Get the right experience for you. Please select your location and investor type.

IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Company contributions to sustainable human development

Since our first sustainable development-focused strategy launched in 2005, human development has been a key focus area given our long history of investing in Asia Pacific and emerging markets.

Recently we have been expanding the way we assess and report on how our companies are contributing to various solutions to human development challenges. This builds upon our work mapping the contribution our companies are making to climate solutions featured in Project Drawdown.

The idea of ‘sustainability’ is simple and easy to understand. Yet at the same time, it is a concept which has spawned innumerable marginally different definitions. Each interpretation of the concept is inevitably imperfect and incomplete, and at the same time has something to offer. We do not presume that our own framework is the ‘right’ approach, let alone the only valid one.

How we think about sustainable development

Since 2012 we have used a framework developed by the Global Footprint Network for describing sustainability, which brings together the twin imperatives of human development and environmental sustainability. To us, combining these two high-level goals is a solid basis for understanding what sustainability is at its heart. This is a goal which economist Kate Raworth describes as providing “for every person’s needs while safeguarding the living world on which we all depend.”1

The graph below from the Global Footprint Network encapsulates this.2 On its vertical axis, the graph uses the concept of ‘ecological footprint’ to plot humanity’s use of the Earth’s regenerative and absorptive capacity in terms of water, land, food and other natural resources.3 On its horizontal axis, the graph uses a broad measure of human development – the Human Development Index (HDI) developed for the UN by economist Amartya Sen, and which includes metrics related to income, education and health.4

Source: Global Footprint Network, 2019 National Footprint Accounts www.footprintnetwork.org and data.footprintnetwork.org/#/sustainableDevelopment?cn=all&yr=2016&type=BCpc,EFCpc. Latest country data for the Ecological footprint is 2016.

The bottom right quadrant (coloured light sage green) is the area of global sustainability: the zone in which a society has delivered ‘high human development’ but still lives within its environmental means. Unfortunately it is quite a lonely part of the graph!

We use this framework to help think about the sustainability positioning of individual companies. Our aim is to find companies which are contributing to and benefiting from sustainable development. That means we look for business models which help move societies from north to south on the chart by reducing environmental impact, and from west to east by improving human development outcomes.

To deepen our understanding we recently evaluated companies on their contribution to environmental solutions using an external framework developed by Project Drawdown which identified 80 climate change solutions. We are continuing this work by doing the same for human development. However, a comparable framework to Project Drawdown does not exist and so we have instead expanded on the components of the HDI.

Deepening our understanding of human development

The HDI used in the chart works well as a high level measure. Countries which score well on it genuinely do tend to be delivering for their citizens, and vice versa. However, like all metrics it has its limitations. Many companies which we believe to be sustainable do not map directly to any of its constituent components – income, education and health – and so we have spent some time thinking about how we would expand this idea.

Taking inspiration from many different sources, we have determined 10 broad pillars which we believe encapsulate the essence of human development in a slightly more detailed way, and to which we could readily map companies. We believe that our investee companies should all be contributing in a tangible way to at least one of the ten pillars.

10 pillars of human development

- Nutrition

- Health & wellbeing

- Water & sanitation

- Education

- Information & connectivity

- Energy & electricity

- Income & employment

- Financial inclusion

- Housing

- Standard of living

These pillars cover a range of areas which we believe to be central to the spirit of sustainable human development, and quality of life for people around the world, particularly in emerging markets. Most of them are self-explanatory and link back in clear ways to Sen’s concept of ‘development as freedom’5 and the HDI.

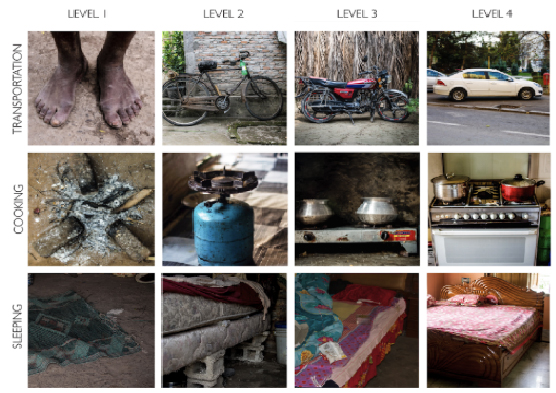

To elaborate on probably the least self-evident pillar and to illustrate our thinking more generally, our conception of Standard of living is an idea inspired by the late Hans Rosling’s work. It is approximated in the HDI as GDP per capita.6

At heart, it refers to people’s ability, through the ownership of private goods, to attain a higher quality of life. As shown below, Rosling’s exceptional book Factfulness illustrated this with reference to transport, cooking equipment and sleeping arrangements.7 We could equally refer to ownership of air conditioning – which in many tropical emerging markets has clear links to educational attainment and labour productivity – or to family possession of white goods – which have been instrumental in allowing women to enter the workforce in many societies around the world.

Demonstrating positive impacts on human development

To test and demonstrate our approach, we have analysed the companies in our Global Emerging Markets Sustainability strategy against the pillars, and will soon roll this analysis out to other strategies as has previously been done for Project Drawdown solutions.

For clients in the Global Emerging Markets Sustainability strategy, for instance, we own shares in a Chinese provider of extractor fans and gas cooking hobs. In a Chinese context, these products have huge environmental and health benefits. Households switching from burning solid fuel to using gas has been shown to be the single biggest contributor to improving air quality in China, preventing an incredible 400,000 premature deaths annually.8 The company, in our view, maps clearly onto the Energy & electricity pillar, since its business model is to provide people with a cleaner form of cooking fuel.

The strategy also has a position in a leading provider of medicines in Bangladesh. With over 700 drugs and the only truly nationwide distribution system, the company has a focus on anti-infectives, as well as treatments for the non-communicable diseases which are now the leading causes of illness in Bangladesh.

Source: Gapminder and Dollar Street - Free material from www.gapminder.org, CC-by license.

In a country in which the annual medical spend was a paltry US$36 per person per year in 20179, the company is well-positioned to continue to deliver access to medicines in a society which desperately needs it. It maps neatly onto the Health & wellbeing pillar.

These are just two of the many tangible and inspiring ways that each of our companies are contributing to solving the world’s human development challenges.

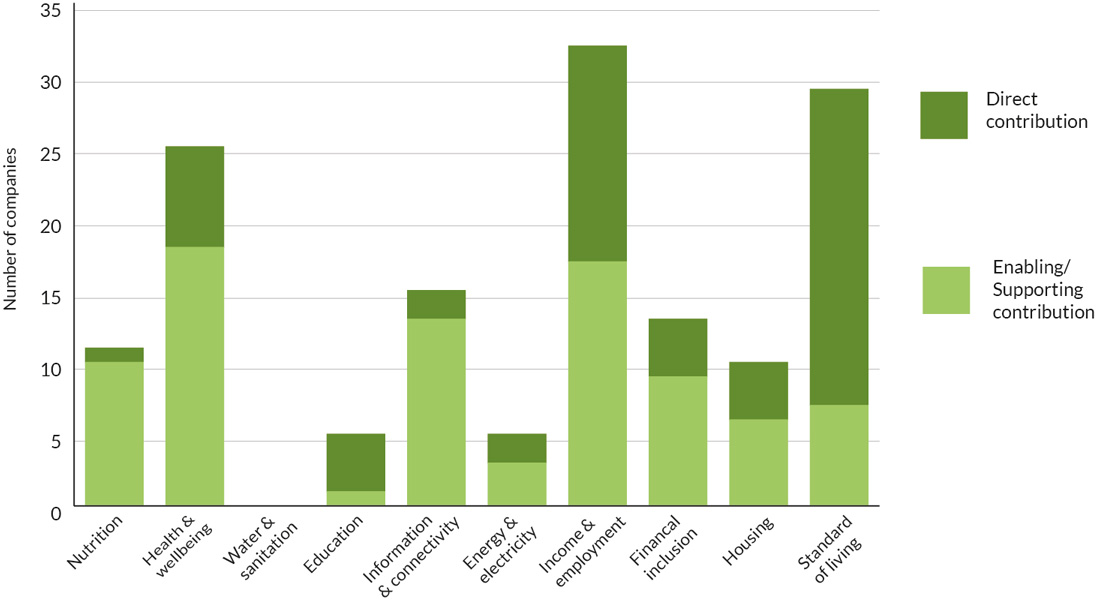

When we group companies together by pillars, we begin to get a picture of where the investee companies of the Global Emerging Markets Sustainability Strategy are contributing most to human development in emerging markets.

We currently own shares on behalf of clients in companies in the portfolio which contribute meaningfully to all of the pillars except for one, Water & sanitation.

The largest concentrations of contributions arise in three areas.

The first is Health & wellbeing, and includes companies which are manufacturing drugs and personal care goods, as well as pharmaceutical retailers and companies providing medical diagnostic services.

The second is Income & employment, where a good example would be a company in Brazil which provides enterprise resource planning (ERP) software to half the country’s small and medium sized enterprises, thereby supporting the jobs of millions of Brazilians.

And the third concentration of company contributions is in Information & connectivity, and includes businesses like a Czech software company, which provides internet security software to 400m consumers.10

When we think about the solutions holistically, we also begin to see how our investee companies’ contributions are complementary in their impact on human development.

Take the example of Housing. Population growth and rapid urbanization has put huge strain on infrastructure and housing stocks in emerging markets cities, and today approximately 880m people globally are classified as slum-dwellers.11 This is a tragedy, not just for the quality of life for those millions of people, but for society: the ability to get an education, to access employment and to deliver social justice is tightly linked to adequate housing.

We mapped six existing Global Emerging Markets Sustainability strategy holdings onto the Housing pillar.

HDI Pillars

Source: Stewart Investors, November 2020.

They included companies providing mortgage financing, one being a company which since 1977 has financed an incredible 7.8m housing units in India, with an average loan size of US$35,700. Last year, 37% of their loans by volume were in the affordable housing segment, with an average loan size of just $15,00012 – loans aimed at helping people upgrade their quality of housing at the bottom of the pyramid (poorest part of society).

The companies mapped onto Housing also included companies providing building materials which are central to the construction of safe dwellings. An excellent example is an Indian decorative paint company. In a country where 90% of paint does not comply with regulations on lead content, a company like the one we own shares in for clients – which sells water-based, lead-free and low VOC13 decorative paint – is well positioned to grow its sales more quickly as a result of its leading position on these issues, as well as save lives in the process.14 In the developed world, paint is primarily an aesthetic consideration, but in the humid climate of South Asia, paint plays a crucial role in preventing damp and mould, aiding waterproofing and ensuring buildings last longer. Without high quality, non-toxic paint, housing units in tropical climates quickly become unfit for human habitation.

Sustainable investing as an enabler of human development

Many of the contributions which our companies are making to sustainable human development are not ground-breaking. Most are not eye-catching or headline-grabbing. But they are no less powerful or important for that.

It is the essential medicines in Bangladesh, the first time mortgages in India, the gas cookers in rural China and the safe, low-toxicity paint in India that are helping and will continue to help hundreds of millions of people in emerging markets to live longer, better and healthier lives.

We continue to believe that the best way to allocate capital responsibly and productively over the long term is to find companies which are contributing to and benefiting from sustainable development. With our new frameworks, we have powerful tools to analyse and find such companies, and to communicate their contributions to clients.

We look forward to continuing to do so in coming months and years.

Jack Nelson

December 2020

Investment terms

View our list of investment terms to help you understand the terminology within this website.

Want to know more?

Important Information

This material is a financial promotion / marketing communication but is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Group portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Group.

Selling restrictions

Not all First Sentier Group products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Group in order to comply with local laws or regulatory requirements in such country.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in

- Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group