Get the right experience for you. Please select your location and investor type.

Worldwide Leaders Sustainability

The Worldwide Leaders Sustainability strategy launched in November 2013 and transitioned to become a dedicated sustainability strategy in October 2016.

Download overviewThe Worldwide Leaders Sustainability strategy launched in November 2013 and transitioned to become a dedicated sustainability strategy in October 2016. The strategy invests in 30-60 high-quality global companies that are particularly well positioned to contribute to, and benefit from, sustainable development.

Leaders simply means that this strategy is focused on companies with a market cap value of at least USD5 billion.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q2 2024

Worldwide Leaders Sustainability strategy update: 1 April - 30 June 2024

“We know we’re not going to get our money out, so we’d rather burn it up in paying our employees1”.

For Lincoln Electric (United States: Industrials), getting out the Russian market was an easy decision, the only question was how. They stopped production in April 2022 and have focused on supporting their former employees as they look for options to divest their facility. Meeting with companies in person helps us to understand the quality of management through the decisions that they take.

We recently visited the United States to meet with a wide range of industrial and consumer companies across Chicago, Cincinnati, Columbus, Cleveland, Boston and New York. In total we met with 50 companies, many of them leaders in their industries. We highlight some of the companies we met with in more detail here along with the reasons why we believe they fit so well with our investment approach. The trip was a great reminder of the number of excellent companies out there with competent and ethical stewards that generate returns by focusing on building long-term franchises in profitable niches.

During the quarter we added a new position in Ashtead Group (United Kingdom: Industrials), an industrial and construction equipment rental company with a long-tenured leadership team. Despite being founded in the UK in 1947, Ashtead Group currently derives more than 80% of its revenues from the United States due to its acquisition of Sunbelt in the 1990s2. Renting equipment reduces the need for companies to own equipment that sits idle leading to improved resource efficiency and reduced environmental impact. It also provides for a franchise that generates high returns and opportunities for strong growth prospects given the current fragmented nature of the equipment rental market. We continued to add to our position in TSMC (Taiwan: Information Technology) reflecting our conviction in the long-term potential of its business. We also added to positions in MonotaRO (Japan: Industrials), Fortinet (United States: Information Technology) and Old Dominion Freight Line (United States: Industrials).

We divested completely from two companies, Samsung C&T (South Korea: Industrials) and EPAM Systems (United States: Information Technology), preferring to consolidate exposure in higher conviction ideas. We also trimmed exposure to Mahindra & Mahindra (India: Industrials), and Infineon Technologies (Germany: Information Technology).

During the quarter, one of our companies was targeted by an activist investor who was concerned that it was overbuilding manufacturing capacity. Their concerns were based on near-term revenue expectations in an industry that is expected to grow by multiples in the coming years. We disagreed as the company’s record of counter cyclical and industry leading investments has handsomely rewarded patient shareholders and we wrote to offer them our support.

The overall market continues to become increasingly concentrated in any company connected with building Artificial Intelligence (AI) infrastructure. We do not have any insight into how new technologies work through an economy nor where the revenues or profits will appear. Instead of allowing ourselves to be distracted by a single growth driver, we seek to build a portfolio of companies that can benefit from a wide range of diverse growth drivers, as we believe that this is the best way to protect and grow our clients’ capital over the long term.

1 Source: Stewart Investors investment team, June 2024

2 Source: Stewart Investors investment team and company data

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q1 2024

Worldwide Leaders Sustainability strategy update: 1 January - 31 March 2024

During the quarter we added a new position in TSMC (Taiwan: Information Technology) and added to Samsung Electronics (South Korea: Information Technology). Both companies are fabricating the chips that will be used by technology companies to drive innovative solutions to the world’s problems and are an essential part of the semiconductor value chain. In addition, both companies are well run with strong growth prospects and reasonable valuations.

We also entered a new position in Japanese diagnostics company Sysmex (Japan: Health Care). Sysmex play a key role in the early detection and prevention of diseases and are also driving accuracy, affordability and efficiency in surgery through investments in surgical robots.

Other new positions include Samsung C&T (South Korea: Industrials) and Techtronic Industries (Taiwan: Industrials) as we took advantage of attractive valuations to buy companies well set up to grow over the next decade. We also took the opportunity to add to several industrial companies that we already own at reasonable valuations including Lincoln Electric (United States: Industrials), Linde (United States: Industrials) and MonotaRO (Japan: Industrials).

These changes were funded by exiting companies where we have lost conviction in their opportunities for future growth. These include two Japanese companies, Unicharm (Japan: Consumer Staples) and Shimano (Japan: Industrials). They also include two developing market banks in Kotak Mahindra Bank (India: Financials) and OCBC Bank (Singapore: Financials). While these remain good companies, the increasingly competitive environment that they are facing and the opportunities to find growth elsewhere led us to divest.

Lastly, we divested from CSL (Australia: Health Care) as the stock had become fully valued and a range of more attractive opportunities were available. We also reduced our position in Costco (United States: Consumer Staples) due to concerns about valuations.

As we head further into 2024, there remains little consensus around whether inflation will continue to fall or rise further, whether interest rates will remain where they are or be cut, or whether we are heading into a stronger or weaker economy. However outside of the world of macro we are seeing some return to normality. Companies that we meet with are welcoming the end of a phase of de-stocking that was brought about by the supply chain issues and overstocking of 2022 and are looking forward to a return to more typical growth trends. We remain as reticent as ever to predict the path of macroeconomic variables, instead, focusing on finding high quality companies supported by a diverse range of structural growth drivers, with strong balance sheets and competent management.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2023

Worldwide Leaders Sustainability strategy update: 1 October - 31 December 2023

The strategy experienced a year of strong returns over 2023. We do not fully understand short-term market moves and so won’t speculate on the causes of short-term performance. The market continued to rise, despite a turbulent environment as it absorbed higher inflation and interest rates, worries about recession and increasing geopolitical tensions.

Our focus, as always, is to look for high-quality management teams, running businesses that drive human development forward. Buying companies with strong balance sheets that can weather any coming storm, that have structural tailwinds driving their growth and reasonable valuations is the best way to invest our clients’ savings, and we have found many interesting investment opportunities.

We added five new companies to the strategy during the quarter. Lincoln Electric (United States: Industrials) is the world’s leading maker of welding equipment and is a high-quality franchise that is well positioned to benefit from the tailwinds of increasing automation, safety and transition to greener infrastructure. Linde (United States: Materials) is the world’s leading industrial gases company and a high-quality franchise with strong sustainability tailwinds that should drive growth for years to come. Samsung Electronics (South Korea: Information Technology) operates in consumer electronics, information technology and communications worldwide. We took the opportunity of attractive valuations to invest in a company that is well positioned to contribute technology solutions to most global development challenges. EPAM Systems (United States: Information Technology) is a digital platform engineering and software development services company. We have been interested in the company for a while and took advantage of attractive valuations to initiate a position. Midea (China: Consumer Discretionary) is a home appliances manufacturer with strong cash flows and an exciting direction of travel into innovative technologies.

We funded these new positions by divesting three stocks completely. We have been monitoring Philips (Netherlands: Health Care) since a safety recall of ventilators in 2021 and this quarter lost conviction that management could sufficiently improve the quality of the culture and franchise. We also sold our position in Constellation Software (Canada: Information Technology) which has been an excellent investment over the past few years but had become very expensive. While we retain conviction in its management and business model, its valuation left no room for error and we feel there are better opportunities elsewhere. Finally, we sold Nestlé (Switzerland: Consumer Staples) as it is struggling to grow the business at the same time as it is increasing its levels of debt. In addition, we trimmed positions in CSL (Australia: Health Care) and Tata Consulting Services (India: Information Technology) as they had become fully valued.

During the year we visited India and met with many of the companies in the strategy, including Mahindra & Mahindra (India: Consumer Discretionary) and HDFC Bank (India: Financials). Our conviction in our Indian holdings continues to remain high in the context of the quality of these institutions and the growth opportunities they are presented with.

Our portfolio is well diversified, not only across sectors and geographies, but also across growth drivers such as improving energy efficiency, the rise of living standards in India and building clean infrastructure in the United States. As we look at a portfolio of high-quality, great sustainability companies with resilient cash flows and strong competitive positions bought at reasonable valuations, we are excited about the future.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2023

Worldwide Leaders Sustainability strategy update: 1 July - 30 September 2023

During the quarter we did not add any new stocks to the portfolio but did rebalance the portfolio when presented with an opportunity to buy more of a quality company at a lower price.

Key increases over the quarter included Fortinet (US: Information Technology), Graco (US: Industrials) and Watsco (US: Industrials). We funded these additions through trimming Mahindra & Mahindra (India: Consumer Discretionary). While it remains one of the highest conviction positions in the portfolio, the increase in share price during the quarter required us to rebalance the position.

We divested of one stock during the quarter, selling out of Cognex (US: Information Technology) due to decreasing conviction on the strength of its franchise compared to its valuation.

We believe the best way to protect and grow our clients' capital over the long term is to invest in high-quality franchises, run by competent and honest stewards that have strong financials enabling them to contribute to and benefit from strong sustainability tailwinds.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Proxy voting: Q2 2024

Worldwide Leaders Sustainability proxy voting: 1 April - 30 June 2024

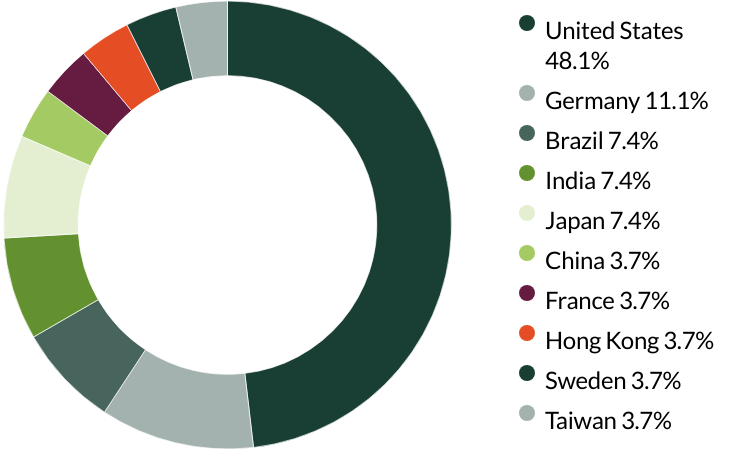

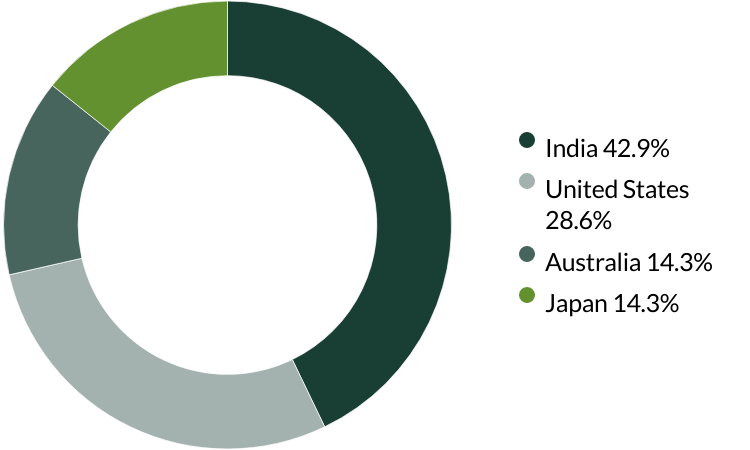

Proxy voting by country of origin

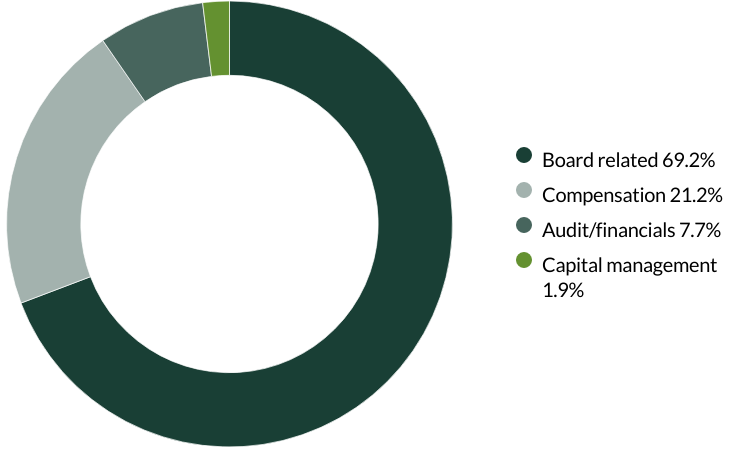

Proxy voting by proposal category

During the quarter there were 332 resolutions from 26 companies to vote on. On behalf of clients, we voted against 23 resolutions.

We voted against the appointment of the auditor at Arista Networks, bioMérieux, Edwards Lifesciences, EPAM Systems, Expeditors, Fastenal, Fortinet, Graco, Lincoln Electric, Markel, Old Dominion Freight Line, Roper Technologies and Texas Instruments as they have been in place for over 10 years and the companies’ have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (13 resolutions)

We voted against the proposed employee stock ownership plan at Midea as we believe non-executive director involvement could lead to conflict of interest and would not be in shareholders' interest. (three resolutions)

We voted against recasting and cumulative voting at WEG as this would allow the board to make changes without shareholder assessment or knowledge of candidates. (three resolutions)

We abstained from voting on requests for a separate board election and the election of a Supervisory Council position at WEG due to insufficient information and our preference for the current family stewards to remain in place. (two resolutions)

We voted against a shareholder proposal regarding board declassification at EPAM Systems as we do not deem it necessary for all directors to stand for election annually and believe this could destabilise the board by allowing excessive turnover. (one resolution)

We voted for a shareholder proposal encouraging alignment with the Paris Agreement with regards to greenhouse gas (GHG) emissions targets and also voted against a shareholder proposal requesting a Diversity & Inclusion Report at Expeditors as we believe this issue requires a wider discussion and cannot be resolved through disclosure alone. (two resolutions)

We voted against a shareholder proposal regarding simple majority voting at Fastenal as this was covered by the company's own proposals. (one resolution)

We voted against a shareholder proposal regarding GHG emissions disclosure at Markel as the proposal called for disclosure of emissions from underwriting, insuring and investments, which is not yet widely or reliably reported in the industry, hence we would prefer to discuss the issue with the company. (one resolution)

We abstained from voting on a shareholder proposal regarding the adoption of greenhouse gas (GHG) emissions targets aligned with the Paris Agreement at Old Dominion Freight Line as we have previously engaged with the company on this issue and prefer to continue dialogue to better understand their plans. (one resolution)

We abstained from voting on a shareholder proposal to remove supermajority requirements for certain issues at Roper Technologies as the board didn't provide a recommendation. (one resolution)

We voted for shareholder proposals regarding the right to call a special meeting and requesting a report on customer due diligence at Texas Instruments as we found both to be sensible. (two resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q1 2024

Worldwide Leaders Sustainability proxy voting: 1 January - 31 March 2024

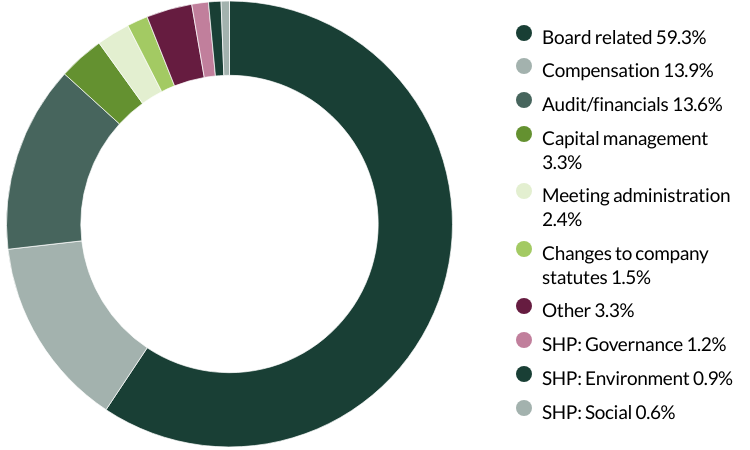

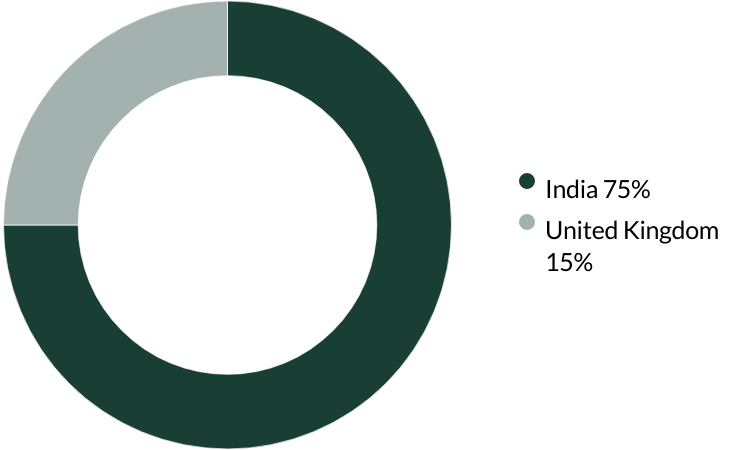

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 96 resolutions from 9 companies to vote on. On behalf of clients, we voted against 3 resolutions.

We voted against a shareholder proposal for Costco to conduct a feasibility study of reaching net zero by 2050, as we believe the company is making progress with tangible near-term climate targets in place. Long-term projections with regards to the net zero transition are difficult and can be fraught with errors, hence we currently find the company's approach reasonable and sensible. (one resolution)

We voted against an adjustment of the Guarantee for Controlled Subsidiaries Assets Pool Business at Midea as we found the guarantee amount to be excessive and not in shareholders' best interests. (one resolution)

We voted against a Board appointment at Samsung Electronics as we would prefer to see more independent, non-family associated Directors. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2023

Worldwide Leaders Sustainability proxy voting: 1 October - 31 December 2023

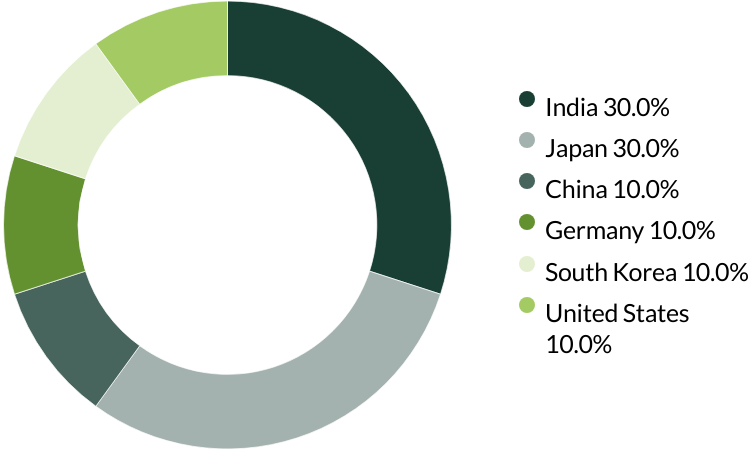

Proxy voting by country of origin

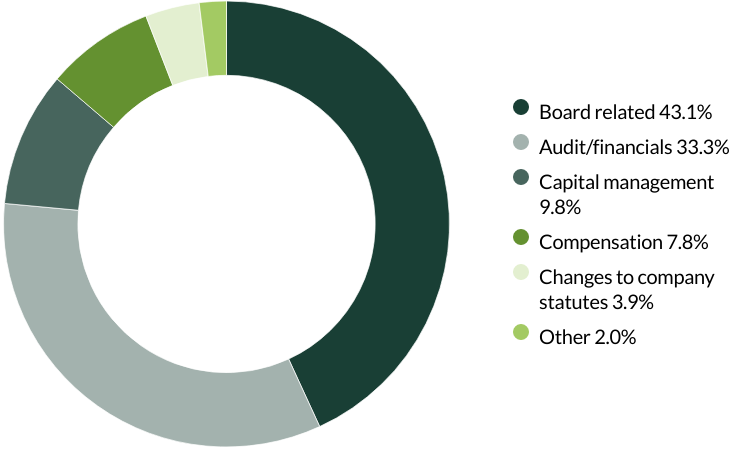

Proxy voting by proposal category

During the quarter there were 52 resolutions from six companies to vote on. On behalf of clients, we voted against one resolution.

We voted against the appointment of the auditor at Copart as they have been in place for over 10 years and the company has given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2023

Worldwide Leaders Sustainability proxy voting: 1 July - 30 September 2023

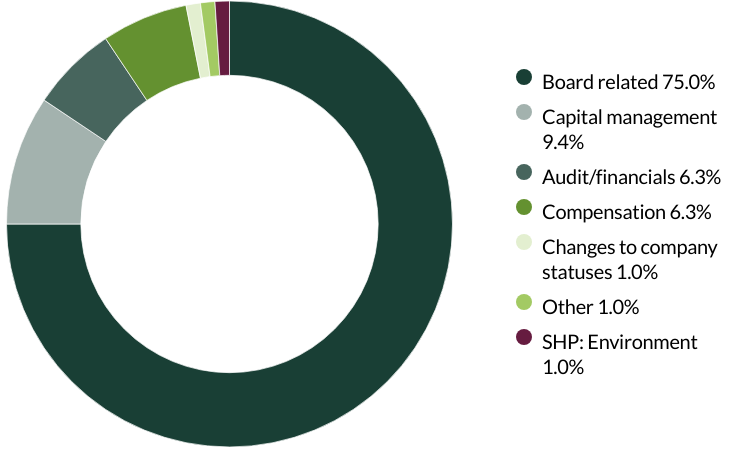

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 51 resolutions from four companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific Sustainability Strategy, Asia Pacific & Japan Sustainability Strategy, Asia Pacific Leaders Sustainability Strategy, European Sustainability Strategy, European (ex UK) Sustainability Strategy, Global Emerging Markets Leaders Sustainability Strategy, Global Emerging Markets Sustainability Strategy, Indian Subcontinent Sustainability Strategy, Worldwide Sustainability Strategy and Worldwide Leaders Sustainability Strategy accounts as at 30 June 2024. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.

Fund data and information

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Worldwide Leaders Sustainability Fund

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Worldwide Leaders Sustainability Class I (Acc) | Irish UCITs | USD | 19.57 | 0.19 | 26 Jul 2024 | |

| Stewart Investors Worldwide Leaders Sustainability Class III (G Acc) | Irish UCITs | USD | 37.36 | 0.19 | 26 Jul 2024 | |

| Stewart Investors Worldwide Leaders Sustainability Class III (Acc) | Irish UCITs | USD | 16.54 | 0.19 | 26 Jul 2024 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Following the UK departure from the European Union, the First Sentier Investors ICVC, an open ended investment company registered in England and Wales ("OEIC") has ceased to qualify as a UCITS scheme and is instead an Alternative Investment Fund ("AIF") for European Union purposes under the terms of the Alternative Investment Fund Managers Directive (2011/61/EU). Accordingly, no marketing activities relating to the OEIC are being carried out by Stewart Investors in the European Union (or the additional EEA states) and the OEIC is not available for distribution in those jurisdictions. We have made documents available for existing EU investors in the ICVC which can be accessed here.