Get the right experience for you. Please select your location and investor type.

Asia Pacific Sustainability

This strategy aims to deliver long-term capital growth by investing in companies in the Asia Pacific region, including Australia and New Zealand but excluding Japan.

Originally launched in December 2005, this equity-only strategy aims to deliver long-term capital growth by investing in between 30-60 companies in the Asia Pacific region, including Australia and New Zealand but excluding Japan. As with all of our strategies, we are looking for businesses that are well positioned to contribute to, and benefit from, sustainable development.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly update

Strategy update: Q1 2024

Asia Pacific Sustainability strategy update: 1 January - 31 March 2024

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term.

During the quarter we initiated three new positions in Samsung C&T (South Korea: Industrials), Techtronic Industries (Hong Kong: Industrials) and MediaTek (Taiwan: Information Technology).

Samsung C&T is the holding company for Samsung Biologics with sizeable positions in group companies such as Samsung Electronics (c.5%).

Samsung Biologics is a world leader in affordable healthcare. Samsung Electronics is a global leader in consumer electronics and chip manufacturing.

In its core business, the company is aiming to invest into areas with strong demand tailwinds such as renewable energy and battery recycling. The group aims to improve governance practices by returning excess cash to shareholders, cancelling treasury shares, improving profitability in core assets and articulating a clear strategy for future capital allocation.

Techtronic Industries is dominant internationally in an array of cordless, hand, measuring and trade power tools for both home and commercial use. They have ownership of strong brands in consolidated areas which results in pricing power. The company is positioned well to grow organically and by acquisition.

MediaTek is a fabless (outsourced production) semiconductor company. They are leaders in integrated chip system solutions which are estimated to power over two billion devices a year from smartphones to home entertainment, connectivity and the internet of things (IoT) products.

We exited Altium (Australia: Information Technology), Vinda International (China: Consumer Staples) and HDFC Life (India: Financials). We sold Altium after it was approached by Japanese listed Renesas Electronics for acquisition at 37% premium to the prevailing market price. We sold Vinda after it was approached by RGE Ltd for acquisition at an 18% premium to the prevailing share price. HDFC Life was sold to fund better ideas elsewhere. We reduced Pigeon (Japan: Consumer Staples) as we have lost conviction in the speed and extent of the evolution of the franchise.

We took advantage of lower valuations in China and continue to build positions in Centre Testing International (China: Industrials), Midea (China: Consumer Discretionary), Shenzhen Inovance Tech (China: Industrials), Glodon (China: Information Technology) and WuXi Biologics (China: Health Care). We also topped up the holding in Samsung Electronics (South Korea: Information Technology) and AirTAC International (Taiwan: Industrials).

To finance new investments and our latest additions, and to control position size we trimmed holdings in Tube Investments (India: Consumer Discretionary), CG Power (India: Industrials), Tata Consumer Products (India: Consumer Staples), Tata Consultancy Services (India: Information Technology), Mahindra & Mahindra (India: Consumer Discretionary), Godrej Consumer Products (India: Consumer Staples), Tech Mahindra (India: Information Technology), Marico (India: Consumer Staples), Tokyo Electron (Japan: Information Technology), Unicharm (Japan: Consumer Staples), Fisher & Paykel Healthcare (New Zealand: Health Care), Delta Electronics (Taiwan: Information Technology) and CSL (Australia: Health Care).

Views on investment opportunities in Asia have not changed; the strategy continues to look to invest in high-quality companies that are aligned with sustainable development. We look for stewards who are low profile, competent, long-term decision makers, franchises free from political agendas and financials that are resilient, not frail. Our focus is on quality, and we remain indifferent to many of the large, well-known companies, regardless of lower valuations.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q4 2023

Asia Pacific Sustainability strategy update: 1 October - 31 December 2023

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term.

During the quarter we initiated three new positions in Samsung Biologics (South Korea: Health Care), Wuxi Biologics (China: Health Care) and RBL Bank (India: Financials). We have admired the Samsung Biologics franchise for many years. They have expanded production capacity quickly and efficiently which has helped them to increase wallet share with existing clients and win important new clients. Our more constructive stance on governance at the Samsung Group was another important consideration. We have also been studying Wuxi Biologics for a number of years. It is a leading contract research provider and manufacturer for pharmaceutical companies. The stewards have spent the last decade nurturing strong relationships with customers across geographies, and are building on their research relationships to scale up manufacturing services. The nature of the business, where the timeline from drug discovery to manufacturing can be decades, means that long-term customer relationships are crucial, and the trust built is difficult to disrupt.

RBL Bank is a full-service bank that provides services to over 13 million customers across India. Under a new and reinvigorated management team, RBL is in early stages of building a high-quality lending institution. In terms of additions, we continued to build our holding in Midea (China: Consumer Discretionary), the largest home appliances business in China.

There were no complete divestments during the period. We trimmed Tata Consumer Products (India: Consumer Staples), Tech Mahindra (India: Information Technology) and Tata Communications (India: Communication Services) to control position size. We also trimmed HDFC Bank (India: Financials) and HDFC Life (India: Financials) to make room for the new holding in RBL Bank. We also reduced the holding in CSL (Australia: Health Care). We are still long-term supporters of this extremely high-quality franchise but consider there to be marginally better risk-reward opportunities elsewhere.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2023

Asia Pacific Sustainability strategy update: 1 July - 30 September 2023

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term. High-quality companies at reasonable valuations tend not to come along too often. In the absence of such opportunities, we are very comfortable long-term owners of companies in the portfolio.

During the quarter we initiated positions in three companies. Hangzhou Robam (China: Consumer Discretionary) manufactures kitchen appliances. The company is founder owned and managed with politically uncontentious stewards and products. It has a dominant position in the manufacture of oven hoods which generate impressive cash flows that are being invested into lowly penetrated markets such as dishwashers. Midea (China: Consumer Discretionary) is a manufacturer of home appliances. Midea is a high-quality franchise where the stewards are investing cash flow from their dominant market position, in exciting new technologies and automation to enhance growth prospects. We also initiated a position in Samsung Electronics (South Korea: Information Technology). We have long admired the strength of the Samsung Electronics franchise which should benefit from strengthening geopolitical headwinds and a desire to reduce dependence on Taiwanese manufacturers. Samsung Electronics demonstrates an impressive ability to generate cash and boasts a solid balance sheet. A recent visit to South Korea prompted a reappraisal of the quality of governance which has improved significantly.

We also added to positions in Zhejiang Supor (China: Consumer Discretionary), Glodon (China: Information Technology), HDFC Bank (India: Finanicals), Voltronic Power (Taiwan: Industrials) and Telkom Indonesia (Indonesia: Communication Services). There is no commonality or theme to these additions, they are simply high-quality companies at reasonable valuations.

We sold holdings in Foshan Haitian Flavouring (China: Consumer Staples) where we have increasing concerns about franchise development and BRAC Bank (Bangladesh: Financials) due to rising regulatory headwinds for the banking sector in Bangladesh.

To control position sizes we trimmed Tube Investments (India: Consumer Discretionary), Mahindra & Mahindra (India: Consumer Discretionary) and Shenzhen Inovance Tech (China: Industrials). We also reduced Kingmed Diagnostics Group (China: Health Care) on increasing concerns about governance.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2023

Asia Pacific Sustainability strategy update: 1 April - 30 June 2023

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term. High-quality companies at reasonable valuations tend not to come along too often. In the absence of such opportunities, we are very comfortable long-term owners of investee companies.

We initiated a new position over the quarter with the purchase of Telkom Indonesia (Indonesia: Communication Services). Telkom Indonesia has a strong track record of growth and profitability sitting as the backbone of Indonesia’s digital growth. Telecoms is notoriously a tough industry as there is little in the way of differentiation between what tend to be equally matched players. In Indonesia, Telkom has significant market leadership in a consolidated market providing them valuable cash flows to reinvest in growth ahead of peers. Telkom is also a unique example of a telecom company that has a robust, near-net cash balance sheet.

We also started a position in Cyient (India: Information Technology), as we believe, under a new management team, the company has set itself on a clear path of improvement as they refocus their efforts on becoming a leading provider of outsourced engineering services.

Our Chinese holdings have been whipped around in recent months as short-term views shift on a daily basis on whether there is evidence of a post-covid economic recovery and what stimulative polices the government will resort to. The Chinese stock market is dominated by state-owned enterprises. These companies trade on very low valuation multiples – rightly in our view – which when viewing the Chinese market purely from a top-down perspective, muddies the picture on what valuations are being asked of privately owned, high-quality franchises. We are starting to see such companies approach valuations that we are comfortable paying. But on the whole, we do not yet see the bargain valuations that tend to come up when there is genuine fear in a market. We added to our positions in Shenzhen Inovance (China: Industrials) and Amoy Diagnostics (China: Health Care) as top-down macro-driven concerns helped depress valuations.

We also added to our holding in Aavas Financiers (India: Financials). We believe Aavas has a fantastic opportunity to generate very attractive levels of long-term growth thanks to their leadership in providing low-cost mortgages to low-income households in India: a market where mortgage penetration is around 11% compared to over 60% in the UK1. We have a lot of respect for the conservative manner in which Aavas has built its balance sheet, which helps provide resilience in times of stress while also reducing the cost of providing mortgages which Aavas then passes on to customers.

To fund these transactions we trimmed two of our Indian holdings: Infosys (India: Information Technology) and Tube Investments (India: Consumer Discretionary).

1 Source: Aavas Annual report 2022-2023

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

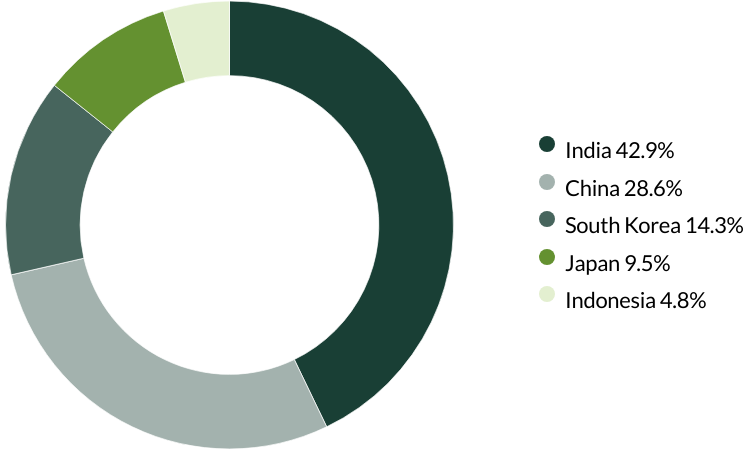

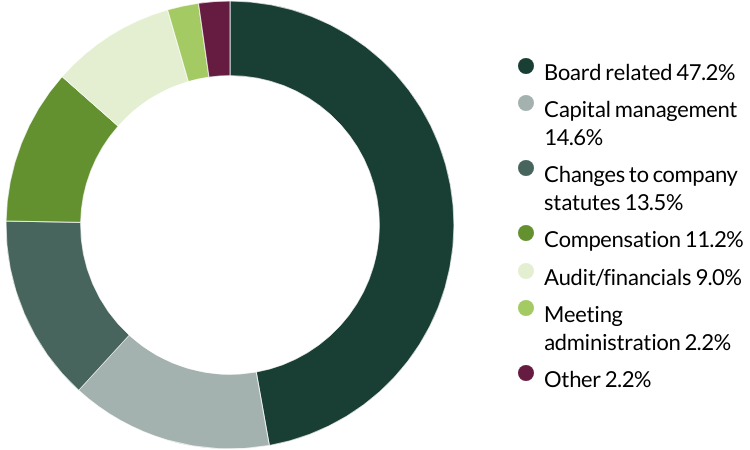

Proxy voting: Q1 2024

Asia Pacific Sustainability proxy voting: 1 January - 31 March 2024

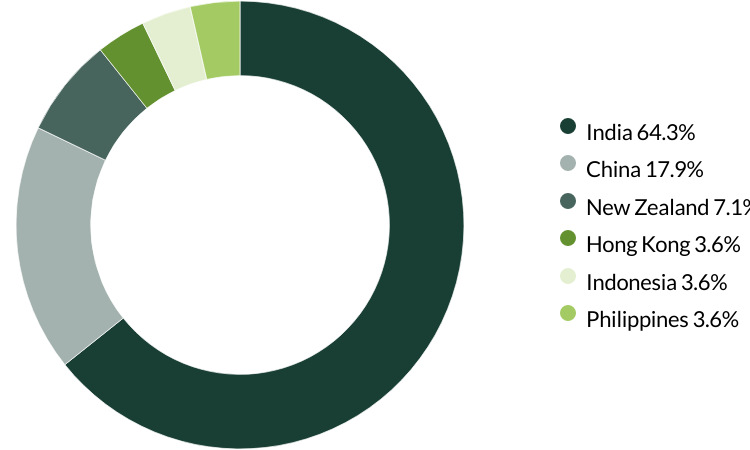

Proxy voting by country of origin

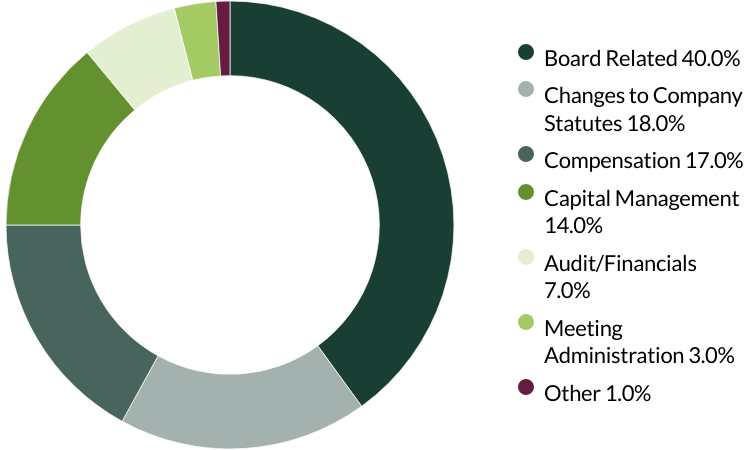

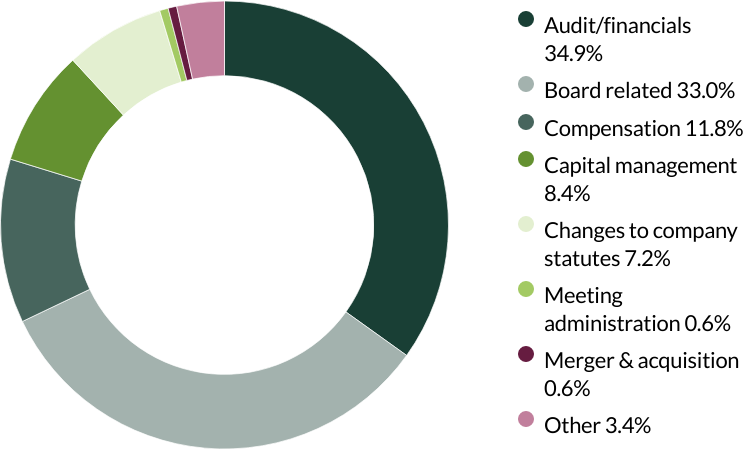

Proxy voting by proposal category

During the quarter there were 89 resolutions from 20 companies to vote on. On behalf of clients, we voted against 3 resolutions.

We voted against excessive executive remuneration at Bank Central Asia. (one resolution)

We voted against an adjustment of the Guarantee for Controlled Subsidiaries Assets Pool Business at Midea as we found the guarantee amount to be excessive and not in shareholders' best interests. (one resolution)

We voted against a Board appointment at Samsung Electronics as we would prefer to see more independent, non-family associated Directors. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2023

Asia Pacific Sustainability proxy voting: 1 October - 31 December 2023

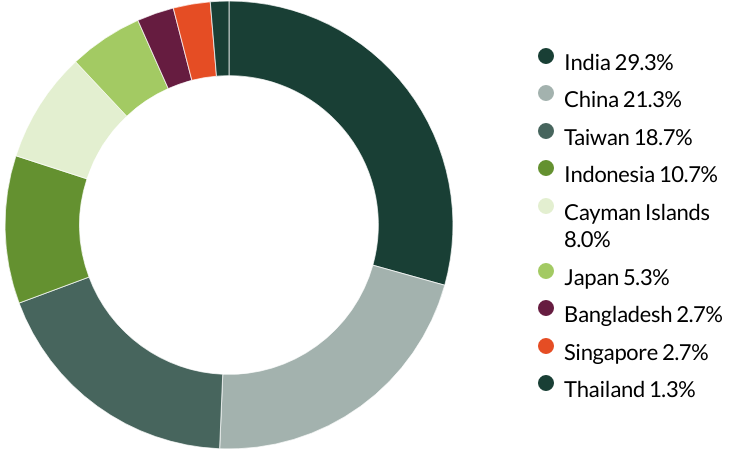

Proxy voting by country of origin

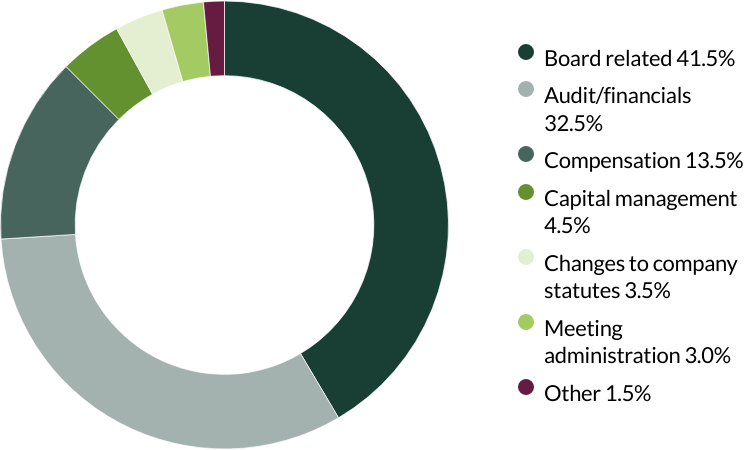

Proxy voting by proposal category

During the quarter there were 100 resolutions from 18 companies to vote on. On behalf of clients, we voted against 24 resolutions.

We voted against the Board re-election at ResMed as we were not able to vote against individual directors and opted to vote against Mr P Farrell who retired from the company 10 years ago and we believe he should step down from the board. We voted against the company’s executive remuneration, as we believe it to be complex and measured on many adjusted metrics. We also voted against the re-appointment of the auditor as they have been in place for 29 consecutive years. (24 resolutions - the resolutions for this company are duplicated as one vote instruction is for the company’s global meeting and the other is for the company’s domestic meeting)

We abstained from voting on the approval of a renewed liability insurance for Directors, Supervisors, and Senior Management at Midea Group as we did not have sufficient information on the details of the insurance policy at the time of voting. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2023

Asia Pacific Sustainability proxy voting: 1 July - 30 September 2023

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 200 resolutions from 27 companies to vote on. On behalf of clients, we voted against four resolutions.

We voted against the election of the Chair of the Nomination Committee at Hangzhou Robam in support of encouraging better gender diversity. At present the company has no female directors, and we believe the Chair of the Nomination Committee has an important role in facilitating a more gender diverse Board of Directors. (one resolution)

We voted against a related party transaction at Kingmed Diagnostics Group which would transfer 73% ownership of a subsidiary pharmaceutical company to the Deputy General Manager of the listco. We could not find any reasons behind the sale nor the valuation at which the transaction would happen. (one resolution)

We voted against Philippine Seven’s request for management to approve all other business matters before the annual general meeting (AGM) of shareholders. We consider ourselves active shareholders and prefer to vote on such matters at the AGM. (one resolution)

We voted against the appointment of the auditor and the company’s ability to set auditor fees at Vitasoy as they have been in place for over 10 years and the company has given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

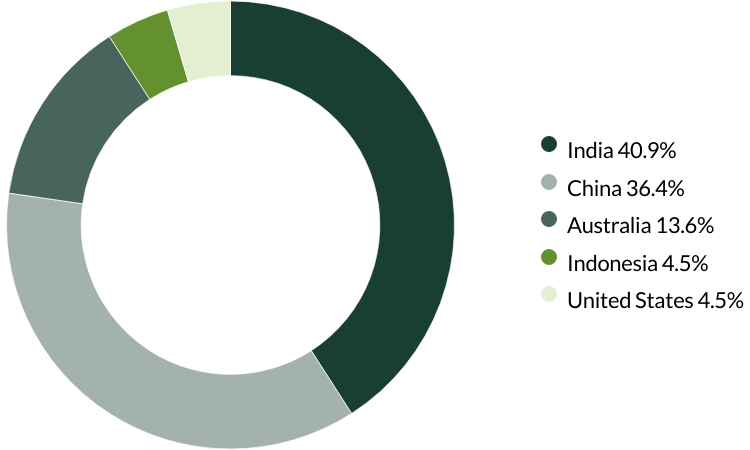

Proxy voting: Q2 2023

Asia Pacific Sustainability proxy voting: 1 April - 30 June 2023

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 321 resolutions from 38 companies to vote on. On behalf of clients, we voted against 14 and abstained on one resolution.

We voted against Aavas Financiers' request to reprice options granted under various equity stock option plans for employees due to a share price fall. We do not believe this request is in shareholders’ interest. (three resolutions)

We voted against BRAC Bank’s request to increase authorised share capital by more than 100%, as the company had not given any justification for why they are doing this at the time of voting. (one resolution)

We voted against Foshan Haitian Flavouring’s request to approve connected transactions entered into between the Company and related entities and their respective annual caps. We do not believe these requests are in shareholders’ interests. (two resolutions)

We voted against the appointment of the auditor Foshan Haitian Flavouring, Glodon, Selamat Sempurna, Telkom Indonesia and Yifeng Pharmacy Chain as they have been in place for over 10 years and the companies have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (five resolutions)

We voted against Pentamaster’s request to issue shares without pre-emptive rights, as the share discount rate had not been disclosed. (one resolution)

We voted against Vinda International’s request to issue shares without pre-emptive rights and issue repurchased shares, as the share discount rate had not been disclosed. (two resolutions)

We abstained from voting on the appointment of Kalbe Farma’s auditor and their request to set auditor fees as at the time of voting the company had not disclosed the name of the auditing firm. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific Sustainability Strategy, Asia Pacific & Japan Sustainability Strategy, Asia Pacific Leaders Sustainability Strategy, European Sustainability Strategy, European (ex UK) Sustainability Strategy, Global Emerging Markets Leaders Sustainability Strategy, Global Emerging Markets Sustainability Strategy, Indian Subcontinent Sustainability Strategy, Worldwide Sustainability Strategy and Worldwide Leaders Sustainability Strategy accounts as at 31 March 2024. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.