Get the right experience for you. Please select your location and investor type.

Global Emerging Markets All Cap

The Global Emerging Markets All Cap strategy invests in between 30-75 high-quality companies that are contributing to a more sustainable future.

Our Global Emerging Markets All Cap strategy was launched in 2009 and invests in between 30 to 75 high-quality companies that are contributing to a more sustainable future. The strategy’s bottom-up approach allows us to find only the very best businesses from an investable universe of some 65,000 companies. We are looking for companies well positioned to contribute to long-term sustainable development; businesses with high quality management teams, franchises, and financials.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Proxy voting

Global Emerging Markets All Cap proxy voting: 1 January - 31 March 2025

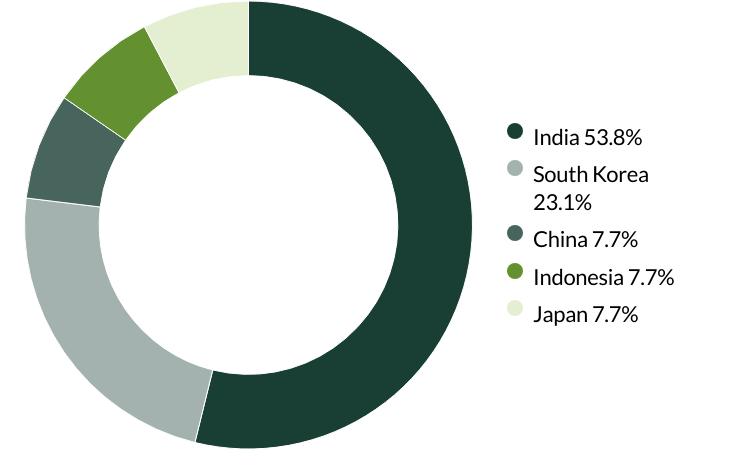

Proxy voting by country of origin

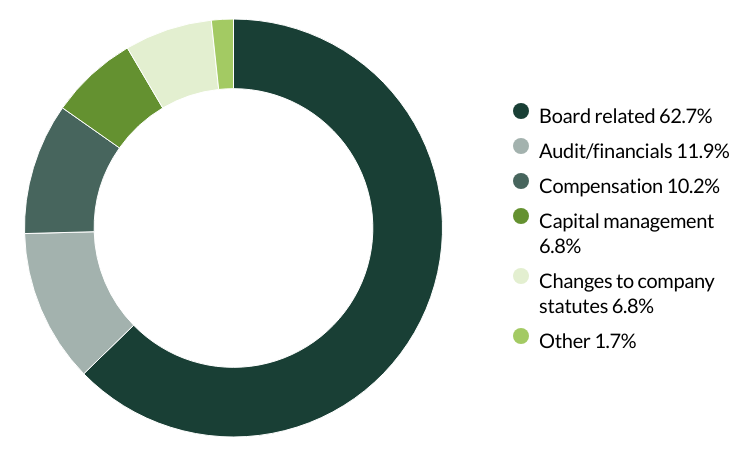

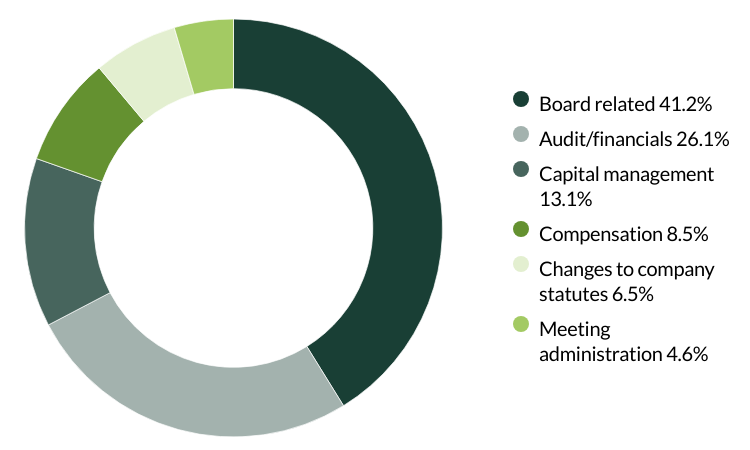

Proxy voting by proposal category

During the quarter there were 59 resolutions from 12 companies to vote on. On behalf of clients, we voted against six resolutions.

We voted against executive remuneration at Bank Central Asia because we believed it was excessive. (one resolution)

We voted against the election of a director and their remuneration at IndiaMART as we seek to encourage greater diversity and independence on the board. (one resolution)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

We voted against the election of the audit committee chair at Unicharm as we do not believe they are independent. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Global Emerging Markets All Cap proxy voting: 1 October - 31 December 2024

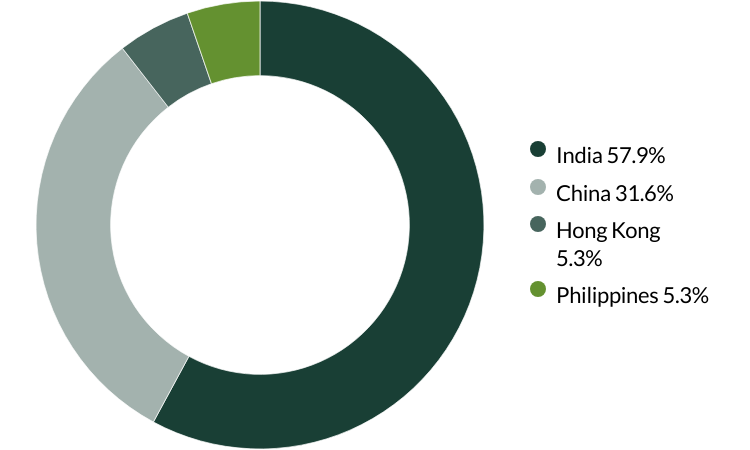

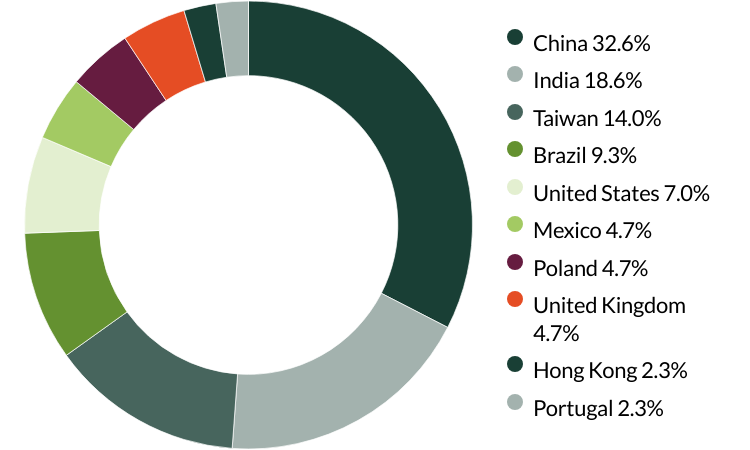

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 28 resolutions from eight companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Global Emerging Markets All Cap proxy voting: 1 July - 30 September 2024

Proxy voting by country of origin

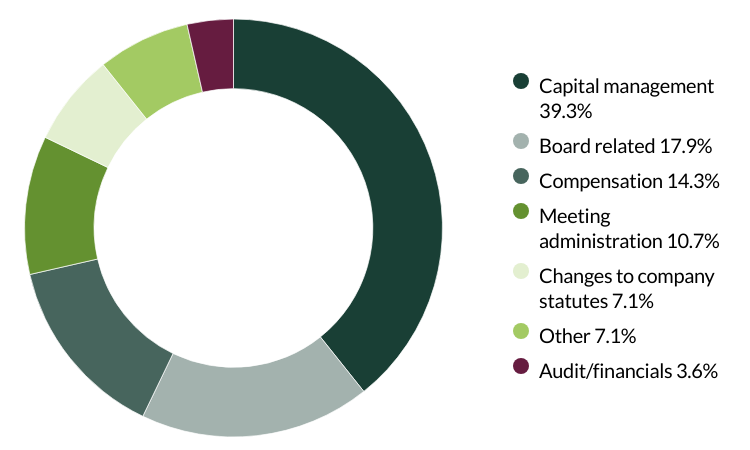

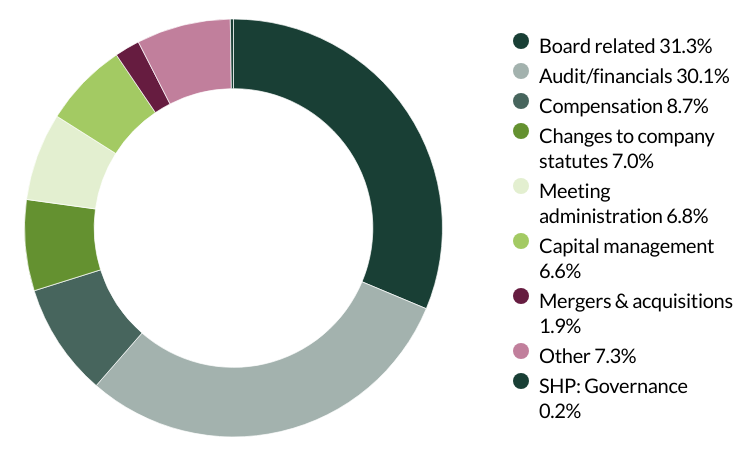

Proxy voting by proposal category

During the quarter there were 153 resolutions from 17 companies to vote on. On behalf of clients, we voted against three resolutions.

We voted against the appointment of the auditor at Philippine Seven as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. We also voted against proposals on transaction of business, as the company did not provide enough information about the proposals. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (two resolutions)

We voted against the appointment of the auditor at Vitasoy as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Global Emerging Markets All Cap proxy voting: 1 April - 30 June 2024

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 412 resolutions from 38 companies to vote on. On behalf of clients, we voted against 14 resolutions.

We abstained from voting on amendments to work systems for independent directors and board meeting procedures at Amoy Diagnostics as the company did not provide sufficient data on the proposed amendments. (two resolutions)

We voted against the appointment of the auditor at EPAM Systems, Glodon, Yifeng Pharmacy Chain and Zhejiang Supor as they have been in place for over 10 years and the companies’ have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (four resolutions)

We voted against the proposed employee stock ownership plan at Midea as we believe non-executive director involvement could lead to conflict of interest and would not be in shareholders' interest. (three resolutions)

We abstained from voting on amendments to articles at Quálitas as the company did not provide sufficient information on the amendments. (one resolution)

We voted against the recasting of votes for the supervisory council at RaiaDrogasil as we believe the principle of recasting votes for an amended slate is poor practice and would prefer the slate to be resubmitted for voting. (one resolution)

We abstained from voting on a series of proposals regarding capital and shares allocation and board elections and reports at Regional as the company provided insufficient information. (12 resolutions)

We voted against the establishment of a supervisory council and cumulative voting at TOTVS as no detail on the candidates was provided. (two resolutions)

We voted against recasting and cumulative voting at WEG as this would allow the board to make changes without shareholder assessment or knowledge of candidates. (three resolutions)

We abstained from voting on requests for a separate board election and the election of a Supervisory Council position at WEG due to insufficient information and our preference for the current family stewards to remain in place. (two resolutions)

We voted against a shareholder proposal regarding board declassification at EPAM Systems as we do not deem it necessary for all directors to stand for election annually and believe this could destabilise the board by allowing excessive turnover. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, European All Cap Strategy, European (ex UK) All Cap Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 31 March 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.