Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Indian Subcontinent All Cap

Launched in 2006, the Stewart Investors Indian All Cap Strategy is a long-term, equity-only strategy that aims to invest in shares of high-quality companies positioned to contribute to, and benefit from, the sustainable development of the region. Given the size of the economy and the investment universe, the majority of the strategy’s 30-60 investments are in Indian-listed companies.

Strategy highlights: a focus on quality and sustainability

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

- Companies must contribute to sustainable development. Portfolio Explorer >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Latest insights

Quarterly update

Strategy update: Q4 2025

Indian Subcontinent All Cap strategy update: 1 October - 31 December 2025

In November 2025, First Sentier Group (FSG) announced a strategic transition of Stewart Investors’ (SI) investment management responsibilities to its affiliate investment team, FSSA Investment Managers (FSSA). This was decided to be in the best interests of our clients, given the significant overlap in SI’s and FSSA’s investment capabilities and our shared history and heritage.

Introducing FSSA Investment Managers

FSSA has been investing in Asia Pacific and Global Emerging Market equities since 1988 as part of the former Stewart Ivory & Company, which subsequently became First State Stewart. After years of organic growth, the First State Stewart team split in two in 2015, leading to the formation of FSSA Investment Managers and Stewart Investors.

Like SI, we are long-term and quality-focused investors. We pay little attention to the index or short-term performance, preferring to focus on generating absolute returns for our clients in the long run. From our research, we aim to construct relatively concentrated portfolios made up of the best ideas that we can find across Asia and emerging markets. As responsible, long-term shareholders, we have integrated sustainability analysis into our investment process and engage extensively with companies on environmental, labour and governance issues.

Following the transition of SI’s portfolios to FSSA, the Stewart Investors Indian Subcontinent portfolio is now being managed by Sree Agarwal and Rizi Mohanty.

Sree Agarwal is a Portfolio Manager at FSSA Investment Managers. He joined the team in 2014 and focuses on India, Australia, and smaller companies research across the Asia region. Sree is the lead manager of the Scottish Oriental Smaller Companies Trust, and the FSSA Indian Subcontinent and FSSA Asian Opportunities strategies. Sree has more than 10 years of investment experience and is based in Singapore.

Rizi Mohanty is a Portfolio Manager at FSSA Investment Managers. He joined the team in 2016 and focuses on the Southeast Asian markets as well as Asia ex-Japan equities more broadly. He is the lead manager of the FSSA ASEAN All Cap and FSSA Asian Growth strategies. Rizi has more than 14 years of investment experience and is based in Hong Kong.

Sree and Rizi are supported by a broader team of investment analysts, with an average of 14 years of investment experience and 8 years tenure with the team. All 15 members of the FSSA investment team are analysts first and foremost, including the portfolio managers, and we spend the majority of our time meeting companies, writing research and seeking quality companies to invest in.

How we invest

FSSA’s investment philosophy, which shares its genesis with SI, has remained broadly unchanged since the First State Stewart team was established in 1988. We focus on identifying quality companies, buying them at a sensible price and holding them for the long term. Most importantly, we invest our clients’ capital as if it were our own. As long-term investors and owners of businesses on behalf of our clients, we look for founders and management teams that act with integrity and risk awareness, and dominant franchises that have the ability to deliver sustainable and predictable returns over the long term.

As a team, we conduct over 1,000 direct company meetings each year across Asia and other emerging markets. The most significant source of investment ideas comes from these company visits and country research trips. We find that our reputation as patient, long-term investors has given us unparalleled access to management, which allows us to gain valuable insights and a thorough understanding of the businesses we want to invest in.

As a result of our long-term time horizon and conservative investment approach, our portfolios – and our performance – can look very different to the index. We shy away from “flavour of the month” themes (such as the current AI-driven boom), and instead look for high-quality companies that can deliver attractive returns for much longer than the market expects – and extend our investment time horizon to capture that advantage. When you own quality businesses, time isn’t a risk – it’s an asset.

Our performance may lag in very buoyant or momentum-driven markets, but we usually compensate very quickly once such bubbles burst. Based on historical data, our long-term track record shows that our portfolios tend to perform better in “normal” markets (-15% to +15% 1-year rolling returns) and bear markets (more than 15% decline), than in steeply rising markets (defined as over 15% 1-year rolling returns).

A smooth transition

Given the significant overlap in SI’s and FSSA’s investment philosophy and portfolios, we know all the holdings well. As part of the transition, we made a few changes to tilt the portfolio towards companies with stronger cash generation, higher returns and better long-term growth prospects.

Below, we highlight a few of the key additions and disposals over the fourth quarter of 2025.

New purchases:

Kotak Mahindra Bank (KMB) is one of India’s leading financial services companies – it has consistently improved the strength of its deposit franchise and maintained better asset quality than peers through the business cycle. While the founder, Uday Kotak, has stepped down from his managing director/CEO role due to the central bank’s limits on leadership terms, he remains closely involved as a board director and should ensure that the bank’s risk awareness and long-term thinking is maintained. Meanwhile, the new CEO (Ashok Vaswani) aspires to grow the business further by focusing on consumer banking and digitisation. We expect to see a growing trend of formalised financial savings, benefiting KMB’s insurance, mutual funds and asset management businesses.

KEI Industries is a leading cables and wires company. The company started as an institutional / tender business, which evolved into a diversified retail franchise. The track record of growth and returns on capital employed has been solid, while customer concentration has reduced and cash conversion has improved. Now, it is focusing on executing the next stage of growth – high-voltage cables and exports. We believe the quality of the business has improved significantly in recent years, and it still has room to grow.

Bosch India is a leading auto-components manufacturer. It was the market leader in fuel injection systems in India, developing new technologies to meet the increasingly stringent Bharat Stage (BS) emission standards in India. This enabled Bosch to maintain its dominant place in the industry (45% - 85% market share across various internal combustion engine (ICE) segments) over several decades. Today, Bosch has evolved to become one of the world’s top EV-component manufacturers. Under the leadership of the new CEO, Bosch is starting to gain market share and improve margins in this space. Bosch globally has invested over €10bn in EV development and maintains significant manufacturing and engineering capacity, including the largest pool of EV engineers in India. We believe it is well positioned for the ongoing EV transition, and it should benefit from rising auto penetration in India – regardless of which auto manufacturer dominates.

Complete sales:

Motilal Oswal Financial Services is a non-bank financial company (NBFC) in India. We sold out of a lower conviction holding to raise cash for better ideas elsewhere.

KPIT Technologies is an Engineering Research & Development company focused on the automotive sector. We sold on account of its expensive valuations and concerns about headwinds for its key customers after a strong period of growth.

CG Power & Industrial makes transformers that are used in power and industrial applications. We believe it is expensively valued for a cyclical business.

Performance and outlook

With our long-term investment time horizon, we tend not to pay much attention to short-term market fluctuations. We invest on at least a three-to-five-year view, though we often hold on to companies for much longer. In an industry rife with short-termism, we believe our long-term approach stands out from the crowd.

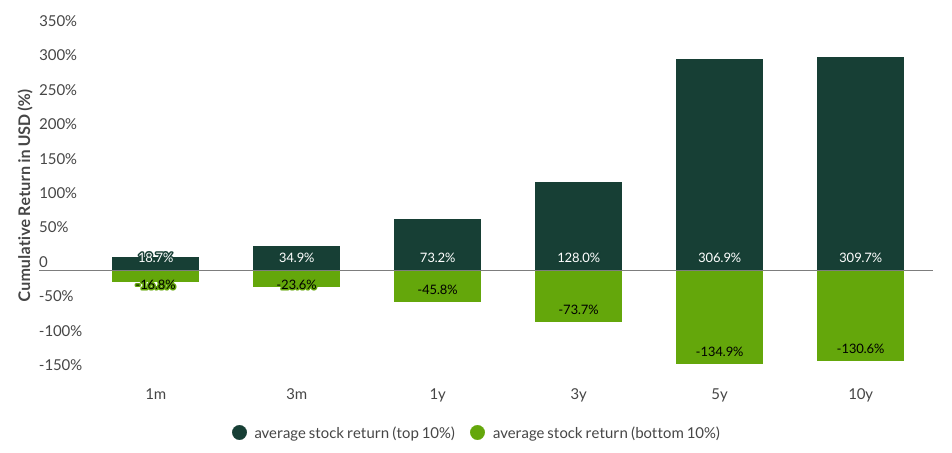

What we have seen, over the past few decades, is that average holding periods for stocks have fallen from over eight years in the 1960s to less than six months today. Yet this shift has come at a cost: it reduces investors’ ability to generate outsized returns that are materially different from the broader market. The reason is simple — as investment horizons shrink, so does the return dispersion between the best- and worst-performing companies. With less time in the market, investors end up tracking the index, not beating it.

Emerging Markets: time horizons matter

MSCI EM Index -dispersion around mean return for top 10% top / bottom stock performers

Source: MSCI Emerging Markets Index, as at 31 May 2025

In a world where markets rise consistently, that might seem like an acceptable outcome. But markets don’t move in straight lines; and in addition to the higher costs and transaction fees that come with frantic trading activity, the bigger issue is that investors miss out on what is far more important – the future value creation that the best companies tend to generate. This is often poorly understood by the market, with many investors simply focusing on the next quarter or year ahead. Yet the real drivers of returns lie in the cash flows that come well beyond that timeframe.

With that context in mind, we highlight the key contributors and detractors from performance over the fourth quarter of 2025.

The largest contributor to performance over the period was CarTrade Tech, a leading online marketplace for new and used vehicles. The platform offers a variety of solutions across the automotive value chain for marketing, buying/selling and financing new and used autos (including cars, 2-wheelers and commercial vehicles) as well as farm and construction equipment. Recent earnings results were solid, with a growing number of monthly visitors to its portal, strong consolidated revenue growth and margin improvement across segments.

Tech Mahindra was the second largest contributor to performance, as it showed solid progress towards its medium-term goals. The management had laid out a clear roadmap to achieve its 2027 strategy, aiming to drive profitable growth, optimise its operational mix and expand its presence in high-value sectors. Having met the new CEO, Mohit Joshi (joined in 2024), and his team on several occasions during a challenging period for the industry, we are confident that Tech Mahindra is becoming a stronger business due to these transformations.

The third largest contributor to performance was Mahindra & Mahindra, the flagship company of the Mahindra group. Since Dr Anish Shah took over as CEO, the group has been reinvigorated, with a greater focus on shareholder returns and strict controls on the capital allocation process. The group has refocused on growing its core businesses – automotive, farm, financial services and IT services – and has exited unprofitable businesses, or those where the opportunity to scale-up significantly was lacking. The group has set ambitious targets for the next five years, and we believe management execution remains on track to deliver robust growth.

On the negative side, Tube Investments of India was the largest detractor from performance, as it reported sluggish business performance and rising competition in the electric vehicle (EV) space. Despite its early mover advantage, Tube has struggled to maintain market share. It plans to arrest these challenges by increasing the number of dealership partners and entering new sub-segments in EV battery packs. On a positive note, the core business is stable with robust returns on capital employed, and it generates healthy free cash flow which is being invested in new businesses with high returns potential. In this endeavour, we are backing the management, particularly Vellayan Subbiah (executive chairman), who has an exceptional track record and has created tremendous value for shareholders.

The second largest detractor was Tarsons Products, a manufacturer of plastic laboratory ware. While recent earnings results were resilient, with first half earnings growing at high-teens along with margin expansion, the company has faced intense competition in the domestic market and declining exports/shipment delays due to US tariff concerns.

Bajaj Holdings & Investment was the third largest detractor, due to concerns about its subsidiary business – Bajaj Finance had declined on concerns about rising credit costs and provisions, an early sign of potential stress in its loans book. That being said, we believe Bajaj should have a long runway of growth, given its ability to build new franchises with high profitability by cross-selling to its customers. While there may be short-term challenges, due to a slowing economy and rising consumer leverage, we believe technology and management execution will enable it to continue to compound in the years to come.

Looking forward

While certain parts of the Indian equity market looks expensively valued, we believe there are still good opportunities for active managers to add value with a disciplined, research-driven approach. India, unlike other emerging markets that are heavily reliant on exports, is largely driven by domestic consumption and investment. This demand base provides a cushion against external shocks and trade disruptions, making India relatively resilient in times of global uncertainty.

This increased purchasing power is transforming several consumer categories. Higher salaries and the availability of credit and financing are making durable goods more accessible, leading to healthy demand across discretionary goods – from air-conditioners to refrigerators, smartphones and two-wheelers. Services too are seeing a boom. As basic needs are met, consumers are starting to spend on private healthcare, travel and entertainment. These categories are all expanding rapidly in India, driven by a more discerning consumer base that is climbing the traditional hierarchy of needs.

With our long-term time horizon, and our focus on quality businesses with sustainable earnings growth, we remain excited about the high-quality companies in India. India’s growth is being underpinned by growing levels of urbanisation, favourable demographics, rising middle-class consumption and a strong digital infrastructure push. We believe the companies we have invested in are at the forefront of this transformation and are well positioned to benefit from these structural tailwinds for years to come.

SFDR Article 9 and FSSA’s approach to sustainability

All SI portfolios will continue to be managed true to label, with due consideration given to SI’s SFDR Article 9 sustainability requirements. Importantly, both FSSA and SI had operated as one team for 27 years (1988-2015) before the decision was made in 2015 to split into two teams. This is heavily reflected in our investment philosophies and processes and our respective approaches to sustainability.

At FSSA, we believe it is everyone’s responsibility to think about sustainability as part of his or her investment decision-making. We don’t use external consultants or environmental, social and governance (ESG) ratings, nor do we outsource the sustainability work to a separate team. In our research, we focus on evaluating the long-term merits of a given investment opportunity. Given that sustainability issues are effectively investment issues, we believe that these challenges and opportunities – and management’s response to them – can have a significant impact on a company’s returns. As such, we look for evidence that the management operates the business effectively and in the interests of all stakeholders – both now and for the longer term.

While issues relating to climate change, or people and communities, are often the ones that get the most attention, most of our company engagements relate to management quality and corporate governance systems, as we believe that good governance is the foundation on which great companies are built. We often engage with management teams on capital allocation and strategy, remuneration structures and succession planning, board diversity and tenure, and ensuring high levels of transparency and company disclosure – to highlight just a few.

For more information on FSSA, or if you have any questions about the transition, please do not hesitate to contact us.

NB Both Stewart Investors and FSSA have been supported by the same centralised Responsible Investment team within the First Sentier Group, who will continue to support FSSA after the transition of SI funds.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2025

Indian Subcontinent All Cap strategy update: 1 July - 30 September 2025

Review: continuity and change

On one level, the third quarter saw significant changes at Stewart Investors. After acting as careful stewards of our clients’ capital over many years, three of our colleagues stepped back from their portfolio-management responsibilities in August and left the business.

While the list of portfolio-management responsibilities within our team looks different now than it did when the quarter began, on a deeper level, nothing has changed: the philosophy and approach that has defined Stewart Investors since 1988 is deeply engrained and continues to define what we do. Our structure is flat. Every member of the investment team is first and foremost an analyst and our collective focus is on identifying high-quality companies, with resilient financials, guided by ambitious stewards. This is the bedrock on which returns from all our strategies have been built.

This strategy’s new lead manager is Jack Nelson. He joined Stewart Investors in 2011 and is also the lead manager of our Global Emerging Markets Leaders and Global Emerging Markets All Cap strategies. He continues to apply the same principles to managing this strategy that have guided it since its launch, working as part of the same tight-knit group of investment analysts and drawing on the same common pool of investment ideas.

India: a question of quality

Over the past quarter, some of our clients questioned our longstanding enthusiasm for investing in India. Given that the Indian stockmarket has been one of the weaker performers among the world’s major markets in 2025, those concerns are understandable. The reasons for the relatively lacklustre returns the Indian market has generated recently have included:

- Concerns that some companies’ share prices may be too high relative to their underlying profits (valuations).

- The potential impact from trade tariffs.

- A slowdown in domestic consumer spending.

- A depreciation of the rupee currency.

Nine months is, of course, far too short a timeframe over which to judge equity performance. Focusing too narrowly on the short term also discounts the compelling returns that many of our investments in India have generated over the past five-to-10 years.

From our perspective, we remain focused on the bottom-up analysis of companies – on their quality, sustainability, and valuations. And, although we recognise the impact that these top-down concerns have had on investor sentiment towards those businesses in the short term, we continue to view India as a compelling destination for long-term investors. We believe investing in high-quality companies addressing the sustainable growth needs of India and monitoring their valuations should yield good returns over the years and decades to come.

In particular, we continue to be excited by the opportunities that are presented by the companies that are seeking to meet demand in India’s large and growing domestic market. We also keep a keen eye on valuations, aware that index valuations are not a fair representation of the investment prospects of the individual companies whose shares we own.

Activity

This quarter, we re-established a position in Tata Consultancy Services (Information Technology). Its shares have fallen by almost a third since the end of 2024.1 Recent increases in the cost of H-1B visas, which US companies use to hire foreign workers – including India’s IT specialists – further weakened sentiment. Set against that, however, this well-stewarded franchise remains a critically important partner for many global companies.

We initiated a position in Mankind Pharma (Health Care), which is known for providing affordable healthcare. We first met this company a year ago during a research trip to India and have developed our understanding of it further over the last 12 months. Mankind’s operations span pharmaceuticals, consumer healthcare, and over-the-counter (OTC) medicines. It also has a particularly strong presence in rural India as well as its smaller cities.

We sold our positions in Tata Communications (Communication Services) and Dr. Reddy’s Laboratories (Health Care). Our conviction in the strength of their franchises had waned and the opportunity cost of holding them relative to our other, stronger investment ideas had increased. We also completed the sale of VST Tillers Tractors (Industrials), which faces increasingly tough competition from cut-price imports.

[1] Source: S&P Capital IQ as of 30 September 2025.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.