Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

The race to zero

Welcome to our climate report. Here we share a baseline of our climate change-related risks, opportunities and impacts, from which our progress towards zero-carbon portfolios and operations can be assessed in the years ahead.

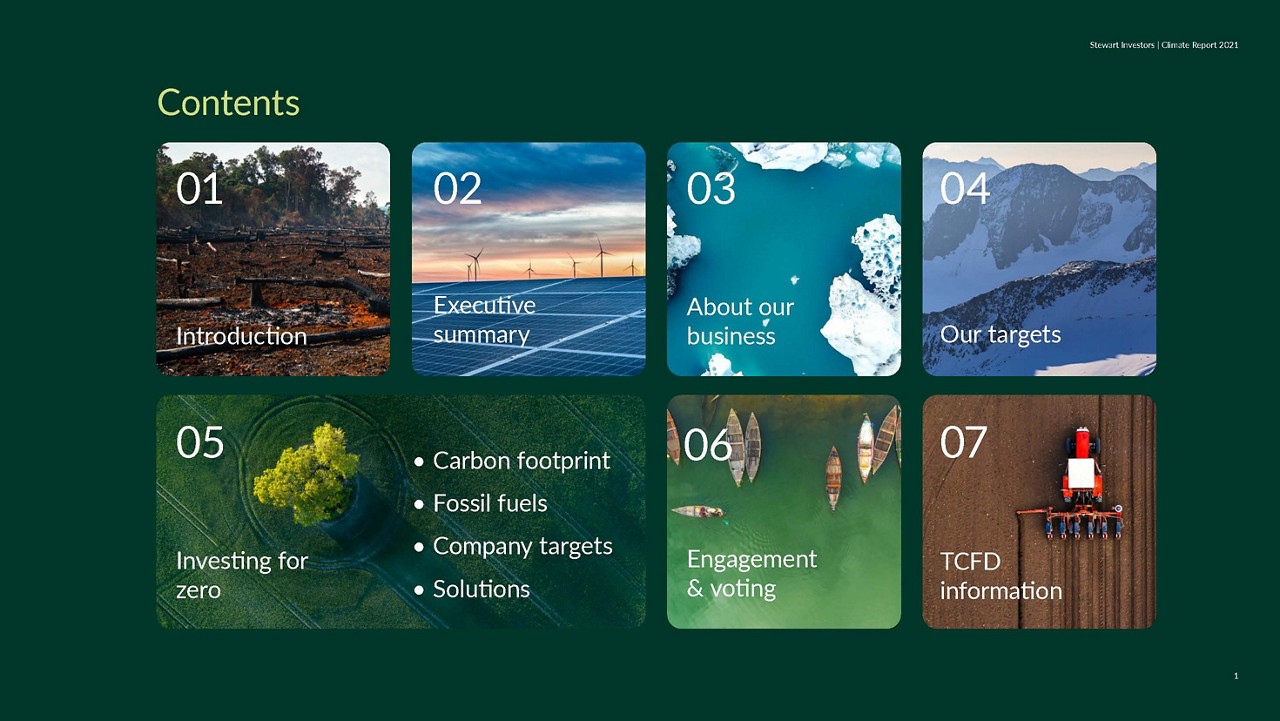

Climate Report

Climate change is a critical social, environmental, economic, and therefore investment issue. This report details our approach to the risks and opportunities in line with the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations. It also offers relevant climate-related information, like the carbon footprint of our portfolios, and our efforts to encourage the companies we invest in to help with the race to zero.

The challenge

The challenge of reducing emissions, and managing increasingly intense and frequent climate-related impacts in the global economy is complex, with varying implications for different industries, countries and companies. Climate change is also deeply interrelated with other sustainable development challenges, from biodiversity loss, to improving access to energy and other basic services in developing countries. Despite these complexities, the need to rapidly decarbonise the economy and build resilience in communities so they can adapt to climate change is necessary.

Our starting point

For more than 15 years, the foundation of our investment philosophy has been to invest only in high-quality companies that contribute to, and benefit from, sustainable development. In drafting our climate change statement in 2021 and reviewing various climate-focused industry initiatives, it became clear that our starting point is not the same as investors who do not share our history or focus on sustainable investing.

The race to zero

While there has been a significant trend in the industry to adopt ‘net-zero’ targets, generally by 2050, we prefer to think of the challenge as a race to zero, as each tonne of emissions adds to global warming. We also recognise that delivering on other sustainable development challenges – particularly human development in low and middle-income countries – is crucial for achieving a zero-carbon economy.

We recognise that carbon and climate change reporting by companies and investors remains inconsistent, while approaches to achieving genuine abatement remain highly contested. The potential for greenwashing, or well-intended but ultimately ineffectual efforts, is high.

As long as the broader economy remains carbon-intensive, our portfolios will remain relatively low carbon in comparison, but they will not be able to achieve our goal of zero emissions due to the interconnectedness with the global economy. However, as the broader economy reduces emissions at the speed and scale required to keep warming well below 2oC, the gap between our portfolios and the broader market should close, even as our footprint continues to fall. Real success would see the market catching up to us in the race to zero.

More information

The information provided on this webpage does not constitute any investment advice or recommendation with regards to any investment product/services.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, Realindex Investments and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), Realindex Investments (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.