Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Amazon fires, Global Deforestation and what we are doing about it

In this featured article we review the role of companies and business risks of this global issue.

Background

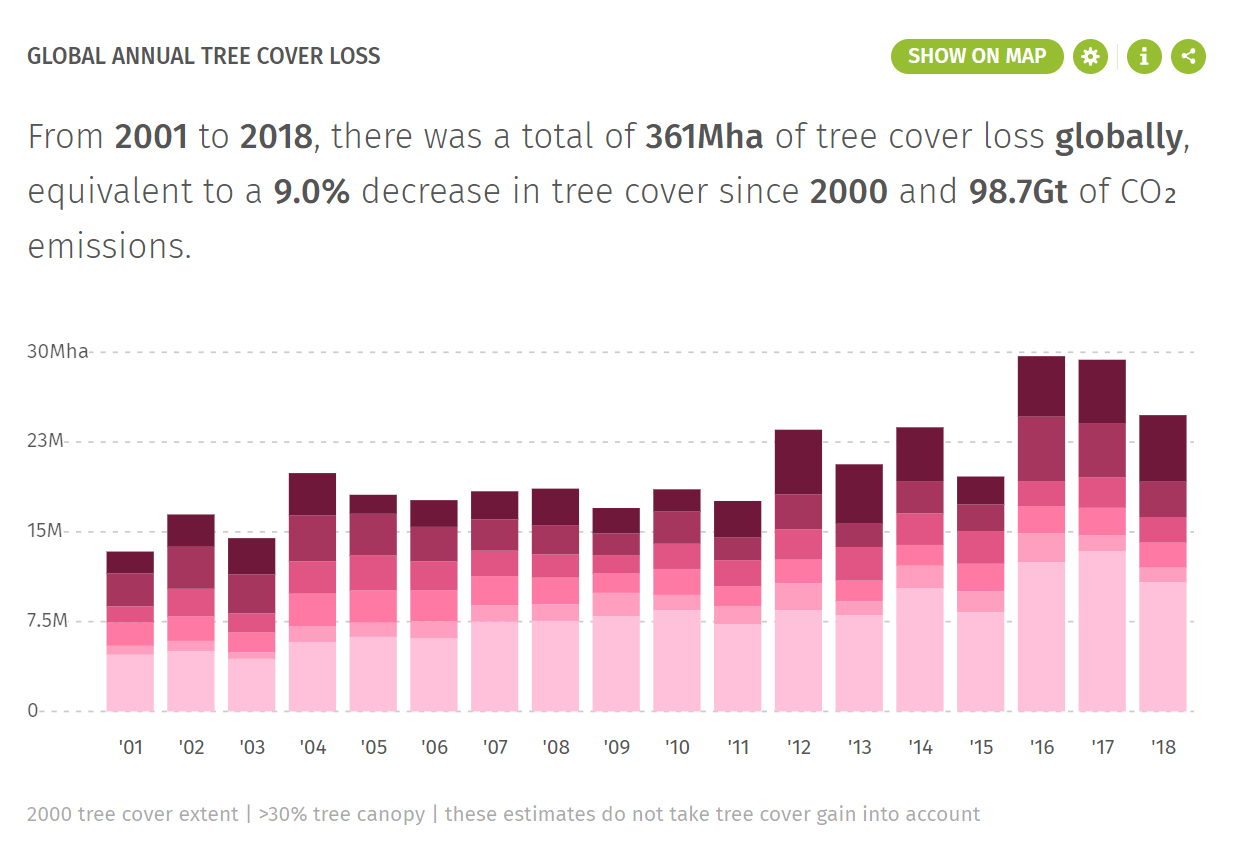

The fires in the Amazon have rightfully captured a lot of attention given the global significance of the biome1. However, it is important to recognise that deforestation is a global crisis. Countries like Cambodia, Malaysia and Paraguay have lost more than 10% of their forests in just six years. Globally, we have lost 9% of forest cover since 2000. There are many reasons for tree cover loss with the primary drivers of permanent deforestation being agriculture and urbanisation (agriculture is a 4,000 times larger contributor than urbanisation).

Source: Global Forest Watch. “Tree Cover Loss Globally”. Accessed on 3rd October 2019 from www. globalforestwatch.org

Deforestation, like many issues today, is complex and often painted as competing with objectives of economic development and feeding a growing population.

However, the impact of deforestation on issues like the extinction crisis (with 75% of the terrestrial environment “severely altered” by human actions2) and climate change (around 13% of global emissions) makes this a Faustian bargain. Both economic development and food security are ultimately compromised if the causes of the climate and biodiversity crises are not addressed.

It doesn’t need to be this way

Between 2000 and 2010 Brazil achieved a 70% reduction from the 1960-1999 average in deforestation. Looking only at tree cover loss it was closer to 50%. This was an extraordinary conservation success story with the success being attributed to many players: “The factors responsible for this accomplishment include government policies and enforcement actions by prosecutors, on both the federal and state levels; incentives created by Norway’s pledge of up to $1 billion in results-based compensation; the concerted pressure exerted by non-government organizations (NGOs) on the government and the soy and beef industries; and the positive response by those industries, resulting in the 2006 soy and 2009 beef moratoria.”3

The role of companies

While governments are clearly very important, zero deforestation commitments and supporting actions from companies are critical for turning the issue around. Unfortunately, despite the seriousness of the issues linked to deforestation the New York Declaration on Forests (NYDF) assessment report found that corporate commitments had slowed.4

They also found that while “Commitments cover large shares of production in international palm oil markets (65%) as well as the largest paper and pulp players operating in tropical regions (70%), the shares are low in the global soy and beef markets.”

More important than commitments is action.

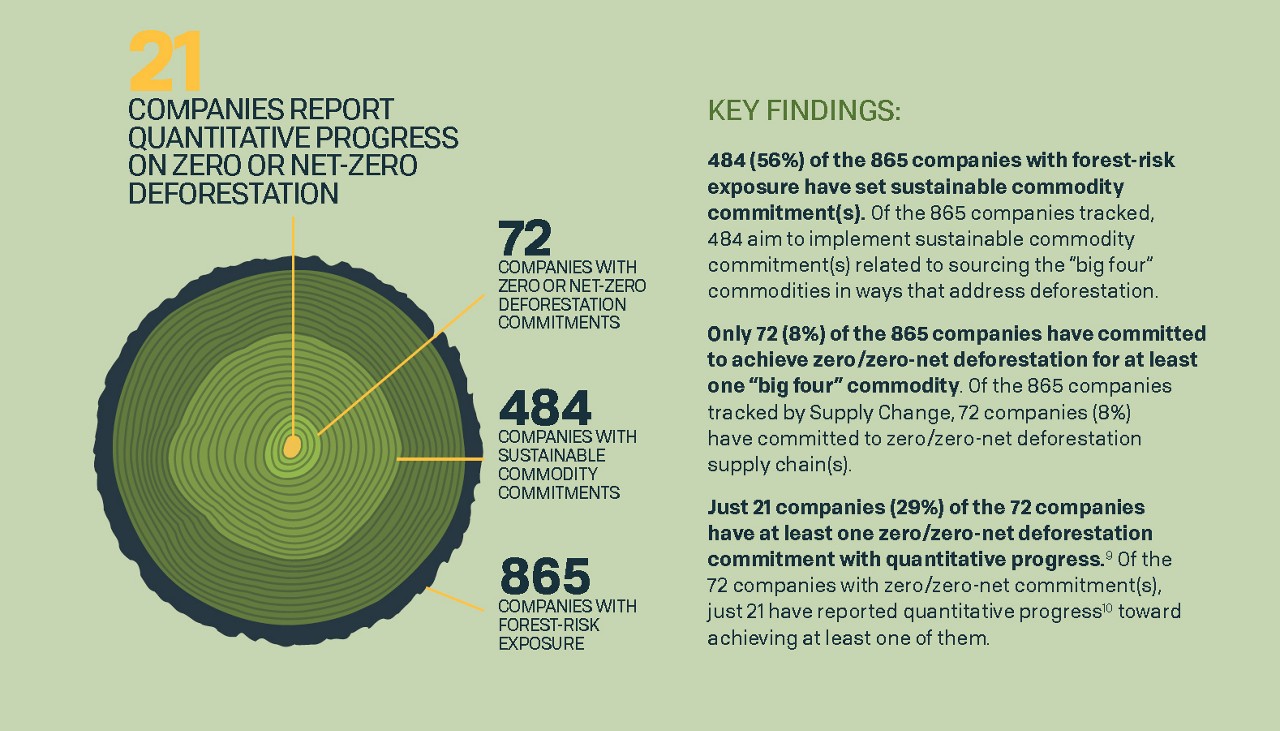

A recent CERES report found that while there were many commitments, there was less tangible action and progress, with only 21 companies out of more than 800 disclosing quantitative indicators of progress.5

A CDP report similarly found governance gaps and a lack of disclosure, with 70% of companies with a high impact on forests failing to disclose. Those that did disclose reported over US$30bn in losses due to deforestation risks.6

Deforestation is a business issue

Deforestation creates business risks. The potential for regulatory and community changes threaten companies with compromised supply chains, including sudden cost increases, unavailability of key product inputs and delays. Reputational harm, particularly through consumer boycotts are a real threat in an age of rapidly transmitted social media controversies. We have seen some brands react quickly to cease purchases of leather from Brazil in response to the fires.

Source: CERES. “Out on a limb: The State of Corporate No-Deforestation Commitments and Reporting Indicators that Count” (June 2019)

As investors, we are not forest experts and cannot claim to have the solutions, but we do try to understand risk. The deforestation trends suggest that the current approach is not working and something different needs to be done.

What does this mean for investing?

For the Stewart Investors Sustainable Fund Group, sustainable sourcing and environmental stewardship are critical considerations in our company analysis. We have never owned livestock, big agricultural or trading companies due to the quality of franchise, quality of management and sustainability head winds.7 However, the complexity and opacity of soft commodity8 supply chains make complete avoidance of deforestation very difficult, and near impossible for global food companies.

Global consumer companies such as Henkel, Unilever, Jeronimo Martins, Marico, Kikkoman and Vitasoy, all buy and use agricultural commodities. Due to the complexity and limited traceability in soft commodity markets, particularly for soy, it is likely Brazilian sourced soft commodities linked to deforestation exist in these companies’ supply chains.

For example Jeronimo Martins, a Portuguese company operating in food distribution and specialised retail, notes that despite having a strong sustainable sourcing framework, 9,366 tonnes of soy, almost two thirds of the total purchased, came from countries at risk of deforestation, with only 20% of this soy being certified sustainable. Most companies do not disclose this information nor have the sustainability ethos of Jeronimo Martins.

In various assessments including Forest 500, the CERES report mentioned above and our commissioned research, Henkel and Unilever are consistently amongst the best-rated companies globally for deforestation commitments and actions. Jeronimo Martins and Vitasoy have strong and evolving sustainable sourcing strategies which explicitly call out deforestation. Marico has a responsible sourcing programme which is focused on farming communities but does not explicitly highlight deforestation. While Marico does sell soy sauce in Indonesia, it is mostly exposed to coconuts and we expect total exposure to commodities linked to deforestation to be limited. Kikkoman provides limited disclosure on their sourcing practices.

Furthermore, companies such as Novozymes are producing microbes that help increase soft commodity yields and reduce the need for chemical herbicides and pesticides.

What are we doing from here?

Our plan in response to the most recent Amazon fires is to:

- Join the PRI’s (Principles of Responsible Investment) joint Investor statement on deforestation and forest fires in the Amazon.

- Continue our support of CDP Forests.

- Write to targeted companies we are invested with who have an exposure and potential influence on deforestation.

- Include notes in our company engagement system to prompt us to follow up on the issues in our future face-to-face meetings.

- Write to our clients to ask them to join with us in these activities.

We have also commissioned our own research on Palm Oil and Soy, to understand better the issues faced and shape our engagement on these soft commodities.

What we are asking of companies

In our letter we refer to the CERES report, “Out On a Limb: The State of Corporate No-Deforestation Commitments & Reporting Indicators that Count”, which recommends three measures from the CDP Forest questionnaire investors should be asking companies to disclose in support of their commitments:

- Percent of total production/ consumption covered by commitment.

- Percent of total production/ consumption volume traceable; point to which commodity is traceable.

- Whether the company specify any sustainable production/procurement standards for its disclosed commodity(ies), other than third-party certification? And to indicate the percentage of production/ consumption covered and if it monitors supplier compliance with these standards.

In addition, we ask companies to show greater ambition in terms of deforestation, engage with the large trading companies who dominate deforestation-linked soft commodities, and to review industry group memberships to ensure alignment on deforestation commitments.

Conclusion

Like many of the sustainability challenges we face, deforestation is complex, interconnected with other issues and not something any organisation can solve on their own. However, the 70% reduction in land use change achieved in Brazil in the early 2000s shows what is possible with concerted effort. The backward steps since then shows more needs to be done and different approaches will be needed. Investors have a key role to play. For our part, we will continue to encourage the companies we invest in, our clients and the broader industry to join the movement for a zero-deforestation future.

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Want to know more?

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group