Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Beyond Due Diligence: A multi-stakeholder approach to responsible mineral sourcing

An insight into our collaborative engagement on conflict minerals in the semiconductor supply chain.

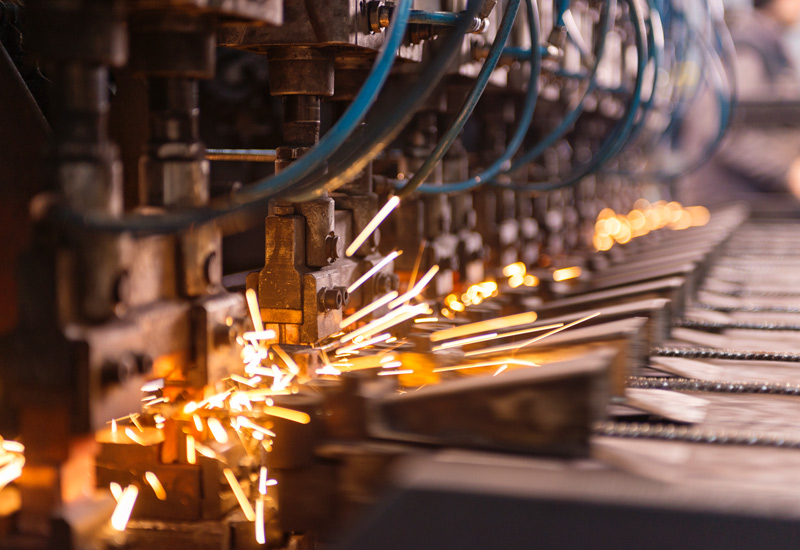

The production of everything from our personal electronics to the green technologies helping the transition to a lower carbon future rely on a number of key ingredients; tin, tantalum, tungsten, cobalt and gold. These minerals, collectively known as “conflict minerals" derive their name from the fact they are mined predominantly in fragile regions, vulnerable to political instability and violence, including sub-Saharan Africa, Southeast Asia, and South America.

The African Great Lakes region, and specifically countries including the Democratic Republic of the Congo (DRC), Rwanda, and Burundi, have significant reserves of these minerals. In fact the DRC has almost half of the world’s total reserves of Cobalt at an estimated four million metric tons1. Together with Rwanda, the DRC also produces nearly half the world’s coltan, from which tantalum is derived, as well as a significant share of global tin and tungsten ores. These minerals are known to be extracted from areas where armed groups and criminal networks vie for control, which has led to exploitation, violence, forced labour, and extrajudicial killings.

The issue of conflict minerals first received international attention in 2010 with the introduction of the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act, which required companies to determine the source of these minerals and disclose. Despite the implementation of such due diligence measures, according to a recent report by Global Witness, "tainted minerals" continue to enter international supply chains, contributing to violence and child exploitation in the DRC.

Artisanal mining, which is often informal and unregulated, is common in the DRC and it is a source of livelihood for many, particularly people living in rural areas where alternative employment is limited. Of the 2 million people actively involved in mining in the DRC, an estimated 250,000 of these are classed as artisanal miners. These workers, which estimates include up to 40,000 children, are often exposed to violence and exploitation, forced to work in unsupported and unventilated pits with no more than basic hand tools. Injuries, collapse and deaths are common. The electronics industry, which relies heavily on these minerals, has come under increasing scrutiny in recent years for allegedly turning a blind eye to these human rights abuses, as well as the environmental impacts associated with the sourcing of these minerals.2

The DRC is the world's largest producer of cobalt, accounting for over 70% of global production. Whilst some manufacturers have implemented due diligence measures and established certification schemes, it is still challenging to ensure that minerals sourced from conflict-affected areas do not enter global supply chains, not least because these minerals pass through multiple intermediaries before reaching their final destinations.

China is the world's largest consumer of the majority of the minerals produced in the DRC, including cobalt, copper and coltan, and despite being a signatory to the Organisation for Economic Co-operation and Development’s (OECD) Due Diligence Guidance, has faced criticism for its lack of transparency and oversight. Chinese owned companies also account for a significant proportion of the smelters and refineries that process these minerals, in fact China’s share of the global production of these critical materials has become overwhelmingly dominant, at more than 80% for tungsten and roughly 90% for antimony3. According to the Responsible Minerals Initiative (RMI) an estimated 90% of the cobalt that enters the markets is refined by Chinese SORs which only adds to the difficulties of traceability4.

In addition to addressing the significant human cost, responsible mineral sourcing is also crucial for reducing the environmental impacts of mining. The extraction and processing of minerals and metals can have significant environmental impacts, including deforestation, water pollution from the use of toxic chemicals including mercury and cyanide, and greenhouse gas emissions.

Due to their reliance on lithium-ion batteries, many green technologies such as electric vehicles and renewable energy systems also rely heavily on these minerals and other rare earth elements. While these technologies offer significant benefits in terms of reducing greenhouse gas emissions and combating climate change, it is important to ensure that their production does not come at the expense of environmental protection and human rights.

Whilst efforts have been made to ensure that global mineral supply chains are free from conflict minerals, there are still significant challenges in ensuring that minerals sourced from conflict-affected areas do not enter global supply chains. It is clear that the mining and production of these minerals continues to come at a significant human and environmental costs, particularly in conflict-affected areas like the DRC.

As investors, consumers and citizens, we all have a role to play. Addressing this problem will require a coordinated effort from all stakeholders and improving transparency in the supply chain is a critical first step. In response, at the end of 2021 we launched the collaborative engagement: Tackling conflict mineral content in the semiconductor supply chain. This initiative was supported by 160 signatories amounting to US$6.59 trillion of assets. Since then it continues to attract more interest from a number of large financial institutions.

The demand for minerals and metals used in electronics and green technologies is growing rapidly, however, addressing the root causes of the problem will also require a long-term commitment to promoting sustainable development in the DRC and surrounding countries. This includes investing in infrastructure, education, and healthcare, and supporting responsible mining practices that prioritise the well-being of workers and the environment.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, Realindex Investments and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), Realindex Investments (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.