Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

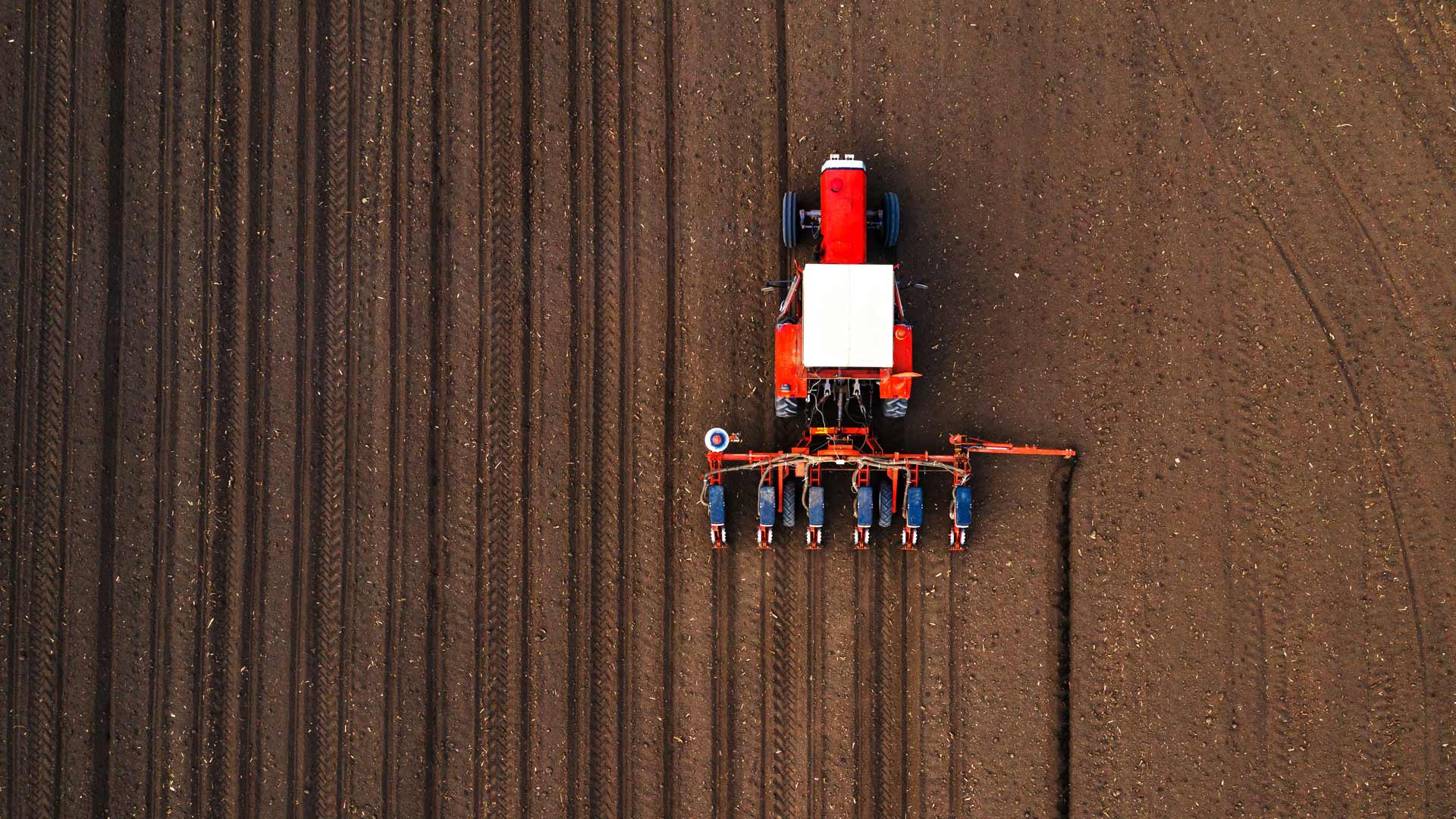

The future of food and sustainable agriculture

Agricultural techniques have changed dramatically over the last 50 years, particularly in more developed nations.

More efficient farm machinery, genetic modification of seeds and the use of fertilisers and agrochemicals have all helped to increase crop yields significantly. However, while the industrialisation of farming has brought a multitude of benefits, it is also contributing to an array of unintended negative consequences, particularly for the environment.

Challenges

The Stockholm Resilience Centre has identified nine planetary boundaries which humanity should not breach if we are to maintain a safe operating space for society. Modern agriculture practices contribute negatively to eight of the nine boundaries, including biodiversity loss, climate change, fresh water use, land system change, and nitrogen and phosphorus flows to the biosphere and oceans. In most of these areas, safe limits have already been breached.

Emissions from agriculture, forestry and land clearing make up 23% of the world’s greenhouse gas emissions and if the entire food chain is included (e.g. fertiliser, transport, processing) the contribution could be as high as 37%1. Cattle and dairy cows alone emit enough greenhouse gases to put them on a par with the highest-emitting nations. Agricultural expansion also continues to be the main driver of deforestation, forest degradation and the associated loss of forest biodiversity. Large-scale commercial agriculture, primarily cattle ranching and cultivation of monoculture soya bean and palm oil, alongside subsistence agriculture, accounts for up to 80% of deforestation globally2.

The overuse of chemical fertilisers has also contributed to water pollution and soil degradation in many areas, with excess nitrogen in the soil causing soil acidification and salinisation (increasing salt content). According to the United Nations (UN), a third of the world’s soil is now moderately to highly degraded, largely due to intensive agricultural practices3. Overuse of garden variety herbicides and weed killers also threatens the health of waterways and fish, and some products are currently the subject of ongoing investigations about their carcinogenic qualities.

Demographics and changing human diets also present environmental challenges. Global populations are set to rise to 10 billion people by 2050 versus 7.8 billion today4, meaning agricultural demand could grow over 50% in a business-as-usual scenario5. Increased demand for food is also driven by rising incomes in emerging markets, and the UN estimate that meat consumption is set to rise 76% by 2050, including a doubling in the consumption of poultry, a 69% increase in beef and a 42% increase in pork6. High levels of meat consumption have been linked to negative health consequences, including colorectal cancer, diabetes and heart disease, as well as dire impacts on the environment7.

There is also a severe imbalance in the production and distribution of food globally, with 80% of the world’s population relying on imported food and countries today not producing enough food to feed themselves8. Global supply chains are increasingly coming under the spotlight, especially in light of Covid-19, with countries placing more importance on local versus global production.

At the same time, 50% of the population is either overweight or undernourished (39% overweight, 11% undernourished), while 25-30% of all of the food that is grown globally goes to waste9. In developing countries food is mostly lost from ‘farm to fork’, where a large amount of food spoils before it reaches the consumer due to poor infrastructure, while in developed countries food is mostly wasted by retailers and consumers buying more than they need, and letting food spoil.

There are other serious challenges related to intensive factory farming, animal welfare, antibiotic use, the rise of livestock epidemics, monocultures and genetic engineering, climate change threats to food security, lack of land tenure and a need for agricultural land reform in many emerging markets... the list could go on and on.

A vision for a more sustainable future

Although there are many farmers and food producers globally that utilise sustainable agricultural practices, it is clear that many parts of the ‘food system’ would benefit from a fundamental overhaul. Given the severity of the challenges ahead, systemic change is required in order to protect our soils, waterways, forests and wildlife, reduce emissions and at the same time to feed our growing population.

In particular, there is an urgent need to conserve and restore tropical forests in order to protect against biodiversity-loss but also to increase carbon sequestration. This is highlighted by Project Drawdown, an initiative that has identified and researched c. 80 climate change solutions with the potential to solve collectively the climate crisis. Project Drawdown has identified 19 solutions related to food and agriculture, including forest protection, reducing food waste and a shift to plant-based diets, and has calculated that these alone could contribute over 20%10 of the emission reductions needed to achieve the goal of the Paris Agreement.

In addition, greater adoption of more holistic regenerative farming techniques can also help to rebuild the quality of the soil and, in the process, help to sequester carbon. Typically this involves using cover crops and perennials so that bare soil is never exposed, reducing the use of tilling, rotating diverse crops and integrating livestock, limiting the use of chemicals, and composting and recycling as much farm waste as possible. There is evidence to suggest yields from this type of agriculture can be higher than conventional agriculture, while at the same time helping to prevent soil erosion, re-mineralising the soil, protecting groundwater and reducing damaging pesticide and fertiliser runoff.

Investment opportunities

This shift to a more sustainable food system is presenting a number of excellent investment opportunities.

The market for sustainable food ingredients such as organic, local, ‘free-from’ products has been increasing rapidly in developed markets along with soaring demand for plant-based proteins. The global plant-based protein market is forecast to reach USD35.5 billion in 2024, representing 14% annual growth for the period spanning 2020-202411. Considering a typical plant-based burger uses up to 95% less water and land, generates 90% fewer greenhouse gases, and requires 46% less energy than a normal beef burger, this can only be a good thing for the environment and human health12.

Indoor vertical farming is also booming, especially in urban areas, which offers the prospect of more local production. Vertical farming can increase yields 300x compared with conventional outdoor farming13, with the potential to have an almost closed loop system, reusing water and nutrients, without soil contamination and pollution run off.

Precision farming is also a growing area which offers huge potential. Agri-robots, artificial intelligence (AI) and big data, satellite positioning, drones, weather prediction and soil testing all offer the potential to enhance yields and reduce environmental impacts. The food waste management sector is also steadily growing, and is anticipated to expand at a CAGR of 5% between 2019 and 202514.

How are we positioned?

There are clearly a number of rewarding investment opportunities that can support this vital transition to a more sustainable food and agricultural system, including a Hong Kong listed maker of over 300 plant-based products, such as soya and nut milk, tofu, tea and juices. Their beverages offer sustainable nutrition and a healthy alternative to sugar-laden carbonated drinks, with their core raw ingredient, soy beans, being high in protein and cholesterol-free. Growing soy beans is significantly less water and resource-intensive than meat or dairy production, however it is also linked to deforestation in certain regions. It is estimated that over 85% of soy is grown to feed livestock, underlining the systemic nature of these issues15. We have engaged with the company on deforestation and they continue to improve their sourcing policies, traceability and standards for contract farmers.

Two Danish companies, are also playing a significant role in improving global food and agricultural practices. The first is a global leader in producing natural enzymes and microorganisms that are used across a range of industries, including the food and agriculture industries. In agriculture, their microbes and enzymes increase crop yields, reduce the need for pesticides and fertilisers and improve animal health. In food production, their enzymes are used to extract protein from plants, to improve the texture and flavour of plant-based ‘meats’, and to reduce the sugar and lactose content in dairy products.

The second, is another global leader, this time in manufacturing microbes and enzymes. Its cultures are used to improve the yield, taste, nutritional value and shelf life of a wide range of foods, while at the same time reducing the need for artificial additives and preservatives. Their bacteria and microbes are also used to improve soil health naturally, increase crop yields and protect plants against disease and pests.

Other companies which support the transition to a more sustainable food and agricultural system include:

- A US-listed maker of food safety diagnostic tests, animal health products and genomics test kits. The company is investing in blockchain and AI technology to track the environmental conditions of food and animal products all the way from ‘farm to plate’.

- A Norwegian-listed maker of automated recycling technology and a global leader in sensor-based food sorting and peeling technology. Their sorting machines inspect millions of individual food pieces per hour, help increase the yield of produce by 5-10% and save as much as 25,000 trucks of potatoes every year16.

- A UK-listed maker of testing and measurement instruments. They offer soil analysis tools to help farmers analyse soil fertility and enhance crop yields, contributing to agricultural productivity and ensuring sustainable food production systems.

Research and engagement

As long-term, active investors, we regularly conduct research and engage with companies on a wide range of sustainability topics. We have commissioned and undertaken our own research into challenges within the palm oil and soy supply chains and have conducted extensive engagement on the topic of deforestation. We have also engaged a number of consumer companies on sugar content in their product portfolios and plastic packaging, and will soon begin a new round of research and engagement on the use of agricultural chemicals, as well as the importance of supporting smallholder farmers.

In summary, the future of food and sustainable agriculture offers a myriad of investment opportunities that can benefit our clients, and at the same time, help to support and promote a more sustainable and resilient food system. We believe this can be a positive situation for all, but there are many hard yards still to be covered.

Glossary

Active investors: take a hands-on approach, typically making portfolio decisions based on their own analysis as opposed to passive investors who buy shares based on index constituents and weightings.

Blockchain: digital information (the block) stored in a public database (the chain).

Compound annual growth rate (CAGR): a statistic that measures the compound annual return of metrics over a set period of time, assuming gains are reinvested (i.e. compounding effect).

Indoor vertical farming: the practice of growing produce stacked one above another in a closed and controlled environment. By using growing shelves mounted vertically, it significantly reduces the amount of land space needed to grow plants compared to traditional farming methods.

Monoculture: the agricultural practice of producing or growing a single crop, plant or livestock species, variety, or breed in a field or farming system at a time.

Paris Agreement: The Paris Agreement sets out a global framework to avoid dangerous climate change by limiting global warming to well below 2°C and pursuing efforts to limit it to 1.5°C. It also aims to strengthen countries’ ability to deal with the impacts of climate change and support them in their efforts. The Paris Agreement is the first-ever universal, legally-binding global climate change agreement, adopted at the Paris Climate Conference (COP21) in December 2015.

Subsistence agriculture: when farmers produce just enough food to feed their families with little left to sell on.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity.

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Want to know more?

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group