over 10 years. These companies have given no information on rotating their auditors, something we believe is important to ensure a fresh perspective is brought to their accounts. (11 proposals)

We voted against the recasting of votes (the ability for voters to change their original votes on a particular matter in response to new information or changes to a proposal) for the supervisory council at WEG as we believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. We also abstained from voting on a request for a separate board election and the election of a supervisory council position. According to Brazilian voting practices, we are unable to vote for this proposal while simultaneously supporting the board in its candidate elections. (two proposals)

We abstained from voting on proposals at Rentokil Initial that would grant the company the authority to issue shares as it did not disclose the reasons for the issuance. Without clearer information regarding the potential capacity expansion and/or acquisition for which this issuance is intended, it is difficult for investors to assess the potential value creation and strategic fit of such an investment. (three proposals)

We abstained from voting on amendments to articles (rules and regulations that govern the company's operations) at bioMérieux as the company did not provide enough information on the amendments. (one proposal)

We abstained from voting on a shareholder proposal at Old Dominion Freight Line regarding the adoption of greenhouse gas (GHG) emissions targets aligned with the Paris Agreement. We were scheduled to meet the company shortly after the annual general meeting (AGM) and prefer to continue discussing this topic directly with the company. (one proposal)

We voted against a shareholder proposal requesting that an independent director serve as chair of the board at Fortinet. We continue to support the current CEO and chair of the board. (one proposal)

We voted against a shareholder proposal regarding simple majority voting at Markel as we support the stewards of the company. (one proposal)

We supported a shareholder proposal regarding greenhouse gas (GHG) emissions disclosure at Markel to encourage improved transparency and better disclosure of relevant emissions data. (one proposal)

We supported shareholder proposals regarding the right to call a special meeting at both NVR and Texas Instruments as we believe that the stock ownership threshold of 10% to call a meeting is appropriate, given the companies’ size and shareholder base. (two proposals)

We supported a shareholder proposal at Synopsys regarding the approval for severance payments (an amount paid to an employee on the early termination of a contract) when they exceed the stated threshold. This support is due to concerns about potential shareholder dilution that larger severance policies might cause. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q1 2025

Worldwide Leaders proxy voting: 1 January - 31 March 2025

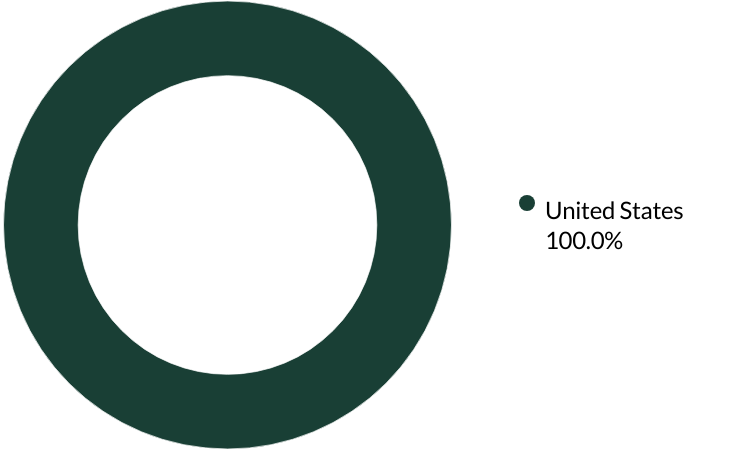

Proxy voting by country of origin

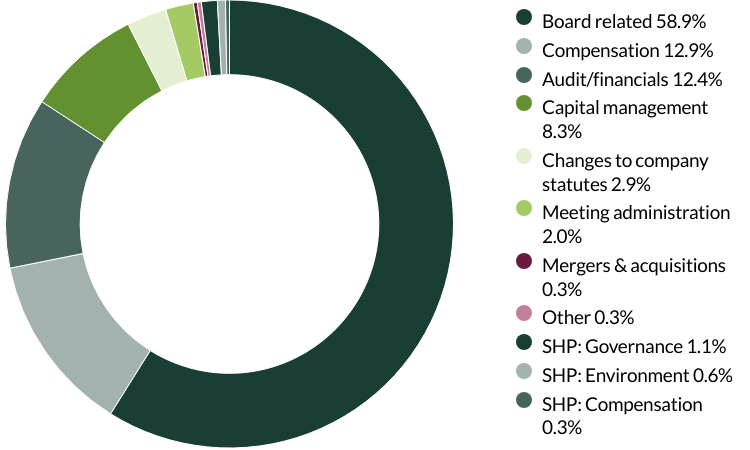

Proxy voting by proposal category

During the quarter there were 64 resolutions from five companies to vote on. On behalf of clients, we voted against six resolutions.

We voted against a proposal on transaction of business at ABB, as they did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (one resolution)

We voted against the appointment of the auditor at Costco as they have been in place for over 10 years. The company has given no information on intended rotation, which we believe is important to provide a fresh perspective on the accounts. We voted against a shareholder proposal requesting the company publish a report assessing the risks of maintaining its current diversity, equity and inclusion (DEI) roles, policies and goals as we support the company in their commitment to obey with the law and that their DEI efforts are legally appropriate. (two resolutions)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q4 2024

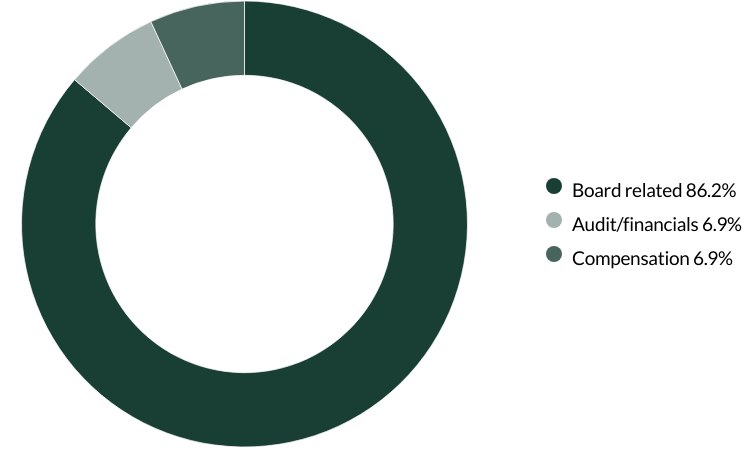

Worldwide Leaders proxy voting: 1 October - 31 December 2024

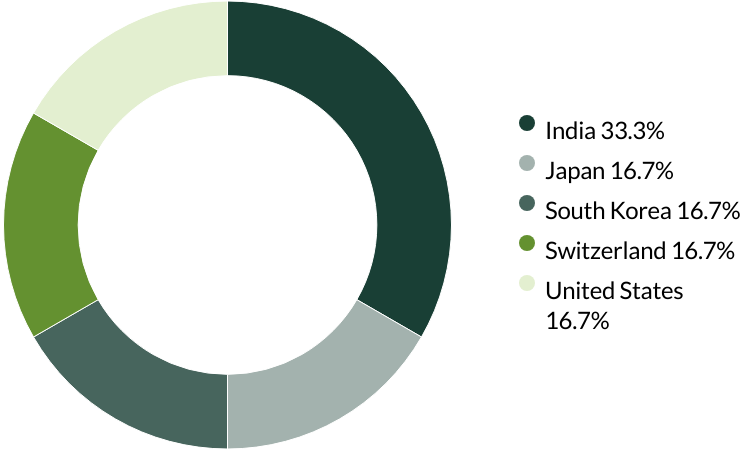

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 25 resolutions from two companies to vote on. On behalf of clients, we voted against one resolution.

We voted against the re-appointment of the auditor at Copart as they have been in place for or over 10 years and the company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q3 2024

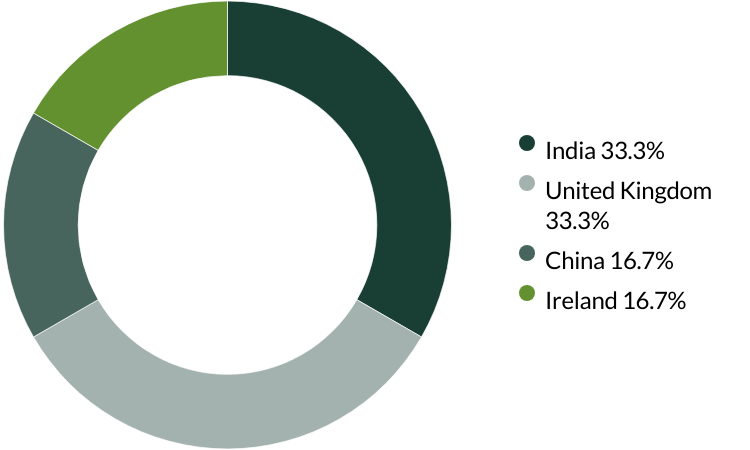

Worldwide Leaders proxy voting: 1 July - 30 September 2024

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 116 resolutions from six companies to vote on. On behalf of clients, we voted against four resolutions.

We voted against remuneration motions at Ashtead Group as we were concerned about excesses in CEO salary. (two resolutions)

We voted against the appointment of the auditor at Linde as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (two resolutions*)

*The same proposal was voted on different stock lines.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Sustainable investment labels help investors find products that have a specific sustainability goal. This product does not have a UK sustainable investment label as it does not have a non-financial sustainability objective. Its objective is to achieve capital growth over the long-term by following its investment policy and strategy.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 June 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Key documents

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Worldwide Leaders (UK OEIC)

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Worldwide Leaders Class A (Acc) | OEIC | GBP | 758.83 | 0.15 | 06 Oct 2025 | |

| Stewart Investors Worldwide Leaders Class B (Acc) | OEIC | GBP | 913.82 | 0.16 | 06 Oct 2025 |

Stewart Investors Worldwide Leaders (Irish VCC/Offshore)

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Worldwide Leaders Class I (Acc) | Irish UCITs | USD | 22.30 | -0.14 | 06 Oct 2025 | |

| Stewart Investors Worldwide Leaders Class III (G Acc) | Irish UCITs | USD | 43.03 | -0.13 | 06 Oct 2025 | |

| Stewart Investors Worldwide Leaders Class III (Acc) | Irish UCITs | USD | 19.01 | -0.13 | 06 Oct 2025 | |

| Stewart Investors Worldwide Leaders Class VI (Acc) | Irish UCITs | EUR | 9.74 | 0.48 | 06 Oct 2025 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.