Get the right experience for you. Please select your location and investor type.

Worldwide Leaders Sustainability

The Worldwide Leaders Sustainability strategy launched in November 2013 and transitioned to become a dedicated sustainability strategy in October 2016.

Download overviewThe Worldwide Leaders Sustainability strategy launched in November 2013 and transitioned to become a dedicated sustainability strategy in October 2016. The strategy invests in 30-60 high-quality global companies that are particularly well positioned to contribute to, and benefit from, sustainable development.

Leaders simply means that this strategy is focused on companies with a market cap value of at least USD5 billion.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q1 2024

Worldwide Leaders Sustainability strategy update: 1 January - 31 March 2024

During the quarter we added a new position in TSMC (Taiwan: Information Technology) and added to Samsung Electronics (South Korea: Information Technology). Both companies are fabricating the chips that will be used by technology companies to drive innovative solutions to the world’s problems and are an essential part of the semiconductor value chain. In addition, both companies are well run with strong growth prospects and reasonable valuations.

We also entered a new position in Japanese diagnostics company Sysmex (Japan: Health Care). Sysmex play a key role in the early detection and prevention of diseases and are also driving accuracy, affordability and efficiency in surgery through investments in surgical robots.

Other new positions include Samsung C&T (South Korea: Industrials) and Techtronic Industries (Taiwan: Industrials) as we took advantage of attractive valuations to buy companies well set up to grow over the next decade. We also took the opportunity to add to several industrial companies that we already own at reasonable valuations including Lincoln Electric (United States: Industrials), Linde (United States: Industrials) and MonotaRO (Japan: Industrials).

These changes were funded by exiting companies where we have lost conviction in their opportunities for future growth. These include two Japanese companies, Unicharm (Japan: Consumer Staples) and Shimano (Japan: Industrials). They also include two developing market banks in Kotak Mahindra Bank (India: Financials) and OCBC Bank (Singapore: Financials). While these remain good companies, the increasingly competitive environment that they are facing and the opportunities to find growth elsewhere led us to divest.

Lastly, we divested from CSL (Australia: Health Care) as the stock had become fully valued and a range of more attractive opportunities were available. We also reduced our position in Costco (United States: Consumer Staples) due to concerns about valuations.

As we head further into 2024, there remains little consensus around whether inflation will continue to fall or rise further, whether interest rates will remain where they are or be cut, or whether we are heading into a stronger or weaker economy. However outside of the world of macro we are seeing some return to normality. Companies that we meet with are welcoming the end of a phase of de-stocking that was brought about by the supply chain issues and overstocking of 2022 and are looking forward to a return to more typical growth trends. We remain as reticent as ever to predict the path of macroeconomic variables, instead, focusing on finding high quality companies supported by a diverse range of structural growth drivers, with strong balance sheets and competent management.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q4 2023

Worldwide Leaders Sustainability strategy update: 1 October - 31 December 2023

The strategy experienced a year of strong returns over 2023. We do not fully understand short-term market moves and so won’t speculate on the causes of short-term performance. The market continued to rise, despite a turbulent environment as it absorbed higher inflation and interest rates, worries about recession and increasing geopolitical tensions.

Our focus, as always, is to look for high-quality management teams, running businesses that drive human development forward. Buying companies with strong balance sheets that can weather any coming storm, that have structural tailwinds driving their growth and reasonable valuations is the best way to invest our clients’ savings, and we have found many interesting investment opportunities.

We added five new companies to the strategy during the quarter. Lincoln Electric (United States: Industrials) is the world’s leading maker of welding equipment and is a high-quality franchise that is well positioned to benefit from the tailwinds of increasing automation, safety and transition to greener infrastructure. Linde (United States: Materials) is the world’s leading industrial gases company and a high-quality franchise with strong sustainability tailwinds that should drive growth for years to come. Samsung Electronics (South Korea: Information Technology) operates in consumer electronics, information technology and communications worldwide. We took the opportunity of attractive valuations to invest in a company that is well positioned to contribute technology solutions to most global development challenges. EPAM Systems (United States: Information Technology) is a digital platform engineering and software development services company. We have been interested in the company for a while and took advantage of attractive valuations to initiate a position. Midea (China: Consumer Discretionary) is a home appliances manufacturer with strong cash flows and an exciting direction of travel into innovative technologies.

We funded these new positions by divesting three stocks completely. We have been monitoring Philips (Netherlands: Health Care) since a safety recall of ventilators in 2021 and this quarter lost conviction that management could sufficiently improve the quality of the culture and franchise. We also sold our position in Constellation Software (Canada: Information Technology) which has been an excellent investment over the past few years but had become very expensive. While we retain conviction in its management and business model, its valuation left no room for error and we feel there are better opportunities elsewhere. Finally, we sold Nestlé (Switzerland: Consumer Staples) as it is struggling to grow the business at the same time as it is increasing its levels of debt. In addition, we trimmed positions in CSL (Australia: Health Care) and Tata Consulting Services (India: Information Technology) as they had become fully valued.

During the year we visited India and met with many of the companies in the strategy, including Mahindra & Mahindra (India: Consumer Discretionary) and HDFC Bank (India: Financials). Our conviction in our Indian holdings continues to remain high in the context of the quality of these institutions and the growth opportunities they are presented with.

Our portfolio is well diversified, not only across sectors and geographies, but also across growth drivers such as improving energy efficiency, the rise of living standards in India and building clean infrastructure in the United States. As we look at a portfolio of high-quality, great sustainability companies with resilient cash flows and strong competitive positions bought at reasonable valuations, we are excited about the future.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2023

Worldwide Leaders Sustainability strategy update: 1 July - 30 September 2023

During the quarter we did not add any new stocks to the portfolio but did rebalance the portfolio when presented with an opportunity to buy more of a quality company at a lower price.

Key increases over the quarter included Fortinet (US: Information Technology), Graco (US: Industrials) and Watsco (US: Industrials). We funded these additions through trimming Mahindra & Mahindra (India: Consumer Discretionary). While it remains one of the highest conviction positions in the portfolio, the increase in share price during the quarter required us to rebalance the position.

We divested of one stock during the quarter, selling out of Cognex (US: Information Technology) due to decreasing conviction on the strength of its franchise compared to its valuation.

We believe the best way to protect and grow our clients' capital over the long term is to invest in high-quality franchises, run by competent and honest stewards that have strong financials enabling them to contribute to and benefit from strong sustainability tailwinds.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2023

Worldwide Leaders Sustainability strategy update: 1 April - 30 June 2023

During the quarter, we added to Atlas Copco (Sweden: Industrials), Infineon Technologies (Germany: Information Technology), Deutsche Post DHL Group (now DHL) (Germany: Industrials), bioMérieux (France: Healthcare), Fortinet (US: Information Technology), Texas Instruments (US: Information Technology) and Edwards Lifesciences (US: Health Care) as valuations became more reasonable.

These are high-quality companies well positioned to evolve and grow in the coming decades. We funded this through divestments in Coloplast (Denmark: Health Care), Synopsys (US: Information Technology) and Jack Henry & Associates (US: Financials) where valuations were becoming expensive.

We recently visited India and met with many of the companies held in the strategy. Mahindra & Mahindra (India: Consumer Discretionary) remains cheaply valued despite a solid track record of compounding book value at high rates over the last few decades. There is a much sharper focus on capital allocation, growth and returns under the current management. This alongside a desire to lead on sustainability outcomes makes it one of the highest conviction ideas in the strategy. Elsewhere, HDFC (India: Financials) is preparing to merge with its subsidiary bank. The consolidated institution should become stronger than the sum of its parts with an expanded set of growth opportunities. HDFC is the cheapest it has been for many decades. Our conviction in our Indian holdings continues to remain high in the context of the quality of these institutions and the growth opportunities they are presented with.

The strategy experienced strong absolute returns over the year. We do not fully understand market movements in the short term so it is best we refrain from speculating on the reasons for short term portfolio performance. On the macro front, we continue to worry about the flood of cheap money over the last few decades which would require unwinding at some stage. We also observe that until recently, inflation has remained low for a long time, inequality in society is the highest it has ever been, government and corporate balance sheets are stretched and the world has experienced benign geopolitics for many decades. These are some of the risks we think about and we certainly cannot predict if, and when, they come to bear. We would equally not be surprised should these conditions continue for many decades to come. Continuing to invest in well managed companies with structural tailwinds, strong and improving market positioning, safe balance sheets and reasonable valuations is the best way to manage society’s savings in the face of constantly evolving or unchanged macroeconomic conditions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Proxy voting: Q1 2024

Worldwide Leaders Sustainability proxy voting: 1 January - 31 March 2024

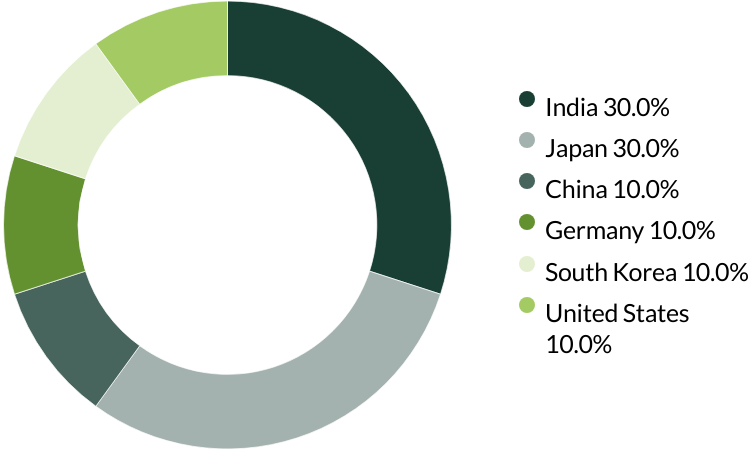

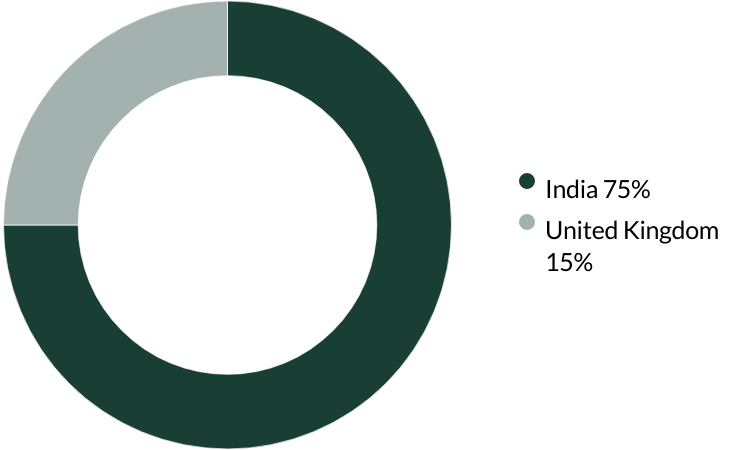

Proxy voting by country of origin

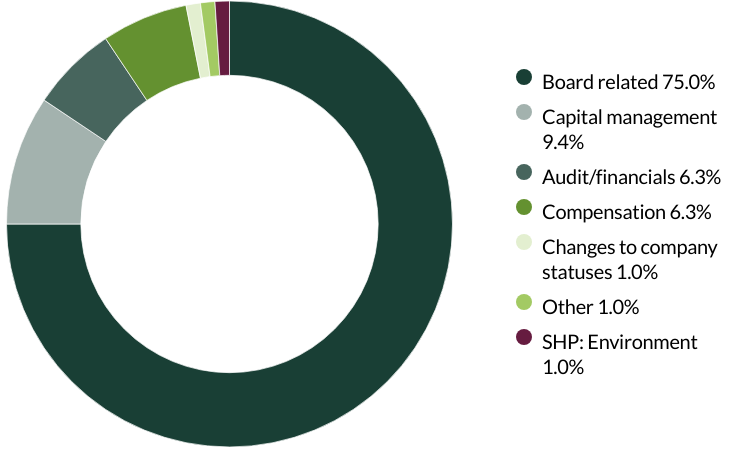

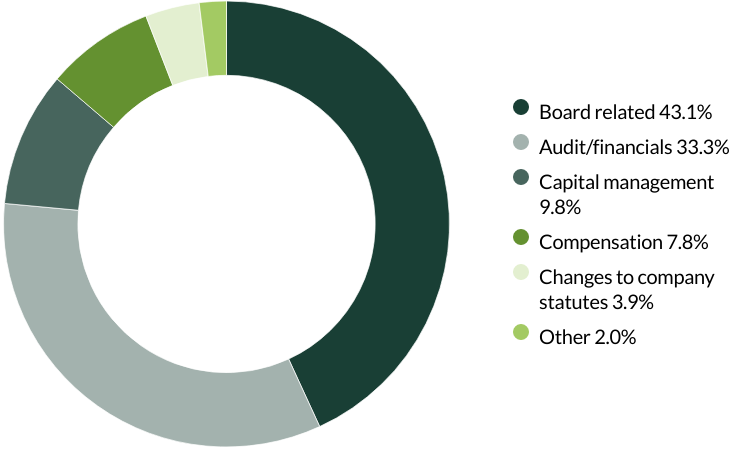

Proxy voting by proposal category

During the quarter there were 96 resolutions from 9 companies to vote on. On behalf of clients, we voted against 3 resolutions.

We voted against a shareholder proposal for Costco to conduct a feasibility study of reaching net zero by 2050, as we believe the company is making progress with tangible near-term climate targets in place. Long-term projections with regards to the net zero transition are difficult and can be fraught with errors, hence we currently find the company's approach reasonable and sensible. (one resolution)

We voted against an adjustment of the Guarantee for Controlled Subsidiaries Assets Pool Business at Midea as we found the guarantee amount to be excessive and not in shareholders' best interests. (one resolution)

We voted against a Board appointment at Samsung Electronics as we would prefer to see more independent, non-family associated Directors. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2023

Worldwide Leaders Sustainability proxy voting: 1 October - 31 December 2023

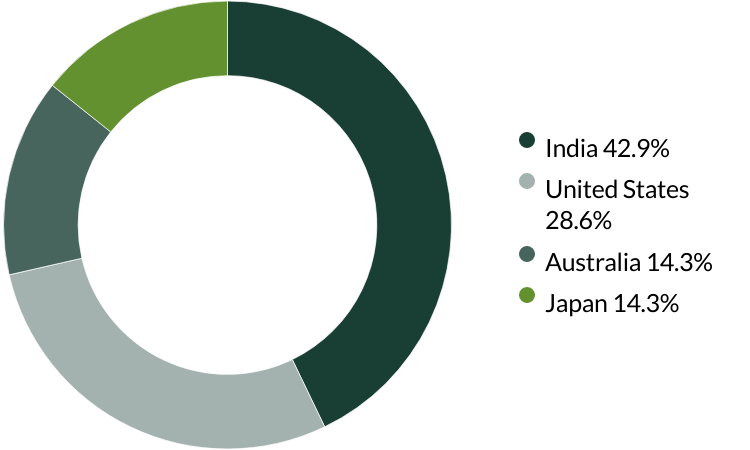

Proxy voting by country of origin

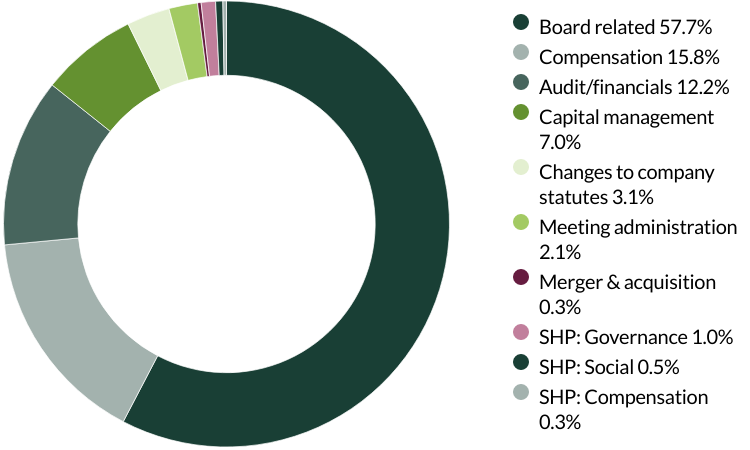

Proxy voting by proposal category

During the quarter there were 52 resolutions from six companies to vote on. On behalf of clients, we voted against one resolution.

We voted against the appointment of the auditor at Copart as they have been in place for over 10 years and the company has given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2023

Worldwide Leaders Sustainability proxy voting: 1 July - 30 September 2023

Proxy voting by country of origin

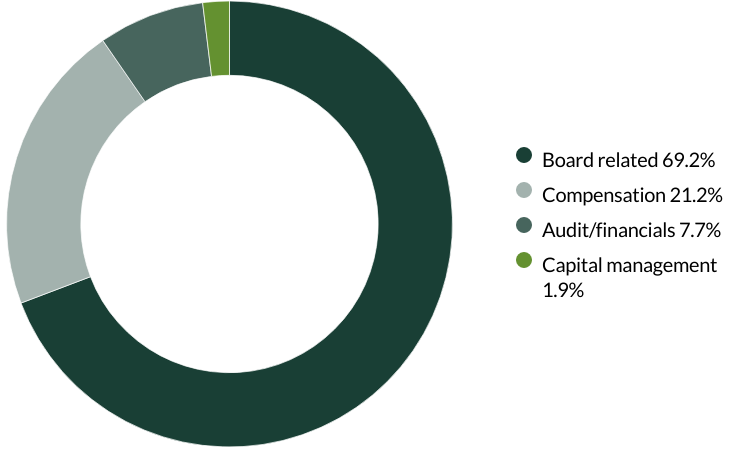

Proxy voting by proposal category

During the quarter there were 51 resolutions from four companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2023

Worldwide Leaders Sustainability proxy voting: 1 April - 30 June 2023

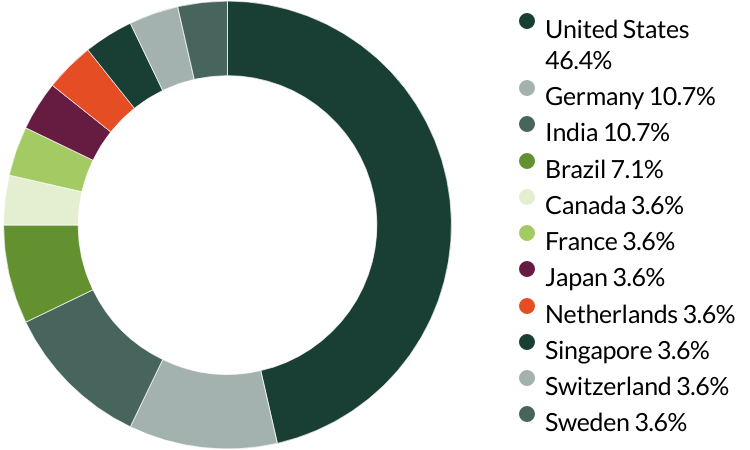

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 385 resolutions from 27 companies to vote on. On behalf of clients, we voted against 35 and abstained on one resolution.

We voted against the appointment of the auditor at Arista Networks, Beiersdorf, bioMérieux, Cognex, Constellation Software, Edwards Lifesciences, Expeditors, Fastenal, Fortinet, Graco, Markel, Old Dominion Freight Line, Roper Technologies, Synopsys, Texas Instruments and Watsco as they have been in place for over 10 years and the companies have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (18 resolutions)

We voted against Edwards Lifesciences’ request to remove personal liability from certain senior officers. We believe such an amendment is unnecessary and do not think the company’s reasoning holds merit. (one resolution)

We voted against Fortinet’s request to remove personal liability from certain senior officers. We believe such an amendment is unnecessary and do not think the company’s reasoning holds merit. (one resolution)

We voted against a number of proposals relating to Philips. We voted against the allocation of dividends as we believe the company needs to pay back debts before paying out dividends. We voted against the company’s remuneration report as we believe the remuneration structure needs a complete overhaul which is not being addressed in the proposal despite there being an opportunity to do so. We voted against the election of the CFO and Chair of the Audit Committee given the precarious position of the company’s finances and in our view little has been done to improve the quality of the financials. We voted against the request to suppress pre-emptive rights of shareholders as the use of readjusted metrics to overlook accountability for acquisitions and other restructuring decisions is not something management and the Board have earned in our view. We also voted against the request to repurchase shares as we believe the company should use cash flows to reduce leverage. (six resolutions)

We voted against Roper Technologies’ request to remove personal liability from certain senior officers. We believe such an amendment is unnecessary and do not think the company’s reasoning holds merit. (one resolution)

We voted against Synopsys’ executive remuneration and amendments to their Employee Equity Incentive plan as we believe it is subject to adjustments to facilitate payments to management. (two resolutions)

We voted against Texas Instruments’ executive remuneration, as we believe the absolute pay-outs for the CEO are high compared to other executive directors and the median employee. We also disagree with the vast majority of remuneration being discretionary and believe it is in shareholder interests for management to be measured against a few key metrics that hold them to account over the long term. (one resolution)

We voted against WEG’s request to recast votes for the amended supervisory council slate, as we preferred to vote in favour of the female candidate nominated by minority shareholders and who has been on the fiscal council for two years. We abstained from voting on the election of the supervisory council as we preferred to support the minority candidate. (one resolution against, one resolution abstained)

We voted against two shareholder proposals relating to Expeditors. The first proposal requested the company seek shareholder approval for severance payments valued at 2.99 times the sum of salary and short-term bonus. The company has a very different remuneration culture to its peers. Managers are not paid bonuses if the company generates operating losses until all the losses are recouped. We believe the Board has also provided sufficient explanation that under no circumstances will executives be paid severance of that magnitude. The other proposal requested the company conduct further quantitative analysis and publish a report assessing its diversity, equity and inclusion (DEI) efforts. We believe the company’s approach to diversity is reasonable and that the Board has provided enough evidence of a responsible and progressive attitude to DEI matters. (two resolutions)

We voted against a shareholder proposal relating to Nestlé which would have enabled an independent proxy to vote on additional or amended proposals from shareholders at the company’s annual general meeting. We consider ourselves active shareholders and voting an important responsibility in our investment management duties. (one resolution)

We voted against a shareholder proposal relating to Synopsys which would enable shareholders with a combined 10% share ownership the right to call a special shareholder meeting. (one resolution)

We supported a shareholder proposal relating to Edwards Lifesciences which requested that the company separate the roles of the Chair and CEO. (one resolution)

We supported shareholder proposals relating to Texas Instruments which requested the company report on its process for customer due diligence, by outlining sanctions and export control compliance, risks associated with Russia’s invasion of Ukraine, more information on the know-your-customer due diligence process, and an assessment of legal, regulatory and reputational risks to the company. We also supported a request for the company to adopt a 10% threshold for calling special meetings as currently the Board’s threshold is a shareholding of 25% which appears high. (two resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific Sustainability Strategy, Asia Pacific & Japan Sustainability Strategy, Asia Pacific Leaders Sustainability Strategy, European Sustainability Strategy, European (ex UK) Sustainability Strategy, Global Emerging Markets Leaders Sustainability Strategy, Global Emerging Markets Sustainability Strategy, Indian Subcontinent Sustainability Strategy, Worldwide Sustainability Strategy and Worldwide Leaders Sustainability Strategy accounts as at 31 March 2024. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.