Get the right experience for you. Please select your location and investor type.

Stories of Sustainability virtual event

The most sustainable companies you've never heard of

Navigate through the noise to discover some of the high-quality companies who really are contributing to a more sustainable future.

Watch videos from our virtual event which took place on 29 September 2021. The Sustainable Funds Group discuss frameworks they use to evaluate a company's contribution to a sustainable future and provide examples of sustainable companies that you've likely not heard of. The CEO of HDFC also joins us to discuss the history and culture of the company and how their services are evolving to consider the growing risks of climate change.

Introduction and welcome from Felicity Masson & Hanna Ranstrand

Individual presentations

Speaker biographies

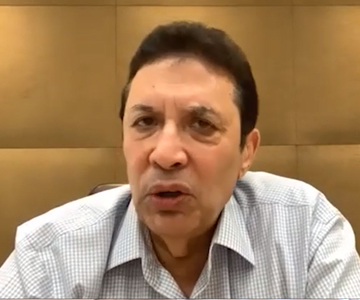

Mr. Keki Mistry – Vice Chairman & CEO, HDFC

Mr. Mistry joined HDFC in 1981. He was appointed as the Executive Director of the Corporation in 1993, as the Deputy Managing Director in 1999 and as the Managing Director in 2000. He was re-designated as the Vice Chairman & Managing Director of the Corporation in October 2007. Mr. Mistry has been the Vice Chairman & Chief Executive Officer of the Corporation with effect from January 1, 2010.

David Gait

David is Head of the Sustainable Funds Group and a Portfolio Manager. He sits on the Stewart Investors Board. David joined the team as a graduate in 1997.

He is lead manager of Asia Pacific Sustainability strategies, as well as Pacific Assets Investment Trust.

David holds an MA with honours in Economics from Cambridge University, and holds a Master of Science in Investment Analysis from Stirling University.

Jack Nelson

Jack is a Portfolio Manager with the Sustainable Funds Group at Stewart Investors. He joined the team in September 2011 as a graduate.

Jack is lead manager of the Global Emerging Markets Sustainability strategy.

He holds a BA (Hons) in Politics, Philosophy and Economics from Queen’s College, Oxford.

Mohan Gundu

Mohan is an Analyst with the Sustainable Funds Group at Stewart Investors. He joined the team in December 2016.

Previously, Mohan worked in various brokerage firms, including Jefferies and CLSA.

He holds an MBA from the Indian Institute of Management in Bangalore, as well as a Bachelor of Technology in Civil Engineering from the Indian Institute of Technology in Mumbai.

Nick Edgerton

Nick is a Portfolio Manager with the Sustainable Funds Group at Stewart Investors. Nick joined the team in April 2012, following two years in the First State Investments group.

He is lead manager of the Worldwide Sustainability strategy.

Previously, Nick worked as an analyst with the Sustainability funds at AMP Capital Investors, and has experience as a consultant, public servant, and academic in sustainability and economics.

He holds a Bachelor of Economics from Macquarie University, and a Master of Science with Distinction in Ecological Economics from the University of Edinburgh.

Sashi Reddy

Sashi is a Portfolio Manager with the Sustainable Funds Group at Stewart Investors. He joined the team in August 2007.

Sashi is lead manager of the Worldwide Leaders Sustainability strategy and the Indian Subcontinent Sustainability strategy.

Previously, he worked at Irevna Research, an Indian equities research house from 2005 to 2007.

Sashi has an engineering degree from the National Institute of Technology, Trichy and an MBA from the Schulich School of Business, York University in Toronto.

Sujaya Desai

Sujaya is an Analyst with the Sustainable Funds Group at Stewart Investors. She joined the team in October 2016 as a graduate.

Sujaya holds an MPhil in Development Studies from the University of Cambridge and a BA (Hons) in International Relations and Anthropology from Brown University.

Subscribe to our updates

To get regular updates and content from Stewart Investors, please register here.

Important Information

This video has been prepared for general information purposes only and is intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer video, and does not constitute an offer, invitation, investment recommendation or inducement to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any matter contained in this video.

This video is confidential and must not be copied, reproduced, circulated or transmitted, in whole or in part, and in any form or by any means without our prior written consent. The information contained within this video has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy or completeness of the information. We do not accept any liability for any loss arising whether directly or indirectly from any use of this video.

References to “we” or “us” are references to Stewart Investors. In Australia, this video is issued by First Sentier Investors (Australia) IM Limited AFSL 289017 ABN 89 114 194 311 (FSI AIM). Stewart Investors is a trading name of FSI AIM. First Sentier Investors entities referred to in this video are part of First Sentier Investors, a member of MUFG, a global financial group. First Sentier Investors includes a number of entities in different jurisdictions. MUFG and its subsidiaries do not guarantee the performance of any investment or entity referred to in this video or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk including loss of income and capital invested.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell. Reference to the names of any company is merely to explain the investment strategy and should not be construed as investment advice or a recommendation to invest in any of those companies.