Get the right experience for you. Please select your location and investor type.

Sustainable development in emerging markets

Why sustainable development and returns can be achieved in emerging markets.

In late 2013, we wrote a company report on a Zambian bank. The company had a customer base of around 650,000 people, made up of consumers, farmers and small and medium enterprises. Banking penetration in Zambia at the time was especially low; only 18% of adults had bank accounts, compared to 65% in Nigeria and Kenya.1 In that context, we were excited by the prospect of a company well-positioned to extend financial inclusion at primarily the bottom of the pyramid2 in Zambia and benefit from that tailwind.3

The bank certainly appeared to have the quality to take advantage of this opportunity. Its largest shareholder was a Dutch co-operative focused on rural and sustainable banking. In financial terms, the bank was well-capitalised, producing attractive returns on equity and growing earnings at 25% a year.4 The recommendation was a BUY.

That was seven years ago. Thankfully, following team discussion and further reflection we did not purchase shares in the company. Since then, the share price has fallen 92% in US$ terms.5 The company’s market capitalization has collapsed from US$467m in 2013 to just US$36m today.6

What went wrong?

There are some contextual factors that are important: namely that banking is a fragile and cyclical business model, and that the initial valuation of 3.6x price to book left plenty of room for a decline in the share price.7

These, though, are necessary rather than sufficient conditions for 92% value destruction in seven years.

The main cause of such a calamitous result is the fact that banks tend to be ‘warrants on the economy.’8 That is to say, it is almost impossible for a bank to thrive in an environment of economic crisis.

And since 2013 that is, unfortunately, exactly what has happened to Zambia. The local economy has been the victim of a lethal cocktail of climate change, macroeconomic turbulence and institutional weakness.

| Dec 2013 | Nov 2020 | |

|---|---|---|

| Price ZMW | 1.8 | 0.5 |

| P/Bk | 3.6 | 0.8 |

| ZMW / USD | 5.5 | 20 |

| Price USD | 0.33 | 0.025 |

| Market cap USD | 467 | 36 |

Source: S&P Capital IQ as of November 2020.

In recent years, Southern Africa has warmed around twice as fast as the global average;9 rainfall has become more extreme and less reliable. From 2017 to 2019, an unprecedented multi-year drought imposed development setbacks upon millions of people: crop failure, food insecurity, increased disease and crime, and reduced educational attendance were amongst the many social impacts.

In terms of macroeconomics, the primary effect was inflation; food is 70% of the consumer price index and what most Zambians spend a majority of their income on.10 Shortages naturally mean higher prices. Moreover, since over 80% of Zambia’s electricity generation is from hydropower11, the severe lack of rain also resulted in rolling 18-hour blackouts and a doubling in the price of electricity in January 2020.12

Zambia is a very narrow and therefore fragile economy. Around 75% of the country’s exports are copper,13 leaving foreign earnings highly dependent on the price of the metal.

This left Zambia unable to deal with the twin shocks of weak copper demand and drought, and the economy has been caught in a classic emerging markets trap.

An external shock results in currency weakness. Devaluation fuels inflation and prevents authorities from cutting interest rates, guaranteeing recession. International investors’ nervousness becomes self-fulfilling: Moody’s and Fitch14 both downgraded Zambia’s debt in April 2020 and triggered another round of devaluation. The yield on the Zambian government’s ten year bonds is now an eye-watering 38%.15

The economy’s near-term prospects look bleak. No wonder, in this environment, as a warrant on the economy, the company’s share price has fallen over 90% in US dollar terms.

The sustainable investment dilemma in emerging markets outside of Asia

Zambia is an extreme example of what has afflicted many developing countries in the last decade, particularly outside of the Asia Pacific region, in an environment of more subdued resource demand.

The structural role in the global economy of emerging markets outside of Asia is as a source of raw materials. Iron ore, wheat, beef, copper, coffee and oil flows from Africa, Latin America and the Middle East to the three industrialized regions of the world economy: North America, Europe and East Asia.

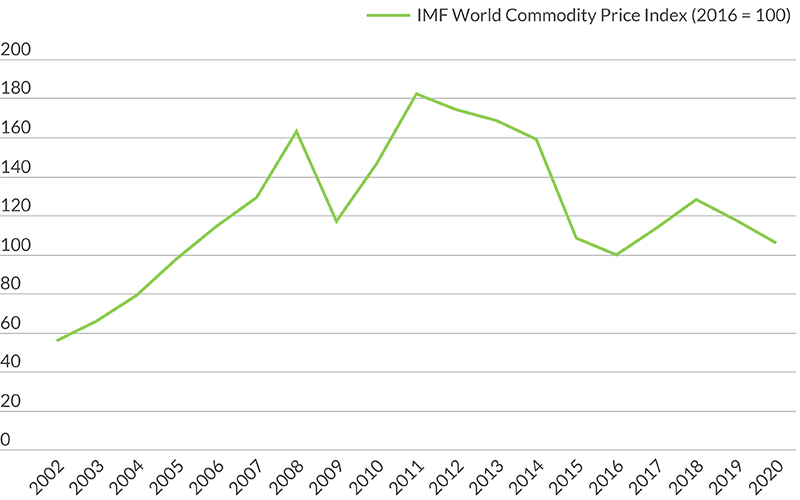

This has been the case for decades and in some cases centuries. It is a reality which makes it difficult for economies in these regions to grow quickly, alleviate poverty and not come under structural macroeconomic pressure during times of resource price weakness, like that which we have seen since 2014.

During that period, Brazil and South Africa suffered a similar combination of corruption scandals, power shortages and drought. Nigeria and Egypt were forced to abandon currency pegs16 in the wake of falling commodity prices. Argentina and Turkey have persisted with poor policy choices which have led to high inflation and risk of debt defaults. Russia entered a deep recession following the oil price crash.

Long before Covid-19, almost all major emerging markets outside of Asia had experienced recession in the last five years as a consequence of commodity price falls.

| US $1 | Dec 2013 | Nov 2020 | % |

|---|---|---|---|

| Zambian kwacha | 5.5 | 20 | 264% |

| South African rand | 10.3 | 16.3 | 58% |

| Nigerian naira | 158 | 381 | 141% |

| Egyptian pound | 6.9 | 15.7 | 128% |

| Brazilian real | 2.3 | 5.7 | 148% |

| Argentinian peso | 6.3 | 78.3 | 1143% |

| Mexican peso | 12.9 | 21.1 | 64% |

| Russian rouble | 33 | 77.8 | 136% |

Source: S&P Capital IQ as of November 2020.

And in almost all cases, the release valve for these macroeconomic pressures has been through their currencies. Significant devaluation has been widespread outside of Asia, making attractive equity returns for hard currency investors tough to come by. The scale of these slides have meant that in many cases foreign investors have had to make well over 10% a year in local currency before breaking even in US dollars.

Source: IMF Data as of June 2020.

This creates an apparent dilemma for us as emerging markets investors who are passionate about sustainable development.

We view our role as helping to responsibly allocate the savings of the developed world, where our clients are located, to those economies that need it most - an act of diligently moving capital from where it is abundant, and therefore earns a low return, to where it is scarcer and therefore earns a higher return.

We believe such capital flows can simultaneously deliver attractive long-term returns to clients while at the same time benefiting the societies in which we invest. We seek to provide capital to companies which are involved in providing poverty-alleviating goods and services – financial inclusion, access to medicine or essential everyday goods, like soap and shampoo – because we feel they should offer the most attractive long-term, risk-adjusted returns.

The tension arises from the fact that it is those countries with the greatest need for capital and where allocating that capital might have the greatest impact on sustainable development, like Zambia, which simultaneously are the riskiest for our clients’ capital to be invested in. The markets which dominate benchmarks – China, South Korea and Taiwan – are lower risk, have the lowest costs of capital and have the least need for foreign capital to aid development.

So at first glance, there appears to be a trade-off between the extent to which we can adhere to the twin imperatives of, on one hand, being conservative and focused on preserving clients’ capital and, on the other, allocating that capital in the most socially-useful way.

In practice, we would argue that there is a simple way to overcome this apparent quandry - through being highly selective on quality.

Changing the frame: sustainability as a driver of individual company returns

We do not own ‘South African stocks’ - we own two companies which we believe are the best in the country. We do not own ‘Brazil’ - we own four companies there, which we believe are the highest quality ones we can find. We do not own anything in Russia, or Saudi Arabia, or Mexico – because we do not think we have found the right quality companies at the right valuation. Our clients do not own ‘emerging markets’ - they own shares in what we believe are the best companies in that universe.

Being extremely selective on quality is especially well suited to the highly volatile emerging markets of Africa, Latin America and the Middle East. In our stock picking over the last five years, we have been especially aware of the difficult environments these companies operate in and the risks of currency weakness. We have tried not to own ‘warrants on economies’.

We have instead primarily focused on owning for clients companies that fall into one of two categories, each of which contain only a very small fraction of the listed universe.

The first is those companies that are globally competitive. These are exporters which compete successfully with firms from the US, Western Europe and Asia. They are a rare occurrence in Latin America, Africa and the Middle East, but they exist. For example, a Brazilian company’s electric motors are amongst the world’s most efficient, while two IT service companies, one based in Argentina, the other in Belarus, are the global leaders in ‘digital transformation’ services.

The focus for these kinds of companies is on innovation and technology. They typically spend a sizable portion of revenue on research and development. Having such companies based in emerging markets can mean a build-up of much-needed human capital in those countries and skilled employment for engineers.

In many cases they manage to derive a sizeable portion of their earnings from the US and Europe, and therefore earn hard currency.17 They also often choose to list in developed markets. These characteristics help them sidestep the headwinds of devaluation in local currencies discussed above.

The second type of company we have focused on are those that are domestically-focused, but which are able to grow earnings per share consistently, even during recessions. Such a feat requires a powerful combination of strong growth and high calibre management. In practice, we find many of these companies are amongst the best positioned for sustainable development: often, their rapid growth is fuelled by business models delivering socially-useful, valued goods to consumers.

An Egyptian medical diagnostics company is a great example. Last year it delivered 30 million medical diagnostic tests, at an average cost of US$4.60, to underserved populations in Egypt, Jordan, Sudan and Nigeria.18 The demand for affordable, reliable medical tests in those countries gives the company a fantastic tailwind.

In all of these cases, the sustainability of the company’s business model is central to our long-term investment thesis. Being convinced that a company is contributing to and benefiting from sustainable development is an absolute prerequisite for us to allocate capital.

In the end, rather than there being a dilemma between allocating capital in a socially-productive way and preserving clients’ capital, the two ends are actually perfectly aligned.

It is precisely those companies that are benefiting from sustainability tailwinds that are the ones that are able to survive and thrive, even in tough macroeconomic environments, and thereby ensure clients’ capital is safe.

We believe that a highly selective method and a twin focus on quality and sustainability is the most fruitful approach, for us, to tackle the challenge of allocating capital in emerging markets outside of Asia.

Jack Nelson

December 2020

Subscribe to our updates

To get regular updates and content from Stewart Investors, please register here.

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group