Get the right experience for you. Please select your location and investor type.

Asia Pacific and Japan Sustainability

The strategy was launched in June 1988, and since September 2019 has been a dedicated sustainability strategy.

The strategy was launched in June 1988, and since September 2019 has been a dedicated sustainability strategy. This equity-only strategy aims to achieve long-term capital growth by investing in a portfolio of between 30-60 companies in the Asia Pacific region, including Japan, that are helping to bring about a more sustainable future.

The ability to invest directly in Japan allows clients to own high-quality Japanese companies far earlier in their Asian growth journeys, as well as accessing a greater pool of domestic companies with attractive growth opportunities that are positioned to contribute to, and benefit from, sustainable development.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q4 2023

Asia Pacific and Japan Sustainability strategy update: 1 October - 31 December 2023

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term.

High-quality companies at reasonable valuations tend not to come along too often. In the absence of such opportunities, we are very comfortable long-term owners of companies in the portfolio.

During the quarter we initiated two new positions in Wuxi Biologics (China: Health Care) and RBL Bank (India: Financials). We have been studying Wuxi Biologics for a number of years. It is a leading contract research provider and manufacturer for pharmaceutical companies. The stewards have spent the last decade nurturing strong relationships with customers across geographies, and are building on their research relationships to scale up manufacturing services. The nature of the business, where the timeline from drug discovery to manufacturing can be decades, means that long-term customer relationships are crucial, and the trust built is difficult to disrupt. RBL Bank is a full-service bank that provides services to over 13 million customers across India. Under a new and reinvigorated management team, RBL is in early stages of building a high-quality lending institution.

We took advantage of recent share price weakness to add to MonotaRO (Japan: Industrials), Yifeng Pharmacy Chain (China: Consumer Staples), Glodon (China: Information Technology), Nihon M&A Center (Japan: Industrials) and Centre Testing International (China: Industrials). Centre Testing International provides inspection and certification services for industrial and consumer products across China, ensuring product quality and safety standards. The franchise benefits from being one of the first movers in the country, and continues to take share in a fragmented market as scrutiny rises on health, environmental and product standards. The balance between long-term family stewards and a professional manager who spent decades at one of the world’s leading inspection and certification services firms helped us build conviction in the quality of people here as well.

We sold the holding in Unilever Indonesia (Indonesia: Consumer Staples) following some recent management changes and we trimmed Tata Consumer Products (India: Consumer Staples) and CG Power (India: Industrials) to control position size.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q3 2023

Asia Pacific and Japan Sustainability strategy update: 1 July - 30 September 2023

Despite the evocative headlines and lowly valuations of the Chinese index, the companies that exhibit the quality and sustainability credentials we value so highly, for the most part, don't yet trade on enticing valuations.

There have, however, been a couple of opportunities to initiate positions in new Chinese holdings: Milkyway Chemical Supply Chain Service (China: Industrials) and Midea (China: Consumer Discretionary). Milkyway is China’s leading independent specialised chemical logistics company. We believe their reputation for quality and safety as well as their long-term, aligned, management team has the ability to benefit from the consolidation of a very fragmented industry while improving the outcomes in a critical, but fragile, industry. Midea is a leading provider of household appliances in China. Their strong balance sheet, entrepreneurial culture and robust cash flows provide a solid foundation from which we believe they can evolve the franchise to potentially dominate in robotics and industrial sectors.

To fund these new purchases marginal positions in Foshan Haitian Flavouring (China: Consumer Staples) and Info Edge (India: Communication Services) were sold. Relatively inflated valuations alongside growing unease around the long-term resilience of their business models led to their sale.

There were also a number of smaller transactions across the portfolio with the most material being the trimming of positions in Mahindra & Mahindra (India: Consumer Discretionary) and Tube Investments (India: Consumer Discretionary). Both companies performed well over the last year and had come to dominate the top ten of the portfolio. We continue to have long-term conviction in these franchises but are mindful not to let the portfolio become overly exposed to a small set of companies.

Weakness in existing Chinese holdings, Zhejiang Supor (China: Consumer Discretionary) and Glodon (China: Information Technology), allowed us to increase the weight in two very high-quality companies, with industry leading brands and technology.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2023

Asia Pacific and Japan Sustainability strategy update: 1 April - 30 June 2023

Over most three-month periods, there should be relatively little change in the portfolio. We aim to build resilient portfolios of high-quality companies with diversified streams of cash flows that have the ability to grow in value over the long term. High-quality companies at reasonable valuations tend not to come along too often. In the absence of such opportunities, we are very comfortable long-term owners of investee companies.

We started a position in Cyient (India: Information Technology), as we believe, under a new management team, the company has set itself on a clear path of improvement as they refocus their efforts on becoming a leading provider of outsourced engineering services.

Our holding in Aavas Financiers (India: Financials) was increased over the period. We believe Aavas has a fantastic opportunity to generate very attractive levels of long-term growth thanks to their leadership in providing low-cost mortgages to low-income households in India: a market where mortgage penetration is around 11% compared to over 60% in the UK1. We have a lot of respect for the conservative manner in which Aavas has built its balance sheet, which helps provide resilience in times of stress while also reducing the cost of providing mortgages which Aavas then passes on to customers.

There were also opportunities to add to three of our Japanese holdings: Nihon M&A Center Holdings (Japan: Industrials), MonotaRO (Japan: Industrials) and MANI (Japan: Health Care). In each of these names we are slowly building positions in companies that we believe are very well managed by long-term stewards and who have the ability to generate above average growth in free cash flow, regardless of what happens to the Japanese economy. The position in Advanced Energy Solutions (Taiwan: Industrials), a leading provider of battery solutions, was increased as top-down concerns around electric bike sales offered valuations which we believe fail to reflect the opportunity for longer-term growth in data-centres and electric vehicles.

1 Source: Aavas Annual report 2022-2023

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q1 2023

Asia Pacific and Japan Sustainability strategy update: 1 January - 31 March 2023

The major changes to the strategy over the course of the quarter were the sale of Techtronic Industries (Hong Kong: Industrials) and the initiation of positions in Zheijang Supor (China: Consumer Discretionary) and Nihon M&A Center (Japan: Industrials).

Zheijang Supor is a leading manufacturer of cookware and small domestic appliances in China. Supor is majority owned by the French company SEB, who itself has family ownership behind it. Leading the business day to day is a high-quality, professional management team that boasts experience at Microsoft and Nestle: we believe family ownership and a competent management team is a very powerful combination. Longer term, Supor is well positioned to benefit from China’s middle classes want to spend time and money on eating at home. In other countries we have seen kitchen appliances are relatively defensive purchases and not tied to housing cycles: we believe that to be the case with Supor.

We also initiated a position in Japan’s leading provider of SME (Small & Medium sized Enterprises) advisory services, Nihon M&A Center. Japan has a looming succession crisis in its pivotal SME sector: 3.6m companies that employ roughly 70% of private sector employees1. With the average age of these entities now over 60 years old and only half having a successor in place, they must either sell or be shut down. Nihon M&A Center plays an important role in matching sellers and buyers of SMES through their large network of tax accountants and regional banks. The opportunity that lies ahead of Nihon M&A Center to facilitate progress in Japan’s SME market remains vast, and we believe the people at the helm have the right combination of long-termism and competence to ensure Nihon continues to be a leading franchise in this space.

We increased our position in Aavas Financiers (India: Financials), a leading provider of home loans to low and middle-income households, mostly in urban locations in India. Through multiple conversations and a study of history, we believe the people and culture at Aavas Financiers operate at the other end of the spectrum to the financial institutions that have grabbed headlines over the course of the last month or so. This is backed up with tremendous asset quality and a conservatively levered balance sheet. With mortgages to GDP levels at 4% in the areas Aavas Financiers focuses2, compared to 68% in the UK3, we believe there are many years of growth ahead for a trusted partner for those looking to buy their home for the first time. We have admired Aavas Financiers for a long time, but only in recent months has the valuation reached levels we were comfortable paying.

These purchases were funded by the sale of our position in Techtronic Industries. We have long been attracted to the franchise at Techtronic Industries, a leading player in the development and roll-out of battery-powered power tools. However, we have grown increasingly uncomfortable with the management team and culture. We are very fortunate in Asia to have a long list of high-quality companies to invest in where we do not need to take such risks with management teams that make us uneasy.

Smaller transactions over the period included adding to positions in Japan Elevator Service (Japan: Industrials) and Mani (Japan: Healthcare), two Japanese names that we believe to have world-class franchises and are offering fantastic growth opportunities. The strategy’s largest holding, Tube Investments (India: Consumer Discretionary), was trimmed to manage position size.

1 Source: OECD iLibrary, Financing SMEs and Entrepreneurs 2022: An OECD Scorecard, https://www.oecd-ilibrary.org/sites/a4e7ef59-en/index.html?itemId=/content/component/a4e7ef59-en

2 Source: The Times of India, Low-income home loan turning affordable housing into a reality in India, 30 November 2022. https://timesofindia.indiatimes.com/blogs/voices/low-income-home-loans-turning-affordable-housing-into-a-reality-in-india/

3 Source: HDFC, Investor Presentation, February 2023. https://www.hdfc.com/content/dam/housingdevelopmentfinancecorp/pdf/investors/relations/investor-presentations/2022/hdfc_02_feb_2023.pdf

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Proxy voting: Q4 2023

Asia Pacific and Japan Sustainability proxy voting: 1 October - 31 December 2023

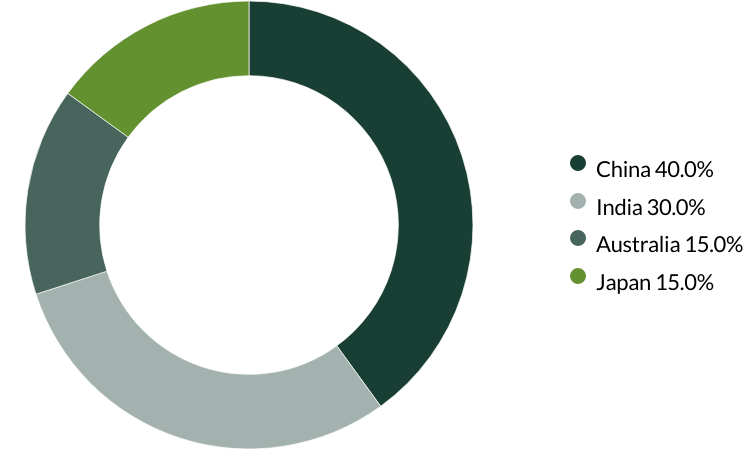

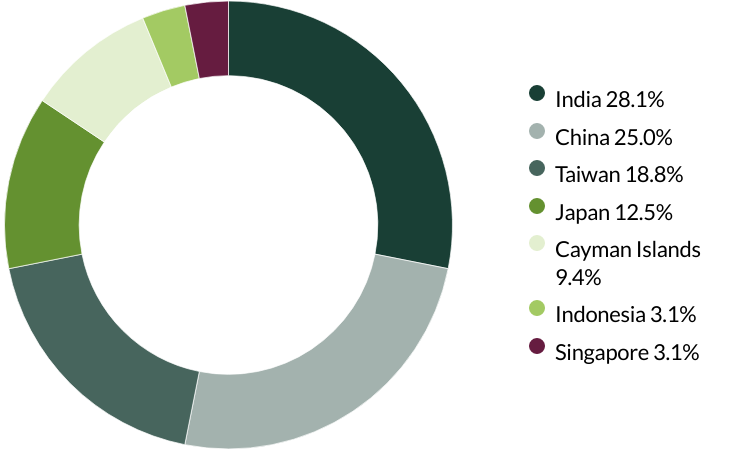

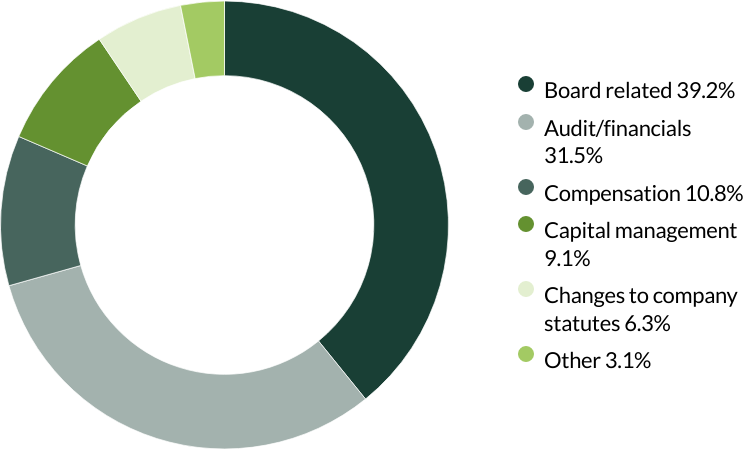

Proxy voting by country of origin

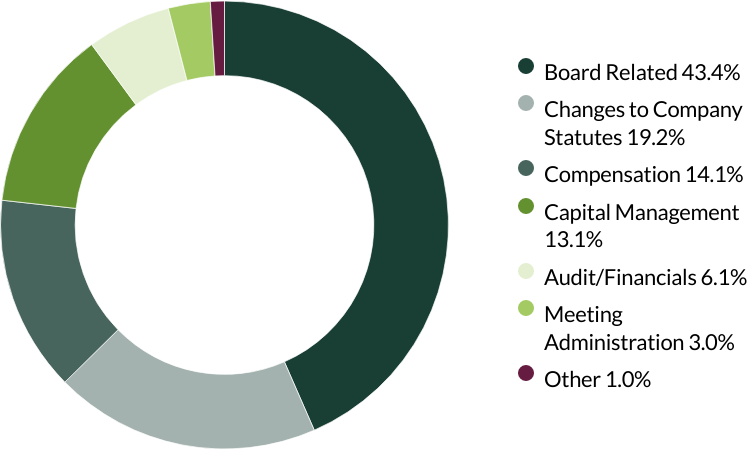

Proxy voting by proposal category

During the quarter there were 99 resolutions from 16 companies to vote on. On behalf of clients, we did not vote against any resolutions.

We abstained from voting on the approval of a renewed liability insurance for Directors, Supervisors, and Senior Management at Midea Group as we did not have sufficient information on the details of the insurance policy at the time of voting. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2023

Asia Pacific and Japan Sustainability proxy voting: 1 July - 30 September 2023

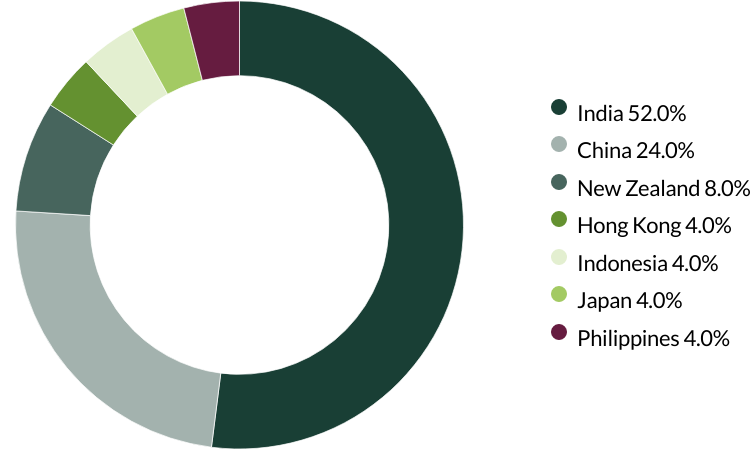

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 167 resolutions from 23 companies to vote on. On behalf of clients, we voted against three resolutions.

We voted against a related party transaction at Kingmed Diagnostics Group which would transfer 73% ownership of a subsidiary pharmaceutical company to the Deputy General Manager of the listco. We could not find any reasons behind the sale nor the valuation at which the transaction would happen. (one resolution)

We voted against Philippine Seven’s request for management to approve all other business matters before the annual general meeting (AGM) of shareholders. We consider ourselves active shareholders and prefer to vote on such matters at the AGM. (one resolution)

We voted against the appointment of the auditor and the company’s ability to set auditor fees at Vitasoy as they have been in place for over 10 years and the company has given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2023

Asia Pacific and Japan Sustainability proxy voting: 1 April - 30 June 2023

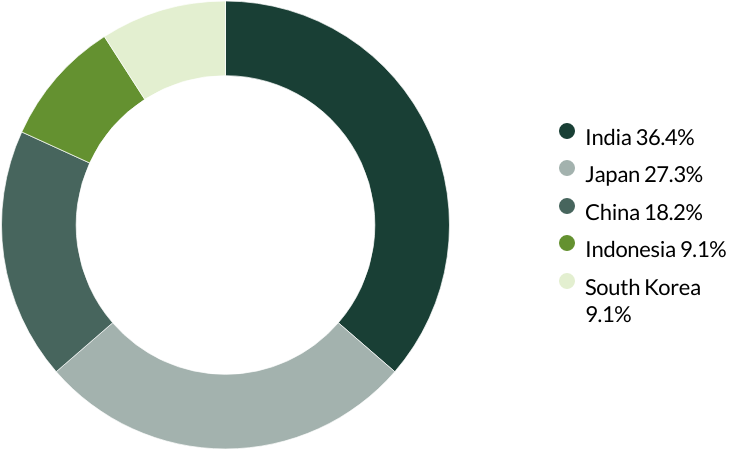

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 286 resolutions from 32 companies to vote on. On behalf of clients, we voted against 11 resolutions.

We voted against Aavas Financiers' request to reprice options granted under various equity stock option plans for employees due to a share price fall. We do not believe this request is in shareholders’ interest. (three resolutions)

We voted against Foshan Haitian Flavouring’s request to approve connected transactions entered into between the Company and related entities and their respective annual caps. We do not believe these requests are in shareholders’ interests. (two resolutions)

We voted against the appointment of the auditor at Foshan Haitian Flavouring, Glodon and Yifeng Pharmacy Chain as they have been in place for over 10 years and the companies have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (three resolutions)

We voted against Pentamaster’s request to issue shares without pre-emptive rights, as the share discount rate had not been disclosed. (one resolution)

We voted against Vinda International’s request to issue shares without pre-emptive rights and issue repurchased shares, as the share discount rate had not been disclosed. (two resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

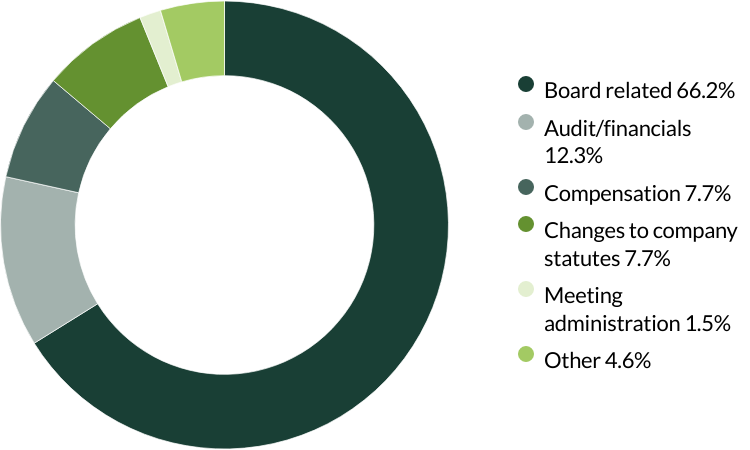

Proxy voting: Q1 2023

Asia Pacific and Japan Sustainability proxy voting: 1 January - 31 March 2023

Proxy voting by country of origin

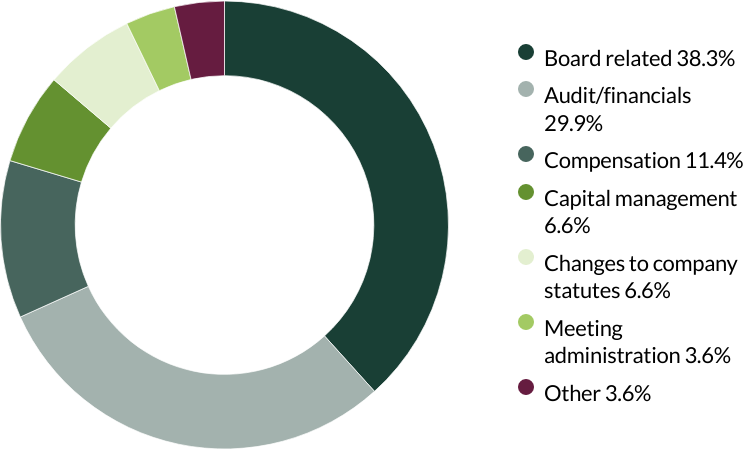

Proxy voting by proposal category

During the quarter, there were 65 resolutions from eleven companies to vote on. On behalf of clients, we voted against one resolution.

We voted against Amoy Diagnostics’ request to increase share capital and share count as we did not have sufficient information at the time of voting for the justification of these amendments to articles. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific Sustainability Strategy, Asia Pacific & Japan Sustainability Strategy, Asia Pacific Leaders Sustainability Strategy, European Sustainability Strategy, European (ex UK) Sustainability Strategy, Global Emerging Markets Leaders Sustainability Strategy, Global Emerging Markets Sustainability Strategy, Indian Subcontinent Sustainability Strategy, Worldwide Sustainability Strategy and Worldwide Leaders Sustainability Strategy accounts as at 31 March 2024. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.