Get the right experience for you. Please select your location and investor type.

Worldwide Sustainability

An unconstrained investment strategy that invests in companies across the world which are positioned to contribute to, and benefit from, sustainable development.

Strategy overviewOur Worldwide Sustainability strategy was launched in November 2012. It is an unconstrained investment strategy, by which we mean it is not restricted to certain countries, and is able to invest in between 40-60 companies all over the world. As with all of our strategies, we are interested in finding only the very best businesses; those with high quality management teams, franchises, and financials, that are well positioned to contribute to, and benefit from, sustainable development.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development. Portfolio Explorer >

- We invest in high-quality companies with exceptional cultures, strong franchises and resilient financials. How we pick companies >

- We avoid companies linked to harmful activities and engage and vote for positive change. Our position on harmful products >

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic

- We focus on capital preservation as well as capital growth – we define risk as the permanent loss of client capital

Latest insights

Quarterly updates

Strategy update: Q1 2024

Worldwide Sustainability strategy update: 1 January - 31 March 2024

The market continues to look very concentrated, particularly for any company connected to Artificial Intelligence (AI). And, while the Magnificent 7 is no more as the likes of Tesla and Apple have slowed, NVIDIA, Microsoft and Meta continue to climb. Although we do not hold these companies, we are excited about the possibilities of AI to contribute to innovative solutions and drive human development, as reflected in some new positions in the portfolio.

During the quarter we added new positions in both TSMC (Taiwan: Information Technology) and Samsung Electronics (South Korea: Information Technology). Both companies are fabricating the chips that are designed by AI companies and are an essential part of the semiconductor value chain. They are also both well run with strong growth prospects and reasonable valuations. And it is not only in the developed world that increasing data, digitalisation and connectivity will be driving opportunities for growth. We entered a position in Tata Communications (India: Communication Services) as we also see exciting prospects for these structural growth drivers in India. We also added to Elisa (Finland: Communication Services) to take advantage of reasonable valuations and EPAM Systems (United States: Information Technology) as we continue to build our conviction in them.

We completely divested three portfolio companies. Cochlear (Australia: Health Care) remains a high-quality sustainability company and our decision to sell was prompted by concerns about its valuation compared to its growth prospects. We sold Cognex (United States: Information Technology) and Alfen (Netherlands: Industrials) due to concerns about their ability to weather more challenging end market environments ahead.

Controlling the portfolio sizes of companies also raised cash for new positions. These fell into three broad areas: Firstly, trimming the size of top ten holdings which have run up in price including Fortinet (United States: Information Technology), Beiersdorf (Germany: Consumer Staples), bioMérieux (France: Health Care) and Admiral (United Kingdom: Financials). Secondly, we are watching the emerging competitive environment facing Indian banks and controlling our exposure by reducing our position in Kotak Mahindra Bank (India: Financials).

Thirdly, we continued to take some profits from our position in Adyen (Netherlands: Financials). This stock has been exposed to the full force of market irrationality over the last six month and its price fell by over half in August when it slightly missed earnings growth expectations. We took the opportunity to add several times over the next few months before the price started to increase again. We then trimmed twice during the quarter to take profits and control the position size, but we retain conviction in the quality of its franchise and growth runway ahead.

As we head further into 2024, there remains little consensus around whether inflation will continue to fall or rise further, whether interest rates will remain where they are or be cut, or whether we are heading into a stronger or weaker economy. However outside of the stock market we are seeing some return to normality. Companies that we meet with are welcoming the end of a phase of de-stocking that was brought about by the supply chain issues and overstocking of 2022 and are looking forward to a return to more typical growth trends. We remain as reticent as ever to predict the path of macroeconomic variables, instead, focusing on finding high-quality companies supported by a diverse range of structural growth drivers, with strong balance sheets and competent management to take advantage of them.

Case Study: Fortinet

Listing: NASDAQ

Market cap: US$51bn

Shareholders since: July 2019

Company description

Founded in 2000 by brothers Ken and Michael Xie, Fortinet is one of the largest global providers of network security hardware and software. These solutions support customers across a highly diversified set of geographies, industries and customers. In 2023, their Fortiguard services offering blocked 2.4trn vulnerability attempts and 3bn malware deliveries to protect customers.1

Why do we like it? / Investment rationale

Fortinet’s strength lies within its founders’ expertise, patience, and ambition. Together, Ken and Michael have almost 50 years of experience in network security. They had the foresight as early as the late 1990s to invest in the design and manufacture of firewall-specific processing chips (application-specific-integrated-circuit, or ASICs).

When compared to firewalls run on general-purpose computing processors, Fortinet’s ASIC-based firewalls operate more quickly and efficiently, allowing them to block more complex threats from accessing the network. Not only do Fortinet’s chips offer better performance at lower power requirements (-88% vs. industry-standard processing chips), reducing the overall cost of ownership for customers, but vertical integration helps them secure chips, even during recent supply chain snarls in which some competitors experienced months-long shipping delays.

This technical expertise has helped Fortinet build a strong franchise across a highly diversified customer base, with its single biggest country exposure being the US at 27% of sales. More predictable services revenues now amount to 60% of sales, while Fortinet has grown free cash flow at a compounded average growth rate of 27% since 2015. Pleasingly, the Xie brothers’ long-termism has seen much of this bolster a balance sheet which has more cash than debt. They have also been able to invest cash flows into research & development, and have invested $1.7 billion to this end since 2017. This investment underpins Fortinet’s ambitions to grow further through end-to-end network security solutions – protecting infrastructure, data, access and applications.

As such, Fortinet is well-placed to capitalise on structural tailwinds around our economy’s increasing dependence on computing networks to connect data, devices, and people – fanned further by the possibilities of broader AI adoption – but also the mounting risks posed by cyberattacks. Some estimates suggest global cybercrime costs could hit $10.5 trillion dollars by 20252, to say nothing of less-easily quantified reputational risks or consequences of state-sponsored attacks on critical infrastructure. In an increasingly uncertain world, Fortinet’s technical expertise and patient investment offers customers the protections they need to seize the digitalisation opportunity.

What could go wrong? / Risks

Fortinet itself faces the risk of cyberattacks and technological disruption, although we feel these are mitigated by their R&D investment and expertise. Similarly, deteriorating macro-economic conditions could pressure customer budgets and push out cybersecurity investments, although recurring revenues and cash generation should help Fortinet weather short-term demand weakness.

1 Fortiguard Outbreak Alerts Annual Report 2023

2 2022 Official Cybercrime Report by Cybersecurity Ventures: https://www.esentire.com/resources/library/2022-official-cybercrime-report

Reference to the names of each company mentioned in this material is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

You can build a bespoke report for all our strategies on the full Quarterly update report.

Strategy update: Q4 2023

Worldwide Sustainability strategy update: 1 October - 31 December 2023

The strategy performed well in Q4, resulting in a positive return for the full year. However, it was another turbulent year, following on from the travails of 2022, leading to a challenging environment for most portfolio companies and fluctuations in portfolio performance.

In 2022, Russia’s invasion of Ukraine led to a short-term boom in energy prices and a longer-term rise in geo-political tensions which have continued throughout 2023. Also during 2022, many companies had to cope with supply chain challenges, which led to overstocking in many instances and contributed to higher inflation. Throughout 2023, de-stocking and slowing demand was a common challenge, along with interest rates that in many countries ended the year approximately five times higher than they were at the start of 2022.

The period between August and October was particularly challenging as many macroeconomic concerns came to a head. At other times the overall market was buoyant, but this was largely driven by United States mega-cap tech stocks and fashionable themes such as artificial intelligence (AI) and weight loss drugs. Outside a very narrow range of stocks, the threat of recession, uncertainty over central bank actions and the increasingly pessimistic outlook from China put downward pressure on the valuations of small and mid-cap stocks and on many European-listed stocks. Against this backdrop and an increasingly concentrated market, the dispersion of returns was wide and there were some sharp drawdowns in the share prices of some portfolio companies.

An example was Adyen (Netherlands: Financials) whose price fell by 60% in August1 after it missed its growth estimates. This occurred at a time when the business was investing for the long-term, by increasing their headcount, which reduced their profit margins in the short term. We retained our conviction in the management team, business model and opportunity for the company and added to our position twice in October.

Fortinet (United States: Information Technology) also experienced a large price drawdown after its annual earnings were slightly lower than estimates due to clients shifting orders from June to July2 and worries of a slow-down in their core market of secure networking. However, the company is pivoting to faster growing security operations and universal Secure Access Service Edge (SASE) segments and has achieved consistently resilient growth over many years. It is forecast to grow by 25% a year for the next few years and we remain convinced it offers an excellent long-term investment opportunity. We took the opportunity to add to our position at attractive valuations.

We made no new additions to the portfolio in Q4 but increased positions in several companies with resilient cash flows on compelling valuations, including Halma (United Kingdom: Industrials), Spectris (United Kingdom; Information Technology) and Edwards Lifesciences (United States: Healthcare). We also added to companies that had become deeply out of favour but which have sound fundamentals and are well set up to benefit from tailwinds in automation, in the case of Zebra Technologies (United States: Industrials), and the energy transition, in the case of Alfen (Netherlands: Industrials).

Valuations also played a role in decisions to trim positions in Admiral (United Kingdom: Financials), Arista Networks (United States: Information Technology) and Advanced Drainage Systems (United States: Industrials). And we completely divested from Constellation Software (Canada: Information Technology) due to high valuations. While we retain conviction in its management and business model, its valuation left no room for error and we feel there are better opportunities elsewhere.

The most disappointing aspect of performance over the last two years has been the negative contribution from healthcare companies. As well as their contribution to human development, we expect them to be resilient and steady compounders of value over the long term. Our sense is that many of them have weathered the storm of post-pandemic de-stocking and are well-placed to grow as the sector normalises.

As always, we remain focused on buying companies with high-quality management teams and exceptional franchises that are driving human development and alleviating environmental pressures. Our portfolio is well diversified, not only across sectors and geographies, but also growth drivers such as improving energy efficiency, the rise of living standards in India and the growth of diagnostics. With portfolios of high-quality, great sustainability companies bought at reasonable valuations, we are excited about the future.

1 Source: S&P Capital IQ

2 Source: S&P Capital IQ

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q3 2023

Worldwide Sustainability strategy update: 1 July - 30 September 2023

The narrowing of the global equity market that started in Q2 continued throughout Q3 and the dynamic of a rising market driven by a few large US technology stocks has been a strong feature of much of this year. As active investors, we don't start with the index composition but build portfolios from the bottom up. This allows us to ignore the stretched valuations in large tech stocks and look for quality companies with excellent stewards and a long runway for growth driven by strong sustainability tailwinds.

Over the quarter we initiated a position in Japanese bicycle maker Shimano (Japan: Consumer Discretionary) which has a third generation family steward, a reputable brand and the financial quality to allow it to benefit from the growing market in e-cycles. We also added EPAM Systems (US: Information Technology) a digital platform engineering and software development services company. We have been watching it for a while given its adaptability, quality and favourable positioning in enterprise software development, design and consulting and took advantage of attractive valuations to initiate a position.

Over the same period we divested two stocks fully from the portfolio. We sold Fanuc (Japan: Industrials) due to concerns about its profitability, competitiveness and future outlook. Although Tokyo Electron (Japan: Information Technology) has been a great contributor to the strategy, we grew concerned about its valuation and ability to weather the shifting dynamics of the semiconductor industry.

Another feature of the markets over the quarter has been the dramatic over-reactions to company news. When investing for the long-run, volatility in stock prices does not present concern, but rather provides opportunity. This quarter we took the opportunity to top-up on key positions, adding to high-quality companies with great growth prospects such as Fortinet (US: Information Technology), Adyen (Netherlands: Financials) and Veeva Systems (US: Health Care). These were funded by trimming positions that had run up in price including Marico (India: Consumer Staples) and Advanced Drainage Systems (US: Industrials)

We believe the best way to protect and grow our clients' capital over the long term is to invest in high-quality franchises, run by competent and honest stewards that have strong financials enabling them to contribute to and benefit from strong sustainability tailwinds.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Strategy update: Q2 2023

Worldwide Sustainability strategy update: 1 April - 30 June 2023

Markets seem to have performed strongly so far this year which again serves to highlight the difficulties in drawing helpful short-term conclusions on a naturally long-dated asset class such as equities. From our preferred bottom-up perspective, the outlook remains mixed.

On the one hand we are seeing some profit warnings stemming from tightening concerns which is stymieing demand for various goods and services. At the same time, a recent trip to India showed a buoyant economy with fantastic companies preparing for a very bright few years ahead. Trying to draw general conclusions from all of this data is impossible so we remain, as ever, focused on trying to find the best managed companies working to deliver a sustainable future at suitable valuations while also pulling at threads in the investment cases of companies held across the portfolios.

Over the past quarter, we have taken the opportunity to initiate a new position in Swedish conglomerate Assa Abloy (Sweden: Industrials) which focuses on security products from locks to biometric access. We have followed the company for many years and took an opportunity at a reasonable valuation to initiate a position. We also added to some of our favourite existing positions including Indian financial institution HDFC (India: Financials), several US industrial companies including Watsco (US: Industrials), Advanced Drainage Systems (US: Industrials) and Zebra Technologies (US: Information Technology) as well as European holdings including Infineon Technologies (Germany: Information Technology) and Roche (Switzerland: Health Care). We funded some of these additions by trimming holdings in Elisa (Finland: Communication Services), Beiersdorf (Germany: Consumer Staples), Cochlear (Australia: Health Care) and Constellation Software (Canada: Information Technology) among others as valuations crept up. We did not divest any positions in the quarter.

Irrespective of how markets behave or the macro noise in the short term, we remain committed to understanding the bottom-up fundamentals of each investment. We continue to consider the evolution of the governance, franchise and financial quality of our holdings alongside their sustainability positioning and strive to distil corporate quality from this. We believe these aspects to be far more tangible than any top-down focus on macroeconomic factors which do little to tell us about corporate quality which is ultimately what endures.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

Proxy voting

Proxy voting: Q1 2024

Worldwide Sustainability proxy voting: 1 January - 31 March 2024

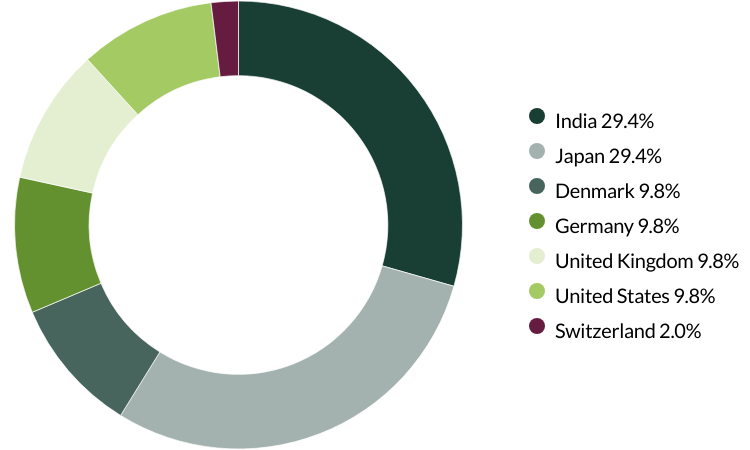

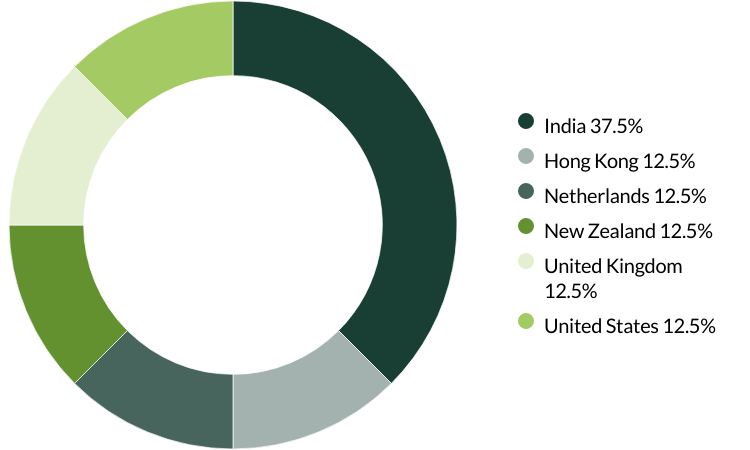

Proxy voting by country of origin

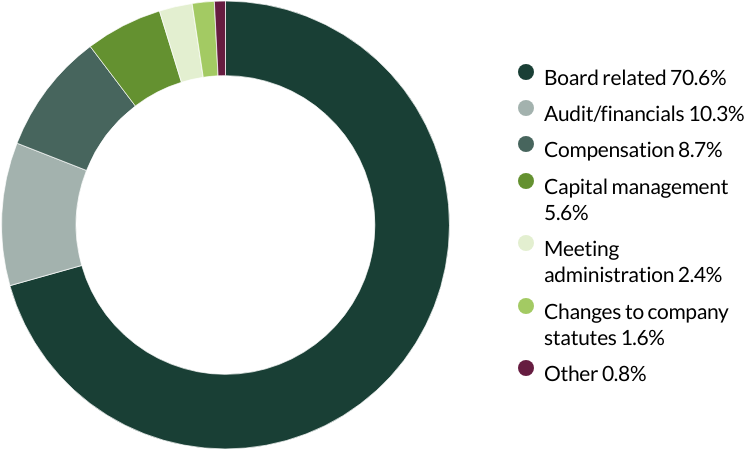

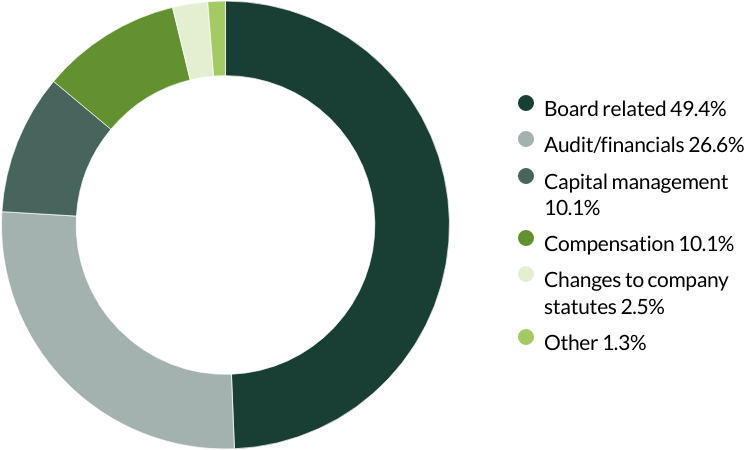

Proxy voting by proposal category

During the quarter there were 126 resolutions from 10 companies to vote on. On behalf of clients, we voted against 7 resolutions.

We voted against the appointment of the auditor at Nordson and Roche as they have each been in place for over 10 years. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts and follows best practice. We also voted against excessive executive renumeration at Roche. (seven resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q4 2023

Worldwide Sustainability proxy voting: 1 October - 31 December 2023

Proxy voting by country of origin

Proxy voting by proposal category

During the quarter there were 42 resolutions from five companies to vote on. On behalf of clients, we didn't vote against any resolutions.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q3 2023

Worldwide Sustainability proxy voting: 1 July - 30 September 2023

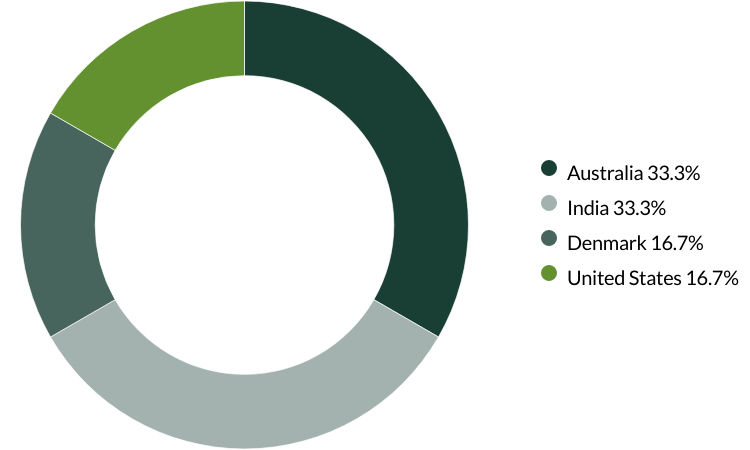

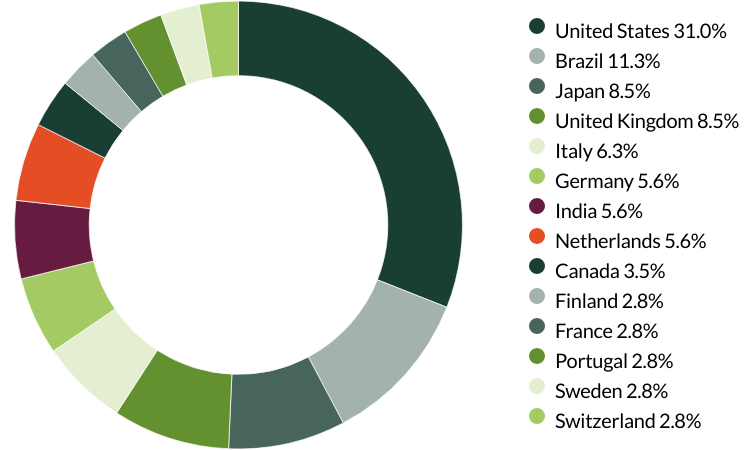

Proxy voting by country of origin

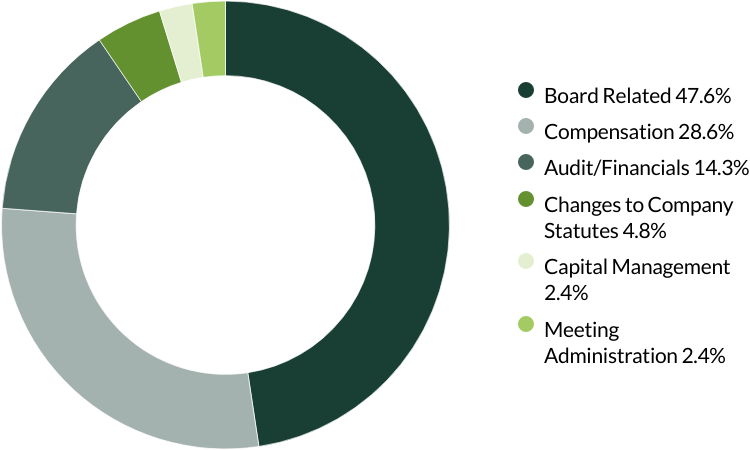

Proxy voting by proposal category

During the quarter there were 79 resolutions from eight companies to vote on. On behalf of clients, we voted against two resolutions.

We voted against the appointment of the auditor at Advanced Drainage Systems and Vitasoy as they have been in place for over 10 years and the company has given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (two resolutions).

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Proxy voting: Q2 2023

Worldwide Sustainability proxy voting: 1 April - 30 June 2023

Proxy voting by country of origin

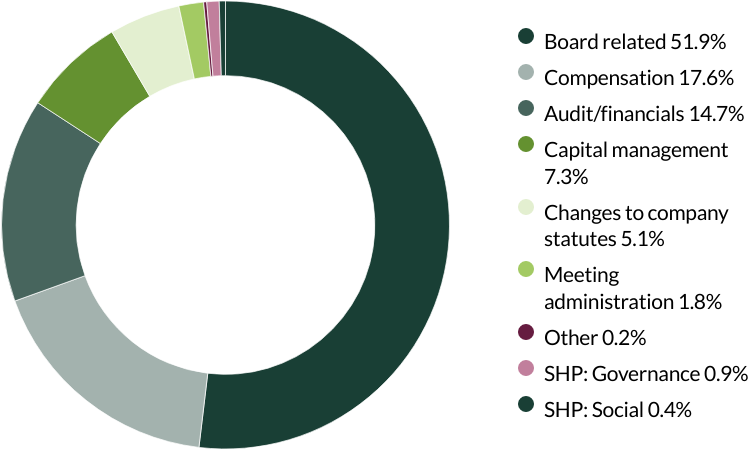

Proxy voting by proposal category

During the quarter there were 449 resolutions from 32 companies to vote on. On behalf of clients, we voted against 30 and abstained one resolution.

We voted against the appointment of the auditor at A.O. Smith, Arista Networks, Beiersdorf, bioMérieux, Cognex, Constellation Software, Edwards Lifesciences, Elisa, Fortinet, Markel, Synopsys, Texas Instruments, Veeva Systems, Watsco and Zebra Technologies as they have been in place for over 10 years and the companies have given no information on intended rotation. We believe rotating an auditor on a relatively frequent basis (e.g. every 5-10 years) helps to ensure a fresh pair of eyes are examining the accounts, and follows best practice. (16 resolutions)

We voted against Edwards Lifesciences’ request to remove personal liability from certain senior officers. We believe such an amendment is unnecessary and do not think the company’s reasoning holds merit. (one resolution)

We voted against Fortinet’s request to remove personal liability from certain senior officers. We believe such an amendment is unnecessary and do not think the company’s reasoning holds merit. (one resolution)

We voted against Natura’s remuneration policy as we do not believe it is particularly long-term and the absolute pay amounts have increased significantly, especially in the context of recent poor performance. We voted against the establishment of a supervisory council as at the time of voting the company had not disclosed the candidates that would be up for election. We also voted against the election of a candidate, appointed by minority shareholders, to the supervisory council in alignment with our vote against the establishment of the supervisory council and we do not believe the candidate is truly independent. (four resolutions)

We voted against Synopsys’ executive remuneration and amendments to their Employee Equity Incentive plan as we believe it is subject to adjustments to facilitate payments to management. (two resolutions)

We voted against Texas Instruments’ executive remuneration, as we believe the absolute pay-outs for the CEO are high compared to other executive directors and the median employee. We also disagree with the vast majority of remuneration being discretionary and believe it is in shareholder interests for management to be measured against a few key metrics that hold them to account over the long term. (one resolution)

We voted against WEG’s request to recast votes for the amended supervisory council slate, as we preferred to vote in favour of the female candidate nominated by minority shareholders and who has been on the fiscal council for two years. We abstained from voting on the election of the supervisory council as we preferred to support the minority candidate. (one resolution against, one resolution abstained)

We voted against Zebra Technologies’ executive compensation as we believe there is a large disparity between the CEO’s pay and the other executives. (one resolution)

We voted against a shareholder proposal requesting A.O. Smith report on racism in company culture. We believe the company is committed to diversity and inclusion as reflected in its Board which is 50% female and/or from underrepresented racial/ethnic groups. The company began tracking racial diversity in leadership roles in 2021, has enhanced its inclusivity training for leaders and continues to promote and discuss the topic heavily. (one resolution)

We voted against a shareholder proposal relating to Synopsys which would enable shareholders with a combined 10% share ownership the right to call a special shareholder meeting. (one resolution)

We voted against a shareholder proposal at Veeva Systems which requested amendments to bylaws. We believe the company is shareholder friendly, and the proposal would breach the Company’s Certification of Incorporation. (one resolution)

We supported a shareholder proposal relating to Edwards Lifesciences which requested that the company separate the roles of the Chair and CEO. (one resolution)

We supported shareholder proposals relating to Texas Instruments which requested the company report on its process for customer due diligence, by outlining sanctions and export control compliance, risks associated with Russia’s invasion of Ukraine, more information on the know-your-customer due diligence process, and an assessment of legal, regulatory and reputational risks to the company. We also supported a request for the company to adopt a 10% threshold for calling special meetings as currently the Board’s threshold is a shareholding of 25% which appears high. (two resolutions)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Portfolio Explorer

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* from representative Asia Pacific Sustainability Strategy, Asia Pacific & Japan Sustainability Strategy, Asia Pacific Leaders Sustainability Strategy, European Sustainability Strategy, European (ex UK) Sustainability Strategy, Global Emerging Markets Leaders Sustainability Strategy, Global Emerging Markets Sustainability Strategy, Indian Subcontinent Sustainability Strategy, Worldwide Sustainability Strategy and Worldwide Leaders Sustainability Strategy accounts as at 31 March 2024. *Assets that the strategies may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

The Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company), or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.