Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

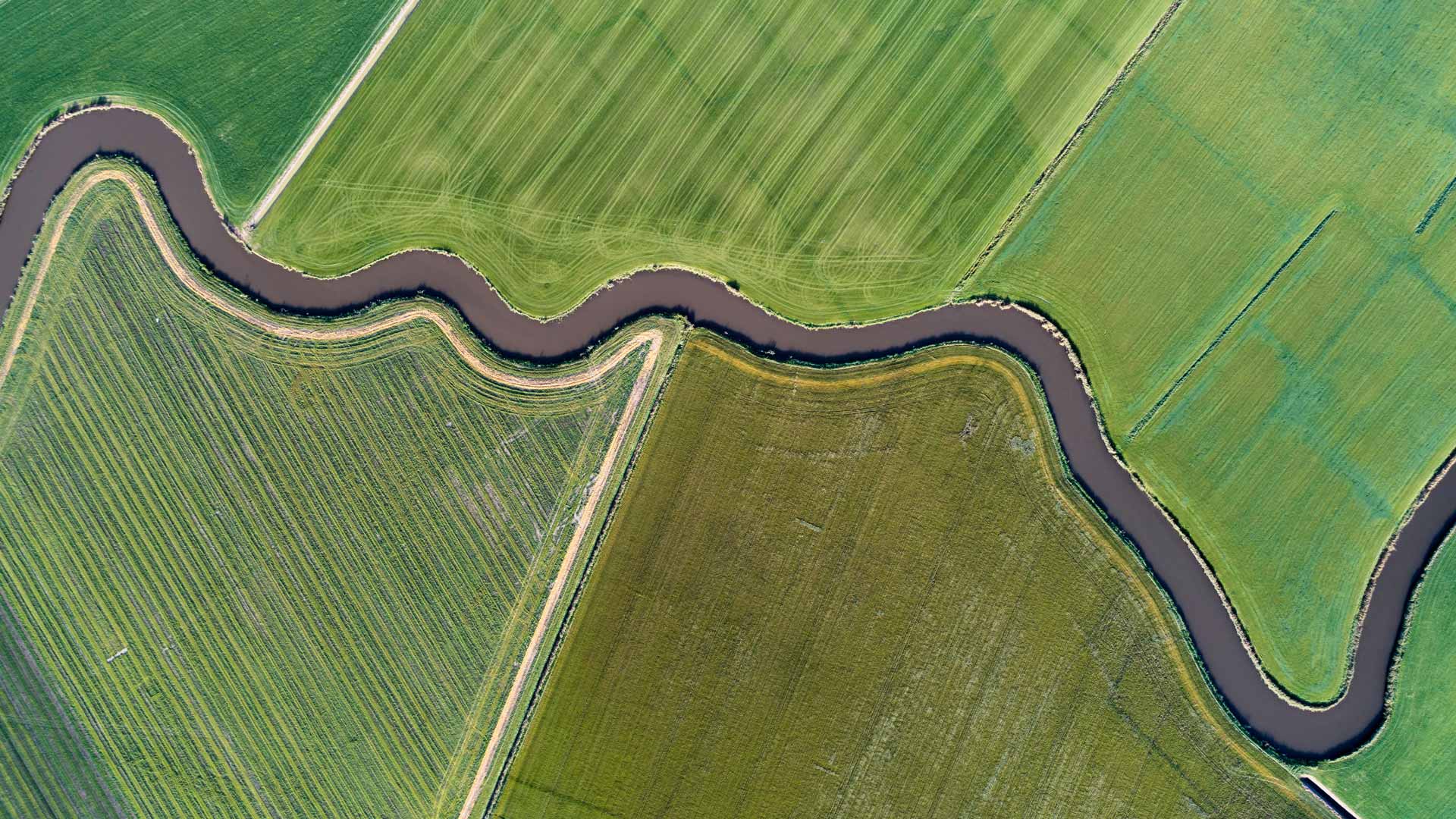

We believe the true drivers of sustainable development are to be found in people and enterprises, from the bottom up.

Take soy milk company Vitasoy1 as an example. Vitasoy is stewarded by the Lo family. The founder Dr. KS Lo sold soy milk door to door as a low cost source of protein from 1940, a time of food shortages and malnutrition in Hong Kong. Over the eight decades since, the company has been managed with competence, humility and integrity, and now provides healthy dairy alternatives in 40 countries.

What Dr. Lo didn’t know back in 1940, was that plant-based proteins like soy milk would one day be vital for managing a different crisis - climate change. Soy results in less than a third of the greenhouse gas emissions of dairy milk, along with a fraction of the land and water use. However, while Vitasoy’s business drives an important climate change solution – plant-rich diets - it is often not categorised as a ‘climate solutions company’ by sustainability researchers.

It is stories, like Vitasoy’s, which show the limitations of top-down, narrowly focused efforts at aggregating sustainability metrics. While we could develop portfolio level metrics and elaborate calculators, which aggregate and quantify the contributions the companies we invest in are making to sustainable development, such an approach would always be heavily laden with assumptions and be driven by abstraction. Has my investment really resulted in 1,000 cars worth of emissions being taken off the road? Or 500 previously excluded people being included in the financial system?

It would also fail to capture the central role the leaders and employees of the companies we invest in play in achieving these outcomes, which also happens to be the question we focus on more than any other – can we trust the stewards of this company to do the right thing with our clients’ capital? Nor would it reflect the bottom-up way we invest, leaving us open to charges of greenwash.

We couldn’t guess at how much less ruminant emissions will be from the growth of soy milk vs dairy in one scenario vs another, or the number of hectares of forest that will be saved thanks to Vitasoy’s plant-based milk sales, but we know the potential is huge. Like colour by numbers, sustainability by numbers forces investors to stay within the lines. This results in the deep interconnections between social and environmental issues being missed, even though we believe, this is where some of the best opportunities that sustainable investment has to offer lie.

Taking a holistic view

A holistic view of sustainable development allows us to better appreciate the many different ways companies can and are contributing to a better future for people and planet.

We have identified credible frameworks which we use to further test and validate the sustainable development contribution of the companies we invest in. While no single framework can capture all the different dimensions of sustainable development, assessing companies against frameworks like Project Drawdown’s c.90 climate change solutions helps inform without dictating what sustainability means. Incidentally, according to Project Drawdown, plant-rich diets can make the fourth largest contribution to achieving a 1.5oC climate outcome2.

In addition to Project Drawdown we have also identified 10 human development pillars, and consider company contributions to the Sustainable Development Goals. Using multiple lenses for viewing companies allows us to look at them from different angles and gain a more complete view of their sustainable development contributions, along with the areas where they need to improve.

Introducing our Portfolio Explorer

In the same way they help us, we believe these perspectives can help our clients and other stakeholders better understand how we invest. The stories of these impactful but imperfect companies also makes sustainable investment real by connecting them to the products and services we consume in our everyday lives. For this reason, we have developed Portfolio Explorer, our new interactive tool.

We believe that Portfolio Explorer is unique as it tells the stories of all the companies we invest in across our regional and global strategies. Importantly, the company descriptions have been written by our investment team and provide a balanced view highlighting both the positive contributions along with the risks and areas for future engagement.

We know that too much information can be as bad as not having enough! So we’ve provided four simple views of our strategies which display companies by their location on the map as well as their contribution to climate change solutions, human development or the Sustainable Development Goals.

Explore companies from the bottom-up - the same way we invest.

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Want to know more?

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group