Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Sustainable Investing: Don’t forget the humans

Climate change is one of our greatest threats. At Stewart Investors we consider it a key investment risk, and an investment opportunity.

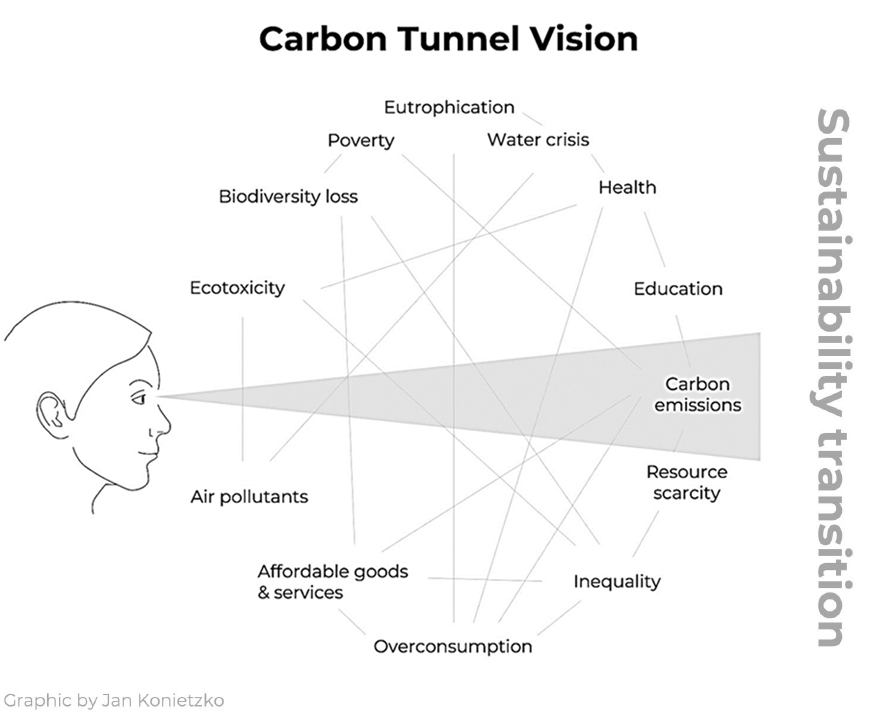

Sustainable investment is increasingly focused on climate change and the transition to a low carbon economy.

Morningstar identified 860 funds with a climate-related mandate in 2021 and estimates this number increased by more than a third in 20221 Financial regulators are calling for investors to increase their climate-risk disclosure and there is an increasing number of industry collaborations such as the Glasgow Financial Alliance for Net Zero. This increased attention to climate change by the financial community is both welcome, and understandable, given the frequency of record-breaking weather events and concerning levels of pollution and biodiversity loss we face.

Climate change is one of our greatest threats. At Stewart Investors we consider it a key investment risk, and an investment opportunity. However our definition of sustainability is broader than just climate change, and encompasses a wide range of environmental and human development considerations. Instead of viewing sustainability issues in isolation, we think of them as part of an interconnected and interdependent web of challenges.

Take income inequality as an example. It is usually linked to access to education, which is often linked to poverty, which can be linked to food insecurity, which is increasingly linked to climate change and biodiversity loss, which can link back to poverty and inequality, and so on. Efforts to improve human development will be limited if we don’t address climate change, and efforts to address climate change will be undermined, if we don’t improve human development.

Why? Let’s consider demographic change. In 2022, the eight billionth person was born2. The world’s population grew by one billion people over the last 12 years3, mostly in Asia. It is currently growing by more than 200,000 people each day4. As things stand, 70% of the world’s population live in countries running an ecological deficit while generating a below-world-average income5. If everyone is to live like the average Brit or American, we will need at least 3-5 planets worth of resources to sustain ourselves.6

The Global Footprint Network illustrates this point well, and maps countries according to their human development and ecological footprint.

The Human Development Index (horizontal axis) measures a country’s life expectancy, education and income. The ecological footprint (vertical axis) measures the stock of natural resources it takes to sustain a country’s economy and population.

As countries improve their human development, they also tend to increase their ecological footprint. Wealthy people and countries have a disproportionately large ecological footprint and some studies suggest they are responsible for a growing proportion of total global emissions.7

So it is clear we need to change, and find ways to improve living standards while staying within environmental limits. This requires governmental action and broad societal change, but the private sector has a crucial role to play too. This is our investment hunting ground, where we search for publicly-listed companies that are helping societies move to the bottom right-hand section of the chart above.

How do we invest?

Our investment philosophy is to only invest in high-quality companies that we believe are contributing to a more sustainable future. We look for companies that are helping to reduce our ecological footprint, or advance human development, or ideally both. Some companies are reducing healthcare costs, or providing financial services to lower income communities in emerging markets. Others are providing technologies for electrification, waste reduction and industrial process efficiencies.

Many companies are doing wonderful things for society or the environment, but we only invest in those that meet our high quality criteria. Equally, there are many high-quality companies in our investable universe that we avoid because they are not contributing to a more sustainable future.

When we refer to quality, we don’t simply focus on high margins, profit growth and returns. We take a more nuanced and qualitative approach, and assess the quality of the people running the businesses, the quality of the franchises and the financials. Among other things, we look for companies led by outstanding, long-term focused stewards, who look after all their stakeholders. We look for franchises that are resilient, competitive and have pricing power. And we look for companies with simple and conservative financials, with strong balance sheets, that avoid financial shenanigans.

Similarly, for sustainability, we don’t rely on simple Environmental, Social and Governance (ESG) scores, or carbon footprints. We focus on the societal impact of the products and services being sold; on how company leaders behave; on the operational impacts of the company, and on how well placed a company is to benefit from sustainability tailwinds. We pay just as much attention to human development as we do to environmental issues, because both are equally important for a more sustainable future.

We believe this rounded approach to sustainable investment helps us avoid and mitigate risks, identify opportunities that are different from our peers, and above all, deliver strong returns.

Company Case Study 1 – HDFC Corporation (HDFC)

HDFC is the leading provider of housing loans in India and one of the most recognised and trusted brands in the country8. Around half of their loans are to new home owners and around a third to lower-income households. The company is benefiting from structural tailwinds as mortgage penetration in India is still only 11% of GDP , compared with 52% in the USA9; two-thirds of India’s population is under the age of 3510; and the average age of a first-time home buyer is 3811. Mortgage demand is increasing as people migrate from rural areas to cities and as the nuclear family model becomes more commonplace. Since its founding in 1978, HDFC has financed over nine million housing units and the mortgage market is expected to more than double in the next five years12.

Company Case Study 2 – bioMérieux

bioMérieux is a family-owned company providing instruments and consumables for diagnosing infectious diseases and detecting bacteria in food, pharmaceutical and cosmetic products. It is also the world leader in researching and providing solutions for antimicrobial resistance13, which kills 700,000 people each year. The business model is resilient, with 90% of revenues coming from the recurring sale of reagents and services, and the balance sheet is net cash14. The company is benefiting from the move towards personalised medicine, while combatting the increasing number of infectious diseases we face.

For more information about each company we invest in, and a summary of how each improves human development and reduces our ecological footprint, please visit our interactive portfolio explorer tool here.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.