Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Our Hippocratic oath in action

Our Hippocratic oath is something we all hold dearly and have all signed. It underpins our investment philosophy, which is based on identifying quality stewards of strong franchises with good long-term prospects.

Our Hippocratic oath is something we all hold dearly and have all signed.

It underpins our investment philosophy, which is based on identifying quality stewards of strong franchises with good long-term prospects. Three tenants of our oath are particularly pertinent and worthy of deeper reflection in the context of our recent trip to China.

We will not forget in our search for returns that the primary risk faced by our clients is losing their capital.

Our definition of risk is simple: the permanent loss of capital. One of the most shocking ways of losing capital is when ownership is taken without proper compensation, either by force or stealth. The majestic buildings on the Huangpu River in Shanghai serve as a good reminder of how quickly and terribly circumstances can change. Number 12, the Bund, was designed by British architects to be ‘the best bank in the world’ in the 1920s. This magnificent building was the headquarters of HSBC in Shanghai before it had to be handed over to the municipal communist government in 1956. Further along the road, the Keswick family lost control of number 27 on two occasions, first to the Japanese and then to the Chinese government in 1954.1

At this time Great Britain was one of the most significant investors in China, four times larger than the USA, and had the most to lose from nationalisation. The then British Chamber of Commerce (chaired by J. Keswick in Shanghai - possibly slightly biased!) estimated British investment amounted to £1 billion pounds in Shanghai alone. Another large loser was Shell. According to The Story of Shell in China, the company was the largest foreign operator of filling stations in Shanghai and employed some 2,600 Chinese staff.2 However, we are told “over the years 1951-53 Shell relinquished most of its depots, residences and service stations in the Republic to the government, together with various quantities of oil and chemicals”.3 Not only were assets under threat of confiscation but income was reduced by insidious expense inflation after the government linked Chinese wages at British firms to the price of rice, which was in chronically short supply. It was a difficult time for foreign investors and what made matters worse was the absence of recourse in the law courts to claim compensation.

Turning eastwards, the ever-developing skyline of the Pudong is an impressive sight. On this trip we could actually see the futuristic skyscrapers set against a clear blue sky, rather than noxious clouds which have obscured the buildings in previous years. It is easy to get carried away with the sheer scale of the vista. It is intended that way! This special economic zone was the brainchild of the indomitable politician Zhu Rongji who wanted to inspire confidence in domestic and foreign investors after much social disquiet. This worked; the skyline is now one of most photographed in the world and has come to symbolise a bold future with wealth creation a plenty, although not for everyone.

Less impressed by this view are the farmers and families who were encouraged, with scant compensation, to vacate their homes and livelihood to make way for construction. Author Zhaohui Hong calculated these farmers received only one third of the value of the land with the remainder benefitting the public coffers.4 A study by the World Bank estimated that local governments expropriated around US$320 billion worth of land from farmers between 1990 and 2010.5 The common thread is a continued disrespect for ‘property rights’. It is with this in mind that we are especially vigilant to study the substance rather than just the form of each possible investment in China.

The extremely popular internet giants (Alibaba, Tencent and Baidu) and the legal structures on which they rely are a case in point. These structures are known as variable interest entities (VIE), an American creation, made famous by Enron in 2001. In the case of China they are used to circumvent restrictions on foreign investment in certain key industries, such as steel and media. It is a complicated arrangement as it permits two different parties (the Chinese regulators and foreign investors) to claim ownership of the same operating assets. Each VIE is different but the common feature is that investors can only buy shares in a listed company with no actual ownership of sometimes the most valuable assets, gaining only a promissory note of entitlement. Instead, investors are asked to rely on a legal agreement that entitles the ‘listco’6 to a share of the profits from the separate company. Using the prospectus of JD.Com as an example, investors are clearly warned that the government could confiscate income or force interests to be relinquished if it is deemed that regulations, or the interpretation of existing regulations, is changed. It is worth pondering how companies incorporating such risks could be allowed to list in the US but the SEC (Securities and Exchange Commission) cannot ban offerings for being too risky or even potentially illegal, all they can do is require full disclosure of the risks. With such warnings in writing, it would be extremely difficult to protect investor’s rights should anything untoward unfold.

These risks have arisen in China not just in the early decades of communist rule, but recently. In 2008, the Agria Corporation lost control of a Chinese subsidiary to a discontented executive. The asset was only returned to the company when the executive received additional compensation. Another example is the disappearance of Alipay, much to the chagrin of minority investors, Yahoo and Softbank, to a company owned by the founder Jack Ma. More recently, shareholders of RenRen (a social media network) alleged in an open letter that the founders were attempting to “enrich themselves to the detriment of all other shareholders”.7 In this case governance was tested, animosity lingers and the share price has fallen 75% from its all-time high. One further governance concern is an iniquitous8 number of votes, attached to different classes of shares, which is common among these companies. In the case of JD.Com, foreign investors need to be completely confident of their alignment with the founder as he controls twenty times more voting power should any disagreement occur. While these arrangements have so far been honoured, they are ripe for abuse and give no guarantee that they will stand the test of time or any political change.

We are particularly nervous about Emerging Market billionaires who become politically connected and advantaged. Political connections can provide tailwinds but we find it very difficult to predict, as and when, such winds may alter course. At present, media in China is mostly closed to foreign competition but should the increasingly powerful Chairman of everything, Xi Jinping, feel threatened, or simply so inclined, circumstance could quickly change. We remember too well what happened to the share price of Russian company Yukos when its CEO fell out of political favour. He who giveth can taketh away! In addition to politicians, society provides a license to operate which, as in the case with Facebook, can be harmed if it is deemed to be overly intrusive or misused. Despite such apparent risks, Chinese internet companies have proven to be extremely popular. In 2017 they doubled in value and are collectively worth more than US$1trillion in market capitalisation. Their substance is poor but their form is good with strong operating and share price momentum. For many investors this presents interesting behavioural challenges. At Stewart Investors we are shielded from these by strict adherence to another tenant of our Hippocratic Oath.

We will not succumb to irrational exuberance in good times, nor to unjustified gloom in bad times.

There are a number of signs pointing to irrational exuberance in the Chinese internet sector. While they are evident and intensifying, such pointers provide no precision on timing - irrational exuberance can persist for quite some time. Nonetheless, it is worth reminding ourselves of some of the more obvious evidence. Today, 96% of the recommendations by analysts on Alibaba are positive, outperform or buy. The remaining 4% are restricted or prohibited from giving advice, likely because of conflicted bankers. There are fifty enthusiastic analysts writing about Alibaba as opposed to only six covering unfashionable Swire Pacific - owners of some of the oldest, most recognisable brands and properties in Asia.

Other anecdotes of irrational exuberance include placings by large founding shareholders; standing room only in investor meetings; investors willing to pay four times more to meet an internet company than other types of company; new jargon to explain new paradigms; the cult-like popularity and media obsession of the CEOs; multiple, previously disinterested people, becoming experts on investment; pained looks of sympathy from friendly competitors and clients accompanied with the questions “why don’t you just buy those companies?” The subtext here is ‘you are just not getting it, it is different this time so buy it and move on’, or “why don’t you neutralise the risk?” The last comment reveals a fundamental difference in the definition of risk which is not, in our minds, the deviation from a comparative index or the fear of losing out! Put simply we consider there to be a risk of capital loss should we invest with these stewards. Such a capitulation would be against our investment philosophy and is prevented by our Hippocratic Oath.

We will strive to achieve, through hard work, sober analysis and sound judgement, the best risk-adjusted returns possible for our clients.

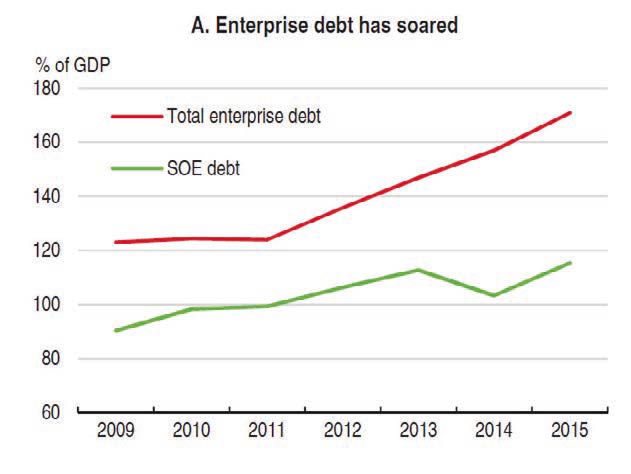

Most enterprise debt is from state-owned enterprises (SOEs)

Source - OECD Economic Surveys - China - March 2017. http://www.oecd.org/economy/surveys/china-2017-OECD-economic-survey-overview.pdf

There are approximately 3,000 listed companies in China. Here, as with every other market in the world, we feel no compulsion to cover them all. We do not start with a list of companies. Instead, we start with a blank sheet of paper and seek to entrust client money to those companies we believe are best positioned to deliver attractive long-term risk-adjusted returns. We spend more time worrying about what could go wrong with our investments than trying to predict what may go right. This almost immediately precludes companies that are influenced by the state, either by ownership or policy, or both.

The HNA Group illustrates that it is not always easy to identify the ultimate owner of the assets but one quick clue - albeit crude - is provided by the balance sheet, with high debt ratios often suggesting some sort of government backstop. This so called ‘implicit guarantee’ can lead to extremely fragile balance sheets and is an indication of absent owners and poor stewardship. This is not to imply that all companies with net cash balance sheets are unrelated to the government and therefore quality: China Mobile is a case in point. The largest telecom operator currently has approximately US$72bn of cash on the balance sheet which should provide stability in time of stress. However, a history of peculiar capital allocation combined with high state ownership control means there is high risk this cash could be deployed unwisely. We prefer to find companies that fly somewhere below the government’s radar – where there is no need or desire for the state to take interest.

In the second half of our trip we travelled round the southern province of Guangdong to meet a handful of high quality companies we know and would like to partner with in the future. A simple condiment manufacturer provides a good example of the type of company we met. Here there is a history of strong stewardship over a fully-owned, desirable brand which is gaining popularity and market share. This is reflected in high employee ownership and attractive, financial characteristics: a high cash margin9 and a low requirement for working capital.10 These combined with conservative brand accounting11 produces an attractively robust balance sheet - tangible assets predominantly financed by equity.12 The company also boasts a long and predictable runway from the launch of new but related products, industry consolidation and export growth. Some of these financial metrics are notably similar (except for conservative accounting) to those of the internet companies but it is the presence of careful owners combined with clear legal structures and politically agnostic products that are importantly different.

At Stewart Investors we follow our Hippocratic Oath which keeps us true to an investment philosophy which has remained unchanged for almost three decades. This has led us towards companies like the condiment manufacturer, where we are aligned with the founders, and away from lower quality companies, that are frequently large and often politically connected. The usual performance outcome has been to trail rapidly rising markets while preserving capital during falling markets. This can lead to an unnerving deviation from any comparative benchmark especially when investors are very exuberant as they have been for some time now. However, over previous cycles our focus on the avoidance of capital loss has provided a superior result. We are confident that this philosophy will hold true now as in the past and we will continue to invest in quality companies with substance rather than being beguiled by companies which are fashionable.

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Want to know more?

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group