Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Trip report: Japan

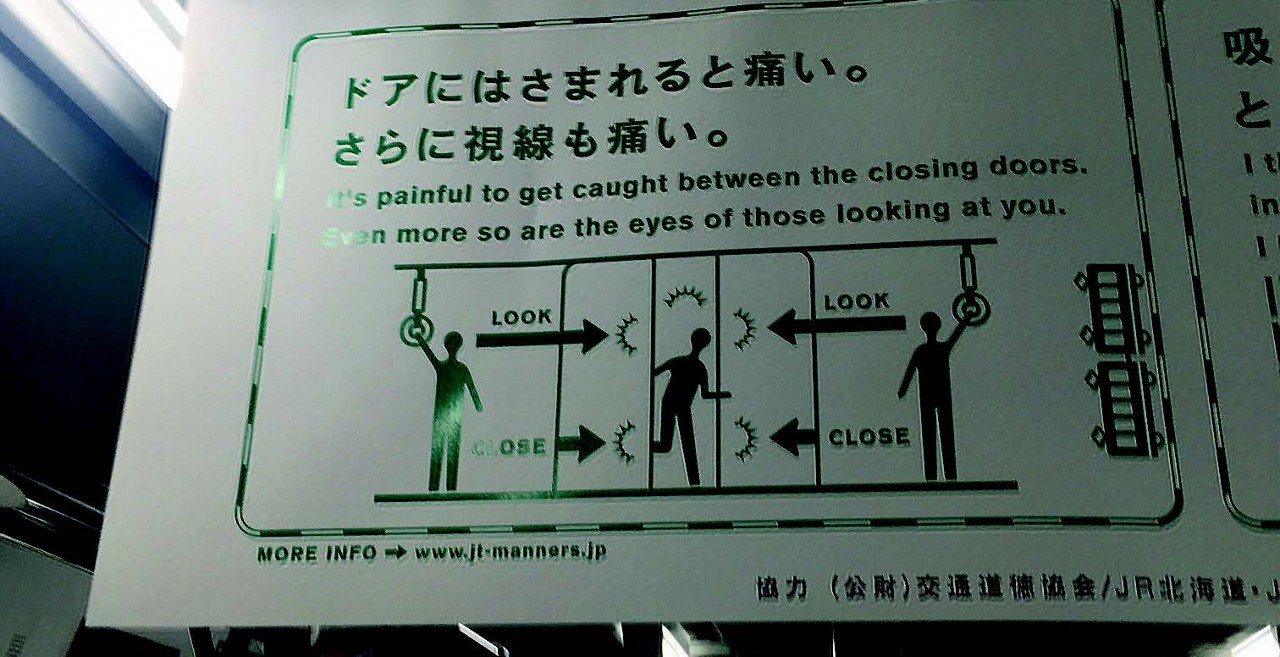

The below image is a sign from a packed subway line en route to the bullet train at Shinagawa Station. A sign that initially amused but then began to hold more power as a metaphor as the trip went on.

In most other countries, a sign highlighting the pain that comes from getting trapped in a train door would be enough to deter passengers from trying their luck with some automatic doors.

Why the second point and why the emphasis on that being the major deterrent to risky behaviour? After some internet searching we find a form of social phobia, one which occurs primarily in Japan. Called Taijin Kyofusho it translates as ‘the disorder of fear’ – a social paranoia characterised by a fear of harming or offending others. The potential consequence of a culture that emphasises conformity?

This fear looks to continue from the commute to the board room. Those management teams and corporate cultures that have managed to overcome the pressure of conformism and take assertive risks, stand out as companies that have and should continue to thrive both domestically and on a global scale. It has been in the best interests of management and shareholders for these companies to show some ‘irresponsible responsibility’ and break from the herd. As we know in many facets of life (including investing) and in every corner of the globe, it is far better for the reputation to fail conventionally than to succeed unconventionally.

We met a number of primarily domestically-focused companies on this trip who at some point in their history succeeded in thinking unconventionally and recognised early in their journey that they should not be constrained by the traditional means of operating their businesses. Choosing instead to follow their own path, whether that be in consolidating a market (Miraca), creating a new market (MonotaRO or Kakaku.com) or thinking with long enough time horizons to align their franchise with the government’s inevitable aim of reducing the country’s healthcare costs (Ain), all have proven to be vitally important endeavours since unlike India, Japan lacks a tidal wave of demand that many investors hope will raise all ships.

Then there are those companies who chose to take on a greater task and the greater risk of non-conformity by venturing overseas. This would have been an almighty decision at the time but for those who have fostered contrarian cultures and have a franchise to back up these ambitions, there remains vast potential to thrive on foreign soil. Unicharm, Nippon Paint, Hoya, Nidec and Kikkoman have been able to establish quality franchises in growing markets where they successfully go toe-to-toe with global multinationals.

It is no surprise then that it is these types of companies that lead the way on governance, diversity and meritocracy. They are, of course, not perfect but they have at least (very consciously) made early moves to break from toeing the line and think a little differently about the importance of the people within the business. This must be respected. All look to have realised the importance in hiring local management within their foreign operations and the more progressive have allowed this thinking to rise to senior management and the board. Hoya is a great example of a non-conformist steward with a relatively young, multinational management team and an independent board. They show few signs of the reactive moves to corporate governance box-ticking that exist among the lesser quality corporates we have met around the world over the last few years. Omron talked candidly of the challenges they face in fostering diversity of thought and the associated risks to the long-term survival of their franchise. Domestically, MonotaRO is a fascinating illustration of a company swimming against the tide with its 40-year-old CEO and independent board.

Sadly, as a result of Japan’s inheritance tax laws, it’s very difficult for families to preserve control over a number of generations. There are very few multi-generational Ayalas or Tatas here. This makes life a little harder for the long-term investor to find suitable stewards of our clients’ capital. The best we can do in the absence of such stewards is to find those management teams and cultures that exhibit values similar to the long-term owners we admire: think like owners with long time horizons which allows them to continue to invest in the business, exhibit contrarianism and a respect for all stakeholders. A lack of such values, combined with cash-heavy balance sheets, sadly increases the likelihood of Robin Hood shareholders coming to rob from the long-term to give to the short-term, usually in the form of aggressive buybacks and a leveraged balance sheet.

Those companies that incorporate all stakeholders within their decision making stand out when it comes to understanding the long-term threats to their franchise. Companies such as Unicharm, Kikkoman, Omron, Hoya, and to some extent Nippon Paint, are well placed to benefit from and contribute to sustainable development. Kikkoman should benefit from the increasing consumption of plant-based proteins and naturally brewed soy sauce, while Unicharm is making a considered move to reduce the environmental impact of their supply chain and continue to invest in the holy grail of affordable recyclable diapers.

Many of the higher quality companies we met on this trip have strong brands built on technical competence and are guided by capable management teams with global attitudes. The next challenge many face is to continue this development and ensure success in new markets. Similar to conversations we have had with other companies within the region, China is where the majority complain of the almost impossible task of keeping pace with the demands of the growing middle class and the evolving distribution channels that feed these wants. Fortunately for many of the Japanese companies who have ventured abroad, the country’s reputation for quality goods has afforded them a head start over many competitors. This is especially the case in industries where domestic brands have let down an increasingly informed consumer base (viz. adulterated milk or diapers). For consumer companies this has made brand-building a far easier exercise than it otherwise would have been. Unicharm for example can’t simply follow the same strategy they applied in China and Indonesia in the Indian market as the Indian consumer doesn’t hold Japanese products in similar levels of esteem. Bottom-up (no pun intended) brand-building is the only answer. Here Unicharm are saved both by their willingness to provide relative autonomy to local management and their ability to share and reflect upon mistakes made in other markets.

For these companies, new and growing markets offer the potential for greater sales, higher margins and healthier returns than what are commonly very competitive domestic markets. We mustn’t overlook the fact that those companies that have managed to prosper through twenty years of deflation and zero interest rates will come to the global market armed with a cut throat mentality and should pose serious challenges to global competitors who have been fortunate to have an easier time finding growth, and have likely built up some fat in the process. This offers these companies the opportunity to invest cash flows in growing, profitable ventures that should ensure both the quality of their franchise and the quality of growth continue long into the future. This hopefully allows them to avoid the closing doors of the economic and political malaise that much of the world finds itself in today.

Japan’s leaders have had the eyes of the world on them for a few years now. Their quivers must feel increasingly light as their arrows struggle to ignite the growth craved to pull the country out from under (the rising) mountain of debt. This is an increasingly difficult task in a world with a slowing China, low oil prices (Japan is a net energy importer) and where their shrinking population has offset any advances in productivity. Today, however, Japan no longer stands alone. Much of the developed world now shares the characteristics of low interest rates, low inflation and stacks of debt. Unconventional monetary policy no longer feels that unconventional. Companies don’t operate in a vacuum but thankfully those whose management teams have taken considered risks, managed to diversify the cash flows generated by globally competitive franchises and have exposure to growing markets, should continue to be attractive long-term investments and survive the fluctuations caused by economies and short-term investors. We were fortunate to meet a number of such franchises on this trip but as is the case with most other regions in our investible universe, quality isn’t cheap.

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Want to know more?

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group