Get the right experience for you. Please select your location and investor type.

Global Emerging Markets Leaders Sustainability

The strategy invests in 25-60 high-quality emerging markets companies that we consider to be well positioned to contribute to, and benefit from, sustainable development.

Download overviewThe Global Emerging Markets Sustainability All-Cap strategy launched in February 2009. Due to capacity constraints of the All-Cap strategy and strong demand and desire to offer clients an emerging markets solution, we launched the Global Emerging Markets Leaders Sustainability strategy in April 2020. It invests in 25-60 high-quality emerging markets companies that we consider to be particularly well positioned to contribute to, and benefit from, sustainable development.

Leaders simply means that the strategy is focused on companies with a market cap value of at least USD1 billion.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q4 2023

Global Emerging Markets Leaders Sustainability strategy update: 1 October - 31 December 2023

Over the course of this quarter, we initiated three new positions in the portfolio. Two of these new positions are in China: Centre Testing International (China: Industrials) and Wuxi Biologics (China: Health Care).

Centre Testing International provides inspection and certification services for industrial and consumer products across China, ensuring product quality and safety standards. The franchise benefits from being one of the first movers in the country, and continues to take share in a fragmented market as scrutiny rises on health, environmental and product standards. The balance between long-term family stewards and a professional manager who spent decades at one of the world’s leading inspection and certification services firms helped us build conviction in the quality of people here as well.

We also initiated a position in Wuxi Biologics, a leading contract research provider and manufacturer for pharmaceutical companies. The stewards have spent the last decade nurturing strong relationships with customers across geographies, and are building on their research relationships to scale up manufacturing services. The nature of the business, where the timeline from drug discovery to manufacturing can be decades, means that long-term customer relationships are crucial, and the trust built is difficult to disrupt.

The last new addition to the portfolio was Allegro (Poland: Consumer Discretionary), the leading e-commerce platform in Poland with 40% market share. The core business has continued to be resilient through a period of mismanagement, and they remain nine times larger than their next competitor. With a new CEO in place, Allegro is focused on improving their international operations and re-focusing on profitability.

We have also continued adding to some of our high-quality holdings where valuations have become more attractive. One such example is WEG (Brazil: Industrials), a manufacturer of electric motors, which are sold into areas like electric vehicles (EVs) and renewable energy with structural growth opportunities. WEG has been consistently investing behind expanding outside of Brazil and is focused on Mexico, China, and India as their next large regions of growth. Alongside, they have recently completed their largest acquisition with the balance sheet remaining in sound health.

To fund these additions we trimmed a few positions where valuations had become less attractive including MercadoLibre (United States: Consumer Discretionary), Hoya (Japan: Health Care), and Tata Consultancy Services (India: Information Technology). In each of these cases, we continue to have conviction in the quality of people and the franchises, but believe increasingly stretched valuations suggest we might have better opportunities elsewhere.

Finally, we exited one position in the portfolio: Clicks (South Africa: Consumer Staples). We continue to have a lot of respect for the quality of the management team at Clicks as well as the business they have carefully built over decades. The combination of possibly slower growth over the next decade, stretched valuations, and South African Rand depreciation meant that the potential for hard currency returns is not as attractive, leading us to exit.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q3 2023

Global Emerging Markets Leaders Sustainability strategy update: 1 July - 30 September 2023

The third quarter of 2023 has been marked by a greater than average number of new names entering the portfolio. In total, we initiated new holdings in five companies. This activity reflects more attractive valuations, particularly in companies exposed to China’s industrial and consumer cycles.

We initiated a new holding in Midea (China: Consumer Discretionary), China’s dominant domestic home appliance manufacturer, which is expanding into attractive growth areas like digital building automation, integrated energy management and industrial robotics. We also initiated a new holding in Sunny Optical Technology (Hong Kong: Information Technology) which is a top-tier manufacturer of camera lenses for use primarily in smartphones, but where most of the value lies in their burgeoning vehicle camera business, where lenses are used in driver assistance systems. In both cases, a core set of cash flows linked to Chinese consumption are being valued modestly by the market, and little value is being assigned to the significant opportunities in new business areas.

We also initiated new holdings in Hong Kong Exchanges & Clearing (Hong Kong: Financials), which owns a legal monopoly on trading in many types of financial securities in Hong Kong, with most activity linked to Chinese companies, and in AirTAC International (Taiwan: Industrials) which manufactures pneumatic equipment used in manufacturing, and which derives over 90% of sales from China. Both are superb, high barrier to entry businesses, and whose shares are sensitive to perceptions of the broader Chinese economic environment which are now particularly negative.

We also added to two existing Chinese holdings; semiconductor design company Silergy Corp (Taiwan: Information Technology) and construction software vendor Glodon (China: Information Technology) during the quarter. In both cases we remain convinced of both the fundamental quality of these businesses and the people who run them. Their shares have been sold off sharply as a function of the current broader pessimism around China.

While we have always struggled to gain enough conviction in a sufficient number of companies in China to attain anything like the benchmark weighting in the country, we have been steadily expanding the list of Chinese companies on our Focus List, and building conviction in those already there. This has allowed us to increase our exposure at prices we now consider to offer attractive entry points for the long-term investor. We have nothing particularly insightful to add on China’s political, demographic or geopolitical risks; these are well understood. We invest not top-down, in countries, but bottom-up, in specific companies. In our view it is perfectly compatible to have a cautious view on the macro whilst having a positive view of the bottom-up opportunities that specific companies have. It is exciting to be able to add to our favourite Chinese companies at current valuations.

Our final (re)initiation was in Samsung Electronics (South Korea: Information Technology), which looks poised to benefit from a recovery in the memory market, aided by burgeoning new uses in artificial intelligence (AI). Valuations do not currently reflect in our view, a coming upcycle in memory, and are very far short of the hype surrounding more popular companies exposed to AI.

We have funded these purchases by trimming some of our existing holdings which have performed particularly well. While it is important to ‘run one’s winners’, it is also important to be conscious of position sizing and to be disciplined with regards to valuations.

We trimmed both Mahindra & Mahindra (India: Consumer Discretionary) and HDFC Bank (India: Financials) in the context that each, at the time, had come to represent more than 7% of the portfolio. We had not targeted such a large exposure in either case, with those figures achieved through strong share price performance (and a corporate action in the case of HDFC Bank). Whilst such significant weightings are not unheard of in Stewart Investors strategies, they are a rarity. There is always a balancing act between backing our best ideas and managing the risk of losing a significant percentage of clients’ capital invested in the portfolio, in the context that there are always unknown unknowns. Typically, this means these sorts of weightings are at the extreme higher end that are observed in our strategies.

We also reduced our more modest exposure to companies like Advantech (Taiwan: Information Technology), Delta Electronics (Taiwan: Information Technology) and Dr. Reddy’s Laboratories (India: Health Care). In each of these cases, share prices have appreciated particularly strongly, and valuations had reached stretched levels. We often seek to take some profit in such instances, as it seems to us that in such a scenario where future returns have been pulled forward by exuberant markets, the potential return going forward has been commensurately reduced. In each case, share prices have pulled back since we trimmed our positions.

We exited one holding; London-listed but UAE-based payments company Network International (UK: Financials), after the company received an offer from private equity some 28% above the closing share price on the day of the announcement.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2023

Global Emerging Markets Leaders Sustainability strategy update: 1 April - 30 June 2023

This was a quiet quarter for the strategy. We made no disposals and initiated one new holding, Walmart de México (Mexico: Consumer Staples), colloquially known as WalMex.

WalMex is the dominant grocery retailer in Mexico and Central America, with overwhelming scale advantages. Through formats ranging from neighbourhood Bodegas to Sam’s Club warehouse stores, it provides necessary staples to millions of people on a daily basis. Over extended periods, it has proven well-run and resilient, with very robust margins, a strong balance sheet and steady sales growth. After a sell off, shares have approached the lowest price-to-cash flow multiple they have traded on over the last decade, presenting what we think will prove an exciting entry point to what can be a core long-term holding.

Our relative inactivity does not signify neglect of our fiduciary responsibilities. Too often, asset managers are overactive, trading in and out of positions based on news flow, anticipation of short-term quarterly results, or share price momentum. It is an oft-quoted stat, but one worth repeating, that the average holding period for US equities is as little as 10 months1.

We are undertaking a very different approach to do our best to deliver attractive long-term returns to clients, since we remain unable to forecast short-term corporate results, interest rate moves or inflation figures. We have learned over time that high-quality organisations with resilient cultures can prove persistently both robust in times of distress and well-placed to capitalise on their opportunities. It is extremely difficult to trade in and out of such rare high-quality companies with any success. The power of compounding is extremely powerful, but needs to be given time to work.

Once exceptional companies have been identified, the best forward-looking strategy is usually to hold onto our clients’ shares in those businesses, and focus on determining if the features enabling the company’s long-term success are still in place. This is a central tenet of our day jobs. Accordingly, all but one of our largest 15 holdings have been held since inception; across our broader Global Emerging Markets portfolios, we have held shares in these companies for 8.4 years on average, and none for less than 3 years2.

Another element of our role is to use the opportunity given to the long-term investor by the short-termism and volatility that afflicts financial markets to take advantage of others’ myopia. Whilst trying to own shares for ten years rather than ten months, we will trim when valuations run up, and add when they become more attractive. During the quarter, trims were made to holdings in WEG (Brazil: Industrials) and Unicharm (Japan: Consumer Staples), in response to relatively full valuations. The proceeds of these sales were reinvested into existing holdings at more attractive valuations including Infineon Technologies (Germany: Information Technology), Techtronic Industries (Hong Kong: Industrials) and a number of IT service companies.

In the current environment, we are finding that shares of a number of high-quality businesses in that sector, particularly digital transformation specialists like EPAM Systems (US: Information Technology) and Globant (US: Information Technology), have become especially attractive. These companies have seen growth rates decline precipitously, amid worries about a US recession and a retrenchment in spending by large corporates. We believe this slowdown to be temporary, with the long-term drivers of revenue growth (the need for every business to become omnichannel) perfectly intact. As shares in these companies have been sold off by investors more concerned about one year performance relative to the benchmark, we have been accumulating shares. We are confident they will make a meaningful positive contribution to client returns over the long term.

1 Source: eToro,

2 Source: Stewart Investors

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q1 2023

Global Emerging Markets Leaders Sustainability strategy update: 1 January - 31 March 2023

This quarter was a comparatively active one for us. We exited three holdings and initiated two new positions in the strategy.

We sold out of a small holding in robotics company Estun Automation (China: Industrials). Nothing significant has changed in our view of the quality of the company. However, we felt that after some share-price strength, which has taken valuations towards extremes, the opportunities for attractive returns have diminished significantly and there are now more attractive alternatives available.

We also exited MediaTek (Taiwan: Information Technology), a Taiwanese chip designer with earnings primarily driven by smartphone demand in China. As consumer sentiment has returned with the re-opening of that country, the share price has performed well. We feel there are likely companies with better earnings-growth profiles within the semiconductor sector that we would rather own for the long term.

In particular, during the quarter we have initiated a position in German semiconductor supplier Infineon Technologies (Germany: Information Technology). Infineon Technologies is a company we have long held in our Worldwide strategy, yet the majority of the company’s sales are to emerging markets in Asia. Infineon specialises in chips that control power supply, with 2.5x the market share of the #2 competitor1. This gives the company great exposure to rapidly growing end markets, like renewable energy, smart grids and electric vehicles.

In making the switch from MediaTek to Infineon, we feel we have exchanged a company primarily exposed to more saturated consumer technology to one primarily exposed to more quickly growing industrial end markets. Given extremely similar valuations, and that it seems more likely that Infineon can deliver sustained earnings growth over the long term, this felt like an upgrade in likely future returns.

In the case of Natura (Brazil: Consumer Staples), we felt that the investment case had changed considerably from our initial thesis. During the last short while, a difficult economic environment has exposed some weaknesses in the franchise, the balance sheet has deteriorated, and the company has changed senior leadership. Exiting a position and realising a significant loss is never a pleasant experience, but it is usually best to avoid sunk-cost fallacy and anchoring biases, and to focus on quality. After much discussion, we decided the company faces a tough road ahead and that we have better ideas at attractive prices today.

One such opportunity is Globant (Argentina: Information Technology), an IT services company that primarily serves US corporates in their digital transformation projects, in which we have re-initiated a position during the quarter. We held Globant from early-2020 until early-2021, and sold based solely on valuation concerns after shares increased in value almost 5-fold. Since then, shares have more than halved and valuation multiples are back to the lows seen during the initial covid sell-off, as investors are now worried about potential spending slowdowns if there is a recession in the US. While we have no predictions of the macroeconomic environment, we know these IT service businesses have proven resilient through past cycles. When the short-term concerns of markets gives us opportunities to accumulate shares in great companies at reasonable prices, we will certainly do so.

1 Company Q1 2023 FY update

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

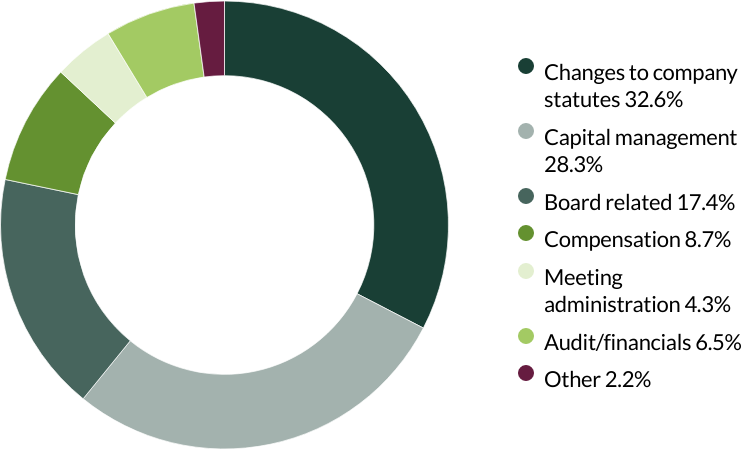

Proxy voting: Q4 2023

Global Emerging Markets Leaders Sustainability proxy voting: 1 October - 31 December 2023

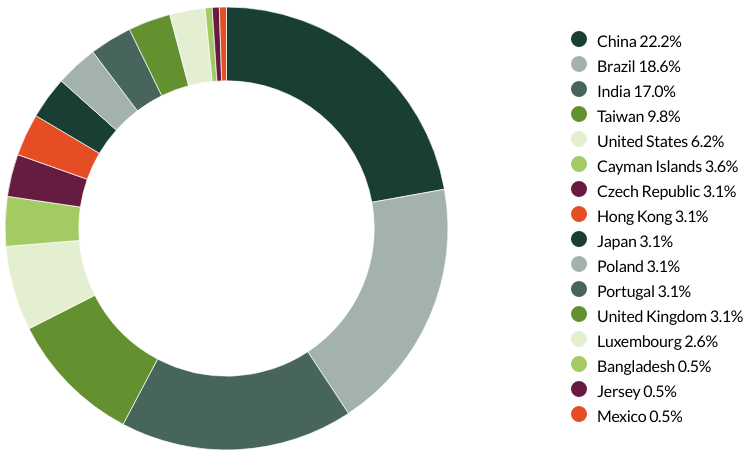

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 46 resolutions from 8 companies to vote on. On behalf of clients, we didn't vote against any resolutions and abstained from one resolution.

We abstained from voting on the approval of a renewed liability insurance for Directors, Supervisors, and Senior Management at Midea Group as we did not have sufficient information on the details of the insurance policy at the time of voting. (One resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

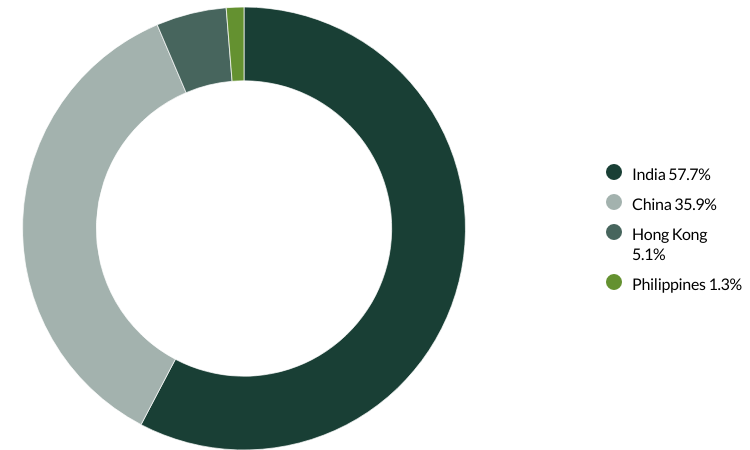

Proxy voting: Q3 2023

Global Emerging Markets Leaders Sustainability proxy voting: 1 July - 30 September 2023

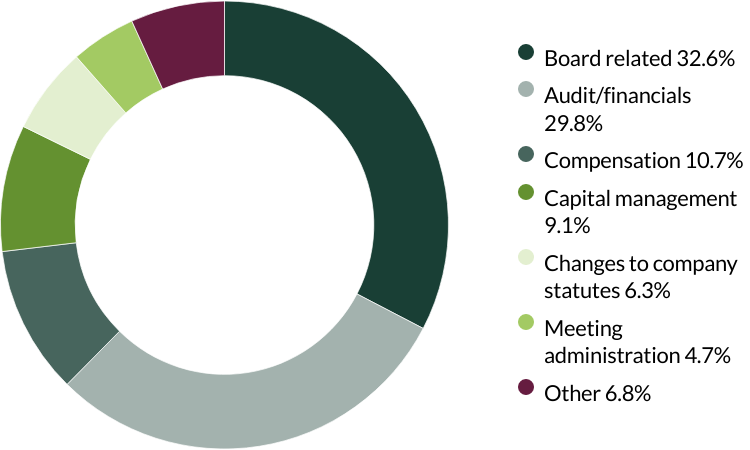

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 99 resolutions from 13 companies to vote on. On behalf of clients, we voted against three resolutions.

We voted against the election of the Chair of the Nomination Committee at Hangzhou Robam in support of encouraging better gender diversity. At present the company has no female directors, and we believe the Chair of the Nomination Committee has an important role in facilitating a more gender diverse Board of Directors. (One resolution)

We voted against a related party transaction at Kingmed Diagnostics Group which would transfer 73% ownership of a subsidiary pharmaceutical company to the Deputy General Manager of the listco. We could not find any reasons behind the sale nor the valuation at which the transaction would happen. (One resolution)

We voted against the appointment of the auditor and the company’s ability to set auditor fees at Vitasoy as they have been in place for over 10 years and the company has given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (One resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2023

Global Emerging Markets Leaders Sustainability proxy voting: 1 April - 30 June 2023

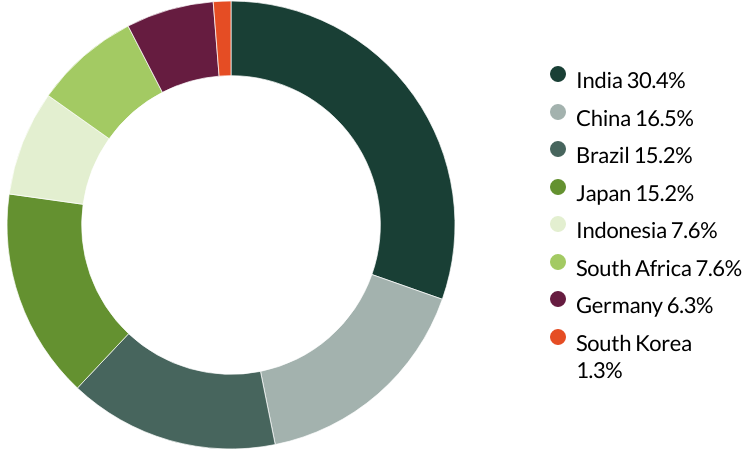

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 281 resolutions from 28 companies to vote on. On behalf of clients, we voted against 20 and abstained on four resolutions.

We voted against Dino Polska’s accounts and reports because the auditor has been in place for over 10 years and the company has given no information on intended rotation. We also voted against their remuneration report as we believe the scheme is too short term. (Four resolutions)

We voted against the appointment of the auditor at EPAM Systems, Foshan Haitian Flavouring, Glodon and Yifeng Pharmacy Chain as they have been in place for over 10 years and the companies’ have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (Four resolutions)

We voted against Foshan Haitian Flavouring’s request to approve connected transactions entered into between the Company and related entities and their respective annual caps. We do not believe these requests are in shareholders’ interests. (Two resolutions)

We voted against Raia Drogasil’s request to adopt cumulative voting and to recast votes for the amended Board and supervisory council slate, as well as for permission to re-consider voting instructions should the meeting be held on second call. We do not believe these requests are in shareholders’ interests. We abstained from voting on the request to hold a separate election for Board members and for a minority candidate as we prefer to support the Board. (Four resolutions against, two resolutions abstained)

We voted against Techtronic Industries’ share award and options scheme as the company had not disclosed how options are awarded other than at the absolute discretion of the Board, who also award options to themselves, family members and non-executives. (Two resolutions)

We voted against Totvs’ remuneration policy and long term incentive plan as in our opinion it is excessively diluted and we would prefer for the Founder/Chair not to receive a performance based remuneration like the management team. We also voted against and abstained from voting on proposals relating to the company’s request to establish a supervisory council as we did not have sufficient information to know who we would be voting for. (Three resolutions against, one resolution abstained)

We voted against WEG’s request to recast votes for the amended supervisory council slate, as we preferred to vote in favour of the female candidate nominated by minority shareholders and who has been on the fiscal council for two years. We abstained from voting on the election of the supervisory council as we preferred to support the minority candidate. (One resolution against, one resolution abstained)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

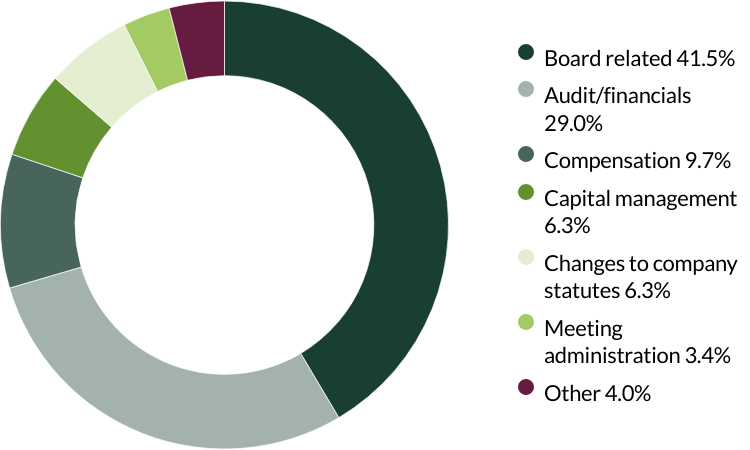

Proxy voting: Q1 2023

Global Emerging Markets Leaders Sustainability proxy voting: 1 January - 31 March 2023

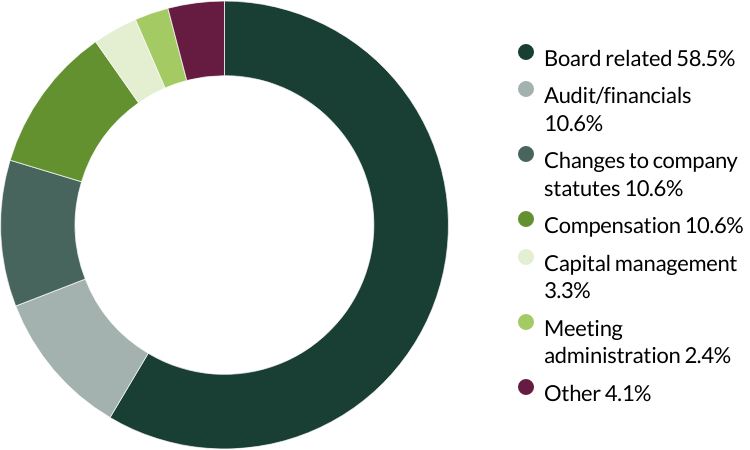

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 113 resolutions from 13 companies to vote on. On behalf of clients, we voted against four resolutions.

We voted against Amoy Diagnostics’ request to increase share capital and share count as we did not have sufficient information at the time of voting for the justification of these amendments to articles. (One resolution)

We voted against Banco Bradesco’s remuneration policy as we believe it lacks long-term alignment with company performance and market best practice. We also voted against the company’s request to recast votes for an amended slate of directors, as we do not believe this is in shareholders’ interest. (Two resolutions)

We voted against the appointment of the auditor at Infineon Technologies as they have been in place for over 10 years and the company has given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (One resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific Sustainability Strategy, Asia Pacific & Japan Sustainability Strategy, Asia Pacific Leaders Sustainability Strategy, European Sustainability Strategy, European (ex UK) Sustainability Strategy, Global Emerging Markets Leaders Sustainability Strategy, Global Emerging Markets Sustainability Strategy, Indian Subcontinent Sustainability Strategy, Worldwide Sustainability Strategy and Worldwide Leaders Sustainability Strategy accounts as at 31 December 2023. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.