Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Small is beautiful

This rule of thumb was coined in order to combat a common challenge facing teams trying to solve complex problems. In pursuits like investing, there is a tendency to increase the number of people providing input to the point that the team gets bloated and functions less efficiently.

Famously, Jeff Bezos thought that team size ought to be capped by the ‘two pizza rule’; if a team couldn’t be fed with two pizzas, it was too big.

This rule of thumb was coined in order to combat a common challenge facing teams trying to solve complex problems. In pursuits like investing, there is a tendency to increase the number of people providing input to the point that the team gets bloated and functions less efficiently.

Intuitively, we tend to think that adding more people to a process will help it get done more quickly or better. This appealingly simple idea certainly holds for certain types of tasks. If the goal is to dig a hole, the more people helping the better. Many hands make light work, and the hole will undoubtedly get dug faster with a larger team.

Investment, though, is quite a different type of task. Investing is a complex, constantly-evolving problem-solving exercise, where the outcomes attained by individuals and teams are highly dependent on intangible factors like motivation.

"We believe success in investing requires passion and intense curiosity. Without an environment that cultivates these, team members can quickly feel alienated and unmotivated."

Collective ownership

Drilling into the accounts of a Japanese consumer company in a way that yields useful insight requires the analyst to feel that the effort is worth it, in the sense that the work can impact client portfolios directly and meaningfully. Investigating the links between Board members of an Indian IT company and former government ministers is akin to detective work, and if an analyst doesn’t feel determined to get to the bottom of things, both for their own intellectual curiosity and to support client outcomes, he or she is unlikely to do a good job.

It is therefore essential to cultivate a sense of team belonging, a feeling of collective ownership for portfolios and of individual empowerment. These are crucial characteristics which are, in our view, far easier to achieve in a smaller team.

Undoubtedly, greater team size facilitates the gathering of more information. But good investment decisions do not follow automatically or even naturally from more data points. Usually, insight arises not from knowing more than anybody else, but from being able to identify the small handful of very important points from the sea of noise.

A small team is often much better placed than a large team to focus on the few salient points of an investment case.

In most investment cases there are probably four or five central considerations which, in our view, constitute 80% of what one needs to know in order to approach investing: the competence and integrity of management, the sustainability of the business model and its profitability, the quality of the financials and a simple approach to valuation.

But there is almost no end to the amount of extra information one could, if inclined, supposedly seek to bolster the robustness of an investment conclusion.

One very likely outcome in our view, though, is that you end up with a ‘woods for the trees’ situation.

All that extra information serves only to disguise the key points on which the investment ultimately turns.

This is very common because the investment industry has tended to encourage a high degree of specialisation, with analysts providing ‘coverage’ of a particular sector. A sector specialist may be able to value the shares of their allotted companies to the second decimal point, but be unable to undertake meaningful comparative analysis across countries or synthesise insights from indirect sources and other industries.

Big versus small

A small team is often much better placed than a large team to focus on the few salient points of an investment case, and to utilise collective ownership and widely dispersed knowledge.

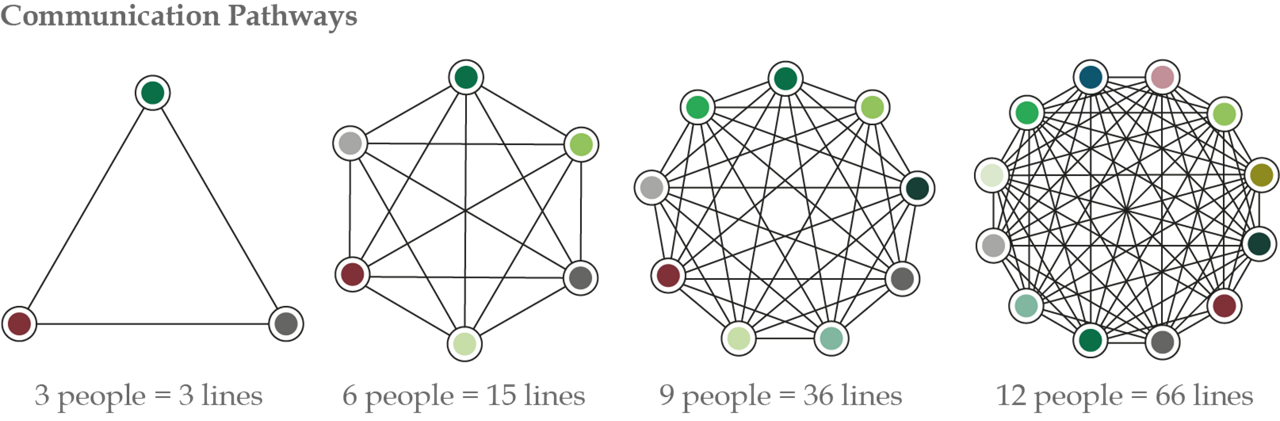

And of course there are obvious acute downsides which come with large teams. With a tight-knit team of three, there are just three relationships – or ‘communication pathways’ in the parlance of psychologists – which the team has to nurture and manage.

But as more members are added, this number grows exponentially. Between six team members, there are 15 relationships. At 12 members, this jumps to 66 links. By the time you have a team of 50 analysts, there are 1,225 different relationships within the team. It is impossible for a team above a certain – quite small – size to be internally cohesive.

In practice, it is very difficult for anyone to maintain strong working relationships with more than a relatively small handful of other investors, especially if these colleagues are spread around the globe. And without a strong sense of mutual respect, trust, and ultimately friendship, robust investment discussions become harder.

The ability of an analyst to take challenging questions on their work and ideas in their stride is greatly aided by having mutual understanding built on many hours of interaction over years. Such strong relations between colleagues are, simply due to the numbers outlined previously, much easier to attain in smaller groups.

Having a voice

And there is a real sense in which an individual in a large team can very often feel that their voice is not easily heard, especially if that person is relatively junior. We know from our own team that when we have in the past tried to have 30-something voices around a table on video-conference, it is nigh-on impossible to discuss constructively a company’s approach to its supply chain or the quality of its accounting.

More junior people, younger people and introverts are far less likely to make their views known in such a setting, denying the team the benefit of their opinion. In such crowd-like environments, it is often the person who speaks loudest or most forthrightly who gets the most air-time, rather than the one who has the most to offer the conversation.

In order to preserve the efficacy of the team’s investment process, we have strived to maintain a structure which enables small teams to thrive. In 2015, the First State Stewart team split to form two separate teams: First State Stewart Asia and Stewart Investors, in order to allow both teams to preserve investment outcomes through reduced team sizes.

The success of Stewart Investors going back to the 1980s has always been built on small, tight-knit investment groups who feel passionately connected to the companies in which they invest and to portfolio outcomes. We will continue to evolve our structure in order to enable small teams to flourish and aim to deliver attractive risk-adjusted returns for clients. For our approach, small remains beautiful.

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Want to know more?

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group