Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Worldwide All Cap

Our Worldwide All Cap strategy was launched in November 2012. It is an unconstrained investment strategy, by which we mean it is not restricted to certain countries, and is able to invest in between 40-60 companies all over the world.

As with all of our strategies, we are interested in finding only the very best businesses; those with high quality management teams, franchises, and financials, that are well positioned to contribute to, and benefit from, sustainable development.

Strategy highlights: a focus on quality and sustainability

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

- Companies must contribute to sustainable development. Portfolio Explorer >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Latest insights

Voting

Voting: Q3 2025

Worldwide All Cap voting: 1 July - 30 September 2025

Voting by country of origin

Voting by proposal category

During the quarter there were 96 proposals from eight companies to vote on. On behalf of our clients, we voted against two proposals.

We voted against the appointment of the auditor at Advanced Drainage Systems and Vitasoy, as they have been in place for over ten years. The companies have given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (two proposals)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q2 2025

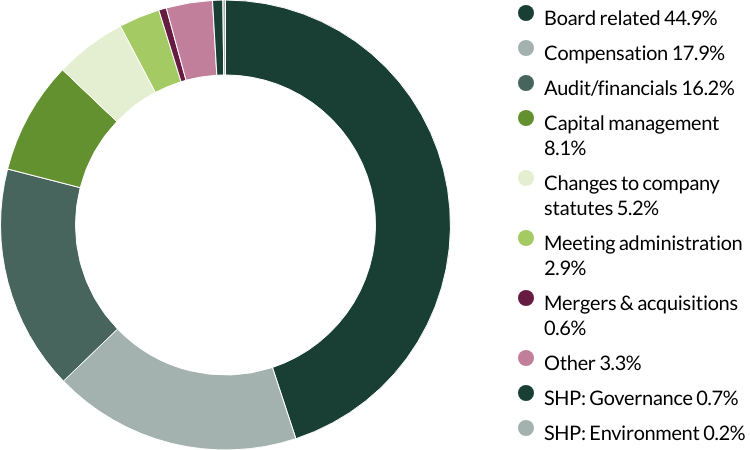

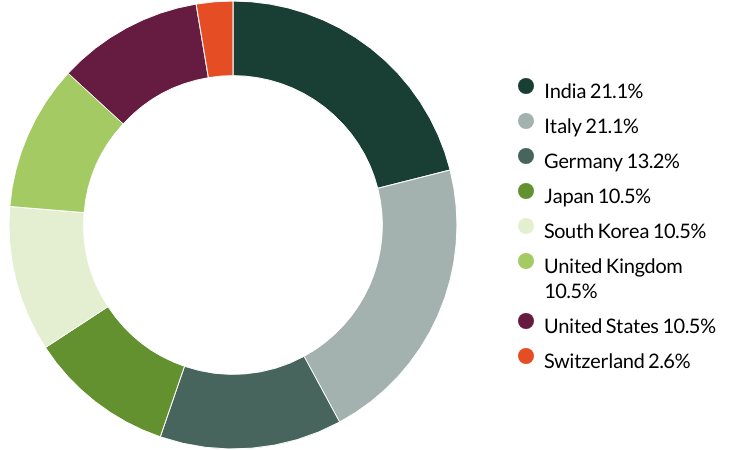

Worldwide All Cap voting: 1 April - 30 June 2025

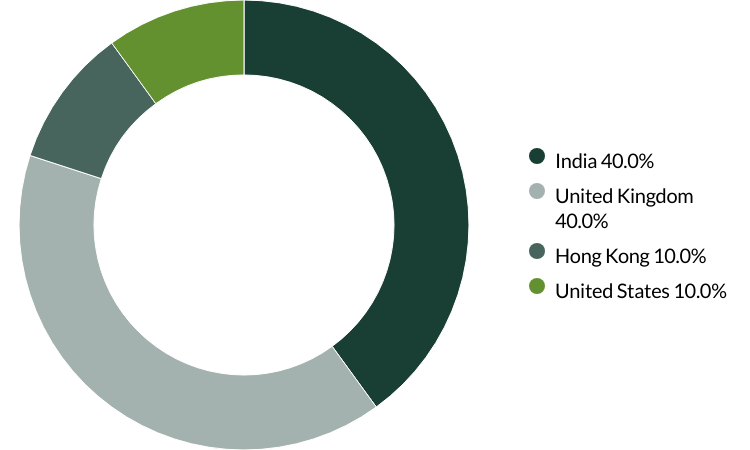

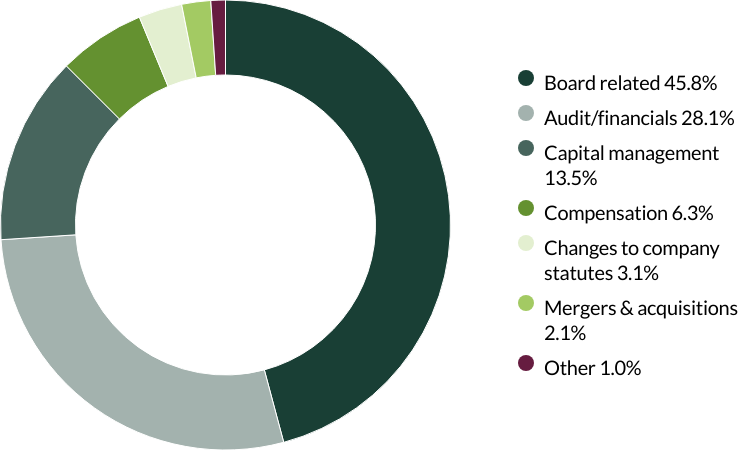

Voting by country of origin

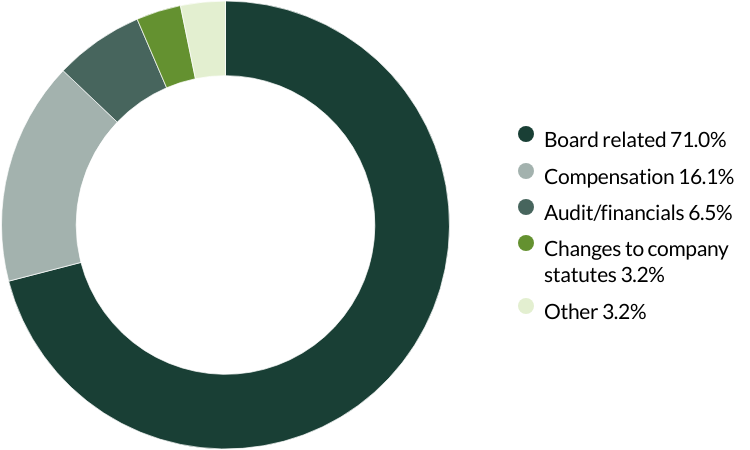

Voting by proposal category

During the quarter there were 546 proposals from 35 companies to vote on. On behalf of our clients, we voted against 20 proposals and abstained from voting on four proposals.

We voted against the appointment of the auditor at Arista Networks, Brown & Brown, Edwards Lifesciences, Fortinet, Glodon, Markel, Roper Technologies, Texas Instruments, Veeva Systems and Westinghouse Air Brake Technologies Corporation (Wabtec) as they have been in place for over 10 years. The companies have given no information on rotating their auditors, a practice we believe is important to ensure a fresh perspective is brought to their accounts. (10 proposals)

We voted against changing the terms of the board at EPAM Systems as the proposed changes would require all directors to stand for election annually instead of on staggered terms. While we understand the rationale for annual elections, we believe that a staggered approach provides continuity and helps prevent excessive turnover. We also voted against changes to limit the liability of certain officers, as we believe the company has demonstrated its ability to attract and retain an admirable management team under the current structure, which encourages managers to think and act as long-term owners. Finally, we voted against the appointment of the auditor as they have been in place for over 10 years. The company has given no information on rotating its auditor, something we believe is important to ensure a fresh perspective on their accounts. (three proposals)

We voted against the election of an employee shareholder representative at Nexans. With two candidates standing for election, we chose to support the candidate who was elected by employees who are registered shareholders and was also the board's preferred candidate, due to their international experience as a corporate officer. (one proposal)

We voted against the recasting of votes (the ability for voters to change their original votes on a particular matter in response to new information or changes to a proposal) for directors and the supervisory council at RaiaDrogasil. We believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. (two proposals)

We abstained from voting on proposals at Rentokil Initial that would grant the company the authority to issue shares as it did not disclose the reasons for the issuance. Without clearer information regarding the potential capacity expansion and/or acquisition for which this issuance is intended, it is difficult for investors to assess the potential value creation and strategic fit of such an investment. (three proposals)

We voted against the recasting of votes for the supervisory council at WEG as we believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. We also abstained from voting on a request for a separate board election and the election of a supervisory council position. According to Brazilian voting practices, we are unable to vote for this proposal while simultaneously supporting the board in its candidate elections. (two proposals)

We voted against a shareholder proposal regarding simple majority voting at EPAM Systems as this topic was already covered by the company's own proposal, which we supported. (one proposal)

We voted against a shareholder proposal requesting that an independent director serve as chair of the board at Fortinet. We continue to support the current CEO and chair of the board. (one proposal)

We voted against a shareholder proposal regarding simple majority voting at Markel as we support the stewards of the company. (one proposal)

We supported a shareholder proposal regarding greenhouse gas (GHG) emissions disclosure at Markel to encourage improved transparency and better disclosure of relevant emissions data. (one proposal)

We supported a shareholder proposal regarding the right to call a special meeting at Texas Instruments as we believe that a stock ownership threshold of 10% to call a meeting is appropriate, considering the company’s size and shareholder base. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q1 2025

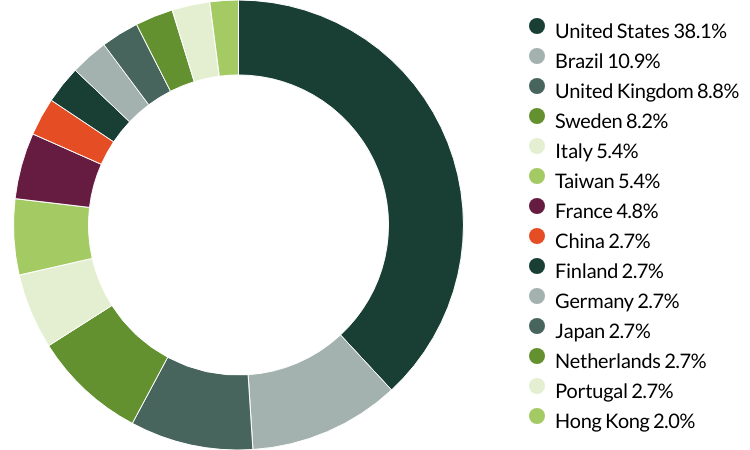

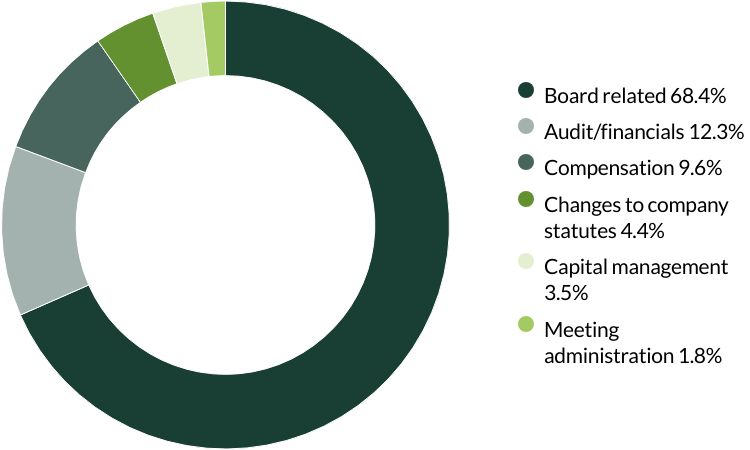

Worldwide All Cap proxy voting: 1 January - 31 March 2025

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 114 resolutions from eight companies to vote on. On behalf of clients, we voted against eight resolutions.

We voted against the remuneration policy at Diploma as we believe the increase in short-term (annual) bonus incentive does not encourage long term decision making. (one resolution)

We voted against executive remuneration and the remuneration report at Roche as we believe amounts paid to executives is high and lacks key metrics to determine and/or justify the amounts. We voted against a proposal on transaction of business as the company did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (four resolutions)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q4 2024

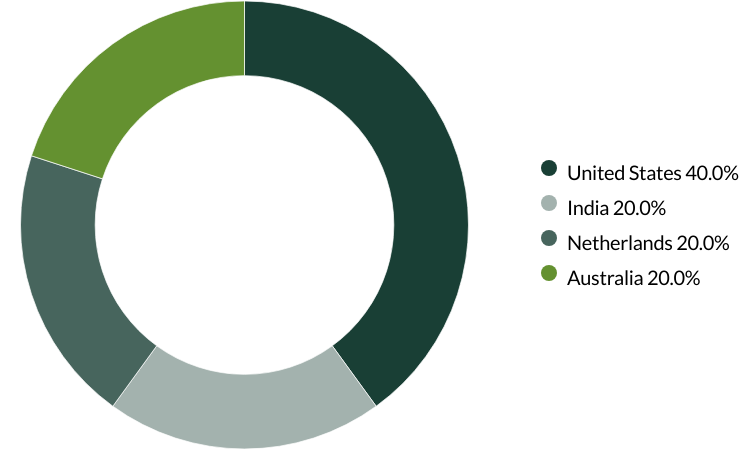

Worldwide All Cap proxy voting: 1 October - 31 December 2024

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 31 resolutions from five companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 September 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.