Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Asia Pacific Leaders

The Asia Pacific Leaders strategy was originally launched in December 2003 and invests in large and mid-sized companies which generally have a total stock market value of at least US$1 billion (hence ‘Leaders’).

This equity-only strategy seeks to invest in between 30 to 60 high-quality businesses in the Asia Pacific region (including Australia and New Zealand, but excluding Japan) that are helping bring about a more sustainable future.

Strategy highlights: a focus on quality and sustainability

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

- Companies must contribute to sustainable development. Portfolio Explorer >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

Latest insights

Quarterly updates

Strategy update: Q4 2025

Asia Pacific Leaders strategy update: 1 October - 31 December 2025

In November 2025, First Sentier Group (FSG) announced a strategic transition of Stewart Investors’ (SI) investment management responsibilities to its affiliate investment team, FSSA Investment Managers (FSSA). This was decided to be in the best interests of our clients, given the significant overlap in SI’s and FSSA’s investment capabilities and our shared history and heritage.

Introducing FSSA Investment Managers

FSSA has been investing in Asia Pacific and Global Emerging Market equities since 1988 as part of the former Stewart Ivory & Company, which subsequently became First State Stewart. After years of organic growth, the First State Stewart team split in two in 2015, leading to the formation of FSSA Investment Managers and Stewart Investors.

Like SI, we are long-term and quality-focused investors. We pay little attention to the index or short-term performance, preferring to focus on generating absolute returns for our clients in the long run. From our research, we aim to construct relatively concentrated portfolios made up of the best ideas that we can find across Asia and emerging markets. As responsible, long-term shareholders, we have integrated sustainability analysis into our investment process and engage extensively with companies on environmental, labour and governance issues.

Following the transition of SI’s portfolios to FSSA, the Stewart Investors Asia Pacific Leaders portfolio is now being managed by Martin Lau and Rizi Mohanty.

Martin Lau is one of the Managing Partners of FSSA Investment Managers. He has been with the team for more than 23 years (since 2002) and worked closely with members of the SI team before the 2015 reorganisation. He is a well-known and experienced investor and is lead manager of a number of FSSA strategies, including FSSA Asian Equity Plus, FSSA Asia Focus, FSSA China Growth and FSSA Hong Kong Growth. Martin has more than 30 years of investment experience and is based in Hong Kong.

Rizi Mohanty is a Portfolio Manager at FSSA Investment Managers. He joined the team in 2016 and focuses on the Southeast Asian markets as well as Asia ex-Japan equities more broadly. He is the lead manager of the FSSA ASEAN All Cap and FSSA Asian Growth strategies. Rizi has more than 14 years of investment experience and is also based in Hong Kong.

Martin and Rizi are supported by a broader team of investment analysts, with an average of 14 years of investment experience and 8 years tenure with the team. All 15 members of the FSSA investment team are analysts first and foremost, including the portfolio managers, and we spend the majority of our time meeting companies, writing research and seeking quality companies to invest in.

How we invest

FSSA’s investment philosophy, which shares its genesis with SI, has remained broadly unchanged since the First State Stewart team was established in 1988. We focus on identifying quality companies, buying them at a sensible price and holding them for the long term. Most importantly, we invest our clients’ capital as if it were our own. As long-term investors and owners of businesses on behalf of our clients, we look for founders and management teams that act with integrity and risk awareness, and dominant franchises that have the ability to deliver sustainable and predictable returns over the long term.

As a team, we conduct over 1,000 direct company meetings each year across Asia and other emerging markets. The most significant source of investment ideas comes from these company visits and country research trips. We find that our reputation as patient, long-term investors has given us unparalleled access to management, which allows us to gain valuable insights and a thorough understanding of the businesses we want to invest in.

As a result of our long-term time horizon and conservative investment approach, our portfolios – and our performance – can look very different to the index. We shy away from “flavour of the month” themes (such as the current AI-driven boom), and instead look for high-quality companies that can deliver attractive returns for much longer than the market expects – and extend our investment time horizon to capture that advantage. When you own quality businesses, time isn’t a risk – it’s an asset.

Our performance may lag in very buoyant or momentum-driven markets, but we usually compensate very quickly once such bubbles burst. Based on historical data, our long-term track record shows that our portfolios tend to perform better in “normal” markets (-15% to +15% returns over one year) and bear markets (more than 15% decline), than in steeply rising markets (defined as over 15% returns over one year).

A smooth transition

Given the significant overlap in SI’s and FSSA’s investment philosophy and portfolios, we know all the holdings well. As part of the transition, we made a few changes to tilt the portfolio towards companies with stronger cash generation, higher returns and better long-term growth prospects. In general, we are adding to holdings in China, where we have found leading businesses like Tencent, with strong competitive advantages and attractive growth at reasonable valuations. We are reducing exposure to India, mainly in cyclical businesses like Tube Investments of India and Motilal Oswal, where valuations are expensive and the growth outlook has deteriorated.

Below, we highlight a few of the key additions and disposals over the fourth quarter of 2025.

New purchases:

Tencent Holdings is the largest social media network and online gaming company in China, with growing businesses in online advertising, cloud services, e-payments/e-commerce and overseas gaming. Tencent has created an ecosystem of businesses which are unrivalled and should continue growing over the medium term. It has continued to develop new functions within WeChat (such as Video Accounts and Mini Shops), which should slowly improve monetisation and enhance the quality of the franchise. At FSSA, we have been shareholders of Tencent since 2005 and have consistently found the management to be effective long-term stewards of the business. In recent times, we have been impressed by Tencent’s AI strategy and its disciplined approach to technology investments, which aligns with our conservative view on AI capex spending.

Realtek is an integrated circuits (IC) design company based in Taiwan which focuses on connectivity solutions such as WiFi, Ethernet and Bluetooth. While wireless technology is relatively mature and seemingly commoditised, there does seem to be some differentiation between providers. With rising competition from Chinese chip designers who often undercut on price, Realtek is focusing more on value-added products and has targeted applications with higher tech requirements, such as Edge-AI devices and AI glasses. We are optimistic that Realtek will be able to fend off the competition with higher barriers to entry as it moves up the value chain, and that margins should improve due to the product mix. The company has a long history and good track record and should benefit from the broadening use of AI in on-device AI agents.

H World is the second largest hotel chain in China. The company has emerged as a dominant force in China’s hotel industry, with a strong brand portfolio and deep operational expertise. H World is widely regarded as an industry innovator, with a strong focus on digital infrastructure and IT systems. These investments have helped it become a cost leader in the sector, while its membership programme has emerged as a key driver of organic traffic and customer retention. We believe H World has a long runway of growth as it taps into China’s rising domestic travel demand, urbanisation and upgraded consumer preferences. H World’s significantly larger economies of scale – and its pricing premium over other hotels in similar locations – should drive outsized profit in the long run.

Complete sales:

SF Holdings is a leading express logistics company in China with directly managed model. However, we question the sustainability of the franchise in a highly competitive and somewhat commoditised industry. From a regional portfolio perspective, we believe there are better opportunities elsewhere.

Tech Mahindra was sold on expensive valuations. It appears to be priced for a turnaround, while the IT services industry is undergoing a period of weakness due to AI disruption and a halt in discretionary spending. We believe there is better risk/reward elsewhere.

Glodon is a leading construction software vendor in China. We have known the company for many years. The challenges related to the property sector mean that the growth outlook is unattractive. Based on the current near-term weakness, we believe the valuation does not adequately account for the risks.

Performance and outlook

With our long-term investment time horizon, we tend not to pay much attention to short-term market fluctuations. We invest on at least a three-to-five-year view, though we often hold on to companies for much longer. In an industry rife with short-termism, we believe our long-term approach stands out from the crowd.

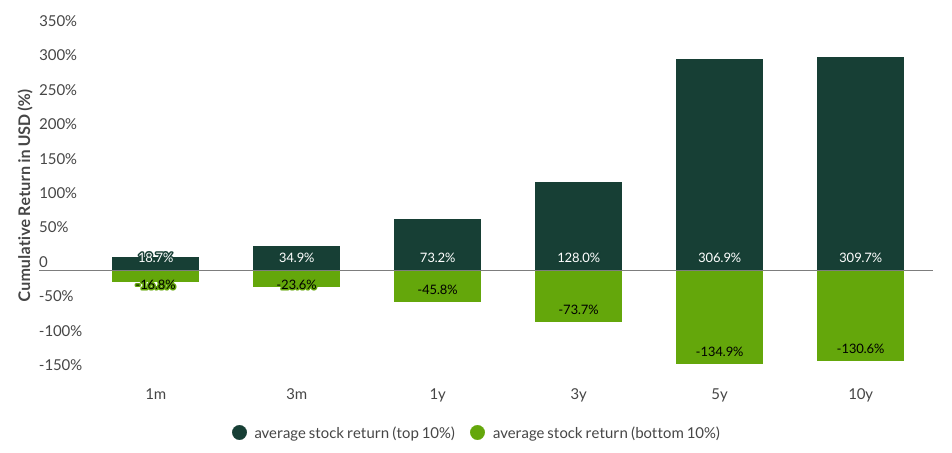

What we have seen, over the past few decades, is that average holding periods for stocks have fallen from over eight years in the 1960s to less than six months today. Yet this shift has come at a cost: it reduces investors’ ability to generate outsized returns that are materially different from the broader market. The reason is simple — as investment horizons shrink, so does the return dispersion between the best- and worst-performing companies. With less time in the market, investors end up tracking the index, not beating it.

Emerging Markets: time horizons matter

MSCI EM Index -dispersion around mean return for top 10% top / bottom stock performers

Source: MSCI Emerging Markets Index, as at 31 May 2025

In a world where markets rise consistently, that might seem like an acceptable outcome. But markets don’t move in straight lines; and in addition to the higher costs and transaction fees that come with frantic trading activity, the bigger issue is that investors miss out on what is far more important – the future value creation that the best companies tend to generate. This is often poorly understood by the market, with many investors simply focusing on the next quarter or year ahead. Yet the real drivers of returns lie in the cash flows that come well beyond that timeframe.

With that context in mind, we highlight the key contributors and detractors from performance over the fourth quarter of 2025.

The largest contributor to performance over the period was Samsung Electronics, a leading manufacturer of memory and semiconductor chips. In recent years, Samsung’s foundry business has been a major point of investor concern, which culminated in significant losses in the first half of 2025. These losses were exacerbated by one-time charges related to US export controls to China. The company has since undertaken a strategic shift from a “capacity-first” to a “customer-first” model, which appears to be bearing fruit. The shares rose during the quarter, as Samsung continued to benefit from surging AI-related demand for its high-bandwidth memory chips as well as tightness in traditional DRAM demand-supply. Strong results from US chipmaker Micron reinforced expectations of a sustained memory upcycle into 2026. With the turnaround in its foundry business and a strong legacy memory business, we believe the risk-reward looks favourable.

The second largest contributor was Oversea-Chinese Banking Corp (OCBC). Headquartered in Singapore, OCBC is a high-quality bank with a sensible attitude to risk. It has a strong base in two regional hubs: Singapore – to capture growth in Southeast Asia; and Hong Kong – for the Greater China region. As long-term investors, we like its conservative approach and its focus on growing the wealth management business. Recent earnings results were better than expected, driven by strong fee income as well as rising assets under management (AUM) and fees in its wealth management business.

Taiwan Semiconductor Manufacturing (TSMC) was the third largest contributor to performance, as it continued to see solid revenue growth and strong demand from cloud AI for its leading-edge chips. Given the lead time and supply shortages, this provides visibility into 2026 earnings and possibly even beyond into 2027. TSMC is expected to invest in capacity expansion, with top line growth to follow.

On the negative side, Alibaba was the largest detractor from performance. The shares weakened over the last few months of 2025 on concerns about its e-commerce business and the resulting pressure on earnings. Losses from its Taobao Instant Commerce business (food delivery and on-demand retail) weighed on the share price. On the other hand, Alibaba has had a strong run-up over 2025, driven by its investments into AI and growing demand for cloud computing. Alicloud revenue has accelerated in recent quarters and is expected to continue at pace in the coming quarters.

Sea Ltd was the second largest detractor, as it continued to decline on concerns about margins, given its marketing tactics and promotional spending. Shopee, its e-commerce platform, has expanded its VIP program to Singapore and Taiwan (in addition to Indonesia, Malaysia, the Philippines, Thailand and Vietnam), which includes extra cash-back, monthly discount vouchers and free delivery – all for a fixed monthly subscription fee. On a positive note, recent results indicated robust earnings and growth across segments. Management subsequently announced a US$1bn share buyback, the first for the company, suggesting confidence in Sea’s outlook.

The third largest detractor was Shenzhen Mindray, which declined after announcing disappointing earnings results. Although the company’s revenue and sales improved, the expansion of China’s centralised procurement policies for medical equipment put pressure on its pricing.

Looking forward

We are optimistic on the outlook for Asian equities. With a rising share of global gross domestic product (GDP) growth, Asia should continue to benefit from the shift towards higher value services-led growth, digital transformation and the financial activities across the region. Valuations also look attractive in comparison to developed markets like the US, while low ownership of Asian equities in global portfolios provides a good backdrop for positive returns.

Across the team’s Asian equity portfolios, our core holdings have continued to deliver good underlying business performance and shareholder returns. Current portfolio valuations remain attractive – as they have been over the last couple of years. Looking forward, we expect earnings to grow at low double-digit rates with circa 20% average returns on equity, while companies are generating more cash and returning it to shareholders.

While we can’t second guess when the AI theme might run its course, our holdings are characterised by strong competitive advantages, and they have historically managed to preserve margins and profitability through the cycles. We are confident that their strong fundamentals will translate into attractive shareholder returns in the long run, as the market broadens, over time, from its narrow focus on AI.

SFDR Article 9 and FSSA’s approach to sustainability

All SI portfolios will continue to be managed true to label, with due consideration given to SI’s SFDR Article 9 sustainability requirements. Importantly, both FSSA and SI had operated as one team for 27 years (1988-2015) before the decision was made in 2015 to split into two teams. This is heavily reflected in our investment philosophies and processes and our respective approaches to sustainability.

At FSSA, we believe it is everyone’s responsibility to think about sustainability as part of his or her investment decision-making. We don’t use external consultants or environmental, social and governance (ESG) ratings, nor do we outsource the sustainability work to a separate team. In our research, we focus on evaluating the long-term merits of a given investment opportunity. Given that sustainability issues are effectively investment issues, we believe that these challenges and opportunities – and management’s response to them – can have a significant impact on a company’s returns. As such, we look for evidence that the management operates the business effectively and in the interests of all stakeholders – both now and for the longer term.

While issues relating to climate change, or people and communities, are often the ones that get the most attention, most of our company engagements relate to management quality and corporate governance systems, as we believe that good governance is the foundation on which great companies are built. We often engage with management teams on capital allocation and strategy, remuneration structures and succession planning, board diversity and tenure, and ensuring high levels of transparency and company disclosure – to highlight just a few.

For more information on FSSA, or if you have any questions about the transition, please do not hesitate to contact us.

NB Both Stewart Investors and FSSA have been supported by the same centralised Responsible Investment team within the First Sentier Group, who will continue to support FSSA after the transition of SI funds.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q3 2025

Asia Pacific Leaders strategy update: 1 July - 30 September 2025

- Responsibility for managing some of Stewart Investors' portfolios has changed but our engrained investment philosophy, process, and organisational ethos have not.

- Over the short term, our style of investing, which aims to deliver compelling absolute returns over the long term, has not kept pace with returns from regional indices, which have been led by sharp gains from mega-cap technology stocks.

- Although we continue to find interesting investment opportunities in China, we are not willing to compromise on quality to invest in many of the country's largest companies, whose recent gains could prove ephemeral.

- We added new holdings in three companies - Singtel, Jardine Matheson, and AIA - to the portfolio over the quarter.

Review: continuity and change

On one level, the third quarter saw significant changes at Stewart Investors. After acting as careful stewards of our clients’ capital over many years, three of our colleagues stepped back from their portfolio-management responsibilities in August and left the business.

While the list of portfolio-management responsibilities within our team looks different now than it did when the quarter began, on a deeper level, nothing has changed: the philosophy and approach that has defined Stewart Investors since 1988 is deeply engrained and continues to define what we do. Our structure is flat. Every member of the investment team is first and foremost an analyst and our collective focus is on identifying high-quality companies, with resilient financials, guided by ambitious stewards. This is the bedrock on which returns from all our strategies, including Asia Pacific Leaders, have been built.

We cherish our team-based approach to identifying high-quality companies

Before being appointed as the lead manager of the Asia Pacific Leaders strategy, Doug Ledingham was already the manager of a number of Stewart Investors’ other Asia Pacific strategies, including the UK-listed Pacific Assets Trust. Those strategies invest in many of the same companies as Asia Pacific Leaders. Doug, meanwhile, continues to apply the same principles to managing this strategy that have guided it since its launch, working as part of the same tight-knit group of investment analysts and drawing on a common pool of investment ideas. He recently wrote a piece explaining why we consciously resist the growing pressure to focus on the short term:

“At Stewart Investors, we have always sought to occupy a space that protects our clients’ capital. One of the threats we are striving to protect it from is short-termism: from the incessant distraction provided by 24-hour news, from the temptation to digest every morsel of noise, from the danger of trying to react to every macro data point or tweet, and from the pressure to fixate on quarterly earnings. That’s increasingly important in a world where long-term thinking is in increasingly short supply.”

You can read the rest of the piece here: Slow has all the power: why we invest alongside long-term owners.

Investing in the ‘picks and shovels’ of the AI boom while focusing on the long term

Our clients have understandably been keen to discuss the changes that have taken place within our business. Set against that, however, we have been careful to ensure that the majority of our time and attention remains on companies. As part of this, we have been discussing the broader forces being felt by companies across the Asia Pacific region, particularly the extraordinary surge of investment in the build out of AI infrastructure. Although AI is often viewed as a US-focused phenomenon, many of the leaders in this space are actually found in Asia rather than America. They include the manufacturers of the advanced semiconductors that supply computing power to AI data centres, the companies whose technology tests those semiconductors for reliability, and the suppliers of essential components to data centres, such as uninterruptible power supplies.

Many of the immediate financial beneficiaries of the AI infrastructure boom have, therefore, been suppliers of its ‘picks and shovels’. We are cognizant of the intense geopolitical pressures that surround some of these companies, such as the desire of the US to ‘nearshore’ production of semiconductors or to keep the most advanced chips out of the hands of its perceived strategic enemies. These carry the potential to influence corporate behaviour in a way that may not necessarily be to the advantage of long-term shareholders. This is something we are debating and watching closely.

To deepen their understanding of this subject, two members of our team recently visited South Korea, which, along with Taiwan, is at the heart of the global semiconductor industry. Korea is also enacting corporate governance reforms designed to improve shareholder returns. Recent trip reports from Indonesia, India and the Philippines are available on our Insights page, and a report from South Korea should be available next quarter.

A final illustration of continuity over the past quarter: turnover within the portfolio remained typically low. We added three new holdings while selling five. The final section of this update describes the reasoning behind those changes. Our longstanding clients have grown accustomed to seeing modest levels of turnover within the portfolio and, while there may be periods when turnover waxes and wanes, they should not expect that to change.

Looking ahead

Today, our companies generally enjoy lower leverage (less debt) and generate higher free cashflows than the benchmark index. This gives them a buffer against any renewed macroeconomic volatility or geopolitical instability. We believe they can use their financial strength to take advantage of any renewed short-term uncertainty and to extend their advantage relative to their peers. Those companies also have multi-year opportunities for growth in front of them.

At a time of change in markets, trade and geopolitics, our underlying approach remains consistent: we continue to focus on generating attractive returns over the long term rather than attempting to outperform through every short-term period. We look forward to demonstrating the fruits of that approach over the years and decades to come.

Activity

New holding: AIA (Hong Kong: Financials)

Over the course of more than a century, AIA has steadily developed a distinct culture combining a conservative approach to investment with an entrepreneurial structure. Its business is built around a high-quality salesforce who foster long-term relationships with its customers. AIA demands higher levels of professionalisation from its agents than many of its peers, who often rely on armies of part-time agents. Although this means there have been times when AIA has grown more slowly than its peers, putting the needs of its customers above drive for short-term expansion has enabled it to build a premium brand. It now has an opportunity to grow by fulfilling unmet insurance needs across China, India and Southeast Asia. While those countries are getting richer, they lack social safety nets, making insurance products a necessity. This is especially true in China, where the regulator has recently allowed AIA to expand into new regions beyond its historical areas of strength in Beijing, Shanghai, and the Pearl River Delta.

New holding: Jardine Matheson (Hong Kong: Industrials)

Jardine Matheson is a complicated company whose journey towards greater simplicity and professionalisation has the potential to reward patient investors. The current chairman, Ben Keswick, took over from his uncle in 2019. He inherited a sprawling Asian conglomerate whose interests span retail, property, financial services, healthcare, autos, construction equipment, hotels and mining. He has steadily divested non-core assets in a way that would have previously been unthinkable. One result is that debt, excluding financial services operations, fell by more than a fifth over the first half of 2025.1 His vision is to appoint high-quality professionals to run the company’s business units, give them well-defined targets and then grant them autonomy to hit those targets. He keeps a deliberately low profile and acknowledges the missteps the business made over the past decade. Both are valuable signals of humility and an openness to change.

A new chief executive, Lincoln Pan, is due to join later this year. His initial focus seems likely to be on Astra, the listed Indonesian conglomerate, in which Jardine own a majority stake and which is a major contributor to group cashflows. Political uncertainties are an overhang in Indonesia. But as we discussed in a recent report– Is Indonesia still ‘at a crossroads’? – investing in companies who have been able to grow and refine their franchises, and to generate returns for their shareholders irrespective of the wider flux in Indonesia’s economy and politics, is an exciting prospect. Astra currently trades on price-to-book and price-to-earnings multiples not seen since the global financial crisis; one of Mr Pan’s goals will be to change that. Jardine Matheson is some distance from being the highest quality company in our portfolio, but we believe that will start to change over time.

New holding: Singtel (Singapore: Communication Services)

Adding up the market value of Singapore Telecommunications’ (‘Singtel’) various businesses produces an interesting result. The combined value of its shares in Globe Telecom of the Philippines, Indonesia’s Telkomsel, India’s Bharti Airtel, Thailand’s AIS and its parent Intouch along with its holdings in Singapore Post and fibre optic network Netlink gives a total implied valuation above Singtel’s current market value. That implies that its two core businesses, SingTel and Optus, an Australian telecoms network, have a negative value, despite having 4.5 million and 10.7 million mobile customers respectively.2 This is suggestive of the extent to which Singtel remains out of favour among investors despite the fact that, under the leadership of Kuan Moon Yeun, we believe it is better-managed than it has been for some time. Since 2021, he has been refocusing on its core telecoms businesses by disposing of non-core assets acquired under the previous leadership, which made an ill-fated and costly attempt at diversification by venturing into unrelated areas such as digital marketing and online advertising. While the growth potential of its core units is undeniably limited, they deliver steady, predictable and diversified cashflows. Given that Temasek, Singapore’s state-owned investment arm, is its majority owner, it would appear to serve the interests of the government to ensure that Singtel keeps generating cashflows and healthy dividends.

Sold: Advantech (Taiwan: Information Technology)

Amid market exuberance towards parts of the technology sector, we have trimmed our exposure to it by selling the holding in industrial ‘internet-of-things’ company Advantech, where our levels of conviction were dwindling and whose valuation had begun to appear demanding.

Sold: Dabur (India: Consumer Staples)

Dabur directly contributes to improving the health and wellbeing of the Indian population by selling herbal and Ayurvedic products covering hair care, oral care, health care, skin care, home care, food and beverages. A net cash balance sheet and emerging franchises outside of India provide resilience and potential for further growth. But how much more growth can we reasonably expect? Our sale was a recognition that the valuation being awarded to its shares left no room for disappointment.

Sold: Tata Communications (India: Communication Services)

Tata Communications is in the midst of a transformation, evolving from a utility company into a technology business partner, offering a range of digital services and solutions to its clients. While profitable, this is also a highly competitive area and the valuation of its shares left little room for disappointment. As a result, our conviction here has weakened. We can now find stronger ideas – and better homes for our clients’ capital – elsewhere.

Sold: Tokyo Electron (Japan: Information Technology)

Tokyo Electron sells manufacturing equipment to semiconductor foundries such as Samsung Electronics and TSMC. Having grown increasingly concerned about the valuation on which its shares trade, we believe we can find better homes for our clients’ capital elsewhere.

Sold: Unicharm (Japan: Consumer Staples)

Through the 2010s, Unicharm sold an increasing number of nappies to an aging Japanese population, but we failed to anticipate the difficulties it would encounter in replicating its success in other parts of Asia. With the benefit of hindsight, we misidentified the challenges that confront Unicharm. We believed it was encountering shorter-term, cyclical pressures; in reality, those headwinds are structural. After meeting the company’s management, we concluded it is not responding to tougher competition and decreasing brand loyalty sufficiently quickly. We should have sold our holding sooner.

[1] Source: Jardine Matheson Analyst Presentation: 2025 Half-Year Results, pg 15.

[2] Source: Singtel: Annual Report 2025.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2025

Asia Pacific Leaders strategy update: 1 April - 30 June 2025

Shortly after the quarter began, President Trump announced his ‘Liberation Day’ tariffs. With China responding in kind, the prospect of a sharp contraction in global trade saw markets worldwide – including Asia – falling sharply.

Within a matter of days, however, a fall in the US dollar and the threat of a rout in the US government bond market encouraged the president to impose a 90-day moratorium on introducing many of his tariffs. As the world pulled back from an outright trade war, Asian markets rallied, with the gains being led by markets in the export-dominated economies of South Korea and Taiwan. Given our enthusiasm for a number of India’s high-quality, entrepreneurial companies, we were pleased to see share prices in that country starting to rally off the lows seen earlier in the year. The rally was aided by a cut in interest rates but also, we would argue, by valuations that appear attractive in view of those companies’ long-term growth potential.

Although share prices in some parts of Asia have recovered from the sell-off seen at the start of the quarter, the on/off discussions on tariffs have undoubtedly created lingering uncertainty. Some of the companies we have met are looking ahead to a potential resumption of talks on trade through the summer. Although we won’t try to predict their outcome, we would note that business leaders are often preparing for the worst while hoping for the best. While the market waits for greater clarity on trade, we continue as usual: seeking companies led by high-quality stewards, with strong franchises and resilient financials. We have found this combination provides resilience during periods of uncertainty.

We added three new holdings to the portfolio during the quarter. SM Investments (Philippines: Industrials) is the holding company of the Sy family, who own substantial stakes in property, retail and banking companies, including one in BDO Unibank. Trip.com (China: Consumer Discretionary) is an online travel agency. It offers excellent and fully comprehensive travel services across a multilingual and multi-currency platform. It has emerged as China’s leading online travel agency, with a 60% market share1. Sea (Singapore: Communication Services) is the dominant e-commerce platform and internet ecosystem across Southeast Asia and parts of Latin America. There were no complete sales during the quarter.

We estimate that, of the holdings in our Asian portfolios, roughly three-quarters are primarily focused on sales in their domestic markets, offering them a useful buffer amid ongoing concerns about potential disruptions to international trade. With valuations across Asia currently standing at what we regard as extremely attractive levels, we remain confident in the prospects for returns from our carefully selected high-quality companies.

1 Source: Bernstein China SMID Internet: Diamonds in the Sky...Initiating with Trip.com Group November 2024.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q1 2025

Asia Pacific Leaders strategy update: 1 January - 31 March 2025

While broad Asia Pacific market indices edged slightly higher in both US dollar and Australian dollar terms, they moved slightly lower in euro and sterling terms. Perhaps of greater significance was that political turbulence resulted in a wide divergence of returns on a country level. Market indices in China, South Korea and Singapore moved higher but fell across the rest of the region, with some markets suffering double-digit falls.

Most notable was the extent of the divergence in returns between markets in India (down) and China (up). Investors’ enthusiasm for Chinese equities was, in part, a response to DeepSeek’s impressive demonstration of the progress the country is making in AI. Market-friendly rhetoric from the government in Beijing and hopes that the United States’ trade tariffs might not prove too onerous also helped to underpin the gains. In contrast, while there was relatively little news from India, share prices fell back from elevated levels, as they did in many other parts of the world; returns from the Indian market over the quarter were broadly in-line with those from markets in the United States.

During the quarter, we added new positions in S.F. Holding (China: Industrials), Mindray (China: Health Care) and Alibaba (China: Consumer Discretionary). We believe all three companies have the potential to benefit from China’s new emphasis on national self-reliance. Over the last five years, the stewards of Chinese companies have, often for the first time, been tested by genuine economic and political adversity. They have applied the lessons learned during this period of adversity, strengthening their franchises and balance sheets. This, in combination with valuations that appear modest by global standards, means we have been identifying a greater number of new investment ideas in China.

We are also finding quality companies at attractive valuations in the Philippines and India. The competition between new ideas for a place in the portfolio has rarely been this intense. The result was a busier-than-normal quarter. As part of this, and in addition to the Chinese names mentioned above, we added Bank of the Philippine Islands (Philippines: Financials) and BDO Unibank (Philippines: Financials). Both banks are family owned and professionally managed. They complement our existing investment in Ayala (Philippines: Industrials), to which we also added over the quarter. In India, we added a new holding in Bajaj Auto (India: Consumer Discretionary), a leading manufacturer of motorcycles, scooters and auto rickshaws backed by a high-quality steward.

To finance these additions, we trimmed our holdings in companies whose cashflows we believe are at greatest risk from the imposition of new tariffs by the Trump administration, such as Cochlear (Australia: Health Care), CSL (Australia: Health Care), Fisher & Paykel Healthcare (New Zealand: Health Care) and Dr. Reddy’s Laboratories (India: Health Care). All of these businesses import products into the United States from manufacturing plants overseas. We sold out of ResMed (Australia: Health Care), partly for valuation reasons and partly in view of its susceptibility to potential changes in US tariff policy. In a similar vein, we continued to reduce the holding in TSMC (Taiwan: Information Technology) as evidence continued to mount that it is losing control of capital expenditure.

Elsewhere, we reduced our holding in Mahindra & Mahindra (India: Consumer Discretionary) to control the size of our position. We also pared back holdings in Godrej Consumer Products (India: Consumer Staples), Marico (India: Consumer Staples), and Tech Mahindra (India: Information Technology) partly for valuation reasons but also to help finance the new investments mentioned above. A similar logic informed our complete sale of Tata Consumer Products (India: Consumer Staples).

As the long period of US exceptionalism draws to an end, we hope investors will begin to pay attention to the abundance of attractively valued companies to be found in the Asia Pacific region. Clearly, if the US economy falters and global demand falls, then economies across Asia will be impacted, albeit to differing degrees. We are also conscious that political risks appear to be rising in many Asian countries. Those risks, however, are far from uniform. The region’s technology complex, centred around Taiwan, South Korea and China, would appear to be particularly vulnerable to a global slowdown. India, by contrast, remains a domestically driven growth story and, as such, is somewhat isolated from the tumult in the global economy. The Philippines, meanwhile, could receive a significant economic boost if a global slowdown results in a meaningful fall in oil prices.

Predicting how any of today’s economic and geopolitical challenges will play out lies beyond our remit and our skillset. Fortunately, the Asian companies we invest in tend to have long memories; they still have the scar tissue formed during previous crises. These businesses have been forced to learn, to adapt and to become resilient. As a result, we believe they are set up not only to perform when conditions are fair but to navigate through whatever political and economic turbulence lies ahead.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific All Cap Strategy, Asia Pacific & Japan All Cap Strategy, Asia Pacific Leaders Strategy, Global Emerging Markets (ex China) Leaders Strategy, Global Emerging Markets Leaders Strategy, Global Emerging Markets All Cap Strategy, Indian Subcontinent All Cap Strategy, Worldwide All Cap Strategy and Worldwide Leaders Strategy accounts as at 30 September 2025. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer. Not all strategies are available in all jurisdictions or to all audience types.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2025 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Fund data and information

Fund prices and details

Click on the links below to access key facts, literature, performance and portfolio information for the funds and share classes available in this jurisdiction:

Stewart Investors Asia Pacific Leaders

Stewart Investors Asia Pacific Leaders Fund

| Fund name | Fund type | Currency | Price | Daily change | Price date | Factsheet |

|---|---|---|---|---|---|---|

| Stewart Investors Asia Pacific Leaders Class I (Acc) | Irish UCITs | EUR | 3.57 | -0.76 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class I (H Dist) | Irish UCITs | EUR | 3.25 | -0.76 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class I (Acc) | Irish UCITs | SGD | 10.94 | -0.77 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class I (H Dist) | Irish UCITs | SGD | 10.89 | -0.77 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class I (H Dist) | Irish UCITs | USD | 11.60 | -0.72 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class I (Acc) | Irish UCITs | USD | 10.71 | -0.72 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class VI (Acc) | Irish UCITs | EUR | 3.49 | -0.76 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class VI (H Dist) | Irish UCITs | EUR | 2.41 | -0.76 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class VI (Acc) | Irish UCITs | GBP | 14.35 | -0.64 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class VI (Acc) | Irish UCITs | USD | 15.54 | -0.72 | 06 Feb 2026 | |

| Stewart Investors Asia Pacific Leaders Class VI (H Dist) | Irish UCITs | USD | 15.08 | -0.72 | 06 Feb 2026 |

Share prices are calculated on a forward pricing basis which means that the price at which you buy or sell will be calculated at the next valuation point after the transaction is placed. Where a fund price is marked XD, this means that the fund is currently Ex-Dividend. Past performance is not necessarily a guide to future performance. The value of shares and income from them may go down as well as up and is not guaranteed. Please note that the yield quoted above is not the historic yield. It is considered that the yield quoted represents the current position of investments, income and expenses in the fund and that this is a more accurate figure. Investors may be subject to tax on their distribution. The yield is not guaranteed or representative of future yields. You should be aware that any currency movements could affect the value of your investment. The Funds within the First Sentier Investors Global Umbrella Fund plc (Irish VCC) are denominated in USD or EUR.

Following the UK departure from the European Union, the First Sentier Investors ICVC, an open ended investment company registered in England and Wales ("OEIC") has ceased to qualify as a UCITS scheme and is instead an Alternative Investment Fund ("AIF") for European Union purposes under the terms of the Alternative Investment Fund Managers Directive (2011/61/EU). Accordingly, no marketing activities relating to the OEIC are being carried out by Stewart Investors in the European Union (or the additional EEA states) and the OEIC is not available for distribution in those jurisdictions. We have made documents available for existing EU investors in the ICVC which can be accessed here.

Strategy and fund name changes

As of end of 2024, please note that Stewart Investors strategies and the Funds within the UK First Sentier Investors ICVC, First Sentier Investors Global Umbrella Fund plc (Irish VCC) and First Sentier Investors Global Growth Funds (Singapore Unit Trust) have been renamed. Please refer to our note via the link below for further information.