Get the right experience for you. Please select your location and investor type.

Global Emerging Markets Sustainability

The Global Emerging Markets Sustainability strategy invests in between 30-75 high-quality companies that are contributing to a more sustainable future.

Our Global Emerging Markets Sustainability strategy was launched in 2009 and invests in between 30 to 75 high-quality companies that are contributing to a more sustainable future. The strategy’s bottom-up approach allows us to find only the very best businesses from an investable universe of some 65,000 companies. We are looking for companies well positioned to contribute to long-term sustainable development; businesses with high quality management teams, franchises, and financials.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q1 2024

Global Emerging Markets Sustainability strategy update: 1 January - 31 March 2024

Over the course of this quarter, we exited our positions in three holdings and initiated in one new company.

The first of the three exits was Vinda International (China: Consumer Staples), a Hong Kong listed tissues maker that was steadily offering higher-quality hygiene products with higher pricing power. The company was stewarded by the combination of the Li family as owner-managers and Essity, the Swedish multinational. We exited our holding in the company after a bid to acquire the company was accepted by the majority shareholders.

We also exited Komerční banka (Czech Republic: Financials) and Infosys (India: Information Technology). Both companies remain high-quality, well-run franchises but were getting closer to fairly valued rather than cheap. As such, we decided to use the proceeds to invest in ideas where we saw the potential for better returns.

One such example is Allegro (Poland: Consumer Staples), a dominant e-commerce platform in Poland with c.40% market share, nine times larger than their nearest competitor. Allegro has been able to steadily defend this market share against new entrants, even through a period of mismanagement. With a new CEO in place, Allegro is focused on improving their international operations and re-focusing on profitable growth.

We also took the opportunity as valuations have come off across a number of our high-quality Chinese holdings to continue to build position sizes. A few of these include Glodon (China, Information Technology), Milkyway Intelligent Supply Chain Service (China: Industrials), and Yifeng Pharmacy Chain (China: Consumer Staples) – all well placed to be the leaders in their respective industries, aligned with the broader sustainable development of the economy, and remain on reasonable valuations for steady earnings growth.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q4 2023

Global Emerging Markets Sustainability strategy update: 1 October - 31 December 2023

Over the course of this quarter, we initiated four new positions in the portfolio. Two of these new positions are in China: Centre Testing International (China: Industrials) and Midea (China: Consumer Discretionary).

Centre Testing International provides inspection and certification services for industrial and consumer products across China, ensuring product quality and safety standards. The franchise benefits from being one of the first movers in the country, and continues to take share in a fragmented market as scrutiny rises on health, environmental and product standards. The balance between long-term family stewards and a professional manager who spent decades at one of the world’s leading inspection and certification services firms helped us build conviction in the quality of people here as well.

We also initiated a position in Midea, China’s dominant domestic home appliances manufacturer. Midea is taking the cash flows from this business, and reinvesting behind expanding into attractive growth areas like digital building automation, integrated energy management and industrial robots.

The third new position was a re-initiation in Samsung Electronics (South Korea: Information Technology). We have long admired the strength of the Samsung Electronics franchise, along with the ability they have shown to evolve. We believe current valuations do not reflect a recovery in the memory market, or the investments that Samsung Electronics continues to make behind long-term growth. The business continues to have an impressive ability to generate cash, and a solid balance sheet.

Finally we initiated a new position RBL Bank (India: Financials), a private bank in the midst of a turnaround. The bank lost its way through aggressive growth leading to high non-performing loans (NPLs). As a measure of abundant caution India’s central bank stepped in to change management and solidify the foundations of the bank. We believe new management is putting in place the right systems to build a quality credit culture with a focus on lower risk assets funded mostly by deposits. A successful turnaround could yield attractive returns for shareholders.

We have also continued adding to some of our high-quality holdings where valuations have become more attractive. One such example is WEG (Brazil: Industrials), a manufacturer of electric motors, which are sold into areas like electric vehicles (EVs) and renewable energy with structural growth opportunities. WEG has been consistently investing behind expanding outside of Brazil and is focused on Mexico, China, and India as their next large regions of growth. Alongside, they have recently completed their largest acquisition with the balance sheet remaining in sound health.

To fund these additions we trimmed a few positions where valuations had become less attractive including MercadoLibre (United States: Consumer Discretionary), Hoya (Japan: Health Care), and Infosys (India: Information Technology). In each of these cases, we continue to have conviction in the quality of people and the franchises, but believe increasingly stretched valuations suggest we might have better opportunities elsewhere.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2023

Global Emerging Markets Sustainability strategy update: 1 July - 30 September 2023

Over the course of this quarter, we initiated three new positions in the strategy and exited three of our holdings.

Regional (Mexico: Financials) was the first of the new positions we initiated. The founding owner-managers, the Rivero Santos family, continue to act as stewards here, and have a history of delivering steady, conservative growth. Regional is focused on lending to Mexican small and medium-sized enterprises (SMEs), maintaining long relationships and steadily deepening access to credit across the country. The combination of conservative stewards, history of profitable lending, and runway for growth led us to initiate a position in the bank at reasonable valuations.

Secondly, we initiated a position in AirTAC International (Taiwan: Industrial), the second largest pneumatic equipment provider in China. AirTAC has consistently strengthened its competitive positioning in the country, gaining market share in a consolidating industry. Barriers to entry in this business are high, with clients looking for customised solutions delivered in short spans of time. The founder and long-term managers remain stewards of the business, continuing to reinvest in the growth of the franchise and preserve the strength of the balance sheet in a cyclical industry.

Milkyway Chemical Supply Chain Service (China: Industrials) was the final company we initiated a position in this quarter. Milkyway is a third-party logistics provider focused on the safe and reliable transport of chemicals across the country. Founder Yin He Chen continues to grow the business with a focus on quality of customer relationships over price-led volume growth, which has led to enduring, sticky relationships with key customers. This is a business where cost of failure is high in dealing with hazardous chemicals, and reputation matters, so Chen’s focus on quality has led to Milkyway gaining market share in a fragmented industry.

The three positions we exited over the quarter were Network International (UK: Financials), Foshan Haitian Flavouring (China: Consumer Staples) and BRAC Bank (Bangladesh: Financials). Network International is an outsourced payments provider, aiding the adoption of digital payments across the Middle East and Africa. We unfortunately had to exit our position after they accepted an acquisition bid that takes the company private. We chose to exit our holding in Foshan Haitian in the face of rising margin pressure as they expand out of their dominant position in the soy sauce category. The franchise has a history of being competently managed as seen in the strength of the soy sauce business, and is one we continue to watch closely. BRAC Bank was sold due to rising regulatory headwinds for the banking sector in Bangladesh.

As ever, we continue to focus on bottom-up analysis of the fundamental quality of stewards, franchises, and financials and the sustainable growth tailwinds these businesses might enjoy. We believe this remains the best way to continue protecting and growing clients’ capital in emerging markets.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2023

Global Emerging Markets Sustainability strategy update: 1 April - 30 June 2023

This quarter has been a comparatively quiet one in our emerging markets strategies, during which we initiated a position in one new company, Globant.

Globant (Argentina: Information Technology) is an IT services company that primarily serves US corporates in their digital transformation projects. Globant’s co-founders remain at the helm of the company, and the franchise continues to focus on strengthening their deep relationships with existing clients. We have met Globant a few times since 2016 and, recently, valuations have come down to very reasonable levels with concerns around potential spending slowdowns if there is a recession in the US. While we have no predictions of the macroeconomic environment, these IT service businesses have proven resilient through past cycles. When the short-term concerns of markets gives us opportunities to accumulate shares in great companies at reasonable prices, we will certainly do so.

We also continued to add to some high-quality companies where valuations have become more reasonable in the face of some of these nearer term concerns, including EPAM Systems (US: Information Technology) and Aavas Financiers (India: Financials). Similar to Globant, IT services provider EPAM remains a resilient business with long-term client relationships that they continue to invest behind. Equally, Aavas Financiers, a rural Indian mortgage provider has spent the last decade setting up the foundations for their growth and, with low leverage on the balance sheet, has a great runway to continue expanding over the years ahead.

During the course of this quarter, the investment team also travelled to Mumbai and Bangalore to meet with the management teams of some of our largest Indian holdings and spend time finding new ideas. Trips such as these continue to help us reiterate the quality of the businesses we own on behalf of clients and the people managing them, as well as helping us to build conviction in smaller positions. Our conviction in our holdings in India continues to remain high in the context of the growth opportunities these companies have available to them in the decade ahead.

As ever, we continue to focus on bottom-up analysis of the fundamental quality of stewards, franchises, and financials and the sustainable growth tailwinds these businesses might enjoy. We believe this remains the best way to continue protecting and growing clients’ capital in emerging markets.

During the quarter Jack Nelson, Portfolio Manager, gave an update on the strategy, commenting on its exposure to India and the potential opportunities the team are seeing in China. He also explained how the team assess the strategy against macro factors and commented on the medium-term risks the team see in the strategy, and in emerging markets more broadly. Find out more.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

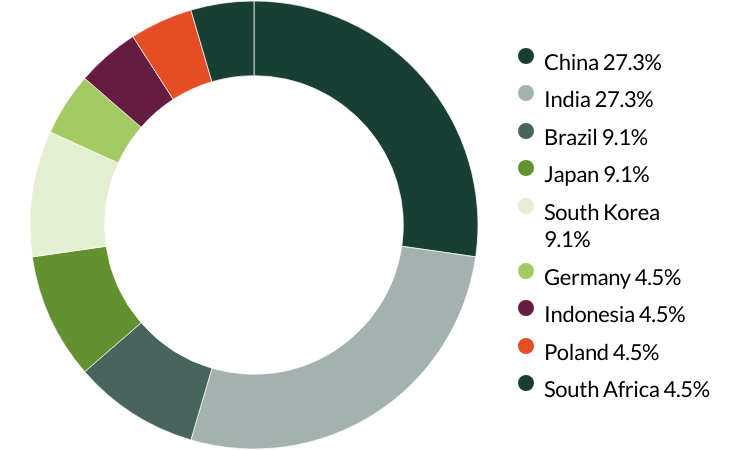

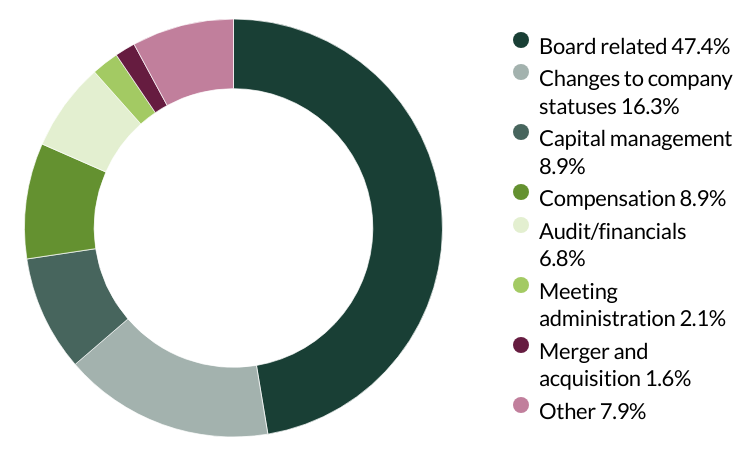

Proxy voting: Q1 2024

Global Emerging Markets Sustainability proxy voting: 1 January - 31 March 2024

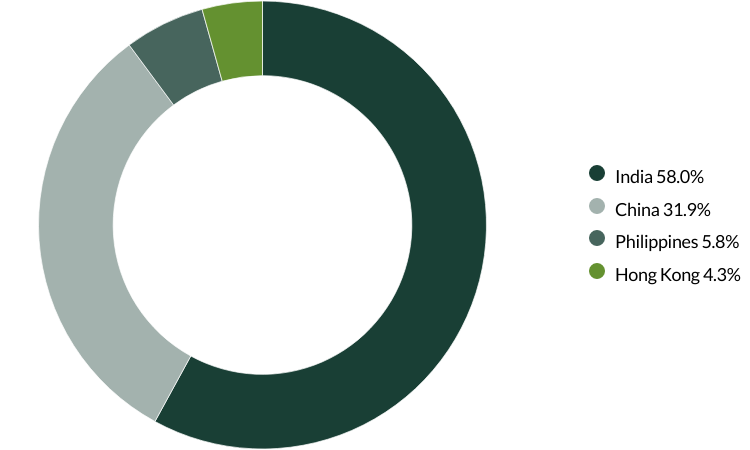

Proxy voting by country of origin

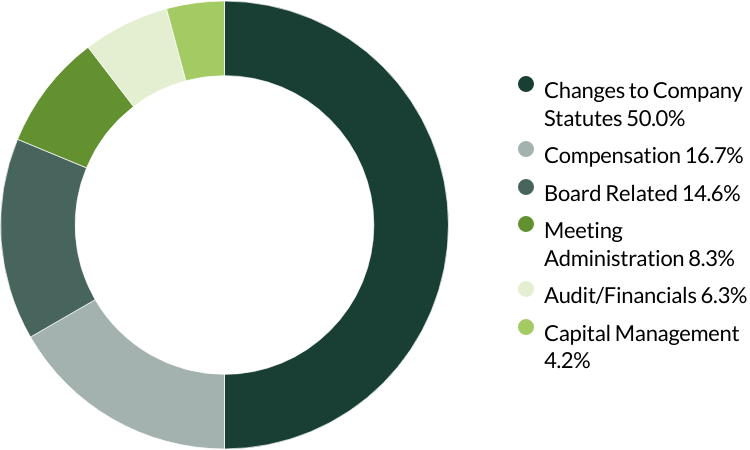

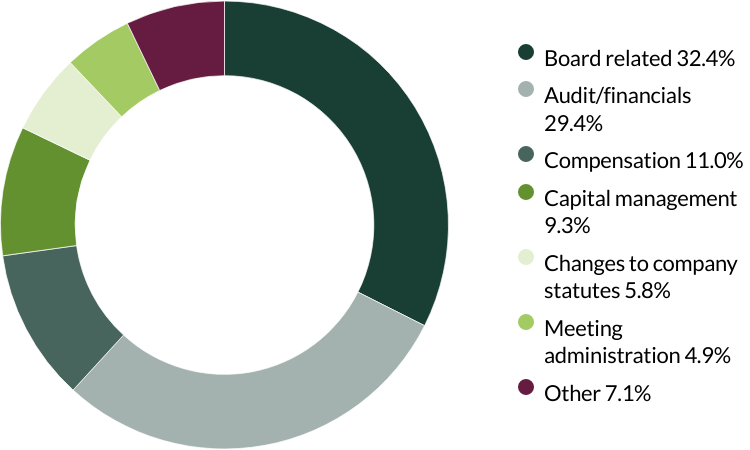

Proxy voting by proposal category

During the quarter there were 190 resolutions from 20 companies to vote on. On behalf of clients, we voted against 8 resolutions.

We voted against a Board appointment at Banco Bradesco as we would encourage the appointment of more external independent Directors. We also voted against an increase in Authorised Capital as we found the proposed dilution to be overly high, and voted against requests for cumulative voting and to recast votes for an amendment on the day of voting. (five resolutions)

We voted against excessive executive remuneration at Bank Central Asia. (one resolution)

We voted against an adjustment of the Guarantee for Controlled Subsidiaries Assets Pool Business at Midea as we found the guarantee amount to be excessive and not in shareholders' best interests. (one resolution)

We voted against a Board appointment at Samsung Electronics as we would prefer to see more independent, non-family associated Directors. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

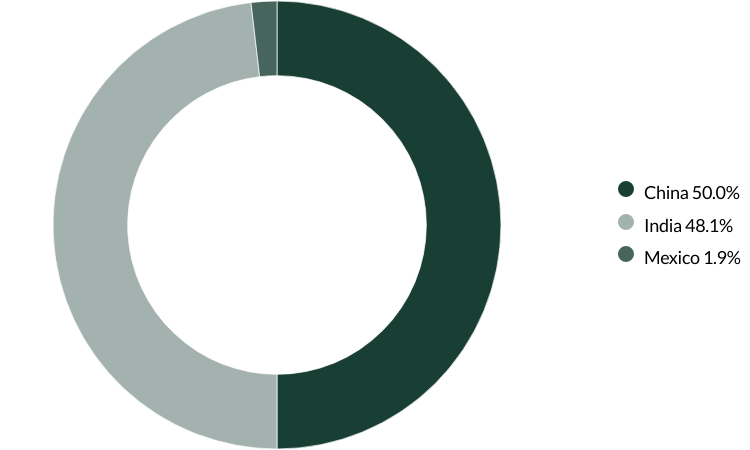

Proxy voting: Q4 2023

Global Emerging Markets Sustainability proxy voting: 1 October - 31 December 2023

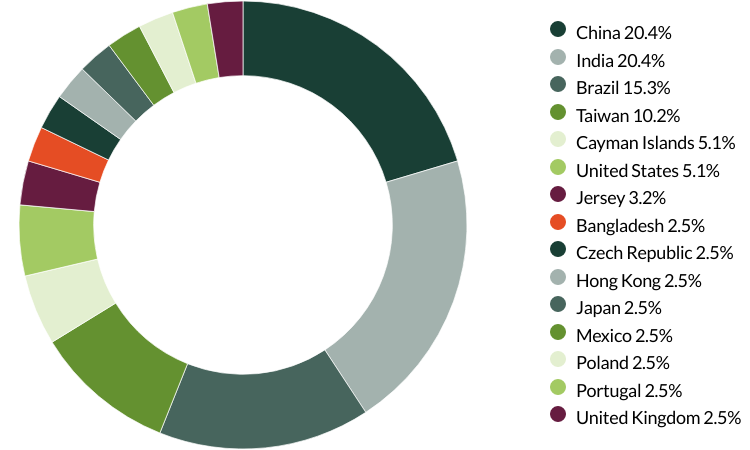

Proxy voting by country of origin

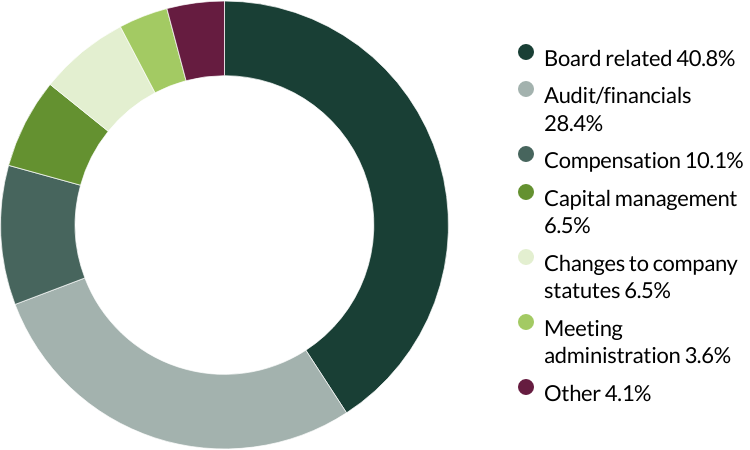

Proxy voting by proposal category

During the quarter there were 48 resolutions from 11 companies to vote on. On behalf of clients, we did not vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2023

Global Emerging Markets Sustainability proxy voting: 1 July - 30 September 2023

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 169 resolutions from 20 companies to vote on. On behalf of clients, we voted against four resolutions.

We voted against the election of the Chair of the Nomination Committee at Hangzhou Robam in support of encouraging better gender diversity. At present the company has no female directors, and we believe the Chair of the Nomination Committee has an important role in facilitating a more gender diverse Board of Directors. (one resolution)

We voted against a related party transaction at Kingmed Diagnostics Group which would transfer 73% ownership of a subsidiary pharmaceutical company to the Deputy General Manager of the listco. We could not find any reasons behind the sale nor the valuation at which the transaction would happen. (one resolution)

We voted against Philippine Seven’s request for management to approve all other business matters before the annual general meeting (AGM) of shareholders. We consider ourselves active shareholders and prefer to vote on such matters at the AGM. (one resolution)

We voted against the appointment of the auditor and the company’s ability to set auditor fees at Vitasoy as they have been in place for over 10 years and the company has given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2023

Global Emerging Markets Sustainability proxy voting: 1 April - 30 June 2023

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 364 resolutions from 36 companies to vote on. On behalf of clients, we voted against 26 and abstained on four resolutions.

We voted against Aavas Financiers' request to reprice options granted under various equity stock option plans for employees due to a share price fall. We do not believe this request is in shareholders’ interest. (three resolutions)

We voted against BRAC Bank’s request to increase authorised share capital by more than 100%, as the company had not given any justification for why they are doing this at the time of voting. (one resolution)

We voted against Dino Polska’s accounts and reports because the auditor has been in place for over 10 years and the company has given no information on intended rotation. We also voted against their remuneration report as we believe the scheme is too short term. (four resolutions)

We voted against the appointment of the auditor at EPAM Systems, Foshan Haitian Flavouring, Glodon and Yifeng Pharmacy Chain as they have been in place for over 10 years and the companies have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (four resolutions)

We voted against Foshan Haitian Flavouring’s request to approve connected transactions entered into between the Company and related entities and their respective annual caps. We do not believe these requests are in shareholders’ interests. (two resolutions)

We voted against Raia Drogasil’s request to adopt cumulative voting and to recast votes for the amended Board and supervisory council slate, as well as for permission to re-consider voting instructions should the meeting be held on second call. We do not believe these requests are in shareholders’ interests. We abstained from voting on the request to hold a separate election for Board members and for a minority candidate as we prefer to support the Board. (four resolutions against, two resolutions abstained)

We voted against Techtronic Industries’ share award and options scheme as the company had not disclosed how options are awarded other than at the absolute discretion of the Board, who also award options to themselves, family members and non-executives. (two resolutions)

We voted against Totvs’ remuneration policy and long term incentive plan as in our opinion it is excessively diluted and we would prefer for the Founder/Chair not to receive a performance based remuneration like the management team. We also voted against and abstained from voting on proposals relating to the company’s request to establish a supervisory council as we did not have sufficient information to know who we would be voting for. (three resolutions against, one resolution abstained)

We voted against Vinda International’s request to issue shares without pre-emptive rights and issue repurchased shares, as the share discount rate had not been disclosed. (two resolutions)

We voted against WEG’s request to recast votes for the amended supervisory council slate, as we preferred to vote in favour of the female candidate nominated by minority shareholders and who has been on the fiscal council for two years. We abstained from voting on the election of the supervisory council as we preferred to support the minority candidate. (one resolution against, one resolution abstained)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific Sustainability Strategy, Asia Pacific & Japan Sustainability Strategy, Asia Pacific Leaders Sustainability Strategy, European Sustainability Strategy, European (ex UK) Sustainability Strategy, Global Emerging Markets Leaders Sustainability Strategy, Global Emerging Markets Sustainability Strategy, Indian Subcontinent Sustainability Strategy, Worldwide Sustainability Strategy and Worldwide Leaders Sustainability Strategy accounts as at 31 March 2024. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.