Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Global Emerging Markets All Cap

Our Global Emerging Markets All Cap strategy was launched in 2009 and invests in between 30 to 75 high-quality companies that are contributing to a more sustainable future. The strategy’s bottom-up approach allows us to find only the very best businesses from an investable universe of some 65,000 companies. We are looking for companies well positioned to contribute to long-term sustainable development; businesses with high quality management teams, franchises, and financials.

Strategy highlights: a focus on quality and sustainability

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

- Companies must contribute to sustainable development. Portfolio Explorer >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Latest insights

Quarterly update

Strategy update: Q3 2025

Global Emerging Markets All Cap strategy update: 1 July - 30 September 2025

Emerging markets enjoyed another strong quarter. Given that market indices were driven higher by sharp gains for Chinese stocks that are seen as beneficiaries of the artificial intelligence (AI) boom, it is unsurprising that returns from our strategy lagged some way behind those from the benchmark.

Although some of our Chinese holdings, such as Alibaba, performed well, not all of our holdings there are aligned with the AI theme. Such periods of thematically driven exuberance can be challenging for long-term investors in high-quality businesses who are disciplined around valuations. But we know that our philosophy and process have been proven to deliver over the long term. One of our team, Doug Ledingham, recently wrote a piece explaining why we consciously resist the growing pressure to focus on the short term:

“At Stewart Investors, we have always sought to occupy a space that protects our clients’ capital. One of the threats we are striving to protect it from is short-termism: from the incessant distraction provided by 24-hour news, from the temptation to digest every morsel of noise, from the danger of trying to react to every macro data point or tweet, and from the pressure to fixate on quarterly earnings. That’s increasingly important in a world where long-term thinking is in increasingly short supply.”

You can read the rest of the piece here: Slow has all the power: why we invest alongside long-term owners. It helps to explain why we won’t be abandoning our core beliefs as long-term fundamental investors to chase the AI-driven rally in a bid to match returns from the index in the short term.

The long-term outlook for Indian companies remains bright

The quarter saw a continuation of an unhelpful dynamic: the significant outperformance of the Chinese market relative to India, to which this strategy has a significantly higher level of exposure. Despite this, we remain enthusiastic investors in high-quality companies aligned with India’s economic development. So far, this year has seen a reduction in income taxes and a simplification of the Goods and Service Tax (‘GST’) system. The Reserve Bank of India, meanwhile, has been cutting interest rates. So demand is now being supported by both fiscal and monetary loosening.

There is, of course, more to emerging markets than China and India. Recent trip reports from Indonesia, India and the Philippines are available on our Insights page. Having visited South Korea in September, we are increasingly confident in the changes to corporate governance standards that are unfolding in that country. These echo similar reforms seen in Japan and should have positive effects on shareholder returns in Korea and perhaps across the region more widely – a similar mood of reform now seems to be infecting other countries across Asia.

Continuity and change

It would be remiss not to mention the significant changes that have taken place at Stewart Investors over the last quarter. After acting as careful stewards of our clients’ capital over many years, three of our colleagues stepped back from their portfolio-management responsibilities in August and left the business. While the list of portfolio-management responsibilities within our team looks different now than it did when the quarter began, on a deeper level, nothing has changed: the philosophy and approach that has defined Stewart Investors since 1988 is deeply engrained and continues to define what we do. Our structure is flat. Every member of the investment team is first and foremost an analyst and our collective focus is on identifying high-quality companies, with resilient financials, guided by ambitious stewards.

This strategy’s new lead manager is Jack Nelson, who was formerly its co-manager. He joined Stewart Investors in 2011 and is the lead manager of our Global Emerging Markets Leaders strategy. He continues to apply the same principles to managing this strategy that have guided it since its launch, working as part of the same tight-knit group of investment analysts and drawing on the same common pool of investment ideas.

Activity

We added one new holding to the portfolio during the quarter. Ayala (Philippines: Industrials) is a conglomerate owned by the seventh generation of Zóbel de Ayala family. Its interests span property, banking, car dealerships, renewable energy, and retail. Like us, the Zóbel de Ayala family focus on finding long-term growth opportunities. The Philippines appears to be rich in those opportunities. For example, while around half of Filipinos don’t have a bank account, lenders such as Bank of the Philippine Islands (BPI, in which Ayala owns a significant stake) are opening new branches, acquiring new customers and promoting financial inclusion.1 The Philippines has long been out of favour among international investors but we believe that modest valuations and an increasing focus on shareholder returns should see overseas capital returning to the market.

We sold several holdings where we had lost confidence in the quality of our investment thesis. Vitasoy (Hong Kong: Consumer Staples) has struggled with supply-chain issues. This year, however, its shares have rallied in response to rumours that it would be taken into private hands. This seemed to offer a good opportunity for us to move on and reallocate capital to better ideas.

The situation with home appliance manufacturer Zhejiang Supor (China: Consumer Discretionary) has some similarities. A government subsidy programme introduced earlier this year offers Chinese consumers financial incentives to trade in and upgrade their home appliances. This has helped to foster positive sentiment towards Zhejiang Supor. Looking longer term, however, the outlook for its future growth appears to be muted, so the recent swell of positive sentiment appears to be an opportune moment to sell.

Elsewhere, we sold Hoya (Japan: Health Care) which, despite being listed in Japan, sells the majority of its optical products into emerging markets. We also sold Tata Communications (India: Communication Services) and Jerónimo Martins (Portugal: Consumer Staples). In all three cases, these companies’ shares appeared somewhat expensive given the growth on offer. We believe new ideas such as Ayala – as well as our other existing holdings – now represent a better home for our clients’ capital.

[1] Source: World Bank Global Findex database https://databank.worldbank.org/source/global-findex-database. 2024 data for metric: account (% age 15+) which measures the percentage of respondents having an account at a bank or similar financial institution or using a mobile money service.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Voting

Voting: Q3 2025

Global Emerging Markets All Cap voting: 1 July - 30 September 2025

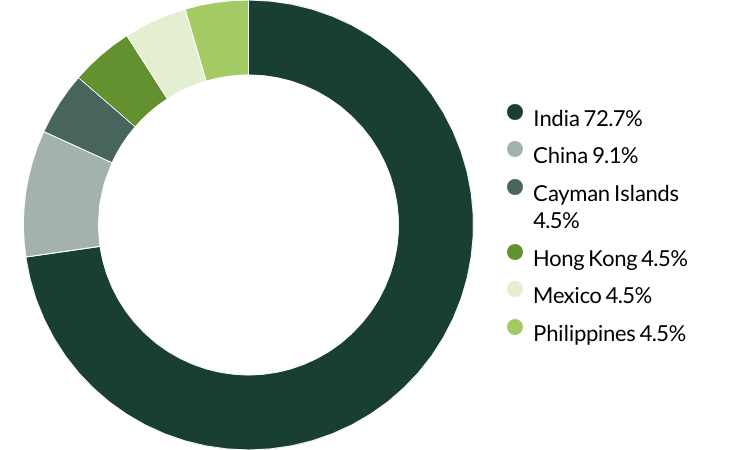

Voting by country of origin

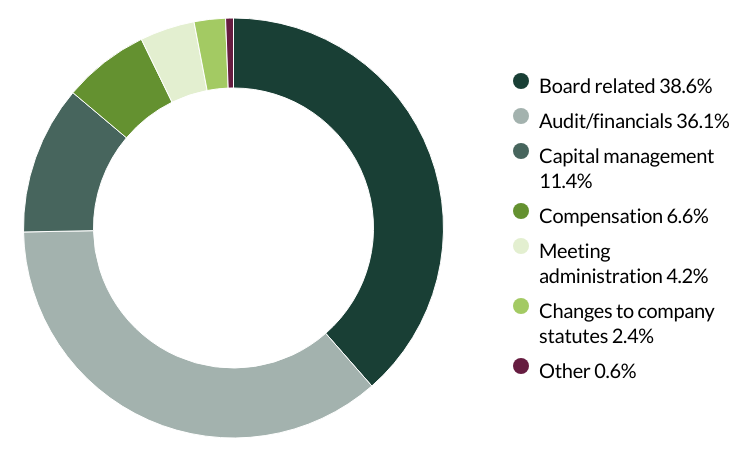

Voting by proposal category

During the quarter there were 166 proposals from 19 companies to vote on. On behalf of our clients, we voted against two proposals.

We voted against a proposal on transaction of business at Philippine Seven, as they did not provide enough information about the proposals. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (one proposal)

We voted against the appointment of the auditor at Vitasoy, as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q2 2025

Global Emerging Markets All Cap voting: 1 April - 30 June 2025

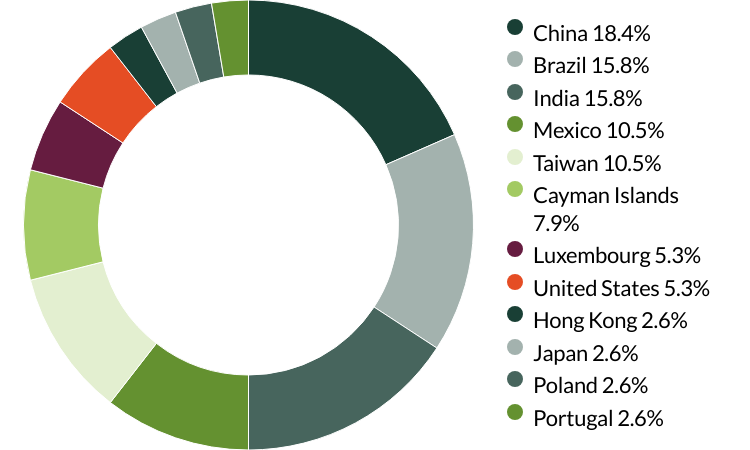

Voting by country of origin

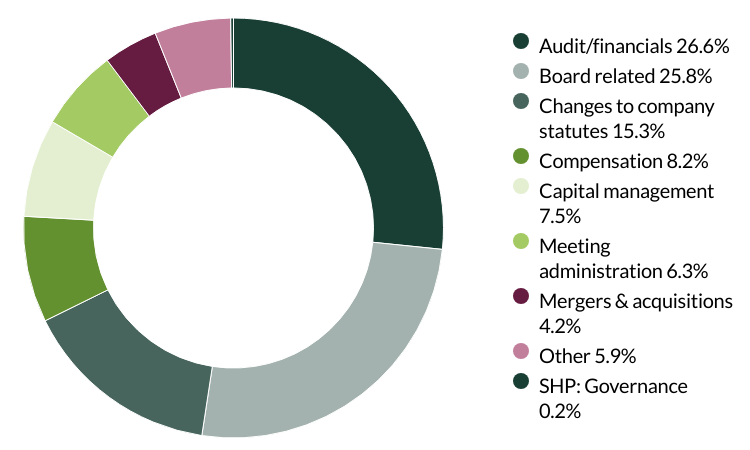

Voting by proposal category

During the quarter there were 477 proposals from 33 companies to vote on. On behalf of our clients, we voted against 11 proposals and abstained from voting on 16 proposals.

We voted against the remuneration report at Dino Polska as we believe the current policy does not encourage executives to focus on long-term goals. Implementing a long-term incentive plan could, along with enhanced disclosure and transparency on the remuneration structure, be beneficial for both the company and its shareholders. (one proposal)

We voted against changing the terms of the board at EPAM Systems as the proposed changes would require all directors to stand for election annually instead of on staggered terms. While we understand the rationale for annual elections, we believe that a staggered approach provides continuity and helps prevent excessive turnover. We also voted against changes to limit the liability of certain officers, as we believe the company has demonstrated its ability to attract and retain an admirable management team under the current structure, which encourages managers to think and act as long-term owners. Finally, we voted against the appointment of the auditor as they have been in place for over 10 years. The company has given no information on rotating its auditors, a practice we believe is important to ensure a fresh perspective is brought to its accounts. (three proposals)

We voted against a proposal at MercadoLibre to move the company’s registration from Delaware to Texas as it did not provide clear reasons for the change, and we do not believe the move aligns with shareholders’ interests. (one proposal)

We voted against the recasting of votes (the ability for voters to change their original votes on a particular matter in response to new information or changes to a proposal) for directors and the supervisory council at RaiaDrogasil. We believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. (two proposals)

We voted against the election of a director at Trip.com due to the company's lack of disclosure regarding director attendance, the number of board meetings held, and the voting results from the previous year. Our aim is to encourage greater transparency and adoption of global governance standards. (one proposal)

We voted against the recasting of votes for the supervisory council at WEG as we believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. We also abstained from voting on a request for a separate board election and the election of a supervisory council position. According to Brazilian voting practices, we are unable to vote for this proposal while simultaneouslysupporting the board in its candidate elections. (two proposals)

We voted against a request for approval to invest in wealth management products at Zhejiang Supor as we believe it carries excessive risk relative to the limited additional returns these products would provide. Making such financial investments is not central to the business and we believe surplus cash is better kept in time deposits at banks. (one proposal)

By supporting the appointment of the auditor at Jerónimo Martins, we abstained from voting on three other proposals related to auditor appointments. (three proposals)

We abstained from voting on proposals relating to the accounts and acts of the board at Regional. At the time of voting, the company had not released its annual report and/or audited financial statements, leaving us without significant information to make an informed decision. (10 proposals)

We abstained from voting on the establishment of a supervisory council at TOTVS as the company had not disclosed which candidates would be up for election to serve on the council. (two proposals)

We voted against a shareholder proposal regarding simple majority voting at EPAM Systems as this topic was already covered by the company's own proposal, which we supported. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q1 2025

Global Emerging Markets All Cap voting: 1 January - 31 March 2025

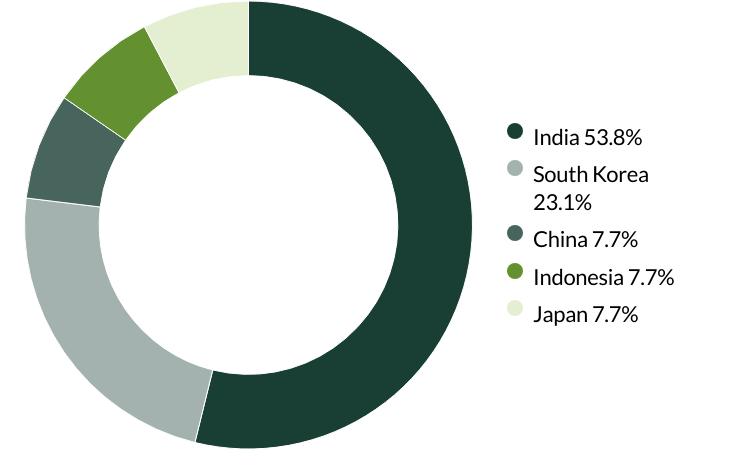

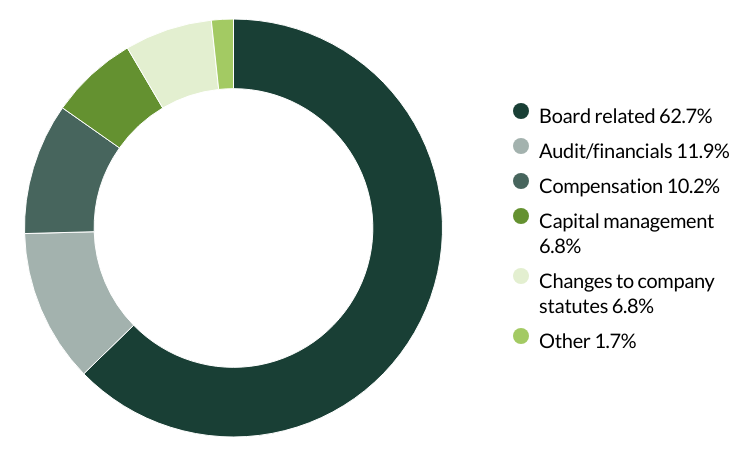

Voting by country of origin

Voting by proposal category

During the quarter there were 59 resolutions from 12 companies to vote on. On behalf of clients, we voted against six resolutions.

We voted against executive remuneration at Bank Central Asia because we believed it was excessive. (one resolution)

We voted against the election of a director and their remuneration at IndiaMART as we seek to encourage greater diversity and independence on the board. (one resolution)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

We voted against the election of the audit committee chair at Unicharm as we do not believe they are independent. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q4 2024

Global Emerging Markets All Cap voting: 1 October - 31 December 2024

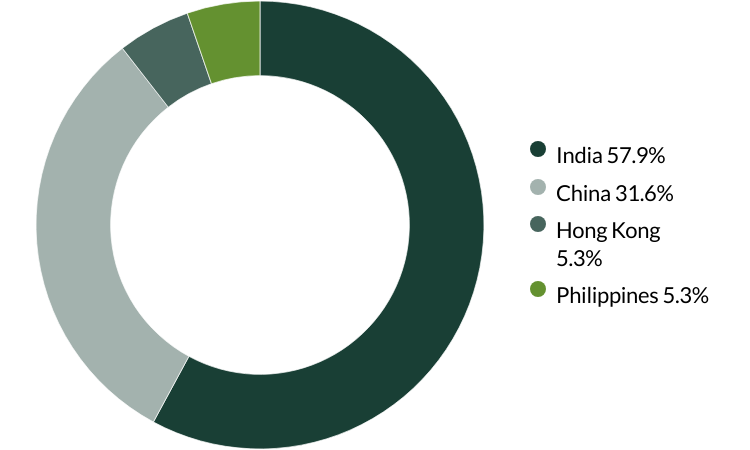

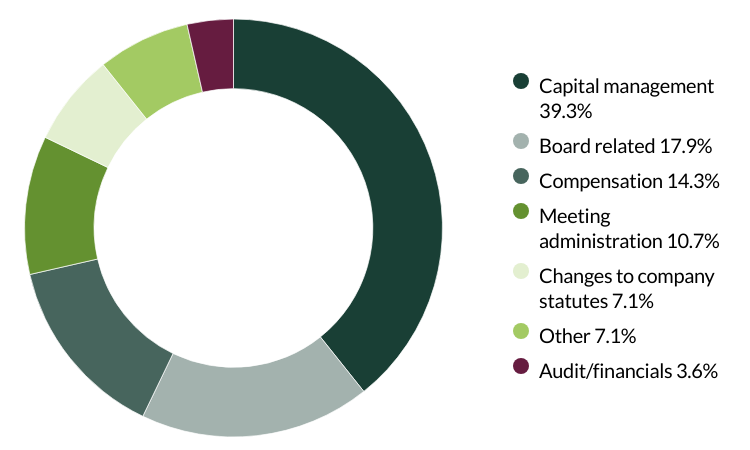

Voting by country of origin

Voting by proposal category

During the quarter there were 28 resolutions from eight companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 September 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.