Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Global Emerging Markets Leaders

The Global Emerging Markets Leaders strategy launched in April 2020. It invests in 25-60 high-quality emerging market companies that we consider to be particularly well positioned to contribute to, and benefit from, sustainable development.

Leaders simply means that the strategy is focused on companies with a market cap value of at least USD1 billion.

Investment objective and strategy

The Fund aims to achieve long term capital appreciation and sustainably invest in companies which both contribute to, and benefit from, sustainable development, achieving positive social and environmental sustainable outcomes. The Fund invests primarily in large and mid-capitalisation equity securities or equity-related securities in emerging economies, including those of companies listed on developed market exchanges whose activities predominantly take place in emerging market countries.

Strategy highlights: a focus on quality and sustainability

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

- Companies must contribute to sustainable development. Portfolio Explorer >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Latest insights

Quarterly updates

Strategy update: Q3 2025

Global Emerging Markets Leaders strategy update: 1 July - 30 September 2025

Emerging markets enjoyed another strong quarter. Given that market indices were driven higher by sharp gains for Chinese stocks that are seen as beneficiaries of the artificial intelligence (AI) boom, it is unsurprising that returns from our strategy lagged some way behind those from the benchmark.

Although some of our Chinese holdings, such as Alibaba and Tencent, performed well, not all of our holdings there are aligned with the AI theme. Such periods of thematically driven exuberance can be challenging for long-term investors in high-quality businesses who are disciplined around valuations. But we know that our philosophy and process have been proven to deliver over the long term. One of our team, Doug Ledingham, recently wrote a piece explaining why we consciously resist the growing pressure to focus on the short term:

“At Stewart Investors, we have always sought to occupy a space that protects our clients’ capital. One of the threats we are striving to protect it from is short-termism: from the incessant distraction provided by 24-hour news, from the temptation to digest every morsel of noise, from the danger of trying to react to every macro data point or tweet, and from the pressure to fixate on quarterly earnings. That’s increasingly important in a world where long-term thinking is in increasingly short supply.”

The long-term outlook for Indian companies remains bright

The quarter saw a continuation of an unhelpful dynamic: the significant outperformance of the Chinese market relative to India, to which this strategy has a significantly higher level of exposure. Despite this, we remain enthusiastic investors in high-quality companies aligned with India’s economic development. So far, this year has seen a reduction in income taxes and a simplification of the Goods and Service Tax (‘GST’) system. The Reserve Bank of India, meanwhile, has been cutting interest rates. So demand is now being supported by both fiscal and monetary loosening.

There is, of course, more to emerging markets than China and India. Recent trip reports from Indonesia, India and the Philippines are available on our Insights page. Having visited South Korea in September, we are increasingly confident in the changes to corporate governance standards that are unfolding in that country. These echo similar reforms seen in Japan and should have positive effects on shareholder returns in Korea and perhaps across the region more widely – a similar mood of reform now seems to be infecting other countries across Asia.

Continuity and change

It would be remiss not to mention the changes that have taken place at Stewart Investors over the last quarter. After acting as careful stewards of our clients’ capital over many years, three of our colleagues stepped back from their portfolio-management responsibilities in August and left the business. While the list of portfolio-management responsibilities within our team looks different now than it did when the quarter began, on a deeper level, nothing has changed: the philosophy and approach that has defined Stewart Investors since 1988 is deeply engrained and continues to define what we do. Our structure is flat. Every member of the investment team is first and foremost an analyst and our collective focus is on identifying high-quality companies, with resilient financials, guided by ambitious stewards.

Jack Nelson remains this strategy’s lead manager. He continues to apply the same principles to managing it that have guided it since its launch, working as part of the same tight-knit group of investment analysts and drawing on a common pool of investment ideas.

Activity

We added three new holdings to the portfolio over the quarter. There were no complete sales.

In addition to Shopee, the dominant e-commerce platform in Southeast Asia, Sea (Singapore: Consumer Discretionary) owns digital entertainment brand Garena and provides digital financial services through SeaMoney. Shopee is increasingly well established around the world, employing 45,000 ‘partner-drivers’ in Brazil.1 We believe Sea now has an opportunity to expand into new markets as well as increasing the penetration of Shopee and SeaMoney. The company’s founder, Forrest Li, remains closely involved in the business but is now supported by a professional management team. He has built a great franchise backed by solid financials (the company has net cash on its balance sheet) that empowers millions of small businesses to grow and create jobs by giving them direct access to their customers.

We also added a new holding in Motilal Oswal Financial Services (India: Financials), a brokerage and wealth management business that is poised to benefit from the desire of India’s increasingly wealthy middle class to have greater access to capital markets. It is still managed by its founders, including the eponymous Motilal Oswal and we can see a steady growth path ahead for the coming decades.

The final new position is MakeMyTrip (India: Consumer Discretionary), a leading online travel website. It should benefit from a continuing shift in India towards booking travel online. Meanwhile, as the disposable incomes of Indian consumers grow, they will increasingly want to travel overseas as well as domestically. While it is 49% owned by Trip.com, the Chinese online travel business, the company’s founders remain involved in the business’s day-to-day activities, supported by a professional management team. It is already a leader in the online travel space in India but the real growth opportunity lies in the offline segment, specifically in bus and hotel bookings, many of which continue to be made in bricks-and-mortar travel agencies.

[1] Source: Sea Shopee Celebrates 5 Years in Brazil, Strengthening Income Generation and Entrepreneurial Growth.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q2 2025

Global Emerging Markets Leaders strategy update: 1 April - 30 June 2025

The announcement of President Trump’s ‘Liberation Day’ tariffs on 2 April and the short, sharp trade war with China that followed ensured a volatile start to the quarter for emerging markets. The uncertainty drove share prices sharply lower until the announcement of a 90-day pause on the introduction of the tariffs helped to calm investors.

That calm endured even when Israel took direct military action against Iran, with the oil price spiking higher only briefly. Perhaps the most interesting development from our perspective, however, was that the US dollar had its weakest start to the year since 19731. We think the pressure on the dollar could persist and may, in time, encourage capital to flow into emerging markets.

We added four new holdings over the quarter: two in China and two in India. Trip.com (China: Consumer Discretionary) is the country’s largest online travel-booking platform. The company’s founders remain involved in the business and have seen it grow organically as well as through mergers and acquisitions. It survived the dead stop in tourism in the covid pandemic and now seems primed to take advantage of a shift to booking travel online. While only about 10% of the Chinese population currently has a passport that proportion is expected to increase2. We took advantage of the volatility at the start of the quarter to build a new position in Tencent (China: Communication Services). The reach of WeChat, a ‘super app’ that allows its users to do almost everything online, is unparalleled in China. Tencent is aligned with the state’s desire to work in partnership with private companies to reinvigorate the economy. It is also enabling China to shift computing tasks to the cloud, which is more energy-efficient than on-premises IT infrastructure.

Cholamandalam Financial Holdings (India: Financials) is an Indian financial services business rolling out general insurance across India. It is associated with the Muragappa family, who we believe to be good stewards of our clients’ capital. ICICI Lombard (India: Financials) is also an insurer. Prime Minister Modi is committed to a programme of delivering ‘insurance for all’ by 2047; we believe both companies will benefit from this drive.

We sold the holding in Jerónimo Martins, the Portuguese-listed owner of Poland’s Biedronka supermarket chain and of Ara in Colombia (around 80% of the group’s revenues are generated in Poland and Colombia)3. We like the company’s management and the outlook for the business, but the stock has performed well and we struggle to see enough growth coming through to warrant the shares’ current valuation.

Elsewhere, we have become increasingly concerned about the outlook for IT services businesses, particularly those with a significant level of exposure to the US. We see a risk that its clients postpone or cancel investments in their IT systems due to the uncertainties currently facing the US economy. As part of our ongoing review of this sector, we also trimmed the holding in Globant (Argentina: Information Technology). We understand the argument that some companies will need IT services businesses to help them to adopt and integrate artificial intelligence (AI) tools. Equally, it may be that its clients actually use AI to replace their existing IT services.

Looking ahead, renewed weakness in the dollar could be the trigger for capital currently domiciled in the US to begin to flow into emerging markets. We remain particularly positive on the prospects for high-quality companies in India. The central bank recently started cutting interest rates, which is a clear positive for demand in rural India. Towards the end of the quarter, we attended a conference of Indian companies and were struck by how positive all of them were about the growth opportunities before them over the next 10 years. In our view, this potential growth – and the size of the Indian market – continues to offer powerful support to valuations.

[1] Source: Financial Times, 30 June 2025 ‘US dollar suffers worst start to year since 1973’.

[2] Source: Straits Times, 21 December 2023 ‘China is world’s second-largest economy but its passport is ranked 63rd. Are things looking up?’.

[3] Source: Jeronimo Martins Operational and Financial Indicators q1 2025.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q1 2025

Global Emerging Markets Leaders strategy update: 1 January - 31 March 2025

The volatility seen across emerging markets in the final quarter of 2024 carried over into 2025. Share prices in India fell sharply due to concerns about a cyclical slowdown. China, by contrast, performed well as investors anticipated a reacceleration in economic growth and began to identify value in many parts of the market. Sentiment was also supported by President Xi, who met executives from a number of private-sector companies.

We added 10 new holdings to the portfolio over the quarter and sold seven. Although it is unusual to see so many names exiting and entering the portfolio, turnover as a percentage of assets under management remained low at around 12%1. We were, in essence, simply tidying up a number of our smaller positions – the ‘tail’ of the portfolio.

In China, we sold out of Glodon (China: Information Technology), Hangzhou Robam (China: Consumer Discretionary), WuXi Biologics (China: Health Care), Ping An Insurance (China: Financials) and Hong Kong Exchanges and Clearing (Hong Kong: Financials). The first two sales were informed by our view of China’s property market, where we don’t see the issue of oversupply being resolved any time soon. Glodon provides software for construction and development companies. The majority of Hangzhou Robam’s appliances, meanwhile, are sold to housing developers. WuXi Biologics was a small position and we couldn’t see any immediate prospect that the ongoing challenges posed by US government trade policy would be resolved. Although Ping An Insurance and Hong Kong Exchanges and Clearing had both performed well, we sold them to reallocate the capital into new investment ideas such as Alibaba (China: Consumer Discretionary), S.F. Holding (China: Industrials) and Mindray (China: Health Care).

Alibaba is one of China’s leading e-commerce platforms. It is using the strength of its balance sheet to invest in its AI capabilities. S.F. Holding has grown into one of China’s leading logistics businesses since its foundation in 1992. Its founder is still involved in the company’s day-to-day management. Mindray is a leading medical company. As trade barriers are thrown up around the world, it has the potential to benefit should there be a shift in China towards buying domestically sourced products.

Elsewhere, we added a handful of new names and trimmed some existing positions. We took some profits in Marico (India: Consumer Staples) and reallocated the capital to Info Edge (India: Communications), Tube Investments (India: Consumer Discretionary), Bajaj Auto (India: Consumer Discretionary) and Bajaj Holdings & Investment (India: Financials). These companies had been on our focus list for a while but their valuations had dissuaded us from establishing positions. InfoEdge is a technology company whose online jobs portal caters to 132,000 corporate customers and hosts around 100 million CVs2. It also has property, matchmaking and educational portals. Tube Investments is an industrial conglomerate whose share price had fallen sharply, providing us with what we believe is an excellent entry point. Bajaj Auto had also sold off allowing us to add this leading manufacturer of motorcycles, scooters and auto rickshaws, which is backed by a high-quality steward. Bajaj Holdings & Investment is the holding company of siblings Rajiv and Sanjiv Bajaj. They have demonstrated an exemplary track record of delivering returns for shareholders in autos and financial services.

Elsewhere, we sold convenience store business Dino Polska (Poland: Consumer Staples), which had performed well but which had become too expensive for its long-term growth expectations. We also sold Unicharm (Japan: Consumer Staples). While it has pivoted to adult diapers in response to demographic change, it has found this shift harder than it had originally envisaged.

We built positions in Samsung Biologics (South Korea: Health Care), Alfamart (Indonesia: Consumer Staples), Voltronic Power (Taiwan: Industrials) and BDO Unibank (Philippines: Financials). We believe Samsung Biologics can use the strength of its parent company’s balance sheet to add capacity more quickly than its competitors and win market share. Alfamart is the second biggest player in Indonesia’s convenience-store sector3. It plans to roll out new stores across the country over the next decade. Its shares sold off as the market took fright at Indonesia’s new government but we can see a clear and dependable growth path before it. Voltronic Power makes uninterruptible power supply units (PSUs). We expect demand for these to increase steadily as a new generation of data centres is built worldwide. Finally, BDO Unibank is the Philippines’ largest lender4. It is backed the Sy family, who we believe are great long- term stewards.

While we are broadly positive on the outlook for emerging markets, we recognise that there is likely to be ongoing volatility for as long as ‘top-down’ uncertainty – inspired by trade tariffs and geopolitical flux – remains at elevated levels. Valuations are certainly attractive and there remains plenty of domestically driven growth in the markets we favour. Our task is to block out the short-term noise to focus on the underlying quality, growth and stewardship of the companies we invest in.

[1] Source: FactSet as of 31 March 2025.

[2] Source: InfoEdge: Annual Report 2023-24.

[3] Source: Fitch Ratings Fitch Revises Alfamart's Outlook to Positive; Affirms at 'AA(idn)'.

[4] Source : BDO Unibank – Company Profile (as of 31 December 2024).

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

Global Emerging Markets Leaders strategy update: 1 October - 31 December 2024

Emerging markets ended 2024 lagging developed markets for the second year in a row. Whilst the MSCI Emerging Markets Index returned 8.1% (USD, total return), developed markets, measured by the MSCI World Index were up 19.2%, driven by strong performance in the United States. Brazil (-29.5%) and Mexico (-26.8%) both had a tough year in 2024 but China, India and Taiwan all posted positive returns1.

Through the last quarter of 2024, markets had to contend with the re-election of Donald Trump and all the expected geopolitical noise that will come over the next four years, as well as the continuing strength of the US dollar. We remain focused on bottom-up stock picking which is at the core of our portfolio construction process and we will continue to seek out long-term growth opportunities regardless of who is the President in the White House.

We bought one new company during the quarter. We have built a position in Naver (South Korea: Communication Services), the leading South Korean internet search engine with a very strong market share. It was founded inside Samsung SDS before being spun out on its own in 1999. It is still run by the founder, Lee Hae-jin who has recently brought in a new management team which is aiming to return the company to a path of steady and profitable growth. One key aim for them is to use the stickiness of their search engine client base to drive increased e-commerce down the same channels. Their e-commerce business is the second largest in South Korea2. Naver’s attractive valuation presented a good opportunity to invest in a business that should achieve double-digit earnings growth each year.

We did not fully exit any positions during the quarter but trimmed several of our Chinese holdings. These included Inovance (China: Industrials) which was becoming expensive, and Ping An Insurance (China: Financials) and Hong Kong Exchanges and Clearing (Hong Kong: Financials) which were trimmed to control larger position sizes. We build our portfolios from the bottom up and any top-down views on countries are reflected through the position size which is risk-weighted according to our conviction in each country. China has a large and deep equity market but we fully recognise that companies both in mainland China and Hong Kong are required to operate within very strict regulations set by Beijing. As a result, we typically have lower position sizes in our Chinese holdings to reflect our more cautious approach. Some of the capital raised from these trims was used to add to Samsung Electronics (South Korea: Information Technology), which we continue to believe is a stock we can own for the next decade.

We continue to look for high-quality companies which we can buy at reasonable valuations. We believe that valuations in emerging markets are now at very attractive levels alongside long-term growth opportunities that we can back for the next decade. The team is planning many research trips for 2025 to seek out new investment opportunities and update our knowledge of existing holdings. We look forward to sharing more with you as the year progresses.

1 Source: MSCI Index Factsheets as at 31 December 2024. All data USD, total returns.

2 Source: External market research.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Voting

Voting: Q3 2025

Global Emerging Markets Leaders voting: 1 July - 30 September 2025

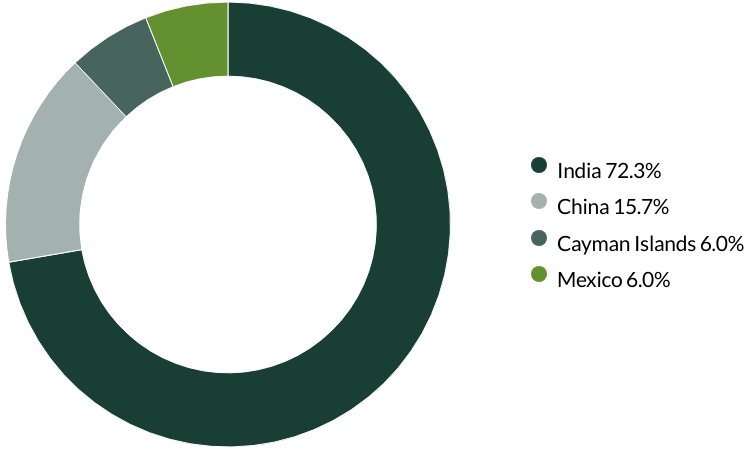

Voting by country of origin

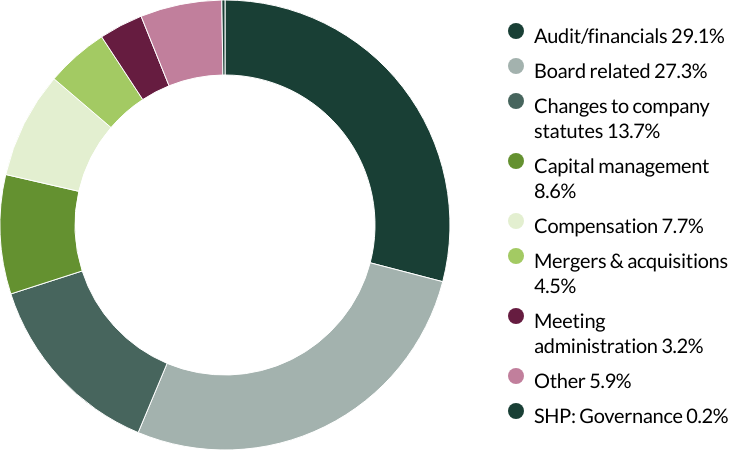

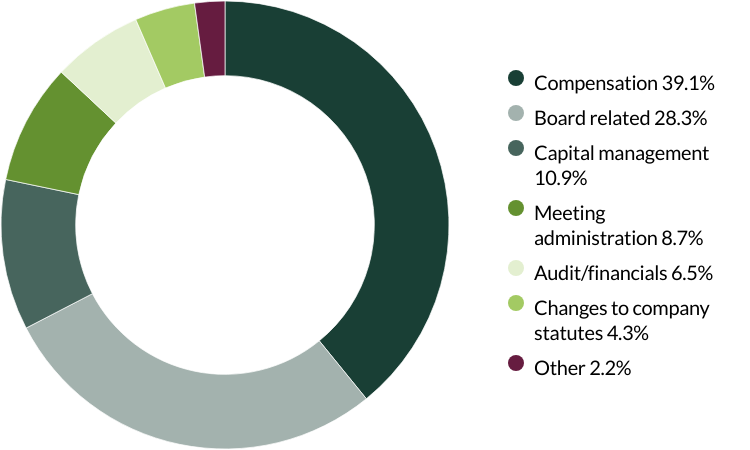

Voting by proposal category

During the quarter there were 115 proposals from 14 companies to vote on. On behalf of our clients, we did not vote against any proposals.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q2 2025

Global Emerging Markets Leaders voting: 1 April - 30 June 2025

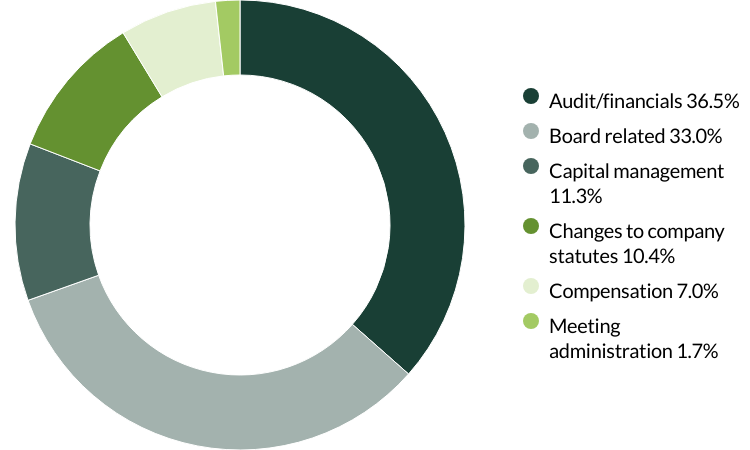

Voting by country of origin

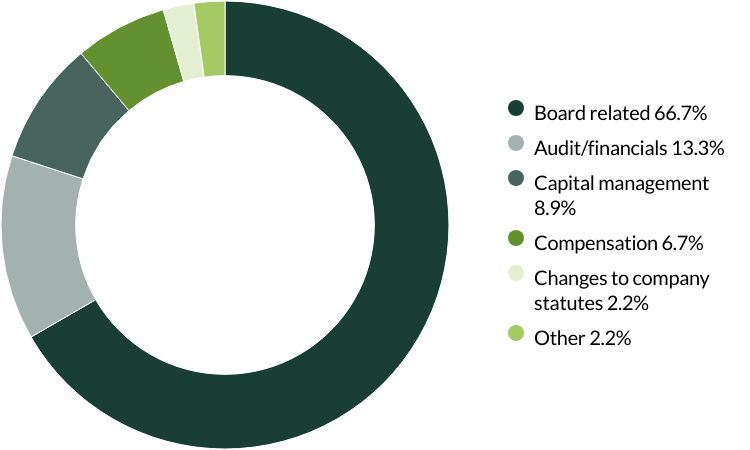

Voting by proposal category

During the quarter there were 444 proposals from 33 companies to vote on. On behalf of our clients, we voted against 10 proposals and abstained from voting on 13 proposals.

We voted against changing the terms of the board at EPAM Systems as the proposed changes would require all directors to stand for election annually instead of on staggered terms. While we understand the rationale for annual elections, we believe that a staggered approach provides continuity and helps prevent excessive turnover. We also voted against changes to limit the liability of certain officers, as we believe the company has demonstrated its ability to attract and retain an admirable management team under the current structure, which encourages managers to think and act as long-term owners. Finally, we voted against the appointment of the auditor as they have been in place for over 10 years. The company has given no information on rotating its auditors, a practice we believe is important to ensure a fresh perspective is brought to its accounts. (three proposals)

We voted against a proposal at MercadoLibre to move the company’s registration from Delaware to Texas as it did not provide clear reasons for the change, and we do not believe the move to be aligned with shareholders’ interests. (one proposal)

We voted against the recasting of votes (the ability for voters to change their original votes on a particular matter in response to new information or changes to a proposal) for directors and the supervisory council at RaiaDrogasil. We believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. (two proposals)

We voted against the appointment of the auditor at Sunny Optical Technology as they have been in place for over 10 years. The company has given no information on rotating its auditors, a practice we believe is important to ensure a fresh perspective is brought to its accounts. (one proposal)

We voted against the election of a director at Trip.com due to the company's lack of disclosureregarding director attendance, the number of board meetings held, and the voting results from the previous year. Our aim is to encourage greater transparency and adoption of global governance standards. (one proposal)

We voted against the recasting of votes for the supervisory council at WEG as we believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. We also abstained from voting on a request for a separate board election and the election of a supervisory council position. According to Brazilian voting practices, we are unable to vote for this proposal while simultaneously supporting the board in its candidate elections. (two proposals)

We abstained from voting on proposals relating to the accounts and acts of the board at Regional. At the time of voting, the company had not released its annual report or its audited financial statements, leaving us without significant information to make an informed decision. (10 proposals)

We abstained from voting on the establishment of a supervisory council at TOTVS as the company had not disclosed which candidates would be up for election to serve on the council. (two proposals)

We voted against a shareholder proposal regarding simple majority voting at EPAM Systems as this topic was already covered by the company's own proposal, which we supported. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q1 2025

Global Emerging Markets Leaders voting: 1 January - 31 March 2025

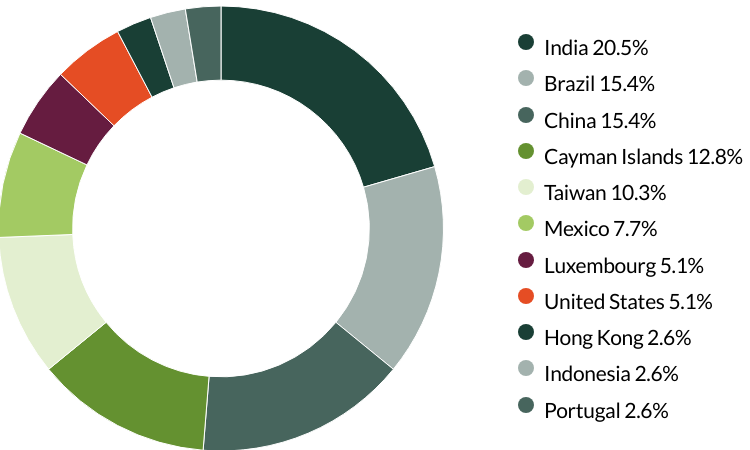

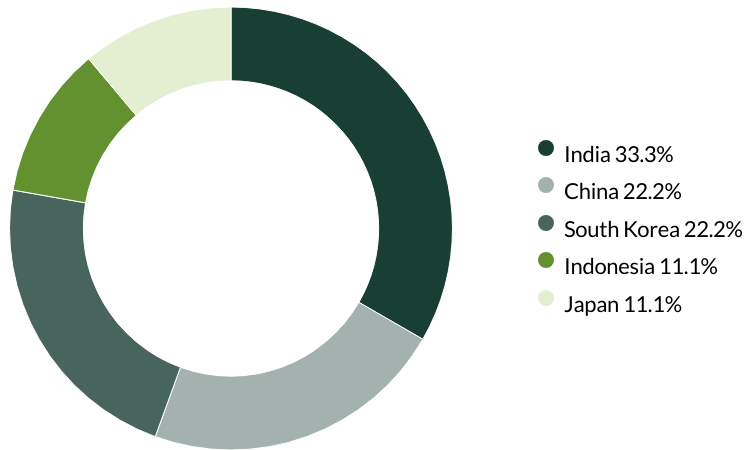

Voting by country of origin

Voting by proposal category

During the quarter there were 45 resolutions from eight companies to vote on. On behalf of clients, we voted against five resolutions.

We voted against executive remuneration at Bank Central Asia because we believed it was excessive. (one resolution)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

We voted against the election of the audit committee chair at Unicharm as we do not believe they are independent. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q4 2024

Global Emerging Markets Leaders voting: 1 October - 31 December 2024

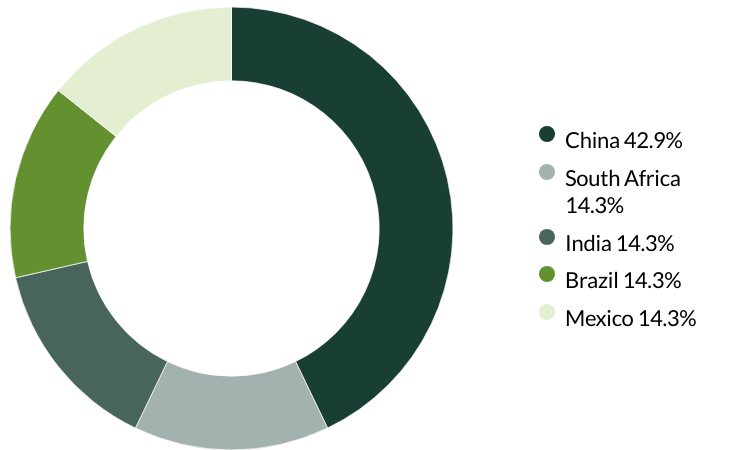

Voting by country of origin

Voting by proposal category

During the quarter there were 46 resolutions from seven companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

The information provided on this webpage does not constitute any investment advice or recommendation with regards to any investment product/services.

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 September 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Key documents

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.