Get the right experience for you. Please select your location and investor type.

Worldwide All Cap

An unconstrained investment strategy that invests in companies across the world which are positioned to contribute to, and benefit from, sustainable development.

Download overviewOur Worldwide All Cap strategy was launched in November 2012. It is an unconstrained investment strategy, by which we mean it is not restricted to certain countries, and is able to invest in between 40-60 companies all over the world. As with all of our strategies, we are interested in finding only the very best businesses; those with high quality management teams, franchises, and financials, that are well positioned to contribute to, and benefit from, sustainable development.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q2 2025

Worldwide All Cap strategy update: 1 April - 30 June 2025

Draw a circle around Asia on a world map and it would look relatively small in comparison to the rest of the globe. That circle, however, would contain more than four billion people – roughly half of the world’s population. In addition to China and India, it also contains Taiwan, one of the world’s most technologically advanced economies, the dynamic economy of the Philippines and Indonesia, the world’s fourth most populous nation1

Despite that, returns from companies in the United States tend to play a dominant role in driving returns from global market indices and, as such, the US is a key area of focus for many investors. At Stewart Investors, however, we start by looking at companies first, rather than at the index: we construct our portfolios from the bottom up. Our heritage of investing in Asian and emerging markets means we can pay full attention to companies in countries with healthy domestic markets and abundant growth opportunities. One advantage of being able to think in genuinely global terms is that we can find diversified sources of growth that are less dependent on the actions of any one politician or on the economic fortunes of a single country. We simply look for what we believe to be the highest quality companies in the world and seek to hold them for the long term.

We added five new holdings over the quarter. Ayala (Philippines: Industrials) is one of the Philippines’ oldest conglomerates, with a history dating back to 1834. Over the past two centuries it has evolved into a diversified holding company with a strong presence across a range of industries including real estate, banking and finance, telecoms, energy, and infrastructure. These businesses all benefit from the long-term growth of the Philippines but Ayala is also finding new growth opportunities in areas such as renewable energy, health, and logistics. The founding family still provides guidance, stewardship and a long-term perspective.

RaiaDrogasil (Brazil: Consumer Staples) is Latin America’s largest chain of drugstores, operating over 3,000 pharmacies across all 27 Brazilian states2. Thanks to its size, it enjoys significant economies of scale. It passes the resulting savings onto its customers, allowing it both to increase access to medicines and to grow its share of what remains a fragmented market. Although the three founding families retain control, it is run by professional managers, creating a combination of stewardship and competence that should enable it to grow for years to come.

Glodon (China: Information Technology) specialises in providing digital solutions to the construction industry. Its founder retains a substantial share of the business he started in 1998 and he continues to advise on its strategic development. Glodon has become dominant in its market by combining a cash-generative business model with a long-term approach to decision-making that has seen it continually reinvesting in technology and distribution. Although construction is a cyclical industry, Glodon is poised to benefit from two underlying trends: China’s construction companies are becoming more focused on resource efficiency and they are increasingly adopting 3D design software.

Indutrade (Sweden: Industrials) specialises in acquiring and then developing technology and industrial companies. The group consists of over 200 underlying businesses spread across engineering, infrastructure, life sciences, energy and water, and technology segments. The cashflows generated by businesses across the group are reinvested in acquiring new companies, providing a powerful motor for compound growth. The Lundberg family’s investment company continues to be Indutrade’s largest shareholder, providing long-term stewardship.

Techtronic Industries (Hong Kong: Industrials) is a global leader in cordless technology for power tools, outdoor equipment, and floorcare products. The strength of its internationally recognised brands such as Hoover, Ryobi and Milwaukee gives it strong pricing power. Techtronic is also playing a key role in moving users away from fossil fuels and towards more energy-efficient tools.

To fund these purchases, we sold our holdings in Texas Instruments (United States: Information Technology), KLA (United States: Information Technology) and Hoya (Japan: Health Care) in view of the potential impact that a global trade war would have on the semiconductor industry, to which all these companies have some degree of exposure. We also reduced our position in TSMC (Taiwan: Information Technology).

We sold Nemetschek (Germany: Information Technology), partly due to its valuation and partly because we could see more compelling investment opportunities elsewhere. Finally, we sold Rentokil Initial (United Kingdom: Industrials) following its change of CEO and in recognition of the challenges it faces in integrating Terminix.

Uncertainty around trade tariffs and associated worries about inflation and geopolitical instability remain a headache for many of the companies that dominate global benchmark indices. Despite this, we are still able to find opportunities to invest in growing, resilient companies. Being unconstrained by a benchmark allows us to seize those opportunities wherever they arise. At a time of rapid economic and geopolitical change, we continue to apply our investment philosophy consistently, focusing on companies with those qualities that we believe drive returns over our investment horizon: exceptional cultures, strong franchises, and resilient financials.

[1] Source: International Monetary Fund - World Economic Outlook (April 2025).

[2] Source: RaiaDrogasil Q4 2024 Presentation.

Case Study: Diploma

Listing: London Stock Exchange

Market cap: GBP6.5 billion1

Held since: June 2020

Company description

While based in the UK, Diploma is an international group of businesses supplying specialised technical products and services across three core segments: controls, seals, and life sciences. With operations in over 30 countries and more than 3,000 employees, Diploma plays a critical role in supporting a range of industries, from healthcare and environmental technologies through to aerospace and industrial manufacturing2.

Investment rationale

As supply chains worldwide come under increasing pressure, Diploma has established an attractive niche by focusing on essential components and consumables. These are often critical to the functioning of its customers’ operations but typically represent only a small portion of their total costs. This means Diploma’s products are deeply embedded in its customers’ workflows and demand for them is both resilient and relatively insensitive to price fluctuations. Its global footprint is extensive, with a strong presence in North America, Europe, and Australasia. This reach is complemented by deep local expertise and technical support, which help to build customer loyalty and drive market penetration.

Its portfolio is diversified across three areas:

- Seals: supplying sealing solutions for the heavy machinery used in the construction, mining, and energy sectors.

- Controls: providing connectors, fasteners, and control devices for applications in aerospace, defence, and the medical field.

- Life sciences: delivering medical devices and consumables to healthcare providers and laboratories, supporting diagnoses and treatment.

Diploma’s decentralised business model fosters entrepreneurial spirit and accountability within its operating units, allowing them to remain agile and responsive to market needs. At the same time, it provides strategic oversight and capital, shielding those businesses from the short-term pressure that public markets can apply and promoting long-term value creation. Under the leadership of CEO Johnny Thompson, who took the helm in 2019, and CFO Chris Davies, who joined in 2022, Diploma has delivered impressive results. Since 2019, its sales have more than doubled, while its gross profits and cashflows have tripled3.

It takes a strategic approach to M&A, targeting complementary businesses that can enhance its existing capabilities and accelerate organic expansion. Rather than pursuing scale for its own sake, it focuses on finding businesses that can strengthen its technical expertise and deepen its customer relationships.

The company’s sustainability framework, Delivering Value Responsibly, places a strong emphasis on talent and culture, viewing both as essential enablers of its strategy. A clear sense of identity and its disciplined approach to growth are reinforced by a thoughtful remuneration structure that aligns incentives with long-term performance.

What could go wrong? / Risks

The main risks facing Diploma include problems acquiring and then integrating good businesses and its exposure to cyclical industries could introduce a degree of volatility to its revenues.

[1] Source: S&P Capital IQ as of 30 June 2025.

[2] Source: Diploma Annual Report 2024.

[3] Source: S&P Capital IQ as of 30 June 2025.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q1 2025

Worldwide All Cap strategy update: 1 January - 31 March 2025

“Only two things make up a railroad: a track and a locomotive.” Amid the constant barrage of news about tariffs, trade wars and geopolitical realignment, this recent comment – by the chief financial officer (CFO) of one of our companies – provided a timely reminder that things are sometimes simple. It also underscored why we are glad to be bottom-up investors. Through all the noise of the first quarter of 2025, we focused on finding companies with experience in navigating unpredictable political and economic storms and who keep their eyes firmly fixed on their long-term goals.

We added four new holdings over the quarter. The first, Cintas (United States: Industrials), began its life in 1929, just as the Great Depression began, by collecting old rags from factories, washing them and then selling them on. Since then, it has grown to become a leading provider of corporate uniforms and related business services, specialising in uniform rental, workplace cleaning and first aid and safety products. It combines the benefits of scale with a local presence across to provide value and excellent service to its customers across the United States.

Mahindra & Mahindra (India: Consumer Discretionary) is a company in which our Asian strategies have been long-term investors, recognising its combination of excellent stewardship and its ability to both contribute to and benefit from sustainable development in India. We believe Mahindra & Mahindra still has plenty of room to grow by leveraging its dominance in the agricultural sector to expand its tractor business, capitalising on the increasing demand for electric vehicles, diversifying its financial offerings to tap into the growth of India’s middle class and reinvesting today’s cashflows in nurturing new businesses and expanding its global footprint.

BDO Unibank (Philippines: Financials) is the largest bank in the Philippines, where it has excellent opportunities for growth. Financial inclusion in the Philippines remains low and the bank is expanding its digital services to reach both the unbanked and underbanked. It benefits from being part of the larger SM Group and from its extensive branch network, through which it offers a comprehensive suite of financial services. We believe BDO Unibank’s shares trade on an attractive valuation, particularly if we consider the strong economic fundamentals of the Philippines and the opportunities the bank has to grow.

Finally, Air Liquide (France: Materials) is a global leader in supplying gases, technology and services to companies across a wide range of sectors including healthcare, chemicals, manufacturing, electronics and food and beverages. It operates in a highly consolidated market and its long-term inflation-linked contracts should help cushion it from any volatility in the wider economy. Meanwhile, the increasing use of hydrogen gives it an opportunity to grow.

To fund these purchases, we sold our holdings in six companies during the quarter. In the case of three – Nordson (United States: Industrials), MonotaRO (Japan: Industrials) and Zebra Technologies (United States: Information Technology) – they had performed well but we began to have concerns over their future growth. We also sold Tata Communications (India: Communication Services) after reassessing the balance between risk and opportunity.

Lastly, we sold the remainder of our holdings in two health-related companies: CSL (Australia: Health Care) and Novonesis (Denmark: Materials). Both had been excellent performers for us but a combination of elevated valuations and the growth expectations they implied prompted us to look elsewhere.

We continue to find opportunities to invest in the shares of reasonably valued companies worldwide that we believe can (profitably) help to solve a range of development challenges. Being unconstrained by a benchmark allows us to seize those opportunities wherever they arise. At a time of rapid economic and geopolitical change, we continue to apply our investment philosophy consistently and to focus on the things that we believe matter over our investment timeframe. As for what comes next? Another comment from the CFO we quoted earlier encapsulates our view: “there’s only one way to go in rail, and that’s forward!”

Case Study: Halma

Listing: London Stock Exchange

Market cap: GBP10 billion1

Held in fund since: March 2020

Company description

Halma is a global group of companies who develop innovative safety, health and environmental technologies aimed at enhancing quality of life and protecting people and the planet. Its stated purpose is “to grow a safer, cleaner, healthier future for everyone, every day.”

Why do we like it? / Investment rationale

In a world in which the importance of health and safety is rightly receiving increased attention, a relatively unknown UK engineering company has been quietly innovating and saving lives for more than 50 years. It has also consistently reinvested cashflows and generated compound returns for its shareholders. Since its foundation in 1972 by David Barber and Mike Arthur, Halma has combined strategic long-term vision with underlying purpose – a combination that still holds true today.

From its early years, Halma has focused on developing innovative safety solutions for industry. Not only has it gained a reputation for quality and reliability, it has also developed a distinctive business model along the way. Key to that business model is the acquisition of niche companies. Halma is a disciplined buyer, targeting well-run small-to-medium-sized companies whose technologies are helping solve some of the world’s most pressing challenges and keeping people safer, cleaner and healthier. Over 50 years on from its founding, Halma consists of nearly 50 companies and employs over 8000 people in over 20 countries.2

- In safety… businesses include Firetrace, which automatically detects and suppresses fires in high-risk equipment.

- In environmental analysis… businesses include Deep Trekker, whose cutting-edge underwater robotics make maintaining offshore wind farms easier.

- In healthcare… businesses include PeriGen, which monitors more than 600,000 births a year, tracking foetal heart rate and labour progression to provide early warnings if things start going wrong. According to the WHO, over 800 women and one million newborns die each year due to preventable causes during pregnancy and childbirth3. After the PeriGen technology was introduced into a regional hospital in central Africa, the mortality rate was reduced by more than 80%.4

By supporting the management of the businesses it acquires and allowing a brand to grow even after the original founder steps away, Halma has steadily built a reputation as a ‘good owner’. This has helped make it the preferred buyer for many founders. This, in turn, has supported Halma’s organic growth and given its shareholders access to the cashflows of businesses that would otherwise have remained in private hands.

Halma’s focus is on growing the market and providing value to its customers by acquiring niche companies, rather than trying to take market share from competitors. Using its internal cashflows to buy companies in areas in which it is already an expert, reduces risk and increases the chances of generating enduring returns. Over the past 20 years, it has grown its cashflows by 12% per annum and its earnings per share by 13% per annum5, as it continues to make good on its long-term vision.

With future growth supported by structural developments such as growing safety regulation, increasing demand for healthcare and clean water and efforts to address climate change and pollution, we see no reason why Halma’s growth can’t continue for at least another 50 years.

What could go wrong? / Risks

The chief risks facing Halma include the levels of debt on its balance sheet, a degradation of its ability to acquire good companies and the potential for product-related failures.

[1] Source: S&P Capital IQ as of 31 March 2025.

[2] https://www.halma.com/who-we-are

[3] https://www.who.int/news-room/fact-sheets/detail/maternal-mortality

[4] https://www.halma.com/our-impact/protecting-mothers-and-babies-during-childbirth

[5] Halma annual accounts between March 2004 and March 2024 as reported by FactSet.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q4 2024

Worldwide All Cap strategy update: 1 October - 31 December 2024

“We are allocating our own money, we act like owners.”1 It’s always pleasing to meet with a company that thinks similarly to us. We are stewards of our clients’ capital, and one key tenet of our Hippocratic Oath is “We will not forget in our search for returns that the primary risk faced by our clients is losing their capital”. The oath underpins our investment philosophy, which is based on identifying quality stewards of strong franchises with good long-term growth prospects.

During the quarter we bought six new companies and the quote above is from a meeting with the company management of the first of them. Brown & Brown (United States: Financials) was founded in 1939 and is still stewarded by the Brown family. Over the past 85 years, the competent, ambitious and long-term management team has enabled it to grow beyond its Florida base to become the sixth largest insurance broker2 in the United States. The company has also been expanding to Asia and Europe and given the fragmented nature of the insurance brokerage industry, there is plenty more room to grow in the decades ahead.

Mining equipment manufacturer, Epiroc (Sweden: Industrials), started life over 150 years ago as part of another Swedish company, Atlas Copco, and was spun out as a separate company in 2018. Their equipment makes it easier and safer to mine the metals that are essential for the functioning of modern society, including the energy transition. They have a solid and long-tenured management team, led by CEO Helena Hedblom, who have delivered growth historically and have positioned the company well for the future.

Nexans (France: Industrials) makes cables for a variety of uses including buildings and energy grids. The need for electrification creates a strong growth driver as more cables are needed to connect diverse energy sources as well as upgrading existing grids. We have watched Nexans for some time and took the opportunity of an attractive valuation to enter a position.

Wabtec (United States: Industrials) is a leading provider of components for rail transportation and can trace its roots back over 100 years. The rail industry is as important now as it was then, as it plays a crucial role in reducing global emissions through both freight and passenger transportation. Rising investment in rail infrastructure along with increasing market share and improving profit margins provide compelling growth drivers over the long term.

KLA Corporation (United States: Information Technology) make inspection tools for the semiconductor industry. These help chip manufacturers control their processes, maximise their output of finished chips and reduce waste. Due to their essential position in the semiconductor manufacturing process, KLA have been able to compound returns solidly over many years generating strong cash-flows and consistent growth.

With household names such as Advil, Sensodyne and Centrum, Haleon (United Kingdom: Consumer Staples) was formed by a merger of the consumer health divisions of GlaxoSmithKline, Novartis and Pfizer in 2022. Providing necessary products to customers is a business model that we always appreciate for its ability to produce consistent cash-flows and to be defensive throughout a market cycle. With healthy profit margins and strong market position, we believe Haleon has the quality needed to contribute to the strategy.

The new positions were funded by selling five companies where we have concerns about the strength of their franchises.

Tecan (Switzerland: Health Care) and Sartorius (Germany: Health Care) have both struggled over the past few years due to a slowdown in investment into biotechnology. Despite seeing green shoots of growth elsewhere in healthcare, these two companies are still struggling, from lack of visibility in customer orders, exposure to China and increasing competition.

We fully exited from our position in Unicharm (Japan: Consumer Staples) due to lack of conviction that Asian consumer markets will provide a large enough growth opportunity in the future. We also sold Shimano (Japan: Consumer Discretionary) due to concerns about their valuation in the face of increased competition from electric bikes. Finally, we sold A. O. Smith (United States: Industrials) as its growth potential faces persistent challenges in its core markets of the US and China.

In the past quarter the US election has taken place, sending Donald Trump back to the White House along with a Republican Party majority in the House of Representatives and the Senate. There have been many column inches written about taxes, tariffs and other general speculation about what the incoming administration might do. We don’t have any insights into the workings of a Trump presidency, instead, we focus on finding companies that are adept at navigating difficult situations and practised at generating growth from the opportunities in front of them. Another tenet of our Hippocratic Oath is “We will strive to achieve, through hard work, sober analysis and sound judgement, the best risk-adjusted returns possible for our clients.” This focus means we will continue to seek companies, like Brown & Brown, who we believe will be excellent stewards of our clients’ savings.

[1] Source: Stewart Investors company meeting with Brown & Brown, February 2024.

[2] Source: Brown & Brown website - https://www.bbrown.com/us/about/

Case Study: WEG

Listing: Brasil Bolsa Balcão

Market cap: US$37bn1

Held in fund since: November 2012

Company description

WEG manufactures electrical products, including energy efficient motors, transformers, turbines and generators. Its production facilities span 17 countries and produce around 19 million motors every year.2

Why do we like it? / Investment rationale

In 1961, a young electrician, mechanic and administrator founded the electric motor company to which they lent their initials: Werner Ricardo Voigt, Eggon João da Silva and Geraldo Werninghaus.

Today, WEG produces electrical products, including motors, for end markets as broad as industrial automation, power generation and distribution, and large electric vehicles. While the second generation of the three founding families remain majority shareholders, it is run by long-tenured managers. The new CEO, Alberto Yoshikazu Kuba, is only the fourth in WEG’s history; he joined the business in 2002, aged 24. He exemplifies how much of WEG’s success derives from a culture built over 65 years.

WEG is a vertically integrated company; they make every element of every product themselves, and even source packaging from their own forest. This helps them supply customers with more customised, hard-to-replace motors. While it is less efficient than outsourcing and slows the rate of capacity expansion, it has a critical advantage for WEG: it empowers them to take market share when competitors are paralysed by supply chain snarl-ups. WEG’s self-sufficiency is helping them supply transformers to electricity-hungry data centres, even as competitors face a four-year delay in building additional capacity.3

Doing more with less, under their own steam, is in WEG’s DNA. Vertical integration also limits production waste. In Brazil, WEG collect and recycle older motors at the end of their life and recycle them along with production scrap metal. In this sense, WEG’s operations mirror their products’ functionality: efficiency. WEG’s motors help customers both reduce their energy requirements and reduce their greenhouse gas emissions. They are even used in dramatic sustainability solutions such as the Kaleshwaram Lift Irrigation Project which helps address water shortages in India. WEG’s motors will help move 240 thousand million cubic feet of water, greater than the volume of Lake Michigan, over 500 kilometres into northern India.4

Operational excellence undergirds WEG’s stable profitability, despite some cyclicality in sales growth. WEG’s balance sheet features a high cash balance to allow for the opportunistic purchase of raw materials when supply chains are fraught, and for acquisitive growth in the international business. We are excited to see where WEG’s conservatism and continuous innovation take the company next.

What could go wrong? / Risks

Risks facing WEG include raw material prices, competition from Chinese and Indian manufacturers, and cyclicality in its end markets.

[1] As of 7.1.25.

[2] 2023 integrated report - https://api.mziq.com/mzfilemanager/v2/d/50c1bd3e-8ac6-42d9-884f-b9d69f690602/b96ceffc-95bf-5115-8eec-72fbc563ea72?origin=1. Production facilities as of 31.12.23; WEG in Numbers | WEG.

[3] World’s largest transformer maker warns of supply crunch’; Financial Times article, 3.11.24.

[4] WEG supply for Kaleshwaram irrigation project. 240 thousand cubic feet = 1.63 cubic miles. Lake Michigan is 1,180 cubic miles by volume: Lake Michigan: How Big Is It? - The Environmental Literacy Council.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2024

Worldwide All Cap strategy update: 1 July - 30 September 2024

The quarter has seen some market turbulence, driven by uncertainty over interest rates and geopolitical developments, as well as emerging questions over the ability of the largest technology stocks to continue their upwards trajectory. The strong focus on technology, and particularly artificial intelligence (AI), over the past year means that other sectors have been neglected. As a result, we believe there are many quality stocks that are now attractively priced for long-term growth, most of them addressing problems in the real world.

We bought four new positions during the quarter, all in the industrials sector, but with very different end customer markets and applications.

Rentokil Initial (United Kingdom: Industrials) is a global leader in pest control services, a necessary and critical health and hygiene service to secure homes, hospitals and businesses against disease and damage. Its business model is fundamentally local in nature and generates lots of cash through resilient, recurring sales. The management team is focused on growth by increasing the density of its route network, and so driving improvements in profitability and earnings.

Applied Industrial Technologies (United States: Industrials) is one of the largest distributors of industrial motion and control technologies in the United States. Its products are used in end applications such as power transmission, fluid power, flow control and other industrial processes that help its customers be more productive and efficient and do more with less. It has a strong brand, well-poised to leverage its scale and customer network for growth as the world becomes increasingly automated.

ESAB Corporation (United States: Industrials) sells gas control equipment, welding equipment and particularly the metal alloys that are required for welding. Welding is not only a foundation technology to support the modern world, without welding there would be no buildings or trains, but it also plays a key role in supporting the green transition through its use in wind turbines and other green infrastructure. Its strength in supplying the metal alloys means they generate a lot of cash from recurring sales, which supports its balance sheet and allows it to invest in new business opportunities.

Simpson Manufacturing (United States: Industrials) make connectors, fastening systems, adhesives and speciality chemicals that connect, strengthen and support the joints within wooden and concrete structures. Its end customers are construction companies which rely on high-quality parts to comply with building codes and regulations. Its products make buildings stronger and safer, improving their ability to withstand extreme weather events, which are becoming more common as the planet warms.

The acquisitions were funded by two divestments during the quarter. Coloplast (Denmark: Health Care) makes ostomy bags and wound care products. We had started reducing the position last quarter due to valuation and decided to exit completely due to potential challenges facing a recent acquisition. Natura (Brazil: Consumer Staples) sells beauty and personal care products. We have held Natura in the strategy for many years as a company with long-term owners that embedded sustainability into their business model from the early days and had international expansion opportunities ahead of it. They acquired Avon in 2022 which ultimately proved more difficult to integrate and turn around than we anticipated, and we have taken the decision to invest in better opportunities elsewhere.

We are always looking at new companies and recently visited Sweden to meet with some new and some old businesses. These included Atlas Copco (Sweden: Industrials), the world's leading manufacturer of air compressors, and access solutions provider Assa Abloy (Sweden: Industrials), both of which are held in the strategy. The opportunity to meet with company management on their ‘home turf’ is invaluable; it is much easier to get a sense of how culture and people have shaped a company and its future return profile when sitting within their offices; or, in the case of Atlas Copco, 20 metres below their office in a test mine. We continue to find excellent investment ideas by focussing on the impact that outstanding people can have on businesses with strong franchises and resilient financials.

Case Study: Atlas Copco

Listing: Nasdaq Stockholm

Market cap: US$83bn1

Held in fund since: September 2020

Company description

Founded in 1873 to make products for Sweden’s railways, Atlas Copco is a multinational provider of industrial solutions including air compressors, vacuum pumps, and tools. It derives 70% of its sales from outside Europe.2

Why do we like it? / Investment rationale

Atlas Copco was named after the mythological Titan who carries the sky on his shoulders; such lofty etymology highlights the ambition, determination and passion that has driven this company over 151 years. Beginning with one of the three original founders of the business, André Wallenberg, Atlas Copco continues to be stewarded by the Wallenberg family, and benefitted from their support during two difficult periods in the 1880s and 1930s when the business pivoted from railway products to diesel motors and, finally, air compressors.

Atlas Copco’s end markets are well-diversified, ranging from manufacturers of semiconductors, automobiles, food and beverage, and pharmaceuticals. The product portfolio is formidable, but Atlas Copco’s key innovation was the development of energy-saving variable-speed drive compressors in 1994, which are still iterated today using new software and sensors to optimise performance. The latest version saves a further 11% of CO2 emissions compared to their predecessors, and as much as 90% of the energy used can be recovered for use in heating or steam.3 Further innovations in dry air compressors – critical in the manufacture of electronics – exemplify the rewards of Atlas Copco’s sustained research and development (R&D) spending, which was 4% of sales in 2023.4

As innovative as Atlas Copco’s new products are, their closeness to customers allows them to seize the opportunity of finding new applications for existing products such as the use of an oil-free air compressor to create ‘bubble curtains’ around offshore wind developments. This reduces underwater noise by over 90% to protect marine wildlife.5

Much of Atlas Copco’s innovation has been spurred by the decentralised model. This splits the business into divisions and smaller business units, which are entrusted with autonomy and accountability for their own profit-and-loss statement, as well as customer engagement. An internal job market and strong encouragement of internal mobility – including internationally – has built a strong culture, whether employees are based in Stockholm or Manila. Testament to this is the enduring tenure of both the CEO Vagner Rego (25 years) and the CFO Peter Kinnart (31 years).

With a relatively asset-light business model and outsourced manufacturing, Atlas Copco’s cash flows are stabilised by recurring servicing and aftermarket revenues. Ongoing acquisitions into new technologies should complement organic growth opportunities within industrial electrification and digitalisation, setting Atlas Copco up for another 150 years.

What could go wrong? / Risks

Atlas Copco faces the risk that worsening macroeconomic conditions may reduce customer budgets and propensity to spend. There is also the risk of intensifying competition from Chinese companies.

1 As of 19.9.24.

2 CapIQ.

3 No waste - low emissons - Atlas Copco Group

4 Keeping it dry - Atlas Copco Group. R&D spend – S&P Capital IQ.

5 Oil-free bubble curtains protecting marine life - Atlas Copco UK.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Voting

Voting: Q2 2025

Worldwide All Cap voting: 1 April - 30 June 2025

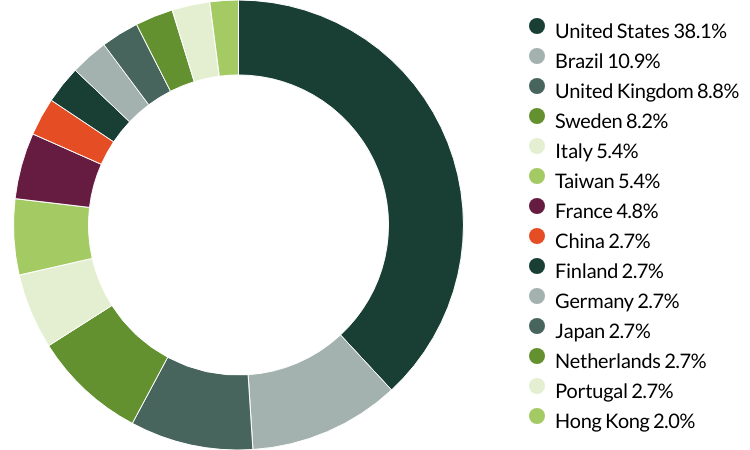

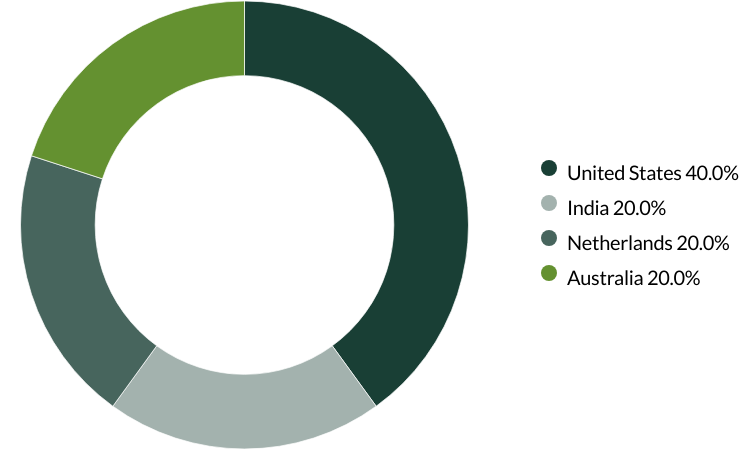

Voting by country of origin

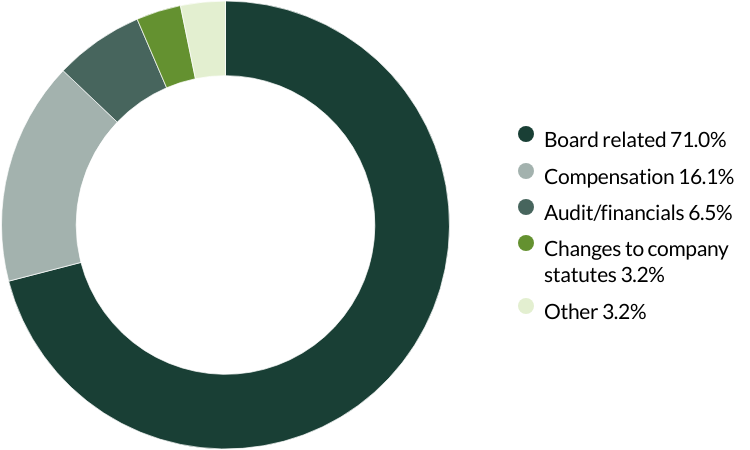

Voting by proposal category

During the quarter there were 546 proposals from 35 companies to vote on. On behalf of our clients, we voted against 20 proposals and abstained from voting on four proposals.

We voted against the appointment of the auditor at Arista Networks, Brown & Brown, Edwards Lifesciences, Fortinet, Glodon, Markel, Roper Technologies, Texas Instruments, Veeva Systems and Westinghouse Air Brake Technologies Corporation (Wabtec) as they have been in place for over 10 years. The companies have given no information on rotating their auditors, a practice we believe is important to ensure a fresh perspective is brought to their accounts. (10 proposals)

We voted against changing the terms of the board at EPAM Systems as the proposed changes would require all directors to stand for election annually instead of on staggered terms. While we understand the rationale for annual elections, we believe that a staggered approach provides continuity and helps prevent excessive turnover. We also voted against changes to limit the liability of certain officers, as we believe the company has demonstrated its ability to attract and retain an admirable management team under the current structure, which encourages managers to think and act as long-term owners. Finally, we voted against the appointment of the auditor as they have been in place for over 10 years. The company has given no information on rotating its auditor, something we believe is important to ensure a fresh perspective on their accounts. (three proposals)

We voted against the election of an employee shareholder representative at Nexans. With two candidates standing for election, we chose to support the candidate who was elected by employees who are registered shareholders and was also the board's preferred candidate, due to their international experience as a corporate officer. (one proposal)

We voted against the recasting of votes (the ability for voters to change their original votes on a particular matter in response to new information or changes to a proposal) for directors and the supervisory council at RaiaDrogasil. We believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. (two proposals)

We abstained from voting on proposals at Rentokil Initial that would grant the company the authority to issue shares as it did not disclose the reasons for the issuance. Without clearer information regarding the potential capacity expansion and/or acquisition for which this issuance is intended, it is difficult for investors to assess the potential value creation and strategic fit of such an investment. (three proposals)

We voted against the recasting of votes for the supervisory council at WEG as we believe the principle of recasting votes for an amended group of candidates is poor practice and would prefer the group to be resubmitted for voting. We also abstained from voting on a request for a separate board election and the election of a supervisory council position. According to Brazilian voting practices, we are unable to vote for this proposal while simultaneously supporting the board in its candidate elections. (two proposals)

We voted against a shareholder proposal regarding simple majority voting at EPAM Systems as this topic was already covered by the company's own proposal, which we supported. (one proposal)

We voted against a shareholder proposal requesting that an independent director serve as chair of the board at Fortinet. We continue to support the current CEO and chair of the board. (one proposal)

We voted against a shareholder proposal regarding simple majority voting at Markel as we support the stewards of the company. (one proposal)

We supported a shareholder proposal regarding greenhouse gas (GHG) emissions disclosure at Markel to encourage improved transparency and better disclosure of relevant emissions data. (one proposal)

We supported a shareholder proposal regarding the right to call a special meeting at Texas Instruments as we believe that a stock ownership threshold of 10% to call a meeting is appropriate, considering the company’s size and shareholder base. (one proposal)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q1 2025

Worldwide All Cap proxy voting: 1 January - 31 March 2025

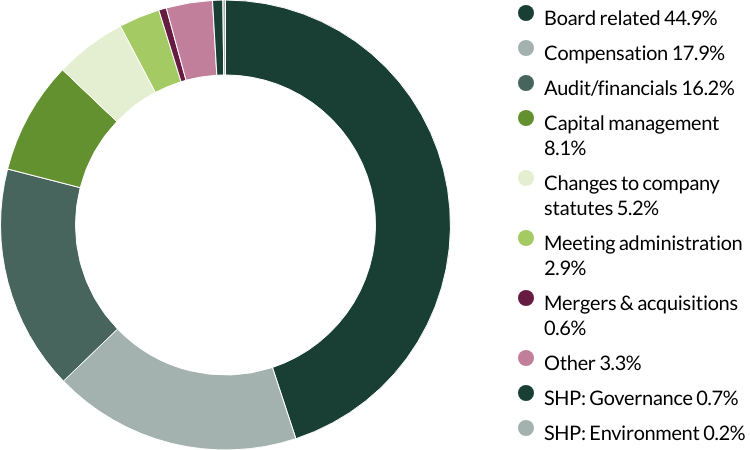

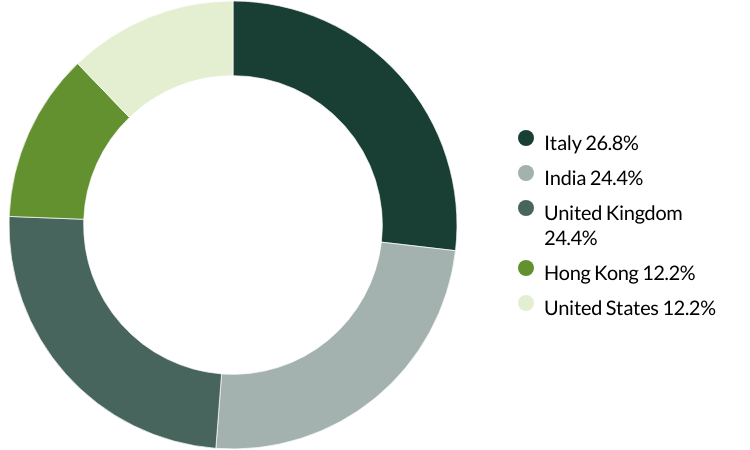

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 114 resolutions from eight companies to vote on. On behalf of clients, we voted against eight resolutions.

We voted against the remuneration policy at Diploma as we believe the increase in short-term (annual) bonus incentive does not encourage long term decision making. (one resolution)

We voted against executive remuneration and the remuneration report at Roche as we believe amounts paid to executives is high and lacks key metrics to determine and/or justify the amounts. We voted against a proposal on transaction of business as the company did not provide enough information about the proposal. We wanted to avoid giving them unrestricted decision-making power without sufficient clarity. (four resolutions)

We voted against the election of two directors and an audit committee member at Samsung Electronics as we do not believe them to be truly independent. (three resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q4 2024

Worldwide All Cap proxy voting: 1 October - 31 December 2024

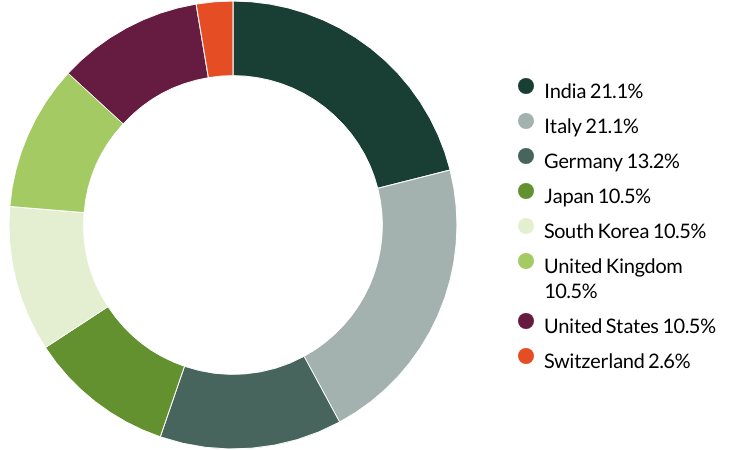

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 31 resolutions from five companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Voting: Q3 2024

Worldwide All Cap proxy voting: 1 July - 30 September 2024

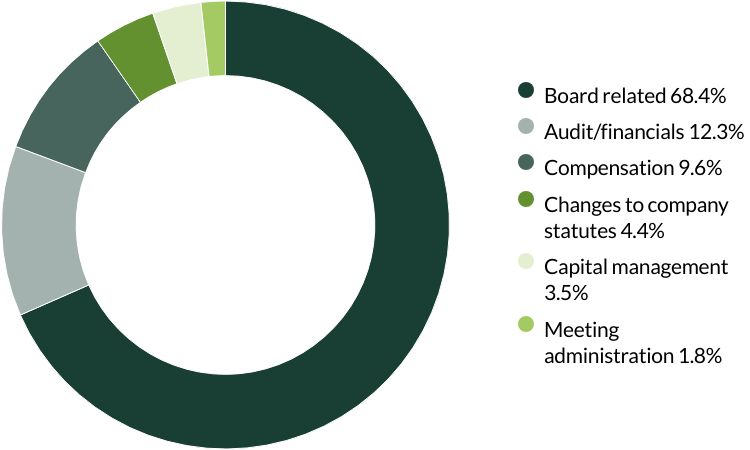

Proxy voting by country of origin

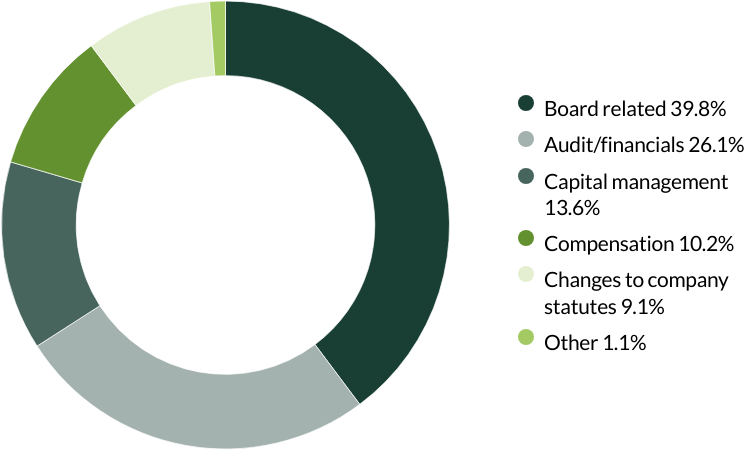

Proxy voting by proposal category

During the quarter there were 88 resolutions from seven companies to vote on. On behalf of clients, we voted against seven resolutions.

We voted against the appointment of the auditor at Advanced Drainage Systems as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one resolution)

We voted against remuneration motions at Ashtead Group as we were concerned about excesses in CEO salary. (two resolutions)

We voted against proposals related to amendments to articles (rules and regulations that govern the company's operations) at DiaSorin as the company did not provide enough information on the amendments. (three resolutions*)

We voted against the appointment of the auditor at Vitasoy as they have been in place for over ten years. The company has given no information on intended rotation which we believe is important for ensuring a fresh perspective on the accounts. (one resolution)

*The same proposal was voted on different stock lines.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, European All Cap Strategy, European (ex UK) All Cap Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 June 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Worldwide All Cap Fund

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Worldwide All Cap Class I (Acc) | Irish UCITs | EUR | 12.96 | 0.56 | 18 Sep 2025 | |

| Stewart Investors Worldwide All Cap Class VI (Acc) | Irish UCITs | EUR | 2.76 | 0.56 | 18 Sep 2025 | |

| Stewart Investors Worldwide All Cap Class VI (H Dist) | Irish UCITs | EUR | 12.76 | 0.56 | 18 Sep 2025 | |

| Stewart Investors Worldwide All Cap Class VI (Acc) | Irish UCITs | GBP | 12.73 | 0.52 | 18 Sep 2025 | |

| Stewart Investors Worldwide All Cap Class VI (Acc) | Irish UCITs | USD | 10.59 | 0.50 | 18 Sep 2025 | |

| Stewart Investors Worldwide All Cap Class VI (H Dist) | Irish UCITs | USD | 10.35 | 0.50 | 18 Sep 2025 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Following the UK departure from the European Union, the First Sentier Investors ICVC, an open ended investment company registered in England and Wales ("OEIC") has ceased to qualify as a UCITS scheme and is instead an Alternative Investment Fund ("AIF") for European Union purposes under the terms of the Alternative Investment Fund Managers Directive (2011/61/EU). Accordingly, no marketing activities relating to the OEIC are being carried out by Stewart Investors in the European Union (or the additional EEA states) and the OEIC is not available for distribution in those jurisdictions. We have made documents available for existing EU investors in the ICVC which can be accessed here.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.