Get the right experience for you. Please select your location and investor type.

Indian Subcontinent Sustainability

Launched in 2006, the strategy invests in companies based in or having significant operations in India, Pakistan, Sri Lanka or Bangladesh.

Strategy overviewLaunched in 2006, the Stewart Investors Indian Subcontinent Sustainability Strategy is a long-term, equity-only strategy that aims to invest in shares of high-quality companies positioned to contribute to, and benefit from, the sustainable development of the region. Given the size of the economy and the investment universe, the majority of the strategy’s 30-60 investments are in Indian-listed companies.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q1 2024

Indian Subcontinent Sustainability strategy update: 1 January - 31 March 2024

During the quarter, we completely exited Tata Technologies (India: Communication Services) and HDFC Life (India: Financials). We applied for shares in the initial public offering (IPO) of Tata Technologies and only received a small allocation given the popularity of the company. On listing, the share price jumped more than 150% making the company expensive overnight. We sold as the strategy was left with a small position in an expensively valued business. We continue to like the quality of stewardship at HDFC Life and the long-term opportunity for life insurance in India. We struggled to build conviction in the complex financial quality and the heightened competitive intensity of the sector. We will continue to monitor the evolution of these businesses. We reduced our holdings in CG Power (India: Industrials) and Tata Consumer Products (India: Consumer Staples) due to expensive valuations. We remain excited for the long-term potential of both companies.

We used the cash from the above sales to fund purchases in some of our reasonably valued holdings such as Cyient (India: Information Technology), Triveni Turbines (India: Industrials), Blue Dart Express (India: Industrials), IndiaMART (India: Industrials) and Tarsons Products (India: Health Care). These companies are leaders in their fields with a significant opportunity set ahead of them.

As ever, we continue to believe that bottom-up analysis, with a focus on fundamental quality and sustainable growth tailwinds, is the best route to tapping into the opportunities and protecting against the risks of investing in the Indian Subcontinent.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q4 2023

Indian Subcontinent Sustainability strategy update: 1 October - 31 December 2023

This was a relatively busy quarter in the Indian Subcontinent strategy where we initiated a new position in RBL Bank (India: Financials) and exited Dabur (India: Consumer Staples) completely.

RBL Bank is a private bank in the midst of a turnaround. The bank lost its way through aggressive growth leading to high non-performing loans (NPLs). As a measure of abundant caution India’s central bank stepped in to change management and solidify the foundations of the bank. We believe new management is putting in place the right systems to build a quality credit culture with a focus on lower risk assets funded mostly by deposits. A successful turnaround could yield attractive returns for shareholders.

We sold the holding in Dabur. We first bought Dabur in October 2007 and have held it continuously until December 2023. The company has compounded returns at an attractive rate during this period and well ahead of inflation and also index returns. Dabur has been a key contributor to the portfolio’s long-term returns while also protecting capital during market falls. We were attracted by Dabur’s family stewardship, professional management, dominant consumer brands and sound financial quality. These qualities remain but valuations are expensive.

We added to many existing companies in the portfolio. These additions were largely due to reasonable valuations and increased conviction in the growth potential of these companies. The additions included IndiaMART (India: Industrials), Triveni Turbines (India: Industrials), Cyient (India: Information Technology), Dr. Reddy’s (India: Health Care) and GMM Pfaudler (India: Industrials) amongst others.

We trimmed our holdings in CG Power (India: Industrials) and Tata Consultancy Services (India: Information Technology) due to expensive valuations. We continue to have high conviction in CG Power as it is favourably exposed to an industrial cycle in India while aspiring to become a quality global supplier of electric motors. The former is a medium-term tailwind while the latter expands the opportunity set for the company multifold over the long term. TCS is one of the highest-quality companies in our universe. TCS is a steady global franchise but growth is unlikely to be as good as their record in the last two decades. We have been reducing our holdings in TCS in favour of businesses at an earlier stage of their evolution with stronger growth prospects.

As ever, we continue to believe that bottom-up analysis, with a focus on fundamental quality and sustainable growth tailwinds, is the best route to tapping into the opportunities and protecting against the risks of investing in the Indian Subcontinent.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2023

Indian Subcontinent Sustainability strategy update: 1 July - 30 September 2023

This was a relatively quiet quarter in the strategy where we initiated one new position in the portfolio: GMM Pfaudler (India: Industrials).

GMM Pfaudler is a leading provider of glass-lined equipment used in chemical and pharmaceutical manufacturing. Stewarded by the second generation of the founding Patel family, GMM’s ambitions are clear in their recent move to acquire their parent company – a rare instance of an Indian subsidiary acquiring a multinational parent. The domestic Indian business has been run far better than its German equivalent, shown by overseas sales accounting for roughly 75% of total revenues and operating profits from the Indian business accounting for a roughly similar proportion of total operating profits1. The opportunity ahead for GMM Pfaudler continues to lie in the combination of competent stewards improving sales growth and driving profitability in the combined business, with a franchise built on trusted relationships with customers.

BRAC Bank (Bangladesh: Financials) was sold due to rising regulatory headwinds for the banking sector in Bangladesh.

The quiet quarter in terms of new positions and exits in the strategy isn’t reflective of a lack of action. Over the course of the last six months, we have organised two investment trips to Mumbai and Bangalore, and continue to spend time meeting new companies and building conviction in our existing holdings.

These meetings have helped reiterate conviction in the likes of HDFC Bank (India: Financials) and Kotak Mahindra Bank (India: Financials), where we have increased position sizes in the strategy. These are some of the highest-quality financial institutions globally, conservatively managed and run with an eye on the long term – they remain well positioned to continue growing and taking market share from lower-quality competitors in the decades ahead.

As ever, we continue to believe that bottom-up analysis, with a focus on fundamental quality and sustainable growth tailwinds, is the best route to tapping into the opportunities and protecting against the risks of investing in the Indian Subcontinent.

1 GMM Pfaulder, 2022 Annual Report

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2023

Indian Subcontinent Sustainability strategy update: 1 April - 30 June 2023

During the course of this quarter, we exited two holdings and initiated two new positions in the strategy.

The first holding we exited was Infosys (India: Information Technology) – a leading IT services company in India. While Infosys remains one of the largest IT services companies in the country, focused on steady execution, we felt there were better opportunities available at more reasonable valuations.

As such, we initiated a position in Cyient (India: Information Technology), a smaller IT services provider. Over the past few years, Cyient has gone through a process of professionalisation, with the founding family handing over management responsibilities to a newer team. The family remains involved at the Board level, helping embed long-termism through the organisation and leaving operational execution to the management team. Cyient continues to focus on developing expertise in a few key industries, to help provide niche solutions for their end clients. The ability for Cyient to continue growing sales and improving margins at appealing valuations led us to start a position here.

We also initiated a position in Mahindra and Mahindra Financial Services (India: Financials). Mahindra Finance is a rural non-banking finance company, majority owned by the Mahindra Group. The business provides financing predominantly for tractors and other automotive vehicles in rural areas across India. Mahindra Finance has gone through a number of changes in the past year, primary amongst those is hiring a new management team that are looking to bring more focus on the quality of credit assessment and profitability of the business going forward. These changes, alongside the continued long growth runway they have in vehicle financing and other adjacent areas, led us to initiate a position in the company.

The other holding we exited from was Pidilite Industries (India: Materials). We first purchased shares in Pidilite in the Indian Subcontinent strategy in 2010 and have watched the company grow leaps and bounds in the ensuing 13 years. Pidilite remains an exceptional business, with long-term stewards who have continued to strengthen the core adhesives franchise, create one of the most recognisable brands in the country, and build out a wide-ranging distribution network across India. Our decision to exit the holding is based solely on valuation discipline – at close to 75x P/E, it became increasingly difficult to see a path to solid long-term returns for clients. We continue to watch the evolution of the business closely and hope to own shares in this unique company again one day.

Alongside some of these changes, we continued adding to an array of high-quality industrial companies in India, including Elgi Equipments (India: Industrials), Triveni Turbines (India: Industrials), and Carborundum Universal (India: Materials). During a recent trip to India, we had the privilege of meeting with the managers of some of these businesses and reiterating our conviction in the bottom-up quality of these franchises. Each of these companies is led by an ambitious manager, building the picks and shovels to industrial capital expenditure across the country. The ambition of these companies is also seen in their nurturing of small export-oriented businesses that have long runways of growth left ahead.

As ever, we continue to believe that bottom-up analysis, with a focus on fundamental quality and sustainable growth tailwinds, is the best route to tapping into the opportunities and protecting against the risks of investing in the Indian Subcontinent.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Proxy voting: Q1 2024

Indian Subcontinent Sustainability proxy voting: 1 January - 31 March 2024

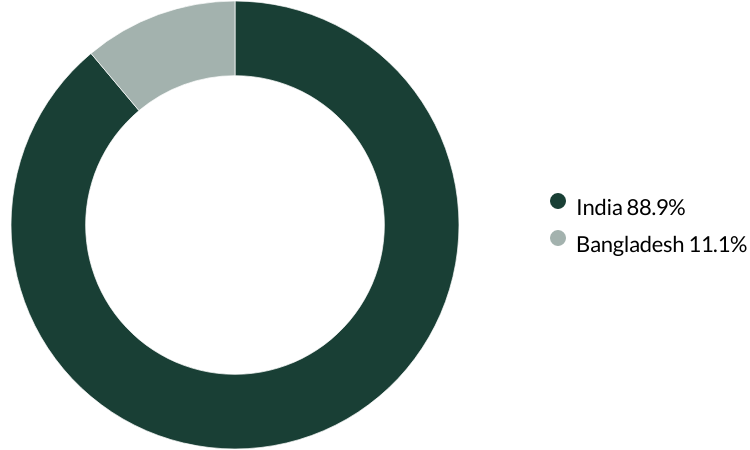

Proxy voting by country of origin

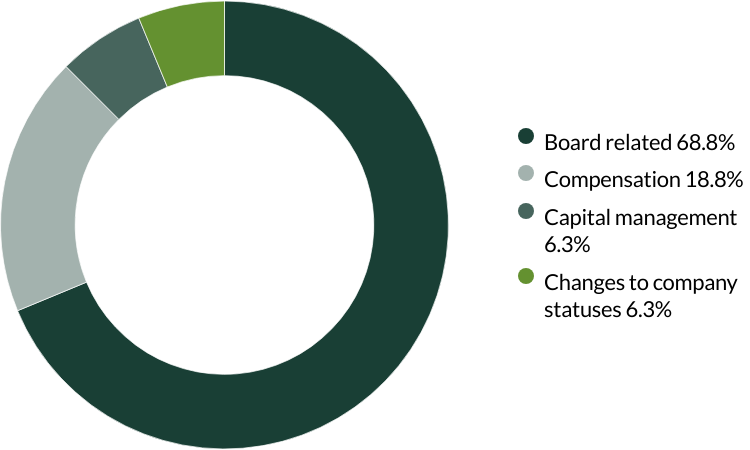

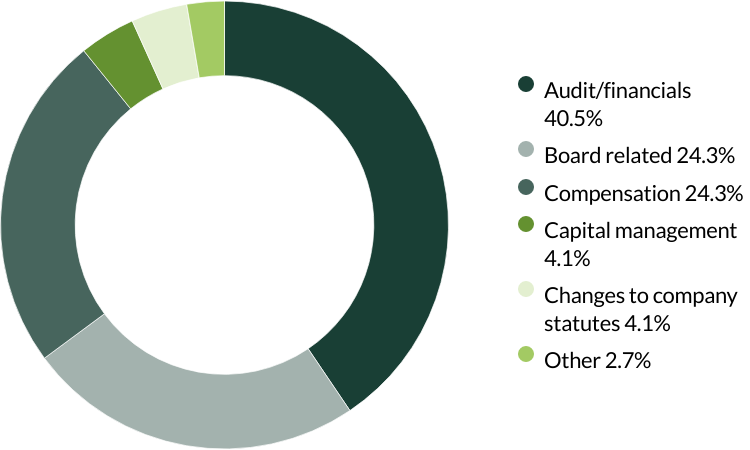

Proxy voting by proposal category

During the quarter there were 32 resolutions from 11 companies to vote on. On behalf of clients, we didn't vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2023

Indian Subcontinent Sustainability proxy voting: 1 October - 31 December 2023

Proxy voting by country of origin

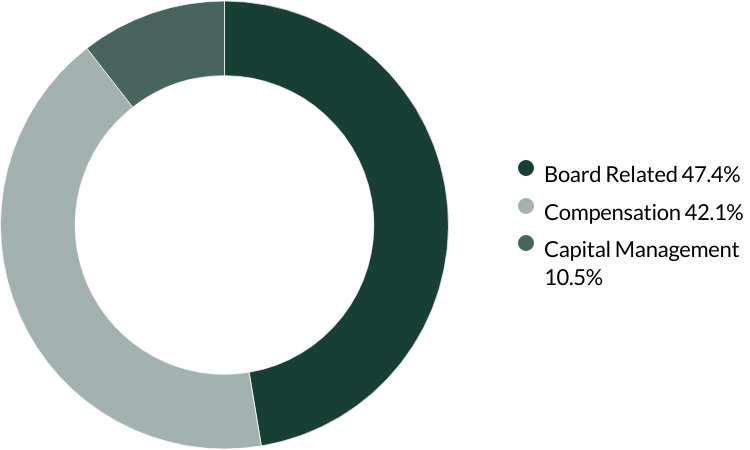

Proxy voting by proposal category

During the quarter there were 19 resolutions from nine companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2023

Indian Subcontinent Sustainability proxy voting: 1 July - 30 September 2023

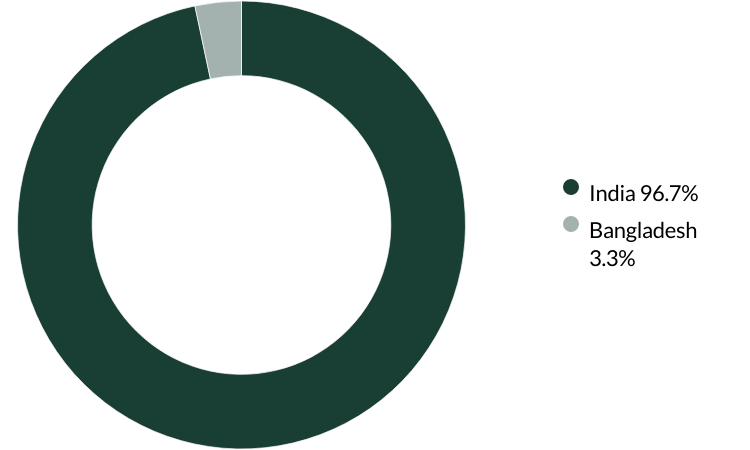

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 229 resolutions from 29 companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2023

Indian Subcontinent Sustainability proxy voting: 1 April - 30 June 2023

Proxy voting by country of origin

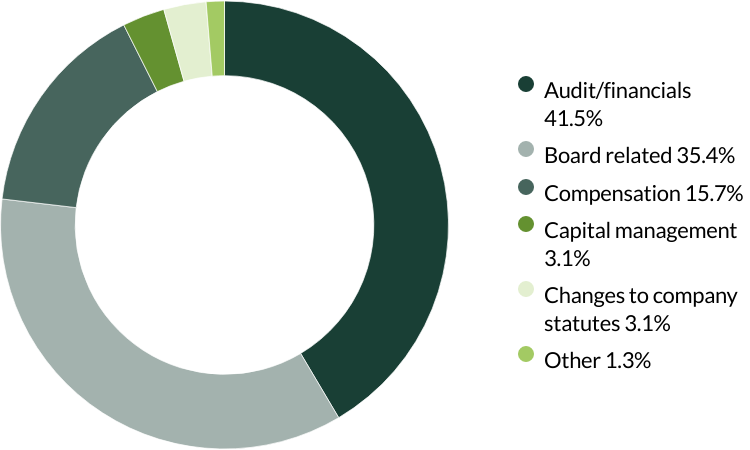

Proxy voting by proposal category

During the quarter there were 44 resolutions from 14 companies to vote on. On behalf of clients, we voted against four resolutions.

We voted against Aavas Financiers' request to reprice options granted under various equity stock option plans for employees due to a share price fall. We do not believe this request is in shareholders’ interest. (three resolutions)

We voted against BRAC Bank’s request to increase authorised share capital by more than 100%, as the company had not given any justification for why they are doing this at the time of voting. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific Sustainability Strategy, Asia Pacific & Japan Sustainability Strategy, Asia Pacific Leaders Sustainability Strategy, European Sustainability Strategy, European (ex UK) Sustainability Strategy, Global Emerging Markets Leaders Sustainability Strategy, Global Emerging Markets Sustainability Strategy, Indian Subcontinent Sustainability Strategy, Worldwide Sustainability Strategy and Worldwide Leaders Sustainability Strategy accounts as at 31 March 2024. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.