Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Spotlight on sustainability: Watsco

Sashi Reddy discusses Watsco, the largest distributor of HVACR (heating, ventilation, air conditioning and refrigeration) products in North America.

As part of our Spotlight on sustainability series, Sashi Reddy introduces Watsco and discusses some of the things we like about the company.

Company information as at 30 September 2023

More information available on our Portfolio Explorer tool.

- Company Information

- Sustainable Development Goals

- Climate Solutions

- Human Development Pillars

Company Profile

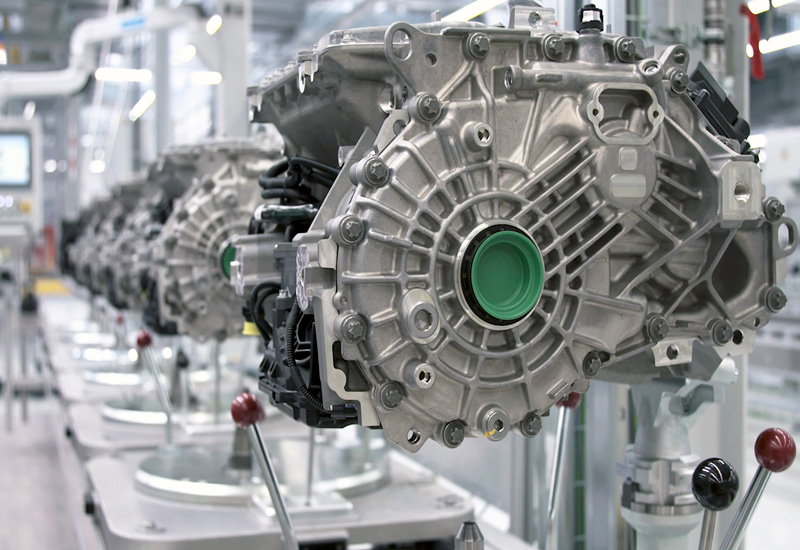

Air conditioning, heating and refrigeration equipment and related parts and supplies.

Stewardship

Entrepreneur. Founder chairman Alfred Nahmad is a controlling shareholder. The majority of the company is free float.

Areas for engagement

- Board gender diversity.

- Role of Distributor in the circular economy.

What we like

- Watsco is the largest distributor of air conditioning (AC), heating and refrigeration equipment in North America.

- The company is founder-stewarded with a long-term mindset at the heart of everything they do.

- Their performance based long-term remuneration in restricted stock that only vests on retirement.

- 70% of the demand for their products is from the replacement market, which is a key enabler of repair and maintenance.

Risks

We believe that the cyclical nature of their business and heavy working capital is a potential risk.

7. Affordable and clean energy

Sale of necessary and energy efficient products.

9. Industry Innovation and Infrastructure

Nearly half the energy used in a US home is for heating and cooling. By replacing older systems with more efficient Watsco HVAC systems, householders can reduce their CO2 emissions and pay less.

Refrigerant Management

Contribution Type

Enabling/Supporting Contribution

Alternative Refrigerants

Contribution Type

Enabling/Supporting Contribution

Description

Watsco is the largest distributor of air conditioning (AC), heating and refrigeration equipment in North America. There are an estimated 110m AC units installed in the US, 80% of which are over 10 years old and operating under old efficiency standards. Replacements of old units makes up 65-70% of Watsco's revenues (versus installing in a new build), and residential and commercial heating, ventilation, and air conditioning (HVAC) equipment account for 69% of Watsco's revenues. HVAC accounts for half of US household energy consumption. Sales of higher efficiency HVAC systems grew organically by 26% in 2021, outpacing overall growth of 17% for US residential HVAC. Roughly one-third of sales are now high-efficiency units.

In 2020 and 2021 over 10m metric tons of CO2e was averted through the sale of replacements. Watsco is transitioning it's HVAC equipment with alternative refrigerants in compliance with the Aim Act 2020. The act addresses the phasedown use of hydrochlorofluorocarbons (HFCs) and requires refrigerants to have less than 750 global warming potential, by January 2025. Watsco also offers a service whereby it recycles older air conditioners which contractors deposit for safe disposal.

Energy - Physical infrastructure

Contribution Type

Enabling/Supporting Contribution

Standard of living - Economic welfare

Contribution Type

Enabling/Supporting Contribution

Rationales

Heating, cooling and ventilation (HVAC) accounts for half of US household energy consumption. Watsco plays a leading role in enabling repair or replacement of HVAC equipment across the Americas. Watsco is the largest distributor of systems and parts in the US with c.65%-70% of revenues coming from replacements.

There are 110m units in the US which operate on older less efficient standards that will need replacing in the years ahead, providing cost savings for end users, along with lower energy and greenhouse gas emissions. Sales of higher efficiency HVAC systems grew organically by 26% in 2021, outpacing overall growth of 17% for US residential HVAC. Roughly one-third of sales are now high-efficiency units.

The information provided on this webpage does not constitute any investment advice or recommendation with regards to any investment product/services.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.