Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Should your clients quit sugar?

By April 2018, 31 countries will have imposed a tax on sugar to tackle the worldwide epidemic of obesity.

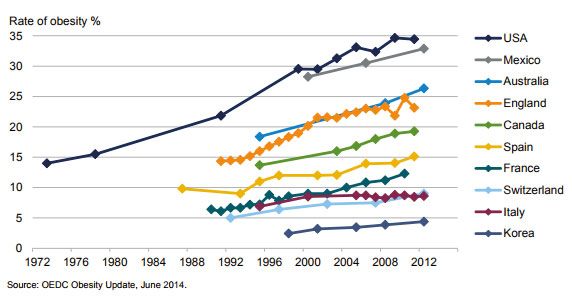

Australia has the third highest obesity growth rate, just behind the United States and Mexico (see chart 1). With 63% of Australian adults either overweight or obese1, and related health costs coming to $14.6 billion per year to treat diabetes alone2, there are renewed calls from medical professionals and health lobby groups for the Federal Government to follow the lead of countries like Mexico, where a new sugar tax has seen the consumption of sugar-laden drinks such as Coke fall.

Australians are becoming increasingly aware about making investment choices that align with their beliefs about sustainability. For clients who have seen similar regulatory changes affect other industries (such as energy and tobacco), a question they might be asking advisers is whether companies with products that are high in sugar are sustainable investments.

Whether it is the introduction of a sugar tax or changing patterns of consumption, these changes pose serious sustainability headwinds for those companies over a long time horizon. On the other hand, companies that are contributing to and benefiting from sustainable development stand to make positive gains.

Lessons from Mexico

Mexico is a useful case study for the case against sugar. In January 2014, the Mexican government implemented a roughly 10% nationwide tax on sugar-sweetened beverages. Since then, the sales of sugary drinks have fallen by 5.5% in 2014 and by 9.7% in 2015.3

As allocators of clients’ capital around the world, we regularly sit down with the management and investor relations teams of companies. During a recent trip to Mexico, a meeting with the Mexican division of Walmart brought to the forefront the question of where the companies in our investible universe fit in the shifting nutritional landscape of Mexico – a question we came back to throughout the trip.

“80% of Mexico’s population in the top cities is within three kilometres or ten minutes of a Walmex store,” the Investor Relations representative of Walmex told us. It was a stunning statistic, and summed up the sheer scale of Walmart de Mexico’s dispersion across the country.

Mexico’s journey along the development trajectory has resulted in a radical change in patterns of food consumption, giving rise to the coexistence of hunger and obesity as two sides of the same coin. This ‘double burden of malnutrition’ is prevalent in middle-income countries across the globe, influenced by income growth coupled with rapid urbanisation. In Mexico in particular, the ramifications have been immense. Roughly a third of the country’s population is now obese, with childhood obesity in particular tripling in a decade. The proportion of obese children in the country is now the highest in the world.4

The scale of the challenge in Mexico is that of a public health crisis. Obesity, and connected diabetes, take a severe toll on those living with the condition and pose an increasing burden on the healthcare system. According to the World Health Organization, diabetes is the leading cause of death in Mexico.5 This is particularly staggering in light of the ubiquitous consumption of carbonated beverages in the country. In 2012, Coca-Cola reported sales of more than two units of Coke products to every man, woman and child in Mexico, every single day.6 Further, obesity and related Type 2 diabetes treatments cost the public health system in the country between $4.3 billion and $5.4 billion a year.7

Chart 1: Rate of obesity, source: OEDC Obesity update, June 2014.

These figures, astonishing as they may seem, closely resemble the growing epidemic of obesity and diabetes in Australia. And while the consumption of Coke hasn’t been rising at the rate of Mexico’s, it’s still high, at one unit every day for every single individual in the country.8

Part of the solution

An encouraging factor that was evident in our meetings with management on this trip was the unquestionable acknowledgment of the problem at hand, and a clear desire to be a part of the ultimate answer. To explicitly admit the extent to which malnutrition is pervasive across society is one of the first steps to addressing the sustainability headwinds that it poses. This was particularly evident in our discussions with FEMSA, which owns the OXXO convenience stores and 48% of Coca-Cola FEMSA. The Investor Relations Manager commented: “We know we are part of the problem, but we also want to be part of the solution.”

Grupo Herdez is another such example. Their core portfolio has long included healthy staple foods such as canned vegetables and tinned tuna, but they have also recently begun to experiment with new ideas such as frozen yoghurt products that are healthy but also fit local tastes, thereby trying to imagine themselves as more holistic wellness brands.

An almost 10% reduction in sugary beverages could potentially mean tens of thousands of fewer cases of diabetes, strokes, heart attacks and deaths in ten years, altering diets especially perhaps of the younger generations, in turn resulting is savings in health care expenditure as well.9

No single arm of society or organisation can solve a challenge of this scale alone. The private sector, by virtue of its scope and pervasiveness, has a vital role to play in developing a sustainable solution to the problem of malnutrition. As such, we continue to aim to allocate clients’ capital to companies that we feel are beginning to realise the necessity improving access to nutritious products, and believe that this is beneficial both for society and long-term investment returns.

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Want to know more?

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group