Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Indian Subcontinent All Cap

Launched in 2006, the Stewart Investors Indian All Cap Strategy is a long-term, equity-only strategy that aims to invest in shares of high-quality companies positioned to contribute to, and benefit from, the sustainable development of the region. Given the size of the economy and the investment universe, the majority of the strategy’s 30-60 investments are in Indian-listed companies.

Strategy highlights: a focus on quality and sustainability

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

- Companies must contribute to sustainable development. Portfolio Explorer >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Latest insights

Quarterly updates

Strategy update: Q3 2025

Indian Subcontinent All Cap strategy update: 1 July - 30 September 2025

Review: continuity and change

On one level, the third quarter saw significant changes at Stewart Investors. After acting as careful stewards of our clients’ capital over many years, three of our colleagues stepped back from their portfolio-management responsibilities in August and left the business.

While the list of portfolio-management responsibilities within our team looks different now than it did when the quarter began, on a deeper level, nothing has changed: the philosophy and approach that has defined Stewart Investors since 1988 is deeply engrained and continues to define what we do. Our structure is flat. Every member of the investment team is first and foremost an analyst and our collective focus is on identifying high-quality companies, with resilient financials, guided by ambitious stewards. This is the bedrock on which returns from all our strategies have been built.

This strategy’s new lead manager is Jack Nelson. He joined Stewart Investors in 2011 and is also the lead manager of our Global Emerging Markets Leaders and Global Emerging Markets All Cap strategies. He continues to apply the same principles to managing this strategy that have guided it since its launch, working as part of the same tight-knit group of investment analysts and drawing on the same common pool of investment ideas.

India: a question of quality

Over the past quarter, some of our clients questioned our longstanding enthusiasm for investing in India. Given that the Indian stockmarket has been one of the weaker performers among the world’s major markets in 2025, those concerns are understandable. The reasons for the relatively lacklustre returns the Indian market has generated recently have included:

- Concerns that some companies’ share prices may be too high relative to their underlying profits (valuations).

- The potential impact from trade tariffs.

- A slowdown in domestic consumer spending.

- A depreciation of the rupee currency.

Nine months is, of course, far too short a timeframe over which to judge equity performance. Focusing too narrowly on the short term also discounts the compelling returns that many of our investments in India have generated over the past five-to-10 years.

From our perspective, we remain focused on the bottom-up analysis of companies – on their quality, sustainability, and valuations. And, although we recognise the impact that these top-down concerns have had on investor sentiment towards those businesses in the short term, we continue to view India as a compelling destination for long-term investors. We believe investing in high-quality companies addressing the sustainable growth needs of India and monitoring their valuations should yield good returns over the years and decades to come.

In particular, we continue to be excited by the opportunities that are presented by the companies that are seeking to meet demand in India’s large and growing domestic market. We also keep a keen eye on valuations, aware that index valuations are not a fair representation of the investment prospects of the individual companies whose shares we own.

Activity

This quarter, we re-established a position in Tata Consultancy Services (Information Technology). Its shares have fallen by almost a third since the end of 2024.1 Recent increases in the cost of H-1B visas, which US companies use to hire foreign workers – including India’s IT specialists – further weakened sentiment. Set against that, however, this well-stewarded franchise remains a critically important partner for many global companies.

We initiated a position in Mankind Pharma (Health Care), which is known for providing affordable healthcare. We first met this company a year ago during a research trip to India and have developed our understanding of it further over the last 12 months. Mankind’s operations span pharmaceuticals, consumer healthcare, and over-the-counter (OTC) medicines. It also has a particularly strong presence in rural India as well as its smaller cities.

We sold our positions in Tata Communications (Communication Services) and Dr. Reddy’s Laboratories (Health Care). Our conviction in the strength of their franchises had waned and the opportunity cost of holding them relative to our other, stronger investment ideas had increased. We also completed the sale of VST Tillers Tractors (Industrials), which faces increasingly tough competition from cut-price imports.

[1] Source: S&P Capital IQ as of 30 September 2025.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q2 2025

Indian Subcontinent All Cap strategy update: 1 April - 30 June 2025

It was another quarter in which our clients were keen to discuss both the short - and long-term prospects for investing in India. The questions we were asked covered a range of topics, including:

- Whether India’s growth is sustainable given global headwinds.

- The risks arising from the country’s dependency on imported energy.

- Whether valuations remain too high.

- The extent to which India’s economic development is inclusive.

All of these subjects are worthy of debate. As always, however, we prefer to think about the investment opportunities from the bottom-up – by looking for and talking to high-quality companies that are both driving and benefiting from long-term human development trends. We believe there are plenty of these businesses in India and we tend to share the excitement expressed by the chief executive of one of our holdings, Mahindra & Mahindra (India: Consumer Discretionary):

Sentiments like these are not uncommon among India’s high-quality companies. They remind us there is still lots of work to be done to build capacity and meet demand. We believe this dynamic should underpin the long-term growth of those companies that can contribute to India’s development in a sustainable way.

We initiated seven new positions over the quarter. Dalmia Bharat (India: Materials) is a well-managed, family-owned supplier of cement and related products. PB Fintech (India: Financials) is the holding company of Policybazaar (an insurance intermediary) and Paisabazaar (a loans intermediary). It is growing nicely and has strong market shares in both areas. Jyothy Labs (India: Consumer Staples) is a family-owned supplier of cleaning and personal care products with a strengthening and diversifying franchise. It has no debt on its balance sheet. Motilal Oswal Financial Services (India: Financials) is a diversified financial conglomerate operating in retail and institutional broking, asset management, wealth management, investment banking, and housing finance with an ambitious-but-conservative steward at its helm. It should benefit from meeting the savings and investment needs of India’s growing middle class. CarTrade Tech (India: Consumer Discretionary) is a platform that helps to match buyers and sellers of new and second-hand cars. Its acquisition of classified-ad portal OLX India has given it the opportunity to expand and diversify away from cars.

Blue Star (India: Industrials) makes, installs and services air conditioners, refrigerators, deep freezers, watercoolers, and cold rooms. Its products are found in a third of India’s commercial buildings2. With family owners and an ambitious, competent, and long-tenured management team, it is well stewarded. The final addition, MakeMyTrip (India: Consumer Discretionary), is India’s leading online travel agency. Its platforms – MakeMyTrip, Goibibo and redBus – facilitate travel and tourism, supporting job creation and economic growth.

To fund these purchases, we sold Syngene (India: Health Care), Cyient (India: Information Technology), Dr. Lal PathLabs (India: Health Care), Bajaj Housing Finance (India: Financials), Tata Chemicals (India: Materials) and Tata Consumer Products (India: Consumer Staples). These sales were prompted either by valuations becoming too stretched or because we felt the opportunity cost of holding these positions was too high given the strength of our conviction in other stocks.

Focusing on what individual companies are saying and doing is especially important as macro news – on the global economy, trade and geopolitics – continues to build. Rather than trying to second-guess politicians, we prefer to spend our time focusing on companies with high-quality management, robust franchises and strong financials with compelling valuations. Although we understand that these companies do not exist in a vacuum, we try to focus on what we can control rather than fretting over those things we can’t. As such, we are striving to analyse the long-term opportunities and idiosyncratic risks facing the companies we invest in.

[1] Mahindra & Mahindra Annual Report 2024 https://www.mahindra.com/annual-report-FY2024/index.html pp. 7/519.

[2] Source: Blue Star Annual Report 2023-24.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q1 2025

Indian Subcontinent All Cap strategy update: 1 January - 31 March 2025

Due to the recent softness in the Indian market, we have received lots of questions from investors and plenty of interest in the strategy. Recent market declines have given us an opportunity to add to some of our existing high-quality holdings at more attractive valuations as well as to add a number of new names.

Over the quarter, we initiated a new position in Bajaj Auto (India: Consumer Discretionary), a leading manufacturer of automobiles. This is another company in the Bajaj stable that we believe represents a strong franchise with a high-quality steward behind it. It joins our existing position in Bajaj Holdings & Investment (India: Financials), which is the holding company of siblings Rajiv and Sanjiv Bajaj, who have an exemplary track record of delivering shareholder returns.

Elsewhere, we continued to build a position in Sundaram Finance (India: Financials), a high-quality and conservative financial services institution stewarded by the Sundaram Group. Meanwhile, to benefit from lower valuations, we added to our existing holdings in Tube Investments (India: Consumer Discretionary), Blue Dart Express (India: Industrials), SKF India (India: Industrials), Elgi Equipments (India: Industrials) and Cholamandalam Financial Holdings (India: Financials).

To fund these additions, we sold our positions in Havells (India: Industrials), Carborundum Universal (India: Materials) and Bosch India (India: Consumer Discretionary). Although we continue to believe in these businesses’ long-term growth potential, we believe there are better returns to be achieved elsewhere given their relative valuations.

The strategy’s performance over the past quarter (and over the past year) has been disappointing. We would have hoped that it would have exhibited greater resilience relative to the market. At the same time, however, we would caution that a single quarter is too short a timeframe over which to measure equity returns. When considering the future of the underlying businesses that we invest in, we look several years – and sometimes decades – into the future. On reflection, we could perhaps have trimmed position sizes more aggressively in our strongest performing industrial names. At the same time, however, we still see good value when considering their long-term potential.

The softness in the Indian market in recent months must be seen in the context of the strong returns that it has generated in recent years. Furthermore, equities are long-duration assets, so we continue to focus on the long-term growth potential of the companies we own. We have made three visits to India over the past four months and, in common with the corporate stewards backing our companies, we remain excited by the opportunity to generate compelling investment returns.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

Indian Subcontinent All Cap strategy update: 1 October - 31 December 2024

One question we increasingly encounter when speaking to clients is: “isn’t India expensive now”? We can understand why clients are asking this, after all the MSCI India index has risen over 85% in the five years to end December 2024 and has increased by over 12% over the past 12 months alone.1

Two answers spring to mind here: firstly, that we are not investing in the index, we are trying to find the highest-quality companies we can and secondly, we keep a keen eye on valuations and position sizes to try and ensure our investments deliver good, long-term returns whilst also protecting capital. To that end we still see lots of reasons to be positive about the outlook for our India holdings.

We have found a few new ideas at acceptable valuations and during the period we purchased Narayana Health (India: Health Care) which is supplying affordable, private healthcare in India. We also increased our holding in insurer ICICI Lombard (India: Financials).

We sold Mahindra Finance (India: Financials) as we struggled to build conviction in the business trajectory.

As far as monitoring valuations, we slightly trimmed our holdings in Mahindra & Mahindra (India: Consumer Discretionary) and Dr. Lal PathLabs (India: Health Care). Our belief in their long-term success remains robust.

More generally, we continue to assess all our investments from a bottom-up perspective, trying to gauge the quality of the people and businesses that we are backing with your money. We are doing our best not to overpay for these investments and to hold them for the long term. We continue to believe that this is the bedrock of long-term capital preservation and growth.

[1] Source: FactSet. USD total returns.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Voting

Voting: Q3 2025

Indian Subcontinent All Cap voting: 1 July - 30 September 2025

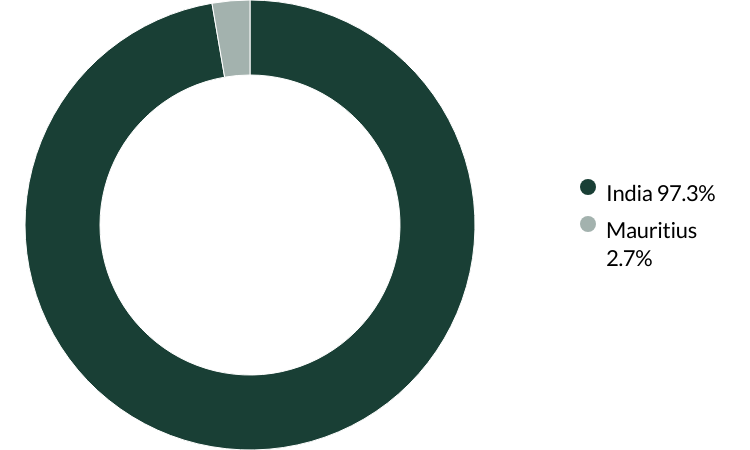

Voting by country of origin

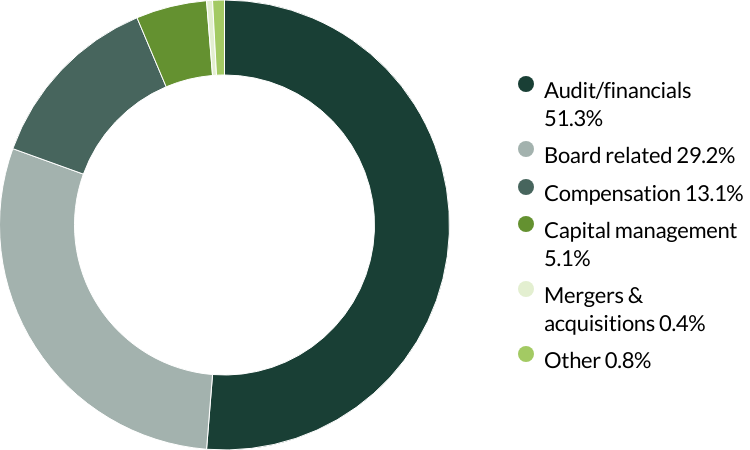

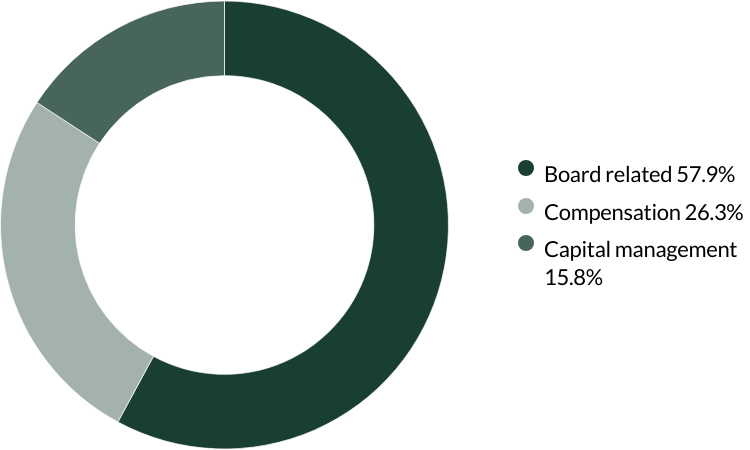

Voting by proposal category

During the quarter there were 236 proposals from 32 companies to vote on. On behalf of our clients, we voted against two proposals.

We voted against the appointment of the auditor at MakeMyTrip, as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one proposal)

We voted against the re-election of a director at SKF India, due to concerns around their level of attendance at board meetings over the past financial year. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q2 2025

Indian Subcontinent All Cap voting: 1 April - 30 June 2025

Voting by country of origin

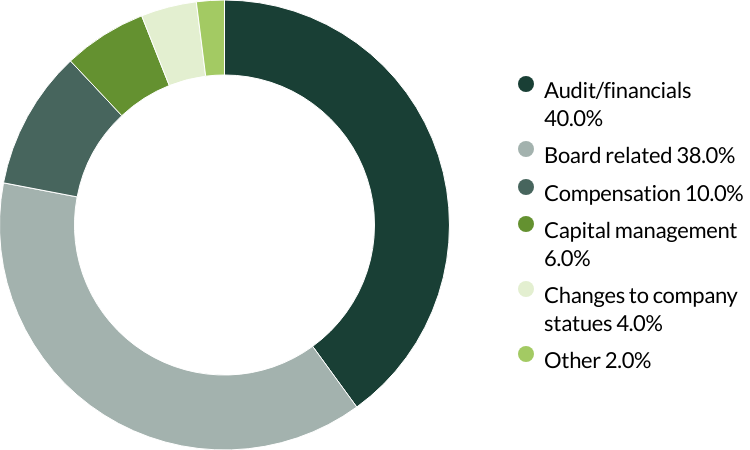

Voting by proposal category

During the quarter there were 50 proposals from 11 companies to vote on. On behalf of our clients, we did not vote against any proposals.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q1 2025

Indian Subcontinent All Cap voting: 1 January - 31 March 2025

Voting by country of origin

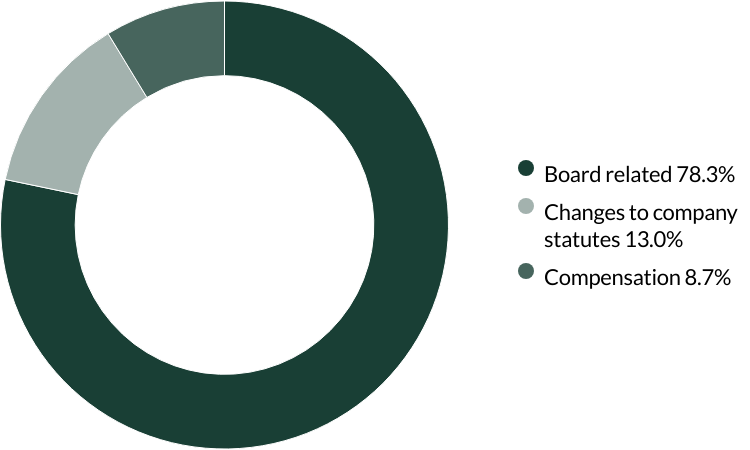

Voting by proposal category

During the quarter there were 23 resolutions from 11 companies to vote on. On behalf of clients, we voted against one resolution.

We voted against the election of a director and their remuneration at IndiaMART as we seek to encourage greater diversity and independence on the board. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q4 2024

Indian Subcontinent All Cap voting: 1 October - 31 December 2024

Voting by country of origin

Voting by proposal category

During the quarter there were 19 resolutions from seven companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 September 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.