Get the right experience for you. Please select your location and investor type.

European (ex UK) All Cap

Investing in 30-45 companies in Europe (excluding the UK), the strategy was launched in January 2022.

We invest in companies that we consider to be the very best sustainability companies in Europe. These businesses have strong and competitive franchises, exceptional people and distinctive cultures, and resilient financials. Individually and collectively they are solving difficult problems, meeting critical needs, and helping bring about a more sustainable future.

By focusing on the highest quality and best sustainability companies in Europe, we believe we can offer an exciting portfolio that stands out from the crowd.

For European investors this strategy is available in our VCC but due to regional differences includes UK companies.

Why invest in European companies?

World-leading sustainability companies

- Europe has a large listed universe, including world-leading health care, clean energy, manufacturing and IT companies

- Many of these companies have large and growing end-markets, including in many emerging economies, and a strong presence globally and locally

Exceptional people and cultures

- Many companies are run by outstanding management teams and are often controlled by long-term stewards – foundations, families and entrepreneurs

- Europe has a high concentration of companies with strong cultures, great franchises, and healthy balance sheets and financial characteristics

Sustainability tailwinds

- Social norms, policies and regulations are often favourable for companies advancing sustainable technologies and solutions

- European companies are known and respected for setting high standards

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Voting

Voting: Q2 2025

European (ex UK) All Cap voting : 1 April - 30 June 2025

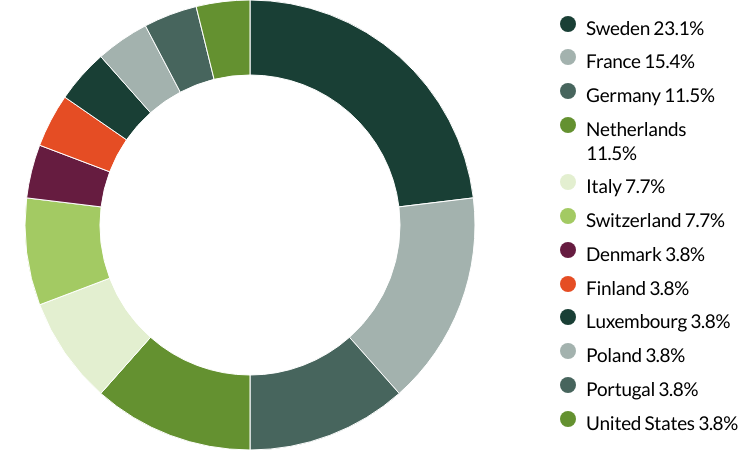

Voting by country of origin

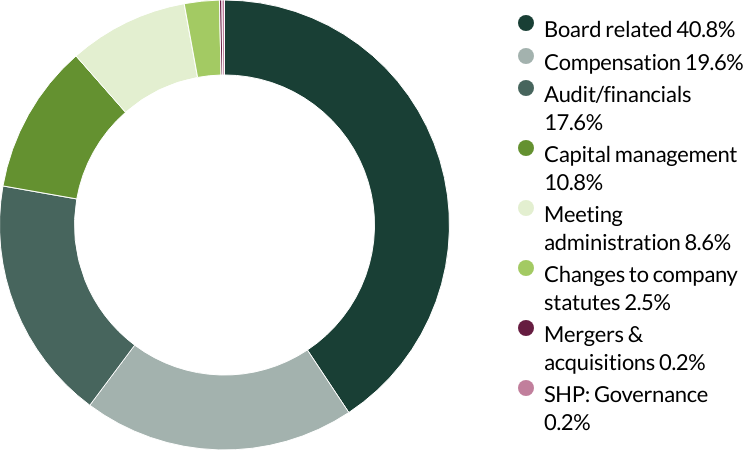

Voting by proposal category

During the quarter there were 560 proposals from 25 companies to vote on. On behalf of our clients, we voted against eight proposals and abstained from voting on four proposals.

We voted against proposals on transaction of business at Alcon and INFICON, as they did not provide enough information about the proposals. We wanted to avoid giving unrestricted decision-making power without sufficient clarity. (two proposals)

We voted against the remuneration report at Dino Polska as we believe the current policy does not encourage executives to focus on long-term goals. Implementing a long-term incentive plan, along with enhanced disclosure and transparency on the remuneration structure could be beneficial for both the company and its shareholders. (one proposal)

We voted against changing the terms of the board at EPAM Systems as the proposed changes would require all directors to stand for election annually instead of on staggered terms. While we understand the rationale for annual elections, we believe that a staggered approach provides continuity and helps prevent excessive turnover. We also voted against changes to limit the liability of certain officers, as we believe the company has demonstrated its ability to attract and retain an admirable management team under the current structure, which encourages managers to think and act as long-term owners. Finally, we voted against the appointment of the auditor as they have been in place for over 10 years. The company has given no information on rotating its auditors, a practice we believe is important to ensure a fresh perspective is brought to its accounts. (three proposals)

We voted against the election of an employee shareholder representative at Nexans. With two candidates standing for election, we chose to support the candidate who was elected by employees who are registered shareholders and was also the board's preferred candidate, due to their international experience as a corporate officer. (one proposal)

We abstained from voting on amendments to articles (rules and regulations that govern the company's operations) at bioMérieux as the company did not provide enough information on the amendments. (one proposal)

By supporting the appointment of the auditor at Jerónimo Martins, we abstained from voting on three other proposals related to auditor appointments. (three proposals)

We voted against a shareholder proposal regarding simple majority voting at EPAM Systems as this topic was already covered by the company's own proposal, which we supported. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q1 2025

European (ex UK) All Cap voting : 1 January - 31 March 2025

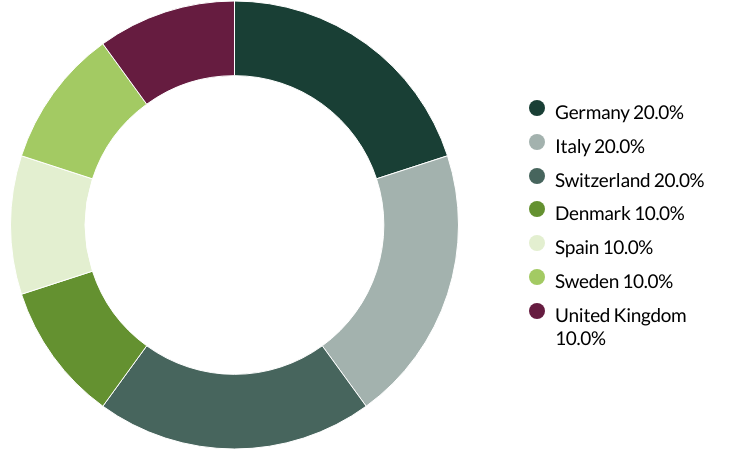

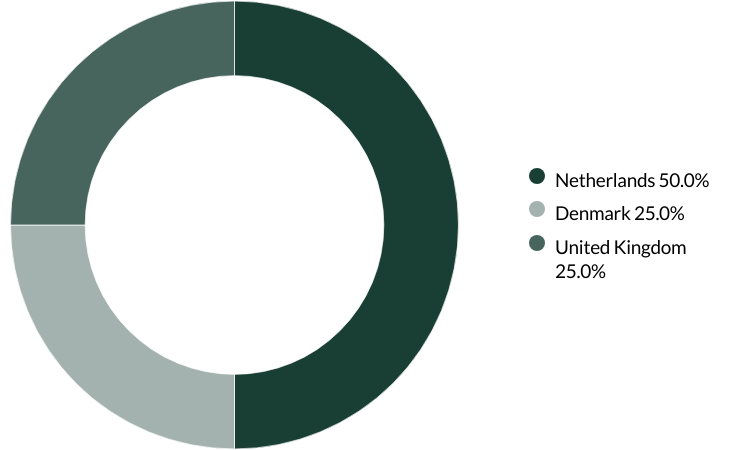

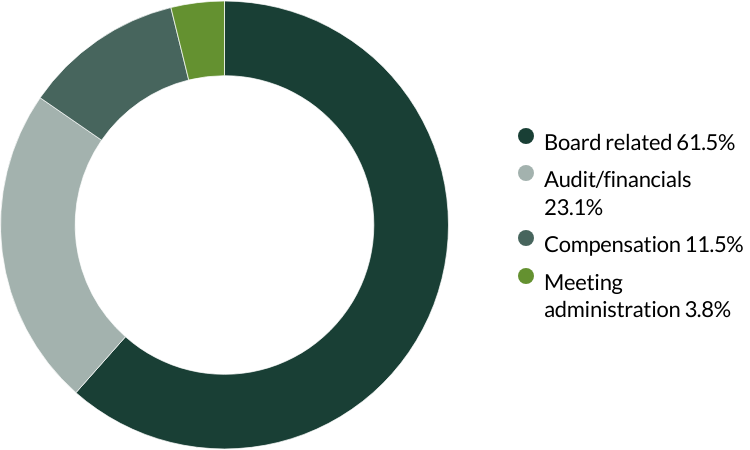

Voting by country of origin

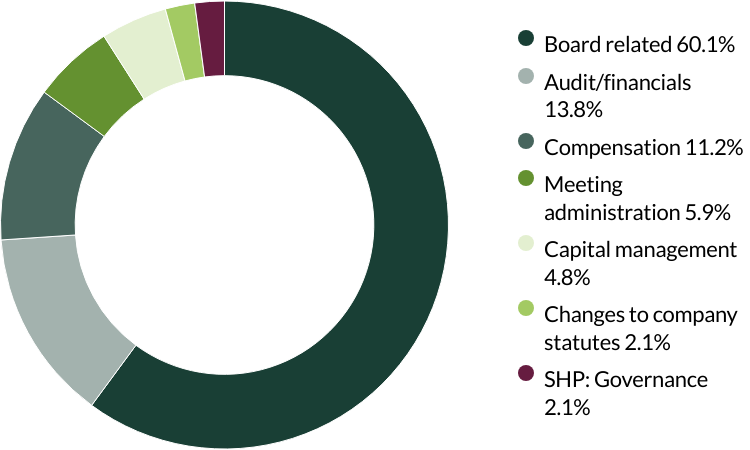

Voting by proposal category

During the quarter there were 188 resolutions from 10 companies to vote on. On behalf of clients, we voted against nine resolutions.

We voted against a proposal on transaction of business at Sika, as they did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (one resolution)

We voted against three shareholder proposals at Handelsbanken regarding banking identification security improvements and changes to dividend payment schedules. We believe management is best positioned to manage security risks and decide on dividend payments. (three resolutions)

We voted against a shareholder proposal requesting shareholder approval to recruit and appoint candidates to the shareholders committee at Ringkjøbing Landbobank. The committee is a channel for recruiting board members, and we believe the board are best placed to identity the skills and experiences required for this committee and future board appointments. (one resolution)

We voted against executive remuneration and the remuneration report at Roche as we believe executive pay is high and there is a lack of metrics to determine and/or justify those awards. We voted against a proposal on transaction of business as the company did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (four resolutions).

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q4 2024

European (ex UK) All Cap voting : 1 October - 31 December 2024

Voting by country of origin

Voting by proposal category

During the quarter there were 26 resolutions from four companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q3 2024

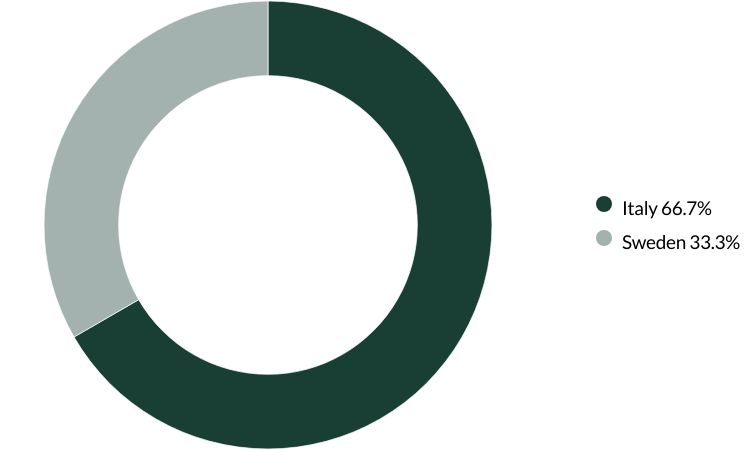

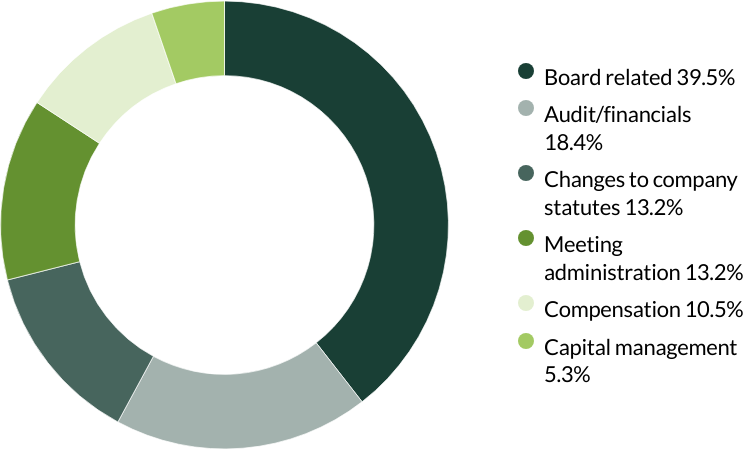

European (ex UK) All Cap voting : 1 July - 30 September 2024

Voting by country of origin

Voting by proposal category

During the quarter there were 38 resolutions from two companies to vote on. On behalf of clients, we voted against two resolutions.

We voted against proposals related to amendments to articles (rules and regulations that govern the company's operations) at DiaSorin as the company did not provide enough information on the amendments. (two resolutions*)

*The same proposal was voted on different stock lines.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, European All Cap Strategy, European (ex UK) All Cap Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 June 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.